| |

I’m wrestling with a puzzle, and maybe you are, too. Is the China growth story still intact, or is it running off the rails? What does this mean for my investments? And if China is in trouble, what should I be buying — and selling — now?

To be sure, we’ve heard premature reports of China’s doom for years. Frankly, I think people who talk about China’s economy imploding should have their heads examined. There are 1.3 billion people in China, and they are making an enormous transition from third-world lifestyles to living like big, fat, Americans.

Even if China slows down, the Chinese will still be ramping up consumption for decades.

The problem is that potential slow-down. If the market has priced in exponential growth, a slow-down is enough to deflate A) commodity prices and B) stocks of companies that are designed around exponential growth in China.

Here are some of the warning signs that have the market rattled:

- Goldman Sachs just lowered its estimate of China’s gross domestic product growth, saying it will rise 9.4% in 2011, less than a previous call of 10%. Royal Bank of Canada lowered its China growth estimate to 9.5%. Both estimates are way down from China’s 10.3% growth in 2010.

- A preliminary purchasing managers index for Chinese manufacturing came in at 51.1, the lowest since July 2010. And industrial production rose by 13.4% in April, slower than the 14.8% gain in March.

- On May 12, the central bank raised banks’ reserve requirement for the fifth time this year. China’s central bank is doing this as part of a concerted effort to fight inflation, which is currently a major policy concern for Beijing. China’s Consumer Price Index was 5.3% in April, slightly down from March’s 32-month high of 5.4%. This stubbornly high inflation leads some experts to predict the central bank isn’t through raising reserve requirements, which would hobble economic growth.

- And China’s central bank could also raise its benchmark interest rate — again — to fight inflation. RBC forecasts that the People’s Bank of China will need to raise interest rates by an additional half a percentage point by the end of the third quarter. That would suck more “hot money” out of the economy.

So you can see why people are concerned. But maybe those concerns are overblown. After all, a reading of 51.1 in the PMI is consistent with growth of 13% in Chinese industrial production and 9% in Chinese GDP.

Is China a Canary in the Coal Mine for the Rest of the World?

If a slowdown in China is taking place, it’s not happening in a vacuum. In the United States, first-quarter GDP came in at a disappointing 1.8%, and preliminary data for April and May suggest that is continuing into the second quarter.

The Philadelphia Fed manufacturing index of business activity fell to a seven-month low of 3.9 from 18.5 in April and March’s 27-month high of 43.4.

The end of quantitative easing — in which the Fed threw money at banks, who in turn threw it at the stock market — should weigh on stock prices if not the actual economy. And the ongoing stalemate over raising the U.S. debt limit hangs like the sword of Damocles over the global economy.

Meanwhile, European economic data continues to disappoint as member countries, including Greece, Spain, Italy, Portugal and Ireland wrestle with their debt crises.

And the Japanese economy shrank at a 3.7% annual rate in the January-March period, even worse than was expected. By the way, it turns out three of the nuclear reactors at Japan’s stricken Fukushima Daiichi nuclear power plant are believed to have suffered meltdowns. I’m wondering how long before we see larger-scale evacuations in that area.

Doctor Copper Says the Chinese Economy Is Feeling Poorly

Copper is an economic bellwether due to its many uses in industry and commerce. It’s called “Doctor Copper” because it takes the temperature of the global economy.

Copper can be a particularly good indicator of the Chinese economy because China uses 40% of the world’s copper. The bad news is China imported 595,963 tons of refined copper in the first quarter, 21% less than the same period a year ago.

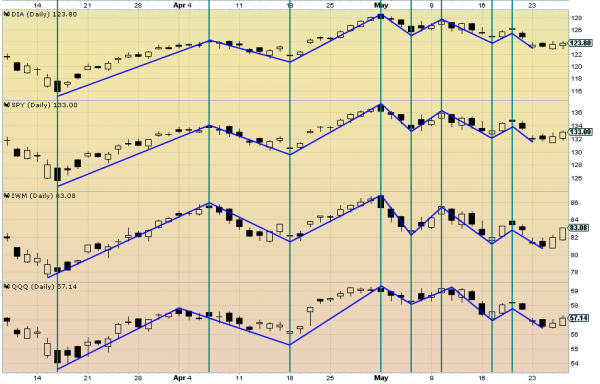

Now, that may just be the Chinese messing with us — they’ve manipulated the copper market in the past to get better prices. But take a look at a chart of copper — you can see the price is really starting to break down:

We’ll see if support around $3.69 holds. If it does, this is only a short-term correction. If it doesn’t, well …

Why This Might Be Just a Correction

| |||||||||||||||

Here’s the thing that has turned the whole China problem into a puzzle for me. The same big banks that are downgrading China’s economy are also raising their estimates for global oil prices.

