by Kimble Charting Solutions

Wednesday, June 22, 2011

FOMC STATEMENT: NO SURPRISES

by Cullen Roche

Nothing too exciting going on here. The Fed keeps rates at current levels. No hints at QE3. They expect a stronger economy is H2:

See the original article >>

Nothing too exciting going on here. The Fed keeps rates at current levels. No hints at QE3. They expect a stronger economy is H2:

“Information received since the Federal Open Market Committee met in April indicates that the economic recovery is continuing at a moderate pace, though somewhat more slowly than the Committee had expected. Also, recent labor market indicators have been weaker than anticipated. The slower pace of the recovery reflects in part factors that are likely to be temporary, including the damping effect of higher food and energy prices on consumer purchasing power and spending as well as supply chain disruptions associated with the tragic events in Japan. Household spending and business investment in equipment and software continue to expand. However, investment in nonresidential structures is still weak, and the housing sector continues to be depressed. Inflation has picked up in recent months, mainly reflecting higher prices forsome commodities and imported goods, as well as the recent supply chain disruptions. However, longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The unemployment rate remains elevated; however, the Committee expects the pace of recovery to pick up over coming quarters and the unemployment rate to resume its gradual decline toward levels that the Committee judges to be consistent with its dual mandate. Inflation has moved up recently, but the Committee anticipates that inflation will subside to levels at or below those consistent with the Committee’s dual mandate as the effects of past energy and other commodity price increases dissipate. However, the Committee will continue to pay close attention to the evolution of inflation and inflation expectations.

To promote the ongoing economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent. The Committee continues to anticipate that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate for an extended period. The Committee will complete its purchases of $600 billion of longer-term Treasury securities by the end of this month and will maintain its existing policy of reinvesting principal payments from its securities holdings. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate.

The Committee will monitor the economic outlook and financial developments and will act as needed to best foster maximum employment and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Richard W. Fisher; Narayana Kocherlakota; Charles I. Plosser; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen.”

See the original article >>

Etichette:

articles,

Economy article,

Finance article,

market articles

Hunger Pains: The Food Crisis Hits Home

by Kevin Kerr

For a very long time in America we’ve enjoyed a seemingly endless, cheap, and abundant variety of foods from all over the globe.

Although for many of us, our understanding of food supply and what it takes to get it all on the grocery store shelves is very limited. Somehow, it just magically appears!

The problem: Like so many of our other natural resources, we have simply taken for granted the costs associated with producing, harvesting, packaging, and shipping the items we have come to expect at the market each day.

But with fuel prices and other costs surging, we are seeing …

The End of Cheap Food

Today, in emerging markets such as India and China, there is exponential growth and a new middle class that is demanding things they’ve never had before. Millions of cars, better housing, electronics, and above all … better foods.

Demand has surged for things like meats, better quality grains, soft commodities including coffee, cocoa, and sugar. This huge increase in demand is rapidly outstripping supplies of many key resources, and putting a strain on an already overloaded agriculture system.

On top of the global surge in demand we are seeing a decline in quality agricultural acreage and arable land in many regions, mainly due to an increase in poor farming methods. In China for example, poor hillside farming techniques are quite common. And antiquated farming equipment is often still the norm.

|

| China is about the same size as the U.S., but they only have about 11 percent arable land compared to 26 percent in the U.S. |

In addition, much of the once abundant younger rural population has fled the farms for the chance of a better life and increased pay in the larger cities and factories. This migration has left behind an elderly and dying rural population that simply will not be able to sustain the growing food demand.

Meanwhile, China has been racing to secure arable farmland anywhere it can, gobbling up land in South America, Europe, and especially Africa. China has made huge investments in parts of Africa and has secured vast amounts of arable land, mining resources, and even a new built-in workforce. China’s influence is so widespread that many people are now referring to parts of the Dark Continent as Chafrica.

The Chinese leadership realizes the dire situation they face if they don’t secure long-term supply lines for food and other raw materials for their people. The widespread unrest this year in the Middle East in places like Egypt, Tunisia, and Libya, in large part was ignited because of surging food and fuel costs. This is very worrisome to the Chinese leadership, as civil unrest in China could be uncontrollable once ignited.

More Hungry

Mouths to Feed

Mouths to Feed

According to the U.S. Census Bureau, the current world population of close to 7 billion is projected to exceed 9 billion by the middle of this century. To put those numbers in perspective, in 1950 there were only 2.5 billion people.

As global population explodes demand for food, fuel and land will increase at a frantic pace as nations work to secure long-term supplies from all corners of the Earth.

High Costs Going

Much Higher

Much Higher

Of course higher prices for agricultural products help farmers, but at the end of the day their input costs have soared as well. Costs for things like fertilizer, equipment, irrigation, seed, and most of all, fuel.

Farming is a very energy intensive business, and as diesel and other fuel costs soar those increased prices roll downhill to the consumer in the grocery aisle. And energy costs don’t just impact the growing process … it also significantly increases the cost of packaging and certainly transport.

As food prices climb, along with everything else, those costs are hitting Americans in the wallet — hard. In fact many people are being forced to make extremely difficult choices. Things have gotten so bad right now that we have over 44 million Americans on food stamps, a grim new record high, according to the latest data from the U.S. Department of Agriculture (USDA).

While surging food and gas prices are hitting Americans with a one two punch, those same prices are even more devastating for poor and developing nations, and often can often become a matter of life and death.

This is only expected to get worse …

According to a June 17, Organization for Economic Cooperation and Development Report, “Cereal costs may average 20 percent more and meat 30 percent more over the next decade than in the last one.”

2011 has been a rough year so far, as widespread natural disasters have caused major crop delays and damage around the globe. Flooding in much of the U.S. has virtually wiped out many farmers’ chances of getting any crops in the ground this season. And those who have gotten crops in the ground, risk a very hot, dry summer which may kill corn and other crops that were planted late.

In addition, many farmers are now worried that because they got the crops in late they may risk an early freeze before they can harvest.

Simply put: 2011 is setting up to be a very expensive year for agriculture and potentially a very profitable one for those who are invested in it.

Do I Think Commodities

Are in a Bubble? No Way!

Are in a Bubble? No Way!

Seems these days that everywhere I go, investors and fund managers are concerned about the rising costs of commodities. They’re always asking me if this is a commodities bubble and when it will burst, and when will prices return to the cheap levels we are used to.

My answers are always the same: This is not a bubble, and the chances of prices falling by any significant amount are slim to none.

Even now, we still have the die-hard dollar bulls coming out and claiming that we really don’t have inflation and the commodities markets are simply speculator driven and the worst for the dollar is over. I strongly disagree.

I believe a small move up in the dollar will continue a bit longer as the euro seemingly crumbles because of Greece.

However, longer term I think the same problems that drove the dollar into the ground will persist, and even worsen. The Fed has dug a hole that is too deep to climb out of, no matter how much funny money they decide to print.

Sure, speculation is a part of this picture. But to lay the blame on the farmer’s doorstep or to say it’s all speculators and hedge funds causing the run-up is a sad mistake.

Real physical demand and the weak U.S. dollar policy are two of the biggest reasons. And I don’t see demand for commodities going anywhere but higher longer term.

One thing you can count on is that everything from milk to yogurt and steak to eggs is going up in price — and not just a little, a lot!

That’s why as consumers and investors, we must look for ways to hedge ourselves against those costs we all are facing in the grocery aisle.

Grow Your Profits!

