By John Mauldin

Unrealistic Expectations

Nominal or Real?

Voting versus Weighing

Chicago, Bismarck, Denver, Etc.

"In the short run, the market is like a voting machine, tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine, assessing the substance [intrinsic value] of a company."

– Benjamin Graham

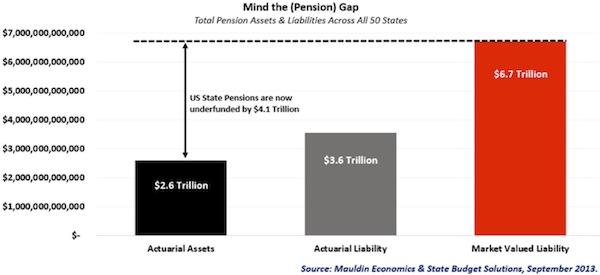

Way back in the Paleozoic era (as far as markets are concerned), circa 2003, I wrote in this letter and in Bull's Eye Investing that the pension liabilities of state and municipal plans would soon top $2 trillion. This was of course far above the stated actuarial claims at the time, and I was seen as such a pessimist. Everyone knew that the market would compound at 9%, so any problems were just a rounding error.

Now it turns out I may have been a tad optimistic. Two well-respected analysts of pension funds have produced reports this summer suggesting that pensions are now underfunded by more than $4 trillion and possibly more than $5 trillion. I would like to tell you that the underfunding is all the bad news, but when you probe deeper into the problems facing pension funds, it just gets worse. The two reports conclude that pension plan sponsors seem determined to keep digging themselves an ever-deeper hole. But to hear the plan sponsors tell it, the situation is readily manageable and the risks are minimal. Except that pesky old reality keeps confounding their expectations.

And that is the crux of the problem. Whether you believe there really is a problem boils down to the assumptions you make about future returns. If you believe the projections trotted out by pension fund management and the bulk of the pension consulting groups, the underfunding is a mere $1 trillion — a large amount to be sure but manageable for most states.

The emphasis here is on most. Some states and municipalities are in far worse shape than others, and to be honest with you, I don't see how some of them can meet their commitments. Others are trying to be responsible and fulfill their pension fund obligations based on the assumptions their "experts" come up with, but the problem is that those assumptions may be overly optimistic. The seemingly small difference of just 1% of GDP growth can make a huge difference in pension liabilities (and thus taxpayer obligations).This week we begin a series focusing on the problems facing US state and local pension funds. This issue has relevance to you not only as a taxpayer but also as an investor, because it goes to the very core of the question, what is the level of reasonable returns we can expect to see from our investments in the future? This is not a problem that is restricted to the US — it's global. Sadly, we don't live in a Lake Wobegon world where all pension funds and investment portfolios are above average. Not everyone can be David Swenson, the famous chief investment officer of Yale University. Truth be told, David Swenson will have a difficult time being David Swenson in the next 20 years.

The past 10 years have seen a growing number of economists and financial analysts questioning the propriety of the methods used to forecast pension fund liabilities. This is more than an academic exercise, as the numbers you choose to base your models upon make massive differences in the projected outcomes. As we will see, those differences can run into the trillions of dollars and can mean the difference between solvency and bankruptcy of municipalities and states. The implicit assumption in many actuarial forecasts is that states and cities have no constraints on their ability to raise money. If liabilities increase, then you simply raise taxes to meet the liability. However, fiscal reality has begun to rear its head in a few cities around the country and arrived with a vengeance in Detroit this summer. It seems there actually is a limit to how much cities and states can raise.

"Aah," cities assure themselves, "we are not Detroit." And it must be admitted that Detroit truly is a basket case. But it may behoove us to remember that Spain and Italy and Portugal and Ireland and Cyprus all said "We are not Greece" prior to arriving at the point where they would lose access to the bond market without central bank assistance.

In response to growing concerns over public pension debt, the Governmental Accounting Standards Board (GASB) and Moody's have both proposed revisions to government reporting rules to make state and local governments acknowledge the real scope of their pension problems. (While it is possible to ignore Moody's, based on the fact that it is just one of three private rating agencies, it is impossible to ignore GASB, which is the official source of generally accepted accounting principles (GAAP) used by state and local governments in the United States.

