by Adam Hamilton

Summary

- The Fed’s third quantitative-easing campaign is due to end in late October. QE3 has massively boosted the stock markets, driving their extraordinary levitation of the past 18 months or so.

- Once QE3 ends, so does the Fed’s implied backstop of stocks. Any selloff can’t be met with rate cuts thanks to ZIRP, and a new QE4 is extremely risky politically.

- So the overdue stock-market selling pressure is likely to cascade with the Fed no longer available to arrest it, like the major corrections after QE1 and QE2 ended.

The Federal Reserve's third quantitative-easing campaign is on track to wind down in late October. At that point the Fed will likely stop printing new money to buy bonds, a sea-change shift with ominous implications for the stock markets. Their entire surreal levitation during QE3 mirrored the huge growth in the Fed's balance sheet from QE3's bond monetizations. When they cease, another major selloff is likely.

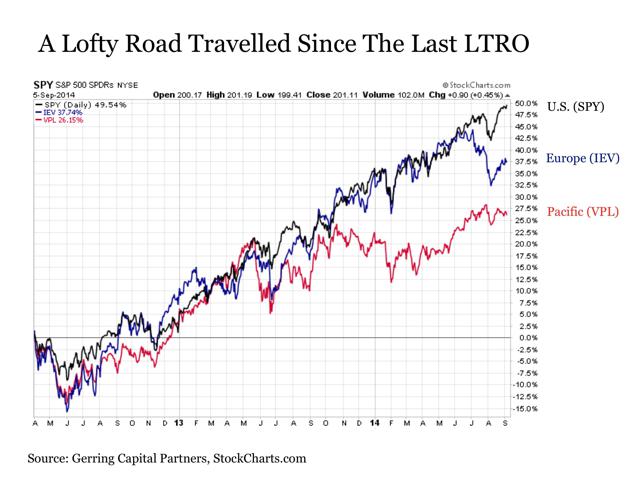

QE3's impact on the global financial markets has been vast beyond belief. The Fed launched QE3 in September 2012, just before the important United States elections. This goosed the US stock markets in that critical final couple months ahead of the elections, right when they were on the verge of selling off dramatically. Odds are very high that the Fed's brazen market manipulation gave the election to Obama.

In the 28 presidential elections since 1900 prior to that 2012 one, the stock markets rallied in September and October 16 times. The incumbent party won 15 of those elections! And during the 12 times when the stock markets fell in September and October, the incumbent party lost 10. The Fed choosing to launch a stock-market-boosting QE campaign in those pre-election months forced stock markets higher.

If the S&P 500 (SPX) had dropped as it was set to do in September and October 2012, Obama would've almost certainly been a one-term president. The Fed's colossal market and political manipulation was no accident. Since QE2, Republican lawmakers had been highly critical of the Fed's money printing to buy bonds. The low interest rates that spawned enabled Obama's record debt-fueled spending binge.

Since the Fed faced serious challenges to its independence all the way up to its very existence from a Republican president and Congress, it massively intervened in the markets to sway an election. And QE3 just got worse from there. The Fed expanded it to include direct monetizations of US Treasuries a few months later in December 2012. That forced rates lower, farther fueling Obama's epic deficit spending.

QE3 was far different from QE1 and QE2, which were finite from their births. QE3 was the Fed's first open-ended debt-monetization campaign, with no prescribed limits. This potentially unlimited scope of QE3 helped create an exceedingly unfortunate side effect in the stock markets. Since QE3 had no defined end, stock traders figured it would be around to backstop stock markets more or less indefinitely.

Led by uber-inflationist Ben Bernanke, the Fed's dovish communications fanned this popular belief among traders. Over and over during QE3 the Fed implied that it was ready to act, in effect to increase the scale of QE3's monthly money printing to buy bonds, if the stock markets slid. This incessant Fed jawboning left stock traders utterly fearless, as they figured the Fed would arrest any major stock-market selloff.

So every dip was quickly bought, leading to the stock markets soaring. The SPX blasted 29.6% higher in 2013, the only full year of QE3! And this flagship index is up 39.5% since QE3's birth. And it wasn't like the stock markets were low before the Fed hatched its QE3 scheme. As of the day before, the SPX had powered 112.3% higher over 42 months in a very large cyclical bull. Stock markets were already lofty.

