by Lance Roberts

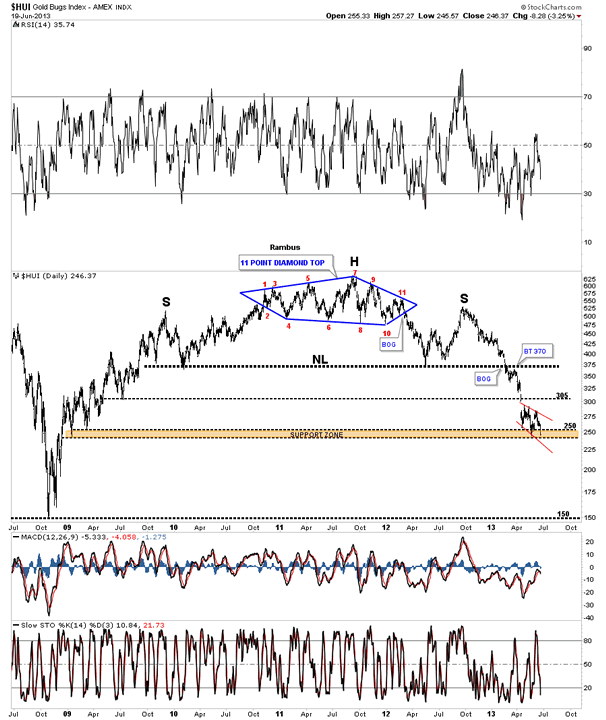

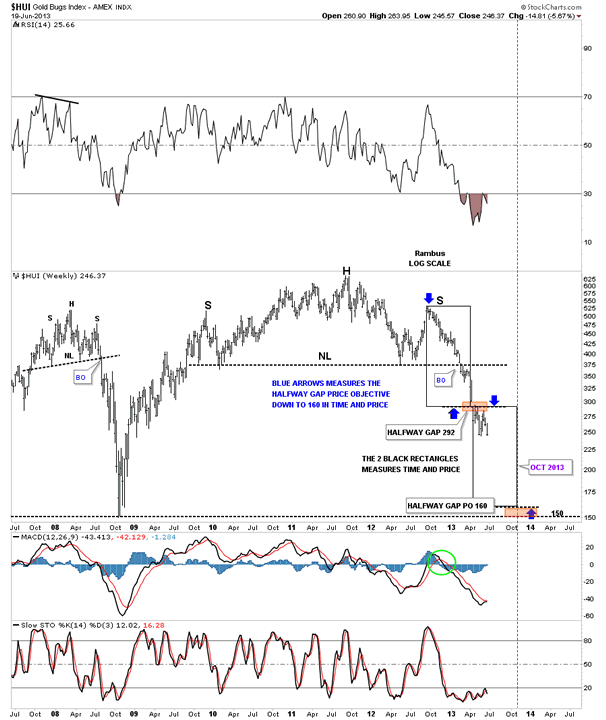

We discussed in last weekend's newsletter that this week would likely lead to a market "sell signal". With the sell off in the markets today the market has not only thrown off a weekly sell signal (denoted by the vertical blue lines) but also violated support at 1600 as shown in the chart below. For a complete explanation of the chart below please review last weekend's newsletter which details all the different indicators in detail.

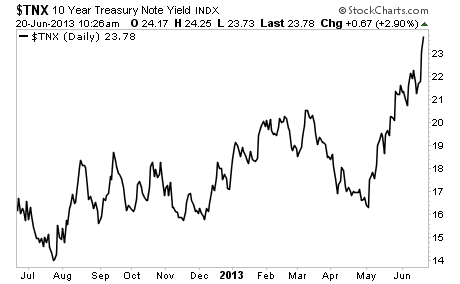

While much of the sell off has been attributed to the Federal Reserves statement yesterday I fear that the real culprit is likely a potential resurgence in the Euro zone crisis as witnessed by spiking yields across the region and an announcement today that the IMF is likely to cease funding aid to Greece. From Zero Hedge:

