The sign on a bank in Western Oklahoma flashed “Wheat - $8.39” last weekend – a price not seen too often in or around the town of Watonga. And as spring-like temperatures in the 70s started bringing dormant wheat to life following a foot of snow only a week earlier, many growers were at a crossroads.

They pondered whether to move stocker cattle off wheat in early March to promote maximum grain development, or graze them out and cash in on high cattle prices. Grazing those steers to 750 lbs. would likely garner over $1,000 at the sale, based off their anticipated $130/cwt. price. And some good wheat yields could still be achieved. But pulling cattle off and pushing for those premium yields and powerful prices could help growers make up for those harvesttime 2010 sales at near $4/bu. before the market surged to $7 and beyond.

It’s a decision many growers make every year, but rarely are prices for wheat, other grains, cattle, hogs, cotton and just about every other commodity so high all at the same time. Wheat prices have remained strong after no changes were made earlier this month in the overall U.S. wheat supply-demand balance sheet for marketing year (MY) 2011-2012. That was despite some offsetting export and stocks changes were made in the supply-demand balance sheets for U.S. wheat classes, say economists at Kansas State University.

Ending stocks and ending stocks-to-use of U.S. wheat for MY 2010-2011 were projected to be 818 million bushels. The U.S. stocks-to-use projection is markedly higher than the 60-year-low in MY 2007-2008 of 13%. Projected U.S. hard red winter wheat and white wheat exports for MY 2010/2011 were raised 10 million bushels, while hard red spring wheat exports were reduced 20 million.

USDA projects wheat cash prices in the U.S. to be in the $5.60-5.80 range for MY 2010-2011, up 10¢ on the lower end. So that $8.39 on the Watonga, OK, bank sign reads pretty well. Other than deciding when to pull stockers off wheat pasture, growers must also decide when to make preharvest sales.

Melvin Brees, economist at the University of Missouri Food and Agriculture Policy Research Institute (FAPRI), regularly advises growers to monitor their profit potential for making sales when grain prices are strong. He points out that like with wheat, new-crop cash bids at most Missouri (and Midwestern) locations are also well above these early 2011-2012 average price projections for corn and soybeans.

