By John Mauldin

The Flat Earth (Employment) Society

Let’s Do a Little Time Travel

The

Implications of an Older Workforce

How Do We “Fix” the Employment

Problem?

Some Thoughts on Gold

Europe, New York, Conferences, Etc.

This week we briefly look at yesterday morning’s dismal unemployment report,

then drop back and survey some other very eye-opening data on employment. Some

groups are (surprise) doing better than others. What would it take to get us

back to “normal,” whatever that is? I give you a link to some webinars I will be

involved in and finish with the answer to the question I am asked most often,

“What do you think about gold?” I tell all. There are lots of topics to cover,

so let’s get started with no “but firsts.” (Note: this e-letter may print out

rather long, as there are LOTS of charts and tables.)

Unless you were completely out of touch this weekend, you know the jobs

report came in flat, as in zero, nada, “0”. The economy was in neutral, at least

as far as employment was concerned. But flat is actually down, as we need

125,000 jobs a month (at least) just to stay up with population growth. And, as

we will see in a few pages, it may well take more than that.

Yes, there was the caveat that 46,000 Verizon workers were on strike, so the

number should have been a positive 46,000. But then there were 20,000 returning

Minnesota state workers who were “added” back in, so maybe the number should be

negative. As it turns out, workers on strike are counted as unemployed when they

go on strike (thus subtracting from the jobs number) and are added as newly

employed when they go back to work. So sometime in the next month or so, when

those Verizon workers settle, the employment report will show a magic increase

of 46,000.

The rules for this are arcane. If you go do the BLS (Bureau of Labor

Statistics) website – assuming you have no real social life and nothing else

better to do – you find that:

Employed persons are “persons 16 years and over in the civilian

non-institutional population who, during the reference week, (a) did any work at

all (at least 1 hour) as paid employees; worked in their own business,

profession, or on their own farm, or worked 15 hours or more as unpaid workers

in an enterprise operated by a member of the family; and (b) all those who were

not working but who had jobs or businesses from which they were temporarily

absent because of vacation, illness, bad weather, childcare problems, maternity

or paternity leave, labor-management dispute, job training, or

other family or personal reasons, whether or not they were paid for the time off

or were seeking other jobs.” (Hat tip, Joan McCullough)

Somehow, strikes don’t count as labor-management disputes. Or personal

problems. Go figure. But that is a distortion of the monthly numbers, which is

why it is better to look at rolling three-month averages to get a clearer

picture. And speaking of three months, the last three months’ job reports were

revised down by a total of 58,000 jobs, making the net over the last three

months a very small number.

However you look at this report, it was just ugly. Yet it goes along with

regional reports that show a contracting economy and the national ISM (which

came out Thursday), which is barely above a contractionary number, at 50.6. The

ugly part of the ISM number is that this was the third straight month in which

inventories rose more than new orders. Historically, as this chart from Rich

Yamarone shows, that suggests we are either in or close to a recession. (Note,

there are some other negative points, but they were not three months in a row

and were not followed by recession.)

