by Tyler Durden

It may be ironic that one of the best and most comprehensive critiques of central bank policy comes from none other than Raghuram Rajan: a visiting professor for the World Bank, Federal Reserve Board, and Swedish Parliamentary Commission, he is the former chief economist of the International Monetary Fund, and currently the chief economic adviser to the government of India. Then again it should not be ironic: Rajan, as the ultimate insider in the dark corridors of the centrally planned New Normal, really gets it, unlike the vast majority of his ivory tower economist peers.

Already a recognized authority on these pages as one of the very few people who understands how shadow banking operates, we were happy to read his recent BIS speech "A step in the dark: unconventional monetary policy after the crisis", which is must read for all Congressmen (and for everyone else) ahead of tomorrow's appearance by Bernanke on the Hill for the first round of hiw Humphrey Hawkins presentation: it is a walk through for everything that central banks may (and are) wrong about although being part of the system, Rajan's diplomatic finesse lays it out in far more politically correct terms.

Consider this brilliant argument for why not only has Bernanke rendered Congress and the entire democratic apparatus meaningless, and hence why tomorrow's presentation is merely a travesty, but why it is central banks, controlled not by the people but by a syndicate of private banks, that truly run the show:

Perhaps the success that central bankers had in preventing the collapse of the financial system after the crisis secured them the public's trust to go further into the deeper waters of quantitative easing. Could success at rescuing the banks have also mislead some central bankers into thinking they had the Midas touch? So a combination of public confidence, tinged with central-banker hubris could explain the foray into quantitative easing. Yet this too seems only a partial explanation. For few amongst the lay public were happy that the bankers were rescued, and many on Main Street did not understand why the financial system had to be saved when their own employers were laying off workers or closing down.

If nothing else, after reading Rajan's thought below at least it will allow for some more intelligent questions if not answers.

A step in the dark: unconventional monetary policy after the crisis

by Raghuram Rajan, via BIS

I am honored to be invited to give the first Andrew Crockett Memorial Lecture at the Bank for International Settlements (BIS). Sir Andrew Crockett was the General Manager of the BIS from 1 January 1994 until 31 March 2003. During this time, he led the Bank through a period of considerable change. In particular, he strongly encouraged the expansion of BIS membership beyond its traditional, mostly European, base. Earlier than most, he saw that multilateral organizations needed to change to stay relevant. But perhaps his most prescient act was the speech he gave on February 13, 2001 entitled "Monetary Policy and Financial Stability".

In it he argued

"the combination of a liberalised financial system and a fiat standard with monetary rules based exclusively in terms of inflation is not sufficient to secure financial stability. This is not to deny that inflation is often a source of financial instability. It certainly is... ...Yet the converse is not necessarily true. There are numerous examples of periods in which the restoration of price stability has provided fertile ground for excessive optimism. ..."

He went on

"If an absence of inflation is not, by itself, sufficient to ensure financial stability...to what can we look to contain their build-up? The answer is, of course, prudential regulation. However, the tools of prudential regulation are themselves based on perceptions of risk which are not independent of the credit and asset price cycle. If prudential regulation depends on assessments of collateral, capital adequacy and so on, and if the valuation of assets is distorted, the bulwark against the build-up of financial imbalances will be weakened."

In these few paragraphs, Andrew Crockett summed up what has taken many of us an entire global financial crisis and years of research to learn. The paper is only 7 pages long but contains many gems that have guided the very active research program at the BIS and formed the basis of numerous papers that have been written since the crisis. The superb research team at the BIS, including Claudio Borio, Bill White, and many others, carried on the research program laid out in Andrew Crockett's speech. It is too bad that the policy establishment paid little attention to them before the global financial crisis of 2007-2012. We must ensure we do not neglect the wisdom of Andrew Crockett and his team once again.

Central bankers today have given us many reasons to go back to Andrew Crockett's speech. In the talk today, I want to go over their new tools, which come under the rubric "Unconventional Monetary Policies". Much of the time, I will be exploring the contours of what we don't know, asking questions rather than providing answers. But let us start at the beginning, to the deeper underlying causes of the recent financial and sovereign crisis in the United States and Europe. By its very nature, this has to be speculative.

The Roots of the Crisis

Two competing narratives of the sources of the crisis, and attendant remedies, are emerging. The first, and the better known diagnosis, is that demand has collapsed because of the high debt build up prior to the crisis. The households (and countries) that were most prone to spend cannot borrow any more. To revive growth, others must be encouraged to spend - surplus countries should trim surpluses, governments that can still borrow should run larger deficits, while thrifty households should be dissuaded from saving through rock bottom interest rates. Under these circumstances, budgetary recklessness is a virtue, at least in the short term. In the medium term, once growth revives, debt can be paid down and the financial sector curbed so that it does not inflict another crisis on the world.

