By Randall Wray

Sorry, this is a day late (but hopefully

not a dollar short).

Say what? You thought that was tulip bulb

mania? Or, maybe the NASDAQ hi-tech hysteria?

No, folks, those were child’s play. From

2004 to 2008 we experienced the biggest commodities bubble the world had ever

seen. If you looked to the top 25 traded commodities, you found prices had

doubled over the period. For the top 8, the price inflation was much more

spectacular. As I wrote:

“According to an analysis by market

strategist Frank Veneroso, over the course of the 20th century, there were only

13 instances in which the price of a single commodity rose by 500 percent or

more. For example, the price of sugar rose 641 percent in 1920, and in the same

year, the price of cotton rose 538 percent. In 1947, there was a commodities

boom across three commodities: pork bellies (1,053 percent), soybean oil (797

percent), and soybeans (558 percent). During theHunt brothers episode, in 1980,

silver prices were driven up by 3,813 percent. Now, if we look at the current

commodities boom, there are already eight commodities whose price rise had

reached 500 percent or more by the end of June: heating oil (1,313 percent),

nickel (1,273 percent), crude oil (1,205 percent), lead (870 percent), copper

(606 percent), zinc (616 percent), tin (510 percent), and wheat (500 percent).

Many other agricultural, energy, and metals commodities have also had large

price hikes, albeit below that threshold (for the 25 commodities typically

included in the indexes, the average price rise since 2003 has been 203

percent). There is no evidence of any other commodities price boom to match the

current one in terms of scope.”

Now here’s the amazing thing about that

bubble. The staff of Senator Joe Lieberman and Representative Bart Stupak wanted

to know whether the bubble was just due to “supply and demand”. Relying on the

expertise of Frank Veneroso and Mike Masters (two experts on the commodities

market), I was able to conclude beyond any doubt that it was a speculative

bubble driven by a “buy and hold” strategy adopted by managers of pension funds.

Hearings were held in Congress, with guys like Mike Masters testifying as well

as representatives from the airlines and other industries.

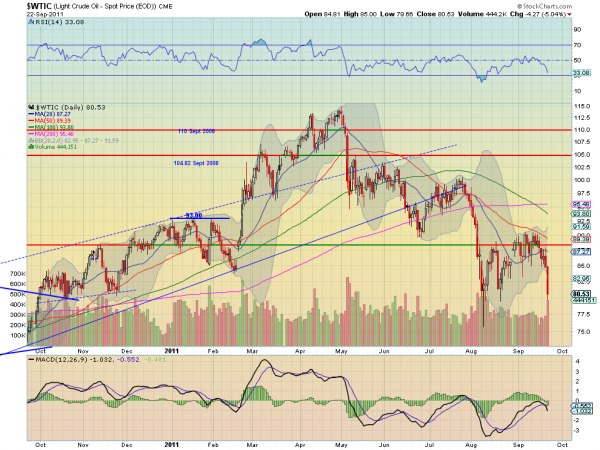

The pension funds panicked, realizing that

their members would hold them responsible for exploding prices of gasoline at

the pump. Pension funds withdrew one-third of their funds and oil prices fell

from about $150 per barrel to $50. If you want to read the detailed analysis, go

to my paper cited above—it has to do with commodities indexes, strategies pushed

by your favorite blood sucking vampire squid (Goldman Sachs), and futures

contracts. It gets wonky. To make a long story short, the bubble ended in fall

of 2008.

But then the crisis wiped out real estate

markets and the economy. Managed money needed another bubble. They whipped up

irrational fears of hyperinflation that supposedly would be caused by Helicopter

Ben’s QE1, QE2, and the newly announced QE3. Better run to good “inflation

hedges” like gold and other commodities. That did the trick. The commodities

speculative bubble resumed.

And boy, oh boy, what a boom. An April

report by expert Jeremy Grantham looks at the last decade’s bubble in

commodities; Frank Veneroso expands upon that in a more recent report. Here’s

the elevator speech summary. Take the top 33 commodities that are globally

traded—everything from gold and oil to to rubber, flaxseed, jute, plywood, and

something called diammonium phosphate. Over the past 110 years, an index price

of these 33 commodities has declined at an annual rate of 1.2% per year. (Sure

there are variations across the commodities—this is the average. And so much for

inflation hedges. Commodities prices fell—they did not keep up with inflation.

If you liked negative returns, commodities were a good bet.) Although demand for

these 33 commodities has increased a lot over the century, new production

techniques plus successful exploration has resulted in a declining price

trend.

Further—and this is a bit

surprising—deviations from the trend follow a normal distribution (you learned

about this in high school; it is a bell curve with nice properties; chief among

these is the finding that about 68% of outcomes fall within one standard

deviation; about 95% fall within two standard deviations (once a generation);

and you’ve got just about a snowball’s chance in hell of finding outcomes that

are three or four standard deviations from the mean).