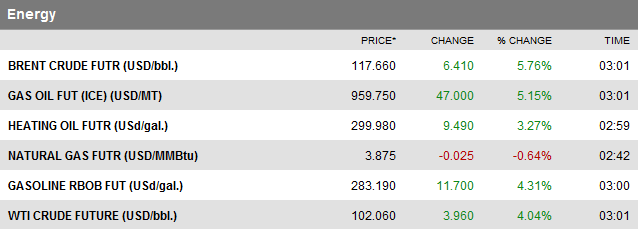

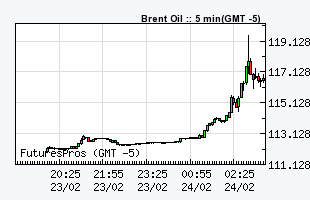

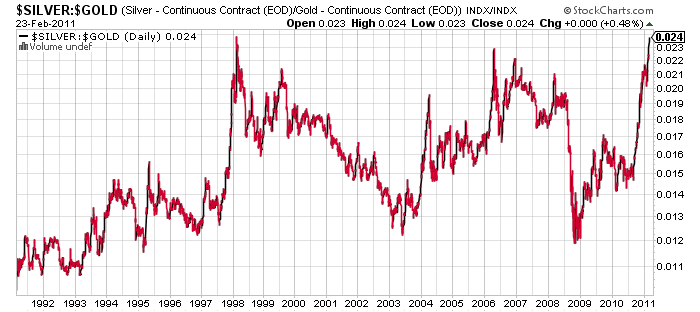

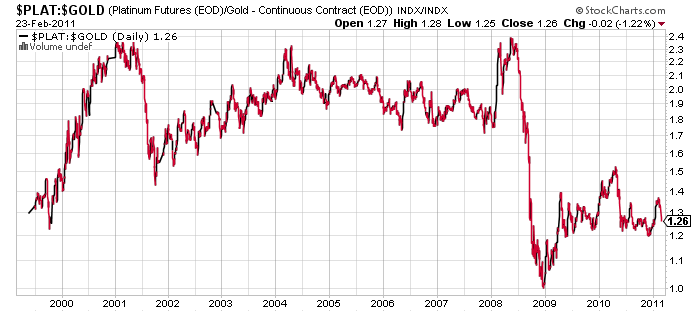

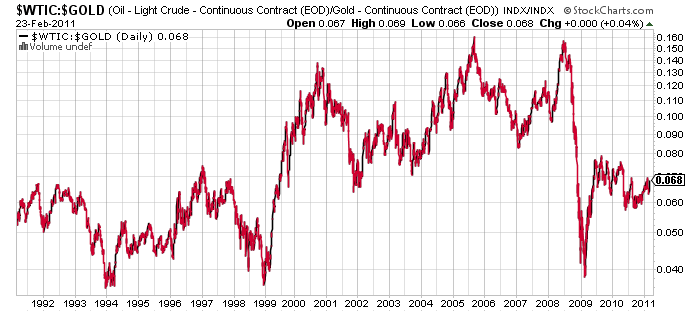

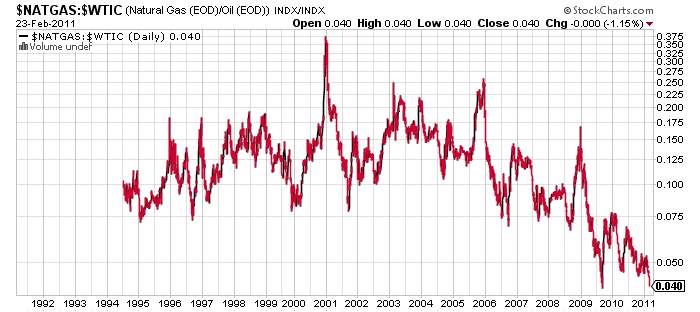

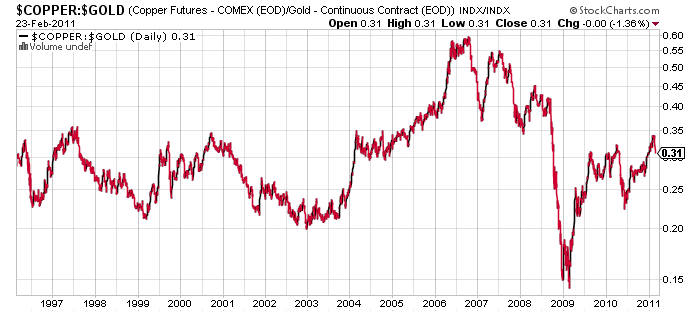

“This suggests that, although prices seem headed higher, there is downside price risk as well,” says Brees. “Many other factors could contribute to price risk. These include energy prices, dollar value, economic conditions, policy decisions, etc. along with foreign political unrest, livestock disease outbreaks and other disasters to name a few. This creates a complex environment for managing price risk.”

Darrel Good, University of Illinois agricultural economist points out that domestic wheat stocks at the end of the current marketing year (May 31, 2011) are expected to be relatively large, accounting for 33.6% of expected use during the current marketing. In addition, winter wheat seedings were reported to be 3.7 million larger than seedings in the fall of 2009, he says.

“Even though the hard red winter wheat crop is not in good condition, there is potential for an adequate crop in 2011 with more favorable spring weather,” says Good, in his farmdoc outlook this week. “Furthermore, wheat is produced in large quantities in a number of countries so there is opportunity for foreign production to rebound from the depressed level of the past year.

“Under more favorable spring weather conditions, for example, wheat seedings in Canada could rebound from the low level of 2010. Russian wheat production was also depressed in 2010 due to severe drought conditions.”

So a lot can happen to impact wheat prices this spring and summer. In fact, they took a 50¢ or better dive this week, possibly due to the recent snowfall over dry fields. No matter what decision growers make on pulling cattle off wheat to maximize grain development, or take advantage of high cattle prices and high wheat prices even with reduced yield from grazed pasture, price volatility remains enormous.