This week we look at data from the Bank of International Settlements, by which (if someone does a lot of work) you can figure out how much US banks have written in credit default swaps to banks in Europe on Greek, Irish, and Portuguese debt. The details should not make you happy. I meditate on whether one should buy a house now, and then discuss “the way out” of all this mess and why we will Muddle Through. Oh, and I’ll ask you for help on yet another book project, on creating jobs. And all while trying to finish early enough to go to dinner. So let’s get started.

Is It Time to Buy a House?

The answer to that question is not simple, but let’s start with my own personal experience. I bought a home in the early ’80s in Arlington, Texas for what we thought was a fair price; but the mortgage was back-loaded, so I was not buying back much equity, just paying a lot of interest. But we had a growing family and the need for space, so we made the move. I must confess I was not the savviest loan customer 30 years ago. I am now aghast.

About eight years later we had the savings and loan crisis in Texas. Real estate became cheap, in some cases real cheap. Our family was growing again and we needed more room. One home we looked at was large and on a golf course. It had also been abandoned for a year and had some damage. The RTC (Resolution Trust Corporation) owned it (the government agency that took all the debt from the failed savings and loans). At one point, it was appraised for $810,000. The loan was (I think) about $690,000.

I had been watching friends buy apartments and loan portfolios from the RTC for a dime on the dollar. True story. The RTC would set out piles of manila folders of loans on a table. You could look the folders and then bid on them. Some of the folders had actual checks from the people who had borrowed money and were still trying to pay on cars, boats, condos, whatever. There were people who would bid the value of the actual “cash” in the folders and get the bid, as the people running the RTC were just trying to get through the mess as quickly as possible. Of course, the taxpayers made up the difference.

If you had cash, you could get apartment buildings and be on positive cash flow on day one. One friend would buy older apartments, turn them into government subsidized homes for the elderly, and get his money back within a few years. For active entrepreneurs with cash, it was a good time. If you owed money or needed money, it was very bad.

In Houston, they were auctioning off homes from the courthouse steps and people were paying for them with credit cards, they were so cheap (some 3-bedrooms went for like $6,000). The economy in Houston was imploding. The joke was,“Will the last person to leave Houston please turn out the lights?”

Anyway, we fell in love with the house in Arlington. My business had (finally!) started to do better and we could afford to “move up.” But given the real estate crash, I was still under water after eight years of making payments on my current house, by about 15% or somewhere in the mid-$20,000 range (I try to forget, as it is painful).

The home we wanted to buy was up for bid. As I said, it needed lots of work. Fire ants had eaten most of the outside wiring. There was no lawn on an almost one-acre property, as it had died the last summer from lack of water. The pool was green slime. And so on.

I put in a bid for $285,000, which was much less (maybe half) than it had cost to build, but I put down a large cash deposit with the bid and offered to take it “as is, where is.” My realtor told us we would not get it, as there were bidders who were offering as much as $50,000 more, but with some requirements. I decided to hold my ground. While this was a dream home for a country boy from a small Texas town, there were other houses going on the block regularly.

As it turned out, the next week we got a call saying the RTC had accepted the bid. When we asked why, we were told they simply did not have the time or people to oversee any “fix this”bids. Even though by a financial analysis there were better bids, it had become a matter of moving that folder off the desk, as there were roomfuls still be dealt with. And having been burned once on a mortgage, I was a lot smarter this time about interest rates and terms. (I had also been in the investment world for nine years, so had learned a few things.) About ten years later, for personal reasons, I sold the home at a nice profit, and this time had paid down the mortgage quite a bit, so I had some equity.

Since then I have leased homes or condos, and still do. I now lease because it makes sense for me, given where I am in my life. I am not sure where I’ll be in five years, or what my business will look like. The world is changing so fast. (Although I could have said that at almost any time for the last 60 years and been right.)

Also, the home I lease is quite nice but would cost me about three times in monthly payments to buy it as to lease it. Does the lease price go up at renewal? Of course. But it is still a lifestyle and cash-flow decision.