But there is another narrative. And that is that the fundamental growth capacity in industrial countries has been shifting down for decades now, masked for a while by debt-fuelled demand. More such demand, or asking for reckless spending from emerging markets, will not put us back on a sustainable path to growth. Instead, industrial democracies need to improve the environment for growth.

The first narrative is the standard Keynesian one, modified for a debt crisis. It is the one most government officials and central bankers, as well as Wall Street economists, subscribe to, and needs little elaboration. The second narrative, in my view, offers a deeper and more persuasive view of the blight that afflicts our times. Let me flesh it out a bit. 2

The 1950s and 1960s were a time of strong growth in the West and Japan. A number of factors, including rebuilding from wartime destruction, the resurgence of trade after the protectionist 1930s, the rolling out of new technologies in power, transport, and communications across countries, and the expansion in educational attainments, all helped industrial countries grow. But as Tyler Cowan has argued in his book, The Great Stagnation, when these "low hanging fruit" were plucked, it became much harder to propel growth from the 1970s onward.

In the meantime, though, as Wolfgang Streeck writes persuasively in the New Left Review, when it seemed like an eternity of innovation and growth stretched ahead in the 1960s, democratic governments were quick to promise away future growth to their citizens in the form of an expanded welfare state. As growth faltered though, this meant government spending expanded, even while government resources shrank. For a while, central banks accommodated that spending. The resulting high levels of inflation created widespread discontent, especially because little growth resulted. Faith in Keynesian stimulus diminished, though the high inflation did reduce public debt levels.

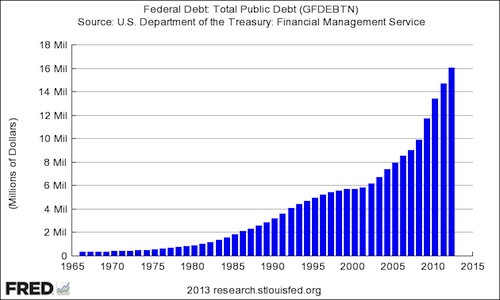

Central banks started focusing on low and stable inflation as their primary objective, and increasingly became more independent from their political masters. Government deficit spending, however, continued apace, and public debt as a share of GDP in industrial countries climbed steadily from the late 1970s, this time without the benefit of unexpected inflation to reduce its real value.

Recognizing the need to find new sources of growth, the United States towards the end of Jimmy Carter's term, and then under Ronald Reagan, deregulated industry and the financial sector, as did Margaret Thatcher's United Kingdom. Competition and innovation increased substantially in these countries. Greater competition, freer trade, and the adoption of new technologies, increased the demand for, and incomes of, highly skilled, talented, and educated workers doing non-routine jobs like consulting. More routine, once well-paying, jobs done by the unskilled or the moderately educated were automated or outsourced. So income inequality emerged, not primarily because of policies favoring the rich, but because the liberalized economy favored those equipped to take advantage of it.

The short-sighted political response to the anxieties of those falling behind was to ease their access to credit. Faced with little regulatory and supervisory restraint, sometimes based on the faith that private incentives worked best in this best of all worlds, the financial system overdosed on risky loans to lower middle class borrowers, aided and abetted by very low policy interest rates.

Continental Europe did not deregulate as much, and preferred to seek growth in greater economic integration. But the price for protecting workers and firms was slower growth and higher unemployment. And, while inequality did not increase as much as in the US, job prospects were terrible in the Euro periphery for the young and unemployed, who were left out of the protected system.

The advent of the euro was a seeming boon, because it reduced borrowing costs and allowed countries to create jobs through debt-financed spending. The crisis ended that spending, whether by national governments (Greece), local governments (Spain), the construction sector (Ireland and Spain), or the financial sector (Ireland). Unfortunately, spending pushed up wages, especially but not exclusively in the non-traded sectors like government and construction. Without a commensurate increase in productivity, the heavy spenders became increasingly uncompetitive and indebted and started running large trade deficits.

Of course, it did not seem at that time that countries like Spain, with its low public debt and deficits, were overspending. But as Andrew Crockett foresaw, the boom masks lending problems. Spanish government revenues were high on the back of the added activity and the additional taxes, and so spending seemed moderate. However, if spending was adjusted for the stage of the cycle, it was excessive. 3

The important exception to this pattern was Germany, which was accustomed to low borrowing costs even before it entered the Eurozone. Germany had to contend with historically high unemployment, stemming from reunification with a sick East Germany. In the euro's initial years, Germany had no option but to reduce worker protections, limit wage increases, and reduce pensions as it tried to increase employment. Germany's labor costs fell relative to the rest of the Eurozone, and its exports and GDP growth exploded. Germany's exports, at least in part, were taken up by the spending Euro-periphery.

