"Wonderful Tonight"

It's late in the evening; she's wondering what clothes to wear.

She puts on her make-up and brushes her long blonde hair. And then she asks me, "Do I look all right?" And I say, "Yes, you look wonderful tonight." We go to a party and everyone turns to see This beautiful lady that's walking around with me. And then she asks me, "Do you feel all right?" And I say, "Yes, I feel wonderful tonight." I feel wonderful because I see The love light in your eyes. And the wonder of it all Is that you just don't realize how much I love you. It's time to go home now and I've got an aching head, So I give her the car keys and she helps me to bed. And then I tell her, as I turn out the light, I say, "My darling, you were wonderful tonight. Oh my darling, you were wonderful tonight." |

Sunday, April 13, 2014

Eric Clapton - Wonderful Tonight

Ukraine Mobilizes Military, Gives Separatists Ultimatum; Russia Slams Escalation As "Criminal", Yanukovich Warns Of Civil War

by Tyler Durden

| If Russia's intention was to give Ukraine enough "escalation" rope with which to hang itself once again, it may have succeeded when a little over an hour ago acting president Oleksander Turchinov said in a televized address that Ukraine has mobilized its armed forces to launch a "full-scale anti-terrorist operation" against pro-Russian separatists. Furthermore, knowing the only real escalation Kiev can engage in is in the war of words department, Ukraine set an 0600 GMT Monday deadline for pro-Russian separatists to give up their weapons and leave buildings they have occupied in the east of the country, a presidential decree said. It is unclear if this would be the catalyst to launch the military operation, but should Kiev indeed bring in the army it is certainly clear that Russia will respond in kind. Reuters reports:

Russia promptly responded, alleging Ukraine's planned operation is criminal:

As usual, the only solace out of NATO was issuing wordy statements:

Adding even more fuel to what increasingly appear a civil war fire, was self-exiled president Yanukovich who said in a televized from Russia's Roston-on-Don that Ukraine is a foot in the door to civil war. “Blood was spilt today,” Yankovich told journalists referring to the events in the eastern city of Slavyansk. “Now our country finds itself in a totally new situation – with one foot in the door of a civil war. Kiev junta has issued a criminal order to use military forces.”

So according to the counter-West narrative, it is the CIA's actions that have led to the escalation in the east, not Russian actions. Bottom line: for now lots of enflamed words, yet no actual actions to resist the "pro Russia separatists." And in the meantime the casualties mount:

Looking ahead in terms of immediate catalysts, 0600 GMT is in a few hours hours, and certainly well before the US market opens. What happens then, certainly nothing if Russian response to previous Ukraine ultimatums is any indication, may determine of last week's sell off continues in earnest on Monday or if, by some surprising development, there is a relief rally. Finally, this just in: SECURITY COUNCIL WILL MEET AT 8 PM NY TIME FOR EMERGENCY MEETING ON UKRAINE CRISIS - RUSSIA'S NEWS AGENCY CITING UN SOURCE. Or just in time for the Nikkei open. |

In Their Own Words: The Fed Heads Were Dead Wrong In 2008. Deja Vu Anyone?

| I suppose when your entire task derives from regression-based statistics, there is the tendency to incorporate straight lines into even your own thought patterns. Of course, that leads to self-reinforcing bias and should be canceled by some governing process. Usually that governing process takes the form of applied knowledge (as opposed to math-based knowledge) and plain common sense. In a large organization, such as the Federal Reserve, the barriers to even common sense are myriad and end up as inertia. Any human endeavor or system, or even any natural system, takes cyclical form. In the case of economics and particularly financial function, there are evident ebbs and flows in the progression to either end. Yet, captured in linearity, these ebbs and flows look something far different separated from a grounded basis in humanity. When the Fed arrived at the precipice of panic in September 2008, there was more than a fair bit of shock at what was unfolding. As I have noted before, the FOMC was far, far more concerned with inflation than anything else, including the potential for severe panic and related economic catastrophe. The reason for that, as I will show here, was this inability to see beyond linear extrapolation – the economists believed they had solved all problems with their actions earlier that year. It is more than fair to conclude that all of the FOMC members saw the failure of Bear Stearns as the nadir, the conclusion that ended the entire episode. Thus, the ebb in crisis between March 2008 and August 2008 was seen as the final expression of a worst case. That view was more than shared by Janet Yellen, the current incarnation of monetary genius and savior. All of the following are taken from the June 24, 2008, FOMC transcripts:

She actually expected that a tightening cycle would be inaugurated at the time the FOMC was instead going full-blown ZIRP. Why? To them the crisis had been wrapped up essentially with the advent and operational implementation of multiple “emergency” liquidity programs.

President Plosser’s comments below immediately follow Eric Rosengren’s more cautious warning that, “I continue to view the downside risk of further financial shocks as being significant.” No one in the meeting followed that line of inquiry, including Rosengren himself.

He joined Yellen’s prediction that the federal funds rate would be back to something above 2.75% by the end of 2008 (as a reminder, the federal funds target rate remains 0%-0.25% almost six years later). The combination here is one of linear thinking and abundant optimism, not about the economy, per se, but about their own ability to control it all. Instead of linking that with time and systemic processing, they mistook it for a condition that their fears would never be realized. In other words, because they had acted and nothing worse had occurred by June, they saw those actions as the very reason for it. More troubling, they extrapolated that those programs were comprehensive and would thus forestall any possibility of eventually realizing those worst fears (in the end, what actually occurred ended up being worse than those worst case expectations).

President Bullard was speaking directly to their experience with, and “successful” handling of, the Bear Stearns collapse. He added later:

His meaning here is plain, if somewhat coded. The idea, echoed throughout that meeting, was that the FOMC had provided the template for any future liquidity episodes, thus there should be no more panic because “everything” had been revealed by that point. The implications of that, for President Bullard, were:

Again, the sentiments were unambiguous, through Yellen, Plosser, Bullard and the rest. Lest anyone think I am overstating this focus, Governor Kohn leaves no doubt by actually vocalizing exactly this linear thinking.

Apparently they did not “learn something about the financial system”, at least not the right lessons. At each ebb in the trajectory, they really thought it represented the end; only to be surprised over the doggedness at which the system refused such benighted assistance. That betrays not just overconfidence but a basic inability to see the system in its actual condition, even to the point of misreading what were really clear market signals. Again, this was June 2008, late June at that, when stock prices had resumed their slump and credit spreads widened once more. Against that backdrop, their linear thinking led to the conclusion below, voiced by President Lacker, supported by every model in the Fed’s arsenal (the Greenbook contains numerous simulations) and further echoed by “private” economic surveys and estimates.

