“Happy days are here again! Stock markets are strong, company profits are up, bankers are making record profits and bonuses, unemployment is declining, and inflation is non-existent. Obama and Bernanke are the dream team making the US into the Superpower it once was.

Yes, it is amazing the castles in the air that can be built with paper money and deceitful manipulation of all economic data. And Madame Bernanke de Pompadour will do anything to keep King Louis XV Obama happy, including flooding markets with unlimited amounts of printed money. They both know that, in their holy alliance, they are committing a cardinal sin. But clinging to power is more important than the good of the country. An economic and social disaster is imminent for the US and a major part of the world and Bernanke de Pompadour and Louis XV Obama are praying that it won’t happen during their reign: ‘Après nous le déluge’…

…most nations seem to have the uncanny knack of selecting the political individuals who will put fuel on the fire and make the situation catastrophically worse.

Greenspan was one such individual. During his 19 years as Chairman of the Fed, he could have limited the economic and social damage that the US would suffer. Instead he took every single measure possible to ensure that there would be a catastrophe with uncontrollable consequences. But we shouldn’t just blame the incompetence of Greenspan. It was sickening to watch every sycophantic congressman and senator licking Greenspan’s boots and praising his wisdom. Because Greenspan’s money printing and incompetent interest rate management created one of the biggest financial bubbles in world economic history. But the politicians loved this.

It made the stock market boom, and house prices surge… And Bernanke de Pompadour is continuing the same disastrous policies of creating money out of thin air. When will they ever learn that creating money out of thin air and running astronomical deficits that never will be repaid with normal money leads to the road of total ruin?... therefore they are leading the world into a hyperinflationary depression that will have uncontrollable and cataclysmic consequences for current and future generations.

Empty stomachs are rioting

We have for years warned about hyperinflation leading to famine, misery and social unrest. Well, this is exactly what is happening in many parts of the world. The protests and overthrowing of regimes in Tunisia, Egypt and Libya are primarily due to a major part of the peoples of these nations having no job, no money and little food. It is their empty stomachs that are rioting…

Although food and fuel inflation is rampant worldwide already, we are only seeing the very beginning…

The Continuous Commodity Index – CCI, (60% food, 17% energy and 23% metals) has almost doubled since the low in early 2009 and has gone up 42% in the last 12 months. The almost vertical rise of the CCI is one of the best indicators of hyperinflation being imminent. A catastrophe of astronomical proportions is looming…

Hyperinflation Watch

The following are INDISPUTALBLE FACTS:

* The US dollar is down 82% against gold since 1999

* The US dollar is down 49% against the Swiss Franc since 2001

* The Dow Jones is down 81% against gold since 1999

* The Continuous Commodity Index is up 100% since 2009

The above facts are clear evidence of an economy that has been totally mismanaged. But more importantly most of these trends are now starting to accelerate – a clear sign that hyperinflation is just around the corner…

‘There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion or later as a final and total catastrophe of the currency system involved.’ –

Ludwig von Mises”

“APRES NOUS LE DELUGE”

Egon von Greyerz, Gold Switzerland, 3/6/11

“End of Dollar as Reserve ‘Disastrous’

Billionaire real-estate magnate Sam Zell warns that Americans should brace for a “disastrous” 25 percent decline in the standard of living if the U.S. dollar’s reign as the global reserve currency ever ends.

“Frankly, I think we’re at a tipping point. What’s my biggest single financial concern is the loss of the dollar as the reserve currency,” he told CNBC in an interview. ‘I can’t imagine anything being more disastrous to our country than if the dollar lost its reserve-currency status.’”

Sam Zell, CNBC Interview, 3/2/11

If one considers the Real Numbers, and not the Bogus Official Statistics (see below) or Main Stream Financial Media Talking Heads’ Spin, one realizes that we are at The Very Threshold of Hyperinflation.

In the U.S. for example, Real Consumer Price Inflation is over 9% (see below).

Furthermore, given ongoing Monetary Inflation (e.g. QE 2, and, notwithstanding official Denials, a prospective QE 3 and possibly 4 and 5) Hyper-Price Inflation is probably baked into the Financial and Markets’ Cake.

The recent nearly Vertical Rise of the Continuous Commodity Index (CCI) provides Objective Confirmation of our recent Subjective Experience – Prices of Essential Commodities, Food and Energy, have skyrocketed recently.

Indeed, the Weimar Experience provides further confirmation of our being on the Hyperinflationary Threshold.