Healthy stock bulls take two steps forward followed by one step back, major uplegs are followed by sharp corrections. These corrections, SPX selloffs between 10% and 20%, are essential as they help keep sentiment balanced. They bleed off greed before it grows too excessive and pulls too much future buying forward, killing the bull. The Fed's implied backstop with QE3 short circuited this natural and crucial process.

When QE3 was launched just before those November 2012 elections, it had already been 11 months since the end of the last SPX correction. Typically they happen about once a year or so on average. And since QE3's debt monetizations have been in force, the necessary sentiment-rebalancing selloffs have become smaller and farther between. Today the SPX is up to an insane 35 months since its last correction!

Provocatively the two previous full-blown corrections of this mighty cyclical stock bull cascaded right after QE1 and QE2 ended. When QE isn't in force, the Fed's implied backstop vanishes. So traders are not as quick to buy stocks indiscriminately, and sellers aren't scared away. The Fed's Federal Open Market Committee is on track to end QE3 at its upcoming October 29th meeting, an ominous omen for stocks.

Without QE3, the Fed can no longer backstop stock markets or even claim it can do so. Thanks to Ben Bernanke's disastrous zero-interest-rate policy that's robbed savers blind since December 2008, the Fed can't cut interest rates if stock markets fall. And ramping up a QE4 is very unlikely if the Republicans regain control of the Senate in this year's elections, as they could potentially vote to revoke the Fed's very charter!

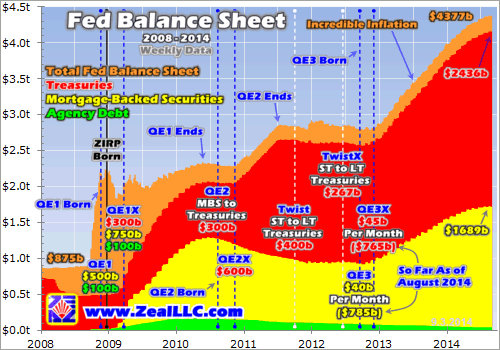

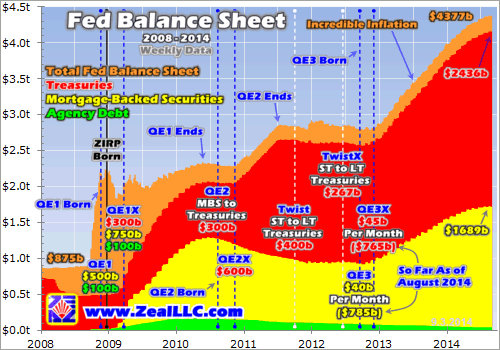

The implications of a post-QE world are vast for the stock markets. To better understand why, you need to grasp the mammoth scope of the Fed's third quantitative-easing campaign. This chart shows the Fed's balance sheet since 2008 when QE was initially born. This data is stacked within the Fed's total balance sheet (orange), with US Treasuries (red) sitting on top of mortgage-backed securities (yellow).

I've written comprehensive essays outlining the history of QE, what the Fed did when and why it decided to act. But for our purposes today, let's focus on the big picture. Prior to QE1's birth during 2008's once-in-a-lifetime stock panic, the Fed's balance sheet averaged $875b in the first 8 months of that year. Today that number has ballooned an astounding 5.0x to $4377b. QE has quintupled the Fed's balance sheet!

When central banks buy bonds, they do so by first creating the money necessary for the purchases out of thin air. It is pure inflation. And when bonds are bought with this new money, it is transferred to the bond sellers to spend immediately as they see fit and the bonds are transferred to the Fed's balance sheet. So the $3502b in bonds the Fed has purchased so far equals the money it has printed for QE.

The Fed's modus operandi for its three QE campaigns, and an intervening "twist" operation in the middle, has been very consistent. The Fed, ever cognizant of political pressure and withering attacks from Republicans who hate money printing, first launches each campaign at a relatively modest scope. And then soon after once the initial political storms blow over, it greatly expands the scale of its bond buying.

