By Guest Author

Balancing Global Imbalances

In some respects, the global economy is in a more precarious position than it was in early 2009. Two years ago, governments around the world were still capable of unleashing trillions of dollars in fiscal stimulus. Central banks were able to slash interest rates, and in the case of the European Central Bank and Federal Reserve, force feed additional trillions of dollars of liquidity into their respective banking systems. The initial goal was to stabilize the global financial system, and subsequently engineer a self sustaining economic recovery in each of their country’s economy.

The results have been uneven. In the United States, GDP growth has been roughly half the average of post World War II recoveries, so the question of whether a self sustaining recovery has taken hold is debatable. Although Germany and France have fared relatively well, the same cannot be said for Greece and Ireland, whose economies are still contracting. Spain, Portugal, and Italy are barely growing, with Spain sporting an unemployment rate of 21%. In order to right its fiscal house, Britain has adopted a stiff austerity program that proposes to cut government spending by more than 20%. In the short run, the decline in government spending will weigh on growth. Japan will rebound from the earthquake/tsunami plunge in GDP, but the rebound will fade into the moribund growth that has plagued the Japanese economy for two decades. On the flip side are China, Brazil, and India, where the combination of fiscal and monetary stimulus succeeded too well, and has led to a bout of real inflation.

The United States, European Union, Japan, and Great Britain account for 62% of global GDP. To varying degrees, these developed economies share a number of common traits that will retard growth for the foreseeable future. Demographically, they have aging populations, which will increasingly stress the social safety nets in each country. Most have a relatively to high debt to GDP ratio, that will slow economic growth in coming years. Slower growth means weaker income growth, so interest payments on their debt will absorb a greater share of total income and leave less for spending and saving. Not the best prescription for long term economic growth.

China, Brazil, and India comprise 15% of world GDP. While each of these countries will continue to enjoy above average growth relative to the developed economies, they are now confronting rising inflation with tighter monetary policy. This will surely lead to a slowdown in their economies in the second half of 2011. Since monetary policy is conducted by looking in the rear view mirror of economic statistics, there is the risk that each central bank may tighten a bit too much, resulting in a deeper slowdown than desired.

Balance is a state in which an object or opposing forces remain steady, while resting on a base that is narrow relative to its other dimensions. Visualize an upside down pyramid, whose tip is balanced on a narrow beam. The object is debt, and the narrow beam is global GDP growth. Given the uncertainty and challenges facing the global economy, the narrow beam may be suspended over an abyss. The pyramid will tip, if global growth isn’t strong enough to support the debt burdens of the developed counties, or if tighter monetary policy slows China, Brazil, or India’s economy too much. If another tipping point is reached, it could prove more devastating than the financial crisis of 2008, since the fiscal and monetary wells are dry. The odds are not comforting, since policy makers in the U.S. and Europe are still operating with the same playbook that got us into this mess in the first place. The banks that were too big to fail in 2008 are even larger today, and the opacity of derivatives remains impenetrable. The business cycle will never be repealed by spendthrift politicians or accommodating central bankers.

The U.S.

Between 1985 and 2008, household debt as a percent of disposable personal income more than doubled, rising from 62% to 135%. At the end of 2010, the ratio was 120%, still well above the 89% it averaged in the 1990’s. The average household would need to cut $26,172 of debt to get back to 1990’s levels. More than half of the $500 billion decline in household debt since 2008 has been the result of defaults on mortgages, credit cards, and auto loans. This ‘improvement’ has come at the expense of lenders, rather than from consumers paying off debt from income gains. It would have been far healthier if the ratio was declining due to solid gains in disposable income.

Unfortunately, just the opposite has occurred. According to the Commerce Department, real private sector wages have increased just 4.2% over the last decade. The last 10 years have been the weakest period by far since 1940. For most of the past 35 years, the 10 year gain in real wages has averaged more than 25%. This is the first recovery since World War II that there has been no gain in wages and salaries during the seven quarters after a recessions end.

