by Kimble Charting Solutions

Saturday, July 16, 2011

The Week Ahead: Are Hedge Fund Investors Bailing Out?

It’s possible that big-time redemptions caused several would-be rallies last week to sputter and die. A short-term rally remains likely, but if the sell-offs continue, June’s lows could be tested, writes MoneyShow.com senior editor Tom Aspray.

It was clearly a rough week for stocks. Despite historic oversold readings after last Monday’s selling, rally attempts have been feeble. Typically, such an oversold market would stage a decent one- or two-day rally, but it never came last week.

Selling by hedge funds could be keeping the market lower…as several days last week, stocks opened strong only for the rally to fizzle quickly. June saw the highest level of hedge-fund redemptions since October 2009, and I doubt things have gotten better in July, as most apparently missed the rally.

For the year, the HFN Hedge Fund Aggregate Index is up just 0.63%, against over 6% for the S&P Total Return Index. Therefore one can see why hedge-fund investors may be looking elsewhere: If the hedge funds are selling in order to meet redemption requests, it could explain the recent action.

Obviously, the stock market and economy had enough barriers to overcome last week without the hedge funds. Early last week, concerns over Italy’s debt surfaced, and of course the ongoing stalemate over the debt ceiling has many worried.

Adding to the volatility were hopes of QE3 after Fed Chairman Ben Bernanke’s testimony. He clarified his comments on Thursday, and stocks quickly sold off.

Click to Enlarge

From a technical standpoint, the market is reaching a critical juncture. As the chart of the Spyder Trust (SPY) indicates, the 50% support level at $130.95 was violated Thursday. This makes the 61.8% level at $129.85 more important.

The McClellan oscillator is an advance/decline indicator that measures whether the market is overbought or oversold. On July 7, it stood at +258 (overbought), but closed Friday at -36.

It is trying to turn up, and is now oversold enough to fuel a rally. One is likely by mid-week.

Gold broke out of its recent trading range in impressive fashion, and looks ready to go even higher. Crude oil also finished the week on a strong note, and overall the firming in the commodity markets suggested to me that the commodity markets had turned the corner.

Most of the economic data last week was better than the horrible job numbers, but not good enough to get anyone excited. The inflation numbers reflected the lower crude-oil prices, retail sales were just barely positive, and consumer sentiment was the weakest in over two years.

This week, the focus will be on earnings reports, as the economic calendar is light. So far earnings have been better than expected, but this has not helped the market.

On Tuesday, we have housing starts, followed by existing home sales on Wednesday. Then on Thursday, in addition to the weekly jobless claims, we get the Philadelphia Fed survey.

WHAT TO WATCH

The sentiment picture reflects that both individual investors and financial newsletter writers are still positive on the market. There has been little change over the past two weeks.

Of course, this must be viewed from a contrarian standpoint, as it could reflect a level of complacency that is negative for the market. An increase in bearishness would be more positive.

Last time, I was looking for a six- to seven-day correction, like we saw in April. Friday marked six days since the high. Clearly, the action early this week will be important

Click to Enlarge

S&P 500

The key support level for the Spyder Trust (SPY) is now $129.80. From a technical standpoint, a daily close below this level will indicate a drop back to the $125 to $127 area.

A close back above the $133 level is needed to signal that the correction is over, while a failed rally to this level would be negative.

As noted last week, the S&P 500 A/D line did make convincing new highs on July 7. It is still above its uptrend from the June lows. A break of this uptrend will indicate a drop back to the June lows.

Dow Industrials

The Diamonds Trust (DIA) has held up much better than the SPY, as the 38.2% support level at $123.93 was only slightly violated last Friday.

The more important 50% support is at $122.83, and a close below $121.79 would be negative.

The Dow Industrials’ A/D line has just corrected back to the late June highs, which is the first good support.

It is still well above both its short-term trend (line a) and longer-term support (line b).

Nasdaq-100

The PowerShares QQQ Trust (QQQ) got a boost on Friday due to the much better than expected earnings from Google (GOOG). The tech giant alone comprises 5% of QQQ.

The 38.2% support level was broken on Thursday, and the A/D on the Nasdaq-100 closed right on its short-term uptrend (line d). It was the move above the downtrend (line c) in the A/D line in late June that signaled the recent rally.

The 50% support level for QQQ is $56.47, and this now becomes more important. A close above last Wednesday’s high of $58.34 would be the first strong sign that the uptrend had resumed.

Russell 2000

Russell 2000

The iShares Russell 2000 Trust (IWM) is also acting better than the SPY, as it is still above its 50% support level at $81.60.

The Russell 2000 A/D line also looks stronger than that of the Nasdaq-100. It was weaker than the others in April, which turned out to be a strong warning.

There is key short-term resistance now at $84.47, which needs to be overcome to signal a stronger rally in small-cap stocks.

Etichette:

Analysis Technic,

analysis technic article,

articles,

eMini SP,

Index,

market articles,

trading

The Perfect Indicator for All Markets

On-balance volume (OBV) is a proven-effective leading indicator that allows traders to spot turning points and valid signals across a wide variety of markets and time frames.

For the majority of technical analysts, volume plays an important role. Unfortunately, simply comparing one day’s volume to a three-month average will not tell you much about whether money is flowing in or out of a particular market or stock.

In the late 1970’s, my father gave me a book by Joseph Granville titled Granville’s New Strategy of Daily Stock Market Timing for Maximum Profit. A few years later, I found Granville’s on-balance volume (OBV) on Compu Trac, one of the earliest technical analysis software programs. I was quickly hooked on the OBV. From the following examples, as well as my daily Charts in Play column, I think you will see why it is my favorite indicator for all markets.

Joe developed the OBV as a way to determine whether the smart money was buying or selling. It is calculated by keeping a running total of the volume figures and then adding in the volume if the close was higher than the previous period, or subtracting the volume if the closing price was lower.

If you are doing this in a spreadsheet, such as Excel, the starting volume can be arbitrary, as it is the pattern of the OBV—not the absolute number—that is important. When viewed on a monthly or weekly basis, this can be very useful in identifying major trends.

From the start, I analyzed the OBV in the same way that I would analyze a price chart. I used trend lines, moving averages, and support/resistance analysis to determine whether the OBV was positive or negative.

Divergence analysis was always quite important, though divergences are not always observed at every important turning point. Like my early work on Welles Wilder’s Relative Strength Index (RSI), it was critical to use divergence analysis on multiple time frames in order to generate valid signals.

In May 1985, my analysis of the OBV on the major currencies was instrumental in helping me identify major bottoms in currencies like the Deutsche mark (DMK) and Swiss franc (CHF), and therefore, the top in the US dollar (USD). At the time, most of the leading economists were expecting the dollar to remain strong for a few years. The dollar had bottomed in November 1980 with the election of Ronald Reagan.

Figure 1

Click to Enlarge

In a May 21, 1985 appearance on the Financial News Network, a precursor to CNBC, I discussed a chart very similar to the one above of the Deutsche mark futures contract traded on the CME. In my early adaptation of the OBV, I had also added a 21-period weighted moving average (WMA) of the OBV, which is plotted in green.