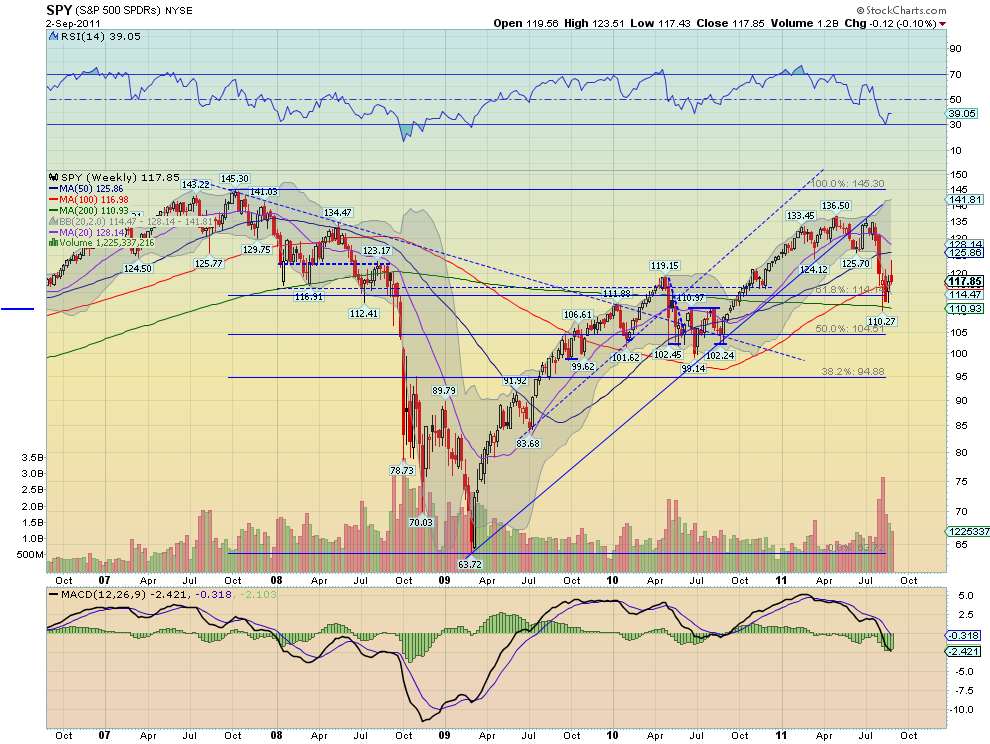

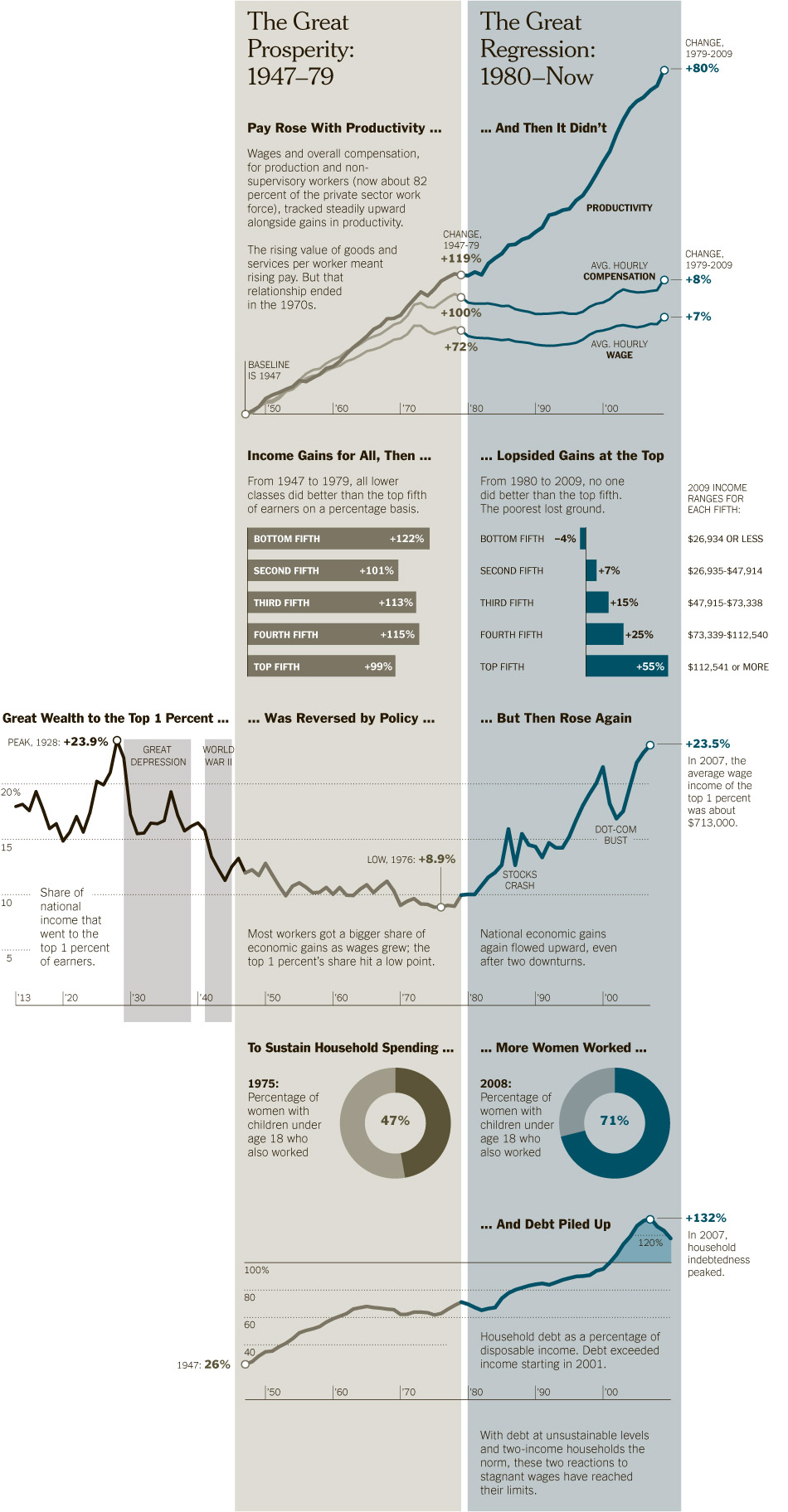

The US has roughly the same number of jobs today as it had in 2000, but the

population is well over 30,000,000 larger. To get to a civilian

employment-to-population ratio equal to that in 2000, we would have to gain some

18 MILLION jobs. The graph below is from the FRED database at the St. Louis Fed.

(Kudos to the guys in St. Louis for maintaining such a wonderful source of data

for all of us! They have thousands of charts and data sets to maintain and do so

with precision, keeping things up-to-the-minute!) Note the precipitous drop in

the ratio in the last ten years, especially during the recession.

Close friend Rob Arnott, founder of Research Affiliates, and I often exchange

emails on a wide variety of topics. His curiosity is matched only by his ability

to come up with new ways to look at old issues. He sent me the following email,

which I am simply going to cut and paste as it is only six paragraphs, but it

sets us up nicely for the next segment [my comments in brackets].

“John, I looked at the composition of the labor force, men and women. Look at

the graph below. From 1948 until 1980, men who considered themselves to be ‘in

the labor force’ (working or wanting work) equaled roughly 98% of the male

population ages 20-64. [Wow. What a quaint concept. If you could work, you

wanted work.] From 1980 to 2005, this proportion fell steadily, from 98% to 92%.

Then, in six years, it fell again by half this margin, to 89%. As for male

employment, it averaged 94% of the population age 20-64, until the 1975

recession. Today, it’s 81%. Let’s assume that the old labor force ratio of 98%

could, in fact, work. That means that male unemployment – including those who

have given up on the idea of gainful employment – is over 17%, and is roughly

tied with the levels of mid-2009.