Under the new GASB rules, governments will be required to use more appropriate investment targets than most public pension plans have been using, bringing them more in line with accounting rules for private-sector plans. Pension plans can continue to use current investment targets for the amounts the plans have successfully funded; but for the unfunded amounts, pension plans must use more reasonable investment forecasts, such as the yield on high-grade municipal bonds, currently running between 3 and 4 percent. From my perspective, not requiring reasonable investment forecasts on already funded accounts is still unrealistic, but the new GASB rules are a major step in the right direction, and I applaud GASB for taking a very politically difficult stance.

Moody's has also proposed new rules to require states to use more appropriate investment targets. Their new rules require pension plans to use investment targets based on the yield of high-grade, long-term corporate bonds, currently just over 4 percent. (Source: http://illinoispolicy.org/uploads/files/Pension_debt_more_than_doubles.pdf)

What difference does a more "realistic" forecast make? According to the survey done by Moody's, it makes a difference of more than $3 trillion, or more than double the total actual assets of the 255 largest state-funded pension plans. This is illustrated in the chart below.

Current official reporting suggests that states have funded 73% of their pension liabilities. The fair-market-value approach used by Moody's and GASB suggests that funding is only at 39%. The difference is almost entirely due to the assumptions one uses about the discount rate for future expected returns.

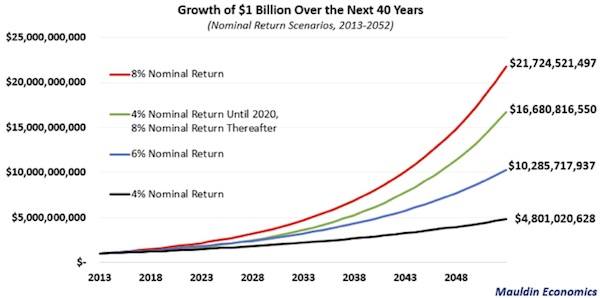

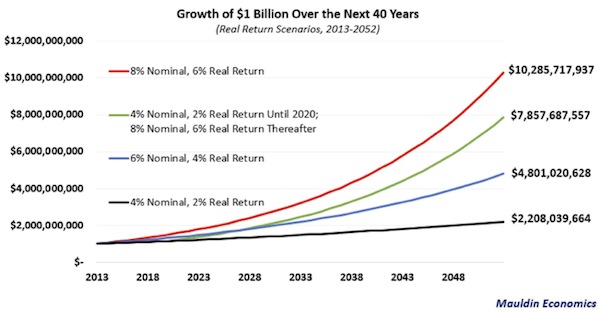

The next two charts provide an illustration. I'm simplifying a bit, but the principles are correct. If you are a pension plan manager, you have to be thinking over very long periods of time. Someone retiring today at age 60 will likely require almost 30 years of pension payments. Someone aged 40 paying into your pension program will likely be getting his or her pension returns 50 years from now. Let's look at a few scenarios of what might happen to $1 billion over the next 40 years under various assumptions of investment returns.

Many state-funded pension plans today assume an 8% nominal return for the indefinite future. Some are beginning to forecast lower returns, but very few would forecast lower than 7%. Moody's argues that somewhere in the range of 4% nominal is more realistic. Notice that the difference after 40 years is well over four times. Even if you assume that magic returns to the markets after 2020 and returns go up to 8% thereafter (the green line in the chart), there is still a gap of $5 billion after 40 years. On assets of $2 trillion, that is a gap of $10 trillion. If you assume only a 4% nominal return for the entire 40 years, the gap is $30 trillion. For the mathematically challenged, that is not a rounding error.

Nominal returns are only part of the story. We live in a world of inflation, and almost all pension funds are inflation-adjusted. The next chart takes the same $1 billion and extrapolates into the future but assumes a modest 2% inflation rate over the 40-year period. The small difference of just 2% annually reduces the real returns by over half. Assumptions can have very wicked children. And grandchildren.