I believe one of the best ways right now to take advantage of the rising agriculture market is by using commodity ETFs. And if you like extra leverage, you can use ETF options. Some potential opportunities I like are:

PowerShares DB Agriculture ETF (DBA) — An unleveraged ETF with broad exposure to agricultural commodities including soybeans, cattle, sugar, corn, coffee, cocoa, hogs, wheat and cotton.

PowerShares DB Agriculture Double Long ETN (DAG) — A 200 percent leveraged long ETN focused on wheat, corn, soybeans and sugar.

iPath Dow Jones-AIG Grains Total Return Sub-Index ETN (JJG) — This exchange traded note is solely focused on the three primary grains: Wheat, corn and soybeans. It uses futures contracts to establish the positions in these grains, the same approach as the PowerShares ETFs.

But before you jump into a trading strategy for the rising food and fuel markets, always get advice from an expert who understands the resource markets inside and out … these markets can be very fast paced indeed.

Etichette:

articles,

commodity,

Economy article,

Finance article,

market articles

Previewing Today's 12:30 EDT FOMC Decision, And The Fed's Options Should The Economy Not Rebound

by Tyler Durden

And from Bloomberg's Senior Economist, Robert Elson:

Fed Options If Economy Does Not Rebound

Just like yesterday's G-Pap vote of confidence was largely a snoozer and a "sell the news" type of event, so today's FOMC meeting and subsequent press conference, will likely disappoint, despite the 2 Year now trading at an Operation Twist 2 "priced in" 0.358%. It is certain that this expectations of at least some modest Fed intervention has slipped into equities. Thus, should Gross' prediction of a tentative QE3 announcement today fall through, and remember that the S&P has to be about 20% lower for the green light in our humble opinion, look for Waddell and Reed to be put under quarantine again at 12:30 when the decision is released.

Here is what one can expect from the FOMC in 5 hours, courtesy of Ran Squawk:

FOMC rate-decision due at 1230 EDT followed by Fed’s Bernanke press-conference at 1415 EDT

It is expected that owing to recent weakness in US economic data, alongside adverse external factors such as the ongoing Eurozone debt concerns, Japanese earthquake and nuclear crisis and tension in the MENA region, the Fed will refrain from any monetary tightening for the time being. At the same time, the central bank is unlikely to opt for another round of Treasury and TIPS purchases as the ongoing debate over the issue of the US debt ceiling together with recent rating agency concerns surrounding country’s ballooning deficit are likely to prove a further deterrent to “QE3”.

In the accompanying press conference, Bernanke is expected to reiterate that the FOMC seeks monetary and financial conditions that will foster price stability and promote sustainable growth in output. He is also expected to support the policy of reinvesting principal payments from agency debt and mortgage-backed securities in longer-term Treasury securities. This would ensure the total face value of domestic securities held in its System Open Market Account (SOMA) is at approximately USD 2.6trl. The Fed will likely keep the fed fund target unchanged in the range of 0%-0.25%, and the chairman may note a disappointing non-farm payroll figures for the month of May, which saw an addition of a meagre 54K jobs to the economy. However, Bernanke is likely to emphasise that the recent weakness is temporary in nature and will dissipate in due course.

Although the Fed is unlikely to change its medium to long term growth and inflation forecasts, it may downgrade its 2011 real GDP forecast, citing a weak first quarter. It is worth noting that the Fed downgraded its real GDP 2011 forecast in April to 3.1%-3.3%, from its previous January projection of 3.4%-3.9%. On the inflation front, the Fed is expected to reiterate that it will pay close attention to the evolution of inflation and inflation expectations, however it may say that any rise in inflation would be transitory, citing the recent downturn in commodity prices. It is also expected that the central bank will keep the “exceptionally low for an extended period” phrase in its June statement.

Markets will also keep a close eye on any comments with respect to the discount window, which currently stands in the range 0%-1.25%. To bolster growth, the Fed may decide to reduce the primary or secondary credit rate from its current 0.75% and 1.25% levels respectively. Alternatively, it may expand the range of collateral it accepts to more riskier assets, thus helping the wider economy and at the same time lowering rates on these assets. A less likely, yet conceivable area to watch for would be any potential comments on setting a higher inflation target, which in turn would accentuate Fed’s “extended period” language.

Overall the Fed is likely to be in “a wait and see” mode and as such the reaction may be a muted. However, in the unlikely scenario that the Fed does opt for “QE3”, it would come as a big surprise to the market and given historic reaction to an increase in quantitative easing the USD would likely come under heavy selling pressure where as stocks may benefit from the Fed’s intention to continue its support for the economy.

In the accompanying press conference, Bernanke is expected to reiterate that the FOMC seeks monetary and financial conditions that will foster price stability and promote sustainable growth in output. He is also expected to support the policy of reinvesting principal payments from agency debt and mortgage-backed securities in longer-term Treasury securities. This would ensure the total face value of domestic securities held in its System Open Market Account (SOMA) is at approximately USD 2.6trl. The Fed will likely keep the fed fund target unchanged in the range of 0%-0.25%, and the chairman may note a disappointing non-farm payroll figures for the month of May, which saw an addition of a meagre 54K jobs to the economy. However, Bernanke is likely to emphasise that the recent weakness is temporary in nature and will dissipate in due course.

Although the Fed is unlikely to change its medium to long term growth and inflation forecasts, it may downgrade its 2011 real GDP forecast, citing a weak first quarter. It is worth noting that the Fed downgraded its real GDP 2011 forecast in April to 3.1%-3.3%, from its previous January projection of 3.4%-3.9%. On the inflation front, the Fed is expected to reiterate that it will pay close attention to the evolution of inflation and inflation expectations, however it may say that any rise in inflation would be transitory, citing the recent downturn in commodity prices. It is also expected that the central bank will keep the “exceptionally low for an extended period” phrase in its June statement.

Markets will also keep a close eye on any comments with respect to the discount window, which currently stands in the range 0%-1.25%. To bolster growth, the Fed may decide to reduce the primary or secondary credit rate from its current 0.75% and 1.25% levels respectively. Alternatively, it may expand the range of collateral it accepts to more riskier assets, thus helping the wider economy and at the same time lowering rates on these assets. A less likely, yet conceivable area to watch for would be any potential comments on setting a higher inflation target, which in turn would accentuate Fed’s “extended period” language.

Overall the Fed is likely to be in “a wait and see” mode and as such the reaction may be a muted. However, in the unlikely scenario that the Fed does opt for “QE3”, it would come as a big surprise to the market and given historic reaction to an increase in quantitative easing the USD would likely come under heavy selling pressure where as stocks may benefit from the Fed’s intention to continue its support for the economy.

Source: RanSquawk

And from Bloomberg's Senior Economist, Robert Elson:

Fed Options If Economy Does Not Rebound

• Fed will acknowledge slowing growth, slightly altering statement to reflect a “recovery that is proceeding at a modest pace.”

• Committee will likely point to falling commodity costs, anchored inflation expectations and labor market slack as trumping transitory bump in inflation.

• Central tendency forecast for 2011 will likely see growth forecast shaved down to 2.75%, or roughly 1% below where Fed started out the year and downward revision to 2012 forecast.

• Questions in presser are likely to revolve around what arrows the Fed has left it its quiver to support the economy should it not rebound.

At its two-day meeting the FOMC will likely discuss what steps to take, if any, to support the economy and financial markets following the culmination of its asset purchase program.

While those options are dwindling, the Fed has at its disposal a series of potent measures that it can implement in the unlikely event that growth slows further in the second half or slows unexpectedly in 2012.

