January's Import and Export Price Report showed significant price increases in both imports and exports, and unfortunately, across both overall measures and those excluding food and fuel. We posit that the chatter that has overwhelmed the financial airwaves of late, making an argument we made years ago mind you, is worth listening to once again. Inflation portends to blindside the market and its caretakers, the group of merry men who shrug off all evil until it is upon them.

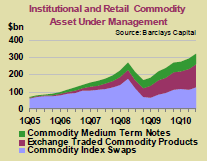

Inflation chatter is all the rage again on the financial airwaves. You will recall our important work on this subject from several years ago. If not for a near depression that depressed prices as demand was desolated, the inflation topic would probably have been the highest concern globally over the last few years. However, now that the global economy is recovering, and with China firing up all engines, inflation signs and concerns are resurfacing. Once again, the scent is first found in raw material resources, including rare earth metals, but also in the high use commodities of energy and agriculture. Those factors were at play again in driving January 2011 Import and Export Prices higher. For now, talking-head speak-easies are blowing off the possibility of feed through to finished goods, but it won't be the first train that runs them over either. Stick with

The Greek, and I'll do my best to keep you out of the way of the

loco.

More signs of economic recovery, and also inflation, were found in the latest import/export prices data, reported today by the Bureau of Labor Statistics for January. Import prices gained 1.5% in January, marking the fourth consecutive month of plus one percent increases. That is something that last occurred in July 2008, which to help you recall the period, was a time in which the now extinct Washington Mutual beast still roamed the earth, though in

small numbers.

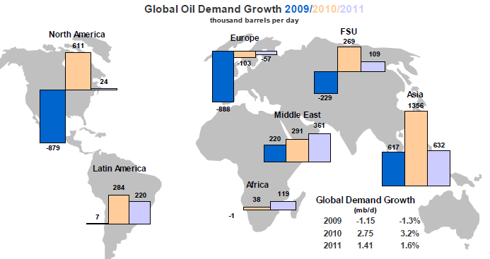

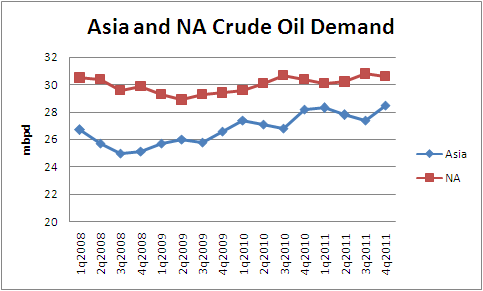

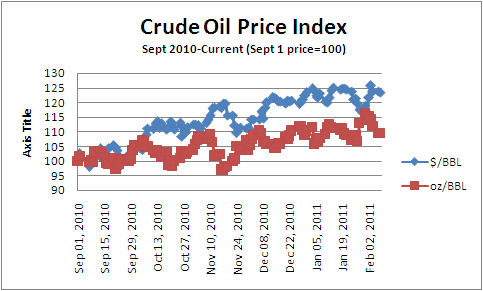

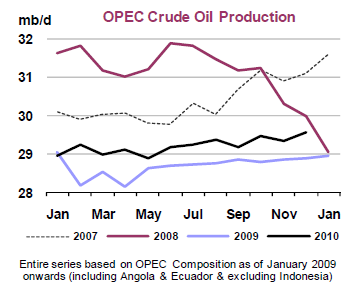

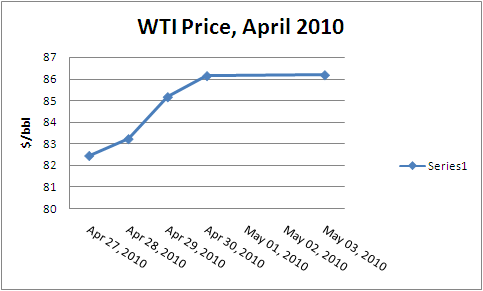

The drivers of import price growth are the same now as they were then, commodities, including energy. Fuel import prices increased 3.9% in January, a snail's pace compared to the 14.1% jump that characterized the previous three months. But January's pace is not to be ignored, and neither is the 12.4% increase of the past year, a period characterized by economic recovery.

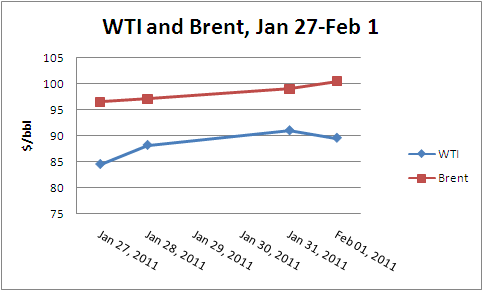

Behind the gains in energy prices were a 3.4% increase in petroleum prices, which have since been dwarfed on Middle East upheaval. And look deeper, as Natural Gas prices advanced 13% through the month. It was a period in which much of the US got buried in snow. In fact, cold and snowy weather so affected fuel usage, that natural gas recently fell below its five-year average for this time of year. As reported by the EIA in its weekly update, for the period ending February 4, Natural Gas Inventory stood 45 Bcf below the five-year average. If things were to continue to trend, we might test the bottom of the historical price range, though the weather is warming significantly across the country this week. Still, the hijacking of several oil tankers in a short span of time, along with raised Middle East worries, have oil supply uncertainty adding to push natural gas prices higher with oil; it being a regionally sourced commodity that is increasingly a replacement resource for oil.