The Monetary Explosion in Weimar preceded the Actual Price Explosion by a couple of years. And, we must recall, that Weimar Hyperinflation was then followed by The Great Depression.

Another Hyperinflationary Harbinger is the continuing swoon in the Purchasing Power of the Worlds Reserve Currency – the U.S. Dollar, a Fiat Currency nonetheless. Thus, it is critical to compare the Real Numbers with the Bogus Official Ones.

Shadowstats.com calculates Key Statistics the way they were calculated in the 1980s and 1990s before Official Data Manipulation began in earnest. Consider

Bogus Official Numbers vs. Real Numbers (per Shadowstats.com)

Annual U.S. Consumer Price Inflation reported February 17, 2011

1.63% 9.07% (annualized January, 2011 Rate)

U.S. Unemployment reported March 4, 2011

8.9% 22.1%

U.S. GDP Annual Growth/Decline reported February 25, 2011

2.70% - 2.21%

U.S. M3 reported March 4, 2011 (Month of February, Y.O.Y.)

No Official Report - 2.06%

And when we compare the past decades’ Stellar performance of Gold and Silver in all Major Fiat Currencies, we begin to realize that Voltaire’s Observation that “Paper Money returns to its Intrinsic Value – Zero” may well reflect Ultimate Fiat Currency Reality. And perhaps even provide… Intimations of Zimbabwe in our Future?

And just one more consideration is relevant before providing Guidelines for portfolio Preparation for the Coming Great Hyperinflation.

Historically, and logically, the Run-ups to Hyperinflation are preceded by a period of Price Run-ups for Risk Assets such as Commodities and Stock Markets.

This provides The Illusion of (a Return to) Financial and Economic Health, just as we are seeing now.

But, inevitably, when, as a result of the preceding Monetary Inflation, Price Inflation begin to skyrocket, that Dramatic Price Inflation Chokes Economic Activity, leading to Economic Stagnation and then Contraction. Voila, a Hyperinflationary Depression – “Mega-Stagflation” to Coin a Term.

[We must note here that there is an Alternative Explanation to von Greyerz’ – that the “incompetence of Greenspan and Bernanke is the cause of the impending Catastrophe”. Namely, that the Catastrophe has been planned by Globalists who wish to facilitate the Adoption of One World Currency as a Stepping Stone to One World Government. (See this evidence in Deepcaster’s article – “Saving Investments, Sovereignty, & Freedom from The Cartel ‘End-Game’ (1/13/11)” in the ‘Articles by Deepcaster’ Cache at www.deepcaster.com)]

At this point, it is essential to add one further consideration for Portfolio Construction – Timing.

Consider Energy for example. Early on in a Hyperinflationary Run-up Energy Prices Soar because the Fed-Created (or Eurozone created, etc.) Monetary Hyperinflation (which started the whole process) causes the Purchasing Power of Fiat Currencies to decline (as we are now seeing). Early on, this results in soaring Energy (and other Commodities) prices.

But as the Price Increases in Energy start to Bite, Demand is Reduced, thus slowing Economic Activity, Energy prices are then likely to drop suddenly and dramatically as Demand swoons.

So what Assets are not only resistant to such a Mega-Stagflation, but also provide Profit Potential?

Fortunately, there are three Assets which provide Protection and Substantial Profit Potential for Portfolios.

Gold

First and Foremost is Gold. Throughout the Process from Monetary Inflation (QE 1, 2…3? 4?) to Price Inflation (e.g. beginning now) to Price Hyperinflation and Depression, Gold tends to appreciate (Caveat: But beware of “Paper Gold” and Cartel* Price Suppression Attacks).

*We encourage those who doubt the scope and power of Overt and Covert Interventions by a Fed-led Cartel of Key Central Bankers and Favored Financial Institutions to read Deepcaster’s December, 2009, Special Alert containing a summary overview of Intervention entitled “Forecasts and December, 2009 Special Alert: Profiting From The Cartel’s Dark Interventions - III” and Deepcaster’s July, 2010 Letter entitled "Profit from a Weakening Cartel; Buy Reco; Forecasts: Gold, Silver, Equities, Crude Oil, U.S. Dollar & U.S. T-Notes & T-Bonds" in the ‘Alerts Cache’ and ‘Latest Letter’ Cache at www.deepcaster.com. Also consider the substantial evidence collected by the Gold AntiTrust Action Committee at www.gata.org, including testimony before the CFTC, for information on precious metals price manipulation. Virtually all of the evidence for Intervention has been gleaned from publicly available records. Deepcaster’s profitable recommendations displayed at www.deepcaster.com have been facilitated by attention to these “Interventionals.” Attention to The Interventionals facilitated Deepcaster’s recommending five short positions prior to the Fall, 2008 Market Crash all of which were subsequently liquidated profitably.