The weekly chart shows that the DMK was in a well-established downtrend (line a) starting in 1982, as it was falling in value against the US dollar. In 1984, the decline accelerated, as it fell 25% to a low of 0.2881, or 3.47 DMK per USD. By comparison, in early 1984, it was 2.5 DMK per USD.

During this decline, the OBV rallied several times to its declining weighted moving average. Then in March 1985, the OBV moved above its weighted moving average and broke its downtrend, line c. The WMA flattened out over the next six weeks before starting to rise.

On several attempts, the OBV was unable break through resistance (line d). With the OBV now above its rising weighted moving average and with confirming bullish signals in the analysis of the CHF and British pound (GBP), it suggested these currencies had bottomed out. The daily technical studies had been positive on the currencies for several months, and this was another negative for the dollar.

The OBV overcame its resistance, line d, on July 5, 1985 (line a). One week later, the DMK also broke through its corresponding resistance, line d. This is one of the reasons I find the OBV to be such a valuable indicator, as it often leads prices by one or more periods. Obviously, this can make the risk/reward on new positions much more favorable.

The DMK tested its downtrend (line a) in August and had a sharp, three-week pullback. During this time, the OBV was much stronger, as it held well above its rising weighted moving average.

In late September, the G5 nations got together over a weekend at the Plaza Hotel in New York and agreed to devalue the dollar. As you can see on the above chart, the DMK futures gapped higher and accelerated to the upside, as there was concerted intervention to lower the dollar. By early 1988, the DMK had more than doubled.

I have found that the OBV works on any market that has good volume, and I have long advised cash forex traders to keep an eye on the currency futures, where the volume data is very reliable.

Click to Enlarge

One of the most simplistic ways to use the OBV is to see if it makes a new high with each price high in an uptrend, or makes a new low with prices in a downtrend. For the past five years or so, I have been reporting on the monthly OBV analysis of the gold futures. The arrows on the above monthly chart of gold reflect the new monthly OBV highs going back to 2003.

On the chart, you will see that each new high in the gold futures has been confirmed by a new high in the monthly OBV. The last closing monthly high in the gold futures was in April and was supported by a convincing new high in the OBV. It is also clear from the chart that the 21-period WMA has acted as a good level of support, as tests of the rising WMA have often marked correction lows.

As I referred to earlier, the OBV is the only indicator that routinely will break out ahead of prices. At the end of December 2008, the OBV closed above resistance at line c when gold closed at $884. It was not until the end of February that the gold futures overcame trend line resistance, line a, at $928.

More serious students of the OBV can also watch for when the indicator is rising or falling more sharply than prices. A good example occurred in the fall of 2010 when the OBV was rising much more sharply (see circle) than gold prices. The chart indicates that gold prices did catch up over the next few months.

If you can’t look at the monthly, weekly, and daily data, then at least look at the weekly and daily data. One of my favorite patterns to watch for is the weekly bottoming formation in terms of price and the OBV.

For 18 months, the OBV for corn was in a trading range, lines e and f. While the price chart was forming lower highs, line d, the OBV was forming higher highs (line e). This was a bullish sign.

In mid-August, corn prices closed above resistance at 412, and this was confirmed by the breakout in the OBV, point 2. For the next eight months, both corn and the OBV were moving sharply higher. The OBV tested its rising weighted moving average in the latter part of November, which presented a good buying opportunity.

Corn prices peaked in April and the new highs were confirmed by a new high in the OBV. But in June, when corn made a further new high, line g, the OBV formed a lower high, line i. The next week, the OBV dropped below its weighted moving average and corn subsequently broke support at line h.

In most cases, an eight-to ten-week divergence in the weekly OBV can lead to a multi-month correction. For corn, it will be important to see if the uptrend in the OBV (line j) does hold.

Figure 3

Click to Enlarge

The OBV is also a valuable tool when analyzing the various market sectors. The Dow Transportation Average is one that I monitor closely. The weekly OBV on the Transports confirmed the March 2009 lows before rising sharply, and by that summer, it was in a clear uptrend.

The OBV peaked in August and then developed a trading range, as indicated by the resistance at line b. The Transports had a corresponding level of resistance at 4287, line a. In late February, the OBV moved above its weighted moving average and two weeks later overcame the resistance at line b. This breakout coincided (line 1) with the close in the Transports above the resistance at line a.

The Transports rallied almost 8% before peaking at the end of April 2010. The Dow Transports consolidated for the next four months, but in the first week of September (line 2), the OBV moved to new highs when the resistance at line d was overcome. The Transports did not overcome the corresponding resistance at line c until eight weeks later, in November.

The Transports made a short-term peak in mid-February 2011 and then declined 7.9% from the highs. The OBV held up much better than prices, and just three weeks later, it made new highs (line 3) and again lead prices higher.

Both the Transports and the OBV made new highs in early May, but as the Transports made a new high the week ending July 7 (line e), the OBV formed a lower high. This may be a significant divergence and does warrant close watching. A drop below its WMA would be an additional warning sign. A violation of support at line g would indicate that an interim top was in place.

Etichette:

Analysis Technic,

analysis technic article,

articles,

trading

Stricter bank test leaves 80 billion euro hole: analyst

by Reuters

Eight small banks on Friday failed a test of how 90 European lenders would withstand a two-year recession and were told to raise 2.5 billion euros.

Twenty top banks would fail a more severe test based on the data they supplied in the official test, with lenders in Britain, France and Germany all falling short, said Kian Abouhossein, an analyst at JPMorgan, in a note on Saturday.

The official tests were criticized for not applying a haircut on sovereign bond holdings in the banking book and having too low a pass mark.

"EBA stress test II is yet again an opportunity missed for EU member states encouraging banks to raise equity as Basel 3 ratios remain low," Abouhossein said.

Europe's banks would need 41 billion euros to keep their core capital ratio above 7 percent, rather than the 5 percent pass mark used in the official test, according to Reuters calculations.

JPMorgan said the shortcomings meant the results were of limited value, although the test provided far greater data and transparency than has been available in the past, allowing analysts to run an "acid test" for 27 banks using stricter criteria including haircuts on sovereign banking book exposures and a 7 percent pass mark.

The banks tested would show an 80 billion euro capital deficit, including 25 billion euros for UK banks, 20 billion euros for French banks, 14 billion for German banks, 9 billion for Italian banks, 4 billion in Spain, 4 billion euros for Portuguese banks and 4.5 billion in Austria, Abouhossein said.