Yes, the expectation of the “best and brightest” was for a “significantly better” outcome as compared to the ridiculously minor dot-com recession and the slightly more serious recession in 1990-91. Common sense would have overridden such incongruity – that there would be much less economic impact from an actual bout of bank runs, collateral chain depression and credit withdrawal turning against housing on an unprecedented scale than what came during Greenspan’s housing bubble solution? As I stated when the 2008 transcripts were finally released, these actual policymaking discussions should disqualify not only the FOMC members but discredit the entire philosophy from the ground up. How can you conclude otherwise? And the relevance here to our current circumstance is obvious, not the least of which given Janet Yellen’s ascendancy. Does anyone honestly believe that anything has changed? It wasn’t just that they missed the timing or proffered the wrong policy mix, it was a fundamental and deep misunderstanding of almost everything in and about finance and economics, including especially the relations between the two. The net result was exactly as we see right now – an overestimation of their abilities to control and manage, owing to this lack of grounded understanding, leading to persistent over-optimism about the economy. As if to remove all doubt, the current FOMC just replayed the June 2008 “ebb” period by again taking a temporary bump in GDP and other factors and translating that in linear fashion to some durable acceleration, rather than the hollow inventory trend that is being steadily revealed. If they couldn’t see recession at the end of June 2008, when might they ever? |

Weighing the Week Ahead: A Volatility Cocktail!

by Jeff Miller

| This week brings the makings of an explosive volatility cocktail:

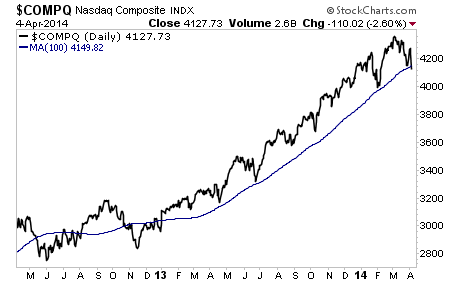

This is a very unusual combination, and the various elements will compete for attention. Prior Theme Recap Last week I expected the theme to test the divergence between economic fundamentals and what I called "fluff." The latter term referring to the collection of top-calling, market-rigging, crash charts, and "This is the big one" stories. This was one of my better forecasts. The economic news was excellent. The market was terrible. Everyone had an explanation – all different, all dubious. This is another good illustration of the reason for my weekly post – planning for the week ahead. Readers are invited to play along with the "theme forecast." I spend a lot of time on it each week. It helps to prepare your game plan for the week ahead, and it is not as easy as you might think. Naturally we would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. This Week's Theme I have almost 27 years of experience as a market professional. I cannot remember planning for a week like this one. Much depends upon the corporate earnings reports. If earnings disappoint, it will be seized upon as conformation of the bad economy, expensive stocks meme. Volatility will increase. Moves during options expiration can be exaggerated, since strike prices formerly thought to be irrelevant come into play. Markets could move much lower. If earnings satisfy, it might have a calming effect. This will be especially true if we get a little more confidence in forward outlook, some hints about future hiring, and more planned capital expenditures. In that case we could have a rebound, with plenty of reduction in the VIX. I have some thoughts that I will share in the conclusion. First, let us do our regular update of the last week's news and data. Readers, especially those new to this series, will benefit from reading the background information. Last Week's Data Each week I break down events into good and bad. Often there is "ugly" and on rare occasion something really good. My working definition of "good" has two components:

The Good There was not a lot of economic data, but it was almost all good.

The Bad There was also some bad news, but not much. I am sure that some of my commenting community will want to add some bad news, but remember that it is supposed to be something that happened last week.

The Ugly The NSA. Reports are that they have long been aware of that Heartbeat Bug that we have been hearing so much about – the one that might be compromising our passwords and online transactions. Bloomberg reports that they chose to use the information for their own purposes. Let the denials begin…. Humor We all deserve some laughs, so how about this one? Fargo sixth-graders beat college investors in a stock-picking contest! (AP with HT to The Kirk Report's excellent weekly magazine). The contest organizer made his first ever trip to ND. Here is his reaction and the comment of one of the entrants:

I recommend taking a look at the winning portfolio (which probably did not do well last week). There is a good lesson in this, in addition to the fun. Quant Corner Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here. Recent Expert Commentary on Recession Odds and Market Trends Georg Vrba: Updates his unemployment rate recession indicator, confirming that there is no recession signal. Georg's BCI index also shows no recession in sight. For those interested in Canadian stocks, Georg has unveiled a new system. RecessionAlert: Great work on the "Yellen Dashboard" which we cited last week. Dwaine's fans should also check out his S&P warning system, based on market breadth. Doug Short: An update of the regular ECRI analysis with a good history, commentary, detailed analysis and charts. If you are still listening to the ECRI (2 ½ years after their recession call), you should be reading this carefully. Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured "C Score." One of his conclusions is whether a month is "recession eligible." His analysis shows that none of the next nine months could qualify. I respect this because Bob (whose career has been with banks and private clients) has been far more accurate than the high-profile punditry. Prof. Robert Shiller joins those who believe that recession odds are low. Rob Wile of Business Insider has the story, featuring this chart as the key reason: The Week Ahead We have plenty of news and data in a short trading week. The "A List" includes the following:

The "B List" includes:

It is a quiet week for Fed speechifying. I do not expect much from the regional Fed surveys. The big news is the serious start to earnings season. How to Use the Weekly Data Updates In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a "one size fits all" approach. To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances? My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage. Insight for Traders Felix has continued with a neutral rating. We have been completely out of US equities and enjoyed a brief, but profitable, investment in bonds (via TLT). By the end of the week we were fully invested for trading accounts – all in Latin American or China. Those who want to follow Felix more closely can tune in at http://www.scutify.com/, where he makes a daily appearance – assuming that I can awaken him from his Spring fever and the attractions of those "high-frequency" models so popular here in Chicago. Felix emphasizes momentum, but with many modifications. Cam Hui has a great post on how many methods work, but not all at the same time. So true. Insight for Investors I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. The current "actionable investment advice" is summarized here. This is still an important time for long-term investors. We all know that market corrections of 15% or so occur regularly without any special provocation. Recent years have been the exception. Over the last several weeks I have emphasized the need to maintain perspective, using market declines to add to positions. It helps if you have been actively rebalancing your portfolio and trimming winners. Then you have some cash. Some readers have asked me to write more on this topic, so I have placed it on the agenda. For now, let me do a quick summary.