Eventually, the financial crisis starting in 2007 brought debt-fueled growth to an end. The United States and Europe fell into recession, in part because debt-fueled demand disappeared, but also because it had a multiplier effect on other sources of demand.

The Case for Unconventional Monetary Policies

The crisis was devastating in its impact. Entire markets collapsed, depositors lost confidence in even the soundest banks, and over time, started losing faith in the debt of weak sovereigns. For the financial economist, perhaps the most vivid demonstration of the depth of the problems in the financial sector was that standard arbitrage relationships such as covered interest rate parity started breaking down. 4 There was money to be had without risk - provided one could borrow! And few could. The real economy was equally devastated. For a while, as economist Barry Eichengreen has pointed out, the downturn in economic activity tracked developments during the onset of the Great Depression.

Hindsight is 20-20. It now seems obvious that central banks should have done what they did then, but in many ways, the central banks were making it up as they went. Fortunately for the world, much of what they did was exactly right. They eased access to liquidity through innovative programs such as TALF, TAF, TARP, SMP, and LTRO. By lending long term without asking too many questions of the collateral they received, by buying assets beyond usual limits, and by focusing on repairing markets, they restored liquidity to a world financial system that would otherwise have been insolvent based on prevailing market asset prices. In this matter, central bankers are deservedly heroes in a world that has precious few of them.

If they are to be faulted at all on the rescue, perhaps it is that the repair the central bankers effected was too subtle for some. Conditional on the illiquid conditions, the financial system received an enormous fiscal subsidy - if central bank actions such as guarantees and purchases had not worked out, the tax payer would have been hit with an enormous loss if matters did not improve. But conditional on repairing the system, the subsidy seemed small. Not surprisingly, rescued bankers (and rescued countries) felt somewhat aggrieved when the rescuers expected them to change their behavior. Instead, the public saw large banker bonuses return, and banker attitudes that implied the rescue was a great investment opportunity conferred on the rescuers. No wonder bankers today, and unfortunately, have a social status somewhere between that of a pimp and a conman. I say unfortunately, because more than ever, the world needs good banking to promote growth.

Be that as it may, the second stage of the rescue was to stimulate growth with ultra-low interest rates. And thus far, the central banks have been far less successful. Let us try and understand why.

The Keynesian Explanation and an Alternative

According to the most influential Keynesian view, the root cause of continued high unemployment and a slow recovery is excessively high real interest rates. The logic is simple. 5 Before the financial crisis erupted in 2008, consumers buoyed US demand by borrowing heavily against their rising house prices. As the crisis hit, these heavily indebted households could not borrow and spend any more.

An important source of aggregate demand evaporated. As indebted consumers stopped buying, real (inflation-adjusted) interest rates should have fallen to encourage hitherto thrifty debt-free households to spend. But real interest rates did not fall enough, because nominal interest rates cannot be reduced below zero - the so-called zero lower bound became a constraint on growth. 6

The Keynesian explanation suggests that the full-employment equilibrium real interest rate in the post-crisis over-leveraged world - the so-called neutral rate -- should be strongly negative. This has been the justification for central banks to employ innovative policies to try and achieve ultra-low real interest rates. That the low rates do not seem to have enhanced growth rates quickly has only made central bankers even more innovative.

But what if low interest rates do not enhance demand in a post-crisis world beyond a point? While low rates may encourage spending if credit were easy to obtain, it is not at all clear that corporations or traditional savers today will go out and spend. Think of the soon-to-retire office worker. She saved because she wanted enough money to retire. Given the terrible returns on savings since 2007, the prospect of continuing low interest rates might make her put even more money aside. Indeed, in simple models of the kind that the Keynesians propose, the existence of savers who have suffered a loss of savings and have end-of-working-life savings objectives can imply that lower real interest rates are contractionary - savers put more money aside as interest rates fall in order to meet the savings they think they will need when they retire. 7

The point is not that this is a strong argument that ultra-low interest rates will have a net perverse effect but that a crisis potentially creates offsetting effects even on aggregate demand (through a readjustment of savings plans) that make it difficult to argue, based on theory, that strongly negative real interest rates are the right medicine to restore demand. Years of strongly negative real interest rates might contribute only weakly to demand growth.

There are two further problems in the view that a restoration of undifferentiated aggregate demand is the right solution. First, after a debt-fueled boom, the paucity of demand is localized in certain social classes, certain regions, and certain productive sectors. Second, in the years leading up to a debt crisis, it is not only demand that is distorted through borrowing, it is also supply.