Etichette:

articles,

Economy article,

Finance article,

market articles

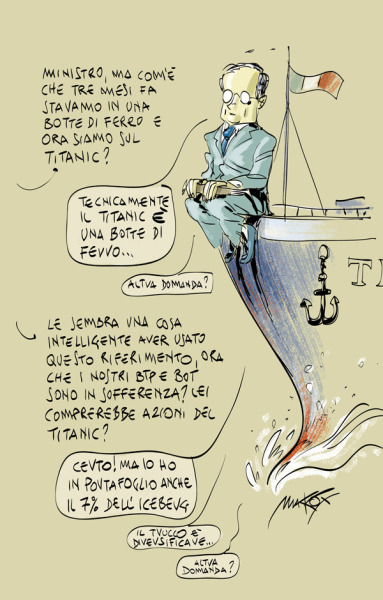

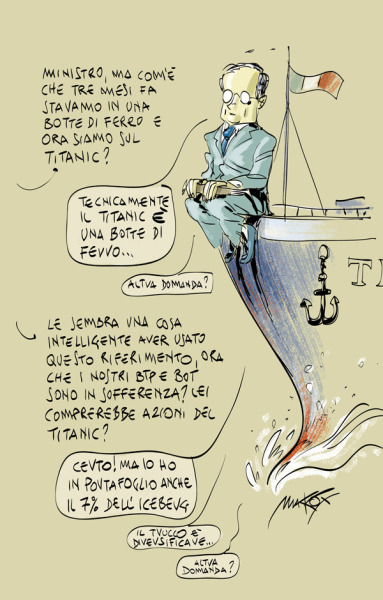

Tremonti: "We are on the Titanic ..."

vignetta di Makkox

See the original article >>

Ricordate quando Pinocchio Tvemonti invitava a spendere (i nostri soldi, non i suoi) in quanto la crisi era solo psicologica, bisognava far girare l’economia? Era il 2009, mica mille anni fa. E quando, sempre lui, il superministro che tutto il mondo ci invidia (ma sarà vero?) sosteneva che “la crisi è superata, grazie a noi, la sinistra mente”. Anche in questo caso sembra passato tantissimo tempo, ma era solo l’anno scorso. È facile dare addosso a chi non si lascia andare a facili ottimisti e resta ancorato alla realtà, facendo la parte del gufo triste, della cassandra portasfiga capace solo di preconizzare avvenimenti drammatici, luttuosi. Eppure tutti i nodi vengono al pettine, e le bugie hanno le gambe corte. Infatti lo stesso Tvemonti, ora invoca l’aiuto dell’opposizione. “Siamo sul Titanic”, dice. “Il debito ci divora”, sostiene. Ma cosa ha fatto il governo in tutti questi anni per lo sviluppo? Ben poco, a sentire l’autorevole Financial Times, secondo il quale “In un mondo ideale Silvio Berlusconi si sarebbe già dimesso”. Ma non per il bunga bunga e le barzellette idiote, bensì per la sua cronica mancanza di credibilità, “per convincere i mercati che l’Italia è affidabile”. E per farlo non basta un pacchetto di misure di austerità, servirebbero provvedimenti in grado di far crescere il nostro Paese. Che magari siano anche in sintonia con quanto democraticamente espresso dagli elettori il 12 e il 13 giugno. Quando cioè hanno detto basta alle privatizzazioni all’italiana che finora hanno portato solo svantaggi ai contribuenti (e invece la manovra dà mandato a una dismissione in tempi più rapidi del patrimonio dello Stato). Come fa a girare l’economia se tutto quello che il “genio della finanza creativa” sa inventarsi è la mancata rivalutazione di pensioni normalissime, che spesso sono utilizzate come vero e proprio ammortizzatore sociale, dato che servono a pagare gli studi ai figli, o per aiutarli a sopravvivere, data la precarietà dei loro lavori malpagati? O l’ennesimo aumento delle accise sulla benzina, che colpisce tutti i cittadini e che sicuramente non contribuisce a far girare l’economia, dato che come si sa con il carburante aumentano anche tutti i beni, dato che il trasporto più caro viene fatto ricadere sull’acquirente?

Evening markets: debate over US heat pulls grains from highs

by Agrimoney.com

See the original article >>

How hot is the Midwest going to be in a week's time?

Investors already appear to have written off next week as a poor one for US crops, notably pollinating corn, bringing uncomfortable heat to the Midwest.

"The limited rains next week will cause crop ratings on corn and soybeans to slide 1-2%," US Commodities said.

"Soil moisture shortages should expand to 40-45% of the Corn Belt."

However, the big question is what happens the week after. Further heat for a crop deprived of soil moisture would be a far bigger threat.

Hot... but for how long

And that concern waned later on Friday.

WxRisk.com said said that weather model data was "pretty clear that the overall hot pattern will come to an end around July 24 to 25."

The weather service added: "All the data shows the heat dome over the eastern us simply breaks down and the cold front which is situated over the upper Plains and the western Corn Belt will get a chance to push into the central Plains and all the Midwest."

Not that everyone was quite so convinced.

"The GFS model continues to indicate more heat and less regression of the [heat] ridge," Darrell Holaday at broker Country Futures said.

Liquidation ahead?

But the doubts were enough to bring corn back well back from intraday highs. Indeed, selling into the rally was the safe option.

"I fear a major flush-out of weak length next week if weather does not agree with every and I mean every bull," Matthew Pierce at PitGuru said.

So December corn closed at $6.85 a bushel in Chicago, a price which, while 1.0% up on the day was still well below the intraday peak of $6.96 a bushel.

The old crop September contract closed at $7.01 ¼ a bushel, below a peak of $7.11 a bushel for the day.

Back to a discount

And with corn, the market leader, giving up ground, there was little hope for other grains, especially after Russia scooped another full house, of 180,000 tonnes, after the latest Egyptian wheat tender, highlighting that US and European supplies are out of the money.

Egypt bought its Russian wheat for $245.59-247.25 a tonne, more than $30 below the cheapest offers for French and US alternatives.

"That continues to be negative to the wheat market," Mr Holaday said.

"The low price of Russian wheat remains the worry factor for European and other markets," the UK grain arm of a major European commodities house said.

With harvest ahead, "at some stage in the next month or two there will be more wheat about in the major producing countries than home [EU] demand can absorb, and then markets will have to fall in order to compete with Russian supplies".

While Paris wheat managed a positive finish, up 1.1% at E200.00 a tonne, Chicago wheat certainly turned downward on Friday, closing down 1.7% at $6.94 ¾ a bushel for September delivery. Indeed, regaining its, unusual, discount to corn.

Floor near?

Soybeans stuck to the low volatility path, gaining some support from the US weather fears to end up 0.3% at $13.85 ¾ a bushel for August delivery, and up 0.2% at $13.87 a bushel for the best-traded November contract.

And, in New York, cotton retained its trading pattern too – meaning another trouncing on concerns that demand has been destroyed by the run up in prices to record highs earlier this year.

Jurgens Bauer at PitGuru said that, for the December contract, "I suspect a floor somewhere between 90 cents and a 100 cents a pound, but see no urgent reason to be in a rush to buy."

Nor did many other investors, with the lot falling the maximum daily limit, of 5.0 cents, to finish at 99.46 cents a pound, dropping below 100 cents a pound for the first time in six months.

The new crop December lot dropped the same limit to 101.35 cents a pound.