When Mrs. OldProf wasn't looking, I violated our "no work on celebration nights" agreement to post an update on how we were trading the market volatility. If you have been reading the WTWA series, you were not surprised. (And thanks for all of the kind Birthday wishes in comments and emails). Because we have been selling in our "long stock" program, we have prepared to buy on dips. We are following the rules that I have recommended for you. I have not added to these positions yet, but we are shopping. I am especially interested in regional banks, energy and some "old tech." Those following our Enhanced Yield approach should also be doing fine. We have experienced only modest volatility, continuing to beat our upside target for the year despite overall market losses. It is important and helpful to own value stocks that pay dividends and add some hedging via short calls. Here are some key themes and the best investment posts we saw last week. Bonds continue to beat stocks. Brian Gilmartin has a thoughtful post that reflects how many of us feel. This demand for Treasuries is unrelenting. There is no easy explanation. Most of those claiming victory were asking "Who will buy our bonds?" only a few weeks ago when the QE tapering became clear. The economy is better. There are new pundit ideas, but they all seem like reaching. The bond yields make sense only if the economy gets worse. The evidence is against this, so I expect the bond to stock rotation to resume. To this advice, I add that most people lack the discipline to buy and sell at the right times. Every week I hear about people who bailed out of the market in 2009 and never got back in. You can be a do it yourselfer, but you need to ignore most of the pundits, popular web sites that promote fear, and focus on hard data. Howard Gold provides evidence about the results and the various errors: The mistake concept is supported by academic research as well. Cass R. Sunstein writes about a personal investment mistake, over-estimating risk and the probability of loss. This is a smart person (like you) who has the same human tendencies. Check out the full article for the three causes of his error. If you simply must do some hedging of your portfolio, beware the leveraged ETFs. Read this article carefully if your time horizon is more than a single day. As usual, Barry Ritholtz has some great advice for the individual investor. He hits on the popular theme of the week: "I was right!" Of course that is claimed by many pundits with different explanations. Nothing has changed, but all of a sudden their pet theory has gained traction. He writes as follows:

If you are obsessed about possible market declines, you have plenty of company. This is one of the problems where we can help. It is possible to get reasonable returns while controlling risk. Check out our recent recommendations in our new investor resource page -- a starting point for the long-term investor. (Comments and suggestions welcome. I am trying to be helpful and I love and use feedback). Final Thought While it is easier to say than to do, investors should focus on risk and fundamentals – not stock prices. The post-2000 market results have frightened an entire generation of investors. Whenever there is a bad stretch in the market, however brief, they are afraid of another "big one." You can imitate what I do for clients.

And keep in mind, what we saw last week is a minor pullback from fresh highs. It is not even close to a full-blown correction, despite the media coverage. If what you see makes you uncomfortable and interferes with your regular life, your position is too big. The fundamental story is an improving economy and a reduction in risk that we can measure objectively. Calculated Risk has a nice summary of the economic prospects for the rest of the year. Bill is drawing upon the work of Goldman's Ian Hatzius, who is no perma-bull. Hatzius was Nate Silver's "hero" in the 2007-08 cycle. Here is the outlook:

If this is accurate – or even close, we will see stronger corporate earnings, higher bond yields, and higher stock prices. |

Why Stocks Won’t Crash (For Now)

