by Greg Harmon

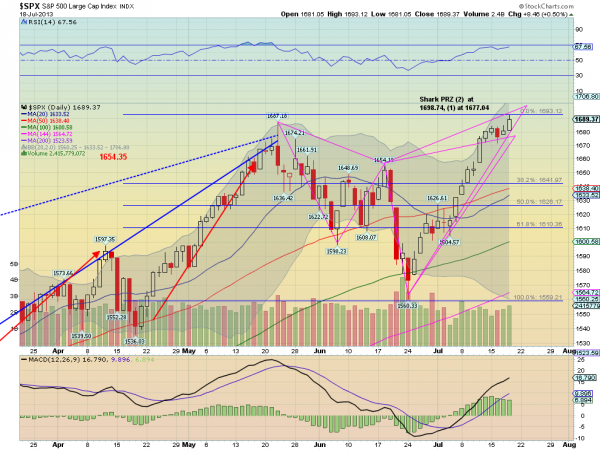

The S&P 500 made new closing highs yesterday and has been in the middle of a strong uptrend on a long term basis. But on a near term basis it is chum in shark infested waters. The chart below explains. The pattern playing out since the May 22 top has been a bearish Harmonic Shark. It has two alternatives and that is why it is in the middle of these shark infested waters. The first has triggered at 1677.04 and it is fastly approaching the second at 1698.74. The trigger for a reversal is a move lower, preferably in one candle back below 1677. Or if the 1698.74 triggers below that, even intraday

would count. The initial price objective lower would be a 38.2% retracement of the range. So, if the move starts lower tomorrow the first target is at 1641.97. The second target is a retracement to the 61.8% movement lower or 1610.36. Both can happen and keep the uptrend in take on a longer term basis. As well, neither could happen and it could just keep going higher. One perspective, and it is your money. You decide.

No comments:

Post a Comment