Buying a home is a personal and lifestyle choice. The owners of the villa we are staying in here in Tuscany have five homes, all over the world. They buy homes that need a lot of work, make them spectacular, and then rent them out, which more or less covers their costs and return on capital; and then they stay in them when they want to. They get people to do the work, other people to pay for it, and they “live large.” Nice life.

Jeremy and Carol Leonard are friends from Canada who are here with us this weekend. He bought a home in Hawaii, where one of his businesses is. He got it for a lot less than it would cost to build, so he was not too worried about the price. He and his family now live there, and he commutes back to Edmonton from time to time for his other business (more on that later).

All that to say is that if you are in a place where you want to buy a home, now may be the right time to start thinking about it. The banks and government are simply overwhelmed with homes that have been repossessed, and it looks like there might be as many as 2 million more homes to come onto the market. Prices in many areas are going to continue to fall, and if you can get credit, mortgage rates are quite low.

If I were buying, I would want to meet agents or bankers who are in the “deal flow.” The anecdotal stories of people getting homes for what seem like very good prices, in this depressed market, are all over the internet. There are homes that are certainly below replacement costs in some areas (and not just in the US but in certain parts of Europe as well). While I think home prices should go somewhat lower, we are out of bubble territory. There are starting to be values in the housing market for savvy shoppers. Which of course is what help creates a bottom. Which I have been writing for many years should happen in 2012-13. So you can be patient, but if you want a home, put in a bid that will make you smile if you get it accepted. No rush. And there are certainly deals for people who can use a little leverage and buy rental property.

And I must admit, if there is another crisis in Europe and prices of vacation homes like the one I am staying in drop a lot? I might just jump in. I like owning stuff. But at the right price.

Time to Get Outraged by the Banks

Long-time readers know I continuously pound the table that credit default swaps need to be put on an exchange. The Frank-Dodd bill failed in so many ways to deal with the last crisis and prevent the next one, it is hard to start a list. But an analysis by economist Kash Mansori, at

http://streetlightblog.blogspot.com/2011/06/betting-on-pigs.html, tears apart the mind-numbing 146-page report from the Bank of International Settlements, which is just one long set of tables and data. I spent an hour with it and almost went blind. (For data masochists, it is at

http://bis.org/publ/qtrpdf/r_qa1106.pdf.)

Kash had to do a lot of work to come up with his tables, which show how much exposure Europe and the US have to Greece, Ireland, and Portugal. (He very politely answered some questions when I emailed him.) There is a lot of useful information buried in the data, showing us who is exposed to the risk of sovereign defaults in Europe. I have openly speculated that US banks were selling CDS to Europe but had no idea how much. Now we do.

From Kash’s blog:

“Observation #1. Default Insurance Matters.

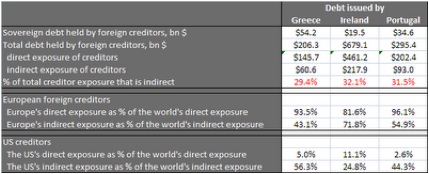

“First, the BIS data very helpfully breaks exposures into two pieces: direct exposures, which basically means creditors who own bonds issued by one of the PIGs; and indirect exposures, which for the most part means agents who sold default insurance to creditors, primarily through credit default swaps. As summarized in the following table, it seems that approximately 30% of total potential exposures to debt from the PIGs are covered by default insurance (see the figures in red). Put another way, if one of the PIGs defaults, creditors who actually hold bonds from that country will absorb about 70% of the losses, while agents (primarily banks and insurance companies) that sold insurance against the possibility of default will have to cover the remaining 30%. That’s not a trivial amount. (All figures below are in billions of USD, as of the end of 2010.)

“Observation #2. Direct Exposure in Europe, Indirect in the US.