Given that the Fed President Ben Bernanke has gone out of his way to state that a near term resumption of asset purchases is unlikely and the hurdle to quantitative easing III is quite high (Please see the June 10 Bloomberg Economic Brief), the Fed can turn to other alternative measures to support the economy if necessary.

Thus, it would not be surprising if one of the first questions in today’s FOMC press conference is what the Fed is ready to do other than another round of asset purchases to support the economy.

Bernanke is likely to state that the central bank has at its command a set of tools that will permit it to support financial markets and economic activity, that do not all rely on asset purchases.

Mostly, they have to do with what the Fed refers to as its communications policy, or its ability to influence the direction of the short and long-term interest rates, financial conditions, and economic activity and inflation expectations.

With the federal funds rate essentially at zero, the central bank can only indirectly influence the level of long-term yields either through asset purchases or committing to remain accommodative for a much longer period of time than is currently expected.

Under traditional monetary conditions, the transmission mechanism starts with the changes in the overnight rate. Under current conditions, the transmission mechanism of begins with attempts to alter the level of long-term rates.

To keep long term yields low, absent further asset purchase, any Fed move to support the economy can best be classified as conditional commitment, formal commitment and going nuclear.

First, the FOMC can conditionally commit to keeping the current policy path for a specific period of time based on the evolution of economic conditions. The Bank of Canada did exactly that from April 2009 to April 2010 when it kept its policy rate at 0.25 percent.

In one sense, the Fed has implicitly done so over the past 18 meetings (2 years, 3 months). Thus, maintaining the phrase “extended period of time” in the statement, and making that commitment more explicit would likely not dislodge long term inflation expectations which currently stand at 2.1 percent, nor cause an upset in financial markets.

A conditional commitment that acknowledges the need to remain on hold until a specific point in the future when the Fed expects the economy will be able to stand on its own, would signal to investors that policy will remain accommodative even as growth and employment modestly rebound.

Along those same lines, the committee could choose to maintain its balance sheet at or near current levels to support lower long and short term yields, to facilitate growth.

Alternatively, The Fed can simply reduce interest paid on reserves to zero to from the current 25 basis points to spur bank lending at low current rates by eliminating the return on excess reserves of the banks at the Fed.

Second, as suggested by a recent Bloomberg news report, the Fed could make explicit its implied inflation target of 2 percent to firmly anchor public expectations of prices if the committee chooses to formally commit to supporting the economy for a longer period than is currently anticipated.

Given the increase in core PCE and CPI over the past few months even with the generous amount of economic slack that remains in the economy, the FOMC could turn to a formal targeting regime to bolster market confidence and buttress its own credibility in light of risks to the outlook from inflation.

Third, should these measures not translate into better employment and growth or deflationary risks return, the Fed could go nuclear. In his 2002 speech “Deflation: Making Sure it Doesn’t Happen Here” Bernanke did make a credible case for capping yields as a method of addressing deflation with interest rates at the zero bound.

Finally, should banks not respond to the incentive of a zero return on holding excess reserves at the Fed, policymakers could impose a penalty on excess reserves essentially taxing banks that choose to park money at the Fed.

While the nuclear option remains an outlier, should the economy prove it is not ready to stand on its own, the committee will likely consider alternative scenarios to support growth and it will be interesting to see if Bernanke provides any hint of conditional or formal commitment in his answers to questions in today’s press conference.

• Committee will likely point to falling commodity costs, anchored inflation expectations and labor market slack as trumping transitory bump in inflation.

• Central tendency forecast for 2011 will likely see growth forecast shaved down to 2.75%, or roughly 1% below where Fed started out the year and downward revision to 2012 forecast.

• Questions in presser are likely to revolve around what arrows the Fed has left it its quiver to support the economy should it not rebound.

At its two-day meeting the FOMC will likely discuss what steps to take, if any, to support the economy and financial markets following the culmination of its asset purchase program.

While those options are dwindling, the Fed has at its disposal a series of potent measures that it can implement in the unlikely event that growth slows further in the second half or slows unexpectedly in 2012.

Given that the Fed President Ben Bernanke has gone out of his way to state that a near term resumption of asset purchases is unlikely and the hurdle to quantitative easing III is quite high (Please see the June 10 Bloomberg Economic Brief), the Fed can turn to other alternative measures to support the economy if necessary.

Thus, it would not be surprising if one of the first questions in today’s FOMC press conference is what the Fed is ready to do other than another round of asset purchases to support the economy.

Bernanke is likely to state that the central bank has at its command a set of tools that will permit it to support financial markets and economic activity, that do not all rely on asset purchases.

Mostly, they have to do with what the Fed refers to as its communications policy, or its ability to influence the direction of the short and long-term interest rates, financial conditions, and economic activity and inflation expectations.

With the federal funds rate essentially at zero, the central bank can only indirectly influence the level of long-term yields either through asset purchases or committing to remain accommodative for a much longer period of time than is currently expected.

Under traditional monetary conditions, the transmission mechanism starts with the changes in the overnight rate. Under current conditions, the transmission mechanism of begins with attempts to alter the level of long-term rates.

To keep long term yields low, absent further asset purchase, any Fed move to support the economy can best be classified as conditional commitment, formal commitment and going nuclear.

First, the FOMC can conditionally commit to keeping the current policy path for a specific period of time based on the evolution of economic conditions. The Bank of Canada did exactly that from April 2009 to April 2010 when it kept its policy rate at 0.25 percent.

In one sense, the Fed has implicitly done so over the past 18 meetings (2 years, 3 months). Thus, maintaining the phrase “extended period of time” in the statement, and making that commitment more explicit would likely not dislodge long term inflation expectations which currently stand at 2.1 percent, nor cause an upset in financial markets.

A conditional commitment that acknowledges the need to remain on hold until a specific point in the future when the Fed expects the economy will be able to stand on its own, would signal to investors that policy will remain accommodative even as growth and employment modestly rebound.

Along those same lines, the committee could choose to maintain its balance sheet at or near current levels to support lower long and short term yields, to facilitate growth.

Alternatively, The Fed can simply reduce interest paid on reserves to zero to from the current 25 basis points to spur bank lending at low current rates by eliminating the return on excess reserves of the banks at the Fed.

Second, as suggested by a recent Bloomberg news report, the Fed could make explicit its implied inflation target of 2 percent to firmly anchor public expectations of prices if the committee chooses to formally commit to supporting the economy for a longer period than is currently anticipated.

Given the increase in core PCE and CPI over the past few months even with the generous amount of economic slack that remains in the economy, the FOMC could turn to a formal targeting regime to bolster market confidence and buttress its own credibility in light of risks to the outlook from inflation.

Third, should these measures not translate into better employment and growth or deflationary risks return, the Fed could go nuclear. In his 2002 speech “Deflation: Making Sure it Doesn’t Happen Here” Bernanke did make a credible case for capping yields as a method of addressing deflation with interest rates at the zero bound.

Finally, should banks not respond to the incentive of a zero return on holding excess reserves at the Fed, policymakers could impose a penalty on excess reserves essentially taxing banks that choose to park money at the Fed.

While the nuclear option remains an outlier, should the economy prove it is not ready to stand on its own, the committee will likely consider alternative scenarios to support growth and it will be interesting to see if Bernanke provides any hint of conditional or formal commitment in his answers to questions in today’s press conference.

