GOFO Goes Into Negative Territory Three Months Out

The Gold Forward Offered Rate, or GOFO for short, is the rate at which dealers are prepared to swap gold for dollars in the London market, i.e. it is the interest rate one must pay if one lends gold and simultaneously borrows dollars for a fixed period. Normally this forward rate should be in positive territory, similar to the gold futures curve being normally in contango. Since there can theoretically never be a 'shortage' of gold as all the gold ever mined still exists, gold is usually not liable to go into backwardation similar to e.g. copper or crude oil. The latter have inventories that are measured in weeks or months of demand. If a near term supply shortage becomes evident, traders will tend to bid up spot and near month futures contracts in these commodities, while later delivery months will tend to trade at lower levels. Backwardation in short is an indicator of an emerging near term supply shortage.

On rare occasions something along similar lines happens in the gold market as well and it is usually a good indicator of developing stresses in the market. It essentially indicates that someone is trying to get hold of bullion in the here and now and finds it difficult to get hold of the desired amount. Since GOFO refers to gold in the form of good delivery bars, its message is actually of some importance. The premiums that occasionally develop on certain small scale forms of gold such as coins or small bars bought by retail investors, by contrast mainly indicate that refineries have been surprised by a surge in retail demand and need to catch up with producing gold in the desired sizes and forms.

GOFO is calculated by subtracting the gold lease rate from LIBOR. Under normal circumstances, the gold lease rate should always be below LIBOR, not least because dollar interest rates must sport a larger price premium; after all, the dollar can be inflated at will, while gold cannot. A swap of gold for dollars is essentially a dollar loan secured by gold collateral – hence the rate one pays is lower than the one paid for an unsecured loan. An analogous trade can be put on by using the futures market: one can e.g. sell physical gold and buy an equivalent number of gold futures contracts three months out. One can then earn the spread between the interest rate on gold as expressed by the contango and the interest one receives for the dollars on the gold sold (as the amount one has to put up for margin earns interest as well, it is a fairly straightforward and theoretically risk-free carry trade). The arbitrage/carry is obviously even better and more obvious on the rare occasions when gold is in backwardation (see Keith Weiner's previous discussions of the topic).

Note that normally, given the positive GOFO rate, people will employ gold to get their hands on dollars. In other words, gold is normally used to obtain dollar liquidity. It follows that their motivation is reversed when GOFO turns negative: in that case, dollars are offered in order to get hold of gold.

