Jeff Clark,

BIG GOLD writes: You’ve probably heard the term “smart money” used by various pundits, a reference to those investors and institutions that are consistently better at making money than the uninformed masses. Which begs the question: are you one of them?

To answer that query, let’s first describe smart money (not to be confused with the magazine by that name) so we have an idea of what makes this group of investors successful…

Smart money buys when others are fearful. A good example of this is last year’s Gulf oil disaster. Wild speculation of British Petroleum’s ultimate demise caused panicked bouts of selling. The stock lost roughly half its value in less than two months. To use a classic idiom, there was blood in the streets – and that, of course, was the time to buy. The investor who did so is currently up 50%, and that’s not even measuring from the stock’s absolute bottom.

Smart money sells when others are greedy. My colleague Doug Hornig is a perfect example of selling when others are greedy. In the Nasdaq hysteria of the late 1990s, Doug had accumulated a number of Internet stocks and watched his brokerage account swell to a level he’d never seen before. The greed around him was palpable; everyone was talking about the latest stock pick, the classic sign of a mania in full bloom. “But I’d had enough,” he told me. “My positions had logged spectacular gains, and bottom line, I knew this couldn’t go on forever.” He sold his Internet stocks prior to the 2000 top, just as the greed reached a pinnacle.

Smart money sees trends others don’t. Doug Casey urged readers in 1999 to buy gold, convinced from his own research and study that a bull market was about to get underway. But he couldn’t get an audience; no one wanted to talk about the metal or mining stocks. It goes without saying that he and many of his readers have since profited enormously, with many stocks earning doubles on top of doubles.

Smart money ignores the headlines. Beyond the traditional advice of “Buy the rumor/sell the fact,” smart money largely ignores the blather from mainstream media and instead focuses on the factors that ultimately drive headlines. When it reaches mainstream coverage, the smart money is already invested. And is looking at what will be tomorrow’s headlines.

Smart money plays the big trend, not the gyrations. What do Jim Rogers, Marc Faber, Rick Rule, Doug Casey, and Warren Buffett have in common? None of them “traded” their way to riches. They identified the fundamental factors driving the trend, bought big, and held on. No technical analysis, no trend lines on a chart, no fancy signals from moving averages. And they didn’t get scared out at the first drop in price.

Smart money doesn’t count its money before it’s made. These investors understand there are no sure things, and further, that no one is going to bail them out if their analysis turns out to be wrong. They keep a realistic expectation – and an eye – on their investments. And if they take a loss, they learn from it and refuse to let it keep them from investing again.

And the one that’s becoming increasingly critical to businesses and investors…

Smart money ignores official government reports and relies on its own research. There are copious examples of government reporting that is patently off base. The best current example is the Department of Labor’s CPI number. It claims that core inflation is a mere 1.1%. When looking at all your expenses over the past year, have they risen just 1.1% since last spring?

Here’s what real inflation looks like compared to what the U.S. government reports.

Costs in every major area of our lives have risen greater than what the government states in its core figure. The smart money ignores the official report and instead focuses on its own research and data.

With that description of smart money, the next logical question to ask is, what are they looking at now?

To answer that question, understand the time horizon they have in mind. They’re not looking at next week or next month like a trader would, nor so far out that it will take the rest of their life to realize a profit. The smart money is looking at the likely trends over the next few years.

Therefore, I think they’re asking themselves questions like these:

- Is real inflation likely to rise or fall over the next few years?

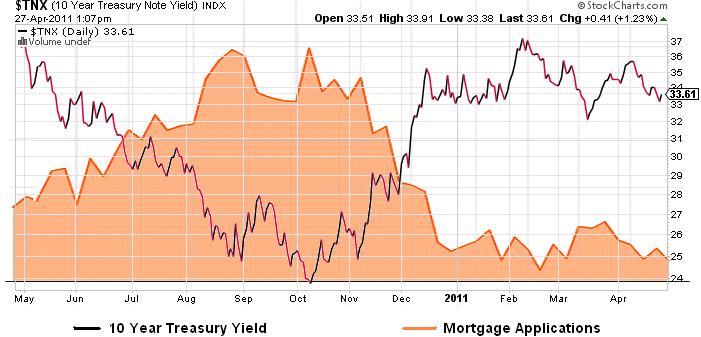

- Is it more probable that interest rates will remain depressed or move higher?

- Is the U.S. dollar likely to be stronger or weaker in the next few years?

- What is the best way to hedge against egregious debt and runaway government spending?

- Which assets are most likely to make money over the next few years? Which should be avoided?

- Is it time to invest in real estate again, or will it take the rest of my life to see big profits?

- Will the global economy be on solid footing during the next few years?

- Is oil – or something else – the best energy investment?

- Are gold and silver in a bubble, or will they push higher in the coming years?

The answers to those questions will dictate how the smart money invests for the next few years.

When it specifically comes to gold and silver, they ignore the bubble talk and instead focus on facts and trends. While they acknowledge that precious metals have risen tremendously over the past decade, they’re analyzing the factors that will either continue to drive prices higher or take them lower. So they’re looking at supply and demand trends; fiat currencies and if they’re likely to be further diluted; the logical outcome of too much debt and too much deficit spending; the direction of inflation; gold’s role as a store of value and if there are reasons for it to remain; and just as important, how the greater masses are likely to react to all this.

Once you address those topics, you can determine if we’re in a true gold bubble. And your answer to those questions will determine the action you should take at the next correction.

How does Doug Casey answer the question as to whether we’re in a gold bubble? Here’s what he told me:

“The peak is not going to be here until you hear the money-honeys talking about gold on television and all your friends are talking about the latest silver stock. Don’t worry about charts. Don’t worry about statistics, lines on charts, supply and demand figures, or any of that. The best indication of where the market is at any moment isn’t mathematics. It’s psychology. Watch the public’s psychology.”

While new investors are beginning to enter our sector, the psychology of the gold market is not like the crazed hysteria with the Internet stocks in late 1999. Yes, gold is not cheap, but if we were in a bubble, those shouting “Bubble!” would be buying gold, not bashing it. By Doug’s definition, it’s when their psychology has turned from negative to giddy that will mark the top.

If your own research tells you this isn’t a true bubble in precious metals, then you might embrace the next correction instead of fearing it.

What is the smart money doing with bets on interest rates, energy, commodities, and real estate? And what do they think about the economy and the likelihood of another recession? Is a global currency war about to erupt? And with the anticipated change in the Fed’s quantitative easing policy, how big and long of a correction do they see coming with gold and silver?