By Joseph Ciolli and Callie Bost

U.S. stocks fell, erasing this year’s gains for the Standard & Poor’s 500 Index (CME:ESM14), as weaker-than-forecast data from China and tension in Ukraine overshadowed reports showing an improving American economy.

United Technologies Corp., Pfizer Inc. and American Express Co. tumbled more than 2.4% to lead declines in the Dow Jones Industrial Average. An S&P gauge of homebuilders lost 3.2%, falling for a seventh straight day. Dollar General Corp. slipped 3.2% as it forecast earnings below analyst estimates.

The S&P 500 fell 1.3% to 1,844.67 at 3:29 p.m. in New York. The benchmark index reversed earlier gains after climbing to within four points of its closing record of 1,878.04 reached on March 7. The Dow dropped 238.67 points, or 1.5%, to 16,101.41. Both gauges are poised for their biggest decline since Feb. 3. Trading in S&P 500 stocks was 4% above the 30-day average at this time of day.

“People have certainly moved on to worrying about global issues and a lot less about domestic ones,” Jeffrey Kleintop, Boston-based chief market strategist at LPL Financial LLC, which manages $414.7 billion, said in a phone interview. “The market is clearly focused on the Ukraine situation today, which could further contribute to volatility tomorrow.”

The S&P 500 has declined 1.6% this week, sending the index to a 0.2% loss for the year, amid concerns that China’s economy is slowing and the crisis in Ukraine is escalating.

‘Very Serious’

The U.S. and Germany stepped up pressure on Russia to back down from plans to annex Crimea from Ukraine after the region holds a referendum in three days, warning they’ll exact an economic toll if Russia doesn’t.

Secretary of State John Kerry told a Senate panel in Washington that the U.S. and Europe will take “very serious” steps the day after the vote “if there is no sign” of a resolution to the crisis.

China’s industrial-output, investment and retail-sales growth cooled more than estimated in January and February, data showed today. China announced an economic growth target of 7.5% last week, the weakest since 1990, and had its first onshore bond default after a solar-panel maker failed to make an interest payment.

“Ongoing concerns about China’s growth and the fluid situation in Ukraine continue to linger on markets,” Ryan Larson, the Chicago-based head of U.S. equity trading at RBC Global Asset Management (U.S.) Inc., said. “As Kerry meets with his Russian counterpart tomorrow in a last ditch effort to divert the referendum, markets could be a little jittery, and we might be seeing some of that play out today as well.”

U.S. Economy

Global concerns overshadowed better-than-forecast data in the U.S. Retail sales rose in February for the first time in three months, as Americans ventured out to shop last month even as colder-than-normal temperatures and severe snowstorms blanketed parts of the U.S. A separate report showed a drop in unemployment benefits for the latest week, indicating further improvement in the labor market.

The government’s monthly jobs report last week showed U.S. employers added more workers than estimated in February. The Federal Reserve is trying to determine how much recent economic data has been affected by weather.

“The lingering question has been how disruptive this deep freeze has been to the economy,” James Dunigan, who helps oversee $127 billion as chief investment officer in Philadelphia at PNC Wealth Management, said by phone. “As we come out of this deep thaw, if we get some better, more clear data on the underlying trend, we’re going to see that the economy is continuing to gain momentum.”

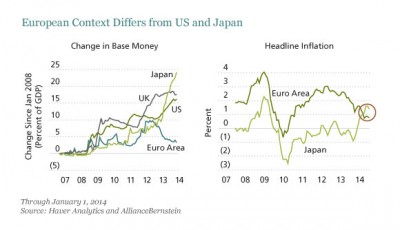

Fed Stimulus

The S&P 500 rallied to all-time highs this year as Fed Chair Janet Yellen said the U.S. economy was strong enough to withstand measured reductions to the central bank’s monthly bond purchases. Three rounds of Fed stimulus have helped push the S&P 500 up 173% from a 12-year low, as U.S. equities begin the sixth year of a bull market that started March 9, 2009.

The Federal Open Market Committee, which meets March 18-19, has cut monthly bond buying to $65 billion from $85 billion in December. Policy makers have indicated they plan to taper by $10 billion at each meeting absent a weakening in the economy.

“After last Friday’s employment numbers, we believed they were worthy of the FOMC continuing to take $10 billion off the table every month,” Ernie Cecilia, chief investment officer at Bryn Mawr Trust Co. in Bryn Mawr, Pennsylvania, said in a phone interview. “After the March 18-19 meeting, we should be at $55 billion a month.”

P/E Ratios

Stocks are falling at the anniversary of a bull market that sent the S&P 500’s price-earnings ratio to 17, approaching the level where equities peaked in 2008. The advance is about a week away from supplanting the stretch of equity gains that lasted from 1982 to 1987 to become the fifth longest of all time, according to Bespoke Investment Group LLC.

It’s also three weeks before the end of the first quarter, a period for which Wall Street analysts have lowered forecasts for U.S. earnings growth to 1.9% from 6.6% at the start of 2014, according to data compiled by Bloomberg. For all of 2014, analysts see profits climbing 7.6%, compared with an estimate of 9.7% at the end of December.

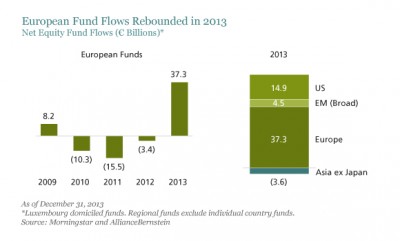

The decline in equities comes after more than $41 billion returned to U.S. exchange-traded funds that own shares in the past four weeks, reversing withdrawals that swelled to as much as $40.2 billion last month, according to data compiled by Bloomberg.

Volatility Gauge

The Chicago Board Options Exchange Volatility Index, a gauge for U.S. stock volatility, rose 15% to 16.58 today. The measure has advanced 21% this year.

Nine of 10 main industries in the S&P 500 fell today, with industrial and technology shares dropping more than 1.7%. The Morgan Stanley Cyclical Index tumbled 1.8% and the Dow Jones Transportation Average slid 1.7%.

An S&P index of homebuilders lost 3.2%, bringing its decline for the month to 8.6%, as Toll Brothers Inc. dropped 3.5% to $36.44 and PulteGroup Inc. declined 3.4% to $19.01.

Discount retailer Dollar General slipped 3.2% to $57.37 after forecasting first-quarter earnings of no more than 74 cents a share, below the 81 cents estimated by analysts.

Family Dollar Stores Inc. tumbled 2.3% to $60.25.

Offshore Drillers

Offshore drillers decreased after ISI Group said in a client note that deepwater rig demand is weaker than the market has anticipated. Diamond Offshore Drilling Inc. slid 4.7% to $44.22, the lowest level since 2005. Noble Corp. fell 4.9% to $28.88. Transocean Ltd. erased 3% to $39.57.

PVH Corp., which owns Calvin Klein, declined 5.6% to $115.20. The company was downgraded to market perform from outperform at Wells Fargo & Co., while Morgan Stanley lowered its rating to equalweight from overweight.

Williams-Sonoma Inc. jumped 9.8% to $64.72. The seller of cookware and home furnishings forecast same-store sales growth of 5% to 7% this year, compared with the 3.7% average analyst projection. Revenue will reach $4.63 billion to $4.71 billion, Williams-Sonoma predicted. Analysts had estimated a number at the low end of that range, data compiled by Bloomberg show.

See the original article >>