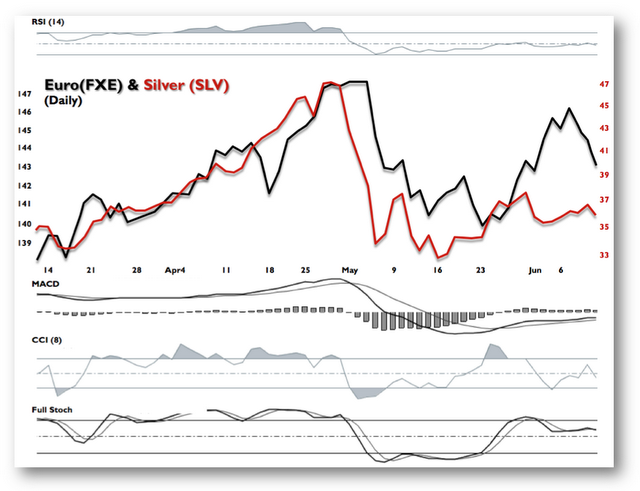

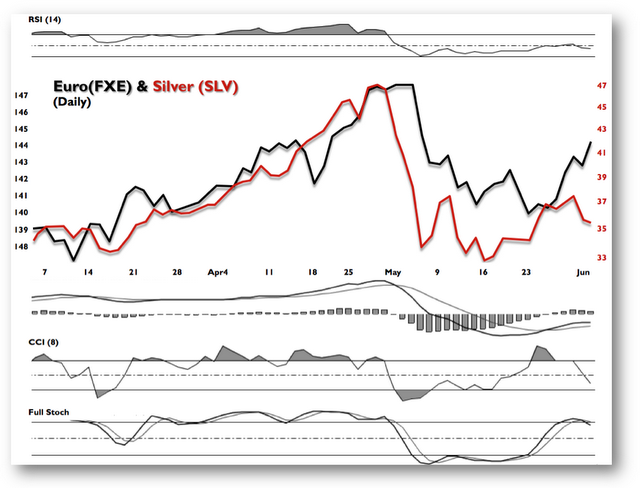

“The table above also hints at striking differences between how European and US creditors would be hit in the case of default by one of the PIGs. If Greece were to default, for example, approximately 94% of the direct losses would fall on European creditors, and only 5% would fall on US creditors. However, US banks and insurance companies would have to make about 56% of the default insurance payouts triggered by such an event, while European agents would make only 43% of those payouts.

“The next table illustrates this difference even more starkly. In the case of Greece and Portugal, the vast majority of the losses that would be borne by creditors in Europe would be direct losses. In fact, French and German creditors would almost certainly be substantial net recipients of default insurance payments. (That’s less clear in the case of Ireland.) Meanwhile, US financial institutions would have to make substantial net default insurance payments, which would account for between 80% and 90% of all losses borne by the US in the case of default (see the figures in red below).

“Observation #3. Similar Overall Exposures in Europe and the US.

“Finally, it’s worth noting that once you account for the substantial payouts that US agents will have to make to European creditors in the case of a default by one of the PIGs, financial institutions in the US have roughly as much to lose from default as those in France and Germany. (See the figures in blue in the table above.) The apparent eagerness of US banks and insurance companies to sell default insurance to European creditors means that they will now have to substantially share in the pain inflicted by a PIG default.

“Implications

“This has some important implications. First, US and European financial institutions are likely to have very different incentives as negotiations regarding debt restructuring and reprofiling proceed. US banks and insurance companies are surely delighted with the “

soft restructuring” that is currently being discussed. Such a partial default would probably not trigger default insurance payments, and so the pain would be borne almost exclusively by European institutions. On the other hand, some time soon it seems likely that European creditors will begin to prefer a “hard restructuring” that would require default insurance payouts from the US institutions that sold such insurance. Given how strikingly one-sided the net default insurance payments will be (from the US to Europe), it’s easy to imagine how that could shape future negotiations over debt relief for the PIGs.

“Second, there’s an interesting puzzle here. Why have European and American financial institutions behaved so differently when it comes to the PIGs? Specifically, why have American firms been so willing to sell default insurance to the Europeans, though they have not bought much PIG debt? And conversely, why have the Europeans systematically been so eager to buy insurance for their PIG debt, even at the very high price such insurance now commands? In essence, European firms have been betting that a PIG default will happen sooner rather than later, while US firms have been betting that default would happen later or not at all.”