To see all this, let us focus for the moment on household borrowing. Before the crisis in the United States, when borrowing became easier, it was not the well-to-do, whose spending is not constrained by their incomes, who increased their consumption; rather, the increase came from poorer and younger families whose needs and dreams far outpaced their incomes. 8 Their needs can be different from those of the rich.

Moreover, the goods that were easiest to buy were those that were easiest to post as collateral - houses and cars, rather than perishables. And rising house prices in some regions made it easier to borrow more to spend on other daily needs such as diapers and baby food.

The point is that debt-fueled demand emanated from particular households in particular regions for particular goods. While it catalyzed a more generalized demand - the elderly plumber who worked longer hours in the boom spent more on his stamp collection - it was not unreasonable to believe that much of debt-fueled demand was more focused. So, as lending dried up, borrowing households could no longer spend, and demand for certain goods changed disproportionately, especially in areas that boomed earlier.

Of course, the effects spread through the economy - as demand for cars fell, the demand for steel also fell, and steel workers were laid off. But unemployment, household over-indebtedness, as well as the consequent fall in demand, as my colleague Amir Sufi and his co-author, Atif Mian, have shown, was localized in specific regions where house prices rose particularly rapidly (and also, I would argue, more pronounced in specific sectors such as construction and automobiles that lend themselves to debt). Hairdressers in Las Vegas lost their jobs because households there skipped on expensive hairdos when they were left with too much debt stemming from the housing bust. Even if ultra-low real interest rates coerce older debt-free savers to spend more, it is unlikely that there are enough of them in Las Vegas or that they want the hairdos that younger house buyers desired. And if these debt-free savers are in New York City, which did not experience as much of a boom and a bust, cutting real interest rates will encourage spending on haircuts in New York City, which already has plenty of demand, but not in Las Vegas, which has too little. 9

Similarly, one could argue that even healthy firms do not invest in the bust, not because they face a high cost of capital, but because there is uncertainty about where, when, and how, demand will reappear. In sum, the bust that follows years of a debt-fueled boom leaves behind an economy that supplies too much of the wrong kind of good relative to the changed demand. Unlike a normal cyclical recession, in which demand falls across the board and recovery requires merely rehiring laid-off workers to resume their old jobs, economic recovery following a lending bust typically requires workers to move across industries and to new locations because the old debt-fueled demand varied both across sectors and geographically, and cannot be revived quickly. 10

There is thus a subtle but important difference between the debt-driven demand view and the Keynesian explanation that deleveraging (saving by chastened borrowers) or debt overhang (the inability of debt-laden borrowers to spend) is responsible for slow post-crisis growth. Both views accept that the central source of weak aggregate demand is the disappearance of demand from former borrowers. But they differ on solutions.

The Keynesian wants to boost demand generally. He believes that all demand is equal. But if we believe that debt-driven demand is different, the demand stimulated by ultra-low interest rates will at best be a palliative. There is both a humanitarian as well as economic case for writing down the debt of borrowers when they have little hope of paying it back. 11 Writing down former borrowers' debt may even be effective in producing the old pattern of demand. But relying on the formerly indebted to borrow and spend so that the economy re-emerges is irresponsible. And new borrowers may want to spend on different things, so fueling a new credit boom may be an ineffective (and unsustainable) way to get full employment back. 12

If the differentiated demand that emerged in the boom is hard or irresponsible to recreate, the sustainable solution is to allow the supply side to adjust to more normal and sustainable sources of demand. Some of that adjustment is a matter of time as individuals adjust to changed circumstances. And some requires relative price adjustments and structural reforms that will generate sustainable growth - for example, allowing wages to adjust and creating ways for bankers, construction workers, and autoworkers to retrain for faster-growing industries. But relative price adjustments and structural reforms take time to produce results.

The five years since the crisis have indeed resulted in significant adjustment, which is why a number of countries appear to be recovering. How much of this recovery owes to the varieties of stimulus, we will debate for a long time to come. Much as quacks claim the self-healing powers of the body to common cold for their miracle cures, I have no doubt that some economists will claim the recovery for their favorite brand of stimulus.

What is true is that we have had plenty of stimulus. The political compulsions that abetted the boom also mandated urgency in the bust. Industrial countries that relied on borrowing to speed up growth typically wanted faster results. With the room for fiscal stimulus limited, monetary policy became the tool of choice to restore growth. And the Keynesian argument - that the equilibrium or neutral real interest rate is ultra-low - has become the justification for more and more innovation.

Unconventional Monetary Policies focused on Ultra Low Rates

I have argued that unconventional central bank policies to repair markets and fix institutions worked. Even the European Central Bank's promise to do what it takes through the OMT program to bolster sovereign debt has bought sovereigns time to undertake reforms, though a fair debate could be had on whether this implicit guarantee has a quasi-fiscal element. As we have seen earlier, it is the central bank's willingness to accept significant losses contingent on its intervention being ineffective that allows it to move the market to a new trading equilibrium where it does not make losses. Many interventions to infuse liquidity have an implicit fiscal element to them and OMT is no exception.

