By: Garry_Abeshouse

Are you ready to weather the coming storm?

It is a truism that financial markets tend to rise into ever greater expectations and to peak when optimism can rise no further. But when a market can rise no higher, “A” peak becomes “THE” peak and once reached the only way left is down. The only conclusion I can come to as to why equities (but not all equities) are so high, is that the majority of market traders (you notice I do not use the term “investors” any more) must be by definition, “True Believers” in the one and only true “Gospel of the Perpetual Rising Market”, where fantasy triumphs over reason. In this fantasy world the fiction of bullish forward P/E Ratios will always triumph over the realities of the living world, because as we all know the one true God resides, not in heaven, but in Wall Street. But Bull Markets if nothing else are ephemeral beasts, so beware of the coming storm.

National economies and financial markets have been peaking sequentially for many years.

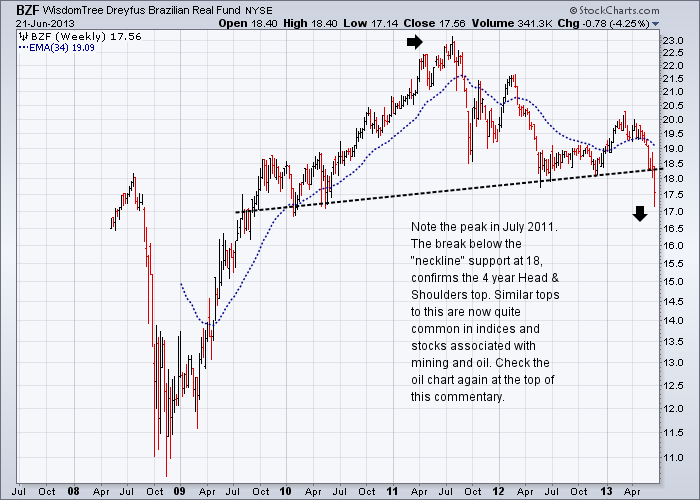

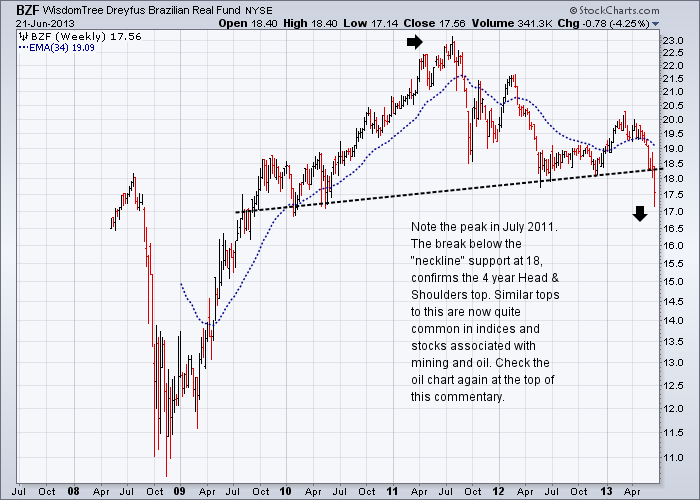

Global GDP has certainly peaked. Gold, Silver and Industrial metal prices have also peaked. Most currencies have peaked against the USD. Equity markets have been sequentially peaking over the last 13 years or more, but have yet to utter the final gasp of the economic endgame. Although the large number of index and stock price failures now apparent on charts, does suggest this time is edging closer. And lastly oil is only up where it is because the major oil companies want to keep the retail price as high as possible as long as possible and stuff the consumers. In Australia they have even got the major supermarket retailers, Woolworths and Coles, helping them do this, while they place an added profit margin to the final price, all the while giving out fake discounts on their supermarket receipts.

Currency markets, skittish in the increasingly risk averse conditions are falling against the USD in rapid succession in a race to be more competitive in a world, where overall consumption is declining, long term unemployment is going through the roof and large corporations like BHP and Rio are preparing for the perceived lean years ahead.

The over concentration of media attention on a small number of US composite indices such as the Dow 30 industrials and the S&P500 Large Cap index has both distorted and underplayed many underlying weaknesses in equity markets across the world. Some people inside the borders of the USA may think they are still the centre of the universe, but there are many others elsewhere, who would disagree. if you are like me and accept that equities are in a multiyear top, it becomes far more logical to accept that equities will top out sequentially over time rather than all at once. If you check a range of long term carts, you will see that this has indeed been the case.

The Bernanke Effect

On both May 22nd 2013 and on June 18th 2013 the Bernanke Effect took hold causing stock market falls from market peaks at both these times. To date nothing much that Bernanke has said could be seen to be set in concrete. In fact, all he had to do was to imply that given certain conditions he may or may not halt the current quantitative easing program, incorporating the selling of long dated bonds. Part of the 2013 version of this Bernanke Effect has been the carefully chosen timing of press offerings, so as to create maximum uncertainty in the financial markets.

The 2013 twist to this process was the fact that the four weeks in between these two dates also coincided with the lengthy and convoluted changeover in the Futures markets from June to September trading. Bernanke would have known this. He also would have known that the prevailing superstition in equity markets of “sell in May and go away!” would also be present. He would have been well aware that equities and other currencies were really only edging up weakly and extremely sensitive to sharp rises and falls, mainly based on pre and post-holiday and long and short covering, rather than a commitment to any one direction.

