by Cullen Roche

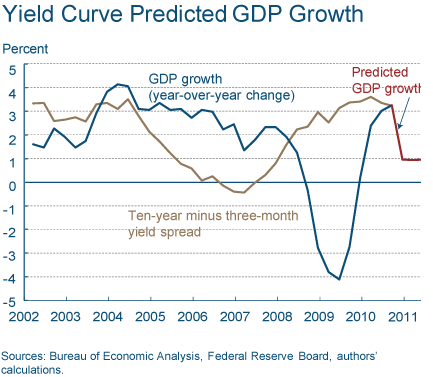

“Continuing a recent trend, the yield curve became steeper over the past month, as long rates increased nearly 0.2 percent, and short rates inched up. The three-month Treasury bill rate moved up to 0.15 percent—just above November and December’s 0.14 percent. The ten-year rate rose to 3.36 percent, up from December’s 3.18 percent and well above November’s 2.89 percent. The slope rose 17 basis points (bp), staying above 300 bp, a full 46 bp above November’s 255 bp.

Projecting forward using past values of the spread and GDP growth suggests that real GDP will grow at about a 1.0 percent rate over the next year, the same projection as in November and December. Although the time horizons do not match exactly, this comes in on the more pessimistic side of other forecasts, although, like them, it does show moderate growth for .....