Monday, February 21, 2011

The Real Crisis That Will Soon Hit the U.S.

By: Chris_Kitze

Phoenix Capital Research writes: Forget stocks, the real crisis is coming… and it’s coming fast.

Indeed, it first hit in 2008 though it was almost entirely off the radar of the American public. While all eyes were glued to the carnage in the stock market and brokerage account balances, a far more serious crisis began to unfold rocking 30 countries around the globe.

I’m talking about food shortages.

Aside from a few rice shortages that were induced by export restrictions in Asia, food received little or no coverage from the financial media in 2008. Yet, food shortages started riots in over 30 countries worldwide. In Egypt people were actually stabbing each other while standing in line for bread.

We’re now seeing the second round of this disaster occurring in Egypt and other Arab countries today. Thanks to the Fed’s funny money policies, food prices have hit records. And een the Fed’s phony measures show that vegetable prices are up 13%!

The developed world, most notably the US, has been relatively immune to these developments… so far. But for much of the developing world, in which food and basic expenses consumer 50% of incomes, any rise in food prices can have catastrophic consequences.

And that’s not to say that food shortages can’t hit the developed world either.

According to Mark McLoran of Agro-Terra, the Earth’s population is currently growing by 70-80 million people per year. Between 2000 and 2012, the earth’s population will jump from six billion to seven billion. We’re expected to add another billion people by 2024. So demanding for food is growing… and it’s growing fast.

However, supply is falling. Up until the 1960s, mankind dealt with increased food demand by increasing farmland. However, starting in the ‘60s we began trying to meet demand by increasing yield via fertilizers, irrigation, and better seed. It worked for a while (McLoran notes that between 1975 and 1986 yields for wheat and rice rose 32% and 51% respectively).

However, in the last two decades, these techniques have stopped producing increased yields due to their deleterious effects: you can’t spray fertilizer and irrigate fields ad infinitum without damaging the land, which reduces yields. McLoran points out that from 1970 to 1990, global average aggregate yield grew by 2.2% a year. It has since declined to only 1.1% a year. And it’s expected to fall even further this decade.

Thus, since the ‘60s we’ve added roughly three billion people to the planet. But we’ve actually seen a decrease in food output. Indeed, worldwide arable land per person has essentially halved from 0.42 hectares per person in 1961 to 0.23 hectares per person in 2002.

It’s also worth noting that diets have changed dramatically in the last 30 years.

For example, in 1985 the average Chinese consumer ate 44 pounds of meat per year. Today, it’s more than doubled to 110 pounds. That in of itself is impressive, but when you consider that it takes 17 pounds of grain to generate one pound of beef, you begin to see how grain demand can rise exponentially to population growth with even modest changes to diet.

Make no mistake, agriculture is at the beginning of a major multi-year bull market. We’ve got rapidly growing demand, reduced production, and decade low inventories.

This is an absolute recipe for disaster.

Etichette:

articles,

Economy article,

Finance article,

market articles

Europe poised for long-awaited vote on GM imports

by Agrimoney.com

Livestock farmers in Europe may on Tuesday gain their second fillip in a week in their battle against high fodder prices, through a concession on genetically modified foods which would facilitate imports of cheaper feed ingredients.

European Union countries are to vote on long-discussed plans to allow small quantities of unapproved genetically modified crops to be permitted in import cargos, before they incur bans under the region's stringent limitations on biotechnology.

Under the current "zero tolerance" policy, even minute traces of biotech products leave a cargo in breach of EU curbs and at risk of being turned away, leaving merchants reluctant to handle shipments from countries offering any risk of accidental contamination.

Tuesday's meeting of a European Commission committee on animal nutrition could see a limit of 0.1% on biotech traces voted in, a move which feed groups have viewed as a "first step" towards freeing up their access to foreign supplies, notably of protein meals such as soymeal.

'Opportune moment'

Indeed, Fefac, the European compound feed industry association, warned that without a concession, "many livestock farmers, especially pig holdings, will have to close down their operations since they cannot pass on higher feed costs to the consumer in the present market context".

And with South America's soybean crop at the start of its harvest, permission for the small levels of biotech contamination would come at "an opportune moment", Fefac director general Alexander Doring said.

Consent would also follow the EU's agreement last week to shelve import quotas on feed barley and wheat , a move which, shipping and currency costs allowing, could encourage purchases from as far as Australia.

French reservations

Feed groups have argued that zero tolerance is unworkable given the high levels of genetically modified crops grown by producers of, in particular, vegetable protein crops, of which there is a limited choice of exporting countries.

In Brazil, for instance, the second-ranked soymeal exporter, an estimated 80% of the soybean crop was planted with genetically modified seed, according to US estimates.

The EU is the top buyer of foreign soymeal, accounting for nearly 40% of global imports last season.

However, in some European countries, biotech crops are anathema even at minimal levels.

The EU last week postponed a vote over genetically modified crops, in the face of opposition from nine member states, led by France.

Tuesday's vote, the result of which is not expected until late in the evening, follows some last-minute changes to the proposal, a commission source told Agrimoney.com.

Etichette:

articles,

commodity,

commodity article,

grains,

meats

Address Structural Economic Problems of Unemployment, Debt, and Inflation With Chicanery

By: D_Sherman_Okst

Structural Economic Problem #1: Unemployment

Seventy percent of our economy is driven from private sector employment:

- Without consumers the economy is finished

- Without jobs and with maxed out debt loads the consumer is finished

A fourth grader can connect these two dots and conclude: “It’s the jobs stupid.”

Our current chicanery “fix” for high unemployment?

- Reporting the unemployment rate at 9.4% - not the actual 23%- as if reporting 9.4% will put the other 13.6% back to work.

- Dump money out there in a “willy-nilly” manner and call it “Stimulus” or “Job Creation Money.”

Given our entire situation, which I’ll address in a second, I don’t believe that “Stimulus” will stimulate job creation or the economy. If they had taken Chris Martenson’s idea of insulating homes I might think differently about this. I say this for two reasons: first, 1 in 6 jobs were housing related—that is the sector that needs the most help. Second, global oil demand has recently out paced global oil production. A plan that would reduce oil demand and global oil stress should be the focus of any stimulus. Oil is an integral part of everything from fertilizer used in farming to the energy that our economy needs to produce and transport the goods and services we rely on.

That being said our economic engineers have come up with and implemented ideas that would make even the most ardent objector of workplace drug screening reconsider his or her view. Case in point #1: National Institutes of Health (NIH) spent $823,200.00 of economic stimulus funds in 2009 on a study by a UCLA research team to teach uncircumcised African men how to wash their genitals after having sex. The good news is that didn’t increase oil demand. The bad news is it didn’t do anything to create jobs here.

Case in point #2: It takes 121,600 gallons of oil to pave 1 mile of road. Last year Government Motors sold more cars in China than in the US. China bought 13.7 million passenger vehicles FY2010, up 33% from FY2009. The bottom line is our highway stimulus will do nothing but drive oil prices higher. China is rushing to get their highway system built to accommodate their new drivers.

While I respect the idea that confidence and psychology affect consumerism, the reality is that a 23% unemployment figure is a depressionary red flag. This tells us that the “Great Recession” has neither ended, nor was it “just” a recession. I know it is hard to dispute the National Bureau of Economic Research (NBER) - after all they were only 9 months late in noticing and calling the greatest economic downturn in history.

The fact remains: We are in a depression and failing to address the structural unemployment problems will make matters worse not better. The first step to fixing a problem is of course admitting that we have one. We’ve squandered valuable time and in doing so we’ve greatly exacerbated the situation.