“For women, society evolved from predominantly ‘homemaker’ employment to a

point, about a decade ago, where women in the labor force equaled about 82% of

the female population aged 20-64. The women in the labor force have dropped from

82% to 78% in ten years, with most of that drop in the past two years; that’s 5%

of the female workforce that’s simply given up in two years. Using the prior

peak of 82%, as the roster who would want to work, the current 71.6% who are

working implies that female unemployment is roughly 13%, and is much higher than

it was two years ago.

“Combine the results, and we get a figure of 15% unemployment, give or take,

relative to past peak labor-force levels, if we include those who have given up

hope. Add in the usual U-6 vs U-3 comparison (including those who are part-time

and want full-time work), and we’re at about 20% true unemployment.

“The good news, is that if our natural “labor force” is 98% of the men

and 82% of the women, and if ‘full employment’ puts 95% of them in jobs, we have

about 25 million new jobs that could be created. If we get out of the private

sector’s way, and allow employers to hire who they want, doing work that both

parties agree to do, for pay that both parties find acceptable. I.e.,

enlightenment in Washington (and Sacramento) could unleash a tsunami of new

employment.

“Caveats: Of course, there were some teenagers and a few senior citizens in

the labor force. So, in theory, the ratio of labor force, relative to the

population age 20-64, could even top 100%. But, this ratio is pretty relevant,

since the overwhelming majority of men in the labor force would be 20-64. I also

made a simplifying assumption that the population of people aged 20-64 is evenly

split. I know there are more women than men, but that’s mostly because women

live longer. Indeed, under age 20, the split is about 51.5/48.5 male majority.

