Driving copper’s interim movements are a confluence of fundamental, technical, and sentimental drivers. And provocatively one of the stickiest in recent years is the flagship S&P 500 stock index (SPX). As irrational as it sounds, there’s no denying the SPX’s influence on copper’s fortunes since early 2009.

Interestingly the catalyst for copper’s linkage to the SPX was 2008’s once-in-a-century stock panic. Prior to the panic copper’s main price drivers tended to be more fundamentally based, supply and demand. But with the panic’s splash damage causing a devastating 69% selloff in this metal, fundamentals essentially went out the door.

At its panic nadir copper was so fundamentally undervalued that its recovery would glom on to the greater stock-market recovery. And for the SPX that recovery commenced following its secondary low in March 2009. By that time the selling was finally exhausted. And when sentiment turned, it was open season on any and all assets that had been pummeled during the panic.

As you can see in this chart, the SPX (red) powered higher in an initial upleg that led to a near double in only about a year. Risk was also on, with the speculators putting big capital to work in the commodities realm. Copper (blue) was of course a huge beneficiary, and it easily outpaced the SPX’s gains over this same stretch.

Following a mid-2010 correction the SPX again powered higher, resuming its recovery turned cyclical bull market. And through the first half of 2011 it achieved numerous post-panic highs. So what did copper do amidst this SPX climb? Yep, you guessed it, it followed in the SPX’s steps. Not only did it deliver its own post-panic highs, copper’s February 2011 apex was an all-time nominal high.

What I really want to bring attention to over this stretch is the correlation between the SPX and copper. And this correlation is apparent not only visually, but mathematically. From the SPX’s March 2009 low to the end of August 2011 the SPX and copper had a super-high correlation of 0.966, yielding an r-square of 93.3%. This means that 93% of the daily behavior of copper’s price could be explained by the daily movement of the SPX. Copper was slave to the SPX for well over two years!

Beginning in September 2011 this correlation started to soften. While the SPX was consolidating following a strong correction, commodities continued to correct in a brutal selloff sparked by economic fears in Europe and a Fed head-fake here in the US. And copper, being an economically-sensitive metal, got crushed to its September low.

When the beat down was finally over copper fell back in tow with the SPX, for the most part. And as you can see in this chart, the SPX’s strong influence over copper persisted essentially through the end of 2012. Though it didn’t achieve new highs like the SPX, nor was the mathematical correlation as tight, the directionality was quite harmonious.

Going into 2013 it wasn’t too much of a concern that copper wasn’t hitting new highs. In a generally weak environment for commodities, copper was still 19% higher than its 2011 low while still being at high levels historically. But as you can see, 2013 hasn’t been kind to this metal. And it is not because the SPX has been dragging it lower. In fact, with the SPX powering higher there’s been a clear disconnect of this multi-year relationship.

This disconnect is obviously quite curious. And it of course begs the question, why did it happen? Naturally there’s been a flurry of speculation tossed around, from copper’s bull market being over to the SPX leaving everything else in the dust as it floats on pure hubris. Ultimately there’s countless ways to rationalize what’s been happening, but I believe there’s one fundamental driver that can shoulder a lot of the blame for copper’s fall, LME stockpiles.

The London Metal Exchange is the world’s premier non-ferrous metals exchange, where over 80% of global non-ferrous business is conducted. And in addition to providing a market for trade and pricing, the LME manages a global network of warehouses that stores the physical metal.

This storage is quite important as not only does it serve to fulfill redeemed contracts, but it offers a place of refuge for excess supply. Now since most of the copper that’s mined is shipped directly to the end user following refinement, the volume that flows through the LME warehouses is quite insignificant as far as the global trade goes. But though this warehoused supply is small, it is vitally important as a buffer between producers and consumers.

LME stockpile levels are also important as they give traders an idea about the economic balance of the copper market. Low and/or declining stockpiles indicate tighter supply, whereas high and/or rising stockpiles indicate excess supply due to overproduction and/or falling demand.

Naturally these factors can have a big influence on price. And thanks to the LME’s ability to track stockpile levels on a real-time basis, we have a unique and accurate fundamental read on copper’s economic balance. And a quick peek at current stockpile levels puts the copper-SPX disconnect in perspective.

To provide some context, over the last 5 years copper has been consumed globally at an average rate of about 53k metric tons per day. So LME stockpile levels at 530k metric tons is equivalent to 10 days’ worth of copper. And while 10 days of supply is most certainly not bull-ending copper-coming-out-of-our-ears levels, it hardly represents a tight economic balance.

What is tight is anything less than about 5 days. And provocatively LME stockpiles were in this danger zone for 4+ years leading into the panic. In fact, back in 2005 alarmingly-low LME stockpiles of only about one day’s worth of supply is what triggered copper to break out to new all-time highs.

