by Tom Aspray

The stock market has been on a tear since the June 24 lows as last week’s gains surprised even the most bullish analysts. The S&P 500 gained 3% for the week and over 6% since the June lows.

The comments last week by Fed Chairman Ben Bernanke fueled a new round of optimism as we entered earnings season. He appears to have silenced concerns that the Fed would cut back on its stimulus. It has been a global affair as the world stock markets are on track to have their best weekly gain in eight months.

The strong earnings from both JPMorgan Chase (JPM) and Wells Fargo (WFC) Friday were a pleasant surprise as heading into earning’s season the consensus estimates was for them to be a fraction lower than the 1st quarter.

A report from Citigroup (C) said that preannouncements on earnings were the most negative since 2009. An early example of this may be United Parcel Service (UPS) as they missed their quarterly earnings and lowered the yearly forecast on Friday. Their stock was down over 5%

The forecasts for earnings growth are the best for the financial sector, which is expected to show a 16% gain this quarter. This is consistent with the technical outlook that I reviewed in last week’s trading lesson, as the monthly, weekly, and daily analyses are positive for the Select Sector SPDR Financial (XLF).

Click to Enlarge

Many investors are trying to determine how they should be investing as the sharp drop in many bond funds has made them question the wisdom of having a large percentage of their portfolio in bonds.

This table from the WSJ shows some of the bond market’s best and worst performers relative to their benchmarks. At the top of the list is the Loomis Sayles Bond Fund (LSBNX), which was down 1.4% beating its benchmark’s 2.5% loss. The DoubleLine Total Return Bond (DLTNX) also beat its benchmark and was the first recommendation in my Eyes on Income column.

On the other end of the spectrum was the 12.4% drop in the Pimco Total Return Asset Institutional (PTTRX) and the 14.3% loss in the DMS India Bank (DAIBX). For those who bought bond funds for safety, these kind of results have been an unpleasant wake-up call.

Two weeks ago in Will the Rates Rally Fizzle or Sizzle? it was my view that the rise in yields was close to a short-term top and that bond holders would get another chance to adjust their bond portfolios this summer.

Click to Enlarge

The daily chart of the 10-year T-note yields shows that yields hit their highest level five days later on July 5. The short-term top has not been confirmed yet but a drop in yields below 2.460% will signal a further decline.

One of my favorite momentum indicators, the MACD, did form a divergence at the recent highs and is negative, consistent with a short-term top. It is quite normal after the completion of a reverse H&S bottom to see a retest of the neckline, which is at 2.278%. This is just below the 38.2% Fibonacci retracement support with the 50% support at 2.173%.

Therefore, a further pullback in yields is still likely this summer but that should be followed by another rally in yields and a further drop in bond prices. This raises the question of what percentage you should have in bonds and what percentage in stocks?

Click to Enlarge

The answer, of course, depends on the individual’s age, as well as other factors, though I have always favored a higher concentration in bonds than stocks. The table above shows how an $100,000 investment would have performed over the past ten years given different portfolio mixes.

The all stocks (represented by the S&P 500) would have grown to $202,249 which is an annualized return of 7.3%. The all bond (using the Barclays US Aggregate Bond Index) would have grown to $155,585 for an annualized return of 4.5%. The performance of the 50/50 mix was in the middle.

I have been recommending since the end of May (4 Ways to Summer-Proof Your Portfolio) that those in bonds should shorten the maturity of their bond portfolio and to gradually build a stock portfolio in the summer months.

It’s important not to chase the market; concentrate on the entry as well as the risk. This should be done in the framework of an overall plan of how much you want to have in each asset class by the fall.

If you have multiple accounts, it is important to be sure you know what percentage is really in each asset class. Next week, I will look at the alternatives that you might consider for shortening the maturity of your bond portfolio.

Though the current data suggests a continually improving economy, there will be some hiccups along the way as the summer months are known for their sharp drops. If the economy is significantly stronger by year end, which is what the stock market is suggesting, I expect to see a low in some of the beaten-down emerging markets.

From a technical standpoint, the correction in the Japanese stock market appears to be already over as new positions were added on the recent drop. I think we are likely to see more problems arise from the Eurozone this summer as their bond yields have also turned higher. This could be a problem for the weakest Eurozone countries. There will also be pockets of strength for new buying opportunities.

The economic calendar was light last week, though on Friday, the Producer Price Index came in at 0.8%, a bit higher than expected while the mid-month University of Michigan Consumer Sentiment was slightly lower.

There is a full slate of data this week as Monday we get Retail Sales, the Empire State Manufacturing Survey, and Business Inventories. Then on Tuesday, there is the Consumer Price Index, Industrial Production, and the Housing Market Index.

On Wednesday Housing Starts will be released with jobless claims and the Philadelphia Fed Survey on Thursday.

What to Watch

The positive divergences in the McClellan oscillator that I discussed in my trading lesson were confirmed on June 27, which was three days after the lows. By early last week, the A/D lines had broken out to the upside confirming that the correction was over.

The rally has been spectacular but this is not a market where you want to chase the indices as most are already close to their starc+ bands. There are many industry groups and stocks like the homebuilders that appear to have just completed their corrections, which will set up good opportunities on a pullback.