QE1 initially started at $600b, but then was soon expanded to a staggering $1750b total. Soon after it ended, QE2 started at $300b but was shortly tripled to $900b. Twist, the Fed selling the shorter-term Treasuries it held to buy longer-term ones to manipulate long interest rates lower, was also expanded. And QE3 followed this template, $40b in monthly buying shooting up to $85b total just a few months later.

QE3 was unique in its open-endedness, the Fed set no limits to its size up front as it did with QE1 and QE2. QE3 ended up running full-steam for all of 2013, boosting the SPX to its massive late-bull gain last year. But last December, the Bernanke Fed finally decided it better start slowing its epic monetary inflation before the inevitable resulting price inflation got out of control. So it started "tapering" QE3.

At every meeting since then, the FOMC has continued to slice away another $10b of new monthly QE3 buying starting the following month. And with QE3 down to just $25b per month today, the Fed only has room to do two more tapers since it has talked about taking the final $15b away at one time to avoid an undue trader fixation on that last $5b. And that full QE3 tapering should happen at the FOMC's late-October meeting.

At that point, QE3 will have grown to $800b in mortgage-backed securities and $790b in Treasuries purchases for a total of $1590b. This won't quite reach QE1's supreme $1750b girth, but it sure dwarfs QE2's $900b. It's the Treasuries portion of QE3 that is the key component. That ran $300b in QE1 and $600b of new buying in QE2, so QE3's massive $790b of buying easily takes the QE Treasuries crown.

All market interest rates key off of the "risk-free" yields of US Treasuries. So when the Fed prints money to buy Treasuries, it effectively pushes down interest rates for the entire markets as its artificial demand forces Treasury yields lower. In addition, the money printed and paid to the Obama Administration to buy Treasuries is immediately spent. So it is directly injected into the real economy, driving price inflation.

The Fed has been the dominant buyer of US Treasuries during the QE era since the 2008 stock panic, purchasing $1956b worth. This works out to just over 25% of all the Treasuries issued since the end of the US government's fiscal-year 2008! Without the Federal Reserve buying up a quarter of all the debt the Obama Administration's extreme overspending has burdened America with, rates would be far higher.

The extraordinary stock-market levitation spawned by the Fed's implied backstopping during QE3 blasted US stocks up to dangerously-high valuations. And the primary reason euphoric stock traders have rationalized them away is bond yields remain super-low thanks to the Fed's brazen interest-rate manipulations. But once QE3 ends, so does that downward pressure on Treasury yields and interest rates.

As rates rise, which is inevitable with a quarter of the world's demand for Treasuries vanishing, stocks are going to look more and more overvalued relative to bonds. That alone is going to eventually lead to some serious selling pressure reemerging in the stock markets. And once a material selloff gets underway and the Fed's implied backstop through QE3 is gone, that overdue selling is going start cascading.