Cocoa sweetens

Not all soft commodities were so negative, with cocoa for September adding 0.4% to $3,168 a tonne in New York, following data showing firmer demand.

The North American cocoa grind rose 6.2%, to 125,000 tonnes in the second quarter, the National Confectioners Association said overnight.

That followed data on Thursday showing the European cocoa grind rose 8.3%, to 356,000 tonnes in the same period.

Etichette:

articles,

commodity,

commodity article,

market articles

Key Earnings Reports Next Week

by Bespoke Investment Group

This week was basically the pre-season to earnings season, as just 32 US companies reported their quarterly numbers. Next week the "regular season" will begin, as more than 300 companies are expected to report. Below is a table highlighting 36 companies reporting next week that investors will be watching very closely. In the table, we provide each stock's year-to-date change, its Q2 EPS estimate, its earnings "beat rate," and its average absolute 1-day change following prior reports going back to 2001. The earnings "beat rate" is the percentage of time the company has beaten earnings estimates using data from our Interactive Earnings Report Database.

The key companies set to report next week that have the highest "beat rates" are Goldman Sachs (GS), Apple (AAPL), Intuitive Surgical (ISRG), United Tech (UTX), and ITT Educational (ESI). These companies have all beaten earnings estimates more than 90% of the time over the last ten years. In terms of earnings report volatility, ISRG tops the list with an average one-day change of +/-13.92% on its report days. SanDisk (SNDK), Baidu (BIDU), Skyworks (SWKS), and Chipotle (CMG) are four other companies that typically see big moves in response to their earnings reports.

On Monday, IBM's report will be the most watched after the close of trading. Goldman, Bank of America, and Wells Fargo are three big banks set to report Tuesday before the open. Apple, Chipotle, ISRG and Yahoo! will be closely watched after the close on Tuesday. Intel (INTC) will get the most attention on Wednesday after the close. Morgan Stanley (MS), AT&T (T), Baidu (BIDU), and Microsoft (MSFT) are on deck for next Thursday, and Ford (F), Caterpillar (CAT), General Electric (GE), and McDonald's (MCD) will round out the week on Friday.

Get ready for a busy week.

See the original article >>

The Fed is FREAKING Out

by Graham Summers

Indeed, it just posted the single biggest money pump since Lehman Brothers… on the week of June 27 2011. If you’re looking for a reason that stocks have been ramped so much higher in the last two weeks. This is it.

Indeed, for the week ended June 27, the Fed flooded the financial system with $76 BILLION in liquidity. Bill King of the King Report puts that number into perspective noting that it’s BIGGEST increase since September 22, 2008 right after Lehman Brothers collapsed.

That’s right, the Fed just juiced the system as much as it did when Lehman Brothers went under. While a shockingly large single money pump, the Fed’s generally been flooding the system with liquidity at a pace equal to that of 2008 since the beginning of the year.

In 2008, the Fed put roughly $1 trillion in liquidity into the system to try and hold things up. So far in 2011, it’s put in nearly $700 billion. You think that the recession ended and systemic risk has gone away? Explain this one.

In simple terms, it’s clear that beneath his attempted calm, Ben Bernanke is in fact scared stiff. Why else would he be printing money night and day? If the financial system was indeed stable and secure, why is he pumping money at the same pace as 2008?

This all ties in with what I’ve been saying for months now… that 2008 was in fact the warm up and that the REAL Crisis is fast approaching. And when it hits, the Fed will be POWERLESS to stop it. Because this time it will be entire countries, NOT just Wall Street banks that collapse. So what’s coming will be the equivalent of 2008 all over again, along with food shortages, civil unrest, outbreaks in crime, bank holidays, and the like. It will, in short, be like what’s going on in the Middle East today (though NATO won’t be bombing us).

Which is why if you haven’t already taken steps to prepare yourself and your portfolio for the coming disaster, you need to do so NOW.

Etichette:

articles,

Economy article,

Finance article,

market articles

Industrial Production Continues Weak Trend

By Jeff Harding

Industrial production remained flat again in June, up 0.2%, according to the Fed’s latest G17 report:

Industrial production in June rose moderately, but mainly due to a rebound in the utilities component. Manufacturing, however, was soft. Overall industrial production in June advanced a modest 0.2 percent, following a 0.1 percent dip in May (originally up 0.1 percent). The market consensus called for a 0.4 percent boost.

Manufacturing, however, was soft with no change after a 0.1 percent increase the month before (originally up 0.4 percent). The auto component has pulled down on production with three consecutive declines. The auto component fell 2.0 percent in June, following a 0.3 percent decrease the month before. Excluding motor vehicles, manufacturing rose 0.2 percent, following a 0.1 percent uptick in May.

Turning to other major sectors, utilities rebounded 0.9 percent after dropping 2.0 percent in May. Mining output grew 0.5 percent after a 0.7 percent increase.

On a year-on-year basis, overall industrial production improved to 3.4 percent from 3.3 percent in May.

Overall capacity utilization in June held steady at 76.7 percent. The June figure posted lower than analysts’ estimate for 76.9 percent.

The decline was reported as having to do with a decline in auto sales and production (-2.0%) and the gain was awarded to utility productions (+0.9%). According to one report, ”the average temperature was 70.7 degrees Fahrenheit (21.5 Celsius) last month, the 26th warmest June in 117 years.” Most economists are expecting gains in auto output as the supply chain disruptions from the Japan earthquake-tsunami are being resolved.

If it weren’t for the trend line shown on the above industrial production chart, one could probably accept the conventional wisdom, but declining-flattening industrial production has been a year-long phenomenon.

Another trend to counter the underlying professional optimism is today’s NY (Empire) State manufacturing survey, here as compared to the Philadelphia survey:

It was a negative 3.76 this month, but better than the -7.79 for last month.

Another trend which I don’t think is a good trend for the economy is the decline in exports and imports, but it is especially the export trend we need to watch:

As we all know, foreign trade is good for everyone, importer and exporter. But while imports have been somewhat steady-to-flat, exports declined last month by $1 billion. Since the dollar has declined 8.5% against our major trading partners’ currencies, one would think that this export boom benefiting the multinationals would continue. If that is starting to decline, then that means our trading partners aren’t buying as much from us. As I posted the other day, “The World Is Turning … Down“, the data shows that our buyers’ economies are also slowing down.

Again, this bears watching, but the bottom line is that as we stagnate, so is the rest of the world. Perhaps there are underlying factors causing this, but who would believe that?

Bank-Rupt?

By DoctoRx

Here is a long-term chart of Bank of America stock (which includes its stock under its prior name of Nations Bank). This is on a semi-log scale, courtesy of Yahoo.

What the graph is shows is that since the stock’s peak a few years ago, it has been in a sharp downtrend bounded by a clear restraining “line”.

This stock recently made a more than 2-year low and is down a bit today even though JPM and Citi reported decent quarters. Northern Trust (NTRS) has again started setting multi-year lows, and even JPM has caught no bounce from its earnings “surprise” this week.

One has to wonder if these bank holding companies hold the capital they say they hold, based on current market prices.