Etichette:

articles,

Economy article,

Finance article,

market articles

Upswing in Minnesota farmland demand continues at record pace

By: Staff Report, Alexandria Echo Press

“While 75 to 85 percent of land buyers continue to be farmers, interest among outside investors has risen,” said Lee Vermeer, AFM, vice president of real estate operations at Farmers National Company. “Despite the robust demand driving sales activity levels, reports show that lenders are taking a relatively conservative approach to lending. Strong profits the past few years have provided cash for farmer buyers, while investors are taking cash from other sources to rebalance portfolios.”

While commodity prices are keeping land values rising, supply of available land for sale is down 30 percent from historical numbers, according to Vermeer. High grain profits and high farm income are tied to the demand for farmland, driving prices up. Low interest rates are also working to keep prices increasing.

“The total crop from last year wasn’t what was projected,” said Vermeer. “The result was a limited supply which resulted in increased prices. We are looking ahead to continued strong commodity prices due to late spring planting. Early summer floods are reducing crop acres.”

Regional Land Value Reports

Iowa and Minnesota

The land market continues to be very strong in the North Central Region including Iowa, Missouri, Minnesota, South Dakota and North Dakota, according to Sam Kain, area sales manager for Farmers National Company in Iowa and Minnesota. Buyers are looking for quality land, with the majority of sales going to farmers.

“There are fewer properties for sale and the spread between low quality land prices and high quality prices continues to widen,” said Kain. “I would say land values in some areas have increased as much as 20 percent in the last six months, and as much as 25 percent compared to a year ago.

In Iowa, top quality land is selling at over $8,000 per acre, with Minnesota values bringing in $7,000 plus per acre. While sales of medium quality land and recreational land in this area have been slow, the pace for high quality keeps rising.

Not only is demand for top land still rising, the availability of property for sale remains limited. Buyers are looking for land with high productivity levels, which is a challenge.

“In my more than 25 years in the business, I have never seen more demand than now,” said Kain. “This is not only from farmers but from individual investors and investor groups.”

Etichette:

articles,

Economy article,

Finance article,

market articles

The Imminent Collapse Of The Euro: How To Protect Your Investments And Play This Inflection Point For Huge Gains

By Jack Barnes

In fact, as all the latest speculation about Greece either abandoning the euro currency - or being booted out of the Eurozone outright - is demonstrating, "the market" is about to apply a level of pressure well beyond what the Eurozone and European Union (EU) were designed to handle.

The number of sovereign states in the EU that are facing difficulty selling new debt, or even a rollover of current debt, is growing.

The Eurozone and the EU are both in trouble. Clearly, the structure that exists today is flawed and will not withstand the rigors and pressures that are headed directly its way.

The ability to kick the can down the road is about to end, and with it some hard decisions will need to be made by the political and wealthy elite.

Let's take a closer look.

But first, if you're interested in a way to make potential profits, no matter what the euro does, click here for our latest report, The "Rich Trick" Strategy That Beats Growth Stocks By 3,000%.

Just a moment ago, I mentioned that "the market" is ready to expose the flaws in the euro mechanism. The truth is that this is already happening. The risk-adjusted interest rates demanded by the market is now significantly higher than what the market would charge a major AAA-rated corporation for money that it borrowed via a bond issue.

As recently as a few months ago, we reached a point where the credit-default-swap (CDS) pricing on Western European states is higher than Eastern European states.

In case you are wondering, this is a first.

Simply put, bond-risk managers want to be paid a higher rate of return to insure Western Europe than Eastern Europe. This is a significant and statistically important point. The Eastern European states are only partially absorbed into the European Union. Of all the participating members, it's this group of Eastern states that could leave the EU the easiest and quickest of the participating members.

This could all help determine the future of the euro. Indeed, if you look at the big picture, the individual European states will need to consider a return to independent sovereign rule in the extreme - or at the very least a return to separate national currencies, thereby ending the Eurozone and euro currency experiments.

The number of governments that have experienced a change since this economic crisis started is growing.

That list includes all of the island nations of Europe - Iceland, Great Britain and even Ireland. (Just yesterday (Tuesday), in fact, Ireland underscored the challenges it faces and stunned observers by disclosing a plan that will have it raiding private pension accounts in order to finance the spending on its job-growth strategy.)

Even in the heart of continental Europe, the number of nations experiencing wrenching change is steadily growing. Belgium has not had a government in almost a year. And Portugal's austerity challenges are so large in scope that not even Socrates could save it - Prime Minister Jose Socrates, that is. He resigned and is being replaced.

In France, President Nicolas Sarkozy, the most visible leader of the French government, is experiencing career-low approval ratings. His party has committed a series of political gaffes, leaving it weakened and distracted in domestic politics. The current Sarkozy government is focused on G20 political events, trying to generate a positive spin on something. President Sarkozy is not expected to survive the next political round of national elections.

The European (Dis)Union - The Dissolution of the EU

In Germany, the heart of industrialized Europe, we're seeing a series of changes in the makeup of the state-level governments. The current national government of German Chancellor Angela Merkel is expected to fall, with a new coalition of parties forming a government to replace her central conservative government.Going forward - no matter who is in charge - you can expect to see a German government that's more willing than ever to make "tough calls." For instance, as a direct result of the nuclear-power plant disaster in n Japan, Germany will experience an ever-increasing pressure to turn off all 17 of its own nuclear plants - a move that will prove very costly for consumers.

In the months and years to come, you can expect to see Germany start to focus more on what is best for Germany - to the exclusion of what is best for Europe - even though that self-interest will come at the expense of the rest of Europe.

Germany is going to be far less likely to agree to additional bailouts for other European countries. In fact, the era of unlimited access to Germany's hefty balance sheet is just about over.

The implications for the EU's overleveraged "PIIG" nations (Portugal, Ireland, Italy and Greece) - which no doubt believed they would always have access to Germany's deep pockets - have yet to be fully determined. But to modify an old Wall Street adage - "Bulls make money, bears make money, PIIGS get slaughtered" - when Europe must do without Germany's deep pockets, investors can expect casualties.

So while the idea of unity in Europe may have merit, and the future of a unified Europe is still open to discussion, the cold reality is that the EU, as it currently exists, is on life support. And in its current state, the union and the currency won't even make it to the end of 2012 - at least not in my opinion.

One major problem I see is that the European Central Bank (ECB), which handles the monetary policy for the 17 Eurozone member states, is not properly capitalized to handle the demands being made upon it.

The ECB is tasked with providing independent monetary actions in an environment of extremely intense political and economic negotiations between historically sovereign states. Needless to say, the most sensitive topic is how much each of the more-affluent member states will provide in the way of financial support to weaker sister states (a key reason that Germany is going to become so much more protective of its national balance sheet).

The Irish Connection and the Future of the Euro

Since its beginnings last summer, the European debt crisis has been a major cause for concern, with global investors worrying that it might cause a double-dip downturn in world economies and financial markets.But as I told some of Money Morning's top editors and writers during one of our regularly scheduled "private briefings", the drawn-out nature of this affair has helped diminish its impact. At that same time, however, I told the editors about a particular set of circumstances that could serve as the catalyst needed to transform the European debt crisis into a full-fledged conflagration - an inferno intense enough to bring about the dissolution of the euro-currency structure.

The catalyst I identified was Ireland.

And Ireland will play a key role in determining the future of the euro.

In the midst of the growing sovereign debt crisis last year, Ireland was forced to seek a bailout because of an economy that shrank 15% from where it was in 2007. Needless to say, debt, too, was a problem: Government borrowings - about 25% of gross domestic product (GDP) at the end of 2007 - are projected to peak at 116% of GDP in 2014.