To show how much of a price driver LME stockpile levels can be, check out the inverse correlation in the several years leading up to the panic. During this time the miners were struggling to keep up with demand, resulting in stockpiles fluctuating between 2 to 4 days’ worth of supply. As stockpiles approached support, prices would rise. And as they approached resistance, prices would ease. But this relationship that sported a strong correlation r-square of 73% was blasted apart by the infamous stock panic.

With the world coming to an end, the miners suddenly had a harder time finding buyers, which prompted more delivery to the LME warehouses. LME stockpile levels thus skyrocketed in unison with copper’s plunge. And ultimately the global economic uncertainty spawned by this panic would really throw levels out of whack in the subsequent years.

Overall it’s probably a good thing copper hitched to the SPX wagon following the panic. If it didn’t, and stuck with its classic LME stockpile correlation, its price wouldn’t have had nearly the run due to the appearance that there was an ongoing ease on the economic imbalance that had strained supply.

Interestingly higher sustained stockpile levels following the panic build is partly a consequence of consumer-level inventory management. Given the economic uncertainty manufacturers tightened inventories, either voluntarily or because they had to considering the lack of available credit.

Also veiled by the post-panic rise of LME stockpile levels was the true state of the copper market, which according to the International Copper Study Group (ICSG) still sported bullish near-term fundamentals. Interestingly from 2009 to 2012 world refined copper production (of which about 85% comes from mining) fell short of meeting usage by 817k metric tons. The copper market was actually in a supply deficit.

Though LME stockpiles didn’t decisively fall under that 5-day inventory threshold that starts worrying traders, they did trend down following the panic build. And even though copper was still glued to the SPX, this downtrend no doubt supported copper’s higher prices.

Also supporting copper on the fundamental front was the fact that world refined copper usage hit successive record highs in 2010, 2011, and 2012 (20.5m metric tons). We didn’t hear much about this from the mainstream media amidst the tub-thumping of their anti-commodities campaign!

This brings us to 2013. And it doesn’t take a rocket scientist to see why copper has disconnected from the SPX. Since their low in October, LME copper stockpiles have soared a whopping 191% to this week. Copper’s producers have pumped 403k metric tons of the metal into LME warehouses in just over 7 months.

This is a major build, the likes of which has only been seen once in copper’s entire bull market. This other build was of course the panic build, and by quantity it only measured a smidgen higher at 439k metric tons. At 614k metric tons today, LME copper stockpiles hold nearly 12 days’ worth of supply. This also represents the highest absolute level in a decade.

Again these are not death-defying levels that alone would signify a bull-ending structural shift. But they are enough to demonstrate a slackening of the tight balance we’re used to seeing. And this fundamental slackening is justification for an ease in copper’s price.

And ease is exactly what copper’s price has done. Copper has disconnected from the SPX’s melt-up to reunite with its old flame, LME copper stockpiles. So now the question begs, what can we expect for copper going forward? Unfortunately, its near-term outlook is pretty grim the way I see it.

The good news is the ICSG forecasts record refined copper usage in both 2013 (20.6m mt) and 2014 (21.4m mt). The problem is this record usage is expected to scrub up with record production (21.2m mt in 2013 and 22.3m mt in 2014) that will push the balance back to a surplus. And a surplus of 1.1m mt will easily offset the shortage seen in the previous few years.

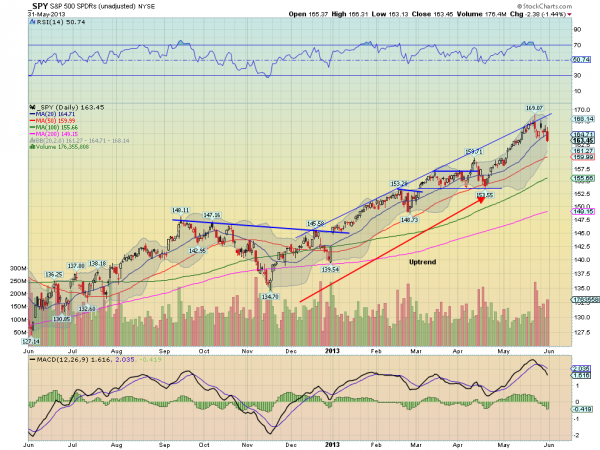

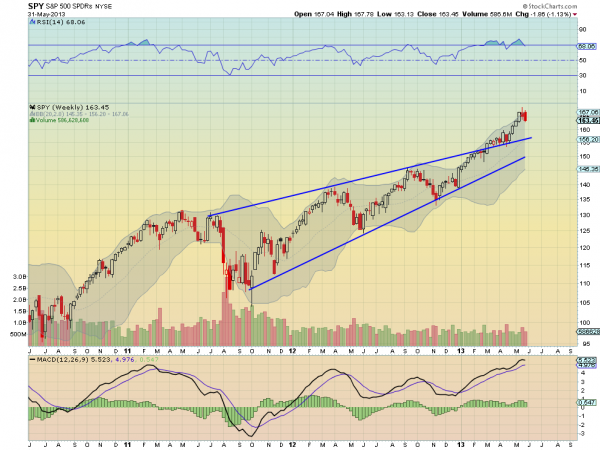

Copper will also likely face downside pressure from an SPX selloff. The stock markets are currently hitting a myriad of technical and sentimental extremes that are only seen at major toppings. And they are well overdue for a major correction.