Globalization was an absolute unmitigated, disastrous failure. The only thing it did was temporally boost stocks and allow some CEOs to make 400 times what their wage-earners made. While the economy appeared to be doing well - it was bubble driven credit binging - not organic spending that was fueling it. One economic blogger who is a CPA and works as a comptroller for an Ivy League college did what no other economist I know did - he investigated where consumers were getting their money from. Something Starbucks Coffee’s economist should have done. Nine billion Home Equity Line of Credit borrowed dollars were spent on 4 dollar coffees at Starbucks. The HELOC rush caused 900 Starbuck stores to close.

Yet, our Federal Reserve’s Federal Open Market Committee (Fed FOMC) minutes from FY2005 indicate that exploiting globalization is funny stuff: “But the common concern coming from the retailers, the rails, the shippers, the shipbuilders, and so on, was the following: Everyone I’ve talked to continues to try to figure out ways to exploit globalization. Each of them, from the IT [information technology] guys to the big box retailers to the specialty chemical firms to the service firms, wants to have offshore supply. One of the CEOs said, “We have a long way to go in exploiting China.” We’ve heard that forever. And one of my favorites was the comment, “China, India, and Indonesia can make Italian ceramics better than Italians can now or could 200 years ago.” [Laughter]”

In the 1950s 28% of our job base was from manufacturing. In 2000 it was 14% and today it is 11%. Water (wages) will slosh around until they stabilize at water level. In other words, our wages will move down towards 2 dollars a day and China’s will move up towards ours, they will meet somewhere in the middle. The bottom line: This is why American workers are stuck at circa 1970s wages and have no money to consume or support our economy.

The laugh is on the American consumer and the American economy. We’ve exploited ourselves and our economy with “thinking” like this. Giving African’s borrowed American tax payer dollars for genital washing after sex, our lying about unemployment rates, and driving up oil demand (or laughing about exploiting workers) won’t fix serious structural economic problems - it'll make it a lot worse.

Structural Economic Problem #2: Absolutely Unmanageable Debt

Watching the House Budget Committee hearing was a surreal mix of fact and fantasy, but mostly fantasy. The fact was that our biggest problem, on a consumer, local, state, federal and global problem is debt.

When businesses or individuals get in over their heads with unserviceable debt levels they make cuts and they borrow. When that fails and they are left taking in and borrowing less than their obligations - they declare bankruptcy, reorganize and move on.

The two options I heard during the hearings?

- Default.

- Raise the debt ceiling and counterfeit, (print more money). Basically: Debt is the problem so lets add more debt?!?!

What I didn’t hear mentioned was even more troubling. There are a million “millions” to a trillion. But the 14 trillion dollar public debt is an iota of our debt. Hidden off balance sheet we have 14.6 trillion in Social Security debt, 76.4 trillion in Medicare debt, 19.6 trillion in Prescription Drugs and about 3 trillion in GSE debt. We make Enron look honest. All toll our debt is roughly 128 trillion. Then we can add to that the state debt and local government debt.

Governor Christie will soon learn that cuts won’t fix too much debt. When your debt to income ratio becomes insanely unmanageable the only solution is to shed the debt.

Add up sales tax, phone bill tax, building permit fees, utility taxes, automobile registration, tolls, parking, automobile inspections, airline taxes, hotel taxes, property taxes and the all the rest and you will soon realize that the consumer works 8 full months for the local, state and federal governments. Paying our fair share is great, but is it smart to leave the consumer with 3.5 months of circa 1970s wages to support the economy with?

If we had just one dynamic person in that room during these hearings we’d have heard another option: Restructure. Our currency needs to be re-valued, they need to issue one new dollar which is worth many, many, many old dollars. Back it loosely and temprarily to gold to ensure faith in the new dollar.

Clearly our problem is debt and there is only one historically way to fix too much debt and that is to restructure.

Don’t get me wrong, “printing”, “counterfeiting”, “monetizing the 1.5 trillion (and rising) of debt our government doesn’t have each year through tax income and borrowing” and “Quantitative Easing” are all one-in-the-same. We are restructuring our debt by re-valuing our currency subvertly, Bernanke et al have just decided to do it “a la Hiroshima style” which will be excruciatingly painful to 99% of all Americans, it will undoubtedly put democracy in harms way and without a backing/anchor to something the new currency will be shunned by the rest of the world. This is not good for a country who doesn't run a trade surplus.

I’ve read just about everything Greenspan has written and said over the years and one of the handful of things he got right was this: “A democratic society requires a stable and effectively functioning economy. I trust that we and our successors at the Federal Reserve will be important contributors to that end.” ~Alan Greenspan

I’m not certain which end he is referring to. The United States is about 234 years old and half of the money supply has been created in this decade. Largely (read: almost entirely) because of what the then Fed Chairman did with interest rates - and the muzzling of Brooksly Born who had the audacious idea of putting measures in place to prevent derivatives from ever becoming a household word.

Which brings us to the next structural economic problem.

Structural Economic Problem #3: The Value of Money & Inflation

The irony here is one of the better explanations of what money is and how inflation works was done by Greenspan in the 1960s when he published a piece that was printed in Ayn Rand’s Capitalism.

He explains what money is:

- A commodity that serves as a medium of exchange. (We all know what happens to the value of a commodity when it is too plentiful - its value decreases greatly)

- Money is a store of value

- A means of savings

- His definition, since written in the 1960s before Nixon slammed the gold window and took us off the quasi-gold standard should be parsed with that in mind

- That limited gold reserves prevented disasters by limiting the over-creation of credit/money

- The recessions were short-lived since the money supply didn’t get out of hand

And then it gets good. Greenspan explains what caused the first Great Depression of our time (too much money):

- “But the process of cure was misdiagnosed as the disease: if shortage of bank reserves was causing a business decline - argued economic interventionists - why not find a way of supplying increased reserves to the banks so they never need be short! If banks can continue to loan money indefinitely - it was claimed - there need never be any slumps in business. And so the Federal Reserve System was organized in 1913.”

- “When business in the United States underwent a mild contraction in 1927, the Federal Reserve created more paper reserves in the hope of forestalling any possible bank reserve shortage.”

- “The excess credit which the Fed pumped into the economy spilled over into the stock market-triggering a fantastic speculative boom. Belatedly, Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929 the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and a consequent demoralizing of business confidence. As a result, the American economy collapsed.”

Sound familiar?

This is, in a sick sort of way, hysterical, for it was he who created a fantastic speculative tech and housing boom through the creation of too much cheap money pumped into the economy and through the dismantling of Glass-Steagall Act, and the muzzling of the watchdog who wanted to protect us the American public from the derivatives fallout.

He then goes onto define what a welfare state is:

- “...the realization that the gold standard is incompatible with chronic deficit spending (the hallmark of the welfare state).”

And how the welfare state steals from its productive hard working citizens:

- “Stripped of its academic jargon, the welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society to support a wide variety of welfare schemes.”

- “A substantial part of the confiscation is effected by taxation.”

- “But the welfare statists were quick to recognize that if they wished to retain political power, the amount of taxation had to be limited and they had to resort to programs of massive deficit spending, i.e., they had to borrow money, by issuing government bonds, to finance welfare expenditures on a large scale.”

Somewhere between 1966 and his term from 1987 to mid 2006 the train left the tracks and kept going.

Thank you Alan for forgetting history and decency. At least know I know to which end you were referring to in your December 5, 2005 speech above.

Without a doubt, with the monetization we have now, we will see hyperinflation as the value of our dollar goes from the current .04 cents to 0.

The Fed in the 1970s, thanks to the Nixon Administration was able to strip out fuel and food from its “Core Inflation" number, something consumers and businesses can’t do. During Clinton’s term Michael Boskin helped tweak inflation by using Hedonics (Greek for feels good), weighting and substitution.

Core inflation and Enron accounting is how they plan on solving inflation. Just remember what the Maestro of Disaster said: The law of supply and demand is not to be conned. As the supply of money (of claims) increases relative to the supply of tangible assets in the economy, prices must eventually rise.