As I watched this unfold I noticed what appeared to be a bottom in the USD exactly on the day I chose to change my June USD chart over to September. Brilliantly played Bernanke. He really did nothing at all, but he still managed to stop the rise in equities. But not all equities have been rising into new highs over the last six months.

For instance:

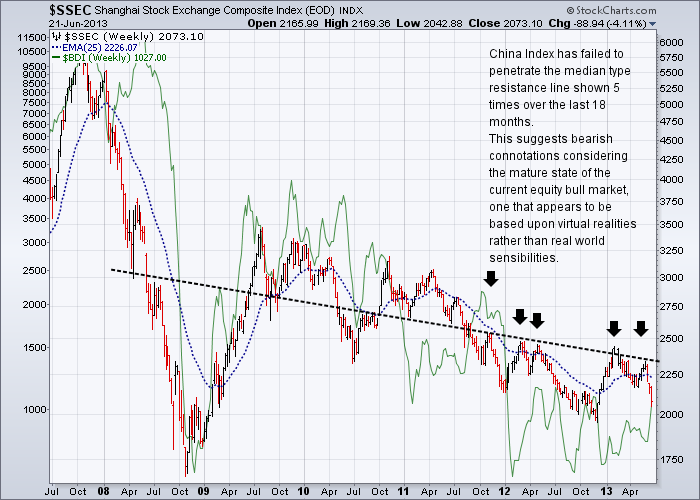

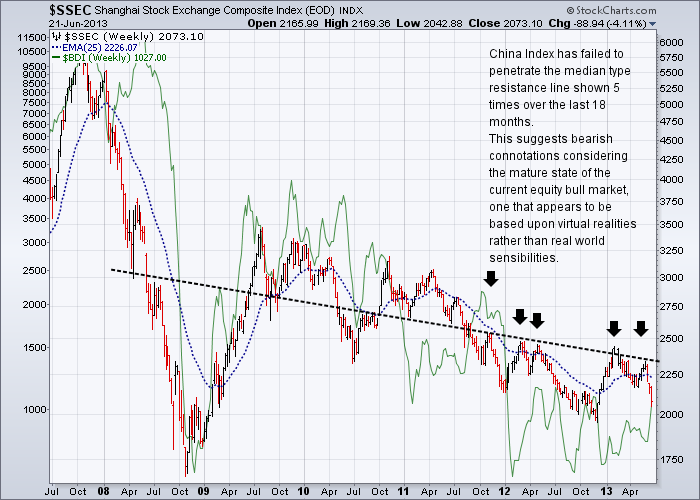

The main China index peaked post GFC in August 2009, while the Baltic Dry Index formed the last of a triple peak in May 2010.

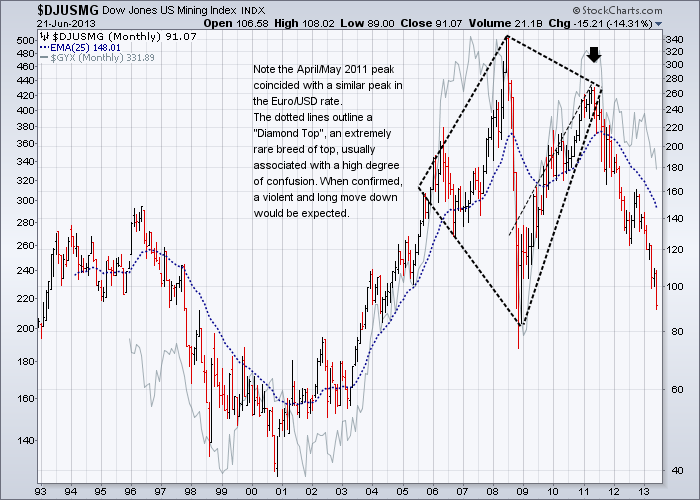

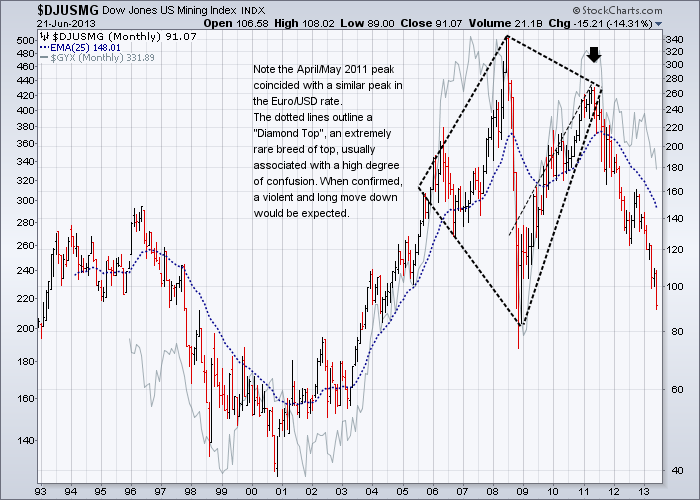

Both the DJ Mining Index and the S&P Industrial Metals Spot Index peaked in April/May 2011. For the DJ Mining Index a testing of the 2001 lows appears to be a likely prospect. The first markers for global industrial growth to rise or fall have always been industrial metal prices and mining stock prices. The bean counters working for the large mutual and hedge funds do their stuff and make their decisions and these decisions show up as buying or selling in the charts. The chart below, along with gold as deflation barometers, have always been on top of my list, and they did not let me down. Even the text books do not show a chart as neat as this one.