Initially, in the Fiat Currency Monetary Hyperinflation phase, Gold, as The Ultimate Money, appreciates because all Fiat Currencies (albeit in varying Degrees) decline in Purchasing Power vis a vis Gold.

And then, as price Inflation becomes Price Hyperinflation, Gold Soars as Fiat Currencies’ Purchasing Power Plunges.

Then, as Economic Depression Sets in (and thus when Fiat Currencies have lost much of their value) Gold tends to Retain its value vis a vis the damaged or Destroyed Fiat Currencies.

One other consideration relates to Gold (and other Precious Metal) Mining Shares. Their Value tends to track Bullion more or less, except that they are after all, and above all, Stocks. Thus, overall Stock Market performance is likely to be a greater determinant of their Value, than their value as actual or potential Precious Metal producers.

Maximizing Value in Precious Metal shares (as opposed to Bullion) is thus in large part a matter of Timing… Generally speaking, they are better purchased near the Bottom of Equities Markets Downlegs.

Silver

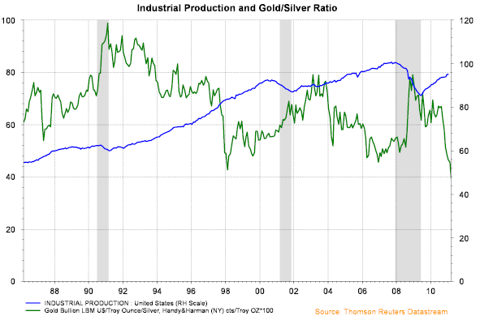

Silver, The Poor Man’s Monetary Metal, can in the Hyperinflationary Process, be expected to perform similarly to Gold, except for the fact that it is also an Industrial Metal, used, and used up, by Industry.

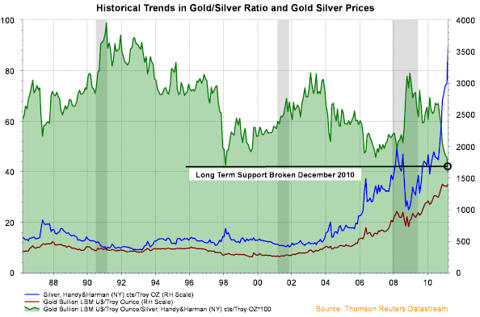

While Gold has recently powered up to trade around its recent all-time Nominal High around $1435ish, Silver is stronger even yet, recently trading around its 21 st Century high of $36/oz.

But it is important to note Silver has recently been acting more like the Monetary Metal that it is, rather than the Industrial Metal that it also is.

The prospect of sustained Higher Oil Prices justifiably exacerbates fears that such high prices will dampen Economic Activity, thus dampening demand for Industrial Metals. But Silver as Safe Haven Money has spiked UP along with Gold and Crude. Indeed, Silver prices are spurred by a Critical and Worsening Supply Shortage of Physical.

Further, Market Intelligence indicates that the Alleged Major Silver Manipulator JP Morgan Chase has recently added 6,000 Short Silver contracts to bring its short holdings to 25,000 contracts – one fourth of total world production! This is either in preparation for a Major Cartel Price Suppression Attack and/or because Silver threatens a Very Serious Breakout. Short-term there will likely be a Takedown Attempt. (See our latest Forecasts at www.deepcaster.com)

Thus we have, and will continue to have, this Very Volatile situation in the Precious Metals Arena with the Contenders being: The Cartel vs. Economic and Financial Reality.

Any perceived diminishment of The Chaos and/or a Major Equities Takedown will surely bring renewed and intensified Cartel Suppression Attacks on the Precious Metals Prices.

As we earlier Forecast, we expect an even more Vigorous Cartel Attack on Precious Metal prices to launch in the next few weeks. Indeed, it may have launched today March 10, 2011, as we write.

We expect the next few weeks will provide a test of The Cartel’s Price Suppression Power.

In the Middle and Long Run, Gold and Silver are likely going higher, much higher.

Caveat: but Consider that Precious Metal Miner and Explorer shares are stocks, and thus tend to mimic overall Equities Market Movements to a degree. In other words, an Equities Takedown would tend to take down Precious Metals shares prices also, but Bullion would tend to be less affected.