Rise will be the understatement of the century.

Many people wrongly argue that the money is sitting, that there is no velocity, or that the Fed can do the Paul Volcker and raise rates. Which brings us to our next topic, monetizing debt through “Quantitative Easing.” (Please See Part 2).

Etichette:

articles,

Economy article,

Finance article,

market articles

Stai diversificando in maniera corretta i tuoi investimenti?

La diversificazione è la tecnica con cui si “mescolano” diversi tipi di investimento all’interno di un portafoglio. Aggiungendo al portafoglio una corretta gestione sui mercati futures apportiamo un benefico abbassamento della volatilità del portafoglio. Questa riduzione del rischio viene determinata dall’utilizzo di una vasta gamma di prodotti finanziari poco o per niente correlati agli asset classici. Inoltre una corretta gestione sui mercati futures generalmente migliora i risultati del portafoglio nelle fasi negative per bond e azioni, costituendo un’ottima risorsa per la protezione di molti portafogli.

La diversificazione degli asset

La diversificazione fra asset che hanno bassa correlazione tra loro migliora la performance globale dei nostri investimenti a parità di rischio, dunque riduce la nostra esposizione al rischio, in quanto diminuisce il cosiddetto "rischio specifico" legato a una singola classe di prodotti finanziari. In pratica, se avete in portafoglio solo azioni, il risultato del vostro trading / investimento è legato eccessivamente alle sorti di un determinato strumento finanziario, per cui state correndo un rischio troppo elevato. Un portafoglio ben diversificato per classi di asset è una delle principali componenti che permettono di creare il portafoglio ottimale. Leggi "The Art Of Asset Allocation" e "Top 10 Rules Of Portfolio Diversification".

La diversificazione all'interno di un asset

Concentrando gli investimenti in singoli prodotti o titoli, ci si espone a un tipo di rischio che non è controllabile, e il rischio diventa incertezza, che è qualcosa di non calcolabile. E' possibile, anche in questo caso, ridurre i rischi specifici facendo trading o investendo, ad esempio, non in una singolo prodotto ma in un paniere di prodotti che rappresenti una quota molto ampia dell'intero mercato. Leggi "The Art Of Asset Allocation" e "Top 10 Rules Of Portfolio Diversification".

La diversificazione dei metodi di trading

Si tratta di combinare l'uso di diversi metodi di trading non correlati fra loro per migliorare il rapporto fra profitto e massima perdita. La bassa correlazione tra metodi diversi tende a diminuire le perdite complessive grazie alla performance combinata dei due sistemi di trading. Si tratta quindi di uno dei metodi più efficaci per migliorare il rendimento dei nostri investimenti riducendo contemporaneamente il rischio. Leggi "The Art Of Asset Allocation" e "Top 10 Rules Of Portfolio Diversification".

La diversificazione dei parametri di un trading system

Consiste nell'usare, nell'ambito di un medesimo sistema di trading diversi set di parametri. Supponendo che un account di trading gestisca un capitale adeguato alla diversificazione, è preferibile diversificare gli insiemi dei parametri piuttosto che fare contratti multipli con lo stesso set di parametri. La diversificazione dei set di parametri aiuta a minimizzare il rischio ed a rafforzare la nostra abilità psicologica nel rimanere disciplinati e coerenti nell'applicazione del sistema di trading. Leggi "The Art Of Asset Allocation" e "Top 10 Rules Of Portfolio Diversification".

TOGETHER TO WIN: GALAXY PORTFOLIO SYSTEMS

Il nostro obiettivo è quello di generare nel medio periodo una crescita significativa dei capitali investiti, indipendentemente dall'andamento dei mercati azionari e dei bond, con semplici e rigide regole di trading e con la massima diversificazione possibile. Tutti i nostri Portfolio Systems sono progettati assemblati e gestiti con questa filosofia. Grazie all'elevata diversificazione operativa che li caratterizza, i nostri Portfolio Systems esaltano le sinergie positive dei singoli Trading Systems da cui sono composti e ne riducono drasticamente il rischio complessivo. La diversificazione rimane la pietra miliare della moderna teoria di portafoglio, ma nonostante questo, molti investimenti "diversificati" hanno seguito l'andamento dei mercati azionari e sono falliti durante la recente crisi finanziaria. Per contro i nostri Portfolio Systems hanno ottenuto i loro migliori risultati proprio nel 2008 grazie alla volatilità di quel periodo, all'elevata diversificazione operativa, ed al modello costruttivo che li rende indipendenti dall'andamento dei mercati azionari e dei bond.

Le tabelle ed il grafico qui sotto rappresentano i risultati mensili MTM del nostro Galaxy Portfolio Systems dal Novembre 2009, considerando un capitale iniziale di $ 200.000. Galaxy è composto dai nostri trading systems Survivor, Ninja and Super Commodity.

Performance MTM Mensile di Galaxy Portfolio System con un capitale iniziale di $ 200.000

Material in this post does not constitute investment advice or a recommendation and do not constitute solicitation to public savings. Operate with any financial instrument is safe, even higher if working on derivatives. Be sure to operate only with capital that you can lose. Past performance of the methods described on this blog do not constitute any guarantee for future earnings. The reader should be held responsible for the risks of their investments and for making use of the information contained in the pages of this blog. Trading Weeks should not be considered in any way responsible for any financial losses suffered by the user of the information contained on this blog.

La diversificazione degli asset

La diversificazione fra asset che hanno bassa correlazione tra loro migliora la performance globale dei nostri investimenti a parità di rischio, dunque riduce la nostra esposizione al rischio, in quanto diminuisce il cosiddetto "rischio specifico" legato a una singola classe di prodotti finanziari. In pratica, se avete in portafoglio solo azioni, il risultato del vostro trading / investimento è legato eccessivamente alle sorti di un determinato strumento finanziario, per cui state correndo un rischio troppo elevato. Un portafoglio ben diversificato per classi di asset è una delle principali componenti che permettono di creare il portafoglio ottimale. Leggi "The Art Of Asset Allocation" e "Top 10 Rules Of Portfolio Diversification".

La diversificazione all'interno di un asset

Concentrando gli investimenti in singoli prodotti o titoli, ci si espone a un tipo di rischio che non è controllabile, e il rischio diventa incertezza, che è qualcosa di non calcolabile. E' possibile, anche in questo caso, ridurre i rischi specifici facendo trading o investendo, ad esempio, non in una singolo prodotto ma in un paniere di prodotti che rappresenti una quota molto ampia dell'intero mercato. Leggi "The Art Of Asset Allocation" e "Top 10 Rules Of Portfolio Diversification".

La diversificazione dei metodi di trading

Si tratta di combinare l'uso di diversi metodi di trading non correlati fra loro per migliorare il rapporto fra profitto e massima perdita. La bassa correlazione tra metodi diversi tende a diminuire le perdite complessive grazie alla performance combinata dei due sistemi di trading. Si tratta quindi di uno dei metodi più efficaci per migliorare il rendimento dei nostri investimenti riducendo contemporaneamente il rischio. Leggi "The Art Of Asset Allocation" e "Top 10 Rules Of Portfolio Diversification".

La diversificazione dei parametri di un trading system

Consiste nell'usare, nell'ambito di un medesimo sistema di trading diversi set di parametri. Supponendo che un account di trading gestisca un capitale adeguato alla diversificazione, è preferibile diversificare gli insiemi dei parametri piuttosto che fare contratti multipli con lo stesso set di parametri. La diversificazione dei set di parametri aiuta a minimizzare il rischio ed a rafforzare la nostra abilità psicologica nel rimanere disciplinati e coerenti nell'applicazione del sistema di trading. Leggi "The Art Of Asset Allocation" e "Top 10 Rules Of Portfolio Diversification".