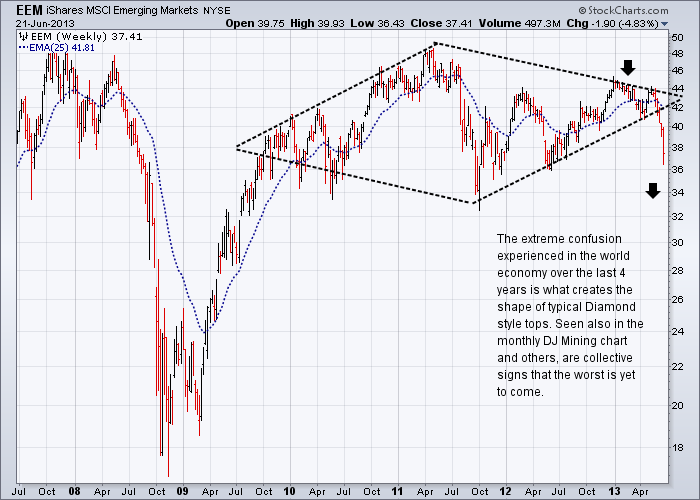

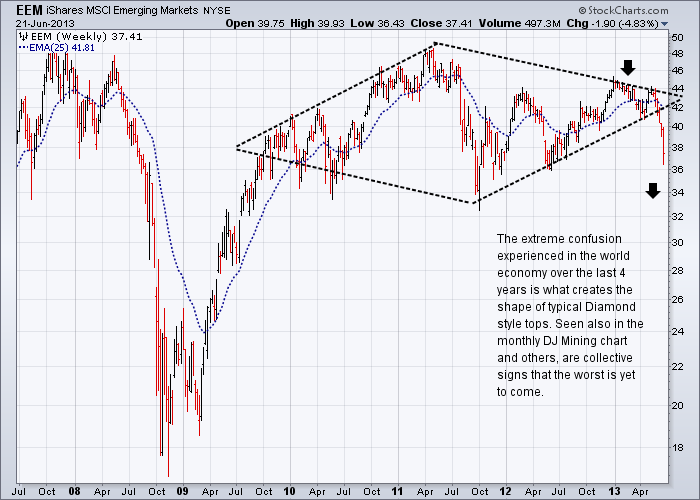

The downturn in world GDP and the problems in Europe did not go entirely unnoticed, with the Emerging Markets ETF peaking in May 2011 and then again in late December 2012. Also a chart for the text books.

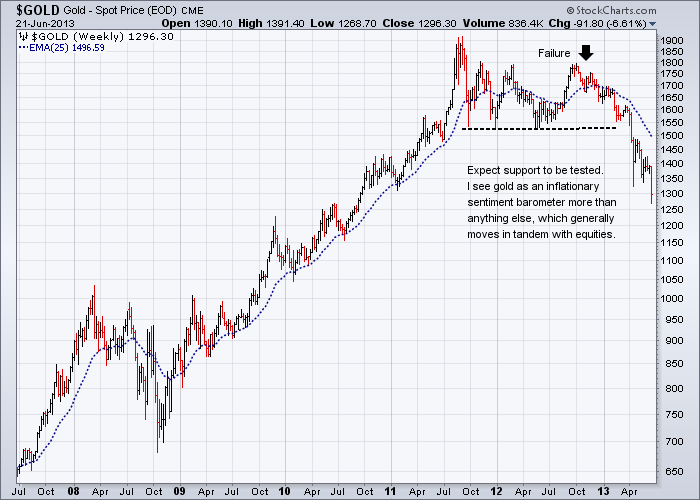

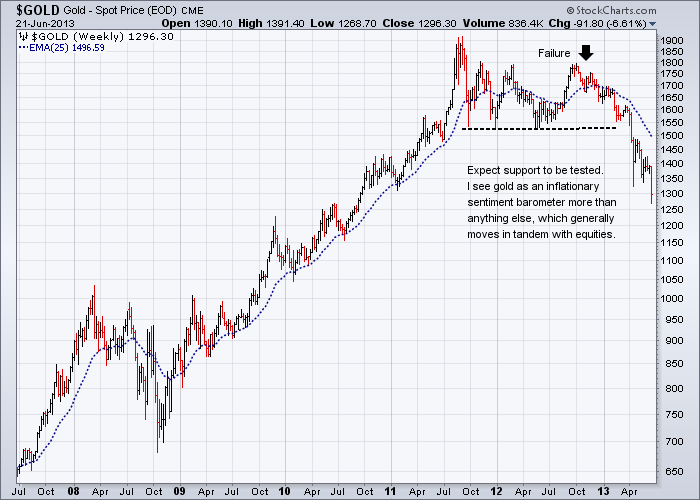

Most of the financial analysts have been wrong on gold in much the same way as economists rarely pick major market downturns accurately – as per 2007/2008.

Gold peaked in September 2011 and as my reader would have been well aware, I have been bearish on gold for quite some time now, although I expected general equity weakness to be the downside trigger rather than a manipulated Flash Crash. (Inserted chart commentary taken from private newsletter, late February 2013).

As mainstream equities have yet to fall, it appears that gold may go a lot lower over the longer term, than the 1100 target I mentioned back in March.