Let us turn now to unconventional monetary policy intended to force the real interest rate very low. 13 As I have argued above, the view that the full employment equilibrium real interest rate is strongly negative can be questioned. Once that is in doubt, the whole program of pushing rates lower as a way of moving the economy back to full employment is also questionable. But I want to move on to focus here on the zero lower bound problem. I will then turn to whether low rates are being transmitted into activity.

Which interest rate is the operative one for influencing economic activity? Clearly, the long term rate matters for discounting asset prices such as stocks and bonds, as well as long term fixed asset investment, while the short term rate affects the cost of capital for entities engaged in maturity transformation. The interest rate channel (where the central bank affects consumption, savings, and investment decisions through the interest rate), the asset price channel (where the central bank aims to alter asset prices and thus household wealth and risk tolerance through interest rates), the credit channel (where the central bank affects the valuation of firm and bank balance sheets and thereby alters the volume of credit) and the exchange rate channel (whereby the central bank affects the exchange rate) all probably work through a combination of short and long rates with varying degrees of emphasis on each part of the term structure. 14

The central bank directly controls the policy rate, and thus the short term nominal rate. The zero lower bound problem stems from its inability to push the short term nominal policy interest rate below zero. Further reductions in the short term real rate will come only if it can push up inflationary expectations.

Because long term nominal interest rates are typically above zero even when the policy rate is zero, the central bank can try to push down long term nominal rates without tampering with inflationary expectations. Of course, an immediate question is why the long term nominal rate stays above zero when the equilibrium long rate is lower. One possible answer is that arbitrage from rolling-over investment strategies using the higher-than-equilibrium expected short rate holds the long rate higher than it should be.

So two strategies of bringing down the nominal long rate present themselves; First, commit to holding the short rate at zero over time even beyond the point when normalizing it would be in order. This is what the Fed calls forward guidance. Second, buy long term bonds thus creating more appetite for the remaining ones in public hands, thus pushing down the long rate. The Fed aims to use its Large Scale Asset Purchase (LSAP) program to take long bonds out of private portfolios with the hope that as they rebalance their portfolios, the price of long bonds (and other assets) will rise and yields will fall. 15 The Bank of Japan wants to add to these strategies by raising inflationary expectations, which is not an explicit objective of the Fed. 16 Neither central bank talks about depreciating the exchange rate as a central objective, though they do not rule it out as a side effect.

One could ask whether these policies should work even theoretically. Forward guidance relies on the central bank being willing to hold down policy rates way into the future below what would otherwise be appropriate - below, for example, that suggested by the Taylor Rule. 1 7 Thus it implicitly implies a willingness to tolerate higher inflation levels in the future. But what ensures such commitment? Will the fear of breaking a prior transparent explicit promise (say to hold policy rates at zero so long as unemployment is above 6.5 percent, inflation is below 2.5 percent, and long term inflationary expectations well anchored) weigh heavily on the governors? Or will they fudge their way out when the time comes by saying that long term expectations have become less well anchored?

Some argue that the source of commitment will be the LSAP itself. The central bank may fear losing value on its bond holdings if it raises rates too early. However, one could equally well argue that it could fear a rise in inflationary expectations if it stays on hold too long, which in turn could decimate the value of its bond holdings. The bottom line is that it is not clear what makes forward guidance credible theoretically, and the matter becomes an empirical one.

And then we have the asset purchase program. If markets are not segmented, a version of the Modigliani Miller Theorem or Ricardian Equivalence suggests that the Fed cannot alter interest rates by buying bonds. Essentially, the representative agent will see through the Fed's purchases. Since the aggregate portfolio that has to be held by the economy does not change, pricing will not change. Alternatively, households will undo what the Fed does. 18 For LSAPs to work, the market must be segmented with some agents being non-participants in some markets. Alternatively, the market must not internalize the Fed's portfolio holdings. As with forward guidance, the effectiveness of LSAPs is an empirical question.

Much of the evidence on the effectiveness of asset purchase programs comes from the first Fed LSAP, which involved buying agency and mortgage backed securities in the midst of the crisis. Fed purchases restored some confidence to those markets (including by signaling that the government stood behind agency debt), and this had large effects on the yields. Event studies document the effects on yields in the following rounds of LSAPs were much smaller. 19

Regardless of the effect Fed purchases may have had on the way in, speculation in May 2013 that it would start tapering its asset purchases led to significant increases in Treasury yields and large effects on the prices of risky assets and cross-border capital flows. This is surprising given the theory, because what matters to the portfolio balance argument is the stock of long term assets in the Fed's portfolio, not the flow. So long as the Fed can be trusted to hold on to the stock, the price of risky assets should hold up. Yet the market seems to have reacted to news about the possible tapering of Fed flows into the market, which one would have thought would have small effect on the expected stock. Either the market believes that Fed implicit promises about holding on to the stock of assets it has bought are not credible, or it believed that flows would continue for much longer than seems reasonable before it was disabused, or we do not understand as much about how LSAPs work as we should!