Compounding my concerns is the stubbornness of oil prices. The global benchmark for oil, Brent, has done this in the past year (courtesy Oilnenergy):

This of course act as a tax on oil-importers.

Meanwhile, the US is financially looking nothing like the 1970s. Bond yields bottomed in the 1940s and gradually started trending up. They began accelerating upward after LBJ’s Viet Nam escalation coupled with Great Society spending. By the 1970s, it was clear that the long-term pattern of price stability in America was over. Rationally, lenders were able to receive more and more dollars per year for parting with their money. By an act of will, the Volcker Fed allowed lenders to finally receive so many new fiat dollars that it defeated the looming hyperinflation. Faith in paper money was restored.

That faith is being lost as the extent of unsound lending that occurred in the recent booms is being revealed. People are realizing that all that has to happen in the US is for some pols to fail to agree on a point of legislation to raise the debt ceiling and either taxes will need to rise massively or an economic depression will occur. Unlike under a gold standard, where global acceptance of gold as the final store of wealth protects individuals and businesses from the profligacy of politicians and bankers, fiat money has nothing behind it. When the government fails to stand behind its own money, chaos results.

Thus my conclusion is that the powers that be have little to gain from this chaos, as too much of their wealth and power is invested in the current system. So while the president hasn’t called me lately to give me the inside scoop, let’s assume that the debt ceiling can is kicked down the road so we can worry about other things. I want to therefore propose a possible scenario for the next months or year or two:

BofA, Citigroup, and/or AIG finally implode under the stress of too many bad loans in a sluggish economic environment and is/are finally put out of its/their corporate misery. This mirrors the Japanese experience of about a decade ago when Japan finally had to “kill” some of its major zombie financial institutions. The media and the government “herds” investors into the “safety” of government debt as stocks take another dive and interest rates on Federal debt amazingly drop further, allowing even more deficit spending. Meanwhile, concurrent global forces push the price of gold higher, with the temporary liquidation panic that to some extent reprises that of 2008 providing a new optimal entry point into gold.

This is not a prediction, as our future is knowable only from a future rear-view mirror, but bulls on the stock market need to explain why stocks have failed to gain ground on gold at all since the “Great Recession” allegedly ended. Here is a chart of the relative strength of the Gold ETF “GLD” and the stock ETF “SPY” for the past 2 years:

Pick a different time frame such as 5 years since gold bottomed in 2001 when Bush-Greenspan began to reprise LBJ’s guns&butter strategy, and the relative strengths will be more or less similar. Even accounting for storage costs of gold bullion and dividends on the SPY, gold has been stronger since the “recovery” began, and this is a part of the economic cycle that, if you go back to the end of the 1973-5 recession, was previously very strong for stocks vs. gold.

There are a couple of reasons that I “like” gold stocks, understanding that I only “like” gold as an investment as a reaction to the bad shows going on elsewhere. One is that Wall Street likes to point to a bull market in some stocks, as the stock market is amazingly profitable for it. Another is that these stocks are ignored and even hated. Yet a growing number of even second-tier gold miners pay dividends. Even a 1% dividend beats the annual return from lending money to the Treasury for 3 years. Analysts say that the profits of the miners are chancy. What if gold prices drop? Yet the same analysts are perfectly happy with General Mills raising its food prices year on year and increasing its gross margin. What if General Mills is fated to have shrinking profit margins for the next 10 years? They answer not. When the price of oil goes up, the price of the stocks of oil producers mechanically goes up. Why are gold miners so different? They are not; they are just more volatile both up or down than is the price of bullion. And perhaps they, and gold, are still climbing the fabled wall of worry.

If one goes back to the “Extremistan” of 1980 and looks at a gold price of $750/ounce and a 30-year Treasury yield of 12%, then from then to the bottom of the gold bear market around 2001, gold lost over 95% of its value versus a zero-coupon Treasury bond. This massive bear market in the ultimate “traditional” hard asset versus paper backed only by the full faith and credit of the government of the US has only partially been reversed. If balance sheet holes in large financial institutions around the world continue to be revealed, the possibility exists that what has been seen in gold and gold mining stocks will rival the NASDAQ mania of the second half of the 1990s– but with a more important rationale. Even a well-meaning pledge of full faith and credit of even the most honest and sincere governmental officials may be seen to have some limits.

This is not a consummation devoutly to be wished, but when there is a certain logic that can explain a variety of seeming unrelated trends, one begins to have a set of hypotheses and eventually a theory. I believe that we are experiencing one of the key insights of von Mises playing out in the real world and therefore in the financial markets, which is that it is better to make public the unsound investments of the boom and move on by liquidating them rather than to pretend they were sound. With 2-year Treasury debt selling at 36 basis points per year in interest and 12-month debt at 14 basis points, though, and with the CPI falling a bit in June, and further with the possibility of oil dropping a good deal in the months ahead due to demand destruction and the conceivable advent of the war in Libya ending, the biflationary theory is looking good for now. To simplify it, it is that the credit-dependent parts of the economy such as houses can fall in value while that which is paid for in cash and cannot easily be hoarded such as food rises. It’s a form of a concealed depression that I suspect requires a period of restrained consumption and sustained investment in the “correct” things to allow a new period of economic growth to occur without being built on the sand of financial engineering.

In Talebian fashion, I am watching what comes aware that the past is always an imperfect guide to the future, if it is any guide at all.

Etichette:

articles,

Economy article,

Finance article,

market articles

Inflationistas vs. Deflationistas: What Does CPI and PPI Tell Us?

By Jeff Harding

Inflationistas are probably confounded by Friday’s Consumer Price Index report that showed a decline of 0.2% in June. The report pins the decline, the first since June 2010, on falling energy costs. As a large component of CPI it:

declined 4.4 percent in June, the largest decline since December 2008. The gasoline index, which fell 2.0 percent in May, declined 6.8 percent in June. (Before seasonal adjustment, gasoline prices fell 5.8 percent in June.) Despite the recent declines, the gasoline index has increased 35.6 percent over the past 12 months.

On the other hand, the deflationists are probably using the data to confirm their belief that we are in a deflation.

The data shows that “core” price inflation, all items less food and energy, was still +0.3%, and up 1.6% for the year. The broad CPI-U was up 3.4% for the year. Core was up 0.03% for the second month, the biggest back-to-back gain in two years.

Some key items:

[E]nergy dropped 4.4 percent, following a 1.0 percent decline. Gasoline fell 6.8 percent after decreasing 2.0 percent in May. Within the core new vehicles increased 0.6 percent, used cars and trucks jumped 1.6 percent, and apparel increased 1.4 percent in June. And owners’ equivalent rent is no longer as soft as in recent months, rising 0.2 percent.