And as Bloomberg pointed out on April 25th:

“Central banks bought the most gold since 1964 last year just before the collapse in prices into a bear market underscored investors’ weakening faith in the world’s traditional store of value. Nations from Colombia to Greece to South Africa bought gold as prices rose for an 11th year in 2011, highlighting the reversal of a three-decade-long bout of selling that diminished the world’s biggest bullion hoard by 19 percent. The World Gold Council says they added 534.6 metric tons to reserves in 2012, the most in almost a half century, and expects purchases of 450 to 550 tons this year, valued now at as much as $25.3 billion.

Central banks are the biggest losers, with about $560 billion of value erased since gold reached a record $1,921.15 an ounce in September 2011. The metal was already in the eighth year of its longest bull market since the end of World War I when reserves started expanding again in 2008. They were also buying in 1980 when bullion peaked at the equivalent of $2,400 in today’s money, and selling in 1999 as prices slumped to a 20- year low.”

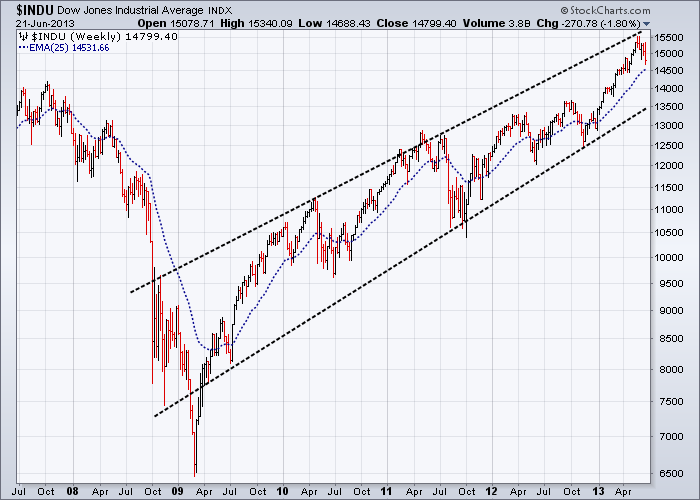

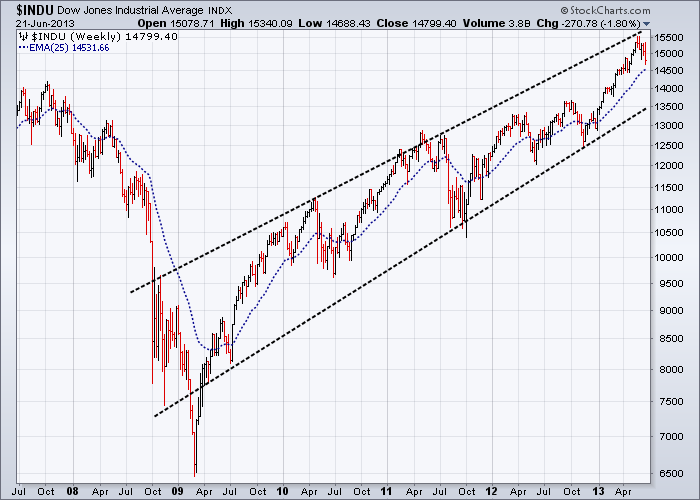

As you can see below, the DJ 30 industrials Index, aided and abetted by an enthusiastic media, continued to rise over the last three months, to eventually peak on June 18th this year. This rise occurred despite the many signs that caution should be the order of the day. Bearish markers ignored include the sequential topping out of much of the long term economic data in western countries, and bearish markers in the equity charts, appear to have simply been ignored.

This rise in equities was also associated with constant media coverage of financial market manipulations on a massive scale, continuing deteriorating economic data, together with increasing unemployment and social unrest at historically high levels across the world.