And, this is The Key Point, since Silver is an Industrial Metal, we expect Silver Shares would be taken down harder in any equities Takedown. But the Severe Silver Bullion Crunch would tend to keep Bullion Prices elevated.

In sum, we consider Silver Bullion a “Buy” and Silver Shares are a Buy too at the right time.

Food

The Third Protective Category with Profit Potential is Agricultural Products (and Producers) in Inelastic Demand. Whether in a Hyperinflation, or in a Depression, people will buy Food first above all else.

In this Sector, there is one Extraordinary Investment Opportunity, still a “Sleeper” Sector to some degree, which, some would argue, is, at this time, even better than Gold and Silver.

Indeed, we are among those who agree that Gold and, with the right timing, Silver, are Two of the Three Best Investment Opportunities for the Next Decade.

But we must also agree that this “Sleeper” Opportunity may at this time be the Best of All, because there are still several companies in this Sector which are quite undervalued.

Indeed, Deepcaster recently recommended two -- one trading at just over $5/share and the Other at just under $2/share in his most recent Alerts.

And recently, we recommended a third ‘Sleeper’ Sector Industry leader, which has a huge and expanding Asian Market and a recent P/E Ratio of under 4, and which trades under 70 cents/share (in $U.S.) and has Tremendous Appreciation Potential.

To Consider these three “Best of the Best” Sleeper Sector Investments, read our latest Letter – “Main Gold, Silver & ‘Sleeper’ Sector Price Movers; ‘Sleeper’ Buy Reco.; Forecasts: Gold, Silver, Equities, Crude Oil, U.S. Dollar, and U.S. T-Notes & T-Bonds; March 2011 Letter”, and Alert -- “Golden Green Opportunity Buy Reco.; Forecasts: Commodities, Gold, Silver, Equities, Crude Oil, U.S. Dollar, and U.S. T-Notes & T-Bonds” in the ‘Alerts Cache’ at

www.deepcaster.com.

In sum, in the Medium and Long Run, we see the aforementioned Equities Bearish Factors overwhelming the Bullish Ones, which will have Severe Negative Consequences for Equities-in-General and for certain Commodities which are in Elastic Demand.

Given this Negative Scenario Safe Havens with Great Profit Potential are Gold, Silver (with Timing Caveats for Shares) and Agricultural Commodities in relatively inelastic demand (such as Wheat and Foodstuffs in general), and businesses focusing on them.

Another important Guideline is that Financial and Economic Conditions are such that we do not recommend shorting Gold and Silver, even in advance of a likely Cartel* Takedown attempt.

Deepcaster’s recommended response to Cartel Market Manipulation (i.e. especially in the Precious Metals Market) is fivefold:

- Buying on Dips, coupled with a Willingness to Tolerate Great Price Volatility

- The Core Holdings of Ones’ Precious Metals Position are best held in one particular form (see our Precious Metal Recommendations) of the Physical Metals, in Personal Possession

- that Well Managed reasonably priced Miners with Substantial Reserves be bought on Dips, and, if one is a Trader, a portion sold near interim highs

- that a portion of One’s Holdings be in a Dividend Paying Precious Metals Fund such as one which we have Recommended, and

- Regarding Silver, since it is also an Industrial Metal, it is especially vulnerable to Slowdown in Economic Activity and (especially for the Shares) Takedowns in the Equities

Markets.

In sum, we expect another Markets Crisis will launch in 2011 (and may well already have) and Gold, Silver and Food are the place to be.

Gold and Silver and Essential Food Products and Producers are the most important Means to Profit and Protect regardless of Economic, Financial, or other Market Conditions, when preparing one’s Portfolio for Hyperinflation.

We reiterate, finally, that, given the aforementioned Negatives, a Crisis is likely already “baked into the cake.” The Fed’s (and Eurozone Bankers) Price boosting via Q.E. can not go on forever, and, in any event, Q.E.

worsens the Inevitable Crash because it serves only to pile more Debt upon already Unpayable Debt.

Moreover, the Bond Markets have already been Signaling that Q.E. will result in increasing Inflation and Interest Rates which will Seriously Injure the Equities Markets, and Burst Equities and other Key Asset Bubbles.

The Bond King, Bill Gross (PIMCO) exiting the long-dated U.S. Treasury Market should be a warning to all.

The Wise are Well-Advised to prepare for the Coming Hyperinflation.

See the original article >>