Food: The food index rose 0.2 percent in June after rising 0.4 percent in each of the prior two months. The index for meats, poultry, fish, and eggs turned down in June, falling 0.4 percent after increasing more than one percent in each of the previous four months. The fruits and vegetables index declined for the third month in a row in June, falling 0.3 percent as the fresh vegetables index continued to decline. In contrast, other major grocery store food groups increased. The index for cereals and bakery products rose 0.6 percent in June, and the dairy and related products advanced 0.5 percent, as did the index for other food at home. The index for nonalcoholic beverages increased 0.3 percent as the coffee index continued to rise. The index for food at home has risen 4.7 percent over the last 12 months, with all the major groups increasing 3.2 percent or more. The index for food away from home rose 0.3 percent in June after rising 0.2 percent in May.

There are some things to take away from this report. Core is still trending upward, but oil seems to be declining and bringing CPI down. Oil is not based so much on market factors as it is by OPEC. Supply and demand has an impact on these prices, but as we all know, OPEC can influence prices by increasing or decreasing production. Thus when economist look at CPI they like to remove the impact of oil to see if they can get a better read on the data without the influence of OPEC.

I would not entirely agree with that. If demand was superfluous to OPEC, then prices wouldn’t fluctuate as much as they have. As demand for oil grows, oil prices rise worldwide. But, I believe prices rise not only because of demand, but because of the impact of a devalued dollar. And we aren’t the only country in the world that is devaluing their currency. So, I believe it is possible to look at oil much as any other commodity that impacts our cost of living, regardless of OPEC’s impact. All I know right now is that demand is down worldwide because of falling industrial production, and prices have fallen. It shouldn’t be excluded from CPI calculation and that is why CPI went down.

As my readers know, I believe “inflation” is an increase of money supply brought about by the Fed, and that price increases are an effect of inflation. To distinguish this from the common definition of “inflation,” I will refer to price increases as “price inflation.” The reason we are not seeing rapid price inflation is that money supply growth has been rather modest considering the Fed’s attempts to pump the economy full of money and credit. Quantitative easing is an inefficient way to create price inflation, at least as compared to an expansion of money and credit by banks. And as we all know, banks aren’t lending robustly these days.

But the Fed is indeed pumping money, and monetary inflation is the reason we aren’t seeing deflation. True (Austrian) Money Supply (TMS2 - green line) exploded post-Crash until January, 2010, dropped like a rock until, late 2010, when it started growing again. See this chart from Michael Pollaro which I have amended with the dates of QE1 and QE2:

As you can see, the Fed has been pushing on a string, attempting to create price inflation and prevent “deflation.” They think they have succeeded in the deflation part, but they are dissatisfied with their attempts at inflation.

The next monetary data report should show more growth in TMS2. QE1 kept TMS2 expanding for about 10 months after it stopped in March, 2009– through January, 2010, when it collapsed again. I would expect the effect of QE2 to be shorter than QE1 because of the post-Crash chaos has been resolved to the extent that now positions are known and we are in a slow but steady debt liquidation process. This liquidation phase is much stronger than the Fed realizes and the resolution of malinvestment is going slowly, no thanks to them. This hampers the formation of new capital and discourages businesses from expanding as the economy remains in the doldrums. Thus more monetary steroids loses its efficacy as this process continues.

So, as an inflationista, why haven’t we seen prices go crazy? Let me summarize my thoughts:

- Inflation is a monetary phenomenon, and price inflation is a result of it.

- Price inflation is caused by an expansion of the money supply.

- There is no such thing as demand-pull price inflation, or that we cannot have price inflation because capacity utilization of factories is low.

- In order for prices to really take off, money supply needs to take off.

- We have had a roller coaster of monetary stimulus through QE, causing significant gyrations in money supply.

- QE (helicoptering money into Wall Street) has a lesser impact on money supply than bank money and credit expansion. It works, it just doesn’t have the multiplier bang for your buck.

- Money supply growth has been historically lower as compared to prior inflations that expanded through bank credit (see 2001 on the chart above).

- The monetary impact of QE2 is not done yet, but it will have a shorter impact on money supply than QE1.

- CPI prices are increasing modestly. The producer price index (PPI) is showing much higher price increases and this is starting to squeeze wholesalers and retailers. They will attempt to raise prices.

- A question arises as to whether or not price increases will be accepted by consumers since wage growth has been flat. I believe increases will be rejected by consumers who will further restrict consumption in response. Or, retailers will swallow the difference, see profits squeezed, and either way, the economy will be harmed from monetary expansion.

- Ultimately the CPI will rise further, especially if the Fed does QE3, which I believe will happen. Flat-to-declining growth will put pressure on the Fed to act. A low CPI (or PCE) and stagnating employment will encourage the Fed to do QE3 to revive a moribund economy.

- That will lead to continued stagnation.

- The key to recovery will be the liquidation of malinvestment and its related debt. It is happening, but the process is slow and more money pumping will only slow it down further.

- Stagflation.

Etichette:

articles,

Economy article,

Finance article,

market articles

Asset Allocation Strategy: Buy and Hold SP500

This will be the first in a series of articles on asset allocation.

It is no secret that tactical asset allocation is my preferred framework for investing. Historically, the data supports such an approach, and intuitively, tactical asset allocation makes sense to me. It feels right. I am not re-inventing the wheel as there are a lot of books and articles on the topic. I just have my own flavor or “secret sauce” if you will. These are the strategies and insights that I write about in this blog, and I am hopeful that my models will set me apart. I am confident that they will.

There is a lot of literature on asset allocation and the following references are a great place to start:

Gibson, Roger C., Asset Allocation: 4th Edition, (2008)

Darst, David H., The Art of Asset Allocation: Principles and Investment Strategies For Any Market, Second Edition, (2008)

Ferri, Richard A., All About Asset Allocation, (2005)

Bernstein, William, The Intelligent Asset Allocator: How To Build Your Portfolio To Maximize Returns and Minimize Risk , (2000)

Swensen, David, Unconventional Success, A Fundamental Approach To Personal Investment, (2005)

Dalio, Ray, “Engineering Targeted Returns and Risk”, (2005)

Merriman-Cohen, Jeff, “The Perfect Portfolio”, (2003)

Faber, Mebane, “A Quantitative Approach to Tactical Asset Allocation” , (2007)

Essentially, the benefits of passive or active asset allocation are well known. For the most part, asset allocation reduces portfolio volatility without sacrificing returns, and the strategies give one the ability to profit in any economic environment. Often over looked and a very important consideration is the fact that asset allocation strategies are very easy for most investors to implement. I find tactical asset allocation suits me well because there is an 1) emphasis on a disciplined strategy; 2) emphasis on money management; 3) emphasis on risk management; 4) emphasis on investing not trading.

The bogey for success for most strategies is buy and hold SP500. That is, how does a strategy compare to buy and hold SP500. Is the return better? Is the risk profile improved? Can a strategy be easily implemented? Can the investor withstand the losses to a portfolio to achieve the necessary return? In general, greater returns are associated with increasing risk, and while “white hot” returns are always welcomed, I always question myself if I can sustain the draw downs or losses to my portfolio that are necessary to achieve such gains. Regardless what you do and how you do it, you want to make sure that the end result is better than buy and hold SP500.