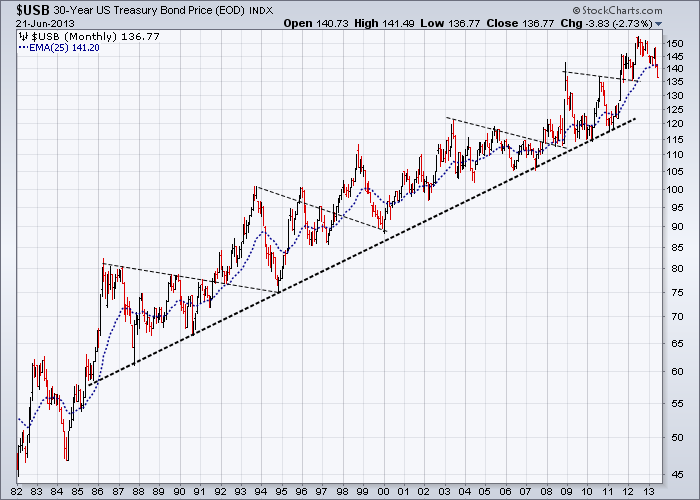

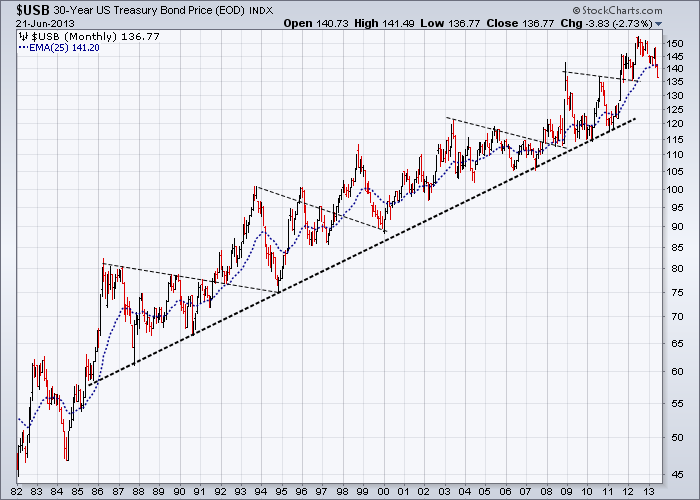

On the other hand US Treasury Bonds were in a long term bull market way before Bernanke decided to begin his quantitative easing programs. And as you can see from the 50 year chart below, they have an unnerving habit of falling into a Bear Trap, just prior to instigating another strong upward move. So do not write off US Government bonds just yet.

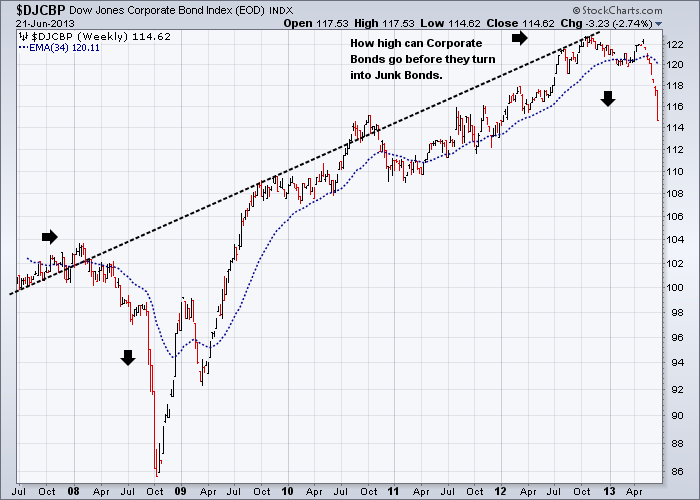

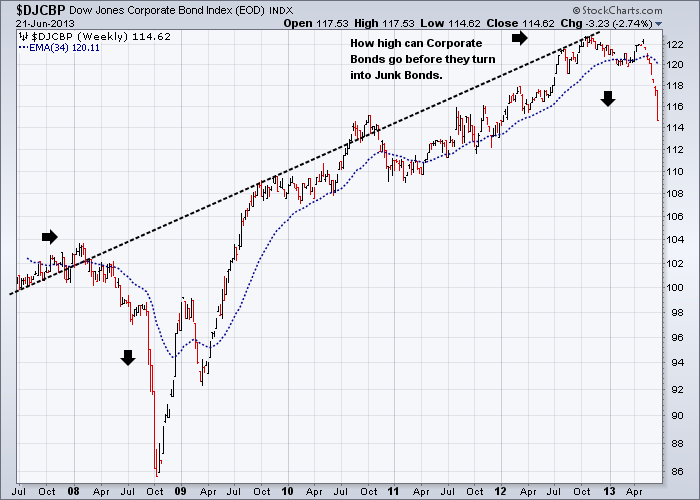

On the other hand Corporate Bonds are a different story indeed – especially as the only protection they have is over optimistic P/E Ratios. I anticipate that Municipal Bonds will go the same way as Corporate Bonds. Down.

“The warnings are out there, but no one is listening, they just don’t want to know.”

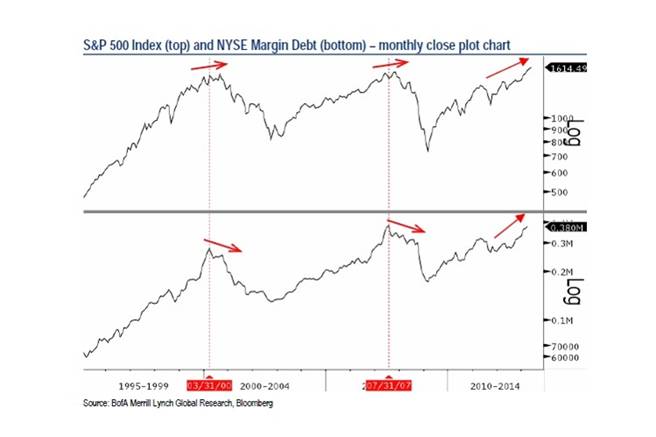

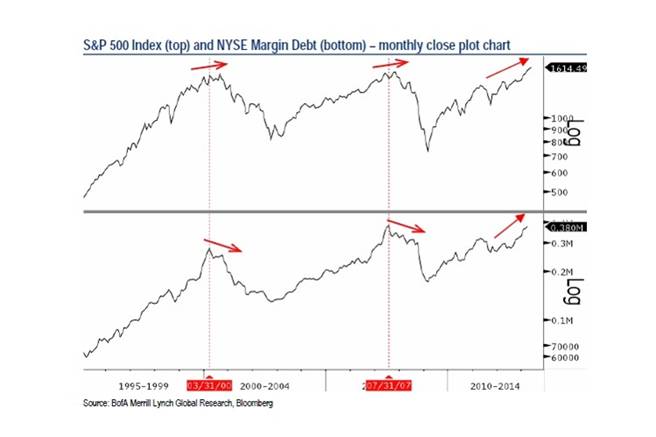

Is it only me, but is there something incongruous in seeing the margin debt of Wall Street gamblers at 2007/2008 levels, as WSJ reported on May 6th:

“High levels of margin debt on the New York Stock Exchange are raising concerns about the state of the rally. Stephen Suttmeier, technical research analyst at Bank of America BAC -1.55% Merrill Lynch, notes leverage, as measured by NYSE margin debt, rose 28% in March from a year ago to $380 billion. That figure is slightly below the July 2007 peak of $381 billion.”