So, I think this is a fair assumption that the populations are about equal in

the working-age cadre, until we can track down more accurate information. Either

way, it’s not going to make more than a slight difference in this analysis.”

While doing some research on Google for today’s letter I came across a new

(to me) web site called Metric Mash (

http://www.metricmash.com/). It accesses public databases and

allows you to slice and dice data on an assortment of things, including

employment. It is now one of my new favorites. I could do a year’s worth of

letters on the charts and graphs I can create there. Way cool.

But I will limit myself to three this week. The only “limit” I found was that

I can only create a chart with four comparisons, and I wanted to use six. Six

graphs, that is, of different age groups and their employment rates. So for this

letter I created two “overlapping” charts. The first covers four age groups,

16-19, 20-24, 25-54, and 55+, for the last five years. It will not come as any

surprise to parents with older teenagers that the rate of unemployment for them

is three times higher than for those over 55. And don’t even think about the

employment problems of black or Hispanic young males.

As it turns out, if we break it down to ten-year cohorts, we find each group

with higher employment rates, except that recently the 34-45 group is slightly

above the 45-54 group.

I was sharing these thoughts with Rich Yamarone (Chief Economist at

Bloomberg), and he said, “Let me send you this chart.” It is a chart of people

who are 75 or older who are working. The numbers are on the rise. They are

literally double what they were just 15 years ago. 1.2 million people over 75

are in the US work force, which is getting ever closer to 1% of the total

working population. It is not just Greenspan and Richard Russell!

This is consistent with what I wrote a few weeks ago. The Boomer generation

is healthier and going to work longer than any previous generation. Part of that

is because some of them need the income, but some of it is simply that they work

because they can and like to. They simply have no reason to want to “retire”;

they like the social interaction and the activity.

But that means they are not giving up jobs that younger people traditionally

take. Go into Barnes and Noble; look at the workers and think back about ten

years. Tiffani worked at Barnes and Noble when she was in her late teens, and I

admit to going to B&N just to walk and look and browse, even though I read

most of my books on my iPad. I still like trolling the aisles looking for

something new. But now the people behind the counter are close to my age (I am

62 next month) or older.

There is a lot to be said for older workers. They are usually more

dependable, as they don’t go out at night as much, have a larger set of work

experiences, and so on. But if more and more Boomers stay in the workforce, the

number of new jobs needed to get back to what we think of as “full employment”

will be just that much higher. Think about it. If only 25,000 Boomers don’t

retire each month (not a stretch) for another ten years, that adds 300,000 jobs

a year we need just to break even. That is 20% more than we currently think of

as the minimum number of new jobs needed per month (125,000). Talk about moving

the goal posts just as we start to get there!

And that brings us to the last chart from Metric Mash, which compares the

employment rates of people with four different levels of education. While the

unemployment rate for those with college degrees is much higher than five years

ago, it is still only just above 4%. But my anecdotal experience (as the father

of kids with degrees) is that a college degree is not the ticket it used to be.

People with degrees are working more, but they are moving down the “food chain,”

taking lower-paying jobs or jobs needing fewer skills than they were trained in.

That is just the way it is.

I actually get that on a closer level. Let’s just say that middle son was not

my scholar. He did not finish high school and had to deal with it being hard to

get good jobs. This year, he woke up and decided that he does indeed need an

education. He went back to online high school and recently finished, and proudly

brought me his diploma. He is enrolling in the local community college. All of

my kids are hard-working, but in today’s world it takes more than a willingness

to work hard. At the lower age and education levels, the competition for what

few jobs there are is fierce. See below.

This Thursday night, 90 minutes before NFL football kicks off, President

Obama will give us his latest version of policies to deal with the high

unemployment rate. I hope we will hear that he is going to tell federal

regulators they have to delete two rules already on the books for every new one

they write, but I will not hold my breath. More green jobs? Why not simply allow

energy companies to drill? I could go on, but the real point is that whoever is

in the White House, Democrat or Republican, will face an uphill battle.

