by Tom Aspray

It seems certain that most investors will be glad January is over and are hoping that February will be less volatile. Many are worried that a lower close in January will mean a lower close for the stock market in 2015.

The so-called January Barometer, developed by Yale Hirsch, has an 88% chance of determining where the market will close using data since 1950. This does not include years where the market closed flat. Recently, it has not been as accurate. The S&P 500 closed January lower in 2014 (-3.43%), 2010 (-3.82%), 2009 (-8.54%), 2008 (-6.09%), and 2005 (-2.53%).

The Spyder Trust (SPY) had a positive return in each of these years except 2008. Data from Morningstar shows the following annual returns: 2014 (13.46%), 2010 (15.06%), 2009 (26.32%), and 2005 (4.83%). In every year except 2008 and 2009, the S&P 500 was also up the following February.

Click to Enlarge

However, I would not expect a return to low volatility in the near future and it could last for most of the year. The Wall Street Journal chart shows that the volatility spiked in October as crude oil started its collapse. An increase in volatility is not surprising as the prior two years had historically low volatility. So far this week, the S&P 500 has had some extreme ranges which have averaged 1.5% daily.

This earnings season has been full of both positive and negative surprises and it isn’t over yet. Several big-cap names have been hit hard as Microsoft (MSFT) will close at the lowest level in six months, while Caterpillar (CAT) made a new low for the year.

This is where the relative performance analysis can be quite helpful as I noted in my review of the big banks before they reported earnings. The analysis of the regional banks also looks negative, suggesting they will continue to be weaker than the S&P 500. The financial sector has been the poorest performer, so far, in 2015.

The stock market seemed to be more interested in the earnings from Apple, Inc. (AAPL) last week than they were about the FOMC announcement. Over the past few weeks, I had received some inquires about my technical view for Apple’s stock.

Following Comments Unfollow Comments ![]()

Click to Enlarge

Therefore, in Tuesday’s column Buy Apple on an Earning’s Miss, I looked at the monthly, weekly, daily, and intraday charts. On all time frames, the technical studies indicated that AAPL had completed its correction from the November high. The weekly chart shows the break of the downtrend, line a, on January 23.

The weekly relative performance had also turned higher and moved back above its WMA and the recent high. The OBV multiple time frame analysis was also positive, consistent with the end of its pullback. It should close the week at another new high.

With the stock’s close Monday at $113.10, a pullback was required to set up a favorable entry price and keep the risk in the 5% area. At the time, I thought it would take an earnings miss to drop the stock to the recommended buying levels. Instead, the stock was hit hard along with the rest of the market, closing before the earnings at $109.03. It is trading at $119.50 early Friday afternoon.

As always, my article elicited a host of comments from people who thought I either was predicting lower earnings, hoping to drive the stock down for my own benefit, or just was not familiar with the company at all. As a technical analyst, I never predict earnings.

Though I do not currently own an Apple computer, I started doing technical analysis on a series of three networked Apple II computers thirty-three years ago and I have followed the company every since. I do not own any Apple stock except in a mutual fund and do not recommend stocks that I own. I certainly was not short the stock, given the positive technical readings.

This news was followed by very surprising earnings from Amazon on Thursday as they actually reported a profit. The stock is up over 13% in early trading on Friday. There were some casualties as Qualcomm (QCOM) dropped 11% last Thursday on disappointing earnings and the apparent loss of some chip business with Samsung.

So, can Apple and the technology sector take the market out of its trading range and provide the fuel for another push to the upside?

Following Comments Unfollow Comments ![]()

Click to Enlarge

The monthly chart of the Dow Jones Technology Index (DJUSTC) made a slightly higher high in December before closing lower. It is also set to close down over 3% in January. The sector was hit hard in October as the long-term support, line a, was tested. This month’s low took the index back to where it closed in October.

The monthly relative performance broke its downtrend, line c, at the start of 2014. It is still well above its rising WMA but below the 2012 high. The monthly OBV has turned lower but did make a new high in November.

The weekly studies (not shown) are slightly negative and a weekly close under 1012 would signal a deeper correction. The index needs a close back above 1045 to complete the recent sideways pattern on the daily chart.

Though there are plenty of companies still to report, from a technical perspective, I can’t count on technology to turn the market higher right now. Actually, I think the energy sector has a better chance as many of the large oil companies have held up pretty well after their earnings were released. It may be that their weak earnings and spending cuts are already factored into their stock prices.

Click to Enlarge

The energy sector and crude oil prices do have a seasonal tendency to bottom in February. The seasonal chart of crude oil shows a typical peak in July, line 1, which is followed by a decline into December.

Historically, the final low comes in early February as indicated by line 2. Though crude was down a bit last week, the March contract will form a weekly doji. Therefore, a close this week above $46.55 would trigger a HCD buy signal.

