by J. M. Manness

Summary

- Apple will announce the new iPhone 6 on Tuesday, September 9, with an A8 processor.

- The A8 will take the iPhone to new performance levels.

- A more powerful companion processor will probably power a new series of Mac laptop and desktop computers.

Apple (NASDAQ:AAPL) led the smartphone revolution when in 2007 it introduced the iPhone. For several years now, the iconic phones, along with their cousin products the iPads, have been driven by Apple's custom designed A-series processors, which have steadily increased in power. In this post I will show how the latest incarnations from its labs are likely to revolutionize the whole electronics industry and send a longtime leader into crisis.

The iPhone has been a success well beyond the expectations of both Apple and the investment community. It now forms over one half of Apple's revenue, and some expect that the new model, that will be announced Sept. 9, will sell 75 million or more by year's end.

Part of the success of the iPhone is the high quality hardware. Each new model has set performance records as new processor chips increase in power. Apple has done an amazing job of keeping ahead of the pack in performance and this has been done through its intelligent development of its System on a Chip (SoC) processors - the A series. Each year it has surprised techno-geeks with the features of its latest processor. It does this by giving incredible focus on performance, but not on technical performance rather the focus is on overall system performance. The A7, for example, runs a lower frequency than its competitors, it has only 2 cores in the CPU while others have 4, yet it consistently matches or beats the performance of its rivals.

Because Apple develops the whole system, hardware, operating system and many applications, it recognizes that the smartphone is different from a PC and has different system needs. Apple attends precisely to these needs, tuning the processor specifications accordingly.

A7 - the current model

Apple's iPhone 5s shocked the tech world with the introduction of the first smartphone based on a 64-bit processor, the A7. Still based on ARM technology by ARM Holdings (NASDAQ:ARMH), the SoC was announced as putting:

...desktop-class processing power in the palm of people's hands.

[image source: here]

In my article a year ago, I discussed in detail the implications of the A7. I noted that to say it has desktop processing power was a little bit of a stretch, but that it approximated the power of netbooks and approached those of moderate range desktops.

The big question here is not where we are now (or last year), but where we are going.

(The new Samsung (OTC:SSNLF) Galaxy Note phablets announced on Sept. 3, by the way, are currently running the Qualcomm (NASDAQ:QCOM) Snapdragon 805 processor which is still only 32-bit. So a year later, competitors have yet to catch up with Apple's innovation.)

A8 - what's to come

What will the new A8 chip be, and what are the implications? To me the implications are less in the A8 but in the groundbreaking B8 processor that I believe will follow.

Caveat:

- I should note here that I have no direct knowledge of Apple's plans and that what follows is speculation. It is, however, speculation based on viewing the current reality and drawing upon that to make some educated guesses.

- The name B8 is particularly speculative.

In an earlier piece I went into great detail on the A8. It will be built on the 20 nm process which will allow lower power and greater complexity than the 28 nm process used in the A7. This will allow:

- Quad-core CPU

- Much larger GPU

- Lower overall power requirements

Yet any particular detail is not really to the point. Whatever any specification may be, overall the new chip will undoubtedly enable in the new iPhone 6 and iPads:

- even greater overall performance

- increase in screen size and resolution

- a bump to 4k video output for external screens

But I am not after what is happening in the mobile market. What I am after is the implication for the Desktop/Laptop (D/L) market.

The B-8 system processor chip

I believe that Apple is also developing a second version of the A8 designed for the D/L market - here I will call it the B8 (although it might be A8X as the A5X was used for the third generation iPad).

There has been some speculation that Apple might use the A8 chip in its hugely popular MacBook Air laptops. I think it will go a lot further.

But first… Why?

Why a separate chip? The physics of processor chips has a simple rule. For any given chip, as you run it faster you generate more heat, and this heat must be dissipated.

According to Wikipedia:

The thermal design power (TDP), sometimes called thermal design point, refers to the maximum amount of heat generated by the CPU, which the cooling system in a computer is required to dissipate in typical operation. [here]

Additionally, as you run the chip faster, you consume more power, and at some point, this power consumption increases faster than does the processing power. (This is one reason why Intel (NASDAQ:INTC) has gone, over the last several years, to increasing CPU power by increasing cores rather than by increasing speed as it did in earlier generations.)

These are both critical elements for mobile computers (smartphones and tablets) as increased power consumption demands either a larger battery or decreased runtime, and only a certain amount of heat can be dissipated by a small unit.

Thus, Apple has resorted to custom designs in its processors to increase performance even though they run at slower, battery saving speeds than do those of competitors.

