SUPER COMMODITY STRATEGY

With our Super Commodity trading system can operate on all commodities markets with a simple, safe and reliable method, generating significant capital growth independent of stock and bond markets, with simple and strict trading rules and risk management rules.

| SUPER STOCKS STRATEGY

Super Stocks is a clone of Super Commodity, works alike and with the same fixed and non-optimized parameters, obtaining very good results even on all the stock markets.

| ||

GREAT NEW

SERVICE

TEST OUR SUPER

STOCKS STRATEGY FOR FREE

CONTROL

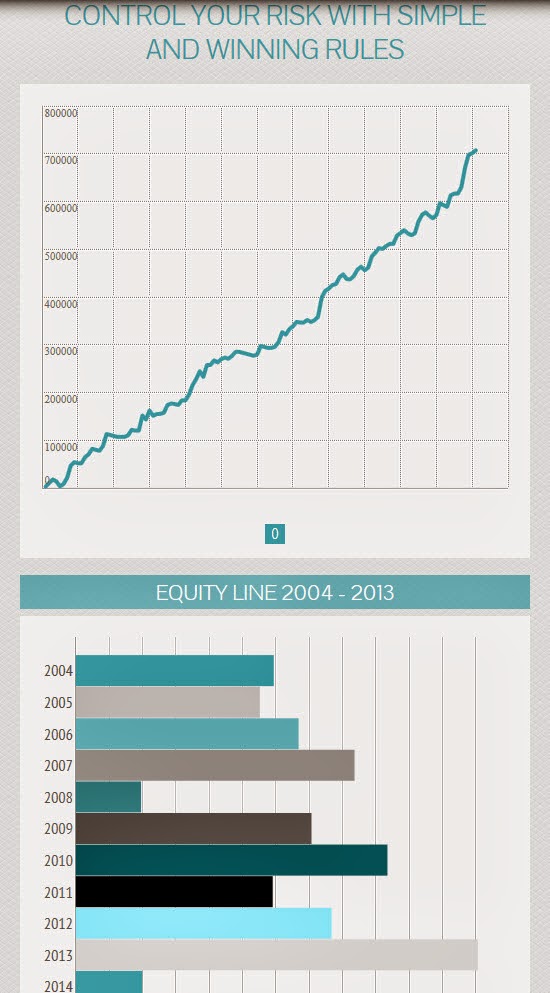

YOUR RISK WITH SIMPLE AND WINNING RULES

We are happy to announce an interesting offer,

a new service that will surely be of significant attention by all the experts.

We are now able to offer to a small

number of selected investors the

signal service or managed accounts service on the stocks of Dow Jones, using our Super Stocks

strategy. Super Stocks

is a clone of Super Commodity, works at the same firm and with the same fixed and non-optimized parameters, obtaining very good results

even on all the stock markets.

We offer free signal service for Super Stocks until

the end of March. Mail me to take the trial demo offer and start the free service michele.giardina@quantusnews.com

|

| ||

BUY LOW AND SELL HIGH!

Super Commodity and Super Stocks wants to be a solid reference point for all those investors which want to approach all the markets world with a robust tool with low risk levels.These strategies works automatically searching for specific patterns around markets, those highly profitable patterns with a good success percentage. These graphic formations demonstrated during the years to be turning points in robust and reliable manner. Both strategies was born in order to use these points as very good launch points for its trades. Super Commodity and Super Stocks must be considered a pattern recognition system which searches graphic formations with preselected features. The system uses six different patterns which determine particular rules the system uses to manage trades. |

PATTERN RECOGNITION STRATEGIES

The strategy uses six different patterns. These determine particular rules the strategy uses to manage trades. The pattern set-up is made after the markets close and any new signals are used in the next market session.These strategies have the undeniable advantage to sell the highs and buy the lows. In fact, they look for the turning points of the market at the end of the waves, taking the highs and lows as stop loss. In this way, when the set-up is correct, we often see the price run in favor of the trade, reaching very often and very quickly the profit target. | ||

HISTORICAL RESULTS

|

HISTORICAL RESULTS

| ||

|  | ||

TRADING SIGNALS SERVICE FOR BOTH STRTEGIES

The signals service with all trading signals will be sent by email at the end of day, and in case again in the next day to intraday updates, through a daily report like this and this. In addition, customers may view at any time the trading signals also on a special page through secure internet access.The service will continue pay a monthly $ 395.00 fee. To activate please contact me. |

MANAGED ACCOUNT SERVICE FOR BOTH STRATEGIES

Our company receives a limited power of attorney on an account that the client opens with the broker Berkeley Futures (www.bfl.co.uk) or Interactive Brokers (www.interactivebrokers.com). | ||

NINJA SYSTEM

SMALL AUTOMATED DIVERSIFIED PORTFOLIO

Nice short-term automated pattern recognition trading systems that works with fixed and not optimized parameters on a limited number of Commodities and Equity Indices, achieving a high diversification, low risk levels, robust and longevity results. Ninia enters our portfolio systems adding diversification and lowering the overall portfolio risk.  |

Equity Line Ninja System 2002/2012 with $ 100K initial

|

ONLY MANAGED ACCOUNT SERVICE

Minimum Account Size $ 100K

Historical Drawdon $ 28K

Max RisK Per Trade Variable

Our company receives a limited power of attorney on an account that the client opens with the broker Berkeley Futures (www.bfl.co.uk) or Interactive Brokers (www.interactivebrokers.com).Will be applied management fee 2% annum charged quaterly, performance fee 30% per year charged quaterly. To get info please contact me. | |

SURVIVOR SYSTEM

FAST INTRADAY DIVERSIFIED PORTFOLIO

Survivor is a intraday pattern recognition trading system which can work on a highly numbers of diversified markets with fixed and not optimized parameters. The Survivor system core elements are the volatility breakout, the filter pattern that validates it and the little number of parameters (3) which regulate its working. The highly selective and combined three variables action makes Survivor one of the more robust and versatile systems in its category. In fact Survivor can operate with profit on many markets and on many time frames. It works with fixed and not optimized parameters on all the markets, this is an essential condition to guarantee constant and robust results. In combination with the Ninja eMini S&P system improves results and risk.  |

Equity Line Survivor System 2002/2012 with $ 100K initial capital

|

ONLY MANAGED ACCOUNT SERVICE

Minimum Account Size $ 100K

Historical Drawdon $ 32K

Max RisK Per Trade Variable

Our company receives a limited power of attorney on an account that the client opens with the broker Berkeley Futures (www.bfl.co.uk) or Interactive Brokers (www.interactivebrokers.com).Will be applied management fee 2% annum charged quaterly, performance fee 30% per year charged quaterly. To get info please contact me. | |

Disclaimer

Past performance is not a guarantee of future returns. Operate with any financial instrument is safe, even higher if working on derivatives. Be sure to operate only with capital that you can lose. Past performance of the methods described on this blog do not constitute any guarantee for future earnings. The reader should be held responsible for the risks of their investments and for making use of the information contained in the pages of this blog. Coincollector should not be considered in any way responsible for any financial losses suffered by the user of the information contained on this blog.

My company are only authorised to provide the managed account service to clients that qualify as professional according to the MIFID directive 2004/39/EC and that are resident in the European Union. Who does not belong to these categories, please contact me directly.

|