Something peculiar has been going on the treasury market during the latest round of quantitative easing (QE). If we study the chart provided below we find that treasury rates increased as soon as a QE-program was enacted, and fell immediately after its termination. Take the TSY 10 year for example; as soon as QE1 was implemented rates rose rapidly from a low of 2.08 per cent to a high of 4.01 per cent. What is striking about this is the fact that the low was set three days into the program, while the high was set three days after the program. A similar development occurred under the QE2 program. Rates reversed their sharp downtrend from the peak set around the end of QE1. A notable difference in the QE2 cycle was the apparent front-running by the market. Investors had obviously learnt how QE impacted various asset classes, so the rate peak came at the middle of the program, not at the end as witnessed under QE1. Still, the collapse in rates right after the program ended was significant.

Then came the maturity extension program (MEP) with a dual – unofficial – mandate. First of all, it was designed to “twist” the yield curve by swapping short term treasury paper for long term. In other words, the yield compression was now a wanted result; while in QE1 and 2 the fight against deflation was used as excuse to bail out Wall Street. In the MEP it was the federal government that needed bail out. And this brings us to the second, unofficial, reason for MEP. With forward guidance incorporated, short term paper was essentially positively yielding cash equivalents for the primary dealers. The Fed told them that prices on shorter maturities would be fixed. Voila, the federal government could easily sell papers along the curve. That rates fell during the MEP-program should not come as a surprise.

When QE ∞ was introduced on the other hand, rates remained stable at a low level. Rates started to climb first when hints of “tapering” to the QE ∞ program was provided. This is the exact opposite of what we have seen in previous programs!

Source: Federal Reserve (Fed), own calculations

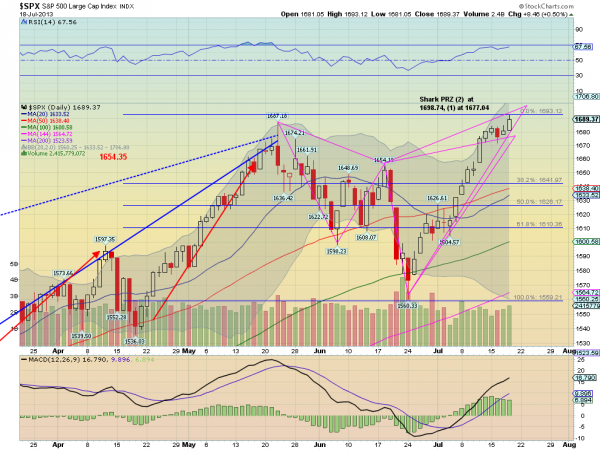

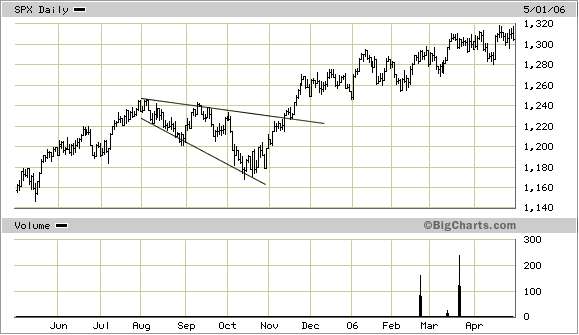

We also looked at the impact FOMC have had on the stock market since Greenspan “the-stock-market-causes-GDP” took the helm at the Federal Reserve. We tested the FOMC impact by compiling an alternative S&P500 index. The alternative index simply traded at 0 on both the day of an FOMC press release and the following day. On all the remaining days the alternative index traded just as the real S&P index. The result speaks for itself: Without trading on the FOMC-days the index is actually trending downwards. So much for following William McChesney Martin`s dictum of “taking away the punch bowl just as the party gets going.” The gang that took root at the FOMC under the Greenspan and Bernanke era added liquor whenever the chance presented itself! In terms of capital destruction no single individual has probably caused more harm to the world than Greenspan; and we include the global elite from 1939 to 1945 when making this statement.

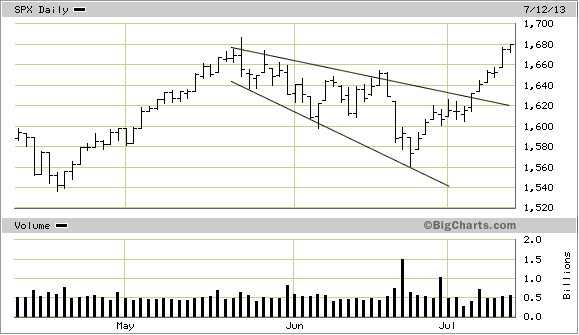

More specifically for the stock market we see that the S&P index behaves more in line with QE1, QE2 and MEP. It goes up until the punch bowl is actually taken away. Then it plunges until Bernanke panics and pour more liquor to keep the party going.

Source: Federal Reserve (Fed), own calculations

So, we know the stock market behaves as usual, so what can explain the marked change in the treasury market? To answer this we looked at QE relative to marketable treasury bills, notes and bonds outstanding. However, the MEP paired with forward guidance complicates our analysis, so we need to find a way to compare apples with apples. We therefore express both the treasury holdings by the Fed and marketable paper outstanding in 10-year equivalents.

Let us start with the Federal Reserve. The first chart depicts the stock perspective, namely the total asset side of the Federal Reserve ledger. The second chart shows the flow perspective in terms of weekly change in both mortgage backed securities (MBS) and treasury securities (TSY).

Source: Federal Reserve H.4 (Fed), own calculations

Source: Federal Reserve H.4 (Fed), own calculations

We then convert this information to ten year equivalents by utilizing the data found in the System Open Market Account (SOMA) held by the New York Fed.

Source: Federal Reserve Bank of New York - SOMA (Fed), own calculations

Source: Federal Reserve Bank of New York - SOMA (Fed), own calculations

We then proceed to outstanding marketable TSY paper available. We use the data as reported by the Treasury Monthly Statement of the Public Debt (MSPD) to get a breakdown by maturity. However, in order to put the whole thing into context we present the reader with a much more interesting chart compiled with statistics from the “Historical Statistics of the United States – Colonial times to 1970” and the Federal Reserve Z.1. statistics

Source: Federal Reserve Z1 (Fed), Historical Statistics of the United States from Colonial Times to 1970, Bureau of Economic Analysis (BEA), own calculations

After some chart-porn we are finally ready to answer the question posed at the beginning: why do interest rates behave different in this QE-cycle while stocks do not? The next chart show the reader the staggering fact that the Fed is about to be the buyer of TSY. If they maintain the current program the Fed will gobble up more than 100 per cent of net issuance by December. In other words, the Fed has become both the indiscriminate buyer and the only buyer. If there is one thing economist learn at University it is the simple fact that the price is set at the margin. But what happens when one single buyer becomes the entire market all the way up to the margin? Well, at that point the “market” price is fully dependent on this single buyer.

Source: Federal Reserve Bank of New York – SOMA (Fed), US Treasury Direct – Monthly Statement of the Public Debt (MSPD), own calculations

The main difference between QE ∞ and the previous programs is simply that the Fed has become the market. So when the Fed hints about tapering, the front-running holders of already issued TSY jump the ship and overwhelm the Fed program. Prices drop, yield spikes and the stock market is getting an additional boost as bonds-sellers park their cash in the S&P bubble!

Conclusion:

The multi-bubble machine called the Fed is at it again. This time they managed to create a gigantic bond bubble which will dwarf both the dot-com- and the housing bubble combined.