by James Gruber

| A Blodget crash Many stock markets are only marginally off record highs and yet there’s already a growing chorus of calls for a larger correction or crash. Comparisons to 2008, 1999, 1987 and 1929 are all the rage. The Internet can be partially blamed for this “noise” as financial bloggers revert to sensationalism to get attention amid the cacophony of market commentary. But it also speaks to the enduring psychological damage to investors from the 2008 financial crisis. Fears that every correction will result in a crash remain front of mind. The market pullback has certainly let the bears come out to play. Well-known commentator, Marc Faber, aka Dr Doom, appeared on television with a twinkle in his eyes to declare a likely re-run of 1987, but worse. Faber suggested the S&P 500 would fall 30% this year. The only problem is that he’s been talking of a market crash for more than two years and it hasn’t happened (see here and here). Henry Blodget of Business Insider also reiterated his less precise, albeit more dire, market call this week. He thinks the US market could drop up to 50% over the next 1-2 years. He bases this on expensive valuations, all-time high corporate margins which are likely to mean-revert and Fed tightening effectively taking away the punch bowl. Asia Confidential believes Blodget makes a number of valid arguments and could end up being right. But he’s way to early with the call. And the principal reason is that history shows Fed tightening has been bullish for stocks, at least initially. Today’s newsletter will explore Blodget’s views in detail, the holes therein as well as the more plausible risk to markets in the short-term: a deflationary bust precipitated by Japan and/or China. A Blodget crash In recent months and again this week, Blodget has made the case that a major market decline of up to 50% is likely over the next 1-2 years. There are cynics who suggest that Blodget is trying to make up for his lack of caution as an analyst. There may be a grain of truth to that but it’s not our immediate concern. Your author will instead focus on Blodget’s considered and thoughtful arguments. Blodget says there are three reasons why the US stock market is vulnerable to a severe correction: 1) Stocks are very expensive. Blodget primarily relies on the cyclically-adjusted Shiller price to earnings ratio (PER). This ratio differs from a normal PER as it takes the average earnings, adjusted for inflation, of the past 10 years. This seeks to smooth out business peaks and troughs. Anyhow, the Shiller PER currently sits at 25x, way above the historical average of 15x. It’s only been at these levels twice over the past century, in 1929 and 2000. We all know what happened in those years. And if you don’t believe the Shiller PE, Blodget says there are a host of other valid methodologies which point to significant market over-valuation. The below chart shows the average return for the next decade forecast by these methodologies is just 2%, well below the historical average 10% returns of the S&P 500. Therefore, even if there isn’t a crash, you can expect poor returns from US equities going forward. 2) Record-high corporate margins should mean-revert. Blodget acknowledges that the current S&P PER of 15x is in line with the long-term historical averages. However, he says this is a distortion caused by current high profit margins. These margins are far above anything seen in the past. Notably, these margins almost always mean-revert. And that means they’re likely to be heading down, impacting earnings and ultimately valuations. 3) Fed tightening has often been bad for stocks. Blodget’s final point is that history shows rising interest rates have normally preceded significant market corrections. Given the Fed has forged ahead with QE tapering and foreshadowed a rise in rates from next year, that doesn’t bode well. Holes in the argument Yes, the Shiller PE has its critics. They point to the ratio only indicating market under-valuation 2% of the time over the past two decades, making for a dubious methodology. I doubt this invalidates it but just indicates that the S&P 500 has been mostly expensive over that time frame. It’s also important to note that other valuation methodologies which suggest a similar levels of over-valuation, such as Tobin’s Q, have received much less criticism. Tobin’s Q, in particular, has been proven robust. To the second point, Blodget overstates the case. Yes, US corporate margins are at record highs, but not to the extent he would have it. The recent lift-off in margins is partly due to an accounting quirk. US corporations have been earning more from overseas (40% of total). Foreign sales are included in the corporate earnings/GDP ratio but costs are excluded. This effectively means overseas operations are treated as earning 100% margins. As the blog, Philosophical Economics, points out, if you remove this accounting quirk, corporate margins aren’t so wildly elevated. Critically too, there are long periods such as 1947-1967, where margins stay high ie. they don’t mean-revert as readily as many suggest. Another critical point is that margins have historically peaked an average 21 months after wage growth has picked up. And the wages component of the Employment Cost Index is broadly flat at present. In my view though, the third point of Blodget’s argument is the most problematic. Blodget suggests that Fed tightening has typically been bad for stocks. That’s not quite right. In fact, the early stages of interest rate rises have been positive for stocks on most occasions, as the below chart from Ken Fisher shows. At no stage over the past century has the S&P 500 peaked prior to or after the first rate rise. Moreover, cyclical bull markets have been one-third the way through when the first rate increase occurs. Market peaks have been reached three years after the initial rate hike, on average. The shortest lag between first rate increase and market peak has been one-and-a-half years in the late ’60s. Typically, the Fed has been slow to aggressively hike rates to tame inflation, and tightening together with a slowing economy has led to recession. Given the Fed won’t start raising rates until next year at the earliest, history would suggest the market may not peak for another two-and-a-half years at a minimum. And that makes Blodget’s forecast of a market crash improbable. A secular bear? Blodget doesn’t say it but his call bears the imprints of a secular bear. His crash forecast effectively suggests that we may be heading into the final stages of a secular bear market. Secular bull and bear markets are long cycles of rising and falling markets. Cyclical bull markets can occur within secular bear markets and vice versa. The average bear market in the US over the past century has lasted 18 years. There’s a view – to which I subscribe – that the US entered a bear market in 2000. And that bear market hasn’t yet finished. Mind you, there’s lots of different opinion on this issue. Some think the bear market ended in 2009, making it the shortest of any bear market of the past 100 years. Others believe the secular bear market only started in 2009 and therefore we have a way to go. What is beyond dispute is that PERs, not earnings, drive secular cycles. During secular bull markets, PERs often start in single digits and move sharply higher before heading down during a secular bear market. The interesting part is what drives PERs higher and lower. The answer is the longer-term trend of the inflation rate. Moving from high inflation towards lower inflation typically drives PERs higher and thus markets higher. Transitioning from low inflation to a period of high inflation or deflation normally drives PERs lower, and markets lower too. Why do these things happen? Well, when inflation and interest rates are high, investors want higher returns and therefore will pay a lower upfront price for stocks. When there’s deflation, future earnings and dividends are assumed lower and investors will want to pay a lower upfront price as well. Conversely, with low inflation and interest rates, investors are willing to pay a higher price for stocks, which drives up PERs. The upshot is that given current low inflation, the risk for markets comes from higher inflation or deflation. Higher inflation doesn’t become a major problem for markets until it reaches 4%. Beyond that point, PERs start to significantly decline. Therefore, a Fed tightening cycle isn’t a concern until inflation hits 4% and we’re a long way from that point. On the other hand, there’s the risk of deflation. For Blodget’s thesis to be proven correct, a deflationary bust is the more likely scenario to make that happen. The deflationary threat The risks from Europe, Japan and China simultaneously conducting further bouts of QE to depreciate their currencies can’t be underestimated. History shows currency wars often lead to trade wars, which negatively impact global trade. In this context, Asia Confidential sees Japan as the biggest wildcard and greatest risk. Any objective assessment of Abenomics would suggest that it’s failing. And that could well result in more unconventional and inherently dangerous policy moves. The Japanese Prime Minister, Shinzho Abe, took office 17 months ago with the aim of reflating the country’s ailing economy. He’s printed truckloads of money to depreciate the yen in a bid to revive trade and put the current account firmly in positive territory. The only problem is that while the yen has fallen more than 20% against the US dollar, export growth has been tepid and the current account has markedly deteriorated. The key issue is that households are being squeezed. Wages are declining. Savings are earning almost nothing as QE keeps rates low. Costs are rising too, as the country’s import bill has soared thanks to the lower currency (which makes for more expensive imports). The lack of domestic spending power is forcing companies to invest their money in exports. But the global export pie isn’t growing much. That means Japan is having to take a greater piece of the pie. Greater market share, in other words. Yet despite the lower yen, Japan isn’t gaining share. Put simply, companies are selling more but at lower prices. Many sell-side analysts point to the so-called J-curve effect, where the increase in exports after currency devaluation typically lags the rise in imports by 12-18 months. Thus they’re suggesting a turnaround in Japanese fortunes is around the corner. Others point out that imports temporarily spiked in anticipation of this month’s consumption tax hike. Both have these things may hold some truth. But the J-curve effect, in particular, is unlikely to prove a long-term solution to Japan’s problems. What’s more likely is that you’ll see more and more desperate actions to try to revive the economy. That could lead to a much lower yen. And that would put enormous pressure on other exporting powerhouses, such as China, South Korea and Germany. Tit-for-tat currency depreciations may result. Of course, the great hope is that Japan will implement economic reforms to improve productivity, increase wages and lift domestic demand. Unfortunately, that’s been the hope for the past 24 years and the forces opposing change have won at every turn. In sum, a market crash as the Fed starts to lift interest rates seems an improbable scenario. Any crash would likely come from a deflationary bust instead. But any deflation will be met by even more stimulus which may serve to delay any economic bust. The odds favour markets grinding higher for a while yet. AC Speed Read - A marginal pullback has led to a number of commentators suggesting a market crash is imminent. - Henry Blodget is among the most prominent, calling for a potential S&P 500 market decline of up to 50% over the next 1-2 years. - There are some flaws in his argument though, as Fed tightening is typically bullish for stocks, at least in the two years after an initial rate hike. - Given a rate hike is likely to happen next year at the earliest, that means a more substantial market correction will have to wait to 2017, if history is any guide. - The key risk to this scenario is a deflationary bust, precipitated by Japan and/or China. |