"As we warned earlier in the week, Greece is notably missing its Troika goals and the issue just became a lot more critical. As The FT reports, the IMF is preparing to suspend aid payments to Greece over what it claims is a EUR 3-4 billion shortfall that has opened up. Between health care budget shortfalls, central banks refusing to roll-over Greek bonds, and amid signs that even the scaled-back privatization plans that Athens had agreed to being behind schedule, the IMF - following its own admissions of mistakes in the Greek bailout, has warned EU officials the shortfall will require it to stop aid payments by the end of July. The equity market is already reacting (as is EURJPY - EUR weakness against the big carry pair) to this re-awakening of EU event risk (and the awkward timing with Merkel's election so close) - with the Fed's comfort blanket somewhat removed."

As I stated in last weekend's newsletter this initial "Sell Signal" is a warning that a further correction is likely to come. This is a wake up call to pay attention to your portfolio. However, this is not a signal to "panic sell" and make emotional based investment mistakes. In this regard here are the actions that should be taken within portfolios.

1) Review all holdings in the portfolio fundamentally to determine if anything has changed within the fundamental storyline.

2) Review each positions weight relative to the portfolio. Assume that each position in a portfolio was 5%. Trim back positions that are now greater than 5% back to portfolio weight. (It is not uncommon that when a warning is issued that the market will continue to rise – therefore, we only want to trim profits currently and sell positions on bounces if trends become broken.)

