by Tyler Durden

Charles Gave of GaveKal has a fascinating summary of where the nearly five-year long experiment in central-planning has taken the US, and by implication, global economy. To wit:

What kind of failure?

By propping up asset markets, the Fed has created an illusion that wealth is being created. The next step, according to Bernanke’s plan, should be for growth to follow. In fact, there is no reason why the rise in prices of financial assets should lead to actual investments or a rise in the median income. So far, it has not. There has been no real increase in the private sector propensity to borrow, and the danger may be that any further public sector borrowing will hasten the decline because of our “permanent asset hypothesis”.

This means that, should the Fed lose control of asset prices (is this what is now happening in Japan?), then the game will be up and the downside move in markets may well be terrifying. Most at risk would be low and medium quality credits, banks, commodity producers, and any companies with negative cash-flow.

It is obvious, then, that if Bernanke’s experiment fails, it will be a profoundly deflationary failure. The best hedges in a deflation and in financial panic are US long bonds and the US dollar. Renminbi bonds seem also to be developing safe-harbor status. In fact, we found it interesting how, in May, every bond market around the world sold-off, except for the RMB bond market.

We agree completely with Gave on his proposed "permanent asset hypothesis" (as explained further below) which is a simple derivation of what happens in a world in which the Keynesian multipler is now negative. It is what we have been saying for over a year, namely that in an environment of permanent low interest rates there is no impetus on behalf of the private sector to spend for growth, either in the form of capital spending or the hiring of incremental workers. The only net money exchange is the issuance of debt to fund dividends and stock buybacks: or simple EPS-boosting balance sheet arbitrage as shown most recently here.

We also obviously agree that if and when Bernanke finally loses control, there are simply no words to describe what would ensue as a situation like that - one where not just the Fed, but every single central bank has gone all in on reflating the world's biggest asset bubble - has never been encountered before.

However, we disagree that the final outcome will be a "profoundly deflationary failure." This will be an interim step. Recall that the Fed and its private bank conspirators simply can not accept deflation as a resolution. Which means that faced with the specter of full on deflationary collapse, Ben Bernanke will simply resolve to doing what he has hinted, if jokingly, in the past: he will literally paradrop money out of helicopters. Maybe not in that fashion, but he will find a way to bypass the banking sector as a monetary transmission mechanism, and bring crisp, fresh, just off the press banknotes into the hands of consumers in order to finally get the much needed inflationary spark as too much cash chases after too few products and services.

And remember: hyperinflation is and always has been a phenomenon concurrent with the full loss of faith in a given currency, be it reserve or not. It may emerge for economic, monetary or purely political reasons. It is also why the most valuable commodity a central bank has is credibility, and faith in fiat, or fiath as we like to call it. Furthermore for those who say that the Fed has a reserve currency premium, we like to show one of our favorite charts: reserve currencies through time...

... as well as our two favorite axioms: Nothing is forever, and this time is never different.

* * *

But those are all thought experiments for the future: a future, in which if we may remind readers, not one nation in history has collapsed due to hyperdeflation...

As for the present, and going back to Gave's wonderful analysis of the can of worms Bernanke's tinkering has unleashed, here is the balance of Charles Gave's "More On the Deflationary Bust Risk" just released paper highlights:

More On the Deflationary Bust Risk

This is what I will, for the purposes of this paper, call my “Keynesian multiplier” - it is simply the arithmetical difference between growth in wealth and growth in public debt—on which I compute the seven-year rate of change.

If the multiplier is expanding, this tells us that an increased level of debt should lead to a greater increase in the household net worth over seven years. And vice-versa. This allows us to roughly evaluate how many dollars of private wealth are created by one more dollar of public debt.

Let us look now at the relationships between our Keynesian multiplier and certain economic variables. The chart below shows that the marginal efficiency of public debt, at least in the US (public spending in emerging markets from a low base usually improves productivity) has been declining structurally since 1981. And it seems that this marginal efficiency has now reached a negative level.

One initial indication that the Keynesian multiplier was now shrinking was the US boom that followed the Clinton/Gingrich balanced budgets and era of government deleveraging between 1997 and 2000. A reality which brings us back to one of the greatest debates between Keynesians and Austrians as to whether Milton Friedman’s “permanent income hypothesis” makes sense, or not; i.e., are economic agents rational enough that when they see an increase in government debt, they will increase their savings, safe in the knowledge that they will have to pay for the debt increase down the road? Or whether economic agents are just too shortterm focused to project themselves that far?

Modifying the above idea somewhat, we have, in the past, come up with a “Permanent Asset Hypothesis” which probably best applies in asset-rich, ageing countries. Basically, as interest rates move ever lower, retirees, pension funds and insurance companies needing to a certain fixed amount of return are forced to buy ever more fixed income. So low rates and rising public debt issuance, instead of encouraging more risk and renewing animal spirits, instead pushes investors feeling ever poorer into increasingly defensive, and yield generating, assets.

In essence, the perception that assets will not generate enough income going forward encourages the average saver to increase his savings, which is the precise opposite of the stated goal. This law of unintended consequences may help explain why the private business sector’s demand for credit remains limp, even though money is being lent for free.

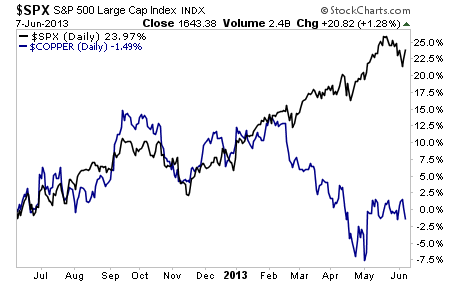

Of course, credit demand may also be weak because there is no immediate reason to expect the rise we have seen in US (and global) financial assets should help boost median incomes. So far it has not:

And in a world where it does not pay to borrow, one should expect a structural decline in the velocity of money to take place. Which is what the next chart is indicating:

A decline in the velocity of money is equivalent to less money circulating in the system, and should lead to a structural decline in the inflation rate:

With the Keynesian multiplier now negative, one would expect very low growth in volumes and nominal GDP. And this, of course, is what we are seeing. Despite the massive stimulus, and the improvement in the US trade balance (thanks to the energy revolution and the US manufacturing renaissance), the US economic expansion remains rather unimpressive. The recent moves in bond yields would seem to suggest that markets are expecting that the economic lift-off is finally about to arrive; either that or that Ben Bernanke will soon throw in the towel and start normalizing monetary policies. Given that the odds of the latter are lower than a snowball in hell (from afar, it usually feels as if the Fed chief has made his motto that of George Bidault’s: “I don’t know where we are going, but we will get there without detours”), it is more likely to be the former than the latter. The problem, for me, is that I struggle to believe that we are on the verge of a new global economic expansion.

Instead, if structural growth is to now be dragged lower by the fact that the Keynesian multiplier has gone negative, and with governments continuing to spend like sailors on shore leave in Hong Kong despite the drag on productivity and structural growth, then we cannot really expect long rates to move decisively higher.

* * *

Summarizing the above: if Bernanke is honestly curious why the economy remains broken, and none of his "central" tinkering has done much to boost the Keynesian multiplier and with it any prospects for real economic growth, he suggest he take a long, hard look in the mirror.