Should you trade stocks on your iPhone?

| More investors are buying and selling shares with their smartphones

More investors are selling stocks the same way they take selfies: With their smartphones. But just because you can trade shares of AAPL on your iPhone doesn’t mean you should, experts say. Customers have long used their smartphones to check stock quotes in real time. But over the past year, the biggest brokerages say they’ve seen significant surges in actual trading. Fidelity Investments, which has nearly 15 million retail brokerage customer accounts, says that in 2013, mobile trading, including trading from tablets, grew 63% over the previous year. The Fidelity financial apps have been downloaded 3.6 million times, according to the firm. E*Trade Financial Corp. /quotes/zigman/118511/delayed/quotes/nls/etfc ETFC -2.42% says the share of its 3 million customers who use mobile trading jumped from 6.5% in 2012 to 8.4% in 2013, and will likely cross the 10% mark in the near future. The online broker says 80% of those trades come from a smartphone. And between 2010 and 2013, trading on mobile phones and tablets increased 713% at Scottrade Inc., which works with 2.4 million customers. This January and February, the online broker saw trading more than double compared with the same two months a year earlier. What’s driving the growth in mobile trading? It’s due in part to technological improvements that have erased most of the difference in speed and reliability between trading from a phone and trading from a PC. The rise of tablets, which keep mobile traders from having to squint at a phone screen all day, has no doubt helped, too. What’s more, many of the investors are Gen X and Gen Y, the companies say—populations that are both comfortable with technology and eager to control their accounts in real time. “Since the crash, they want more control of their accounts, and mobile helps facilitate that,” said John Matos, senior vice president of product management for E*Trade. Usage habits suggest that many of these trades are coming from the kind of active traders who might otherwise be buying and selling from their desktops all day. “We are seeing trading activity that is consistent throughout the day,” said Velia Carboni, SVP for Fidelity’s mobile apps. But “if you see a big shift in the market, we see a big spike in trading on the phone.” Investors who use Fidelity’s application do so pretty consistently, making trades 5-10 times a month. E*Trade, meanwhile, reports that users gear up in the premarket hours to trade from their phone later in the day. “I might not be watching the market, but if I am in the car and realize the market is up 300 points, I can pull over and just jump on my phone and sell something if I want to,” said Sunil Katwala, a Fidelity customer from Long Island, who says he trades on his phone several times a month. Bigger, more diversified brokerages like Bank of America Corp.’s Merrill Edge, Wells Fargo & Co. and Charles Schwab Corp. also say they’re seeing increased demand from investors for mobile trading options. “They can truly do whatever they need to do in their daily lives and have full access to their financial information,” said Paul Vienick at Merrill Edge. The Bank of America unit has noticed an extreme uptick on phone usage in the last two years, with 2013 mobile trading volume up nearly 200% year-over-year. “10 to 20% of trades could be coming through the mobile app,” said Vienick. “Going back two or three years ago, that was more on the 2%-7% range.” The possible perils of mobile tradingAre smartphone traders more likely to make a mistakes or rash decisions? “There’s a chance the transmission won’t go through, or you could end up trading the wrong stock,” said David Hilder, analyst at Drexel Hamilton, who says he doesn’t trade individual stocks. “If you start arranging your life assuming that you can trade whenever you want, but it turns out you couldn’t trade because of a weak signal, that could cause problems with your investment strategy.” Past studies have suggested that non-professional investors who trade more frequently tend to perform less well than those who pursue more of a buy-and-hold strategy. In that sense, mobile trading could make it too easy for some investors to trade too much. See: How individual investors are destroying their wealth. But fans of mobile trading say that these are problems for which the mobile technology itself isn’t to blame. “Chances are if you’re going to screw up, you are going to screw up on a PC also,” says Katwala. Placing a trade on your phone typically involves the same process as entering a desktop online trade. Most online brokers say there is no real lag-time for trading on the phone, as long as the wireless connection is operating effectively. For most of the mainstream trading apps, users have to login every time they make a trade or want to look at their balance: There’s no getting around that security function, say experts. Inside one broker’s mobile tradesTD Ameritrade Holding Corp. /quotes/zigman/9766366/delayed/quotes/nls/amtd AMTD -0.57% , which has 6 million client accounts, has a trading platform tailored toward technically oriented users: they can look up statistics like moving averages and trade options, while also trading complex options, futures and currencies. “The acceleration of the growth of mobile has far outweighed any other technology offering,” said Nicole Sherrod, managing director of the mobile group at TD Ameritrade. Most brokerages decline to share many specifics about their mobile traders’ habits, but TD Ameritrade offers a bit more detail. The brokerage firm says it’s now seeing up to 13.4% of all trading being done through the phone — that’s 67,000 trades per day, with an estimated value of above $1 billion a day. |