Given that long term nominal bond yields in Japan are already low, the Bank of Japan's focus has been more directly on enhancing inflationary expectations than on pushing down nominal yields. One of the benefits of the enormous firepower that a central bank can bring to bear is the ability to unsettle entrenched expectations. The shock and awe generated by the Bank of Japan's quantitative and qualitative easing program may have been what was needed to dislodge entrenched deflationary expectations.

The BOJ hopes to reshape expectations more favorably. Direct monetary financing of the large fiscal deficit will raise inflationary expectations. A collateral effect as the currency depreciates is inflation imported through exchange rate depreciation. Nevertheless, the BOJ's task is not easy. If it is too successful in raising inflationary expectations, nominal bond yields will rise rapidly and bond prices will tank. So to avoid roiling bond investors, it has to raise inflationary expectations just enough to bring the long term real rate down to what is consistent with equilibrium without altering nominal bond yields too much. And given that we really do not know what the neutral or equilibrium real rate is, how much inflationary expectation to generate is a matter of guesswork.

The bottom line is that unconventional monetary policies that move away from repairing markets or institutions to changing prices and inflationary expectations seem to be a step into the dark. Of course, central bankers could argue that their bread and butter business is to change asset prices and alter inflationary expectations. However, unconventional policies are assumed to work through different channels. We cannot be sure of their value, even leaving aside the theoretical questions I raised earlier about pushing down the real rate to ultra-low levels as a way to full employment. Let us now turn to their unintended side effects.

The Unintended Effects of Unconventional Policies

Risk Taking and Investment Distortions

If effective, the combination of the "low for long" policy for short term policy rates coupled with quantitative easing tends to depress yields across the yield curve for fixed income securities. Fixed income investors with minimum nominal return needs then migrate to riskier instruments such as junk bonds, emerging market bonds, or commodity ETFs, with some of the capital outflow coming back into government securities via foreign central banks accumulating reserves. Other investors migrate to stocks. To some extent, this reach for yield is precisely one of the intended consequences of unconventional monetary policy. The hope is that as the price of risk is reduced, corporations faced with a lower cost of capital will have greater incentive to make real investments, thereby creating jobs and enhancing growth.

There are two ways these calculations can go wrong. First, financial risk taking may stay just that, without translating into real investment. For instance, the price of junk debt or homes may be bid up unduly, increasing the risk of a crash, without new capital goods being bought or homes being built. This is especially likely if key supports to investment such as a functioning and well capitalized banking system, or policy certainty, are missing. A number of authors point out the financial risk taking incentives engendered by very accommodative or unconventional monetary policy, with Stein (2013) providing a comprehensive view of the associated economic downsides. 20 As just one example, the IMF's Global Financial Stability Report (Spring 2013) points to the re-emergence of covenant lite loans as evidence that greater risk tolerance may be morphing into risk insouciance.

Second, and probably a lesser worry, accommodative policies may reduce the cost of capital for firms so much that they prefer labor-saving capital investment to hiring labor. The falling share of labor in recent years is consistent with a low cost of capital, though there are other explanations. Excessive labor-saving capital investment may defeat the very purpose of unconventional policies, that is, greater employment. Relatedly, by changing asset prices and distorting price signals, unconventional monetary policy may cause overinvestment in areas where asset prices or credit are particularly sensitive to low interest rates and unanchored by factors such as international competition. For instance, the economy may get too many buildings and too few machines, a consequence that is all too recent to forget.

Spillovers - Capital Flows and Exchange Rate Appreciation and Credit Booms

The spillovers from easy global liquidity conditions to cross-border gross banking flows, exchange rate appreciation, stock market appreciation, and asset price and credit booms in capital receiving countries - and eventual overextension, current account deficits, and asset price busts has been documented elsewhere, both for pre-crisis Europe and post-crisis emerging markets. 21 The transmission mechanism appears to be that easy availability of borrowing increases asset prices, increases bank capitalization and reduces perceived leverage, reduces risk perceptions and measures (as indicated by the VIX index or value at risk), all of which feed back into more credit and actual leverage. When this occurs cross-border, exchange rate appreciation in the receiving country is an additional factor that makes lending appear safer. The mechanism Andrew Crockett laid out has played repeatedly. 22