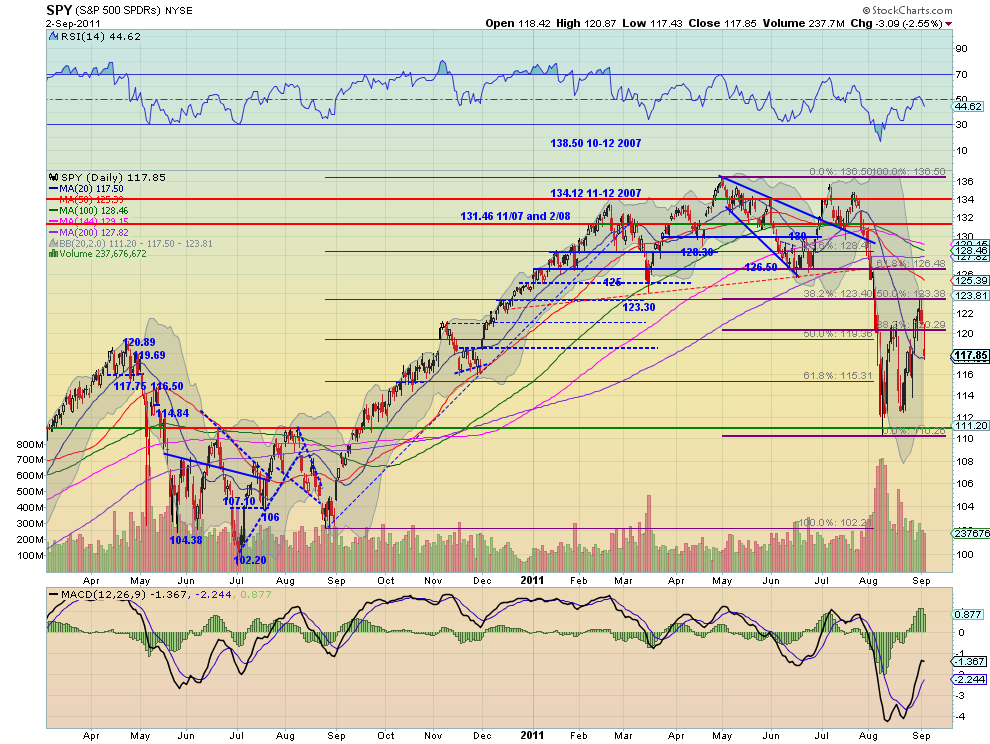

Goldman Sachs recently released a series of graphs for its hedge-fund

clients, talking about ways to play a possible recession, with all sorts of

long-short plays, options, spreads, etc. But in that report is a gold mine of

data, which they should put up on the web in some form as a public service

(without the suggested trades, because of regulations). It is really one of the

better data compilations I have seen in a long time.

We are going to look at one table from that report, which goes along with an

e-letter I wrote about two years ago, talking about how difficult it would be to

recover from the employment losses of the recession. If anything, the situation

has gotten worse since I wrote the original piece, which even back then was

decidedly not optimistic (he says in understatement).

This table shows the number of jobs we would need to create on a consecutive

monthly basis to get back to a given level of the labor force as a percentage of

population, starting at 64%. Remember the chart above that shows we are barely

above 58% now.

Note that simply to reduce the unemployment rate to 8% over two years at the

lowest participation rate of 64% would require 157,000 jobs a month. If those

jobs started showing up, the number of people looking for jobs would increase,

thus increasing the “official” unemployment rate. Most of the numbers of

required new jobs are simply not possible, if history is any guide. (This is a

politician’s nightmare. It will be years before they can take credit for

something they didn’t do.)

Of the 36 numbers in the table, only 6 have historically ever been achieved,

and then only in rousing economies. Certainly not in an economy that is at stall

speed at best.

The simple fact is that net new jobs for the last 15 years came from business

start-ups or rather small businesses, as I have documented in previous letters.

Goldman Sachs notes that historically 90% of new jobs come from small

businesses, with 75% coming from firms with less than 20 employees. Some of

those become Google, but a lot of them are simply small, local services. But

every job, if it is yours, is important.

What we need to do is to make it easier for businesses to start and find

capital. Reduce the regulatory burden that small businesses face. When small

local banks need 1.2 employees to deal with regulations and compliance for every

1 worker they have making loans (as reported in the WSJ this week), something is

seriously wrong.