Shape of the Investment Climate

| The economic data due out in what for many will be a holiday-shortened week is unlikely to change macro-economic picture: • Even though the US economy is strengthening after a dismal first quarter, the peak in the Fed’s balance sheet is still the better part of six months out, and the first rate hike is more than a year away. • China, the world’s second largest economy, has slowed, though the focus is just as much on the financial sector, where the yuan has weakened and financial conditions have tightened. • The world’s third largest economy, Japan has instituted a retail sales tax, just as data shows that industrial production and household spending have turned down. Although first quarter growth likely accelerated from the 0.2% quarter-over quarter pace seen in Q3 and Q4 13, the economy may contract in Q2. • The euro area economy has graduated from contraction to faint growth, but growth remains, as ECB President Draghi say, “weak, fragile and uneven.” Eonia is elevated, and there seems to be a strengthening consensus that more central bank action is required. As the yield on 10-year US Treasuries recorded their biggest decline in a month and US 30-year yields fell to their lowest level since last July, investors learned that weekly initial jobless claims made new cyclical lows. Subdued price prices and inflation expectations (e.g., 5-year/5-year forward breakeven is just below 2.4%, more than 35 bp below the five-year average). Meanwhile, the US S&P 500 suffered its largest drop since 2012. This week’s data is likely to show the even without much use of credit cards (revolving credit), the household consumption (retail sales account for about 40% of consumption) is recovering after a soft start to the year. Industrial output also likely strengthened. Prices (CPI) are subdued. Housing starts are expected to jump back after some weather induced weakness. Yellen’s speech to the NY Economics Club will be scrutinized for policy clues, but we suspect the pendulum of sentiment has swung nearly as far as it will. Interest rates approaching important low levels, like 2.6% on the US 10-year, 30 bp on the US 2-year yield (assuming one 25 bp rate hike in 2015, we estimate fair value as no lower than 40 bp) and near 90 bp implied yield on the December 2015 Eurodollar futures contract. The S&P 500 is approaching an important retracement target just below 1800. At the IMF gathering over the weekend, ECB President Draghi gave the strongest signal to date that the central bank is indeed preparing new unconventional measures to arrest the slide in inflation. He was quoted in the media confirming that the euro’s strength “requires further monetary stimulus.” However, while many observers have advocated quantitative easing, reports suggest that as Bundesbank President Weidmann and Bank of Finland’s Governor Liikanen may be speaking for an emerging consensus that if the problem is the euro’s strength is a major force depressing prices, then the most effective policy is a cut in interest rates rather than QE. There does seem to be truth in IMF head Lagarde’s undiplomatic claim before the weekend that is was just a matter of time before the ECB takes unorthodox steps. Whatever the ECB is going to do is at least a month and a half away. Although officials play down the significance of any one CPI report, the preliminary April reading, due out at the end of the month, is understood to be critical. The ECB is counting the Easter-effect being unwound in April that will boost CPI from 0.5%, the lowest level in more than four years. This was thought to be necessary to give Draghi and others time to build a consensus for action in June, when the staff unveils new inflation forecasts (it has consistently erred in seeing more inflation that actually has materialized). The incredible success of the Greek bond auction has many observers scratching their heads. The economy is 25% small than before the crisis and its debt is closer to 170% of GDP (from 120% on the eve of the crisis), yet some investors, reportedly a third of whom were hedge funds and a full 90% were non-domestic investors) seemingly could not get enough of the paper with a 4.95% coupon. We suspect there is a logic to this and not simply naive and over-the-top speculation as many pundits have intimated. The reasoning is at least three-fold: First, the cost of servicing the country’s debt, which is largely in official hands, is likely to come from easing the conditions through officials reducing the interest rate and extending the maturities, making it easier to service the modest amount of debt in private hands. Second, the diminished risk of Greece dropping out of EMU means that the redenomination risk has all but evaporated. Third, although the bond auction was successful beyond belief, it is unlikely to be repeated often as the private sector funds are still relatively expensive compared with the official sector . China’s financial conditions are tightening, though this week’s data is expected to show that officials are still struggling to slow down lending. Last week China failed to sell the full amount of 1-year paper it offered. Only CNY20.7 bln of the note was bought compared to the CNY28 bln that was offered. The rate was nearly 25 bp higher than expected at 3.63%, and yields were closer to 3.32% for paper with the same residual maturity. The 7-day repo rate, which reflects interbank liquidity jumped 75 bp last week to 3.75%, despite the PBOC conducting its first liquidity injection via repos since January. Corporate tax payments have aggravated the existing pressure and speculation of a rate hike here in Q2 continues to be picked up by the media. Tensions in Ukraine are escalating. Forces sympathetic to Russia, if Russia is to be believed that it is not their personnel , have taken over a couple of cities in the eastern part of Ukraine and have incited unrest in more. Even before this, the US and Europe were threatening more sanction as Russian forces remain amassed on the Ukraine border. The position and weapons of those forces (including surface to air missiles, according to reports) is leading NATO to conclude that Putin is seeking the full occupation of Ukraine. Separately, before the weekend Putin’s letter to European officials warning that Ukraine’s failure to pay for its oil and gas risks cut-offs and pre-payment requirements for further supplies. This got Europe’s attention of course, but there is a contractual dispute. Putin says that Gazprom is owed about $35.4 bln for past subsidies ($17 bln) and fines ($18.4 bln) under a take-or-pay scheme. We conclude by identifying three additional events this week that investors should note: First, the UK’s data is likely to show that the labor market continues to heal and the unemployment rate may slip to 7.0%, the previous threshold in the BOE’s forward guidance. Earnings growth is expected to improve, but the CPI should eased, perhaps falling to 1.5%, which would be the lowest since the beginning of Q4 2009. Second, the Bank of Canada is not about to change rates at this week’s meeting, but it may recognize that the economy is likely to recover in Q2 from a poor Q1, helped by a stronger US economy and that this may help put a floor under prices. Finally, New Zealand reports Q2 CPI figures midweek and barring unexpected weakness, the Reserve Bank of New Zealand appears poised to hike rates on April 24 in Wellington. |

Are We Heading For Another 1987-Style Stock Market Crash?

By: Graham_Summers

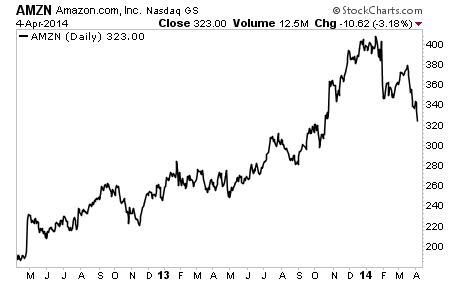

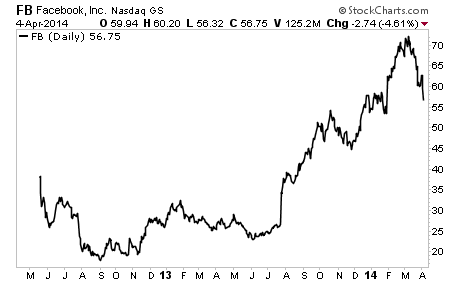

| The big story developing in the US markets regards the sudden crackdown by regulators, most notably the SEC and Justice Department, on High Frequency Trading or HFT. In simple terms, the market exchanges, like the NYSE, would let these firms (for a price of course) see when someone put in a market order to buy or sell shares on the market. The same goes for Facebook: |

