There were evident divergences all across the credit complex as the Yellen Fed takes shape. Maybe it relates to these “markets” being more accustomed to Bernanke and his manner of speech and saying nothing, but to me there appears to be little consensus about anything.

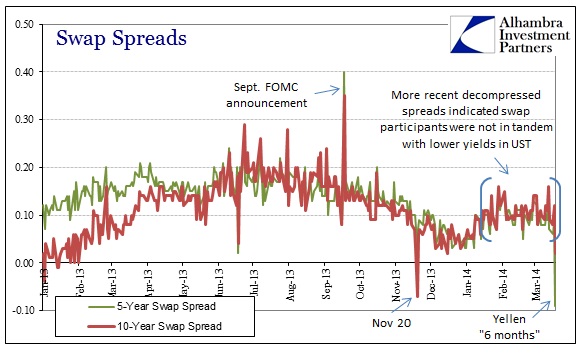

I have said on previous occasions this year that swap market participants are not synchronized with UST rates, as swap spreads have decompressed while treasury rates have fallen (particularly since January 9). That indicates to me wariness against policy changes of the kind we apparently saw on Wednesday. It also appears as if some agent, dealer or major participant got caught, yet again, positioned in the “wrong” direction against rate movements. There was clear desperation, evident more in the 5-year spread than 10-year (5-year spread dropped a massive 18 bps on Wednesday, settling at -.09 bps).

If I had to guess, I would say that the extreme spread movement Wednesday related to the collapse in the curve – a massive flattening that no doubt ran over some positions. We have no idea who was affected and by how much, but to move spreads as much as it did suggests it wasn’t a minor “mistake.”

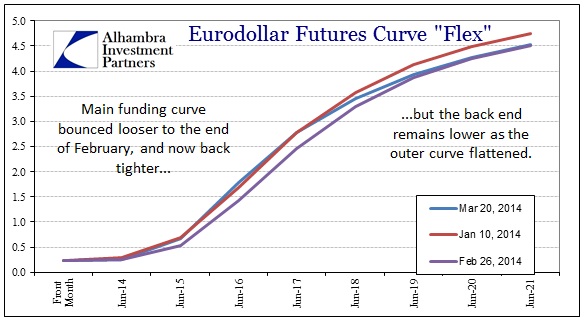

We can pick up some of that in funding markets, as dollars tightened more than a little in the “money” part of the eurodollar curve, but remained unperturbed in the outer years.

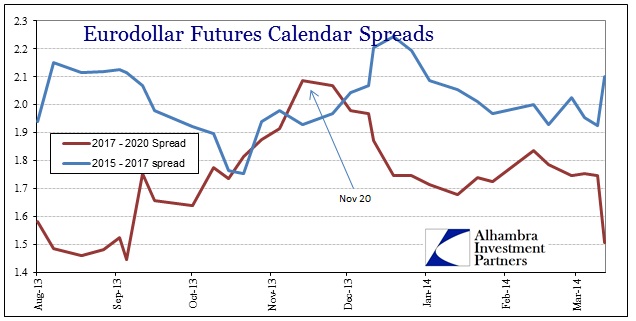

The net result was a rather obvious drop in calendar spreads out to 2020.

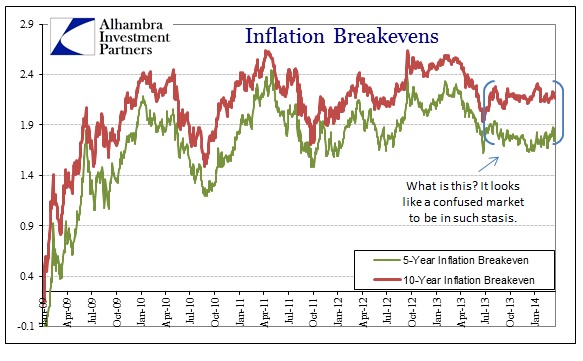

Given all of that “action”, you might expect some kind of change in expectations for inflation, particularly as that has been somewhat of a focus lately of both observation and policy. But the embedded inflation expectations in the treasury market have been more than docile ever since the summer selloff.