"I think we can deal with it," new Irish Prime Minister Enda Kenny said during a meeting of the Council on Foreign Relations in New York last week. "The scale of the challenge is enormous but so is the opportunity."

The new government was brought into power to renegotiate the deal the last government agreed to with the ECB and International Monetary Fund (IMF). This agreement is both technically in effect and technically not fully agreed upon. In other words, it's in kind of a "limbo" status, leaving the Irish government room to demand renegotiations. Prime Minister Kenny is seeking a reduction on the average 5.8% interest rate his country is paying on that aid.

In much the same way that Iceland had banks that were larger than its entire domestic economy, the Irish banks had grown their own balance sheets beyond the size of the nation they represented. As a result of this levering up process, the tab for bailing out the banking sector could swell to $101 billion - or $21,610 for each of Ireland's 4.5 million citizens.

In other words, in a country with a nominal gross domestic product (GDP) of about $230 billion, this banking mess has left "the people" on the hook for debts well beyond anything that they could hope to pay back.

Little wonder that Ireland's new government appears so willing to rob the private pension funds of its citizenry.

In briefing Money Morning's editors, I said that if Ireland's leaders proved themselves willing and able to indebt the country's future generations - to force those generations to cover bad loans made by what had been the country's "private-sector" banking business -I could see the European debt crisis intensifying in a way most observers just weren't seeing.

Those banks are now being nationalized, and the risks absorbed by the balance of the people.

Making matters worse is the reality that renegotiating the bailout package may be easier said than done.

Germany's Merkel is now in a position where she can't afford to appear to be bailing out any of the EU's PIIG-member states. At the same time, it seems that Kenny's new Irish government has staked its future on providing a reduction in the costs of the bailout.

The bottom line: Neither the Germans nor the Irish appear to have an acceptable compromise to present to the home crowds.

On top of all this, looming quickly is the big sovereign-debt rollover for Italy and Spain, which combined owe about $400 billion. It is a sum that "the market" is not likely going to want to provide on terms either government will find acceptable.

This leaves the already-broke ECB, and its new "bad-bank" twin, the European Stabilizing Fund (ESF), along with the IMF, to ride to the rescue. The rescue will not be piecemeal, but will, in fact, be a major package for most of the liquidity-starved states.

The cost will most likely come in the form of giving up individual sovereign rights, while protecting the banking system from itself.

And if this all can't be ironed out, then the future of the euro will be very, very clear. And so will the currency's epitaph.

Finally, the future of the euro is unstable, to say the least, and investors should be preparing their portfolios for years of chaos ahead in the European Union. To learn about a specific Europe-proof investment strategy, click here for our latest presentation.

Action To Take - From The Editor

With impoverished debtor nations and exhausted lender states, the European Union has some very difficult decisions ahead. And investors should take precautions to protect their portfolios against the fallout of a potential EU implosion, while also positioning themselves to profit in the event of a euro crash.When looking at European stocks, watch out for companies that are overexposed to the EU's largest debtor or lender states. These will be the first to pull out - or get booted out - in the event of a collapse.

As for the euro itself, now is the time to start betting against the EU currency. And in this situation, when you want to play the fall of a currency, but not the rise of another, a short ETF is a better choice than jumping directly into the foreign exchange market.

ProShares UltraShort Euro (NYSE: EUO) is one excellent option. This ETF delivers a return of -200% on the performance of the euro - meaning when the euro goes down, EUO will go up twice as much. And with the euro and the EU about to face some very adverse situations, the EUO could see remarkable gains in coming months.

A note to investors: Like other inverse ETFs, EUO is factored in daily increments. And the compounding of these daily changes can cause specific shares to lag the profits or losses seen in the underlying asset - in this case, the euro. This is especially true in volatile markets. Keep a close eye on your inverse ETF investments, and if a significant difference begins to develop, sell and buy back in.

Etichette:

articles,

Currencies,

Economy article,

euro fx,

Finance article,

market articles

Five Ways To Profit As Coffee Prices Soar

By Jack Barnes

If you want physical proof that we're operating in a truly global economy these days, just look at how these three factors have creamed your coffee budget:

- Lousy weather in Latin America is threatening a big chunk of the worldwide coffee crop.

- U.S. coffee stockpiles are reportedly at a 10-year low.

- And Vietnam and Brazil - two of the world's Top 3 exporters - are scheming to hoard their stockpiles.

Expect the trend to continue.

This may be bad news for your pocketbook - but it's great news for your portfolio. Coffee prices are going to rocket even higher from here.

And with the strategy we're about to show you, this run-up in prices will be truly good ‘til the last drop.

Food Price Inflation

In the soft agriculture commodities sector, inflation in food and staples is starting to really hit a lot of people's food budgets. Wheat has really run up in price, and now latecomer coffee is joining the price-increase party.

The price of coffee has been brewing for years, but now it's boiling over. Coffee has zoomed 69% in the last year. Since hitting its market lows back in 2002, coffee has generated a compounded annual rate of return of about 20%.

* Our latest presentation uncovers an investment with much higher potential returns than 20%. The largest pharmaceutical players are rushing to ink deals with a tiny research lab 35 miles outside Washington DC. And why not? They've just discovered a completely new way to battle cancer. It's called "programmed cell destruction" (PCD) and could save 7.6 million lives - per year! This small company's perfectly poised to grab a huge chunk of a $120 billion market... and Big Pharma's monster appetite could shoot their stock even higher. You've got to move fast on this one. Details here.

It's forcing a reaction in the marketplace. The J.M. Smucker Co. (NYSE: SJM) - parent of the Folgers, Dunkin' Donuts and Millstone brands - has raised prices 10%.

"The J.M. Smucker Company has been committed to transparent coffee pricing that reflects the fluctuations of the global green coffee market," a company spokesman said. The Maxwell and Green Mountain brands are also raising prices as their margins get squeezed.

Trust me, you're going to see many more such announcements come along: These are just the first of many trickle-down price increases for consumers, who can expect a flood of these events in the months to come as retailers pass on the increases to their customers.

For now, weather is the biggest catalyst. Three countries combine to provide about 65% of the world's coffee supply, according to the International Coffee Organization. Those three countries, and their respective shares of the global market, consist of Brazil (38%), Vietnam (14.5%) and Colombia (12.3%).

Because the supply of coffee beans is so concentrated, weather plays a huge role in market prices. The weather in Brazil last year and Vietnam this year have played havoc with crops. And in Colombia, high levels of rainfall have caused a major outbreak of fungus.

There are concerns in Congress - specifically in the Senate, that coffee hoarding could break out at the exporter level. As noted, there are already concerns that Vietnam and/or Brazil will start to stockpile coffee, driving up prices even more.

"Stockpiling by the two largest producer countries would have adverse economic consequences for importing countries, as well as for consumers around the world," U.S. Sen. Charles E. "Chuck" Schumer, D-NY, said.

Arabica is the world's most-widely grown coffee. Vietnam is the world's largest producer of robusta beans.

"We've seen some international companies ask for more robusta than they used to," Bui Hung Manh, head of the business department at Tay Nguyen Coffee Investment, Import and Export Co., Buon Ma Thuot, Vietnam, told Bloomberg News. Tay Nguyen Coffee is Vietnam's single-biggest exporter.

Don't Forget Demand

Coffee demand has grown by 2.5% per year for the last decade. For context, demand has grown from 100 million bags in 2000, to 135 million bags today. Each bag consists of a 60-kilo sack of green, unroasted coffee beans.