Copper already has that correlation history with the SPX. And if sliding stock markets face no fundamental resistance, copper will most certainly experience compounded selling pressure. Not much else diminishes confidence in the economy faster than falling stock markets, and this could spawn the perfect storm for economically-sensitive copper.

It’ll be interesting to see if a perceived or righteous weakening economy will finally reverse the upward trend on usage. And if usage indeed goes down and prices stay weak, this will eventually have an adverse effect on mine production as the miners would naturally have a harder time finding buyers (higher-cost producers that have come online in recent years would also face pinched economics).

Overall I suspect we’ll see a myriad of drivers tossing this metal around at least for the near term, with the biggest still being LME stockpiles and the SPX. And given copper’s forecasted production surplus coupled with an imminent SPX correction, we’ll almost certainly see a weaker copper price.

At Zeal we’ve long been bullish on copper and have made a lot of money for our subscribers over the years going long on its miners. And we continue to be bullish on this indispensable industrial metal’s long-term outlook. But in the interim there are just too many bearish factors pitted against it.

In our eyes it’s going to be a rough road ahead as nearly all sectors follow the SPX down. And copper along with most other commodities will hardly be immune to the selling pressure. But we do believe there is one sector that will thrive when most others are struggling, the precious metals.

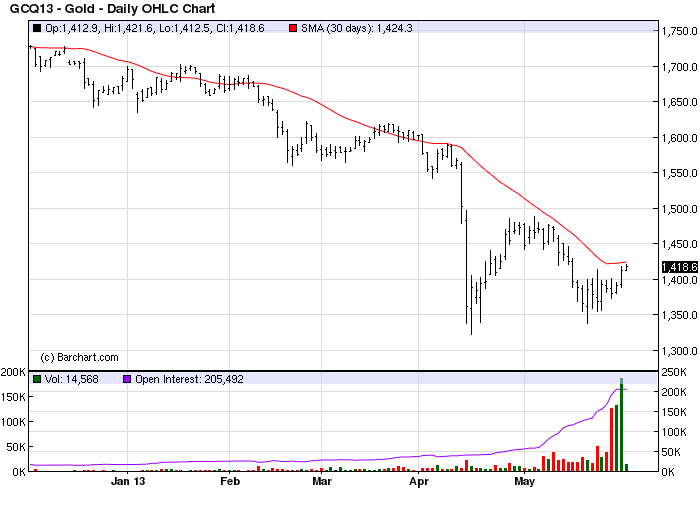

The stars are currently aligned for the precious metals and their stocks to soar. This sector’s fundamentals and technicals are wildly bullish. And for a contrarian there couldn’t be a better sentimental setup to support a reversal of fortunes.

At Zeal we’ve been loading up on elite gold and silver stocks in our acclaimed weekly and monthly newsletters. If you’d like to see which ones we’re recommending to our subscribers, get your subscription today! And if you’d like detailed fundamental profiles on the stocks we own as well as a select group of other high-potential gold/silver miners that we believe will lead the charge, our wildly popular research reports are currently available at a discount.

The bottom line is following several years of copper moving in tandem with the SPX, 2013 has brought about a decisive disconnect. While the SPX continues to melt up, copper has trended well to the downside. And this disconnect was sparked by the rekindling of an old pre-panic relationship.

Soaring LME stockpiles have taken pressure off what’s been a tight economic balance. And copper’s price could face more headwinds via an imminent SPX correction as well as a forecasted supply surplus over the next couple years. Copper’s and stocks’ misfortunes should however open the door for precious metals to shine as investors seek alternatives.

By: Zeal_LLC

Anybody halfway attuned to the markets knows that copper has been a 21st-century rock star. No longer just a boring industrial metal, copper is a flamboyant asset that has made fortunes for investors and speculators. It’s soared a staggering 662% from its 2001 low to 2011 high. And still today in the $3.25 region copper is nearly four-fold its 20-year pre-bull-market average.

Copper’s journey has of course played out under an umbrella of structurally strong fundamentals, but by no means has it been a lucid and linear trek. Copper is a commodity after all, and volatility comes with the territory. Over the last dozen years it’s seen wildly exuberant uplegs as well as crushing selloffs.

See the original article >>