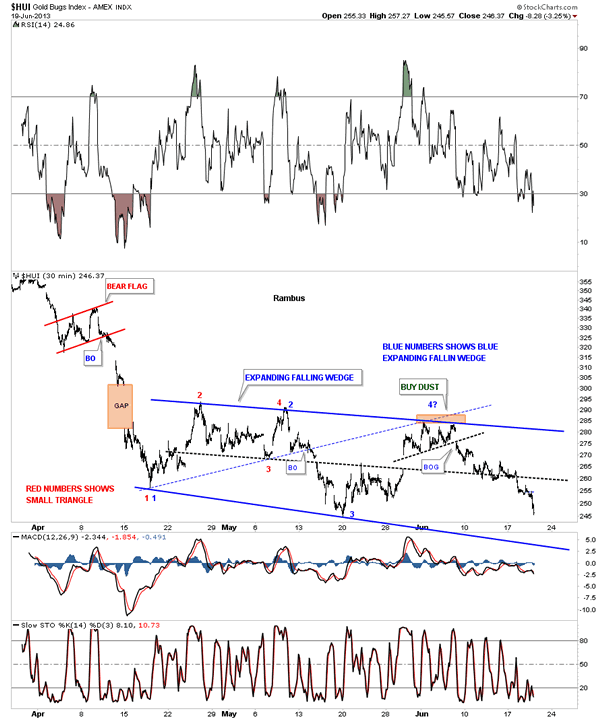

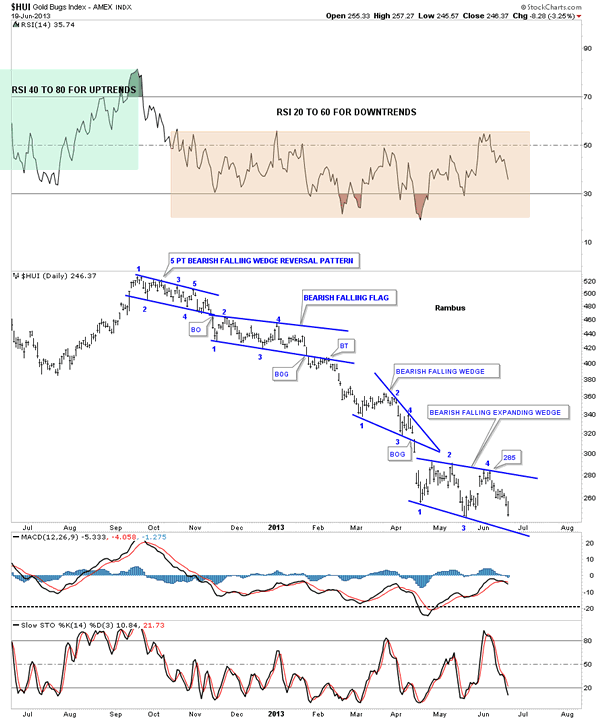

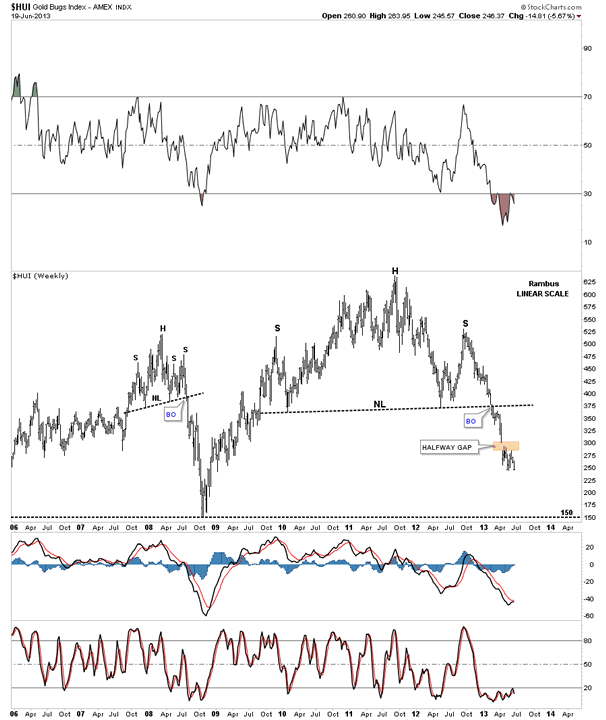

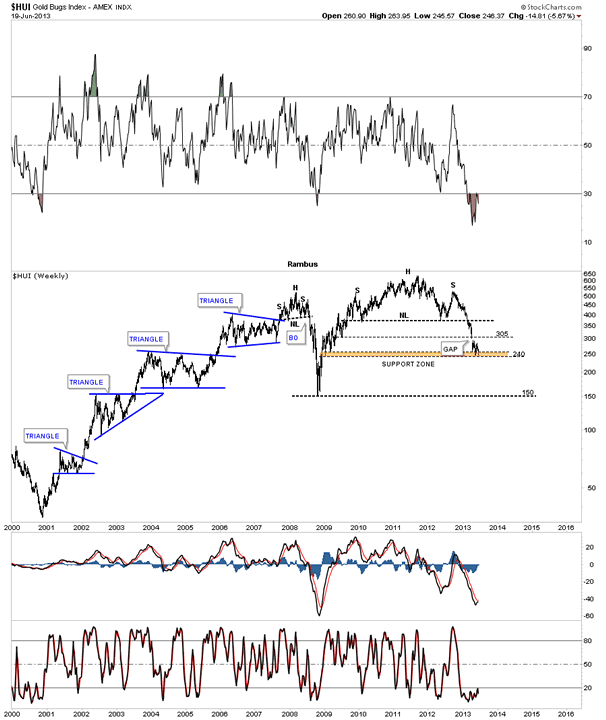

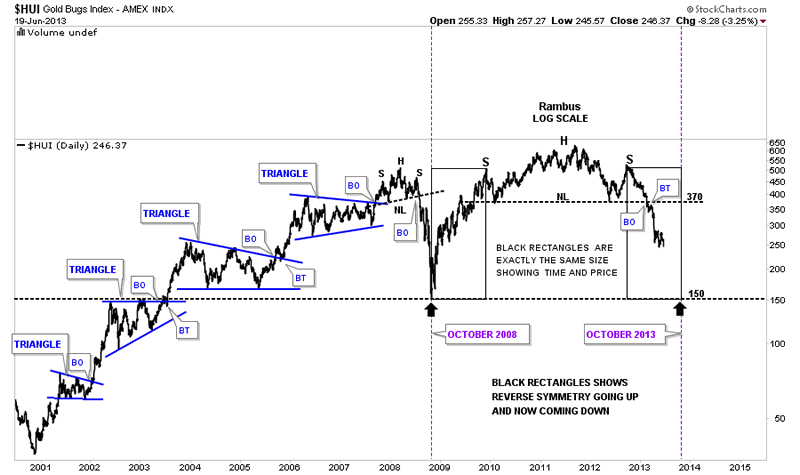

3) Positions that are fundamentally broken, lagging or otherwise not performing should be sold in their entirety UNLESS they are a hedge against a correction. Positions that are lagging during a market rally tend to lead on a market decline. (This includes gold, gold miners, precious metals, etc.)