This demand has continued during the recession, as people have switched from retail purchases, to brewing at home. So while the price of coffee has gone up, and retail stores are experiencing lower volumes, the overall demand for coffee has continued to rise as people drink more at home.

In 2002, when green-coffee-bean supplies were in surplus, a pound of coffee sold for 47 cents.

Today that same coffee sells for more than $3 per pound. The price was around $1.03 per pound in December 2008 during the peak of the economic crisis. That's a nearly 200% increase.

Let's review how the price of coffee has managed to compound by 19.8% per year, every year for the last 8 years, without too much notice. The reality is that:

- Demand has grown, regardless of economic conditions worldwide in the last decade.

- Weather conditions for the last two years have impacted the major exporters.

- About 65% of the world's supply comes from three nations.

- And with demand high and supplies getting squeezed, exporters may be prompted to hoard supplies to further drive up prices.

The price of green coffee beans has a chance to break out to even higher prices in 2011.

While I am bullish on coffee in the intermediate and long terms, I believe there is a very real possibility that we'll see a pullback in the coming days or weeks.

Once that occurs, however, I would urge investors to take a really careful look at coffee as a top profit play, particularly given the demand, hoarding and weather-related catalysts - all of which are bullish for coffee prices.

Here is how we can hedge our own personal exposure to the price of coffee, and make some profits at the same time. There are listed profit plays for coffee in both the European and U.S. markets.

If you live in the United States, you can purchase shares in the iPath Dow Jones-UBS Coffee Subindex Total Return Exchange Traded Note (ETN) (NYSE: JO).

If you live in Europe, or you have trading exposure to the London stock market, you can buy an exchange-traded-fund (ETF) equivalent, which gives you the ability to go "long" on coffee, "short" on coffee, or be 200% leveraged long on coffee.

These ETF-like vehicles also are based on the USB-DJ Coffee sub index and traded on the London stock exchange (LSE). They are, in order:

• ETFS Coffee (LSE: COFF)

• ETFS Short Coffee (LSE: SCFE)

• ETFS Leveraged Coffee (LSE: LCFE)

With this foundation of understanding now established, let's look at some specifics.

If you're a U.S. investor, wait for a pullback of between 5% and 10% in the next few weeks, and then buy an amount of the ETN equal to 3% to 5% of your portfolio. I would suggest using a 10% moving stop loss and look for a 30% gain in the next 12 months to 18 months.

If you want to leverage this trade, look to purchase coffee futures.

Once this move up has been fully digested by the market in 2012, and the weather around the world has permitted growth of a bumper crop big enough to meet growing demand, I would consider switching out of the long side, and buying the short coffee ETN for a chance to "double down" on your profits.

In the near term, you can obviously hedge your own exposure to coffee by buying in bulk at your local Costco Warehouse Corp. (Nasdaq: COST)-type warehouse store. This will be the solution for my family, as my wife will not start her day without her pot of coffee.

You can also hedge your investments using a simple "trick" the rich use to grow infinitely richer - legally, quietly and with very little risk. (No, it's not gold.) In fact, it's already paid out a total of $910 billion to select investors over the last few years alone. Go here for our latest presentation.

See the original article >>

Etichette:

articles,

coffee,

commodity,

commodity article,

market articles,

Softs

The U.S. Federal Reserve Plan For QE3 – And Why It's a Done Deal

By Keith Fitz-Gerald

Let me answer that for you: QE3 is a done deal - although Fed Chairman Ben Bernanke & Co. might well give it another name.

Let me explain ...

$2.3 Trillion ... And Counting

Since December 2008, when a worldwide credit crisis threatened to take down the global financial system, the U.S. Federal Reserve has had a starring role. It has held the benchmark Federal Funds rate at historic lows between zero and 0.25% to keep the U.S. economy from stalling. And it's pumped more than $2.3 trillion into the American financial system, mostly by purchasing securities on the open market.

The key to these asset purchases has been two "quantitative easing" plans. The second of the two, known as "QE2," was a $600 billion initiative that was rolled out in November. It's supposed to wind down when the second quarter ends next week - which is what the Fed promised at the end of its last FOMC meeting in late April.

When the Fed's policymaking Federal Open Market Committee (FOMC) meeting breaks up at around noon today, pundits are expecting Team Bernanke to announce that it's holding rates steady, and is winding down QE2 as promised.

But I'm just not buying this.

You see, there's a reason there's so much interest in the Federal Reserve plan for QE2 - and for its plan for the much-talked-about QE3: At some point, the Bernanke-led Fed will be forced to halt this epic stimulus initiative. And that could ignite an inflationary firestorm not seen in this country in decades - if ever. That will turn the Fed's mandate of maintaining "price stability" into a bad joke.

But, even worse, it could tip the U.S. economy into a double-dip recession, ignite widespread layoffs and drive unemployment skyward, and hammer this country's standard of living - especially in households that didn't prepare for this eventuality.

So when Bernanke takes the podium for his press conference this afternoon (his second so far this year - the only two, in fact, ever held by a sitting Fed chairman), this one question is likely to be the first one that gets asked: "Mr. Bernanke, will you, or won't you, bring on QE3?

After all, the stimulus propped up the global financial markets once before, so why won't it work again ... or so goes the reasoning.

You can certainly understand the intense interest in this element of the current Federal Reserve plan for the American economy.

Here at home, U.S. stocks just concluded a six-week losing streak, and now face the so-called "summer doldrums." The American housing market seems to be getting worse. And inflationary pressures are building even as the U.S. economy appears to be slowing down - forcing investors to face the possibility that we'll see a double-dip recession that's infected with a virulent case of stagflation.

The overseas outlook isn't that much better. In the near term, the potential for a Greek debt default seems to soar one day and plummet the next and there seems to be a general belief that it's going to happen - the only question being when. And there are long-term issues, too, including the so-called "death" of nuclear power, which promises to cause energy prices to spike in the years to come.

So what about QE3?

Given this complicated backdrop, I think it's already baked in. The Fed just won't call it that. And I think they'll play a bit with the timing.

But, even worse, it could tip the U.S. economy into a double-dip recession, ignite widespread layoffs and drive unemployment skyward, and hammer this country's standard of living - especially in households that didn't prepare for this eventuality.

So when Bernanke takes the podium for his press conference this afternoon (his second so far this year - the only two, in fact, ever held by a sitting Fed chairman), this one question is likely to be the first one that gets asked: "Mr. Bernanke, will you, or won't you, bring on QE3?

After all, the stimulus propped up the global financial markets once before, so why won't it work again ... or so goes the reasoning.

You can certainly understand the intense interest in this element of the current Federal Reserve plan for the American economy.

Here at home, U.S. stocks just concluded a six-week losing streak, and now face the so-called "summer doldrums." The American housing market seems to be getting worse. And inflationary pressures are building even as the U.S. economy appears to be slowing down - forcing investors to face the possibility that we'll see a double-dip recession that's infected with a virulent case of stagflation.

The overseas outlook isn't that much better. In the near term, the potential for a Greek debt default seems to soar one day and plummet the next and there seems to be a general belief that it's going to happen - the only question being when. And there are long-term issues, too, including the so-called "death" of nuclear power, which promises to cause energy prices to spike in the years to come.

So what about QE3?

Given this complicated backdrop, I think it's already baked in. The Fed just won't call it that. And I think they'll play a bit with the timing.

