By Joshua Zumbrun and Jeff Kearns

Federal Reserve Chairman Ben Bernanke (Source: Bloomberg)

Federal Reserve Chairman Ben Bernanke (Source: Bloomberg)

Federal Reserve Chairman Ben S. Bernanke said the central bank may start reducing bond purchases later this year and end them in mid-2014 if the economy continues to improve as the central bank forecasts.

“If the incoming data are broadly consistent with this forecast, the committee currently anticipates that it would be appropriate to moderate the pace of purchases later this year,” Bernanke said today in a press conference in Washington. “If the subsequent data remain broadly aligned with our current expectations for the economy, we will continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around mid-year.”

Bernanke spoke after the Federal Open Market Committee said today it would maintain the $85 billion pace of monthly asset purchases and that it sees the “downside risks to the outlook for the economy and the labor market as having diminished since the fall.” The FOMC repeated that it’s prepared to increase or reduce the pace of purchases depending on the outlook for the job market and inflation.

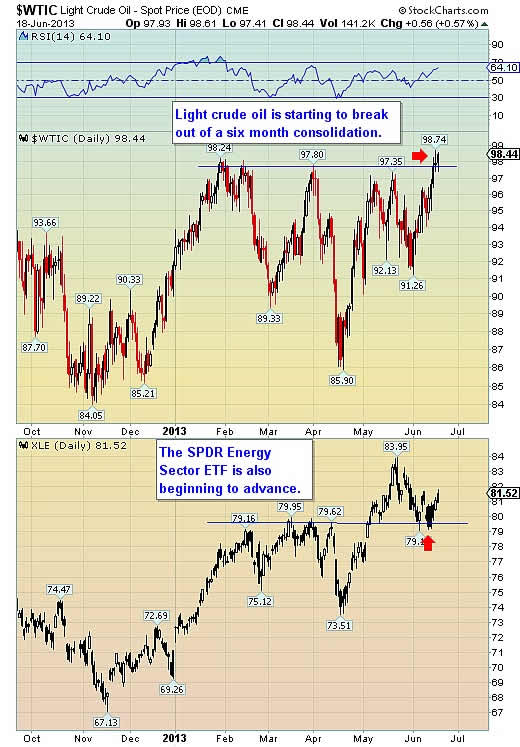

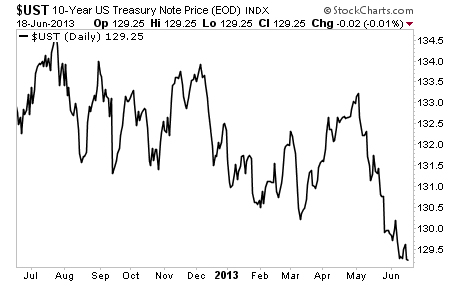

Bernanke is expanding the Fed’s balance sheet toward $4 trillion as he seeks to reduce a jobless rate that stands at 7.6% after four years of economic growth. Concern that the Fed is closer to reducing the pace of asset purchases, also known as quantitative easing, pushed 10-year Treasury yields to the highest since March 2012.

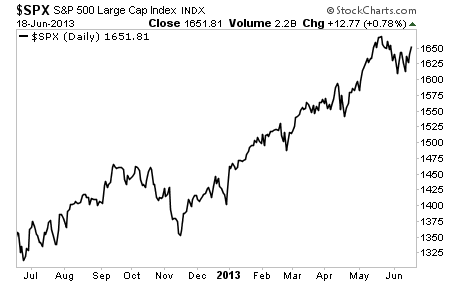

Stocks extended losses after his remarks. The Standard & Poor’s 500 Index declined 1.3% at 3:57 p.m. in New York. The yield on the 10-year Treasury note rose to 2.34% from 2.19% late yesterday.

Downside Risks

“The Fed is out of the closet,” said Ward McCarthy, chief financial economist at Jefferies Group LLC in New York and a former Richmond Fed economist. “They expect to end these QE purchases. Bernanke wasn’t more specific than later this year, but connecting all the dots suggests he is thinking in the fourth quarter.’’

Bernanke stressed that the Fed has “no deterministic or fixed plan” to end asset purchases.

“If you draw the conclusion that I just said that our policies -- that our purchases will end in the middle of next year, you’ve drawn the wrong conclusion, because our purchases are tied to what happens in the economy,” he said. “If the economy does not improve along the lines that we expect, we will provide additional support.”

Unemployment Threshold

The Fed also left unchanged its statement that it plans to hold its target interest rate near zero as long as unemployment remains above 6.5% and the outlook for inflation doesn’t exceed 2.5%.

Bernanke said policy makers might aim for a lower unemployment threshold before considering an increase in short- term interest rates.

“In terms of adjusting the threshold, I think that’s something that might happen,” he said in response to a question. “If it did happen, it would be to lower it, I’m sure, not to raise it.” He said an interest-rate increase is still “far in the future.”

Fed officials lowered their forecasts for the unemployment and inflation rates this year.

They now see a jobless rate of 7.2% to 7.3%, compared with 7.3% to 7.5% in their March forecasts. They predict the jobless rate will fall to 6.5% to 6.8% in 2014, compared with 6.7% to 7% in March.