According to the Federal Reserve, homeowners took out a total of $2.69 trillion of equity in their homes between 2004 and 2006. Coupled with the weak growth in incomes since 2001, this extraction of home equity is the primary reason why household debt as a percent of disposable income soared between 2002 and 2007. As consumers spent most of the $2.69 trillion of equity they pulled out of their homes, GDP growth was stronger in those years than it otherwise would have been. Going forward, the debt induced growth in GDP during the housing bubble years will not only be missing, but now consumers have to service and pay down that debt, which will prove an additional drag on their spending and GDP growth.

Over the last year, average weekly wages have increased 2.4%. However, the overall consumer price index has risen 3.6%, so real after inflation wages actually dropped -1.2%. In order for the ratio of household debt to disposable income to decline from its current level of 120% to the 89% it averaged in the 1990’s, disposable income must grow by 33%, debt levels must be reduced by 25%, or a combination of both must take place. Given the sorry state of income growth during the last decade and past year, this imbalance is going to take many years to correct. Once debt has been pared, the next long term economic expansion that can last for a decade or longer will take hold. Of course, an increase in defaults would speed up the process, but at the expense of more impairment to bank balance sheets. That would likely force the banks to be even more careful and tight fisted with their lending, and potentially require the banks to beef up their capital.

In May, only 54,000 private sector jobs were added, and the unemployment rate ticked up to 9.1%. Every month we have highlighted how weak job creation has been in this recovery, when compared to every other post World War II recovery. Half of the private sector workers in the United States are employed by small businesses, and more than 60% of all new jobs are created by small businesses. For the first time since last September, more small businesses planned to shrink their work force than increase it. This suggests job growth will remain muted in coming months. However, the meager gain in jobs during May likely overstated how weak the labor market really is, just as the three prior months, which averaged more than 200,000 new jobs, overstated its strength. Our guess is that job growth will bounce back to over 120,000 in coming months. This should provide some comfort to those worried about an immediate double dip in the economy.

According to the Case-Shiller Home Price Index, home prices are off 31.6% from the 2006 peak, and down 3.5% from a year ago. In 2006, home owner equity was 57% of the median homes value. It is now down to 38%, as of March 31. In April, 37% of all sales were distressed sales, according to the National Association of Realtors. Zillow.com estimated that at the end of the first quarter, 28.4% of home owners with mortgages were underwater. Future demand will be far weaker, with so many homeowners effectively trapped in their home. Although housing activity will pick up during the summer, we continue to expect home prices to fall further in most areas of the country.

Home-equity loans account for 10% of the mortgage market. According to CoreLogic, 38% of homeowners, who withdrew home equity via a home-equity loan, are underwater. CoreLogic also found that borrowers with a home-equity loan averaged $83,000 of negative equity, versus $52,000 for those with no second mortgage. According to the Federal Reserve, nearly 75% of the $950 billion in home equity loans were held by commercial banks. More than 40% of the total is held by Wells Fargo, Bank of America, JP Morgan, and Chase. If home prices fall as we expect, one or more of these banks will eventually be forced to increase their loan loss reserves.

According to LPS Applied Analytics, 4.2 million homeowners are either seriously delinquent, or in the foreclosure pipeline. Incredibly, two-thirds have made no payments for at least a year, and 30% have gone for more than two years. As these 4.2 million homes are dumped on the market during the next two years, home prices are likely to weaken further, which will increase the number of existing homeowners that are underwater going forward. This is a vicious cycle that will take another one to two years to work through.

We continue to believe economic growth will not rebound as smartly in the second half, as the majority of economists and strategists are forecasting. Yes, Japan will bounce back, but there are far greater forces at work, and imbalances that must be addressed which will keep growth near 2.0%, and well below the historical average well into 2012.