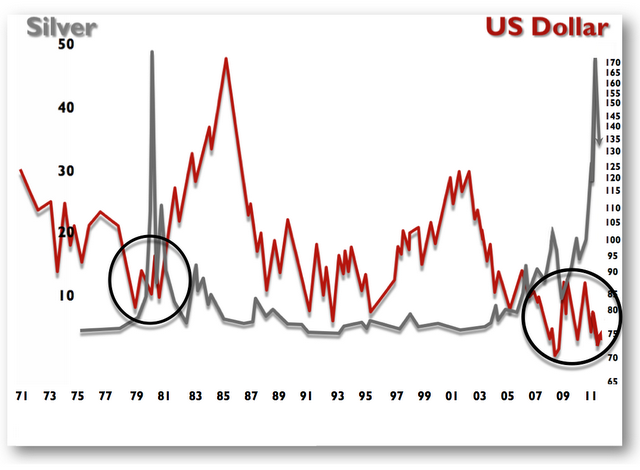

If I read those tables correctly, that means US banks have sold some $120 billion of credit default swaps to European banks. Let’s think about that for a minute.

When, not if, Greece defaults, US banks are going to have to dip into capital to pay those commitments. Capital that should be available for loans to businesses but will have to be paid to European banks instead. Will it be a 100% Greek default, or only 50%? If it is a default, do you have to pay all or just the defaulted portion, and when?

Why, oh why, are banks putting American taxpayers at risk, as these too-big-to-fail banks certainly are? And make no mistake, if several major banks were to collapse, our government would need to step in. The largest banks are too big for the FDIC to handle. Now, shareholders would be wiped out this time and bond holders would face haircuts. No question. But why are investment banks allowed to mix the risk with their commercial banks?

We Need a Mulligan

I occasionally golf, more in past years than today. I am a very bad golfer. I would often negotiate in friendly games a few extra “mulligans” before we started. (A mulligan is where you get to replay the ball without taking a penalty stroke.) I was actually doing my playing partners a favor by moving the game along rather than trying to find lost balls in tall grass.

I and so many other people were all for repealing Glass-Steagall back in 1998. Sometimes we just need to admit that we make mistakes, and this was a big one. We need a national mulligan, a major do-over! We should reinstate Glass-Steagall and separate investment banking from commercial banking. Yes, I know that hurts profits and maybe makes banks less competitive, but I really don’t care. When our tax dollars are risked it is just wrong.

Further, I will bet you that bank chiefs will say they have hedged their risk on European debt. OK, I would like to know, with which counterparty? AIG? Is there another AIG looming out there, selling risk insurance? Who is paying attention?

A Congressional Investigation Is Needed

Frankly, all this needs to come out in the open. Who sold this stuff to whom and for how much, and is the risk hedged, and if so to whom? Why did someone think that betting $34 billion on the ability of Greece to pay its debts was a good idea? And are the Irish CDS sold for government debt or are they bank debt? Note that we have over $100 billion in exposure to Irish debt. Long-time readers know that I think the Irish will at some point tell the ECB to stuff it on the bank debts they assumed as taxpayers. Does this put at risk all Irish debt? It’s all in those contracts.

Maybe I am overreacting (it has happened in my life), but I simply find it outrageous that banks can risk so much with so little to lose if things go bad. Just as in the subprime debacle, they make their bonuses and salaries until the end, and the public picks up the risk. Dodd-Frank was a joke. It did not solve the real problems, and has so many unintended consequences. It should be torn up and we should start over. But first we reinstate Glass-Steagall. At a very minimum, we require that banks that want to sell credit default swaps separate that division from the rest of the bank and capitalize it separately. Investors who buy from them must know that the full capital of the bank does not stand behind the CDS. I don’t care if that cuts into profits. I just don’t want the private risk and profits to become public losses.

How We Get Out of This

A good friend of ours, Jeremy Leonard, has come over from Canada to visit us for a few days. He is (among other things) in the pump business, with an office in Hawaii and in Edmonton, Alberta, Canada. He just launched the Canadian branch 14 months ago. He has figured out a way to make a pump in Canada that is superior to the competition in the mining and the oil sands businesses. When we met last December he was up to ten employees. Now he is at 50 and growing. His staff in Hawaii has doubled from 5 to 10 over the last year. He has also figured out how to solve a major environmental problem in the oil sands region, and that business is growing nicely.