Labor Market

“Labor market conditions have shown further improvement in recent months, on balance, but the unemployment rate remains elevated,” the committee said. “Partly reflecting transitory influences, inflation has been running below the committee’s longer-run objective, but longer term inflation expectations have remained stable.”

Fifteen of 19 policy makers said the federal funds rate will be increased in 2015 or later, according to today’s forecasts. In March, 14 policy makers predicted an increase in 2015 or later.

The Fed repeated that it will keep buying assets “until the outlook for the labor market has improved substantially.” Bond purchases will remain divided between $40 billion a month of mortgage-backed securities and $45 billion a month of Treasury securities. The central bank also will continue reinvesting securities as they mature.

Labor Market

St. Louis Fed President James Bullard dissented, saying the committee should “signal more strongly its willingness to defend its inflation goal in light of recent low inflation readings.”

Kansas City Fed President Esther George dissented for the fourth meeting in a row, continuing to cite concern that keeping the benchmark interest rate near zero risks creating “economic and financial imbalances,” including asset price bubbles.

No change in policy was expected at today’s meeting. Fifty- eight of 59 economists in a June 4-5 Bloomberg Survey predicted the central bank would maintain the pace of purchases.

Investors are scrutinizing the Fed’s communications for signs the period of unprecedented stimulus is coming to an end as the economy recovers from the longest and deepest recession since the Great Depression.

Inflation is providing little impetus for a tapering in bond purchases. A gauge of consumer prices excluding food and energy that is watched by the Fed rose 1.1% in the year through April, matching the smallest gain since records started in 1960.

Biggest Jump

Speculation that an improving economy will prompt Fed policy makers to reduce bond buying last month triggered the biggest jump in 10-year Treasury yields since December 2010.

About $2 trillion has been erased from the value of global equities since Bernanke told U.S. lawmakers on May 22 that the FOMC “could” consider reducing bond purchases within “the next few meetings” if officials see signs of improvement in the labor market and are convinced the gains can be sustained.

Mortgage rates have soared the most in a decade on speculation the Fed’s purchases may slow. The interest rate on a 30-year fixed home loan climbed to a 14-month high of 3.98% last week, according to data compiled by Freddie Mac.

Investors may be over-reacting to the prospect of a reduction in the pace of bond purchases, Nathan Sheets, the former head of the Fed’s international finance division, said before the Fed announcement.

Still Buying

“Tapering is not a reduction in stimulus,” said Sheets, now the global head of international economics at Citigroup Inc. in New York. “The Fed will still be buying, still removing duration from the market.”

Bernanke is nearing the end of his second four-year term, a period marked by unprecedented measures to battle the deepest recession since the 1930s and then to keep the economy growing at a pace that’s brisk enough to put millions of unemployed Americans back to work.

The former Princeton professor cut the Fed’s target interest rate almost to zero in December 2008 and has led the central bank in three rounds of large-scale asset purchases that have swelled the Fed’s balance sheet to a record $3.41 trillion.

Obama Comments

President Barack Obama, in an interview on PBS this week, provided one of the clearest signals yet that Bernanke may not remain beyond the end of his term on Jan. 31. Bernanke “already stayed a lot longer than he wanted or he was supposed to,” Obama said.

Bernanke declined to discuss his future at today’s press conference.

“We just spent two days working on monetary policy issues and I would like to keep the debate, discussion, questions here on policy,” he said in response to a question. “I don’t have anything for you on my personal plans.”

The labor market has gained strength since the Fed began the latest round of asset purchases in September. Employers added 175,000 jobs in May, and the country has regained 6.3 million jobs since 2010, 72% of those lost in the aftermath of the recession.

Still, unemployment has been 7.5% or higher since January 2009, the longest stretch of such high joblessness since the depression. The ratio of workers to the total population fell to 58.2% in 2011, the lowest since 1983. The ratio rose to 58.6% in May.

Global Growth

Slowing global growth and federal government budget cuts are taking a toll on the world’s largest economy. Manufacturing unexpectedly shrank in May at the fast pace in four years, according to figures from the Institute for Supply Management.

“The uncertainty that continues in Washington has an adverse effect on confidence,” Jeffrey Smisek, chief executive officer of United Continental Holdings Inc. in Chicago, the world’s largest airline, said in a June 14 presentation. “We don’t see a degradation in the United States demand, but we don’t see a significant improvement.”

A rebound in housing, fueled by record-low mortgage rates, has shored up the expansion. Home prices rose 10.9% in the 12 months through March, according to the S&P/Case Shiller index of property values in 20 cities, the biggest annual gain since April 2006.

Blackstone Group LP Chief Executive Officer Stephen Schwarzman said this month housing has been a “big winner” in the economy.

The world’s biggest alternative-asset manager has spent $5 billion to acquire almost 30,000 U.S. single-family houses in a bet home prices will maintain gains. New York-based Blackstone has jumped 38% this year before today, more than double the gain for the S&P 500.

“You are seeing a lot of strength in housing and it’s coming from almost every place geographically,” Schwarzman said in a June 11 presentation to investors.