By John Mauldin, Investors Insight

The Burden of Lower Growth and More Frequent Recessions

We’re optimists by nature. The natural order of the world is growth. Trees tend to grow, and economies do, too. Real economic growth solves most problems and is the best antidote to high deficits, but the problems that we have now won’t be solved by growth. They’re simply too big. Unless we have another Industrial Revolution or another profound technological revolution like electrification in the 1920s or the IT revolution in the 1990s, we will not be able to grow enough to pull ourselves out of the debt hole we’re in.

After the dot-com bust in 2000, the phrase “the muddle through economy” (a term coined by John) best described the U.S. economic situation. The economy would indeed be growing, but the growth would be below the long-term trend (which in the United States is about 3.3 percent) for the rest of the decade. (Indeed, growth for the decade was an anemic 1.9 percent annualized, the weakest decade since the Great Depression. Muddle through, indeed.)

The muddle through economy would be more susceptible to recession. It would be an economy that would move forward burdened with the heavy baggage of old problems while facing the strong headwinds of new challenges. The description of the world was accurate then, and it is even more accurate now. In March 2009, when almost everyone was predicting the apocalypse, it was hard to see how things could improve. The GDP turned around, industrial production has shot up, retail sales have bounced back, and the stock market rebounded strongly. Everything has turned up. However, GDP growth is slowing in the United States as we write in November 2010. Compared with previous recoveries, growth does not look that great, and people don’t feel the recovery. This is unlikely to change.

The muddle through economy is the product of a few major structural breaks in the world’s economies that have important implications for growth, jobs, and when we might see a recession again. The U.S. and most developed economies are currently facing many major headwinds that will mean that going forward, we’ll have slower economic growth, more recessions, and higher unemployment. All of these are hugely important for endgame since they vastly complicate policy making.

Lower growth will make our fiscal choices that much scarier. Importantly, these big changes also mean that governments, pension funds, and even private savers are probably making unreasonably rosy assumptions about how quickly the economy and asset prices will be able to increase in the future. As endgame unfolds, the reality of these big changes will set in.

Three Structural Changes

Investors are good at absorbing short-term information, but they are much less successful at absorbing bigger structural trends and understanding when secular breaks have occurred. Perhaps investors are like the proverbial frogs in the frying pan and do not notice long, slow changes around them. There are three large structural changes that have happened slowly over time that we expect to continue going forward. The U.S. economy will have:

1. Higher volatility

2. Lower trend growth

3. Higher structural levels of unemployment (The United States here is a proxy for many developed countries with similar problems, so much of this chapter applies elsewhere.)

1. Higher Volatility

Before the crash of October 2008, the world was living in “the great moderation,” a phrase coined by Harvard economist James Stock to describe the change in economic variables in the mid-1980s, such as GDP, industrial production, monthly payroll employment, and the unemployment rate, which all began to show a decline in volatility. As Figures 4.1 and 4.2 from the Federal Reserve Bank of Dallas show, the early 1980s in fact constituted a structural break in macroeconomic volatility. The GDP became a lot less volatile. As did employment.

The great moderation was seductive, and government officials, hedge fund managers, bankers, and even journalists believed “this time is different.” Journalists like Gerard Baker of the Times of London wrote in January 2007: Welcome to “the Great Moderation”: Historians will marvel at the stability of our era. Economists are debating the causes of the Great Moderation enthusiastically and, unusually, they are in broad agreement.

Good policy has played a part: central banks have got much better at timing interest rate moves to smooth out the curves of economic progress. But the really important reason tells us much more about the best way to manage economies. It is the liberation of markets and the opening-up of choice that lie at the root of the transformation. The deregulation of financial markets over the Anglo-Saxon world in the 1980s had a damping effect on the fluctuations of the business cycle … The economies that took the most aggressive measures to free their markets reaped the biggest rewards.

In retrospect, this line of thinking looks hopelessly optimistic, even deluded. We do not write this to pick on Gerard Baker, but rather to point out that low volatility breeds complacency and increased risk taking. The greater predictability in economic and financial performance led hedge funds to hold less capital and to be less concerned with the liquidity of their positions.

Those heady days are now over, and we have now entered “the great immoderation.” One can confidently say that 2008 represents a structural break, moving back toward a period of greater volatility. Robert F. Engle, a finance professor at New York University who was the Nobel laureate in economics in 2003, has shown that periods of greatest volatility are predictable. Market sessions with particularly good or bad returns don’t occur randomly but tend to be clustered together. The market’s behavior illustrates this clustering. Volatility follows the credit cycle like night follows day, and periods following credit booms are marked by high volatility, for example, 2000–2003 and 2007–2008.