Instead of a significant market correction in the S&P 500, we may see more of rolling corrections where strong sectors take a breather and drop back to support. This is what I think we are now seeing in the regional banks as the SPDR S&P Regional Banking ETF (KRE) is down 3.4% from the July 8 highs.

The sentiment did turn more bullish last week as the number of bulls in the AAII survey jumped to 48.9%, up from 42% the previous week, and 29.5% on June 6. The percentage of bears is at 18.3%, which is the lowest reading since January 2012. The financial newsletter writers were also a bit more optimistic as 46.9% are bullish with 22.9% bearish.

The bottom formation I pointed out in the number of NYSE stocks above their 50-day MAs has been confirmed as it dropped below 26 at the market lows on June 24 and has now risen to 66.

The NYSE Composite came very close to its daily starc+ band last Thursday before Friday’s quiet session. The NYSE is still over 2% below its May high at 9705. The correction held between the 38.2% and 50% Fibonacci retracement support levels from the November lows, which is quite typical.

The McClellan oscillator formed two bullish divergences in June (line b) that were confirmed on June 27 when it moved above the zero line and its previous peak. It turned lower Friday consistent with a short-term pullback.

Click to Enlarge

The NYSE Advance/Decline line moved back above its WMA on the same day and now shows a clear pattern of higher and higher lows. It should hold near its rising WMA on a pullback.

There is first support at 9267 and the 20-day EMA. The quarterly pivot is at 9251 with the monthly at 9143. In a daily column last week, I provided a table with quarterly pivot levels for the key ETFs, which I suggest you keep for reference.

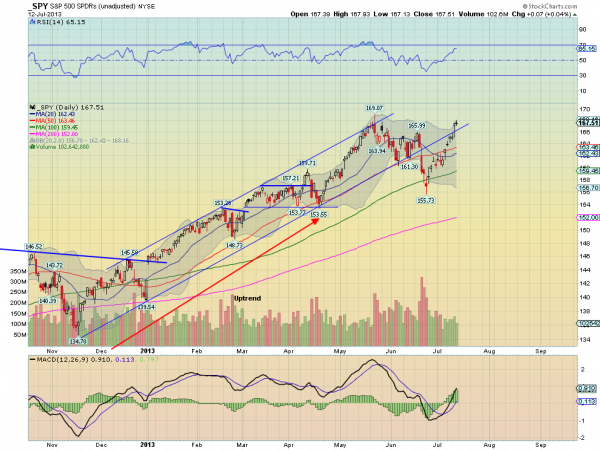

S&P 500

Even though the rally over the past six days has been impressive and the Spyder Trust (SPY) made a new closing high, the intra-day high at $169.24 has not been reached. The decline in June just barely dropped below the 38.2% support level.

The daily OBV lagged prices for the first few days after the low but picked up strength this week. The downtrend, line b, has been overcome and the WMA is now rising. Look for a drop to WMA and then a resumption of the rally.

Click to Enlarge

The S&P 500 A/D line has accelerated to the upside since it moved above its WMA on June 26. The A/D line moved above the May highs (line c) early last week, which is a bullish sign. The WMA of the A/D line is now clearly rising and should provide first support. The A/D line held well above its long-term uptrend on the correction

There is initial support in the $166 area and then at $164.27. The rising 20-day EMA is at $163.41 with the quarterly pivot at $161.01.

Dow Industrials

The SPDR Diamond Trust (DIA) came close to the old highs at $154.98 to $155.14 (line d) but also made a new closing high last Thursday. DIA tested the uptrend from last November’s low but held well above the 38.2% support at $143.47 on the correction in June.

The daily Dow Industrials A/D line broke out of its trading range, line f, last Tuesday and has been acting very strong as it made convincing new highs. The uptrend in the A/D was slightly violated on the correction.

There is initial support at $152.40-$153 with the rising 20-day EMA at $151.19. Additional support is at $150 with the quarterly pivot at $149.52. DIA did trigger an HCD the day after the lows as I noted last time and it turned out to be a very good signal.

Click to Enlarge

Nasdaq-100

The PowerShares QQQ Trust (QQQ) has led the market on the upside as it has gained over 8% from the June lows. It made convincing new highs last week as it gapped sharply higher last Thursday. On the June decline, it broke the 38.2% support intra-day but did not close below it.

QQQ finished the week near its daily starc+ band as it came very close to the quarterly R1 resistance at $75.19. The weekly starc+ band is at $76.67.

The Nasdaq-100 A/D line moved through its resistance on June 28, and then after a slight pullback to the breakout level (line c), accelerated to the upside. The A/D line moved to new highs a couple of days before prices

There is initial support now at the gap between $73.62 and $74.25 with further at $72.70 (line a) and the rising 20-day EMA. The quarterly pivot is significantly lower at $71.13.

Russell 2000

The iShares Russell 2000 Index (IWM) also had a great week, up over 3%, and after closing above the resistance at line d, it really took off. It has already exceeded the 127.2.% retracement target at $102.27 and the quarterly R1 resistance with the R2 at $106.65.

The daily OBV confirmed the breakout in prices by moving through its resistance at line e. It is acting very strong.

The Russell 2000 A/D line caught up with prices after moving to new highs and overcoming the resistance at line f. It is well above its rising WMA so a pullback would not be surprising.

There is initial support at $99.80 to $101.20 with the rising 20-day EMA at $99.20.

See the original article >>