The Federal Reserve Plan for QE3

Here's what I see: Instead of printing more money, the Fed is likely to start reinvesting the proceeds of maturing debt. Ultimately, that won't reduce our government's bloated, toxic balance sheet. But it will change the makeup of that balance sheet - and not for the better.

I believe the Fed will also attempt a freeze of some sorts that effectively removes pressure from the U.S. Treasury markets that would otherwise crater it.

At the same time, I can easily envision continued demand for U.S. Treasuries from abroad that will confound such well-known Treasury bears as Pacific Investment Management Co. LLC (PIMCO) star Bill Gross, who has been wrong on Treasuries before.

The European euro is in real trouble - and so are the institutional investors who have parked their money there. This, in turn, means that the so-called "PIIGS" of Portugal, Italy, Ireland, Greece and Spain truly do run the barnyard - a fact that will help sustain U.S. Treasuries, as well.

As for the so-called "nuclear option" that is so popular on the late-night chat boards sponsored by card-carrying members of the tin foil hat club ... don't waste your time worrying about it. China can't dump U.S. dollars, and neither can Japan. Nor can either country dump U.S. Treasuries en masse. The reality is that there is simply not another alternative on the planet capable of absorbing the proceeds if they did so. So both nations are effectively stuck.

The final reason that I'm sure that QE3 is a done deal is, ironically, a political one. Despite the fact that so much is wrong with this country on so many levels, the fact is that this is an election year and that means the status quo is likely to remain in place until the new guy reaches the White House. And the status quo speaks to the inevitable Federal Reserve Plan for QE3 - even though it's in the "stealth mode" that I'm predicting.

Etichette:

articles,

Economy article,

Finance article,

market articles

Runaway Debt in Europe!

by Smart Money Europe

Not only the Greeks are doing a terrible job at managing their government expenditures and debt levels.

Seems like European mastodons like France and Germany are violating the EU Stability Pact @ 60%.

What’s more, newcomers from Eastern Europe are the best students!

Etichette:

articles,

Economy article,

Finance article,

market articles

Update Oil: Those Simple Bear Necessities

While European leaders are still rolling over the floor about what to do with Greece, the pressure on the international markets keeps on rising. Unmercifully, the clock keeps ticking, with the moment of truth for Europe just around the corner.

We will probably know within weeks if the Greeks will be receiving another bailout, or if EU officials choose to haircut. We are still counting on the first option, as a haircut implicates the end of the European Monetary Union!

The ongoing uncertainty is starting to weigh on various markets. Stock markets, especially in Europe, are almost dropping on a daily basis, as most technical indicators are showing that we are currently in a severe correction mode, following the post-2008-crash revival of about 100 percent.

From the current levels, we could expect another downward acceleration of 10-15% for most indices.

Even commodities aren’t immune for the destructive market forces. We have already been pointing at the weakness in copper. Today, oil is taking it on the chin! Last week, the price of the energy commodity dropped by 6 percent, already losing about 20% from its previous top in April 2011. The price chart has arrived at its 200-day moving average, the long term trend.

And all of a sudden, we start reading ‘doom & gloom’ headlines on populair financial media outlets like Bloomberg. “Oil is about to go into a new bear market!” Analysts are warning the masses: if oil prices drop below their long term averages, better watch your back!

Before you decide to jump out of your window, please have a look at the chart above. The experts have been overlooking the same period last year, as oil was also cracking the 200-day-level. Following the downward break-through, a fast correction of 10 percent took place.

But this fierce price correction only lasted a few months, as in November 2010, the price of oil was simply resuming its upward trend. This was the time when the Fed officialy launched its QE2 program.

Of course, many market observers are referring to the 2008 crash of oil, when the price collapsed from $147 a barrel towards below $40! With the acceleration of the European debt problems, we can see how these professionals are having their flashback moments.

But we are not convinced, this time around, it will be 2008 all over again. Back in those days, the Fed was completely behind the curve, as they dodged a deflationary depression within just a few days. Ever since, Bernanke and his team have been vigilant, closely monitoring the stock and commodity markets, especially the price of oil!

The Fed wants to avoid a repeat of the 2008-drama at all costs. If oil tumbles another 10%, rest assured the markets will receive more dollar stimulus, as was the case last year, with the launch of QE2, injecting another $600 billion.

We expect the current price pressure for oil could persist for some weeks, even months, but we don’t count on another bear market like most analysts are all of a sudden expecting. Even if oil drops towards $80, the price would still be in its uptrend and the secular bull market would stay intact.

We, on the contrary, are going to load up on positions in the oil complex in the coming weeks, as we don’t see any bears down the road.

Etichette:

articles,

commodity,

commodity article,

crude oil,

energy,

market articles,

oil

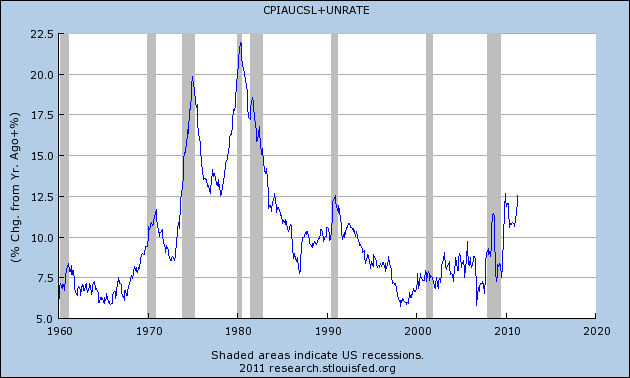

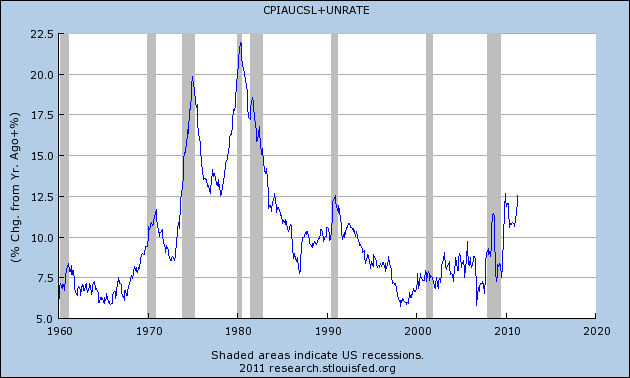

THE MISERY INDEX APPROACHES NEW HIGHS

by Cullen Roche

The misery index, the sum of inflation and the unemployment rate, is back on the climb in recent months. The index is now higher than any point during the credit crisis and just shy of the 2010 highs. If this is a measure of the Fed’s dual mandates I think it’s safe to say that they are failing miserably. But that’s to be expected when the man at the steering wheel doesn’t even understand the system he’s in charge of….

Etichette:

articles,

Economy article,

Finance article,

market articles

Coffee market may be fixed on wrong weather threat

by Agrimoney.com

Investors may be focusing on the wrong weather risk in allowing coffee prices to fall 10% over the last week to their lowest since January, a leading analysts has said.

Coffee prices set course on Tuesday for a fifth successive close, amid waning expectations for a frost in Brazil, the world's major producer – a weather event which has, in the past, proved devastating for crops and provoked large upswing in prices.

"Updated weather forecasts for Brazilian coffee production areas are calling for warmer and dryer weather, which continues to diminish the chances for a damaging freeze to this season's upcoming production," Terry Roggensack at Hightower Report said.

With frost fears fading, Rabobank highlighted that "expectations that supply will make it to the market, [which] have slowed commercial buying", at a time when harvest pressure often prompts a seasonal downswing in prices.