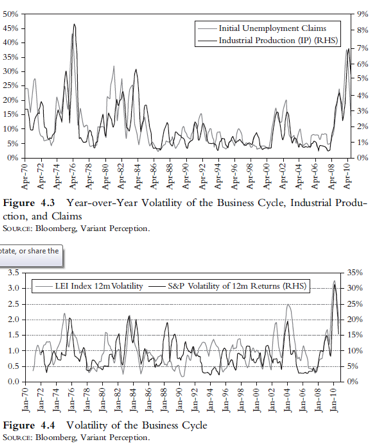

The period of low volatility of GDP, industrial production, and initial unemployment claims is now over. For a period of more than 20 years, excluding the brief 2001–2002 recession, volatility of real economic data was extremely low, as Figure 4.3 shows. Going forward, higher economic volatility, combined with a secular downtrend in economic growth, will create more frequent recessions. This is likely to lead to more market volatility as well.

You can measure economic volatility in a variety of ways. Our preferred way is on a forward-looking basis. We have seen the highest volatility in the last 40 years across leading indicators, as Figure 4.4 shows. These typically lead the economic cycle. This only means one thing, higher volatility going forward.

For far too long, volatility was low and bred investor complacency. Going forward, we can expect a lot more economic and market volatility. We have had a strong cyclical upturn, but we will continue to face major structural headwinds. This means more frequent recessions and resultant higher volatility.

If we look at Japan following the Nikkei bust in 1989, we can see that volatility increased. Note that before the peak in the Nikkei, volatility had been largely subdued, with periodic movements corresponding to increases in the level of the market. As Figure 4.5 shows, following the crash, stock market volatility increased markedly, and volatility to the downside became far more prevalent.

Equity volatility follows the credit cycle. If you push commercial and industrial (C&I) loans forward two years, it predicts increases in the Market Volatility Index (VIX) almost down to the month. We should expect heightened episodes of volatility for the next two years at a minimum. (See Figure 4.6.)

Fixed-income volatility also follows the credit cycle with a two-year lag. Figure 4.7 shows how the Fed Funds rate lags Merrill Lynch’s MOVE Index, which is a measure of fixed-income volatility, by three years.

Another very good reason to believe we’ll continue to have high volatility even after we recover from the hangover of the credit binge is that the world is now much more integrated. This is a paradox and may seem hard to believe, but increased globalization actually makes the world more volatile through extended supply chains! (See Figure 4.8.)

Production in Japan, Germany, Korea, and Taiwan fell far more during the 2007–2009 recession than U.S. production fell even during the Great Depression. Not only was the downturn steeper than during the Great Depression but also the bounce back was even bigger.

This is truly staggering. If you believed in globalization, supply chain management, and deregulation, you would have thought they would lead to greater moderation, but the opposite happened. This was due to the credit freeze that particularly hit export-oriented economies because trade credit temporarily dried up. It was not about globalization per se.

Why has the world economy been so volatile? One of the main reasons is exports. If you look at exports as a percentage of GDP since the end of the Cold War, you’ll see that in almost all countries around the world, exports have rapidly risen in the last 20 years. In Asia, they have doubled, in India they have tripled, and in the United States they have increased by 50 percent. This makes us all more interconnected, and it means that supply chains become longer and longer.

Longer supply chains have enormous macroeconomic implications. As the Economic Cycle Research Institute points out, we’re now experiencing the bullwhip effect, “where relatively mild fluctuations in end demand are dramatically amplified up the supply chain, just as a flick of the wrist sends the tip of a bullwhip flying in a great arc.” The bullwhip effect makes greater export dependence very dangerous to supplier countries, which only contributes to cyclical volatility. This is easily seen in Figure 4.9. That is why Asian countries had some of the largest downturns and steepest upturns in the Great Recession and the following recovery.

2. Lower Trend Growth

We are also seeing a secular decline over the last four cycles in trend growth across GDP, personal income, industrial production, and employment. You can see that in Figure 4.10.

Another view of declining trend growth is the decline in nominal GDP. Figure 4.11 shows that the 12-quarter rolling average has been on a steady decline for the last two decades.

A combination of lower trend growth and higher volatility means more frequent recessions. Put another way, the closer trend growth is to zero and the higher volatility is, the more likely U.S. growth is to frequently dip below zero. Figure 4.12 shows a stylized view of recessions, but as trend growth dips, the economy will fall below zero percent growth more often.

Higher volatility has very important implications for equity and bond investors across asset classes. Indeed, the last three economic expansions were almost 10 years, but in previous decades, they averaged four or five years. From now on, we are apt to see recessions every three to five years. [

..]

Continue reading this article >>