For the receiving country, it is unclear whether monetary policy should tighten and attract more inflows, or be accommodative and fuel the credit boom. Tighter fiscal policy is a textbook solution to contain aggregate demand, but it is politically difficult to tighten when revenues are booming, for the boom masks weakness, and the lack of obvious problems makes countermeasures politically difficult. Put differently, as I will argue later, industrial country central bankers justify unconventional policies because politicians are not taking the necessary decisions in their own countries - unconventional policies are the only game in town. At the same time, however, they expect receiving countries to follow textbook reactions to capital inflows, without acknowledging that these too may be politically difficult. Prudential measures, including capital controls, to contain credit expansion is the new received wisdom, but their effectiveness against the "wall of capital inflows" has yet to be established. Spain's countercyclical provisioning norms may have prevented worse outcomes, but could not prevent the damage that the credit and construction boom did to Spain.

Even if the unconventional monetary policies that focus on lowering interest rates across the term structure have limited effects on interest rates in the large, liquid, sending country Treasury markets, the volume of flows they generate could swamp the more illiquid receiving country markets, thus creating large price and volume effects. The reality may be that the wall of capital dispatched by sending countries may far outweigh the puny defenses that most receiving countries have to offset its effects. What may work theoretically may not be of the right magnitude in practice to offset pro-cyclical effects, and even if it is of the right magnitude, may not be politically feasible. As leverage in the receiving country builds up, vulnerabilities mount, and these are quickly exposed when markets sense an end to the unconventional policies and reverse the flows.

The important concern during the Great Depression was competitive devaluation. While receiving countries have complained about "currency wars" in the recent past, and both China and South Korea seem affected by the sizeable Japanese depreciation after the Bank of Japan embarked on quantitative and qualitative easing (though they benefited earlier when the yen was appreciating) the more worrisome effect of unconventional monetary policies may well be competitive asset price inflation.

We have seen credit and asset price inflation circle around the globe. While industrial countries suffered from excessive credit expansion as their central banks accommodated the global savings glut after the Dot-Com bust, emerging markets have been the recipients of search-for-yield flows following the global financial crisis. This time around, because of the collapse of export markets, they have been far more willing to follow accommodative policies themselves, as a result of which they have experienced credit and asset price booms. Countries like Brazil and India that were close to external balance have started running large current account deficits. Unsustainable demand has traveled full circle, back to emerging markets, and emerging markets are being forced to adjust. Will they be able to put their house in order in time?

What should be done? How do we prevent the monetary reaction to asset price busts from becoming the genesis of asset price booms elsewhere? In a world integrated by massive capital flows, monetary policy in large countries serves as a common accelerator pedal for the globe. One's car might languish in a deep ditch even when the accelerator pedal is pressed fully down, but the rest of the world might be pushed way beyond the speed limit. If there is little way for countries across the globe to avoid the spillover effects of unconventional policies emanating from the large central banks, should the large central banks internalize these spillovers? 23 How? And will it be politically feasible?

Postponing Reform and Moral Hazard

Central bankers do get aggrieved when questioned about their uncharacteristic role as innovators. "What would you have us do when we are the only game in town", they say. But that may well be the problem. When the central banker offers himself as the only game in town, in an environment where politicians only have choices between the bad and the worse, he becomes the only game in town. Everyone cedes the stage to the central banker, who cannot admit that his tools are untried and of unknown efficacy. The central banker has to be confidant, and will constantly refer to the many bullets he still has even if he has very few. But that very public confidence traps him because the public wants to know why he is not doing more.

The dilemma for central bankers is particularly acute when the immediate prospect of a terrible economic crisis is necessary for politicians to obtain the room to do the unpleasant but right thing. For instance, repeated crises forced politicians in the Euro area to the bargaining table as they accepted what was domestically unpopular, for they could sell it to their constituents as necessary to avert the worse outcome of an immediate Euro break-up. The jury is still out on whether the OMT announced by the ECB, essentially as a fulfillment of the pledge to do what it takes to protect and preserve the Euro, bought the time necessary for politicians to undertake difficult institutional reform or whether it allowed narrow domestic concerns to take center stage again.

And finally, there is the issue of moral hazard. Clearly, when the system is about to collapse, it is hard to argue that it should be allowed to collapse to teach posterity a lesson. Not only can the loss of institutional capital be very hard for the economy to rebuild, the cost of the collapse may ensure that no future central banker ever contemplates "disciplining" the system. And clearly, few central bankers would like to be known for allowing the collapse on their watch. But equally clearly, the knowledge that the central bank will intervene in tail outcomes gives private bankers an incentive to ignore such outcomes and hold too little liquidity or move with the herd. 24 All this is well known now. Less clear is what to do about it, especially because it is still not obvious whether bankers flirt with tail risks because they expect to be bailed out or because they are ignorant of the risks. 25 Concerns about moral hazard are, of course, irrelevant if bankers are merely ignorant! Once again, we do not know.