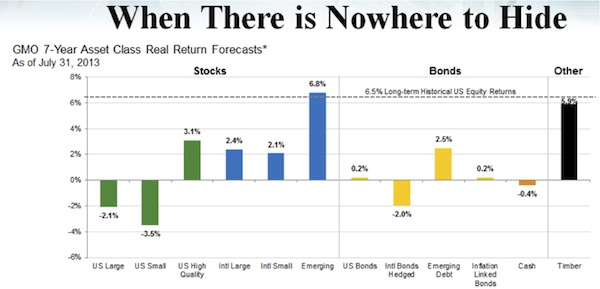

A 4% nominal growth rate, or 2% real growth, sounds so pessimistic, but it is actually in line with what we've experienced over the last 18 years. And you want your assumptions about the future to be as conservative as possible, so that if there are surprises they are pleasant ones. Looking ahead, economic growth does not appear likely to yield pleasant surprises. We use the following chart from Jeremy Grantham at GMO about a month ago, but we need to look at it again in more detail. These are the forecasts that Grantham makes for real (inflation-adjusted) returns over the next seven years:

Notice that if you had a "balanced portfolio," equally distributed among the six equity-asset classes, your total annual real return would be in the 1.5% range. Using the same balanced approach with bonds, your total return would be 0.1%. In the black bar at far right we see Grantham's projected returns for investments in timber, which can be taken as a proxy for "alternative" investments in general. A pension fund investing 55% in equities, 35% in bonds, and 10% in alternatives (not an uncommon pension allocation scheme) would see a total annual real return of around 1.5% real, if Grantham is correct. To bring returns up to even 2% real for the next 10 years, you would have to knock the lights out for the final 3 years of the 10-year time frame.

You may ask, why does Grantham project equity returns to be so small? Can't we assume that over longer periods of time returns will be in the 8%-plus range? Sadly, 8% is an unrealistic number for long-term growth in the equity markets, as Grantham has so ably demonstrated.

The father of value investing, Benjamin Graham, gave us a simple illustration for looking at market valuations. He noted that "In the short run, the market is like a voting machine — tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine — assessing the substance of a company." The message is clear: what matters in the long run is a company's actual underlying business performance and not the investing public's fickle opinion about its prospects in the short run.

(Source: Morningstar)