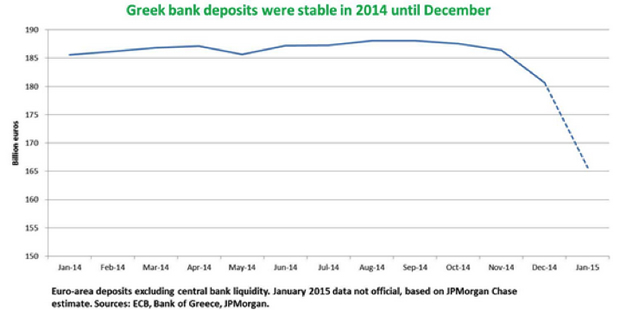

Higher crude would help calm the increased fears of deflation as the EuroZone reported a drop of 0.6% in the year through January. This will help the ECB sell its quantitative easing plan.

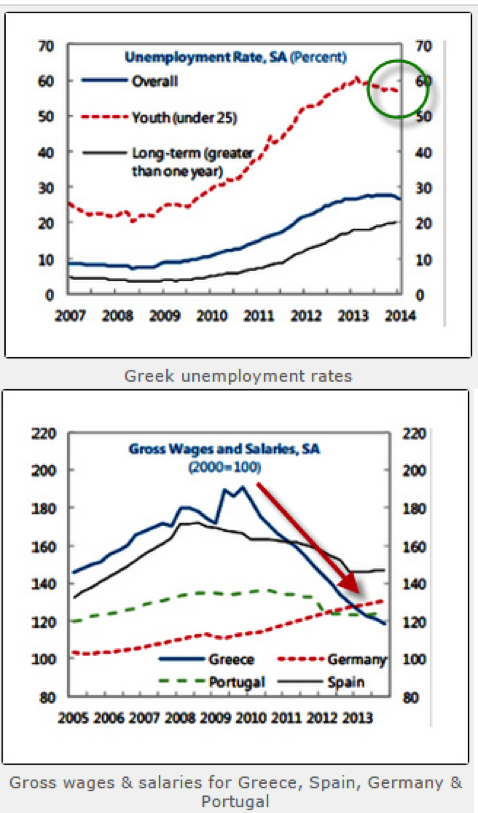

It is also thought that the lower crude oil prices will stimulate buying in other areas. In fact, Spain’s economy is showing the strongest growth in seven years. I continue to expect that the EuroZone economy will surprise many by the end of the year.

The very weak Durable Goods report last Tuesday helped increase the selling in an already weak stock market. The media ignored the sharp rise in Consumer Confidence to 102.6, which was the highest reading since 2007. I had thought last week that it would get above 100 soon but not that fast.

Click to Enlarge

The New Home Sales also beat expectations, while the Pending Home Sales were weaker than expected as they declined 3.7% in December. Last Friday’s GDP report disappointed economists as it reflected a growth rate of just 2.6%. Most were expecting GDP to grow 3.2%. Much of the gain was a result of consumer spending, but it did reverse the positive trend of the past two quarters.

The Chicago PMI came in stronger than expected on Friday while the University of Michigan’s Consumer Sentiment reading of 98.1 held on to the strong mid-month reading.

This week, the focus will be on manufacturing and jobs. On Monday, we get the PMI Manufacturing Index, ISM Manufacturing Index, and Construction Spending. This is followed on Tuesday by Factory Orders.

Along with the ADP Employment report on Wednesday, we also get the ISM Non-Manufacturing Index with the monthly jobs report on Friday.

What to Watch

The stock market tried to rebound several times on Friday but the sellers took over in late trading to close the major averages near the day’s lows. Therefore, some of the key ETFs may close the week below their quarterly pivot levels (see Pivot Table here). This will be updated in Monday’s column.

The failure of the market to respond more positively from the prior week’s upside reversal is a concern. In last Friday’s column Any Warnings from the Monthly Charts?, I took a detailed look at the monthly charts of the NYSE Composite, Spyder Trust (SPY), PowerShares QQQ Trust (QQQ), and the iShares Russell 2000 (IWM).

The monthly indicators typically warn of more significant corrections like we saw in 2011. As I noted last week, a strong close was needed to turn the weekly studies higher. The weekly studies on all the averages except the NYSE Composite have deteriorated further.

A break of the widely watched 1990 level in S&P 500 is likely to trigger heavier selling. If we do see such a further downside break this week, we are still likely to see a snap back rally that will allow us to adjust our strategy. In light of the detailed analysis of the monthly charts, I will focus today on the weekly charts of two key market tracking ETFs.

The daily studies are close to generating additional sell signals and may do so today once the final numbers are in. Some stocks, like those recommended in Three Market Leading Healthcare Picks, are likely to hold up better than the major averages.