But what is more surprising is that over

the past decade, the price rises you find for these 33 commodities are just

about beyond the realm of possibility—2, 3, and 4 standard deviations away from

trend. It is a boom without any precedent. Quite simply, nothing even close has

ever happened before, in any market, including hi tech bubbles and real estate

bubbles.

By now you’ve all read about black swans

with fat tails—a reference to supposedly “unexpected” and highly improbable

default rates on subprime mortgages and other toxic waste assets. (Way out the

normal distribution’s “tail”.) As an insider quipped, you had once in 100,000

year events happening every day. But that is misleading. These were junk assets

that from the get-go had nearly 100% probabilities of default—NINJA loans and so

on. The models were flawed, indeed, fraudulent. That was all a scam. Those

weren’t black swans with fat tails—they were Hindenburg blimps filled with

explosive hydrogen just waiting for someone to light a cigarette.

By contrast, in the case of commodities,

this is real stuff (not IOUs of deadbeats with no prospects). Barrels of oil

that someone really wants. Corn to turn into pig and steer fat, or fuel for

Midwest automobiles. Or gold to be hoarded by the University of Texas. There

really is a demand for it; and someone produces it.

Yes, commodity bubbles happen, but

eventually reality sets in and brings the price back down to reality. You don’t

get 3, 4, and 5 standard deviation events. A four standard deviation price rise

falls outside 99.994% of all outcomes—one in 100,000 years; a five standard

deviation price rise is about one in 2 million years. That pretty much covers

the time since our ancestors beat things with big sticks.

But wait a minute. The standard deviation

of price rises for iron (5), coal, copper, corn and silver (4), sorghum,

palladium, and rubber (3.5), flaxseed, palm oil, soybeans, coconut oil, and

nickel (3), and so on down through jute, cotton, uranium, tin, zinc, potosh and

wool (2) are so unlikely that they quite simply could not have happened.

Individually. Together, the likelihood that we’ve got an unlikely boom in almost

all of the 33 commodities? All at the same time? Impossible. Cannot happen. Not

in the lifetime of our sun, let alone our planet.

But it did.

Why? China. Peak oil. Supply disruptions.

Some markets cornered by speculators. Market manipulation by oligopolistic

suppliers.

Yes, OK, those have played some small role.

But remember, we are in the worst global slowdown since the 1930s. I will not go

through all the data, but demand for most commodities is actually slumping. For

many there is substantial excess supply. And China wants to slow. China is still

largely a socialist society. China basically does what it wants to do. China

will slow.

And yet the prices rise far beyond anything

that has ever happened before. Beyond anything that can happen.

Why? Financialization. Just as homes became

financialized (in many ways, including serving as the collateral for “ATM”

cash-out home equity loans), commodities became thoroughly financialized. (So

did healthcare and death, with peasant insurance and death settlements—topics

for another day.)

Here’s the reason. Believe it or not,

commodities markets are tiny; except for soy, oil, and corn they are smaller

than tiny. Managed money is huge—tens of trillions of dollars floating around

the world looking for high returns. US pension funds alone are three-fourths of

US GDP–$10 trillion give or take. If you put even a fraction of managed money

into commodities index funds, you blow up the prices.

The weapon of choice is the futures

contracts—essentially you buy commodities for future delivery (a couple of

months from now). When they mature, you do not take delivery but instead sell

the contract to someone who actually wants the commodity, and roll into another

futures contract. This is what pension funds, and so on, have been doing. If

prices rise, you always win on the roll (sell for more than you paid).

The typical argument is that this cannot

affect prices since for every buyer (long position in the contract) there must

be a seller (short position). The balance between these two keeps prices in line

with “fundamentals”.

In normal times, yes, more or less. But

here’s the deal. What if I supply diammonium phosphate (whatever the heck that

is) and you are speculating that the price will rise. You and every other

pension fund and client of Goldman Sachs. I want to lock in the expected price

rise, so I am a happy seller of future commodities. If prices go down, I do not

get hurt—I locked in the price rise and have the right to sell the commodity at

the higher price. And so even as prices leave all fundamentals, the producers

continue to sell futures contracts to lock in higher prices.

I win, you win, we all win with price

appreciation.

Now, to be sure, the whole thing is going

to blow up, in what Frank Veneroso calls a commodities nuclear winter. As prices

rise, consumption of the commodities falls (as we are already observing) both

through substitution and through conservation. At the same time, additional

supplies come on line. Real world suppliers feel the imperative to slash prices

to have some actual real world sales. They cannot forever live in never-never

land with rising prices and collapsing sales.

There are many shoes that will drop,

bringing back the Global Financial Crisis with a vengeance. Commodities crash,

default by a Euro periphery nation, failure of a Euro bank, or the closure of

Bank of America or Citi. All of these are likely events, less than one standard

deviation from the mean; probably all of them will happen within the next

year.

No matter what the triggering event is,

that commodities nuclear winter will happen.

Soon.

Sooner than later.