by Tyler Durden

If stock markets really do their best to discount earnings six months ahead of time, then it’s beginning to look a lot like Christmas. ConvergEx's Nick Colas' monthly review of analysts’ revenue expectation for the Dow 30 companies finds that hopes for growth in the second half of 2013 continues to diminish. The upcoming Q2 2013 results won’t be much to write home about either, with average top line growth versus last year of just 1.1% and (0.7% ex-financials), the lowest comps analysts have put in their models since they started posting expectations last year.

Back half expected sales growth is down to an average of 3.0 – 3.2%, where these estimates were over 5% just three months ago. If you are hoping for 3-4% revenue growth – the kind that allows profit margins to expand – you’ll have to wait until 2014, at least according to Wall Street analysts.

Via ConvergEx's Nick Colas,

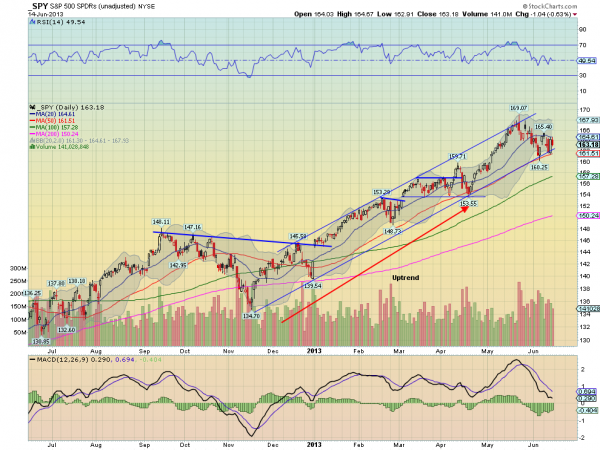

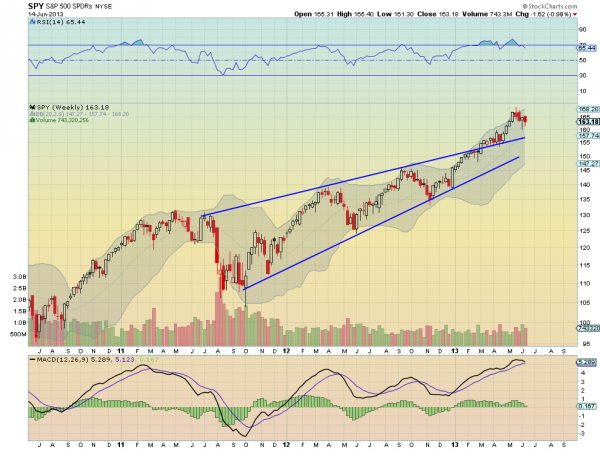

Stock market wisdom says that equity prices discount the economic conditions and profit outlook for public companies 6 months in the future. If investors think corporate profits will peak in two quarters, for example, stocks should decline today. And if the Street’s outlook for earnings in the two-quarter near future become more optimistic, then they should rally. As with any investment guideline – whether it rhymes or not – its actual track record is spotty. Consider the last few major turns in U.S. stocks:

- The now-famous March 2009 intraday low of 666 occurred well after corporate earnings had turned higher. Quarterly earnings for the S&P 500 actually bottomed in Q4 2008 at essentially zero and were already on their way to $10/share for Q1 2009.

- Less tumultuous periods in market history follow the 6-month rule more closely. The March 2000 highs for stocks did a good job of forecasting the fact that Q2 2000 was the peak for quarterly S&P 500 earnings at $14.88. Two quarters later and earnings were running $13, and then $10.73/quarter for Q1 2001. Going back to the turn higher in the early 1990s, market lows around the August 1990 Iraqi invasion of Kuwait accurately reflected that earnings would trough early 1991 (at an average of $4.78/quarter) and head higher after that.

- As of today, S&P is printing expectations for uninterrupted earnings growth over the balance of 2013 and into 2014. The numbers are pretty impressive - $110 for S&P earnings this year, and $123/share for next year. That put stocks at 14.8x earnings for this year, and 13.2x for next year. If you want to jam the bull case for stocks into the smallest possible container, this is it. Stocks valuations are reasonable – if not cheap – by historical standards.

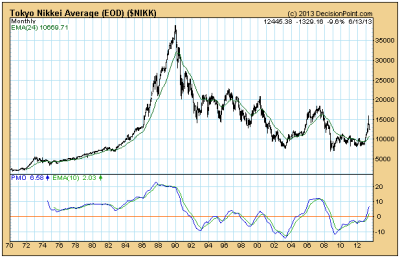

So then what’s up with all the market volatility of late? I lost my “VIX below 18.5” bet with our option desk yesterday, but I don’t really know who to blame (aside from the guy in the mirror). Should I send Ben Bernanke a “WTF?” tweet over the market chatter about the Fed ‘Tapering’ the QE bond buying program? I heard that the Bank of Japan was running out of arrows to fight 20 years of deflation economic stagnation, but Amazon has them listed at 3/$11, shipping included if you are a Prime customer. So that can’t be it… And I have no idea who to blame in Europe. Maybe everybody.

No – if we follow the logic about “Six months ahead” then the market is clearly wondering about how the world will look on December 13. Hanukkah comes early this year – November 27 kicks off the Festival of Lights – so that can’t be it. Allowing for a 2 week fudge factor, you get Christmas. Well, technically you’d be in the heart of Kwanzaa – which goes from December 26 to January 1st - or Boxing Day in the UK. But we’ll go with Christmas out of expediency.

One of the best ways to get a read on Wall Street earnings expectations is to start at the top of the income statement, with trends in revenue forecasts. We do this every month for the 30 companies of the Dow Jones Industrial Average, and the results of that analysis in several tables and charts immediately following this note. The data comes directly from the consensus expectations for quarterly and annual revenue growth between the upcoming Q2 2013 and the end of 2014.

The upshot of the analysis is that analysts are growing more concerned about revenue growth for the remainder of 2013. A few points here:

- Just two months ago, back in April, analysts were forecasting 3.5% sales growth for the Dow companies. Now that number is down to 1.1% year on year growth. Exclude the financials, and the expected Q2 revenue growth rate drops to 0.7%. Now, keep in mind that revenue growth was essentially unchanged in Q1 2013. It looks very much like Q2 hasn’t accelerated from that pace.

- Analysts are clearly also concerned about the pace of revenue growth for the back half of 2013. Back in April they were showing clients financial models which anticipated 5% sales growth for Q3, and 4.5% for Q4. Those numbers are now 3.2% and 3.0%, respectively. Excluding the financial companies of the Dow, revenue growth is now expected to be 3.3% in Q3 2013 and 2.8% in Q4 2013.

- If you want to see the type of revenue growth that more typically generates earnings growth, you’ll have to wait until 2014, at least according to the Wall Street analysts who cover the Dow companies we’re talking about here. Only then will you see the average 4% type of revenue expansion which drives meaningful upside earnings surprises.

Analysts are clearly worried about the trends for revenues and – eventually – profits as we move through the year. Yes, corporations have does great work at generating record profits on the back of far-less-than record economic data. But for all the chatter about a second half expansion of economic activity, analysts clearly are not hearing that kind of macro optimism from either their companies or their own field checks and due diligence. Next year still looks good, but that is a long way off.

The bottom line is that this data provides a less-discussed reason for all the recent stock market volatility. It is actually a pretty straightforward story – as expectations catch up with a still-soft economic reality, are all those lofty earnings expectations really defensible. We’ll have to wait and hear what companies have to say in a few weeks, of course. But the headwinds are clear, and they seem to be strengthening.