Over dinner tonight, we started talking about other businesses. Dr. Mike Roizen (of “You”books and Oprah fame) is coming to stay a few days next week, and he has started lots of businesses, creating over a hundred jobs. And my partners at Altegris and CMG have doubled their staffs in the last five years.

We get out of this conundrum because a million people like Jeremy figure out how to do something faster, cheaper, and better and then actually make it happen. They aren’t sitting around waiting for Greece to default first. If they are smart, they avoid doing something that will be affected by that, and they plough ahead.

And if government gets out of the way, or actually implements policies that help, the economy and employment eventually right themselves. Texas was a basket case 20 years ago. I was fortunate that my business did not depend on the local economy. I had many friends who suffered, who lost jobs and businesses. That’s part of the process. But you get back up and do what you have to do. You figure it out.

And when a nation of entrepreneurs, all working on their individual plans, get it all figured out, the economy is back on track.

In one sense, now is the best time to start a business if you can find the capital, because you can access quality help, get equipment cheaper, lower rents, etc. Challenges? Of course. That comes with the territory of starting a business, and they never end. If you decide to sit back and coast, the world will go on and swallow you up.

20 Policies to Implement to Create Jobs

Maybe I am thinking about employment because I just agreed to do a small book with Dr. Bill Dunkelberg, good friend and fishing buddy, who is also the chief economist of the National Federation of Independent Businesses. It will be on employment in the US and what the government should do to help create jobs. Bill and I have our ideas, but we are also going to “crowd source.”

We will ask our respective readers for their ideas. My bet is that we’ll get a lot better ideas than ones we come up with on our own. The plan is to have it done in time to hit the stores in January, before the political debates really heat up. Whether it will be 10 or 20 or 30 ideas, we don’t know. Not even sure of a title, but Wiley said they would publish it. It will be a fun project and is something I hope can contribute to the “cause” of growing our economy. I believe we have a bright future and want to make sure my kids have the same chances I had.

And now it is late and time to hit the send button. And when you see your congressperson, ask them to look at the credit default swaps debacle that is brewing.

Tuscany, Kiev, Geneva, and London

Tuscany is a slice of heaven. We have already booked the villa for three weeks next year. Next Thursday Trey and I leave to go to Kiev and meet with about 20 classmates from an executive course I did two years ago at Singularity University, who are flying in from all over the world. We will spend three days talking about our businesses and the future. Two years ago we spent nine days (12 hours a day) listening to the real industry leaders talk about where their tech was going, and it was totally worth it. They have another conference in October. If that type of thing interests you, you should do it.

http://singularityu.org/

Then Sunday Trey and I go to Geneva, where we meet with friends and business partners, do a speech, visit CERN on Wednesday for a private tour (in exchange for a few hours of my time) and then fly on to London. On Thursday I will be a guest host on CNBC London Squawk Boxand then do a few meetings and catch a plane back to Dallas. Whew! Then I’ll be home for a while.

One of the delights of having 1,000,000 closest friends read your letter is that you get to meet them from time to time. Simone Pallessi hosted us Wednesday night at a fabulous resort 20 minutes from here, put together by one of the members of the Ferragamo family. 4,500 acres, a large winery, some of the finest villas and apartment/suites/rooms, and an unbelievable golf course, all built on a 900-year-old estate with the castle tower still standing. Simone runs the place and was a very gracious host. The Brunello they make is outstanding.

www.castigliondelbosco.com.

And yesterday as I was outside writing, I saw a gentleman come up to the back gate (on the road) and ask if I was John Mauldin. I said yes. Story is that last night he was driving with his wife, saw the name Trequanda, remembered Il Conte Matto, and decided to change his plans. He later got a room and came by to say thanks for the recommendation and ask me to sign my book. Turns out he owns a car dealership in California. And since he brought wine, how could I say no? Life’s little pleasures.

Time to go now, as I have guests and had to finish this after we came back from dinner. Have a great week. I am behind on my rather ambitious plans to get things done while here, but I am enjoying life. And you should too!

Your watching time pass so quickly analyst,