by Greg Harmon

Money has been moving out of Bonds but many suggest that it is not yet flowing into anything but cash. That could easily be an interim step for the summer. “Hey broker dude, just sell the bonds before they collapse and we will talk about what to do with it after I close the Hampton’s house. And can you get me into Stevie’s next party?”

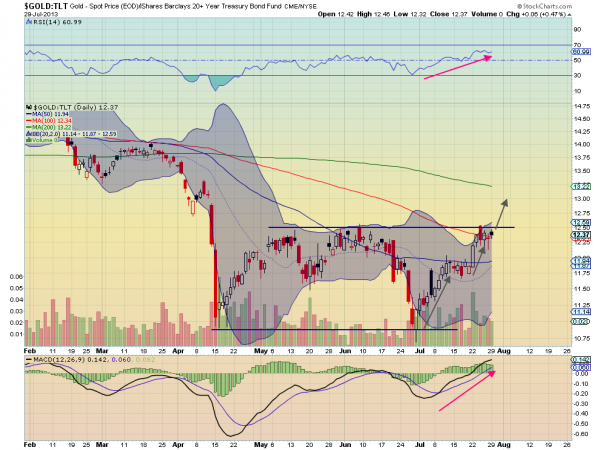

But the ratio chart of Gold ($GC_F, $GLD) to my bond proxy, $TLT, the 20 year US Treasury ETF, suggests flow may be occurring right now. Take a look. Over the last 3 months this ratio has been trading in a channel between a ratio of 10.80 and 12.50. Signs point to the strong possibility that it put in a double bottom in this channel and is ready to move higher. As

it consolidates at the top of the channel, the Relative Strength Index (RSI) is rising to new highs and bullish while the Moving Average Convergence Divergence indicator (MACD) is also rising. Both support a push higher. The ratio itself is stepping higher and over the 100 day Simple Moving Average (SMA). The Measured Move (MM) on a break over the top of the channel takes it to the 13-13.25 area. At the low end of that is a 4% rise in Gold in terms of bonds or a 4% fall in bonds relative to Gold. That is worth trading.

No comments:

Post a Comment