By Jeff Wilson

U.S. soybean farmers are planting a record crop that’s poised to double domestic reserves and expand a global surplus after last year’s drought drove prices to an all-time high.

Stockpiles at the end of August 2014 will have gained 116% to 7.29 million metric tons in 12 months, according to the average of 30 analyst estimates compiled by Bloomberg. U.S. production will jump 12% to 91.74 million tons, adding almost enough extra supply to feed India for a year. The U.S. government updates its estimates tomorrow. Jefferies Bache LLC expects November futures traded in Chicago to plunge 26% to $9.88 a bushel by Oct. 1, when harvesting peaks.

Soybeans, which rose to a record $17.89 during the 2012 drought in the U.S., are now in a bear market along with corn and wheat. The surge from as low as $4.985 in 2005 spurred farmers worldwide to add acreage, increasing supply and keeping the $1.14 trillion global food-import bill in check. Producers in Brazil and Argentina reaped the most soy ever in early 2013, capping a 54% expansion in combined output in a decade.

“We are going from a barren cupboard to abundant supplies in a very short time,” said Dan Basse, the Chicago-based president of AgResource Co., which sells its agricultural research to clients in 81 countries. “Seven years of extremely high prices has spurred global production that will lead to several years of rising supplies and lower prices.”

Top Commodity

While soybeans are now 26% below the record reached in September, the cost of supply for delivery before the harvest has been rising. The July contract rose 10% since the end of April, the most among the 24 commodities tracked by the Standard & Poor’s GSCI Index, which slid 0.3%. The MSCI All-Country World Index of equities fell 1.5% and a Bank of America Corp. index showed Treasuries lost 2.3%.

July futures traded at a $2.08 premium to the November contract, up from $1.6375 on May 1. The gap may widen to $3 next month on prospects for a glut after harvests in the Northern Hemisphere, Basse said.

Global soybean production will jump 6.1% to a record 285.5 million tons this year, while demand rises 4.4% to 270.18 million, according to the U.S. Department of Agriculture, which updates its forecasts at noon tomorrow in Washington.

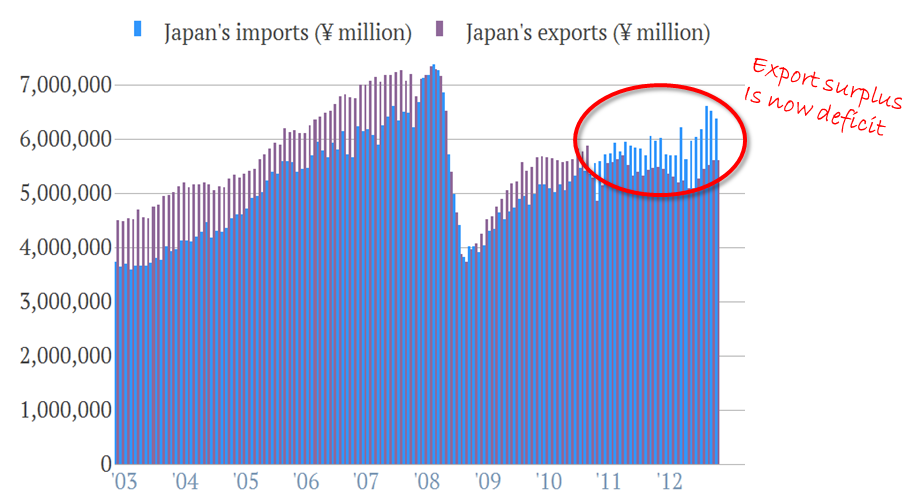

Brazil unseated the U.S. as the biggest grower in the last harvest, producing about 1.44 million tons more, USDA data show. That will reverse this season as rebounding U.S. output exceeds the 85 million tons that Brazilian farmers are forecast to collect in February, the USDA estimates.

Weather Risk

With the U.S. harvest still four months away and about a third of Midwest fields unplanted, unusual weather may yet limit output. In each of the previous two years, the USDA’s forecasts in June were higher than the final tally seven months later.