All The Presidents' Bankers: The World Bank And The IMF

by Tyler Durden

| The following is an excerpt from ALL THE PRESIDENTS’ BANKERS: The Hidden Alliances that Drive American Power by Nomi Prins (on sale April 8, 2014). Reprinted with permission from Nation Books. Nomi Prins is a former managing director at Goldman Sachs. The World Bank and the IMF: Expanding Wall Street’s Reach Worldwide Just after the United States entered World War II, two simultaneous initiatives unfolded that would dictate elements of financing after the war, through the joint initiatives of foreign policy measures and private banking whims. Plans were already being formulated to navigate the postwar peace, especially its international power implications for finance and politics, in the background. American political leaders and scholars began considering the concept of “one world” from an economic perspective, void of divisions and imbalances. Or so the theory went. The original plans to create a set of multinational entities that would finance one-world reconstruction and development (and ostensibly balance the world’s various economies) were conceived by two academics: John Maynard Keynes, an adviser for the British Treasury, and Harry Dexter White, an economist in the Division of Monetary Research of the US Treasury under Treasury Secretary Henry Morgenthau. By the spring of 1942, White had drafted plans for a “stabilization fund” and a “Bank for Reconstruction and Development.” His concept for the fund became the seed for the International Monetary Fund. The other idea became the World Bank. But before those entities would come to life through the Bretton Woods conferences, many arguments about their makeup would take place, and millions of lives would be lost. Keynes, White, and Power Transfer to the United States By early 1944, nearly two-thirds of the European GNP had been devoted to war; millions of people had been slaughtered. But six months after the complete liberation of Leningrad, it was the international financial aspects of the coming peace that exercised the imagination of the policy elites. In July 1944, 730 delegates representing the forty-four Allied nations convened at the Mount Washington Hotel in Bretton Woods, New Hampshire. Amid picturesque mountains, hiking trails, and oppressive heat, they sat to determine the postwar economic system. For three weeks, they debated the charter for the International Monetary Fund and discussed how the International Bank for Reconstruction and Development, or the “World Bank,” would operate. White and Keynes had competed for influence over this final result for the past two years. To a large extent, the personal vehemence of each man aside, they did so as an extension of the jockeying for position between the United States and Britain as the incoming and outgoing financial superpowers. At first, virtually every American banker and politician opposed the main aspects of Keynes’s plans, particularly his idea about creating a new global currency—the unitas—that would supersede gold and the dollar. Many subsequent histories of the Bretton Woods Conference consider the final doctrines for the IMF and World Bank as representing a clear compromise between White and Keynes. But they leaned far more toward White’s model and vision. From the bankers’ standpoint, White’s model was more tolerable because it preserved the supremacy of the dollar. Former President James A. Garfield once said, “He who controls the money supply of a nation controls the nation.” But in the negotiations surrounding those Bretton Woods meetings, the mantra was more “Those who control the banks backed by the currency that dominates the world control world finance.” While final drafts snaked through Congress after the July 1944 meetings, one key US banker maintained his public opposition to Bretton Woods. Even after it became clear that the multinational entities would be dollar-based, Chase chairman Winthrop Aldrich remained opposed to the idea. Mostly, he feared the slightest amount of competition from any uncontrollable source. Though Aldrich favored removing trade barriers, which would provide the US banks a wider field for cross-border financing, he didn’t want some supranational entity getting in the way of private lending to facilitate that trade. In his “Proposed Currency Plan” of September 16, 1944, Aldrich slammed the accords, which he saw as a distinct challenge to the power of private banks. “The IMF,” he said, “would become a mechanism for instability rather than stability since it would encourage exchange-rate alterations.” Like most bankers, Aldrich was fine with the World Bank taking responsibility for exchange-stabilization lending. That element would aid bankers; a supranational entity providing monies to struggling countries would bolster them sufficiently to be able to borrow more through private banks. But bankers didn’t want a fund constructed as a competing lending mechanism that could possibly take business away from them, operating in the guise of economic security. Aldrich warned, “We shall have the shadow of stability without the substance. . . . Perhaps the most dangerous aspect of the Bretton Woods proposals is that they serve as an obstacle to the immediate consideration and solution of these basic problems.” Aldrich’s public outcry was unsettling to President Roosevelt and Treasury Secretary Robert Morgenthau, who knew that it was politically important to get all the main bankers’ support. Not only did they hold a solid proportion of US Treasury debt; they had become the distribution mechanisms of that debt to more and more citizens and countries. There couldn’t be an IMF without the support of private lenders, and if the US was going to be in command of such an entity from a global perspective, US bankers had to be on board. Concession to the bankers wasn’t a matter of empty appeasement but of economic supremacy. The American Bankers Association, on which Aldrich was a board member, also wanted to restrict the IMF’s powers. Burgess, who served as chairman of the American Bankers Association and National City Bank vice chairman, was unwilling to back the Bretton Woods proposals unless White made more concessions to reinforce the supremacy of the US banks and the dollar. He would play hardball and get Morgenthau involved if he had to. Though White refused to bow to Burgess’s requests, Congress incorporated them into the final documents. To make the bankers happy, a compromise was fashioned that restricted the IMF funds to loans offsetting short-term exchange rate fluctuations, such as when one country has a sharp and sudden shift in the value of its currency relative to another. That loophole left plenty of room for banks to supply aggressive financing to developing nations over the loosely defined longer-term. It also meant that all nations receiving short- term assistance from the IMF would likely be on the hook for more expensive debt at the hands of the bankers in tandem, or later. But in the scheme of White’s plan, this alteration was more cosmetic than substantial. The Bretton Woods Agreement Congress approved the Bretton Woods agreement on July 20, 1945. Twenty- seven other countries joined as well. The Soviet Union did not. It was a portent of how rapidly the world was falling into the Cold War and how rapidly the United States was forging its own foreign alliances in the postwar economy. By the time the Bretton Woods delegates reconvened to settle the final details of the agreement at Savannah, Georgia, in March 1946, Churchill had already coined the term “the Iron Curtain” to describe the line between Communist Soviet Union and the West in his famous “Sinews of Peace” speech at Westminster College. In addition to the growing Cold War mentality, or perhaps because of it, expectations that White would lead the IMF were squashed when the FBI alerted President Truman that White and other senior civil servants had passed secret intelligence to the Soviet Union. It’s doubtful that Truman believed the allegations; though he took White out of the bidding for the head position, White remained an executive director. The incident served as a precedent for how the top positions at the World Bank and the IMF would be allocated along political-geographical lines. The post was offered instead to Belgian economist Camille Gutt, establishing the protocol whereby the IMF would be headed by a Western European and the World Bank by an American. But while politics dictated the initial leadership