TOGETHER TO WIN: GALAXY PORTFOLIO SYSTEMS

Il nostro obiettivo è quello di generare nel medio periodo una crescita significativa dei capitali investiti, indipendentemente dall'andamento dei mercati azionari e dei bond, con semplici e rigide regole di trading e con la massima diversificazione possibile. Tutti i nostri Portfolio Systems sono progettati assemblati e gestiti con questa filosofia. Grazie all'elevata diversificazione operativa che li caratterizza, i nostri Portfolio Systems esaltano le sinergie positive dei singoli Trading Systems da cui sono composti e ne riducono drasticamente il rischio complessivo. La diversificazione rimane la pietra miliare della moderna teoria di portafoglio, ma nonostante questo, molti investimenti "diversificati" hanno seguito l'andamento dei mercati azionari e sono falliti durante la recente crisi finanziaria. Per contro i nostri Portfolio Systems hanno ottenuto i loro migliori risultati proprio nel 2008 grazie alla volatilità di quel periodo, all'elevata diversificazione operativa, ed al modello costruttivo che li rende indipendenti dall'andamento dei mercati azionari e dei bond.

Le tabelle ed il grafico qui sotto rappresentano i risultati mensili MTM del nostro Galaxy Portfolio Systems dal Novembre 2009, considerando un capitale iniziale di $ 200.000. Galaxy è composto dai nostri trading systems Survivor, Ninja and Super Commodity.

| Performance Statistics di Galaxy Portfolio Systems Risultati netti anno 2009 107,47 % Risultati netti anno 2010 68,45 % Risultati ultimi 12 Mesi 80,38 % Mesi con risultati positivi 84,00 % Mesi con risultati negativi 16,00 % Migliore performance mensile 27,21 % Peggiore performance mensile 9,51 % |  |

Monthly MTM Equity line of Galaxy Combined Portfolio Systems composed of Survivor System + Ninja System + Super Commodity System |

Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

2009 | 1.19 % | 2.90 % | ||||||||||

2010 | (4.28 %) | 24.49 % | 2.99 % | 1.76 % | 15.62 % | 4.35 % | 10.60 % | (0.41 %) | (4.73 %) | 1.75 % | 12.80 % | 1.50 % |

2011 | 7.54 % | 7.73 % |

|  |

Material in this post does not constitute investment advice or a recommendation and do not constitute solicitation to public savings. Operate with any financial instrument is safe, even higher if working on derivatives. Be sure to operate only with capital that you can lose. Past performance of the methods described on this blog do not constitute any guarantee for future earnings. The reader should be held responsible for the risks of their investments and for making use of the information contained in the pages of this blog. Trading Weeks should not be considered in any way responsible for any financial losses suffered by the user of the information contained on this blog.

Rally in soft commodities isn't over yet

by Agrimoney.com

Setbacks in cotton and sugar prices do not herald the end of the soft commodities rally, analysts have said, with ABN Amro forecasting that $3-a-pound cotton could soon appear a "low call".

A slump in sugar prices, which in London fell on Monday to a two-month low, "is not on the cards for the time being", Commerzbank analysts said.

Although better production is expected in 2011-12 in the key producing countries of Brazil, India and Thailand, with sugar trader Kingsman forecasting a 5.6m-tonne supply surplus in the year from April, "it will take months for the [sugar] market situation to noticeably ease", the bank said.

Indeed, separately ABN Amro said that it saw a "strong chance of speculative investment returning" into sugar thanks to tight global supplies, with price prospects enhanced if India fails to allow exports.

'Higher price spike'

ABN was also upbeat on prospects for cotton futures, which jumped to a new record on Friday, only to close down 7.00 cents at 197.02 cents a pound, falling the maximum allowed by New York exchange.

"Cotton prices at $3 a pound? That could be a low call by the middle of the this year, now that [New York's] benchmark March contract… has breached $2," the bank said, noting it would be some time before the impact of an expected jump in plantings fed through.

"Even though farmers will definitely plant more cotton this year than last, stocks will remain very tight by the end of the 2010-2011 marketing year.

"Our view is that the bounce-back in output will come too late to prevent an even higher price spike."

'Further rally'

Meanwhile, the rally in coffee prices, which has seen New York's arabica futures hit their highest for 13 years, "could have much further to go", ABN added, noting that the world would head into 2011-12, an "off" year in the two-year Brazilian production cycle, with "fairly low stocks" of arabica beans.

Indeed, speculators' bets on rising arabica coffee prices were, at a net long of 32,195 contracts as of February 8, relatively low, holding out the potential for a significant uplift.

Speculators' net long interest, as measured by non-commercial and non-reportable positions, hit 63,775 lots two years ago.

"Given the current relatively low net long of the more mobile speculative money, we could easily imagine a further price rally in the weeks ahead, particularly in arabica," said ABN, whose research is published in conjunction with VM Group.

Strong arabica prices would pull up futures in London-traded robusta beans too, "although at a somewhat slower pace, as evidenced by an arbitrage of more than 160 cents pound" between the two types of coffee.

Market prices

Robusta for March delivery stood 1.3% higher at a two-year high of $2,288 a tonne in lunchtime trade on Monday, while London white sugar for May fell 0.4% to $718.00 a tonne.

Earlier, the lot hit $713.00 a tonne, the lowest for a spot contract since the start of December.

Continue reading this article >>

Etichette:

articles,

commodity,

commodity article,

Economy article,

market articles,

Softs

Global Imbalances: Links to Economic and Financial Stability

By Guest Author

Continue reading this article >>

By facilitating the allocation of the world’s savings to the most productive uses, the free flow of capital across national borders confers substantial economic benefits, including the promotion of economic growth. That said, we have seen a number of episodes in which international capital flows have brought with them challenges for macroeconomic adjustment, financial stability, or both. Such challenges have tended to arise in two situations: first, when the “rules of the game” of the international monetary system–the policy responses that countries are expected to take to help foster a balanced global economy over time–are either poorly articulated or not observed by key countries; and second, when the financial systems of nations receiving strong capital inflows have not been up to the task of investing those inflows productively.

These issues are hardly new. In the late 1920s and early 1930s, the U.S. dollar and French franc were undervalued, with the result that both countries experienced current account surpluses and strong capital inflows. Under the unwritten but long-standing rules of the gold standard, those two countries would have been expected to allow the inflows to feed through to domestic money supplies and prices, leading to real appreciations of their currencies and, with time, to a narrowing of their external surpluses. Instead, the two nations sterilized the effects of these capital inflows on their money supplies, so that their currencies remained persistently undervalued. Under the constraints imposed by the gold standard, these policies in turn increased deflationary pressures and banking-sector strains in deficit countries such as Germany, which were losing gold and foreign deposits. Ultimately, the unwillingness of the United States and France to conduct their domestic policies by the rules of the game, together with structural vulnerabilities in financial systems and in the gold standard itself, helped destabilize the global economic and financial system and bring on the Great Depression.

The Asian financial crisis of the late 1990s illustrates a somewhat different type of risk associated with large cross-border flows of capital. During the 1990s, strong capital inflows helped support robust growth in many Asian economies. But Thailand’s devaluation in mid-1997 triggered closer scrutiny of developments in the region. Investors began to recognize that the financial systems of some Asian economies–because of institutional weaknesses, inadequate regulation, or other deficiencies–had not effectively channeled the surge of incoming funds into productive investments. As foreign investors lost confidence, capital flows into the region reversed sharply, and the credit-driven boom came to a precipitous end. The Asian crisis imposed heavy costs in terms of financial and macroeconomic instability in the affected countries. In this case, capital inflows posed a problem because of weaknesses in the financial systems and regulatory oversight in countries receiving foreign capital.

Although these issues are now generally discussed in the context of emerging market economies, the United States–the recipient of the largest capital inflows in the world–has also faced challenges coping with capital inflows. Notably, the failures of the U.S. financial system in allocating strong flows of capital, both domestic and foreign, helped precipitate the recent financial crisis and global recession.