Europe

In the 1972 movie “The Godfather”, Don Corleone tells his godson that he will get a part in a movie his godson wants to act in, even though he has already been rejected for the part by the head of the studio. When asked by the godson how Don Corleone can be so sure, the Don tells him “I’m gonna make him an offer he can’t refuse.” In the tragicomedy the Greek debt crisis has become, this famous line seems appropriate. The rating agencies have determined that any extension of maturities of Greek debt or involuntary rollover of current holdings of Greek debt would constitute a default. In recent days, discussions have suggested that current debt holders would be able to roll existing Greek debt as it matures on a ‘voluntary’ basis. With existing Greek debt selling at a very deep discount (10 year yields are above 18% and 2 year yields above 28%), no institution would roll over a bond at par, when it could be purchased in the open market for $.50 on the dollar. But these are desperate times and everyone involved wants Greece to receive more funding in a manner that avoids triggering a default now, even though everyone knows Greece will never repay the loans they have already received. Our suspicion is that behind closed doors current holders of Greek debt will be made an offer they can’t refuse. We doubt the financial markets will be so willing.

As we have noted previously, Greece is merely the tip of the debt iceberg the European banking system is on course to collide with, irrespective of any last ditch maneuverings. The fundamental problem is that Greece, Ireland, Portugal and Spain have too much debt, and too little economic growth to service their debt loads. Germany and France have $541 billion of exposure to these weak countries. We continue to believe it is merely a question of when Greece defaults, not if. And when that happens, banks in Portugal and Spain will be severely impacted. According to the Bank of International Settlements, French banks own $57 billion of Greek debt. On June 15, Moody’s warned it may downgrade three French banks, due to their exposure to Greece. In an example of how interconnected the global financial system is, Fitch ratings reported that as of May, almost 50% of the assets in the ten largest prime money market funds were invested in short-term loans to European banks. Fitch noted these funds have sold much of their holdings of Spanish, Portuguese, and Irish debt, and have never held Greek bank debt. In another example of how interconnected the global financial system is today, U.S. banks and insurance companies have issued default insurance on Greece, Ireland, and Portugal debt through credit default swaps purchased by German and French institutions. The French and German institutions will receive payments from the U.S. banks and insurance companies issuing the credit default swaps, for the amount of the insurance coverage upon a default by Greece. Even though U.S. institutions hold only 5% of Greek debt, their exposure to a Greek default will likely be larger than their actual holdings of Greek debt, since they will have to pay for the amount of debt they insured to the German and French institutions. Since credit default swaps are not traded on an exchange or through a clearing house, no one knows precisely the total value of credit default swaps on Greek debt, and more importantly, the exposure for U.S. banks and insurance companies. And, if one of these institutions just happens to be too big to fail, the exposure for the American taxpayer.

One of the contributing factors that fed the financial crisis in 2008 is that no institution will blindly trust every counter party, as long as no one knows what each institution’s exposure really is with certainty. When Greece defaults, confidence and trust will plunge right along with the value of Greek bonds, and it will spread globally within 24 hours, even though a Greek debt default is widely expected. It will be the uncertainty created by the default that will cause liquidity to dry up. Sadly, this lesson from the 2008 crisis has not been addressed, so the murky world of derivatives remains a financial black hole.

What cannot be overlooked is the social displacement and resulting anger the necessary austerity programs will continue to have within many countries. We have seen the riots in Greece, which are likely to become larger and more violent as Greece makes further budget cuts. With unemployment over 20%, the problem of unemployment for those under 25 is an epidemic within the European Union. Millions of young people out of work and losing faith in the current political system and hope for the future are a combustible mix for revolution. Historically, it is rare for revolutions to start at the top of any society, since the ‘establishment’ is more interested in maintaining the status quo. In Spain, the unemployment rate for those with a college degree is over 30%, and without a college degree exceeds 40%. On June 30, hundreds of thousands of British public sector workers are set to strike over jobs, pensions and pay cuts. Britain has instituted a four year plan that is expected to lead the elimination of 300,000 public sector jobs. The imbalances that are now being addressed throughout Europe took decades to build up. What must be appreciated is that we are only at the beginning of this process, which will last several more years. Sooner or later, the anger and frustration will reach a boiling point. Greece or Ireland will choose to leave the European Union, while other governments topple.