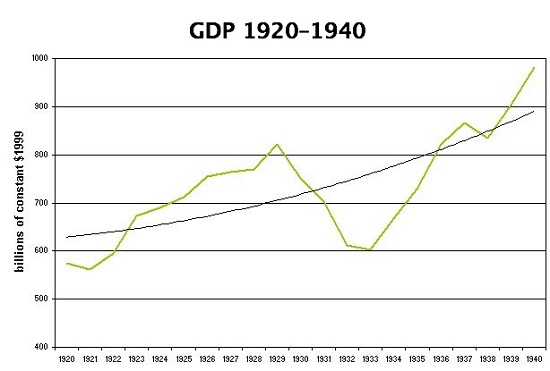

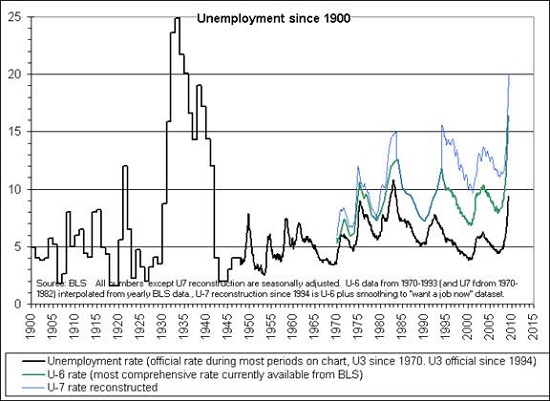

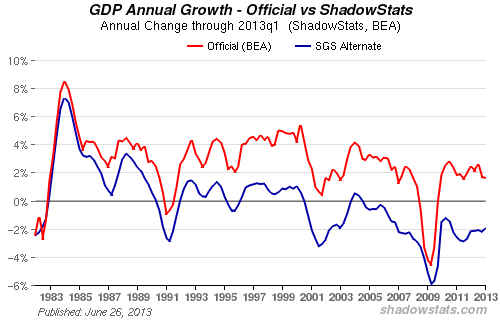

Below are the most recent charts of one month and three month GOFO which were provided to us by the 'dailymarketsummary.com'. As can be seen, both one and three month GOFO have now turned slightly negative:

One month GOFO moves into negative territory – click to enlarge.

One month GOFO moves into negative territory – click to enlarge.

3 month GOFO is likewise in negative territory – click to enlarge.

3 month GOFO is likewise in negative territory – click to enlarge.

What It Means

Look at the other times when GOFO turned negative on the charts above. The last time was at the low in gold prices in 2008, when the market was in the grip of a panicked liquidation of speculative long positions in gold futures. The only previous occasion of note was the large turn into negative territory shortly before the Washington agreement limiting central bank gold sales and gold leasing operations was announced in 1999. The agreement created a big obstacle for the at the time still extremely popular gold carry trade and had market participants scrambling to get hold of gold (presumably they were forewarned).

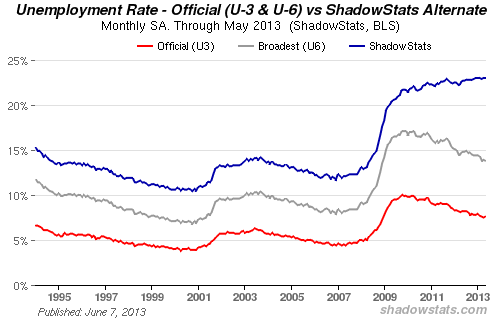

In 2008 and today we believe that the move in GOFO mainly indicates that a gap in perceptions about gold has developed, namely between the perceptions expressed in the 'paper market' for gold on the one hand and the activity in the actual physical market on the other hand. Note that the gold market in London is largely fractionally reserved. Unallocated gold deposits are employed by bullion banks for their own business purposes. The holders of gold in unallocated accounts have a claim to gold, but most of the gold is actually not there – only a fraction of it is, which is thought to be sufficient to satisfy the normally relatively low level of delivery demands. Unfortunately for the gold banks, there is only limited help that can be provided by central banks to stop a run on unallocated accounts. The central banks have large gold reserves, but they cannot create more gold ex nihilo. The Washington agreement has limited the amount the biggest gold holders among the central banks may offer for sale or lending purposes. Moreover, a number of important central bank gold holders have stopped the practice of leasing their gold altogether (for instance the German Bundesbank).

So here is an educated guess as to what we can conclude from the fact that GOFO has moved into negative territory: the sell-off in the COMEX futures market has led to a surge in demand for physical bullion. Obviously many buyers of bullion believe gold to be undervalued at the moment – futures traders got carried away a bit by their bearish sentiment. This general surge in demand has probably in turn led to an increase in delivery demands on unallocated gold accounts. Since these accounts are fractionally reserved, there is now a scramble to get hold of gold for immediate delivery. In order to entice gold holders to part with bullion, the putative borrowers are taking the unusual step of actually offering to pay interest for swapping dollars for gold. Getting hold of bullion in sufficient amounts in the here and now has apparently become a pressing problem.

Again, it must be stressed how unusual this is, given the large extant supply of above ground gold. This is also why we suspect that it is the fractionally reserved nature of unallocated gold accounts that provides the impetus.

Lastly, it should be noted that on previous occasions when GOFO turned negative, large rallies in the gold price ensued thereafter. While there is no guarantee that the same will happen again (the sample size is obviously small), it would actually be logical to conclude that gold is likely to rally in the wake of this development – after all, it signifies a surge in demand.