This high level of margin debt is made doubly dangerous with the current high level of commitment to equities in a market where even the bears are really closet Bulls, expecting only a minor correction at worst.

Bloomberg reported on April 14th that the top 50 managed funds in the USA owned “Regulatory Assets” totalling $1,347,441,287,144 for first quarter 2013. This is compared to the average daily NYSE Group Volume in All Stocks Traded for May 2013 as being 1.445 trillion shares per day. I could not find what that meant in actual dollar value. But I am sure you will get the picture of what the NYSE would look like if everyone tried to sell at once.

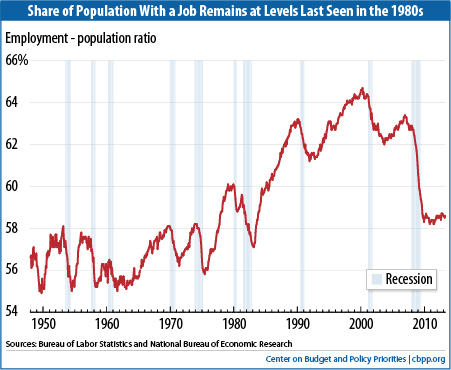

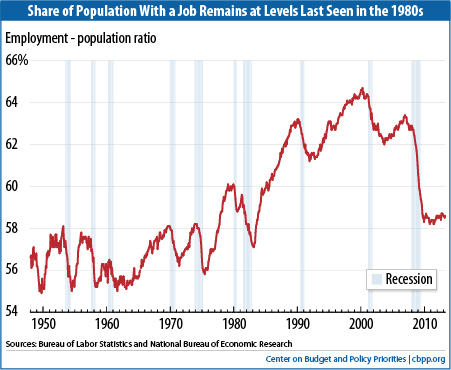

All this while a record number of people are trying unsuccessfully to find a job:

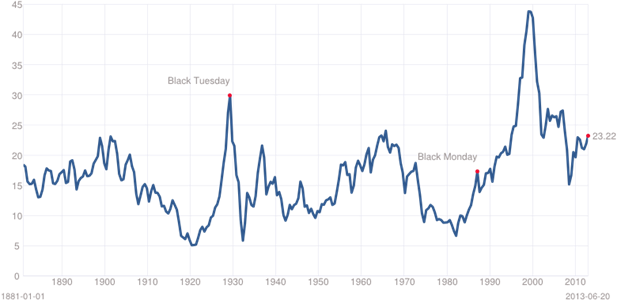

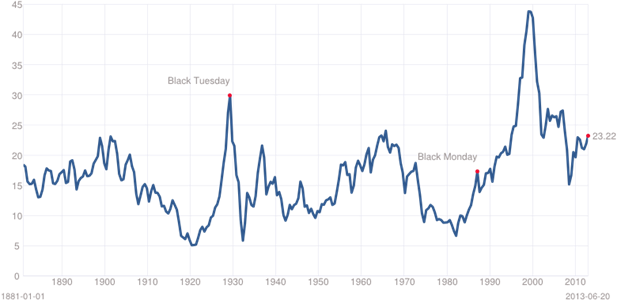

Each time over the last 133 years the Shiller P/E Ratio reached 23 (has already been over 24), it has preceded a major market downturn.

Dancing in the rain with vampire apples and banker psychopaths.

We live in an age of disbelief, where purveyors of spin spruce their wares as if there is no tomorrow and as if the past has given them no lessons to learn or reasons to learn them. And what use is the rule of law when our peers in the financial sector repeatedly thumb their noses at the rest of us, while they criminally take advantage of weaknesses in a dysfunctional and poorly policed financial system. Some of our financial elders such as George Soros, Jeremy Grantham, Gary Shiller and Robert Prechter, ever conscious of historical precedent, show a high degree of concern for the future and for good reason.

There is growing frustration and unease, with the inability of governments to confront economic inequalities and the rampant criminality and corruption in the banks, all well documented by the likes of Matt Taibbi from Rolling Stone magazine and others. The blatant “up yours style” of corporate tax evasion utilised by the likes of Apple, boggling the mind in its complexity, has been given comprehensive media coverage as well.

Underlining the highly emotional and unstable status of equity markets today is the sad but true fact that they are now resting not so safely in the soft young hands of a small number of hyperactive “20 to 30 something” traders. These individuals, working for desperate hedge funds trying to turn a profit, have been able to temporarily defy gravity by pushing up equity markets to the extent that many stocks and indices are now looking down onto the 2007/2008 highs. I anticipate that a combination of desperation to buy “higher yield” for clients in an emotional and low volume market, will almost certainly increase the susceptibility of these markets to experience more dramatic “flash crashes” and so called “Black Swan” events over the coming months. In this situation “high yield” can turn into a “major capital loss” in the blink of a “flash crash” at any time.