Why was the United States, a mature economy, the recipient of net capital inflows that rose to as much as 6 percent of its gross domestic product prior to the financial crisis? A significant portion of these capital inflows reflected a broader phenomenon that, in the past, I have dubbed the global saving glut.1 Over the past 15 years or so, for reasons on which I have elaborated in earlier remarks, many emerging market economies have run large, sustained current account surpluses and thus have become exporters of capital to the advanced economies, especially the United States. These inflows exacerbated the U.S. current account deficit and were also a factor pushing U.S. and global longer-term interest rates below levels suggested by expected short-term rates and other macroeconomic fundamentals.

My earlier comments on the global saving glut hypothesis focused on the sources of the capital inflows to the United States and their effects on global longer-term interest rates and the U.S. current account, without attention to the composition of those flows. My paper for the Banque de France Financial Stability Review extends the basic global saving glut hypothesis to consider the portfolio preferences of foreign investors in the United States and the implications of those preferences.2 Several researchers have argued that capital flows from emerging markets to advanced economies will tend to be directed to the safest and most liquid assets, of which, these researchers argue, there is a relative shortage in emerging markets.3 My paper confirms empirically that the global saving glut countries–principally, some emerging Asian economies and Middle Eastern oil exporters–did indeed evince a strong preference for very safe and liquid U.S. assets in the middle of the past decade, especially Treasury and agency securities.

Although a large share of the net capital inflows to the United States came from emerging markets, substantial gross capital inflows were received from the advanced economies as well. An additional contribution of the paper is to examine the portfolio preferences of these advanced economy, especially European, investors. The paper finds that, like the global saving glut countries, European investors placed a high value on safety and liquidity in their U.S. investments; however, relative to purchases by emerging markets, those of European investors encompassed a broader range of U.S. securities, including sizable amounts of private-label mortgage-backed securities (MBS) as well as other highly rated asset-backed securities. Unlike the global saving glut countries, which funded their acquisitions of U.S. assets through their current account surpluses, Europe on net had a roughly balanced current account and thus issued liabilities to fund acquisitions of U.S. assets. However, as these liabilities were tilted toward more traditional securities, including sovereign debt, as well as bank deposits, the result here too was a net increase in the global demand for highly rated U.S. assets.

The preferences of foreign investors for highly rated U.S. assets, together with similar preferences by many domestic investors, had a number of implications, including for the relative yields on such assets. Importantly, though, the preference by so many investors for perceived safety created strong incentives for U.S. financial engineers to develop investment products that “transformed” risky loans into highly rated securities. Remarkably, even though a large share of new U.S. mortgages during the housing boom were of weak credit quality, financial engineering resulted in the overwhelming share of private-label mortgage-related securities being rated AAA. The underlying contradiction was, of course, ultimately exposed, at great cost to financial stability and the global economy.

To be clear, these findings are not to be read as assigning responsibility for the breakdown in U.S. financial intermediation to factors outside the United States. Instead, in analogy to the Asian crisis, the primary cause of the breakdown was the poor performance of the financial system and financial regulation in the country receiving the capital inflows, not the inflows themselves. In the case of the United States, sources of poor performance included misaligned incentives in mortgage origination, underwriting, and securitization; risk-management deficiencies among financial institutions; conflicts of interest at credit rating agencies; weaknesses in the capitalization and incentive structures of the government-sponsored enterprises; gaps and weaknesses in the financial regulatory structure; and supervisory failures.4 In reflecting on this experience, I have gained increased appreciation for the challenges faced by policymakers in emerging market economies who have had to manage large and sometimes volatile capital inflows for the past several decades.

The global financial crisis is receding, but capital flows are once again posing some notable challenges for international macroeconomic and financial stability. These capital flows reflect in part the continued two-speed nature of the global recovery, as economic growth in the emerging markets is far outstripping growth in the advanced economies.5

In light of the relatively muted recoveries to date in the advanced economies, the central banks of those economies have generally continued accommodative monetary policies. Some observers, while acknowledging that an aborted recovery in the advanced economies would be highly detrimental to the emerging market economies, have nevertheless argued that these monetary policies are generating negative spillovers. In particular, concerns have centered on the strength of private capital flows to many emerging market economies, which, depending on their policy responses, could put upward pressure on their currencies, boost their inflation rates, or lead to asset price bubbles.

Although policymakers in the emerging markets clearly face important challenges, such concerns should be put into perspective. First, these capital flows have been driven by many factors, including expectations of more-rapid growth and thus higher investment returns in the emerging market economies than in the advanced economies. Indeed, recent data suggest that the aggregate flows to emerging markets are not out of line with longer-term trends. Second, as I noted earlier, emerging market economies have a strong interest in a continued economic recovery in the advanced economies, which accommodative monetary policies in the advanced economies are intended to promote. Third, policymakers in the emerging markets have a range of powerful–although admittedly imperfect–tools that they can use to manage their economies and prevent overheating, including exchange rate adjustment, monetary and fiscal policies, and macroprudential measures. Finally, it should be borne in mind that spillovers can go both ways. For example, resurgent demand in the emerging markets has contributed significantly to the sharp recent run-up in global commodity prices. More generally, the maintenance of undervalued currencies by some countries has contributed to a pattern of global spending that is unbalanced and unsustainable. Such imbalances include those not only between emerging markets and advanced economies, but also among the emerging market economies themselves, as those countries that have allowed their exchange rates to be determined primarily by market forces have seen their competitiveness erode relative to countries that have intervened more aggressively in foreign exchange markets.

Our collective challenge is to reshape the international monetary system to foster strong, sustainable growth and improve economic outcomes for all nations. Working together, we need to clarify and strengthen the rules of the game, with an eye toward creating an international system that more effectively supports the simultaneous pursuit of internal and external balance.

To achieve a more balanced international system over time, countries with excessive and unsustainable trade surpluses will need to allow their exchange rates to better reflect market fundamentals and increase their efforts to substitute domestic demand for exports. At the same time, countries with large, persistent trade deficits must find ways to increase national saving, including putting fiscal policies on a more sustainable trajectory. In addition, to bolster our individual and collective ability to manage and productively invest capital inflows, we must continue to increase the efficiency, transparency, and resiliency of our national financial systems and to strengthen financial regulation and oversight.

None of these changes will be easy or immediate. To help us achieve them, we must continue to strengthen our mechanisms for international cooperation, including in the Basel Committee, the Financial Stability Board, and the Group of Twenty Mutual Assessment Process, and work together to enhance surveillance by the International Monetary Fund.

I am pleased that our French hosts are focusing the work of the Group of Twenty on these challenging, but crucially important, issues. I am hopeful that we will make substantive progress on them in the year ahead–an outcome that will strengthen the global economy and benefit all countries.

Continue reading this article >>

Etichette:

articles,

Economy article,

Finance article,

Geopolitical,

market articles

Commodity and Financial Markets Cycles Analysis

By: readtheticker

Hugh Hendry of Eclectica Asset Management and Gary Shilling of A Gary Shilling Company are bearish on China, and the world. We must pay respect to both of these market players as they have had an abundance of correct market calls in the past. Their opinions are contrarian, so for trends to change, major cycles must be ready to roll over. Lets review a few...

First, how can market cycles roll over in a world undergoing massive quantitative easing (QE1 and QE2)? Is it possible that the US Federal Reserve as tamed the market so that there is no more pullbacks, swings or cycles. The US has experienced 'the before/during' quantitative easing (QE = money printing), and has yet undergo the 'after'. A quick review of the 'before' and 'after' effects on the N225 from quantitative easing during Japanese great deflationary bust shows that the 'after' can be very unpleasant.