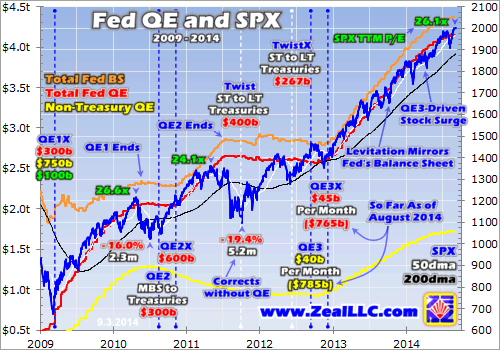

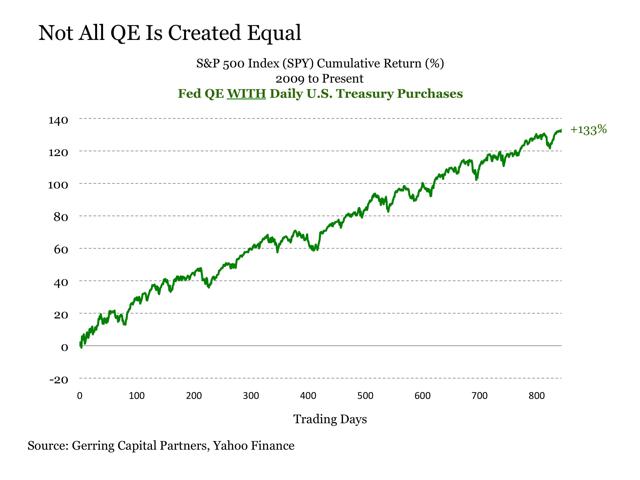

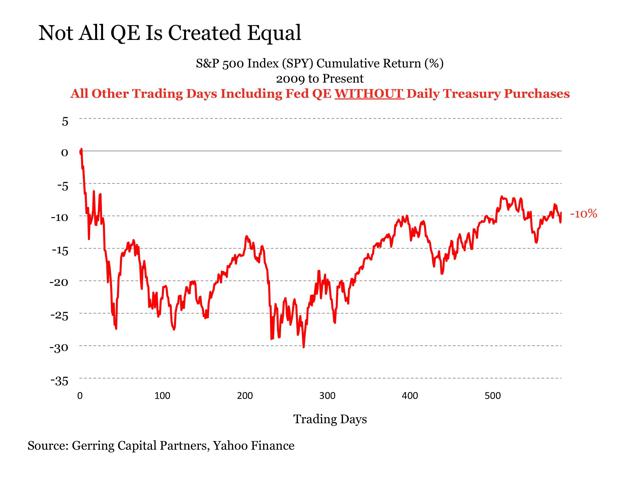

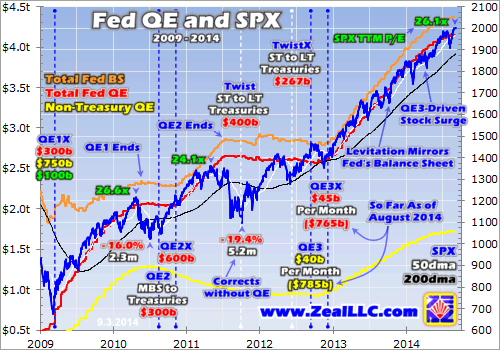

Prudent investors and speculators today don't have to guess about what the end of QE3 means for the lofty Fed-inflated US stock markets. We have the precedent of the ends of QE1 and QE2. This next chart looks at the flagship S&P 500 stock index superimposed over the Fed's balance sheet. And out of all the many thousands of charts I've created over the years, this probably tops the heap as the scariest.

The stock markets are forever cyclical, so after the last cyclical bear that climaxed after 2008's stock panic a new cyclical bull was justified and inevitable. I was one of the few contrarians who called for that bull right at the March 2009 bottom when bearishness and despair were suffocating. Nevertheless, this bull had a very high correlation with the Fed's balance sheet. When QE was underway, stocks powered higher.

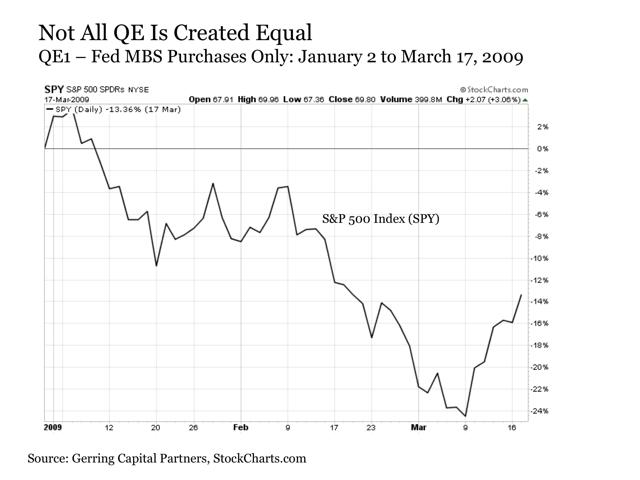

But whenever the Fed tried to wean complacent traders off the QE drug, the stock markets corrected hard. Right as QE1's massive bond monetizations were ending, the SPX tumbled 16.0% in 2.3 months in this bull's first correction. Provocatively the stock markets weren't able to regain their footing until the Fed quickly stepped in to announce QE2. The timing of that mushroomed the Fed-backstopping-stocks notion.

Then during the QE2 money printing and bond buying the stock markets again climbed relentlessly without any correction-grade hiccups. But again the moment those QE2 debt monetizations ceased and the Fed's balance sheet stopped rising, the SPX plunged again. This second and latest correction of this cyclical bull hammered 19.4% off the SPX in 5.2 months. This almost hit the 20% cyclical-bear threshold!