The sentiment picture also reversed last week as the bullish % from AAII rose from 37.14% to 44.17%. More importantly, the bearish % dropped sharply from 30.79% to 22.39%.

Click to Enlarge

The 5-day MA of the % of S&P 500 stocks above their 50-day MAs turned down last week as it closed at 47.97%, which is one standard deviation below the mean of 65.01%. This suggests that it could drop below the January 20 low of 41.36% before the correction is over.

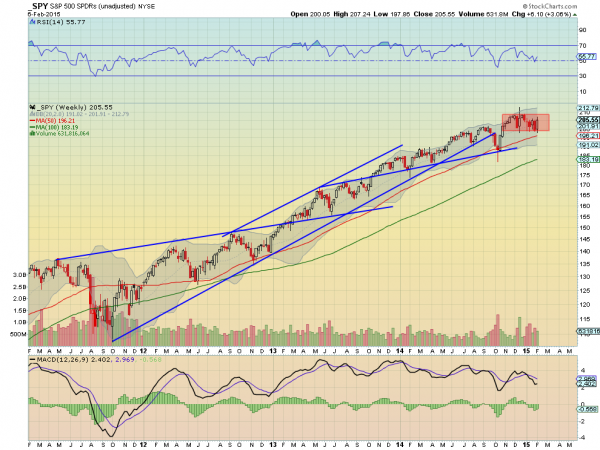

The weekly chart of the NYSE Composite shows that it looks ready to close below the 20-week EMA at 10,770 but may finish above the quarterly pivot at 10,597. These levels can be a valuable way to navigate volatile markets.

There is further weekly support from early January in the 10,440 area, line a. This also corresponds to the monthly projected pivot support for February. The weekly starc- band is at 10,216.

Click to Enlarge

The weekly NYSE Advance/Decline will turn down this week but is still close to an all time high. It would take a week or more before it breaks decisively below its still rising WMA. There is more important support at line b. The daily A/D line is still holding above its WMA.

The weekly on-balance volume (OBV) has deteriorated in the past week as it has dropped back below its WMA, which has now flattened out.

A daily close back above the 10,870 level would be positive.

S&P 500

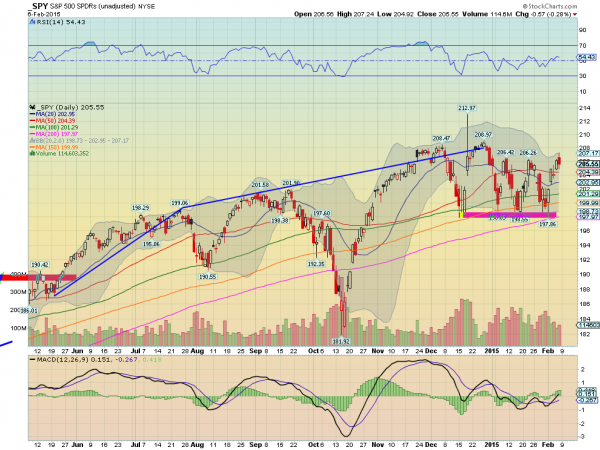

The weekly Spyder Trust (SPY) has been in a tight range over the past four weeks, despite the wide daily swings. In afternoon trading, it is still above the quarterly pivot at $199.42. The starc- band is at $196.76 with further support in the $194 area.

Click to Enlarge

A daily close above $206.50 would be an important sign that the market is ready to move to new highs. The weekly starc- band is now at $215.74.

The SPY moved above and below the slightly rising 20-week EMA at $202.97 quite a few times last week.

The weekly S&P 500 A/D line made a new high at the end of 2014 and is holding just slightly above its WMA. The daily A/D line (not shown) is still holding above its recent lows but is slightly below its WMA.

The weekly on-balance volume (OBV) looks ready to close the week below the previous low and its WMA, which is a bearish sign. It is still well above the long-term support at line c. The daily OBV is just below its declining WMA.

Nasdaq 100

The PowerShares QQQ Trust (QQQ) continues to hold above the quarterly pivot at $99.67, which also corresponds to the four week lows. The weekly starc- band is at $96.59 with the weekly support at $94, line d.

The Nasdaq 100 A/D line made twin peaks in December and is likely to close just below its WMA. It is also quite close to the longer-term uptrend, line e. There is more important support now at the October lows. The daily A/D line formed higher lows last week, but closed below its WMA.

The weekly OBV dropped below its WMA in the first full week of January and has now moved below the prior low. It is therefore now in a short-term downtrend. With the higher close on Friday, the daily OBV (not shown) is back above its WMA.

There is minor resistance now at $103.18 with more important at $104.58. A daily close above this level is needed to shift the short-term momentum to the upside. There is additional resistance in the $105.25-$105.86, which is the upper boundary of the recent trading range.