N225 Chart

N225 Chart

We can see the N225 rallied hard during each of the Japanese quantitative easing (QE) periods. However when QE ended so did the rallies. The American QE programs have been back to back (2009 and 2010), unlike the Japanese experience. One can only imagine what will happen to the worlds financial markets when the American QE ends, if it is anything like the Japanese experience then I fear that the cycles rolling over will be very severe. Copper, Australian and Canadian dollar have all enjoyed strong bullish cycles. They will be our subjects.

The Australian Dollar and Copper are two securities that are aligned to China success story. Copper has been used heavily within Chinese construction industry, and Australia has supplied much of it to them, along with steel, coal, etc. Any hick up with China's story and these two securities will roll over hard. China cannot sustain 10% GDP growth without exports to both Europe and USA. Yet the America and Europe economies have lived off QE to support their GDP growth. What if the QE stops or paused for a few years, what then. If growth cant be maintained without QE, what will happen to the Australian, Canadian dollar and copper cycles, that is easy they will roll over hard !

We all now that the rise and fall of the US dollar as much to do with the cycles below, markets are very correlated. Comments on the US dollar can be found here: US Dollar currency, short term bullish, long term bearish not so sure

NOTE: The cycles found the charts that follow were found with RTT Cycle Finder Spectrum.

Australian Dollar (AUDUSD)

Copper in US Dollars

Canadian Dollar

For the world to avoid these cycles rolling over during 2011/12 quantitative easing would need to be continuous. Its too early to say how or when stimulus Keynesian polices will end, I fear that they never will. As the politicians and central bankers have enjoyed this economic power, and power does corrupt.

Diverging Crude Oil Prices WTI $12 Cheaper than Brent, Anybody Got A Big Rig?

By: Dian_L_Chu

On Wednesday, Feb. 16 Israel said Iran is sending two warships into the Suez Canal on way to Syria, and that the action is considered a “provocation.” Due to the long history of bad blood between Israel and Iran, this very possible scenario was enough to even send the bear-infested NYMEX crude oil futures volume surging midday.

West Texas Intermediate (WTI) on Nymex rose to just below $85, while Brent crude on the ICE futures exchange spiked $2.17 higher to $103.81 a barrel--a 29-month high--widening the WTI-Brent spread to a new record near $19.

High Middle East Tension

Then on Friday, Feb. 18, AFP reported that permission has been granted for Iranian warships to transit the Suez Canal into the Mediterranean. Canal officials say it would be the first time Iranian warships have made the passage since the 1979 Islamic revolution, while Israel has labeled the Iranian action as "hostile' and said Israel was closely monitoring the situation.

As the worst Israel-Iran conflict scenario failed to materialize, at the close Friday Feb. 18, Brent crude oil for April settled at $102.79 while WTI for April delivery rose to $89.71, narrowing the spread to $13.11.

Crude Glut at Cushing, OK

Since WTI is lighter and sweeter crude which requires less processing, it has historically enjoyed a $1 – $2 a barrel price premium to Brent crude oil. According to Bloomberg, the WTI-Brent gap averaged only 76 cents last year.

However, WTI’s premium disappeared about a year ago and in recent days it has been trading at more than a $10/bbl discount to Brent mainly due to rising inventory levels at Cushing OK, the delivery and price settling point of Nymex crude futures (See Chart).

Then on Friday, Feb. 18, AFP reported that permission has been granted for Iranian warships to transit the Suez Canal into the Mediterranean. Canal officials say it would be the first time Iranian warships have made the passage since the 1979 Islamic revolution, while Israel has labeled the Iranian action as "hostile' and said Israel was closely monitoring the situation.

As the worst Israel-Iran conflict scenario failed to materialize, at the close Friday Feb. 18, Brent crude oil for April settled at $102.79 while WTI for April delivery rose to $89.71, narrowing the spread to $13.11.

Crude Glut at Cushing, OK

Since WTI is lighter and sweeter crude which requires less processing, it has historically enjoyed a $1 – $2 a barrel price premium to Brent crude oil. According to Bloomberg, the WTI-Brent gap averaged only 76 cents last year.

However, WTI’s premium disappeared about a year ago and in recent days it has been trading at more than a $10/bbl discount to Brent mainly due to rising inventory levels at Cushing OK, the delivery and price settling point of Nymex crude futures (See Chart).

Source: Bianco Research via The Absurd Report

WTI Undervalued by $12

Energy research and consultancy firm John S. Herold noted that from a historical point of view, the Brent premium was often short-lived. Since the U.S. economy is growing more rapidly than those of most European countries, Herold believes WTI may be undervalued by $12 per barrel as compared to Brent.

WTI Premium May Never Return

Meanwhile, Deutsche Bank thinks the historical WTI premium to Brent may never return and that Brent premium seems to have shifted to a level of $2 to $3 a barrel from the typical historical discount of $1 to $2 a barrel.

For now, between the two oil markers, Brent seems to have the pricing momentum since it is undersupplied, and more likely to be jolted by the geopolitical unrest in MENA (Middle East and North Africa) due to Europe’s close proximity to the region, and the end markets Brent serves.

Cushing Logistic Fix by 2014

The problem with Cushing is that The U.S. oil infrastructure is built around the country being an oil importer with pipelines mostly flowing from the coast to inland.

Many analysts don’t see infrastructure could improve at Cushing any time soon to move crude to the coast and world markets, while oil production from Canada and U.S. oil shales like the Bakken play in N. Dakota are set to rise adding to the glut.

Credit Suisse, for example, sees it will most likely be 2013 or 2014 before the pipeline infrastructure could improve the situation at Cushing.

Beneficiaries - Gulf Coast Crudes

When Brent is higher than WTI, it also drives up the price of low-sulfur U.S. grades that compete with international oils priced against Brent. The recent spike in Brent has sent the premiums for the Gulf Coast Grades--Light Louisiana Sweet (LLS) and Heavy Louisiana Sweet (HLS) crudes--to the highest levels (above $20) against WTI since at least 1991.

Among producers, the largest beneficiaries of this Brent premium include Canada's Nexen Inc. (NXY) and Talisman Energy Inc. (TLM), and U.S.-based Apache Corp. (APA).

Product Prices Trend With Brent

Meanwhile, with the growing disassociation of the WTI to global markets, the domestic petroleum product prices, particularly distillates, have pretty much ignored WTI and are trending more with Brent. The chart below illustrates this trend where United States Brent Oil Fund (BNO), an ETF, was used as a proximate for ICE Brent.

Meanwhile, Deutsche Bank thinks the historical WTI premium to Brent may never return and that Brent premium seems to have shifted to a level of $2 to $3 a barrel from the typical historical discount of $1 to $2 a barrel.

For now, between the two oil markers, Brent seems to have the pricing momentum since it is undersupplied, and more likely to be jolted by the geopolitical unrest in MENA (Middle East and North Africa) due to Europe’s close proximity to the region, and the end markets Brent serves.

Cushing Logistic Fix by 2014

The problem with Cushing is that The U.S. oil infrastructure is built around the country being an oil importer with pipelines mostly flowing from the coast to inland.

Many analysts don’t see infrastructure could improve at Cushing any time soon to move crude to the coast and world markets, while oil production from Canada and U.S. oil shales like the Bakken play in N. Dakota are set to rise adding to the glut.

Credit Suisse, for example, sees it will most likely be 2013 or 2014 before the pipeline infrastructure could improve the situation at Cushing.

Beneficiaries - Gulf Coast Crudes

When Brent is higher than WTI, it also drives up the price of low-sulfur U.S. grades that compete with international oils priced against Brent. The recent spike in Brent has sent the premiums for the Gulf Coast Grades--Light Louisiana Sweet (LLS) and Heavy Louisiana Sweet (HLS) crudes--to the highest levels (above $20) against WTI since at least 1991.

Among producers, the largest beneficiaries of this Brent premium include Canada's Nexen Inc. (NXY) and Talisman Energy Inc. (TLM), and U.S.-based Apache Corp. (APA).