Such a static inflation indication I think goes along with these divergences in various segments. On the one side, there is constant reassurance that inflation will pick up at some point, and that the Fed will “normalize” itself to that inflation paradigm. Yet, for all that talk there is the evident problem that inflation is actually going in the “wrong” direction without anything other than assurances that will change. The net result appears as neither position obtains momentum, and the “market” devolves strangely into this static state.

Credit markets appear almost confused about the most basic factors of credit and interest rates. Could it possibly be from too much monetary interference through the lack of clarity regarding stance? The FOMC talks about forward guidance as if it were almost a direct line to credit “markets”, but these strange indications show that there is very little consensus anywhere about anything.

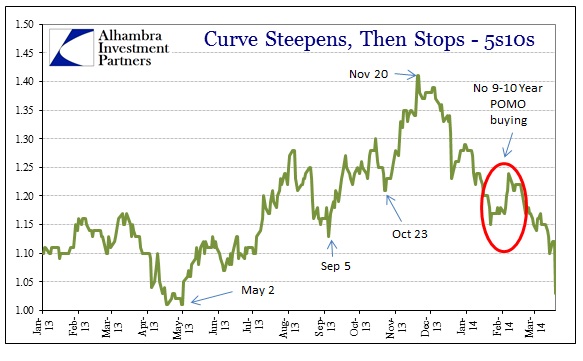

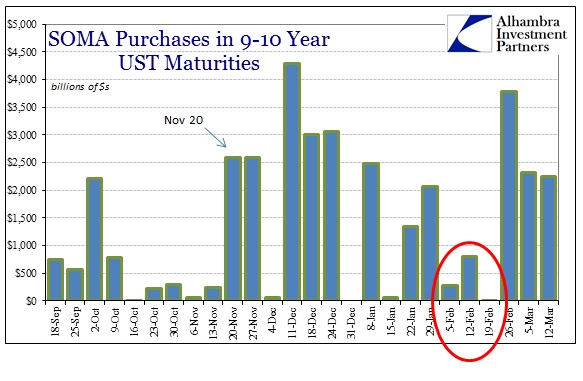

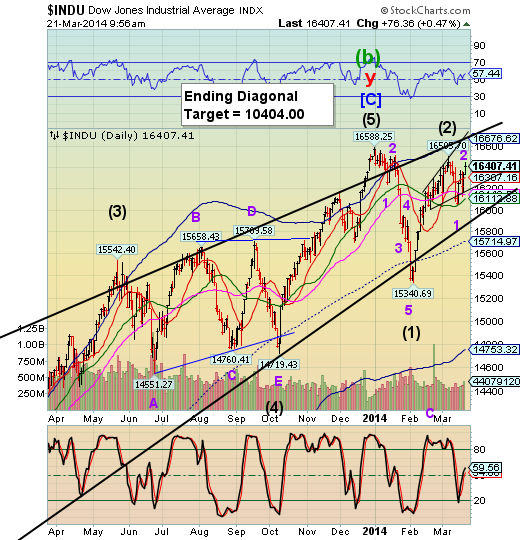

I think that applies as well to the yield curve shape (not unlike the eurodollar curve shape recently). The entire frame of the credit selloff between early May 2013 and November 20, 2013, was a sharp steepening in the belly. Then that reversed in one day, in no small part due to the sudden interest of QE POMO in the 9-10 year maturities beginning November 20. The Fed is still buying there, with only a break in February.

Does that explain why the 5-year (where no POMO activity has taken place at all) is taking the greatest beating? Is the Fed, aware of its “need” to “support mortgage finance” trying to influence the curve shape, and thus manifesting more and more confusion? Or, more precisely, have the credit markets become more attuned to guesses about changes in policy rather than anything else?

I don’t think there is a clear answer to any of those questions, but I do think there is something to them. Between the swaps market, minimal changes in eurodollar curves, and the absolute sclerosis in inflation expectations, I cannot help but wonder what would cause such evident seizure, particularly as major policy changes correspond to each of these pieces. However, the commonality in all of it seems to be a hidden wariness that I don’t believe existed prior to last May, meaning credit was lulled into a false sense of security that is only now being appreciated for what it was.