BRAZIL, CHINA, & INDIA

Two weeks ago, the Reserve Bank of Brazil increased it’s Selicrate to 12.25%, the highest rate in the world. Inflation continues to edge higher, 6.5% in May, and up more than 1% from last year. More importantly, food staples such as beans and rice have almost doubled in the last three years, far out pacing the increase in the average worker’s pay. The unemployment rate is 6.5%, about half the level it averaged between 2000 and 2004, so the unemployment plague affecting many developed countries is not as issue. GDP growth is expected to slow to 3.5%, about half of last year’s growth.

The Brazilian National Development Bank was established in 1952 to support the large infrastructure projects needed to lift Brazil into the developed world. Up until recent years, annual lending was less than $10 billion. Since 2005, lending has exploded, rising from $20 billion to $98 billion last year, which amounts to 5% of Brazil’s annual GDP. This surge in lending certainly works against the tightening of monetary policy by Brazil’s central. To say that lending by the Development Bank is politically driven would be an understatement. Comforting to know that politicians are pretty much the same anywhere.

On June 13, China reported that its consumer price index rose 5.5% in May from a year ago. It’s the largest increase in inflation since July 2008, just before the financial crisis broke in September causing a collapse in oil and commodities in general. On June 15, the Peoples Bank of China increased the bank reserve rate to 21.5%, the sixth increase this year, and eleventh since January 2010. The Chinese government has also attempted to curb real estate speculation by boosting down payment requirements from 40% to 60% for second homes. In 2006, the average apartment in Beijing sold for $100,000, the equivalent of 32 years of the average workers’ disposable income. Average annual wages have increased since 2006 to near $4,000, but the average apartment now sells for $250,000, or 57 years of income. Government policies and high prices have caused property prices in nine major Chinese cities to fall -4.36% since last year. It’s the first decline since the height of the crisis in late 2008 and early 2009, after a large run up in prices.

At the behest of the Chinese government, the state run banks in China lent $3 trillion to stimulate growth and create jobs. This is an extraordinary amount of lending and represents almost 60% of China’s annual GDP. With so much money being thrown around, it’s no surprise that real estate speculation was rampant, and investment in new cities, mass transit, and export production capacity soared. We believe excess capacity problems will emerge, as global growth slows, particularly in developed nations. With average annual income of just $4,000, China does not have a broad middle class to absorb the excess capacity that could develop, if exports to Europe, Japan, and the U.S. slow. Over the next couple of years, as much as 25% of the lending done in 2009 and 2010 could prove problematic and non-recoverable. Much like their U.S. counterparts, the Chinese government will allow the state run banks to ignore the problem. As we are learning almost daily, big financial problems only become bigger when they are ignored.

In India, the producer price index climbed to 9.06% in May from a year ago. On June 16, the Reserve Bank of India increased its repo rate to 7.5%, the tenth increase since March 2010. Tighter monetary policy is beginning to have an impact on India’s economy. In May, car sales slowed to the lowest rate in two years, according to the Society of Automobile Manufacturers. As in other developing countries, food inflation is particularly painful, since food often consumes 40% to 60% of the average workers’ income. India’s food distribution is also a problem, as almost 40% of India’s farm output rots before it reaches a local market.

As we have forecast, Brazil, China, and India are all showing signs of slowing in response to tighter monetary policy and higher interest rates. The slowdown in each of these countries will become more obvious and pronounced in the second half of 2011.

Bonds

We continue to believe that the yield on the 10-year Treasury bond will remain range bound between 2.6% and 3.65%. With the yield currently resting near 3.0%, it is in the middle of the range.

