Richiedi la demo gratuita di 30 giorni di Galaxy Combined Portfolio Systems

In the table below you can see the monthly equity line of the trading systems that make our Galaxy portfolio systems and the MTM performance summary since November 2009. Galaxy ends with a good result also the month of April, after a similar result in the month of January and February, bringing the performance to 29.59 % in 2011. One just closed is the seventh consecutive positive months after the brief pause at the end of the summer last year. The equity continues to grow in harmony while maintaining an upward slope and steady thanks to high diversification within the portfolio. Historical results of Galaxy Combined Portfolio System are available at the following links: http://www.box.net/shared/static/nz7u0ztnbp.xls, http://box.net/shared/b9cg6kfa6s. Historical results of single trading systems are available at the following link: http://www.box.net/shared/5vajnzc4cp.

Request a free demo of 30 days of Galaxy Combined Porolio Systems

Equity Line Trades, Giornaliera e Mensile di Galaxy / Trades, Daily and Monthly Galaxy Equity Line Free Demo Available

|  |  |  |

Performance MTM Mensile di Galaxy Portfolio System con un capitale iniziale di $ 200.000

Monthly MTM Performance of Galaxy Combined Portfolio System with $ 200K initial capital

Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

2009 | 1.19 % | 2.90 % | ||||||||||

2010 | (4.28 %) | 24.49 % | 2.99 % | 1.76 % | 15.62 % | 4.35 % | 10.60 % | (0.41 %) | (4.73 %) | 1.75 % | 12.80 % | 1.50 % |

2011 | 7.54 % | 7.75 % | 8.06 % | 6.23 % |

|  |

Your diversification strategy is working correctly?

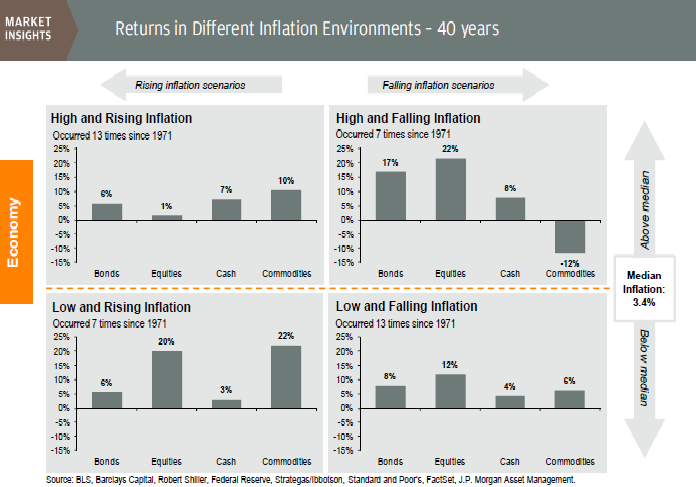

The diversification is a management technique that mixes a wide variety of investments within a portfolio. The main benefit of adding managed futures to a balanced portfolio is the potential to decrease portfolio volatility. Risk reduction is possible because managed futures can trade across a wide range of global markets that have virtually no long-term correlation to most traditional asset classes. Moreover, managed futures funds generally perform well during adverse economic or market conditions for stocks and bonds, thereby providing excellent downside protection in most portfolios.

The diversification between assets

The diversification between assets that have low correlation between them improves the overall performance of our investments for the same risk, thus reducing our exposure to risk decreases as the so-called "specified risk" linked to a single class of financial products. Basically, if you only held the shares, the result of your trading / investment is overly tied to the fortunes of a particular financial instrument for which you are running too high a risk. A well-diversified portfolio asset class is one of the major components that create the optimal portfolio. Read "The Art Of Asset Allocation" and "Top 10 Rules Of Portfolio Diversification".

The diversification within an asset

Concentrating investments in individual products or securities, you are exposed to a type of risk that can not be controlled, and the risk becomes uncertainty, which is something that is incalculable. is possible, even in this case, reduce the specific risks by trading or investing, for example, not a single product but a basket of products that represents a very large share of the market. Read "The Art Of Asset Allocation" and "Top 10 Rules Of Portfolio Diversification".

The diversification of trading methods

It combines the use of different methods of trading not correlated to improve the relationship between profit and maximum loss. The low correlation between different methods tends to reduce overall losses due to the combined performance of two or more trading systems. It is therefore one of the most effective ways to improve the performance of our investments while reducing risk. Read "The Art Of Asset Allocation" and "Top 10 Rules Of Portfolio Diversification".

The diversification of the trading system parameters

Is to use, within the same trading system, of different sets of parameters. Assuming that a trading account manage an adequate capital for diversification, it is better to diversify sets of parameters rather than making multiple contracts with the same set of parameters. The diversification of the set of parameters helps to minimize risk and strengthen our ability to remain disciplined and consistent psychological application of the trading system. Read "The Art Of Asset Allocation" and "Top 10 Rules Of Portfolio Diversification"

TOGETHER TO WIN: GALAXY PORTFOLIO SYSTEMS

Our goal is to generates significant medium term capital growth independent of stock and bond markets with simple and strict risk trading rules with maximum possible diversification. All our Portfolio Systems are designed assembled and managed with this philosophy. Due to the high diversification that characterizes them, our Portfolio Systems enhance the positive synergies of individual Trading Systems which are composed and dramatically reduce the overall risk. Diversification remains the cornerstone of modern portfolio theory. Yet, during the financial crisis many "diversifying” investments readily followed the direction of the equity markets as they collapsed in 2008 and 2009. By contrast, our Portfolio Systems have just obtained their best resultsin 2008 thanks to the volatility of the period, the high diversification and the construction model that makes them independent of market equity and bond.

Material in this post does not constitute investment advice or a recommendation and do not constitute solicitation to public savings. Operate with any financial instrument is safe, even higher if working on derivatives. Be sure to operate only with capital that you can lose. Past performance of the methods described on this blog do not constitute any guarantee for future earnings. The reader should be held responsible for the risks of their investments and for making use of the information contained in the pages of this blog. Trading Weeks should not be considered in any way responsible for any financial losses suffered by the user of the information contained on this blog.