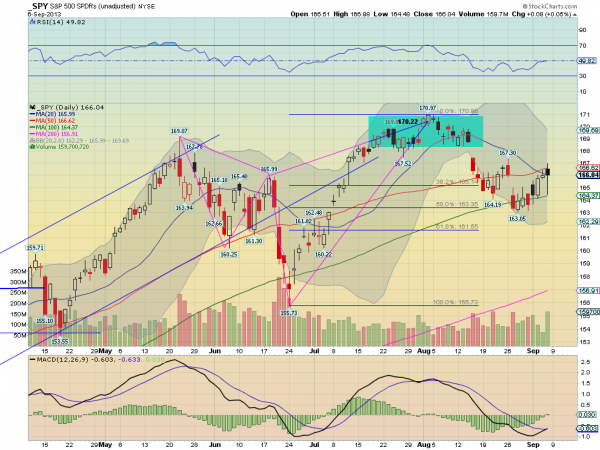

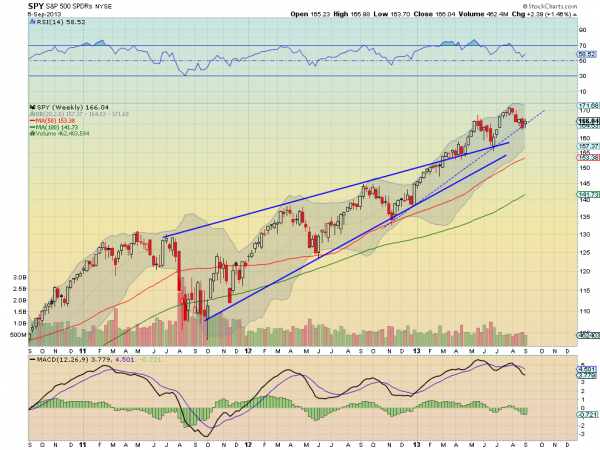

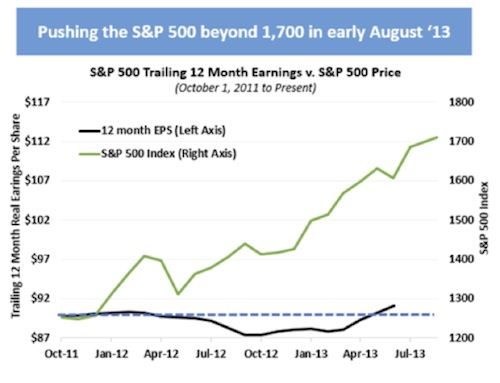

At the end of the day, what the market really weighs is earnings, and that judgment is reflected in the valuation it puts on those earnings. Is $1 worth of earnings worth $8, or $25? Are you expecting a 12% return, or a 4% return? Of course, your answers depend on your view of inflation, what you think of the growth prospects of the company in the economy, and your alternatives for that dollar of investment. The markets can fluctuate a great deal around long-term trends, but they always come back to the average. We've had quite a nice stock market run over the last four years, but let's look at just the last two years, which have theoretically been part of a recovery period. Notice in the chart below that trailing 12-month earnings have been essentially flat, while the market has gone up almost 40%. Almost all of the growth in the stock market has occurred because people were willing to pay a higher multiple for the same dollar's worth of earnings. Valuations are not at nosebleed levels, but they are certainly high; and without something to seriously boost earnings, it is hard to see how the market can justify still higher valuations.

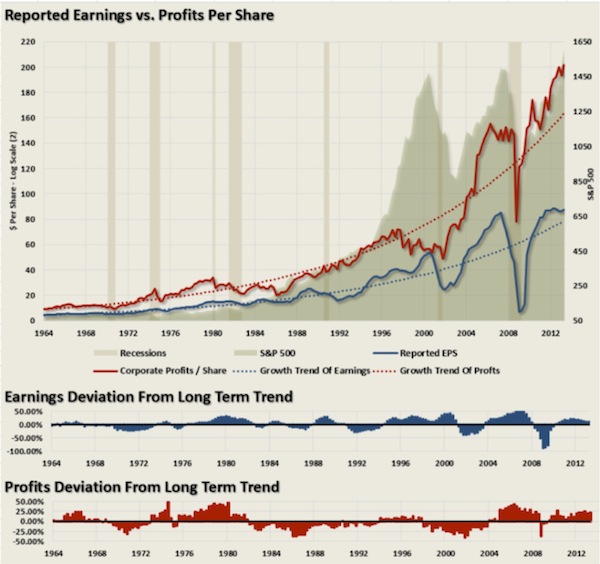

The next chart is from my friend Lance Roberts. Quoting Lance:

As you will notice each time that corporate profits (CP/S) and earnings per share (EPS) were above their respective long-term historical growth trends, the financial markets have run into complications. The bottom two graphs [see below] show the percentage deviations above and below the long-term growth trends.

What is important to understand is that, despite rhetoric to the contrary, "record" earnings or profits are generally fleeting in nature. It is at these divergences from the long-term growth trends where true buying and selling opportunities exist.

Are we currently in another asset "bubble?" The answer is something that we will only know for sure in hindsight. However, from a fundamental standpoint, with valuations and profitability on a per share basis well above long-term trends, it certainly does not suggest that market returns going forward will continue to be as robust as those seen from the recessionary lows.

So what does this academic discussion about future returns have to do with pension funds? It matters because pension funds make assumptions about their future ability to meet their obligation to pay retirees a monthly check based upon their assumptions about returns. In the next few weeks we're going to look at specific states and their assumptions and what that means for their taxpayers in terms of their budgets.

We all know that Illinois is in difficult straits. The state of Illinois has set aside $63 billion to pay for future benefits. But between now and 2045 they're going to have to pay out 10 times that much — $632 billion. By the state pension fund's own estimate, they need another $83 billion to be adequately funded. Just a few years ago their deficit was a mere $50 billion. Compound interest means that the longer you ignore your problem, the faster it gets worse.

Total state revenues for Illinois were $33 billion for fiscal year 2012. Let's see if we can find a politician to propose that they take 25% of the budget every year for the next 10 years to reduce their underfunded pensions (as opposed to the 12% they allot currently). Mayor Emanuel, do you have a plan?

