by Marketanthropology

Like any major move, the crash in crude oil was propelled by more than just one condition. Speculative positioning, production, demand - they all played a supporting role. And although the circumstances that led to its precipitous decline can be reverse engineered and neatly written to lay at the feet of a more conspiratorial and geopolitical commiserator - such as the Saudis, the reality is the currency markets likely played the biggest role over the past year and were instigated by conditions that set sail long before the Saudi's could even look to turn the screws.

As we have speculated, we believe the significant moves in the currency and commodity markets since last summer represent the blowoff tails from these respective trends. Our general belief is the two largest and most traded currencies in the world have been wagged by the divergent policy paths between the U.S. and Europe, which caused a strong disinflationary tailwind to develop in the markets since 2011 when the ECB raised its refinancing rate twice to 1.5% - while the U.S. maintained a zero interest rate policy, subsequently buttressed by additional rounds of quantitative easing. With the ECB finally finding religion and cutting rates below the U.S for the first time in a decade - as well as pulling up to the alter of QE, the torque in the currency markets from the differentials in policy paths should begin to back off.

The blowoff move in the U.S. dollar index is butting up against long-term resistance at its 50% retracement level from the July 2001 high. Interestingly, this set-up was also where a long-term high was established in 2001 from the 50% retracement level from the February 1985 long-term high.

As we showed last November, the dollar appears to be following with approximately a three year lag, the moves in yields. Similar to our expectations that 10-year yields will trough in a range between ~1.5 and 3.0% over the next several years, we still expect the dollar to follow the leading moves lower in long-term yields.

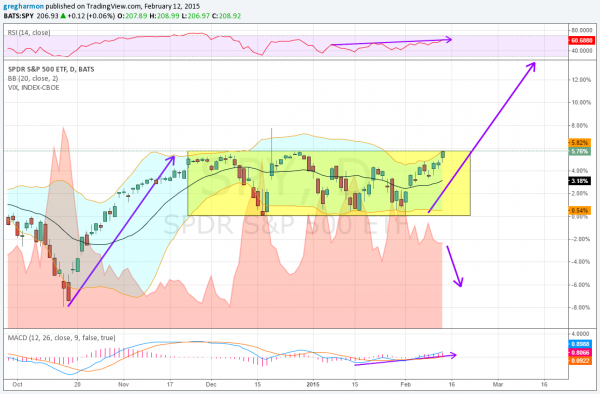

The disinflationary blowoff in the SPX:Oil ratio appears to be exhausting. Should the dollar finally turn lower, similar to our expectations with precious metals - we suspect the commodity will strongly outperform U.S. equities.

To date, oil made a cycle low 32 weeks after turning down last June. Should the low hold, the duration of the decline would be the same as in 2008/2009 and one week less than the move in 1985/1986.

*The duration comparative was corrected to reflect an error we noticed on our last update that measured the move to the low in 2008/2009 to be 33 weeks.

Although we expect yields to be supported over the next several months, we do not foresee a sustained move higher out of the long-term yield trough that would invariably come with the Fed significantly raising rates. Despite yields remaining historically low over the past 6 years, we are reminded that it took over twice that time in the previous cycle to traverse the transitional divide between secular growth cycles. While the Fed has succeeded at gestating a rich valuation premium in the U.S. equity markets, it has largely been maintained at the expense of raising rates. As much as we expect another pulse of inflation to make its way through the system as the economy improves and Europe and China hit the gas, as Larry Summers rightfully mentioned in an interview just yesterday, "We're in an extraordinarily uncommon and unusual place ... so this is not the time for the traditional central bank playbook."

Considering what happened in 1937 (which Summers mentioned yesterday as well) or the cyclical top in equities in 1946 that took shape after the Fed ended their extraordinary support of significant Treasury purchases, we suspect the Fed will be tested and squeezed between their dual mandates. In either case - and despite the daily headline concerns with deflation, we believe those assets closely tied to rising inflation expectations should outperform in the next move across the trough.