This view was validated on Thursday June 20th – as the FT comments:

“Bond market sell-off causes stress in $2tn ETF industry”

“Tim Coyne, global head of ETF capital markets at State Street, who said his company had contacted participants “to say we were not going to do any cash redemptions today”. But he added that redemptions “in kind” were still taking place.

Market participants described the heavy volumes and losses on Thursday as a rare occurrence and said that it could translate into further selling on Friday or early next week.

“The losses for ETFs today were far beyond what the most sophisticated financial risk models could have predicated for worst-case scenarios,” said Bryce James, president of Smart Portfolio, which provides ETF asset allocation models. He added: “The falls violated risk tolerance levels for many investors and if they were leveraged at all they are likely facing capital calls.”

Goldman Sachs makes second hand car salesmen look like highly respected pillars of society.

In stark contrast to the high risk takers in today’s markets, we have the sober assessments of elder statesmen and massive data crunchers such as Jeremy Grantham and Gary Shiller suggesting that equity markets are probably overvalued if we use the more conservative rear view style P/E ratios (see the chart above), which have been until recently sitting at around 19 (S&P) to 24 (Shiller). This should be seen against the view of the rather aggressive marketing entrepreneurs from Goldman Sachs, using the narrowest of terms of reference, who suggested recently, that despite the never ending down grading of economic statistics, forward P/E Ratios should be the way to go, enabling equity markets to continue rising well into 2015:

Courtesy of ZeroHedge on May 21st 2013, "Our earnings estimates remain unchanged but we raise our dividend estimates and index return forecasts for 2013 through 2015. We expect S&P 500 will rise by 5% to 1750 by year-end 2013, advance by 9% to 1900 in 2014, and climb by 10% to 2100 in 2015.” I kid you not, this is a real quote from GS’s report.

The consequences of a strengthening USD

Further financial dislocation will be exacerbated by USD denominated debt in a world where almost all currencies will fall against the USD over the coming months. In my work, I have begun to look at a possible future scenario of how a continuing slowdown in global GDP, combining with and exacerbated by a fall in oil and metal prices and a fall in global equities will impact harder on nations with net debt exposures denominated in USDs. A global trade war threatens, as nations set about devaluing their currencies when they can, in order to improve their export position, with Japan being the most aggressive to date. All these factors taken together are an explosive force that has the capacity to change a nation’s balance of payments from black to red almost overnight.

As I have also mentioned many times over the last four years, regardless of what you think about the USA or its debt, the USD has been in a base for many years and is still, whether you like it not THE major currency on this planet and still the currency of choice during “risk on” economic conditions. A rising USD over the coming months and years will make it inevitable, that countries with USD denominated debt, will quickly find themselves facing much higher and unforseen debt servicing requirements. My interpretation of the financial markets is that few are anticipating a substantial rise in the USD or a protracted fall in equities that will eventually force many national number crunchers to make rapid changes to their servicing requirements.

A side issue concerning those who wish to follow the USD on charts, is that the old USD Index is heavily weighted towards the Euro (57.6%). In a world where other currencies are now increasingly dominating the financial landscape and where there is a race to devalue to retain a competitive edge (note the recent devaluation of the yen), the value of this index as a means of ascertaining USD strength needs to be questioned. I have found that consistently over the last few months, charting signals on the bullish side have been both late and often misleading, while support and resistance areas have reduced significance compared to the good old days of old, when we only had to worry about the Euro:USD relationship. Be your own judge.

Growing unemployment and social instability will be the major drivers of future economic policies

A revolution begins when the collective pain of having no jobs, food on the table or a home to live in reaches a tipping point. This may start simply as a minor event, such as a man setting himself on fire, a government threatening to remove a few trees or just a man standing perfectly still on his own in total silence. The event hits a nerve and the frustration of the masses erupts, travelling instantly to an entire population through social media and igniting a fury that has been held down for generations by that one percent in power.

The inability of visionless politicians and their free market economist advisors to look beyond their economic statistics, autocratic policies, and meaningless political surveys will at some point come back to haunt them. Unless they are seen by the population at large to seek fairness and justice for the lower 99% of the population, there could be another revolution, just as there were 26 times in Brazil between 1789 and 1974. It’s not pleasant, but when pushed to the extreme, justice seeks its own revenge.

History’s perfect storm of job losses, speculative bubbles, fraud and austerity economics.

'Capitalism without humanity, solidarity and the rule of law - has no morality and no future.'

From "Das Kapital: A Plea for Man" by Munich Cardinal Reinhard Marx

According to the Spanish press recently, growing unemployment and social unrest, could be paving the way for social revolution on a global scale. Grass roots social and political activism, angry at continuing injustices and political and corporate criminality are now quite capable in changing the political landscape in the blink of an eye, as can be seen throughout the Middle East, Turkey, Europe, SE Asia and South America, with the list growing by the day. As I write these words I have just found that the ABC has reported that in Brazil, organised through social media, “about 800,000 people have marched in rallies across the country of 194 million people, according to an AFP tally - an intensification of a movement sparked two weeks ago by public anger about a hike in public transport fares.” On SBS news, I heard one young Brazilian protestor sum up the crowd’s mood, by commenting that all he wanted was justice.

Only Wall Street, the US Republican/Tea Party, the NRA and Murdoch’s Fox news appear to be immune, navel gazing while the world implodes around them, protected in their virtual reality by an almost impenetrable firewall of self-delusion and deceit.