choices, private bankers’ behavior would soon overshadow the functions of both bodies. Despite their “international” monikers, the World Bank and the IMF disproportionately served the interests of the Western European nations that were most important to the United States from the get-go. The bankers could exert their influence over both entities to expand their own enterprises. Later, another element that reinforced this dynamic was added. Thanks to a minor technicality introduced by Truman’s Treasury secretary, John Snyder, “aid monies” to “friendly” (or large and friendly) countries would be considered “grants,” which would not show up as national debt, thereby providing the illusion of better economic health. Money granted for military operations or the friendly countries would not show up as debt either. This presented a foreign business opportunity whereby banks could provide loans at better terms to larger countries and make more money off higher interest loans to developing ones because of the disparity in their perceived debt loads. In addition, as Martin Mayer observed in his classic book The Bankers, “the growing and unregulated Eurodollar market would become a cauldron of out-of-control debt and heady profits for US banks.” Through this market, many of the major midcentury postwar loans would be made. Making the World Bank Work for Wall Street Congress had established the National Advisory Council to be the “coordinating agency for United States international financial policy” and as a mechanism to direct that policy through the international financial organizations. In particular, the council dealt with the settlement of lend-lease and other wartime arrangements, including the terms of foreign loans, details of assistance programs, and the evolving policies of the IMF and World Bank. As chairman of the National Advisory Council, U.S Treasury secretary John Snyder carried a vast amount of influence over those entities, as many major decisions were discussed privately at the council meetings and decided upon there. There was one ambitious lawyer who understood the significance of Snyder’s role. That was John McCloy, an outspoken Republican whose career would traverse many public service and private roles (including the chairmanship of Chase in the 1950s), and who had just served as assistant secretary of war under FDR’s war secretary, Henry Stimson. McCloy and Snyder would form an alliance that would alter the way the World Bank operated, and the influence that private bankers would have over it. It was Snyder who made the final decision to appoint McCloy as head of the World Bank. McCloy, a stocky Irishman with steely eyes, had been raised by his mother in Philadelphia. He went on to become the most influential banker of the mid-twentieth century. He had been a partner at Cravath, Henderson, and de Gersdorff, a powerful Wall Street law firm, for a decade before he was tapped to enter FDR’s advisory circle. After the war, McCloy returned to his old law firm, but his public service didn’t translate into the career trajectory that he had hoped for. Letting his impatience be known, he received many offers elsewhere, including an ambassadorship to Moscow; the presidency of his alma mater, Amherst College; and the presidency of Standard Oil. At that point, none other than Nelson Rockefeller swooped in with an enticing proposition that would allow McCloy to stay in New York and get paid well—as a partner at the family’s law firm, Milbank, Tweed, Hope, and Hadley. The job brought McCloy the status he sought. He began a new stage of his private career at Milbank, Tweed on January 1, 1946. The firm’s most import- ant client was Chase, the Rockefeller’s family bank. But McCloy would soon return to Washington. Truman had appointed Eugene Meyer, the seventy-year-old veteran banker and publisher of the Washington Post, to be the first head of the World Bank. But after just six months, Meyer abruptly announced his resignation on December 4, 1946. Officially, he explained he had only intended to be there for the kick-off. But privately, he admitted that his disagreements with the other directors’ more liberal views about lending had made things untenable for him. His position remained vacant for three months. When Snyder first approached McCloy for the role in January 1947, he rejected it. But Snyder was adamant. After inviting McCloy to Washington for several meetings and traveling to New York to discuss how to accommodate his stipulations about the job—conditions that included more control over the direction of the World Bank and the right to appoint two of his friends— Snyder agreed to his terms. Not only did Snyder approve of McCloy’s colleagues, but he also approved McCloy’s condition that World Bank bonds would be sold through Wall Street banks. This seemingly minor acquiescence would forever transform the World Bank into a securities vending machine for private banks that would profit from distributing these bonds globally and augment World Bank loans with their private ones. McCloy had effectively privatized the World Bank. The bankers would decide which bonds they could sell, which meant they would have control over which countries the World Bank would support, and for what amounts. With that deal made, McCloy officially became president of the World Bank on March 17, 1947. His Wall Street supporters, who wanted the World Bank to lean away from the liberal views of the New Dealers, were a powerful lot. They included Harold Stanley of Morgan Stanley; Baxter Johnson of Chemical Bank; W. Randolph Burgess, vice chairman of National City Bank; and George Whitney, president of J. P. Morgan. McCloy delivered for all of them. A compelling but overlooked aspect of McCloy’s appointment reflected the postwar elitism of the body itself. The bank’s lending program was based on a supply of funds from the countries enjoying surpluses, particularly those holding dollars. It so happened that “the only countries [with] dollars to spare [were] the United States and Canada.” As a result, all loans made would largely stem from money raised by selling the World Bank’s securities in the United States. This gave the United States the ultimate power by providing the most initial capital, and thus obtaining control over the future direction of World Bank financial initiatives—all directives for which would, in turn, be predicated on how bankers could distribute the bonds backing those loans to investors. The World Bank would do more to expand US banking globally than any other treaty, agreement, or entity that came before it. To solidify private banking control, McCloy continued to emphasize that “a large part of the Bank capital be raised by the sale of securities to the investment public.” McCloy’s like-minded colleagues at the World Bank—vice president Robert Garner, vice president of General Foods and former treasurer of Guaranty Trust; and Chase vice president Eugene Black, who replaced the “liberal” US director Emilio Collado—concurred with the plan that would make the World Bank an extension of Wall Street. McCloy stressed Garner and Black’s wide experience in the “distribution of securities.” In other words, they were skilled in the art of the sale, which meant getting private investors to back the whole enterprise. The World Bank triumvirate was supported by other powerful men as well. After expressing his delight over their appointments to Snyder on March 1, 1947, Nelson Rockefeller offered the three American directors his Georgetown mansion, plus drinks, food, and servants, for a three-month period while they hammered out strategies. No wives were allowed. Neither were the other directors. This was to be an exclusive rendezvous. It is important to note here that the original plan as agreed upon at Bretton Woods did not include handing the management and organization of the World Bank over to Wall Street. But the new World Bankers seemed almost contemptuous of the more idealistic aspects of the original intent behind Bretton Woods, that quaint old notion of balancing economic benefits across nations for the betterment of the world. Armed with a flourish of media fanfare from the main newspapers, they set about constructing a bond-manufacturing machine. With the Cold War hanging heavily in the political atmosphere, the World Bank also became a political mechanism to thwart Communism, with funding provided only to non-Communist countries. Politics drove loan decisions: Western allies got the most money and on the best terms. |