Incursion into D/L market

As noted above - these two issues with processor speed versus power consumption is critical to smartphones. It is, however, less critical to laptops and even less so to desktops. Laptops have larger batteries for power and larger area for heat dissipation. Desktops have no power issue as they plug into the grid.

Therefore, Apple could realistically pump up the power to their chips significantly. Samsung's new Galaxy Note 4 runs the Snapdragon 805 processor at 2.7 GHz while the A7 in the iPhone 5s is throttled to just 1.3 GHz. There is no reason that Apple could not run the A7 faster - if they were willing to pay the power consumption/heat generation price. To them these would be affordable in D/L applications.

So, I see the new B8 processor as being a higher speed version of the A8, but it will also include more graphics processor cores. (See this explanation of computer and graphics processors, and how they work.)

This would truly bring the processor up to the promise of "desktop-class processing power." It could bring the B8 up to the performance of a Core i5 - if not the current version, then that of a one or two year old model.

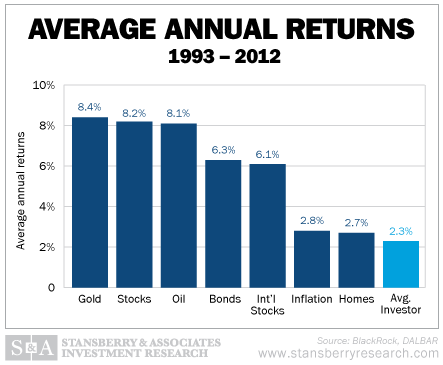

Price driven

The simple reason for all this, is price. The Intel Core i5-4260U in the latest low-end MacBook Air lists for $315 in quantity. I am sure that Apple pays a lot less than that, but even if it pays only $200, that is still roughly ten times the estimated under $20 cost of the A-series chips. With 50% gross margins (less than for the iPhone) saving $180 would cut $360 from the price of a MacBook Air, and provide similar performance. So the entry point for the Airs would be around $549. These would storm the laptop market, yet maintain high margins.

But that is just the beginning

Let's look at the Mac Mini, current entry price $600. If Apple can build the Apple TV and sell it for $99, I don't see why it can't build an A8 based Mac to sell for $400, and still maintain an enviable margin. It would essentially be an iPhone with extra ports and heftier power block, but with no display or battery or radio chip.

(click to enlarge)

[Mac mini - Apple site]

This would be a direct attack on the Microsoft (NASDAQ:MSFT) empire. Windows PCs have achieved domination on several factors, but a major one has always been initial cost. "Macs are too expensive" was the rally cry of IT pros steeped in the MS culture. With a $400 Mac, this could no longer be claimed.

I call this new desktop computer the bMac - it is aimed at the business sector. It would be more powerful than many current low-end computers, clearly sufficient for the majority of office tasks.

Implications

Currently Mac laptops and the iMacs have healthy shares in their market segments, and command a lion's share of profits, but still represent a very small proportion of PC sales. Global PC shipments will likely be over 300 million units in 2015. In the last 4 quarters, Apple sold just shy of 18 million Macs, roughly 6%.

With new low-end models, Apple might easily double that to 35 - 40 million units, or 12% - 15% share. With an increment of 20 million units priced on average of $550 (half Airs and half bMacs) this would generate $11 billion in new revenue. Granted, this would be somewhat offset by lower revenue from lower prices of existing sales (i.e. the existing Airs that now would be sold at lower prices). Still, we might see a total increase of perhaps as much as $10 billion in revenue and more than $2 billion in earnings. This does not even account for related sales such as cables, cases for laptops, monitors for bMacs, etc.

More importantly, the increased D/L sales would increase the market penetration of Apple's ecosystem and foster growth and acceptance of its whole line of products.

Announcement

On September 9, Apple will hold an event presumably to announce new iPhones and some other products. Along with the iPhone there will inevitably be an announcement of the A8 processor along with some rudimentary specs.

Given that the location for the event has been moved form the usual Yerba Buena Center to the more spacious Flint Center for the Performing Arts, and they appear to be building a huge temporary structure outside, it seems certain that this will be a particularly important announcement - probably including the long awaited iWatch or some other secret project.

My guess is that it will be focusing on consumer products here, and that the B8 and bMacs announcements will wait until the new year. However, it is possible that these will actually be the surprise products, and the iWatch will have to wait.

In any case, to my mind the bMac, whatever its name may be, is an inevitable product that will reshape the PC industry.

In a future article I will discuss what this reshaping will do.

What are your thoughts?

Editor's Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks.

See the original article >>