Product Prices Trend With Brent

Meanwhile, with the growing disassociation of the WTI to global markets, the domestic petroleum product prices, particularly distillates, have pretty much ignored WTI and are trending more with Brent. The chart below illustrates this trend where United States Brent Oil Fund (BNO), an ETF, was used as a proximate for ICE Brent.

Beneficiaries - Midwest Refiners

Inland crude in the U.S. is getting cheaper, while petroleum product prices are trending with the higher-priced Brent. Theoretically, this means higher crack spread for refiners, but not all U.S. refineries can get crude at the low WTI benchmark price. WSJ quoted Valero (VLO) that logistical restraints at Cushing have limited Valero to only about 300,000 barrels of WTI a day.

Inland crude in the U.S. is getting cheaper, while petroleum product prices are trending with the higher-priced Brent. Theoretically, this means higher crack spread for refiners, but not all U.S. refineries can get crude at the low WTI benchmark price. WSJ quoted Valero (VLO) that logistical restraints at Cushing have limited Valero to only about 300,000 barrels of WTI a day.

So, only a few Midwest refiners (PADD 2, where Cushing is) with access to Cushing are able to take advantage of this WTI pricing anomaly. Delek US Holdings Inc. (DK), Frontier Oil (FTO), Holly Corp. (HOC), Western Refining (WNR) and Valero (VLO) are among the lucky ones that could see higher earnings in coming quarters.

Anybody Got A Big Rig?

Bloomberg quoted Raymond James that producers can ship crude via rail to the Gulf Coast for about $4 to $6 a barrel and by truck for between $8 and $10 a barrel. Many market players reportedly are using rail and truck shipments to move the glut out of the Cushing to the Gulf Coast where the same barrel of oil would trade at much higher in recent days (see chart below).

Bloomberg quoted Raymond James that producers can ship crude via rail to the Gulf Coast for about $4 to $6 a barrel and by truck for between $8 and $10 a barrel. Many market players reportedly are using rail and truck shipments to move the glut out of the Cushing to the Gulf Coast where the same barrel of oil would trade at much higher in recent days (see chart below).

However, the economics of these alternative transportation modes--trucks in particular--would only work if the spreads stay elevated at the current levels. According to Bloomberg, the WTI-Brent spread between the June contracts already dropped to $9.41 from $11.35 on Feb. 16. And capacity limit of these alternative transports will be another factor.

ConocoPhillips already said it isn’t interested in reversing the Seaway pipeline that brings crude from the U.S. Gulf Coast to Cushing, Ok. So, with Cushing storage near 39 million barrels, barging, rail, trucking, and possibly some pipelines reverse flows may help ease the bottleneck at Cushing and narrow the WTI-Brent spread, but they are unlikely to significantly improve the WTI predicament in the next 18 months or so.

Continue reading this article >>

ConocoPhillips already said it isn’t interested in reversing the Seaway pipeline that brings crude from the U.S. Gulf Coast to Cushing, Ok. So, with Cushing storage near 39 million barrels, barging, rail, trucking, and possibly some pipelines reverse flows may help ease the bottleneck at Cushing and narrow the WTI-Brent spread, but they are unlikely to significantly improve the WTI predicament in the next 18 months or so.

THE RARE 100% IN 100 WEEKS RALLY

by Cullen Roche

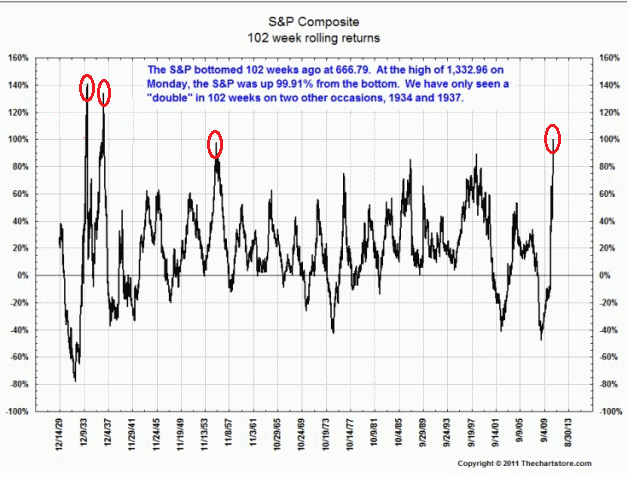

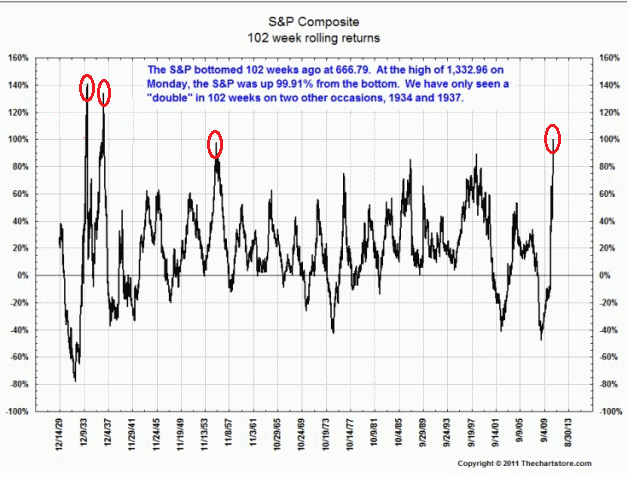

The current market rally of 100% in 102 weeks is highly unusual. How unusual? We’ve only experienced this kind of market performance 3 times in the last 80 years. This chart from The Chartstore shows just how unusual a rally of this magnitude is:

But who cares what the market has done. We want to know where the market is going. Although the sample size is poor it’s useful to gain some perspective from the past.

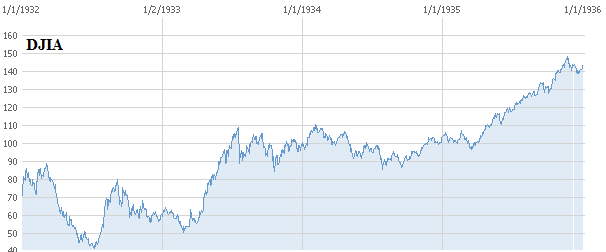

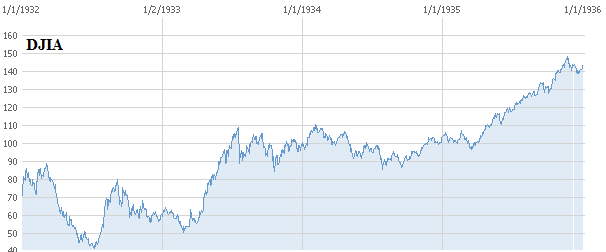

The 1932-34 rally took the market higher by 140% in one year. Although the market ultimately powered higher in 1935 the 34 market was largely sideways to down.

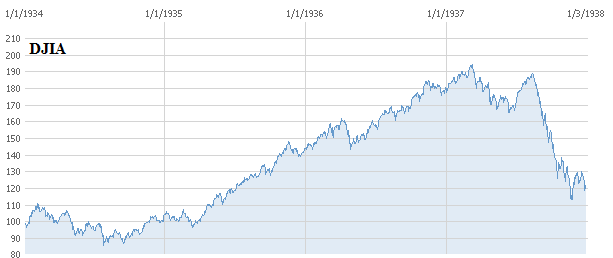

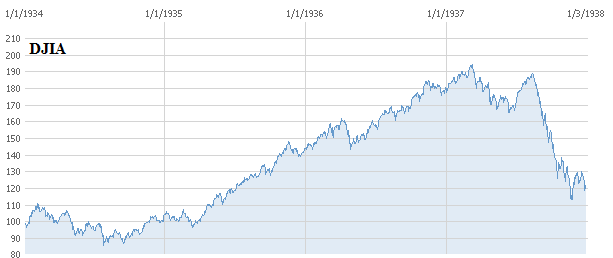

After the breather in 1934 the market continued its climb. Between 1934 and 1937 the market more than doubled again. Ultimately, the gains were given back as 1937 proved to be a disastrous year for the market. Equities traded sideways for the next 6 years.