The sad fact of the matter is that we are in for a long, slow slog uphill on

employment for most the remainder of this decade, until we work through the debt

crisis and deal with the deficits, as I outlined in

Endgame.

[Quick plug. Amazon recently named

Endgame as on of the top ten books so far this year.

I was pleased. And the reviews just keep getting better as the book becomes more

relevant with the passing months. Sadly, much of what we are dealing with all

over the world is what we wrote about last year.

You should get a copy!

We are clearly not coming out of recession like we normally do. That is

because what we just experienced was not a normal “business-cycle” recession,

but a deleveraging/balance-sheet/debt-crisis recession. And the latter simply

take at least 5-6 years to work through, after a country begins to deal with the

problem, which we have not.

To repeat, even if somehow a Republican appeared in the White House tomorrow,

there is no magic he (or she!) could bring with him/her to fix the unemployment

problem. There are just some things the private sector will have to do for

itself, and the sooner the government stops getting in the way, the sooner will

get things fixed. But it will take a long time, no mater what. That is just the

way things are.

The question I am asked the most is some variant on “What do you think about

gold?” So, let me deal with that question here, as it has been a while.

First, I do not think of gold as an investment. It is insurance for me. I buy

a rather fixed amount of gold nearly every month, no matter the price. I hope

the price of gold goes down, because that means I get more coins in the mail to

go into the vault. Yes, I take delivery of my gold, and it is near me if I need

it.

My fondest dream is that I will give my gold coins to my great-great

grandkids some 70-80 years from now, and they will be rather embarrassed that

their “Papa John” bought all that much of that barbarous yellow metal instead of

more biotech stocks. But as I live in the real world, I buy gold, even though I

am optimistic we’ll get through this rough patch; because I simply don’t trust

the bas*%*ds who are driving this ship with 100% of my money in dollars, or any

fiat currency, for that matter.

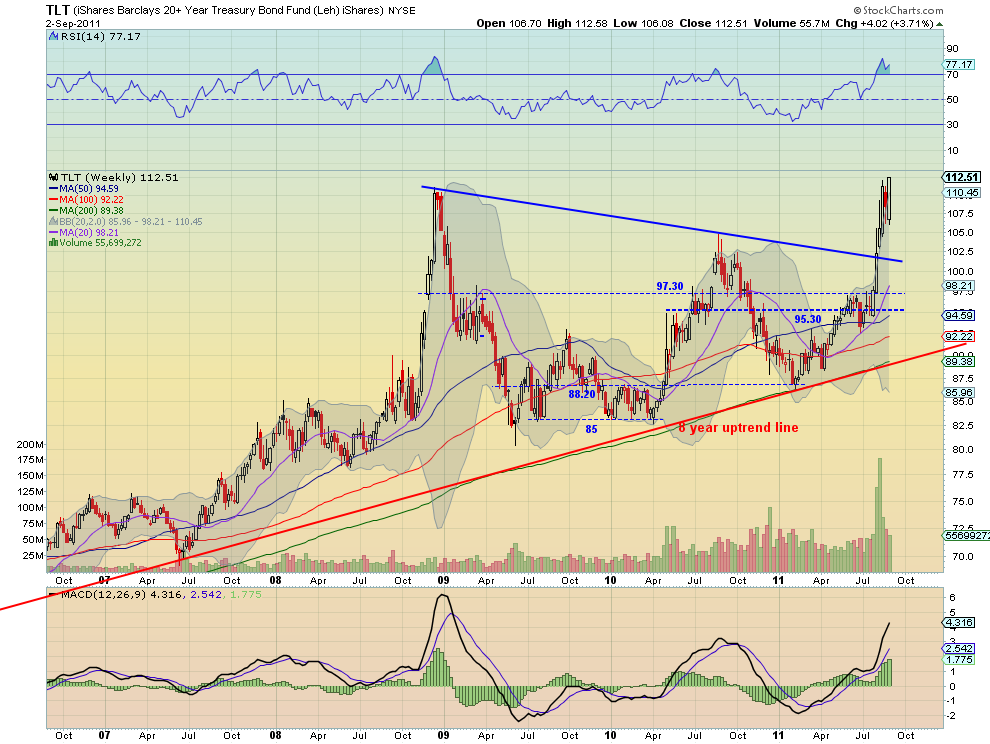

Gold to me is a neutral currency. While the metal looks good over the last

ten years (and I became bullish on it in 2002 in this letter), over the last 32

years it has not had all that much luster. Bonds have been much better as an

investment. It is all about timing.