'Could spell trouble'

However, soft commodities specialist Judith Ganes said that the chances of a Brazilian frost were anyway "minimal, as in any given year". A march north by plantation owners to more tropical climes in recent years has cut the risk of frost.

"Where attention needs to be riveted is on the dryness that is impacting several Central American countries," she said, noting that the same high pressure ridge causing drought in Texas was keeping rain too out of countries further south, such as El Salvador, Guatemala, and Honduras.

"Farmers are worried that this could spell trouble for the 2011-12 crop, with some green beans already dropping to the ground in areas that should normally be drenched in rains at this time of year," Ms Ganes, at J Ganes Consulting, said.

"This could set the stage for continued tightness in mild arabica coffees in the season ahead."

Such a threat, during an "off" season during Brazil's two-year cycle of higher and lower production, meant coffee supplies could "easily become pinched against later this year", and that the "market is not out of the woods yet".

Vietnam acceleration?

The comments come amid reports that coffee production in El Salvador could fall by more than 20% in 2011-12.

However, caution by Ms Ganes over Vietnam - "which simply has not be able to see the strides in production that would have been expected" following strong growth in the 1990s – appeared at odds with forecasts from US Department of Agriculture attaches.

The attaches forecast that slow growth in production in 2010-11 would be followed by a 10.0% rise to 20.6m bags in output next season, thanks to "favourable" weather, and the incentive that high prices have given to farmers to invest in plantations.

Etichette:

articles,

coffee,

commodity,

commodity article,

market articles,

Softs

Graham Summers’ Weekly Market Forecast (Get Defensive Edition)

by Graham Summers

Stocks have taken out the critical support lines of 1,294 and 1,275. We’ve also taken out the 50-DMA in a big way and are now closing in on the 200-DMA. If that line doesn’t hold: LOOK OUT BELOW.

I warned investors to shift into more defensive positions last week. The warning was well place: small caps suffered a far worse decline (nearly 4%) compared to the Dow (less than 2%).

Indeed, we’ve now entered a period of “risk off”. Small cap and Tech stocks, which lead to the upside, are falling hardest. Stocks in general are in full-scale correction mode, while Treasuries have begun to rally:

Treasuries and commodities were ahead of stocks here. And given the sharp rally we’ve seen in the former (and correction in the latter), stocks still have some catching up to do.

In the very near-term, we are oversold and could see a bounce early this week. However, every rally should be used to get more defensive as the primary prop for the stock market (QE 2) is ending in the next two weeks.

The one event traders will be hanging on to is the Fed’s FOMC meeting (June 21-22). If the Fed DOESN’T hint at additional liquidity measures, then stocks could enter a free-fall (the next Fed FOMC is August 9 2011).

Indeed, the Fed has gotten itself into an absolute bind. QE 2 bought roughly three months’ worth of improved economic data while simultaneously blowing energy and food prices through the roof. With public outrage soaring the Fed needs things to cool down before it can announce QE3 or anything like it.

The one exception to this would be if the markets enter a full-scale Crisis and stocks close in on 1,000 on the S&P 500. The most likely candidate to trigger this would be the Euro-zone where the “bailout game” might in fact be about to end. This combined with the ECB’s decision not to raise rates could result in the Euro currency getting VERY ugly in no time.

On that note, if we take out 140 on the Euro, that would be a major warning sign that we could be entering another round of systemic risk.

See the original article >>

Etichette:

Analysis Technic,

articles,

Economy article,

Finance article,

market articles

China Lending Unexpectedly Tumbles, Adding to Evidence Economy Is Slowing

By Bloomberg News

China’s lending tumbled in May and money supply grew at the slowest pace since 2008, adding to signs that the world’s second-biggest economy is cooling.

Loans were 551.6 billion yuan ($85 billion), less than the 650 billion yuan median estimate in a Bloomberg News survey of 20 economists and 639 billion yuan a year earlier. M2, the broadest measure of money supply, rose 15.1 percent, the People’s Bank of China said on its website.

The Shanghai Composite Index slid 0.2 percent as the data fueled concern that interest-rate increases to combat inflation will trigger a slowdown. A report tomorrow may show that consumer prices jumped 5.5 percent in May from a year earlier, the biggest gain in almost three years, the median forecast in a Bloomberg News survey shows.

“This provides another data point highlighting the growth risk,” said Tao Dong, a Hong Kong-based economist for Credit Suisse Group AG. “I think the economy is heading to a soft landing in the second half of 2011, but the risk of a hard landing seems to be on the rise,” Tao said, adding that small companies are short of credit.

New loans in the first five months of the year totaled 3.55 trillion yuan, 12 percent lower than the same period last year and 40 percent smaller than in 2009 when credit surged to cushion the nation from the impact of the global financial crisis.

A moderating expansion in the Chinese economy is adding to concerns that global growth is faltering.

‘Elements of Fragility’

In the U.S., the world’s largest economy, the unemployment rate in May climbed to 9.1 percent, the government said last week, and a report tomorrow may show retail sales fell for the first time in 11 months.

Japan’s economy shrank by more than economists estimated in the first quarter, government data showed last week, and European economies are struggling with debt restructuring.

“There are already elements of fragility,” Nouriel Roubini, the New York University professor and co-founder and chairman of Roubini Global Economics LLC, said in an interview in Singapore on June 11. World expansion may slow in the second half of 2011 as “the deleveraging process continues,” fiscal stimulus is withdrawn and confidence ebbs, he said.

Non-deliverable yuan forwards traded at 6.3920 per dollar, indicating the currency may gain about 1.4 percent in the next 12 months.

Lending Squeeze

At Bank of America Merrill Lynch, economist Lu Ting said that “the chance of a hard landing is very small and the market could be overly concerned about a ‘lending squeeze’ in China.” Lu said that changes to the way that money-supply data is calculated may have contributed to smaller gains. He added that bank lending is “firmly under control.”

China has been reining in lending to control inflation and the risk that bad loans will swell after a record expansion in credit that was the nation’s main response to the global financial crisis. Companies pushing up prices have included McDonald’s Corp. (MCD), the world’s biggest restaurant chain.

The central bank has raised interest rates four times since September and also ratcheted up lenders’ reserve requirements to record levels. The benchmark one-year lending rate is now 6.31 percent and the one-year deposit rate is 3.25 percent.

Inflation Accelerates

Credit Agricole CIB today forecast one more rate increase this year, in June. Daiwa Securities Capital Markets economists led by Sun Mingchun also expect a boost this month in response to an acceleration in May inflation, with no further adjustments after that.

Citigroup Inc. sees one or two benchmark interest-rate increases in the “next couple of months.” Consumer prices may jump by about 6 percent in June and gains will remain elevated in the second half of the year, the bank’s Hong Kong-based economists led by Shen Minggao said in a note today.

“Concerns about over-tightening are unwarranted given that the current pace of monetary growth at around 15 percent is more than sufficient to support economic growth of around 9 percent,” Qu Hongbin, Hong Kong-based economist with HSBC Holdings Plc said in a report after today’s data was released.

China’s slower gains in manufacturing and industrial production have prompted “a shift in market worries from overheating to a hard landing,” UBS AG economist Wang Tao said in a May 31 report. While power shortages and de-stocking by companies will trim growth this quarter, the economy is set to expand more than 9 percent this year, according to Wang.

That pace would compare with International Monetary Fund projections in April of 2.8 percent growth in the U.S. and a 1.6 percent expansion in the euro area.

Etichette:

articles,

China,

Economy article,

Finance article,

market articles

Subscribe to:

Comments (Atom)