If the economy grows as slowly as we expect in the second half, and the risk of a European debt crisis remains visible on the horizon, there is no compelling reason to sell Treasury bonds. In addition, there is a possibility that Congress may make meaningful progress on paring the multi-trillion dollar deficit forecast for the next 10 years. We were heartened that AARP last week softened its stance on Social Security, and will at least be open to modest changes. In the past, they have been steadfast in their opposition to any changes in benefits or increase in the retirement age. If we are to make any serious headway on true deficit reduction, this is the type of compromise all parties involved must make, including tax increases. Dogmatic adherence to ideology has played a significant role in the lack of progress on most of the important issues facing America for far too long. In the past, most threats to our country came from forces outside our borders, so it was far easier to rally public support. We created the current fiscal crisis ourselves. The solutions will require sacrifices by the majority of Americans, with some bearing more of the brunt than others. That won’t be ‘fair’, and for some, it will be a divisive issue. WE must overcome every issue that divides US.

Dollar

There are a number of reasons why the dollar has either made a significant low, or will soon. Sentiment towards the Dollar remains uniformly negative, which has resulted in a huge short position against the Dollar. The brewing sovereign debt crisis in Europe will eventually make the dollar look like the least ugly girl at the dance. If real progress is made on deficit reduction, it will surprise almost everyone (including us). It will also help to make the U.S. look like less of a basket case, when compared to Europe, and certainly Japan. Any spark that results in Dollar buying will ignite a sharp short covering rally. Technically, the Dollar appears to be ‘turning the corner’, as downside momentum wanes. Last month we recommended buying the Dollar ETF UUP at $21.56. Hold the position.

Gold

Strangely, it would be more bearish for gold to make a new high above $1,578.00, than if it declined from current levels. Here’s why. A new high in Gold would not be confirmed by a new high in silver, and the gold stocks. Gold is less than 2% from a new high, but silver is more than 25% below its prior peak, and the gold stocks, as measured by HUI and the XAU, are 14.4% and 13.9% off their respective peaks. It appears that Gold may be finishing a diagonal fifth wave, if it pushes to a new high. Aggressive traders can establish a small short position at $1,550, and add if gold climbs to $1,587.00. If Gold does make a new high, we may send out a special update.

Stocks

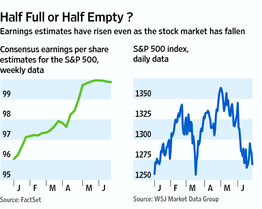

In our June 12 Special Update, we suggested that the S&P was within 1% to 2% of a trading low. We noted that various measures of sentiment had very quickly shifted from extreme optimism in early April, to a far more cautious attitude toward the market. The market was also fairly oversold, and the S&P was just above the 200 day simple and exponential moving averages. Since the close of 1270.98 on June 10, the S&P has traded down to 1258.07, and up to 1298.61. We expect the choppy trading will continue for awhile. The market sold off today, after the Federal Reserve lowered its estimate for 2011 GDP growth to 2.7% – 2.9% from April’s estimate of 3.1% – 3.3%. We have been expecting the economy to slow, so this change was not a surprise. However, most economists have forecast that the economy will rebound in the second half, so the Fed’s downgrade was a dampener.

We think the odds favor another run in the market to above the April high at 1,370. For this to happen, these are the fundamental factors that must fall into place. Greece must receive additional funding in a way that does not trigger a default, according to the rating agencies. All bets are off, if Greece is deemed in default. It is unlikely Greece will ever be able to repay the loans it has already received, and providing Greece with more money is simply throwing good money after bad. But, human nature being what it is, (as best exemplified by politicians), Greece will get more funding. Hoping everything will work out is easier than dealing with another crisis in the short run. It would also be helpful if the June employment report shows that more than 120,000 jobs were created, when it is announced on July 1. (The jobs report is normally announced on the first Friday of the month.) This would allay fears that a double dip is right around the corner.

In the June 12 Update, we recommended taking a half position in the S&P 500 ETF SPY, which opened at $127.89 on June 13. For now, keep the stop at 1,230 on the S&P, which should translate to roughly $123.00 on SPY. We will send out a Special Update when it’s time to add to this position. The market conveniently bounced off the S&P’s 200 day averages, maybe too conveniently. A quick sharp drop below these averages may be necessary, before a sustainable advance takes hold.

See the original article >>