4) Do not sell winners to buy losers. Hold cash as a hedge against the coming correction. Notice that all warnings above are eventually followed by a sell signal and a market correction.

Notice that in the chart above the SELL Signals in the bottom most MACD indicator ALWAYS align with the signals of the other indicators. When all of these signals align it is always in conjunction with a more significant market correction. Currently, the indicators are issuing a very strong "warning" and it is likely that within the next couple of weeks we will see a deeper correction occur.

With support at 1600 now removed it is likely that we could see a retracement to the longer term moving average (red dashed line) above which is currently at 1525. A violation of that level and we have a whole new ball game to deal with.

NOTE: I am not advocating market TIMING – which is trying to be either "all in" or "all out" of the market. This is not a winning strategy. However, I am advocating using price analysis to determine optimal times to manage portfolio risk by increasing or decreasing exposure to equities. Furthermore, as opposed to the mainstream media that tells you that you should "buy and hold," the whole premise of investing is to "buy low" and "sell high." How can you do that if you don't know where "high" and "low" exist?")

It is important to remember that if you think that every position you buy is going to be a winner, or you expect your advisor to only buy winners, then you should NOT BE INVESTING. It is an unrealistic expectation that will lead to larger losses than you can imagine. Having a loser in your portfolio is just a reality of investing – it does not mean you, or your advisor, is loser for making a mistake. There is NO PROFESSIONAL INVESTOR on the planet that doesn't have losers more often than not. It is how you deal with them that matters. Limit the loss, correct the problem and move on.

This is why the greatest investors in history all have the same investing rule in one form or another: "Cut your losers short and let your winners run."

It seems simple – but it is an extremely tough rule to follow.

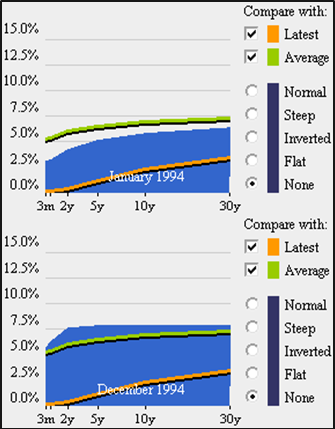

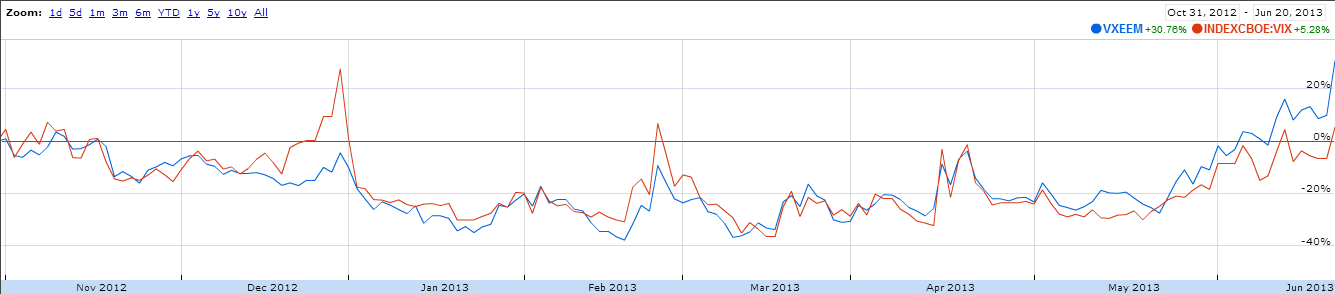

Be sure and subscribe to the email list (it's free and only for email deleivery of the newsletter notification) and I will update the market analysis this weekend along with a sector review and rebalancing suggestions.