Because the pension plans are so underfunded, they would need to see average investment returns of nearly 19 percent per year to cover future payouts. The state predicts its pension funds will earn investment returns between 7 and 8.5 percent per year. Even these returns may be overly optimistic. Over the last decade, the pension funds have earned average investment returns of only 4.5 to 6 percent per year. The funds' unrealistic investment targets have already increased the state's total pension debt by more than $14.3 billion since 1996. (Source: http://illinoispolicy.org/uploads/files/Pension_debt_more_than_doubles.pdf)

The unfunded liability in Illinois is $22,294 per person. What we will find next week is that there are states that are actually in worse shape than Illinois in that regard. And no, California is not one of them. (Hint: they have Republican governors. Oops. That's not supposed to happen. Especially if the governors are considered to be vice-presidential material. Just saying…)

We will also look at the specifics of Detroit. One of the ugliest reports I've read in the last year is the report of the new "emergency" manager of Detroit, outlining his proposal to take the city out of bankruptcy. It makes for some of the most dismal reading anywhere. But buried in the data is this interesting chart that the Detroit Free Press created. Note that the unfunded healthcare liability is far larger than the pension liability. That provides another avenue for us to look down. In the meantime, you might look and see what your city or state assumes about the returns on its pension funds. Then look at what the difference between that amount and 4% nominal might be and see what the effect would be on your tax rate. I suggest you do that only with an adult beverage close at hand.

We will close with one sentence from the report of the Detroit emergency manager, referring to the ability of the city to pay its obligations to those who have already retired: "Because the amounts realized on the underfunding claims will be substantially less than the underfunding amount, there must be significant cuts in accrued, vested pension amounts for both active and currently retired persons." Sadly, that sentence is likely to be cut and pasted into many similar documents around the country unless changes are made now. If you wait until you are Detroit (or Greece), it is too late.

Chicago, Bismarck, Denver, Etc.

Tonight was the theatrical premiere of the documentary Money for Nothing here in Dallas. I predict this movie will soon be winning awards everywhere. The producer and editor, Jim Bruce, has done a magnificent job of giving us a balanced history of the Federal Reserve, with a perspective on how they manage their responsibilities. The movie will open next week in New York and Washington DC and then begin to open around the country. You can find out more by going to www.moneyfornothingthemovie.org. I may be biased because this is a subject that is near and dear to my heart, but everyone in the theater tonight seemed to conclude that this is one of the best documentaries that has been produced in a long time. Jim Bruce makes his living editing major movies in Hollywood, and his talent shows up in spades in this film. Only about 1% of the interviews they recorded (in terms of time) made it from the camera to the actual film. The craftsmanship of weaving all those interviews, one after another, taking small slices here and there and creating one continuous, compelling narrative, is truly amazing. You simply have to see this film if you get the chance.

I know that a lot of Senate staffers (and even a few senators) read this letter from time to time. You have a very interesting vote coming up in a few weeks after President Obama nominates a new Federal Reserve chairman. I strongly suggest you view this documentary prior to casting your vote or asking your questions (if you're on the committee). That will certainly make for a more lively and entertaining committee meeting. Drop me a note and I will arrange for you to get a copy of the film. (If you're in the White House, you might possibly want to watch just to see what kinds of questions could be coming up for your nominee. Just a thought.)

Monday evening I fly to Chicago for a speech and then on to Bismarck for a presentation for BNC Bank. Before ending up in Bismarck, I will fly to Rapid City, South Dakota, to gaze at Mount Rushmore and put my feet on to South Dakota soil, at which point I can say that I've been to all 50 states. My friend Loren Kopseng will pick me up and fly me up to the Bakken oil fields for another tour of the area. The next week I will be in Denver and the following week in Toronto and New York.

It is quite late and time to hit the send button. I might have lingered too long at my friend David Tice's after-moving party, as the conversation was just so much fun. But great conversation didn't get the letter done, so as usual I am up until I can meet the deadline. But it was worth it. I can always sleep late another day. But not today. I promised some of the kids and my sister I would have brunch with them, and I have to set my alarm clock early enough to be on time. Then, in the evening, my daughter Abbi and her new husband Stephen will be down from Tulsa. We will spend the next day or so catching up and doing family stuff. Have a great week.

Your hoping he can find above-average returns somewhere analyst,