So in this presentation, I will present the returns and risk for buy and hold SP500 from November, 1991 to March, 2011. This is our baseline. I have chosen this particular starting date as future articles in this series will be comparing my models (which start in this time frame) to buy and hold SP500.

From November, 1991 to March, 2011, buy and hold (passive) SP500 had a compound annual growth rate of 6.46%. $100,000 becomes $337,617. Figure 1 shows the equity curve for buy and hold SP500.

Figure 1. Equity Curve/ buy and hold SP500

Drawdown is the peak-to-trough decline (in percentage terms) of an investment, and it is measured from the time a retrenchment begins to when a new high is reached. Drawdown is a measure of risk. The maximum draw down for buy and hold SP500 is 56.24%. As of March, 2011, new equity curve highs have not been achieved. Therefore, the draw down is still ongoing having lasted more than 3.5 years. The draw down curve is shown in figure 2.

Figure 2. Draw down/ buy and hold SP500

It should be appreciated that buy and hold investors have “enjoyed” two draw downs greater than 45% in the last 10 years. For incurring this risk, these investors have been rewarded with a 6.46% CAGR. This seems rather excessive, and it clearly makes the case for a more active approach.

In the next installment of this series, I will look at buy and hold with the Dow Jones Composite Bond Index.

ARL Advisers, LLC is the publisher of TheTechnicalTake blog. To learn more about our strategic, balanced and targeted portfolios click on the links below.

Etichette:

articles,

Finance article,

market articles,

trading

Sugar Price Surge Nears Resistance

By: Seven_Days_Ahead

After peaking in early Feb the drop back in Sugar 11 found a low in May, from whence a recovery got underway. This has made a new high on the front month chart, but certain resistance levels are now not far off.

Etichette:

Analysis Technic,

analysis technic article,

articles,

market articles,

Softs,

sugar

Bullish Copper Technicals

By: Zeal_LLC

See the original article >>

Copper is growing increasingly popular among speculators, who are catapulting this unassuming base metal up into the rarified ranks of market-darling commodities. Neither precious like gold, nor immediately consumed like oil, copper’s price action is quite unique. And despite some risky headwinds remaining, its technicals are once again turning bullish today.

I last wrote about copper in mid-February, as it hit new all-time highs of $4.60 per pound. My essay then concluded, “The bottom line is copper is due for a major correction. Sentiment in this metal is wildly bullish thanks to its recent massive upleg and new all-time highs. Copper is very overbought technically, it has rallied too far too fast by its own bull-to-date standards. And it has ignored a major trend change in its LME stockpiles in order to follow the stock markets higher.”

This contrarian prediction came to pass. In the 5 months or so since, copper has not only failed to regain those lofty heights but has indeed corrected. Over several months ending in mid-May this base metal gradually ground 15.9% lower. It surrendered nearly 1/6th of its value in the global marketplace! Copper needed to correct for the reasons I articulated in mid-February, and the selling arrived as expected.

But ever since those mid-May lows, copper has been consolidating and gradually clawing its way higher. This was pretty darned impressive considering some of the stock-market action over the 2 months since. Copper is usually highly correlated with the stock markets, heavily influenced by general sentiment. Yet in the first couple weeks of June when the flagship S&P 500 stock index plunged 5.9%, copper only lost 0.8%. It was truly a remarkable display of relative strength for this economically-sensitive metal.

This resilience probably means one of two things. Copper’s correction could have been big enough and long enough to fulfill its mission of rebalancing sentiment. If its magnitude was sufficient to eradicate the greed of mid-February and usher in fear, then most of the bearish traders were probably squeezed out. This means there weren’t many sellers left in early June, which is a bullish sign for copper prices.

Alternatively, copper simply might not have followed the stock markets’ fast swoon lower then because it didn’t generate much meaningful fear. Copper gets crushed in fear-laden stock selloffs because they lead futures traders to assume global economic growth is in jeopardy, which would retard copper demand growth. If this thesis is correct, and the stock markets start falling again, copper could still get hit hard.

But exogenous sentiment influences aside, copper’s intrinsic technicals are certainly looking bullish. So traders ought to give it the benefit of the doubt today, while remaining vigilant for a stock-market selloff that could bleed into this popular base metal. This first chart examines some of the bullish copper technicals today. This metal’s price itself is rendered in blue and slaved to the right axis.

Copper has certainly enjoyed a spectacular run since 2008’s once-in-a-century stock panic. Between its panic low in December 2008 and its latest high in February 2011, this metal soared an astounding 261.0% higher. That might seem excessive, but realize it is mostly just a recovery after that hellstorm of fear spawned by the panic ripped copper to shreds. Between July 2008 and December 2008, it plummeted an apocalyptic 68.7%! Over 2/3rds of its value vaporized in just 6 months!

We capitalized on those ridiculously irrational and oversold copper prices by aggressively buying copper stocks. An elite-copper-stock long-term investment we recommended to our subscribers in the heart of the stock panic was up 277.8% as of this week! Those panic lows were just absurdly silly. That crazy panic anomaly aside, between its July 2008 and February 2011 highs copper only rallied 13.0%. Far from excessive, this is downright trivial.

So it’s not righteous to look at copper’s post-panic surge in isolation and claim this metal must be in a bubble. In broader secular context stretching back several years before 2008’s panic, copper’s bull has actually been very modest. While the blistering pace of copper’s post-panic recovery won’t be sustainable indefinitely, copper should still continue gradually marching higher on balance. At least as long as its secular fundamentals remain bullish, with its global demand growth outpacing supply growth.

As for its current bullish technicals, note that copper’s recent grinding 15.9% correction over 2.9 months dragged it back down to a couple critical support lines. The first, and most important by far, is copper’s 200-day moving average. In ongoing bull markets, 200dmas are generally the highest-probability bounce points for healthy corrections to bottom.

And after copper first hit this key metric in early May, it spent the better part of 8 consecutive weeks bouncing along it. The longer a price lingers and climbs along a major support line after a correction, the more likely a true bottom has indeed been seen. And 8 weeks is an awfully-long time, especially since this span encompassed that big early-June selloff in the stock markets that copper nonchalantly shrugged off.

In addition, since this latest correction bottomed a secondary support line has held for just as long. Note above that the lower support of copper’s well-defined post-panic uptrend has held strong. The last time this particular support line was approached was back in the summer of 2010 after copper’s last major correction. That earlier selloff was driven by a parallel correction in the stock markets, which is one reason why any new stock correction poses big downside risk for copper.

That same uptrend support line that held strong in the summer of 2010 has so far held strong in the summer of 2011. This is a great secondary confirmation of a probable copper trend change from correction mode to new-upleg mode. But personally, I believe the 200dma holding is far more important. Copper can’t continue surging at its outsized post-panic-recovery pace indefinitely, so at some point this recovery uptrend’s support line will fail even though copper’s secular bull remains intact.

But while copper’s technicals look bullish based on holding strong at multiple support lines for a couple months, all isn’t rainbows and unicorns. Relative to its 200dma, copper never hit very-oversold levels in its recent major correction. This significantly increases the odds that the correction might not be over yet, that we may have to see another low before the next upleg begins. This is based on my successful and profitable Relativity trading system.