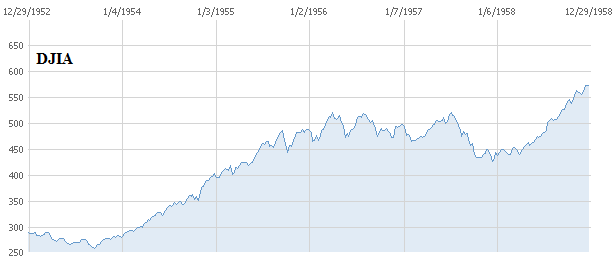

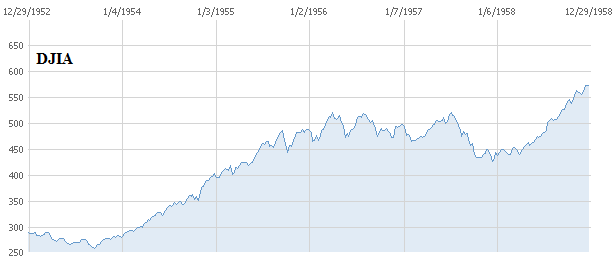

The 1952-1956 rally was similar to the 34 rally. The market powered higher in a near straight line over the course of a 95% rally. The market then hit a wall for two years before correcting 15% from its peak and then continuing its bull run. The 50′s ultimately proved to be a stellar year for equities.

The question the reader must then decipher is whether we are in the 50′s or the 30′s? While one was a disaster the other proved to be one of the great decades in investing history….

Etichette:

Analysis Technic,

analysis technic article,

articles,

Index,

market articles

Gold Uptrend Lacks Enthusiasm

By: Merv_Burak

Well, it was up, up all week long for gold. However, there seemed not to be any enthusiasm behind the move and trends do not last long without enthusiasm. Maybe it will enter this coming week.

GOLD : LONG TERM

Over the past few weeks I had mentioned that my long term P&F chart gave a bear signal BUT that there was still one more support level on the chart that needed to be breached for that bear signal to have meaning. Well, as we have seen, that support has held and we have been in a rally for the past three weeks. The big question now is, is this only a rally or are we in for a new bull move? I’m not very good at predicting the future. It’s enough effort just to understand where we are right now least of all where we will be next week or month. So, where are we right now?

From a long term perspective, although it does appear as if gold has been in a several month topping and turning mode it remains above its positive sloping moving average line. The long term momentum indicator has been moving lower and lower since October but is in one of its upward turns. It is still in its positive zone and now above its long term trigger line. The trigger line has also turned upwards which is a very positive sign. The volume indicator has been moving sideways since December and is very close to breaching into new high ground. During this sideways period its trigger line has moved right up to the indicator and has flattened out but still is in a very, very slight up slope. Everything is still looking okay for the long term. The rating remains BULLISH.

INTERMEDIATE TERM

The intermediate term perspective is also okay. Gold has crossed above its intermediate term moving average line during the week and the line itself has turned to the up side. The intermediate term momentum indicator was in its negative zone for a few days but has once again crossed into its positive zone. It is also above its positive sloping trigger line. The volume indicator is slightly positive and above is positive trigger line. All in all the intermediate term rating remains BULLISH. This rating is confirmed by the short term moving average line crossing above the intermediate term line.

There are many, many technical indicators one can look at to assess where we are but these simple indicators tell us the trend, strength of the trend and interest by speculators in the trend. What more do we need? We wouldn’t be right all the time but I hope we are right most of the time. More importantly, we should not be wrong for any length of time to cause major financial losses. We do not blindly hold as the trend goes against us. That is the sign of an amateur.

SHORT TERM

The short term has been great for the past few weeks but could be coming to an end. We are inside an upward trending wedge pattern. These patterns unfortunately are most likely to be broken on the down side. The strongest move would come when the price is two thirds along its way towards its apex point. As it continues closer and closer to the apex the strength of any break becomes less and less. So, we are not yet at the strongest location should the price break below the lower support line. That would still take a couple more weeks of steady up trend within the confines of the wedge. From here, that does not look probable, so, we should get a break soon but not one that is of any great strength (or longevity).

For now the short term position of gold remains basically positive. Gold has been above its short term moving average line for over two weeks and remains above. Its moving average line remains sloping in an upward direction. As for its short term momentum indicator, well that is comfortably in its positive zone and above its positive trigger line. Only the daily volume action leaves a lot to be desired. During its entire few weeks of price rally the daily volume has remained relatively low. It had remained below its 15 day average value throughout the advance. This does not bode well for longevity of the rally. However, despite the poor volume showing the short term rating remains BULLISH with the very short term moving average line confirming by remaining above the short term line.

With events as volatile as they are in global politics I wouldn’t even try to guess the immediate direction for gold. The direction of least resistance, however, seems to be getting closer and closer to the down side. The Stochastic Oscillator remains in its overbought zone and can’t stay there for much longer. The next turn to the down side by the SO should also see gold turn lower.

SILVER

Silver continues to put in a great performance versus gold. This past week gold advanced by 2.1% while silver advanced 7.7%, almost 4 times the weekly performance. The chart shows that silver has entered new bull market highs and is heading towards its all time high in the low $40s way back in January of 1980. Depending upon the chart one uses the all time high in silver was about $41.50.

A few weeks back silver gave a P&F bear signal, however, I had mentioned a support just below the break that needed to be breached before really going bearish. That support held and silver quickly moved higher. We need to go back to the P&F chart of 17 Dec 2010 where I still had projections to $32.50 and $34.00 that were not met at that time. Well, the recent sharp rally has met the $32.50 projection. Now, on to $34.00. However, with the latest move a new projection can be calculated, to the $42.00 level, just $0.50 above silver’s all time high. One thing all these projections seem to say is that there is still more upside potential for silver.

Without going into details, one can guess that the ratings for silver in all three time periods is BULLISH.

For a cautionary note it is interesting that silver price is now butting up against the previous support up trend line, which can now be considered as a resistance line. Couple this along with weakness in both the momentum and volume indicators and we have the prospect of a reaction very soon. I would suspect that any reaction off that resistance line would not stop at the very narrow up trending channel lower support but break below it also. Just something to be aware of.

PRECIOUS METAL STOCKS

All precious metal stock indices had a good week, some better than others. The silver stocks were, of course, the better weekly performers as is noted by the Indices that have silver stocks as their major components. Although the Indices had a good week ONLY the Merv’s Penny Arcade Index made it into new all time high territory. Go pennies GO. This is one of my best indicators that the major long term bull market in precious metal stocks is not yet over and still has more to go. During the last bull market top when the major Indices (and gold and silver stocks) topped out in early 2008 this Penny Arcade Index topped out a year before the majors. I don’t expect the same year’s notice but I do expect that the pennies will top out before the universe of precious metal stocks top out and therefore we should have this advance warning.

The Penny Arcade IS weakening as far as the momentum (strength) of the recent move is concerned. Although the Index has made new highs the momentum indicator is still below its previous recent high. This is not yet a serious concern as the indicator is very strong, above the 80% level so a slight weakness is not a big deal, but it is so far a weakness in the latest move. Something to watch.

Merv’s Precious Metals Indices Table

It should be noted that the Index values for the FTSE Indices are for the period Thursday to Thursday. For some reason my data vendor does not provide the most recent data for these Indices. I would welcome suggestions for obtaining same day Indices values for the FTSE gold Indices.

Subscribe to:

Comments (Atom)