Exit

Having experienced the side-effects of unconventional monetary policies on "entry", many now worry about exit from those policies. The problem is that while "entry" may take a long time as the central bank needs to build credibility about its future policies to have effect, "exit" may not require central bank credibility, may be anticipated, and its consequences brought forward by the market. Asset prices are unlikely to remain stable if the key intent of entry was to move asset prices from equilibrium. What is held down must bounce up.

One might think that countries that have complained about unconventional monetary policies in industrial countries should be happy with exit. The key complication is leverage. If asset prices simply went up and down, the withdrawal of unconventional policies should restore status quo ante. However, leverage built up in sectors with hitherto rising asset prices can bring down firms, financiers, and even whole economies when they fall. 26 There is no use saying that everyone should have anticipated the consequences of the end of unconventional policies. As Andrew Crockett put it in his speech, "financial intermediaries are better at assessing relative risks at a point in time, than projecting the evolution of risk over the financial cycle."

Countries around the world have to prepare themselves, especially with adequate supplies of liquidity. Exiting central bankers have to be prepared to "enter" again if the consequences of exit are too abrupt. Will exit occur smoothly, or in fits and starts, or abruptly? This is yet another aspect of unconventional monetary policies that we know little about.

Conclusion

Churchill could well have said on the subject of unconventional monetary policy, "Never in the field of economic policy has so much been spent, with so little evidence, by so few". Unconventional monetary policy has truly been a step in the dark. But this does raise the question of why central bankers have departed from their usual conservatism - after all, "innovative" is usually an epithet for a central banker.

A view from emerging markets is that, in the past, crises have typically occurred in countries that did not have the depth of economic thinking that the United States or Europe have. When emerging market policymakers were faced with orthodox economic advice that suggested many years of austerity and unemployment as well as widespread bank closures were needed to cleanse the economy after a crisis, they did not protest. After all, few had the training and confidence to question the orthodoxy, and the ones that nevertheless did were considered misguided cranks. Multilateral institutions, empowered by their control over funding, dictated policy from the economic scriptures.

When the crisis did hit at home, Western-based economists were much less willing to accept that pain was necessary. The Fed, led by perhaps the foremost monetary economist in the world, proposed creative solutions that few in policy circles, including the usually conservative multilateral institutions, questioned. After all, they no longer had the influence of the purse or the advantage in economic training.

This is, however, not a satisfactory explanation. After all, Nobel Laureates like Joe Stiglitz, whatever one may think about his remedies, did protest very publicly about the adjustment programs the multilateral institutions were imposing on the Asian economies.

Consider another explanation; Perhaps the success that central bankers had in preventing the collapse of the financial system after the crisis secured them the public's trust to go further into the deeper waters of quantitative easing. Could success at rescuing the banks have also mislead some central bankers into thinking they had the Midas touch? So a combination of public confidence, tinged with central-banker hubris could explain the foray into quantitative easing. Yet this too seems only a partial explanation. For few amongst the lay public were happy that the bankers were rescued, and many on Main Street did not understand why the financial system had to be saved when their own employers were laying off workers or closing down.

Let me try again. Perhaps it was the political difficulty of doing nothing after spending billions rescuing the private bankers that encouraged central bankers to act creatively. After all, how could one let a technical hitch like the ZLB (zero lower bound) come in the way of rescuing Main Street when innovative facilities such as TARP and TALF had been used to save Wall Street? Was it that once central bankers undertook the necessary rescues of banks, they were irremediably entangled in politics, and quantitative easing was an inevitable outcome?

Or perhaps it was simply common decency: being in a position of responsibility, and in a world where much had broken down, central bankers decided to do whatever they could, which included instruments like quantitative easing.

As with much about recent unconventional monetary policies, there is a lot we can only guess at. The bottom line is that if there is one myth that recent developments have exploded it is probably the one that sees central bankers as technocrats, hovering cleanly over the politics and ideologies of their time. Their feet too have touched the ground.

On a more practical note, let me end with a caution from Andrew Crockett's speech:

"The costs of uncontrolled financial cycles are sufficiently large that avenues for resisting them should at least be explored. At a minimum, it seems reasonable to suggest that, in formulating monetary policy aimed at an inflation objective, central banks should take explicit account of the impact of financial developments on the balance of risks."

Then as now, this is very good advice. Thank you very much.

See the original article >>

Federal Reserve Chairman Ben Bernanke (Source: Bloomberg)

Federal Reserve Chairman Ben Bernanke (Source: Bloomberg)