While China’s centrally driven economy will almost certainly be able to socialise assets from real estate and industry bankruptcies as a result of any major financial downturn, by contrast, capitalist economies may have some difficulty in doing this. But this does not change the fact we now live in a highly interconnected globalised world that will be severely disrupted by coming events. No country can expect to be immune when this occurs.

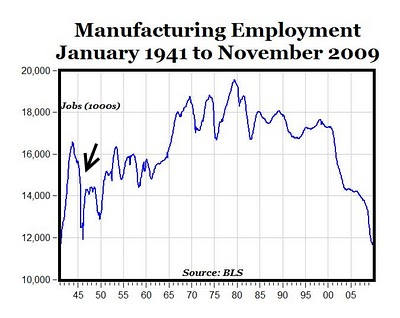

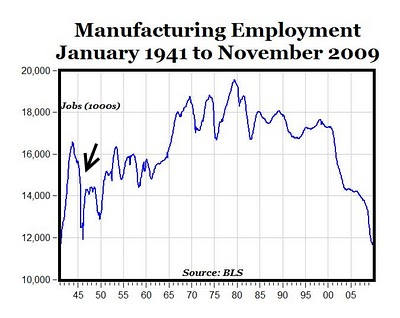

When I combine my studies of financial markets with economic and employment statistics over the last 30 years, what shows up is a long term sequential topping out of western economies, beginning in the 1980’s as jobs in these countries were slowly replaced by cheaper ones in SE Asia. This process was ably assisted by Margret Thatcher’s technique of dehumanising workers as disposable assets, so allowing large corporations to respectably downsize and relocate operations offshore where labour was cheaper and taxes on profits non-existent – all in the name of the so called “Free market”. This may have helped modernise the UK, but it penalised and disenfranchised millions of workers and laid down the foundation of the economic mess that we see globally today.

It’s simple maths. In western countries there has been a massive reduction in the number of real job making or growing the necessities of life rather than guns, while the number of parasitic jobs in the finance industry has gone through the roof during the equity bull market over the last 30 years. Consumer debt increased to maintain lifestyle as new jobs became part time and paid less and the cost of living escalated. For instance, I now pay a phone bill monthly that is way in excess of what I used to pay quarterly. Credit card interest rates are around 20% and petrol prices are way above what they should be. The list goes on.

But as soon as consumption begins to fall and the economy retreats, business starts to lay off jobs in the thousands. Banks and Telcos close their call centres and send thousands of jobs offshore to India and the Philippines. Governments cannot pay for services because the small to mid-sized businesses who used to put all their profits back into the economy one way or another have been replaced by large multinationals who send their profits offshore. Even Standard and Poor documented these changes and warned everyone in a series of economic reports published over the last 18 months.

An endgame by stealth.

When a 200 year bull market comes to an end, it does so with what I call an “elegant complexity” over a large number of years and has little to do with equities inching their way into daily new highs as they have over the last few months. This long topping out process has yet to produce an endgame, but it must be getting close. And especially since 1994/1998, you can trace the sequential topping out in equity charts as a very long drawn out process, ignored by most financial analysts, who have been more obsessed by their 24 hour news cycles, calling price movements of the day as sports commentators call the horse races.

All this, combined with the fact that free money is now seen to grow on trees, means risk is being currently encouraged to find higher returns in markets that are growing more fragile by the day. I am not sure whether Hyman Minsky would be laughing or crying or both if he were alive today, watching how much of his advice was being ignored as equity buyers look to an optimistic future with their feet planted firmly in the air. But as Bernanke announced yesterday, all this free money may soon come to an end over the coming months, although I expect his resolve to be severely tested when his over optimistic forecasts begin to fall short.

The media is massaging the message and self-censoring the news.

Compounding these problems are sections of the world media increasingly covering up and/or playing down important issues of the day, in a way that is certainly designed to deceive more that it is trying to placate a populace concerned for their future. We are experiencing the cumulative effects of centuries of global geopolitical, economic and societal changes. This huge complex of variables concerning multiple countries, cannot be summarized with a few words or charts or analysed out of context. This means that the historical narrative needs to become an essential part of any research process into the human condition and should not be reduced to “cut-and-paste” journalism or hidden from view behind paywalls.

Someone once said that “The purpose of journalism and the media was to inflate weak ideas, obscure pure reasoning, and inhibit clarity.” This has been well illustrated by the recently released high powered documentary “Shadows of Liberty”, while the Doonesbury cartoon below sums up the biases of Murdoch’s Fox News quite nicely.

Doonesbury takes on FOX News - by Garry Trudeau

Quality journalism should be there to do the exact opposite. It should be there to aid our decision making processes, to clarify ideas and to present them in ways that allow our minds to grasp and add new information to existing streams of thought.

Quality journalism is the glue that holds “facts” together. It gives us direction by helping us map complex streams of thought into stories. And the truth is that stories matter. Stories allow us to express the historical narrative in ways that both enhance and challenge our humanity and pattern our expectations of the future. They allow us to find meaning in our lives, about who we are, where we are heading as a society, and whether the markets will go up or down. Narratives help us reclaim order from chaos by assisting our movement forward into not so much a new narrative, but into the inevitable extension of an older one. And without access to free and freely available quality news and journalism, we shall be less informed on how to live our lives, both now and in the future.

The truth about stories is that if we lose them, we shall be less than who we were.

Till next time.

See the original article >>

Wolf Richter

Wolf Richter