Wet, cold weather the past two months from North Dakota to Illinois is increasing risk of lower yields, said Gregg Hunt, an analyst at Archer Financial Services Inc. in Chicago. Planting is off to the slowest start since 1996, with 71% complete on June 9, compared with a five-year average of 84% USDA data show. Unless there is drier weather farmers may decide to leave fields fallow, he said.

About 17.67 inches (44.9 centimeters) of rain fell in Iowa, the biggest U.S. producer, from March 1 through May 31, the most in state records that began in 1873. MDA Information Systems LLC in Gaithersburg, Maryland, said last week that late planting and rising crop-insurance claims will force the USDA to cut its output forecast.

Hedge Funds

Soybean prices jumped 7.9% in May, the biggest gain in 10 months, on concern that U.S. supplies will remain tight before the harvest. Hedge funds and other largest speculators boosted bets on a rally for four consecutive weeks and to the highest in almost seven months, U.S. Commodity Futures Trading Commission data show.

Farmers are holding onto inventories and costs for livestock feed are still rising, Joe F. Sanderson Jr., the founder of Laurel, Mississippi-based Sanderson Farms Inc., the third-largest U.S. poultry producer, told analysts on a conference call June 4. Soybeans are crushed to yield oil used for food and meal used in feed.

Supply may be disrupted by a strike in Argentina, where farmers plan to suspend trade for at least seven days, Eduardo Buzzi, the head of the Argentine Agrarian Federation, said in an interview with Radio Mitre on June 9. The growers are protesting tax increases, government policies and a lack of railways.

Lower Forecasts

Soybeans will average $11.75 in 2013-2014, 16% less than in the previous season, Deere & Co., the world’s largest agricultural-equipment maker, forecast May 15. The Moline, Illinois-based company was anticipating $12.50 in February. Rabobank International expects a fourth-quarter average of $11.75, or 11% less than now.

“The decline in prices in the second half of 2013 could be significant if weather conditions are near normal or even slightly unfavorable,” because output will jump, Goldman Sachs Group Inc. analysts said yesterday in an e-mailed report.

Worldwide soybean inventories will rise 19% to 74.04 million tons in the 12 months ending in September 2014, the biggest pre-harvest reserve ever, according to the average of 16 analyst estimates compiled by Bloomberg.

Price Cure

“The cure for high prices, as the commodities-market adage goes, is high prices,” Greg Page, the chief executive officer of Cargill Inc., wrote in a column for Bloomberg View on May 30. The Minneapolis-based company dominates U.S. grain handling along with Bunge Ltd. and Archer-Daniels-Midland Co. U.S. farm income rose 14% to $128.2 billion last year as prices surged and insurers made record payouts for ruined fields.

Global food costs retreated for the first time in four months in May, the United Nations’ Food & Agriculture Organization estimates. Prices are now 9.5% below the record reached in February 2011, the Rome-based agency says.

Rising prices for U.S. supply will drive more buyers to South America, said Doug Jackson, a vice president at INTL FCStone Inc. in West Des Moines, Iowa. Shipments from New Orleans cost $1.265 a bushel more than in Paranagua, Brazil on June 7, according to data from the USDA and Sao Paulo-based broker Ary Oleofar Corretora de Mercadorias. They were at a 15- cent discount a year ago.

Export Cancellations

U.S. exporters reported more cancellations than new sales in three of the past seven weeks and shipments are at their lowest for this time of year since 2004, USDA data show. China, the biggest buyer, imported 3.4% less in May than a year earlier and has been canceling purchases from the U.S. for delivery before Aug. 31 as it shifts purchases to cheaper supplies in South America. Brazil’s shipments were a record in May, customs data show.

“The pace of Brazilian exports is very strong and will slow demand for U.S. soybeans,” said Anne Frick, the senior oilseed analyst for Jefferies Bache in New York. “We have plenty of global supplies.”