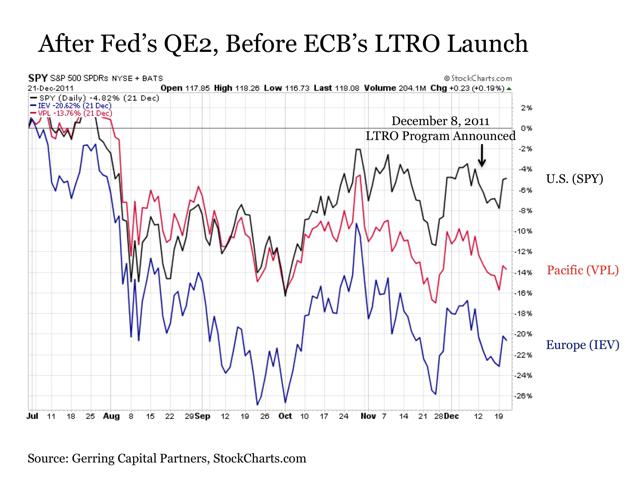

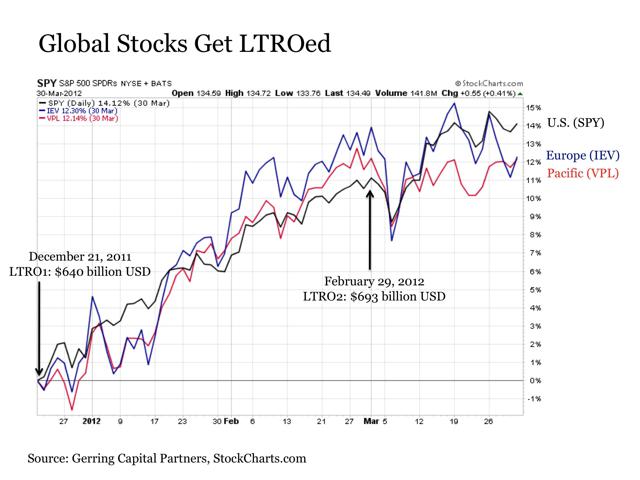

And once again it looked like the SPX didn't bottom naturally, but through Fed intervention. The low of that last correction happened just as the Fed was announcing its Twist campaign to twist the yield curve by selling shorter-term Treasuries it owned to buy longer-term ones. This helped boost the SPX again into another major upleg, which was running out of steam and looking toppy in late 2012 as the US elections neared.

The SPX had actually stalled out in April 2012, without a single new high seen until September 2012 after first the European Central Bank and then the Federal Reserve announced new campaigns to buy bonds. After 5 months of zero upside progress before the ECB and the Fed's QE3 announcement, would US stock markets have rallied into the 2012 elections without the Fed's help? Odds are no way.

As Treasury monetizations are far more potent than mortgage-backed-bonds ones, the stock markets were weaker after QE3's initial MBS buying and the resulting Obama win. But once the Fed expanded QE3 to include Treasuries in December 2012, the SPX started levitating. It soared in a very tight trading range mirroring the Fed's ballooning balance sheet, with no material selloffs to rebalance sentiment.

This chart implies the entire reason the SPX rallied from 1500, the secular-bear resistance it would have almost certainly naturally topped at without the Fed's manipulations, was QE3 and its accompanying dovish jawboning. In my decades of trading, I've probably never seen a more ominous chart than this SPX levitation perfectly tracking the Fed's soaring balance sheet. The SPX/QE3 correlation is just stellar.

If the ends of QE1 and QE2 both sparked major corrections, why shouldn't the end of the far-larger (in Treasury terms) QE3? Back in mid-2010 and mid-2011 when those earlier quantitative-easing campaigns ended, the stock markets where nowhere near as high and euphoric as they are today. Yet stocks still corrected hard when the Fed's inflationary tailwinds, and implied backstopping, were removed.