If I wanted to buy gold for investment or trading, I would simply buy GLD.

(It is an excellent vehicle for traders; however, GLD is not what I think of as

insurance.) And if I were buying gold as a trade, I would buy it in terms of the

euro or yen, which I think are both going down against the US dollar.

For those who want to buy larger sums of gold, there is a program that I like

backed/sponsored by the state government of Western Australia, called the Perth

Mint. You can buy gold certificates that represent actual bullion in vaults in

Perth at reasonable prices. While your gold is stored in Perth, you can take

delivery if you want and leave the country with no taxes owed. Or you can sell

the gold and get cash. You diversify your country risk, have excellent and safe

storage facilities, diversify your currency risk (if, like me, you think of gold

as a currency), and have a different asset class than traditional

portfolios.

You can learn more about the

Perth

Mint. And one of their dealers is an old friend of mine, Mike Checkan of

Asset Strategies International.

I have known Mike for about 30 years, and he does what he says and shoots

straight. He is well-known in the investment information world, with lots of

endorsements. You can learn more about his outfit at or call them toll-free at

(800) 831-0007 in the U.S. and Canada, or direct at (301) 881-8600. You can also

email them from their web site.

Where to buy actual bullion? Gold coins are gold coins. ASI is a good choice,

but I would shop around. Depending on the amount you are buying, mark-ups can be

significant, and there are differences in service and responsiveness. Delivery

can be an issue, although I get mine in the mail with insured mail (although we

do have to pick it up!).

Do I think gold is at a high? While I hope so, I truly do, I rather think

that gold still has some upside because of government policies. When the deficit

gets under control and we are on the road to real recovery, I rather think that

gold will come back down from whatever highs it makes. I remember in 1980 there

were True Believers who thought gold could only go one way.

For the record, I think you should own about 5% of your net worth in gold, as

insurance, not as an investment. The “goal” and your hope should be to never

have a reason to sell your gold. I trust that tells you where I stand.

I am home for another three weeks, and then yet another crazy period of

travel begins. I am off to Malta, London, Dublin, and Geneva late September

through October 5. The next week, on the 14

th, I go to Houston for a

conference (along with David Rosenberg, Ed Easterling and others; more

information at

here).

Then I fly to New York for the weekend, where I will be speaking at the

Singularity Summit, which is October 15-16. This is an outstanding conference,

and I am honored to be asked to speak. It is really a bunch of wild-eyed

futurists (like your humble analyst) getting together to think about what the

future holds for us. For two days, I get to be an optimist, if only in the

longer term! Ray Kurzweil is the guiding light, and he has assembled an all-star

cast. You can learn more at

Singularity Summit. For those who can make it, I think you

will come back amazed and more positive about the future of the world. And you

can see videos of previous conference presentations at the web site. Well worth

an evening or two or three, and the price is right; but if you can make the

conference, you will enjoy the experience and meet new friends.

Next week I will be recording a video with longtime friends Doug Casey and

David Galland on the American Debt Crisis. This is a little new to me, as I will

be in my living room but on video. It will be available the following week for

free to those who sign up

here. It is interesting to be doing this, as I become the

“optimist” in this discussion. Warning: these guys are hard-core libertarians,

but they are lots of fun!

This weekend is Labor Day in the US, and the kids are coming to Dad’s, along

with friends and friends of friends. I see grilled steaks and hamburgers, lots

of side dishes and mushrooms! And lots of family fun. I really like (and live

for) days like this! And I did my part for the US economy and got a new grill,

although I was surprised at how much grill we got for the dollar.

It is time to hit the send button. Have a great weekend and week. And if you

are working, be thankful. There are too many in the world who don’t have that

privilege.

Your glad he has too much to do analyst,

John Mauldin