Goldman Sachs, Morgan Stanley and JP Morgan are all RAISING their estimates of where oil prices will end this year.

The banks issued their forecasts on Brent Crude, an international benchmark. Goldman raised its Brent crude price forecast for 2011 and 2012 on expectation fuel demand growth will sap global inventories and strain OPEC’s spare capacity. The bank raised its year-end Brent forecast to $120 per barrel from $105, and its 2012 forecast to $140 from $120.

Meanwhile, Morgan Stanley raised its Brent crude price forecast for 2011 and 2012, citing an improvement in demand coupled with a loss of Libyan output. The brokerage raised its 2011 Brent crude price forecast to $120 per barrel from $100 a barrel, and its 2012 forecast to $130 from $105. JP Morgan raised its 2011 forecast as well, to $130.

I find it very puzzling that the big banks are raising oil prices while simultaneously lowering forecasts on China’s growth.

And in fact, one part of China that is still full of red-hot growth is its oil demand. China’s implied oil demand hit its third highest monthly level EVER in April.

And there are other areas of the Chinese economy that are also growing rapidly.

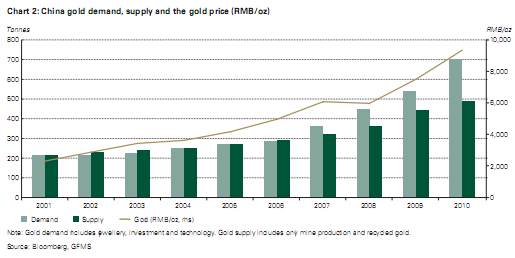

China’s Gold Demand Continues to Soar

The Chinese are buying more gold than ever … and buying more gold for investment than anyone. In fact, China’s investment demand for gold more than doubled to 90.9 metric tonnes in the first three months of the year, outpacing India’s modest rise to 85.6 tonnes, according to data from the World Gold Council. That means China now accounts for 25% of gold investment demand, compared with India’s 23%.

A big driver behind this is that rising inflation in China that I mentioned earlier. China’s citizens, fearing that inflation will eat away at their savings, are buying a lot more gold.

But if the Chinese economy was really slowing down, wouldn’t China’s consumers have less money to spend, and therefore buy less gold? So China’s gold demand story doesn’t fit with the narrative of a slowing economy.

Chinese Silver Imports Are Rising

China imported 3475.4 metric tonnes of silver bullion in 2010, a whopping fourfold increase from 2009’s imports of just 876.8 tonnes. This year, China’s lust for gold keeps rising. China’s demand for silver bullion in April was 339.4 metric tonnes. This compares to 302.09 metric tonnes in April 2010 or an increase of over 12% from the same month last year.

Silver is an industrial metal as well as a precious metal. If China is really slowing down, shouldn’t its silver imports be falling off a cliff?

Solving the Puzzle

We hear predictions of China’s slowdown — and some of the data seems to back that up — but we also see China’s purchases of hard assets including oil, gold and silver booming.

I think the lesson here is to be cautious and selective about how you invest in China. If China is in the market for hard assets, you might want to buy them first.

And if you want a different way to invest in Chinese assets, consider that China will increase investment in water conservation projects this decade to $615 billion, up from $163 billion in the previous 10 years, according to reports in the Xinhua news service.

The plan will allow the nation to fight droughts and floods, which have increasingly affected many regions across the nation, Xinhua said, citing Minister of Water Resources Chen Lei.

Two stocks that are positioned to profit from this investment wave are Veolia Environment (VE on the NYSE) and Insituform Technologies (INSU on the NASDAQ).

Both firms are involved in water infrastructure and transportation, and both have exposure to China.