Provocatively today's lofty stock-market valuations are similar to those seen at the major SPX toppings as QE1 and QE2 ended. When all 500 SPX component companies' individual trailing-twelve-month price-to-earnings ratios are averaged, they reveal the SPX trading at 26.6x near the end of QE1 and 24.1x near the end of QE2. The latest simple-average read for this metric as August 2014 ended was 26.1x!

This is dangerously high, as 28x is actually the historical threshold for a bubble! Add these extreme overvaluations on top of the prevailing extreme euphoria and complacency, cyclical-bull-topping technicals, and a greatly overextended cyclical bull, and it is hard to imagine the end of QE3 not spawning a major selloff! It is actually far more likely to cascade into a new cyclical bear than stay a mere correction.

Again the stock markets are forever cyclical, cyclical bulls are always followed by cyclical bears. The average size and duration of a cyclical bull within a sideways-grinding secular bear like we've seen in the stock markets since 2000 is a doubling in 35 months. Today's bull has nearly tripled, up 196.1%, in 66 months! It is far too big and far too old, meaning a selloff's highest-probability outcome is the next cyclical bear.

Cyclical bears tend to cut stock prices in half over a couple years or so, they are dangerous beasts not to be trifled with. And once QE3 is done, there is no more Fed backstop in place to motivate traders to instantly buy every minor dip. With short rates zero-bound thanks to ZIRP, the Fed has no room to cut interest rates to arrest a stock-market swoon. And again QE4 is very unlikely in this political environment.

The election-year stock-market studies I've seen are for the major presidential election cycles, not intervening midterm elections. But the results are likely similar. Rising stock markets make Americans feel better about everything, so we are more likely to vote for incumbents for more of the same. But we feel worse when stock markets are weaker, making us more prone to kick out the bums in hopes for change.

So if the stock markets are weaker in September and October 2014, the odds grow that the Republicans are going to retake the Senate. They already have an edge, as Obama and the Democrats are very unpopular for a variety of reasons including the disastrous and punishingly-expensive Obamacare burdens on Americans. Republican voters skew older and whiter too, more likely to vote in midterm elections.

The major corrections when QE1 and QE2 ended actually began a little earlier in anticipation, and it is reasonable to expect stock traders to start selling ahead of QE3's rapidly-approaching end too. And since the Fed won't risk the political wrath of the Republicans who will likely soon control the full Congress again, it isn't going to launch a QE4 soon. So any stock selloff won't have any hope of a Fed rescue!

Thus the end of QE3 is exceedingly ominous for these lofty stock markets. A major SPX selloff, whether it is merely a 20%ish correction or a new cyclical bear, will drive devastating losses in everything from the high-flying momentum stocks to the conservative SPX-tracking ETFs like SPY (NYSEARCA:SPY). And it has been so long since we've seen any material selloffs that the resulting hit to complacent and euphoric sentiment will be massive.

How can you protect yourself in this coming swoon? Buy gold. The entire precious-metals sector was abandoned and left for dead during the Fed's QE3-driven SPX levitation. But alternative investments will return to vogue in a big way once normal stock-market behavior including selloffs resumes. The gains coming in the beaten-down precious-metals sector will be vast as flight capital floods in looking for safe havens.

The big risk of serious inflation igniting thanks to QE's huge monetizations remains too, which will act like rocket fuel for gold. Even when QE3's new buying ends soon, the Fed will still have $3.5t of bonds stuck on its balance sheet! That means $3.5t of new money injected into the economy that could start bidding on goods and services and driving up prices any time until the Fed can unwind its QE bonds bought.

The bottom line is the Fed's third quantitative-easing campaign is due to end in late October. QE3 has massively boosted the stock markets, driving their extraordinary levitation of the past year-and-a-half or so along with the Fed's jawboning. Once QE3 ends, so does the Fed's implied backstop of stocks. Any selloff can't be met with rate cuts thanks to ZIRP, and a new QE4 is extremely risky politically for the Fed.

So the overdue stock-market selling pressure is likely to cascade with the Fed no longer available to arrest it. Major stock-market corrections emerged as both QE1 and QE2 ended, and the stock markets are far more extreme today as QE3 winds down. And once again this end-of-QE selling is likely to start in anticipation of the actual event, an ominous omen for stocks that mirrored QE3's Fed balance-sheet growth.

See the original article >>