Interestingly if you take any price in a secular trend and divide it by its own 200dma, the resulting multiple forms a horizontal trading range. This multiple for copper is rendered above in light red, slaved to the left axis. If you flattened the black 200dma line to horizontal, and recast the blue copper-price line as a perfectly-comparable-percentage multiple of it, the result is the Relative Copper (rCopper) line.

Over time, this rCopper construct forms definite support and resistance zones. We define these based on where rCopper has meandered over the latest 5 calendar years. Our subscribers can log in to our website and look at the large high-resolution long-range chart (updated weekly) we used to define copper’s relative trading range. Today it runs from 0.90x on the low side to 1.20x on the high side. In other words, copper tends to trade between 90% to 120% of its own 200-day moving average.

Unfortunately when copper bottomed in mid-May, it was only at 0.971x relative. It wasn’t super-oversold yet, fear simply wasn’t extreme enough, as defined by copper’s bull-to-date precedent. Contrast this with rCopper’s deep 0.883x relative low back in June 2010 after its last major correction. While copper’s recent support-hugging behavior for a couple months after its mid-May low suggests a durable bottom, the lack of a deeply-oversold rCopper reading at that time certainly undermines this.

It’s not that copper remained overbought in mid-May, far from it. But it just wasn’t as low yet as major corrections have tended to drag it over the past 5 years or so. This means that despite copper’s bullish technicals, it likely remains very susceptible to fear splash damage driven by any renewed stock-market selloff. So if the S&P 500 starts falling fast enough to spark real fear, odds are copper will be sold in sympathy. And it will probably hit a new low in this scenario, extending its recent correction.

Because of this ambiguity, I thought about not even writing this essay. But this is simply the way the markets usually work. While there are those rare times when all the indicators line up perfectly to herald a high-probability-for-success buying opportunity or selling warning, most of the time everything isn’t in agreement. The more indicators that agree the better the odds, but they still never approach certainty.

This next chart shows a key fundamental copper-price driver that helps offset the lack of an ideal rCopper low. It is the levels of the London Metal Exchange’s copper stockpiles. The LME runs a global network of warehouses that act as a buffer between copper miners and consumers. While most copper mined is shipped directly from producers to consumers under contract, occasionally a miner will have excess production beyond contract or a factory will need more copper than usual.

So the LME warehouses around the world provide places where this excess physical copper on the margins of global supply and demand can be traded between producers and consumers. Each day the LME publishes these total copper stockpiles, which are eagerly watched by speculators. Rising stockpiles mean copper’s global supply-demand imbalance isn’t as tight, so prices are likely to fall. And declining stockpiles reveal tightening supplies, which usually leads traders to bid up copper.

Because of the wild dislocations spawned by 2008’s stock panic, the relationship between copper prices and LME stockpiles isn’t as clear since then. But if you look at a longer-term chart, it is readily apparent that prices and stockpiles naturally have a strong inverse relationship. The farther the stock panic recedes into the rearview mirror and the more conditions return to normal, the more this logical relationship will reassert itself. With copper now recovered into its pre-panic secular uptrend, stockpiles are important again.

Given the big numbers of and diversity in both the global copper miners and the factories that fabricate finished goods using this copper, it isn’t surprising that changes in aggregate supply and demand move slowly. It takes many months to ramp up mine production or factory production, output changes can’t happen overnight. Thus the LME stockpiles tend to slowly meander in low-volatility trends. Note how straight the red stockpile lines are compared to the blue copper price.

And whenever major trend changes happen, from copper tightness to relative abundance or vice versa, they tend to be gradual and decisive. There aren’t many instances in this bull where LME stockpiles started moving the opposite direction for a month or two where it was merely a head fake. Once supply started outpacing demand or vice versa, the resulting trend changes tended to be durable and sustained.

Note above that back in mid-June soon after copper’s latest bottoming, global LME copper stockpiles peaked near 478k metric tons. In the month or so since, they have been relentlessly drawn down by a material 3.4%. While it is possible this trend change will soon reverse and copper stockpiles will begin rising again, it isn’t probable in light of LME stockpiles’ bull-to-date precedent. And if extra copper continues to be bought out of the LME’s warehouses, traders are likely to bid copper prices higher.

The last couple major draws in LME copper stockpiles are crystal-clear in this chart, a huge 53.2% draw ending in mid-2009 and a longer 37.2% one ending in late 2010. Since stockpiles didn’t get up to their post-panic trading range’s resistance of 550k tonnes in their recent peak, I certainly don’t expect a drawdown of this magnitude. But it would still be perfectly normal for stockpiles to trend down towards their 350k support line. This is another 112k tonnes of copper likely to be drawn over a couple quarters!

If this LME stockpile trend change is durable and sustained, and it gradually heads back down towards its post-panic support, it is hard to imagine speculative capital not flowing back into copper. While copper is still at risk of getting sucked into the fearful sentiment in a material stock-market selloff, falling LME stockpiles will almost certainly dampen its impact on this metal. Bullish fundamentals always generate a tailwind.

So not only are copper’s intrinsic technicals looking pretty bullish, its supply-demand fundamentals are providing confirmation. Though a stock-market selloff could temporarily drag copper to new correction lows, this setup is bullish enough to start a gradual deployment into the beaten-down copper stocks. We just started buying and recommending copper stocks again in our subscription newsletters, with more to come soon if copper’s technicals and fundamentals remain favorable.

At Zeal we’ve been researching and actively trading these secular commodities bulls for over a decade, yielding priceless wisdom, knowledge, and instincts that newer commodities-stock traders can’t match. We’ve generated an awesome real-world track record. Since 2001, all 591 stock trades recommended in our newsletters have averaged annualized realized gains of +51%! Has your capital been growing this fast for a decade? Why not?

We share the profitable fruits of our hard work with our subscribers, who finance our ongoing research efforts. We publish acclaimed weekly and monthly subscription newsletters that help speculators and investors learn to thrive. In them I weave together all our research and experience to show what the markets are doing, why, and where they are likely heading. And when probabilities are favorable, we recommend specific stock trades you can mirror. Subscribe today and start thriving!

The bottom line is copper’s technicals are looking pretty bullish today. Even though copper’s latest correction didn’t leave it quite as oversold as it was after past major corrections, its price action has been excellent since. Major support lines have held strong, even during a sharp stock-market selloff. On top of this, global copper stockpiles appear to have just turned the corner into a new bullish drawdown mode.

Given the stock markets’ strong influence on copper traders’ sentiment, there is still a decent chance that any new stock-market selloff sharp enough to generate fear would drag copper back down. It may even fall far enough to hit new correction lows. Nevertheless, since it has just corrected and its fundamentals are now bullish again, any stock-driven selloff is likely to be short-lived and a fantastic buying op.

Etichette:

Analysis Technic,

articles,

commodity,

commodity article,

copper,

market articles,

metals

Subscribe to:

Comments (Atom)