Drunken train track wandering market guides should take note of the horn in the distance, as non-fuel import prices increased by 0.8% in January. The noteworthy rise was driven by industrial supplies and materials (unfinished metals and chemicals drove this), finished goods, and foods, feeds, and beverages. Consumer goods prices moved 0.3% ahead, with the largest contributors to the increase coming from a 0.9% hike in apparel, footwear, and household goods prices, and a 4.0% rise in jewelry prices. Prices for automotive vehicles rose 0.5%, led by a 1.2% increase in parts prices.

Here we see examples of price increase that affect every consumer.

Price increase is still mostly found in raw materials or unfinished goods, but in the case of rising cotton prices, it is finding its way through to textiles and clothing (apparel up 0.9%). Meanwhile, the government just approved increased ethanol usage in gasoline, which in the past led to mayhem within the whole of agriculture. While December's increase in non-fuel import prices was just 0.3%, November's also marked 0.8%, another measure that draws comparisons to 2008.

Export Prices

Export prices also increased significantly in January, rising 1.2%. The advance for the full year was 6.8%, the largest 12-month increase since that same late 2007 (Sept.) through 2008 (Sept.) period; just before the walls came completely tumbling in on the economy. As the economy improves, it also affects demand for agricultural goods. It is not that people eat more, though that is certainly the case as well (especially for the malnourished), but also that they eat more proteins and more processed foods. As families rise in class, which is occurring in China and India, they also consume more, and more proteins. This in turn pushes prices higher for proteins and for the feeds used to raise livestock, which are likewise derived from agriculture.

Meanwhile, what seems to be climate change driven drought in Russia and this year in China, restricting important supply sources, will only increase pressure on the whole of agricultural goods, and inevitably processed foods. Agricultural export prices rose 3.2% in January, adding to a dramatic 12-month advance of 22.6%. Price increase was driven by advances in soybeans, corn and wheat. While cotton declined fractionally in January, it has more than doubled over the past year. And a recent freeze in Mexico has completely wiped out some vegetable crops and will certainly drive prices higher for Americans.

That is not the end of the story though, as prices for non-agricultural exports also advanced considerably, rising 0.9% in January. Higher prices for industrial supplies and materials, capital goods, and automotive vehicles more than offset a 0.4 percent drop in prices for consumer goods. Higher airfares also contributed to the overall increase, and those of course are impacted and related to increased fuel costs. Consumer goods prices might also benefit from dollar play (longer term), and also economies of scale gained as sales grow. Nonagricultural goods prices are up 5.3% over the last 12 months; that's pretty inflationary for dollar pegged trading partners.

China

Prices of goods imported from China increased 0.3% for the fourth month in a row. Chinese goods are up 1.4% over the past year. That's healthy price rise, and you will see more of this if the US government gets its way with regard to the Yuan. You might see more US jobs return too, but that is debatable, since they might simply find a new foreign home, say maybe Indonesia. Prices of goods from Japan and all our major trading partners were up, with significant increases from the EU, Mexico and Canada, due to fuel.

Conclusion

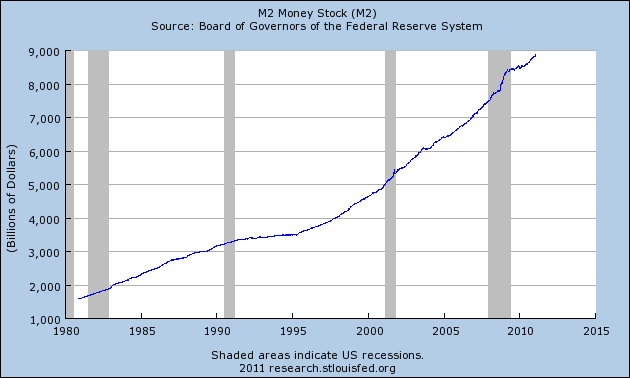

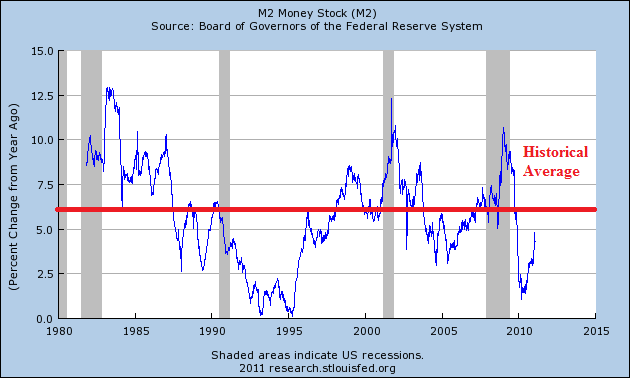

The pace of price increases should intensify as competition for scarce resources squeezes them. With factors at play like civil unrest, wild weather and even pirating and regulation (like with off-shore oil drilling), it seems clear to me that the inflation train is roaring our way. We think dollar dilution, and the Fed's inflated view of its ability to

reverse the curse, should also burden the economy in the future, especially if US Treasuries lose their luster globally. Meanwhile, outside of recent stock market gains, wealth is down due to home value declines. Income should be down also, given high unemployment. Banks may be opening up a bit, but it should take some time, to maybe never, before free capital flow comes to be again (and good riddance). Thus, there's a tight rein around economic horsepower.

We must look towards the expansion of the developing world as the cure for what ails us. In this regard, the birth of new democracies is a good thing, but global instability and weak human nature are ugly flies in that ointment, and could ruin everything.

Continue reading this article >>