by David Stockman

The Fed and the other major central banks have been planting time bombs all over the global financial system for years, but especially since their post-crisis money printing spree incepted in the fall of 2008. Now comes a new leader to the Eccles Building who is not only bubble-blind like her two predecessors, but is also apparently bubble-mute. Janet Yellen is pleased to speak of financial bubbles as a “misalignment of asset prices,” and professes not to espy any on the horizon.

Let’s see. The Russell 2000 is trading at 85X actual earnings and that’s apparently “within normal valuation parameters.” Likewise, the social media stocks are replicating the eyeballs and clicks based valuation madness of Greenspan’s dot-com bubble. But there is nothing to see there, either–not even Twitter at 35X its current run-rate of sales or the $19 billion WhatsApp deal. Given the latter’s lack of revenues, patents and entry barriers to the red hot business of free texting, its key valuation metric reduces to market cap per employee–which computes out to a cool $350 million for each of its 55 payrollers. Never before has QuickBooks for startups listed, apparently, so many geniuses on a single page of spreadsheet.

Tesla: Valuation Lunacy Straight From the Goldman IPO Hatchery

Indeed, as during the prior two Fed-inspired bubbles of this century, the stock market is riddled with white-hot mo-mo plays which amount to lunatic speculations. Tesla, for example, has sold exactly 27,000 cars since its 2010 birth in Goldman’s IPO hatchery and has generated $1 billion in cumulative losses over the last six years—–a flood of red ink that would actually be far greater without the book income from its huge “green” tax credits which, of course, are completely unrelated to making cars. Yet it is valued at $31 billion or more than the born-again General Motors, which sells about 27,000 autos every day counting weekends.

Even the “big cap” multiple embedded in the S&P500 is stretched to nearly 19X trailing GAAP earnings—the exact top-of-the-range where it peaked out in October 2007. And that lofty PE isn’t about any late blooming earnings surge. At year-end 2011, the latest twelve months (LTM) reported profit for the S&P 500 was $90 per share, and during the two years since then it has crawled ahead at a tepid 5 percent annual rate to $100.

So now the index precariously sits 20% higher than ever before. Yet embedded in that 19X multiple are composite profit margins at the tippy-top of the historical range. Moreover, the S&P 500 companies now carry an elephantine load of debt—$3.2 trillion to be exact (ex-financials). But since our monetary politburo has chosen to peg interest rates at a pittance, the reported $100 per share of net income may not be all that. We are to believe that interest rates will never normalize, of course, but in the off-chance that 300 basis points of economic reality creeps back into the debt markets, that alone would reduce S&P profits by upwards of $10 per share.

America’s already five-year old business recovery has also apparently discovered the fountain of youth, meaning that recessions have been abolished forever. Accordingly, the forward-year EPS hockey sticks touted by the sell-side can rise to the wild blue yonder—even beyond the $120 per share “ex-items” mark that the Street’s S&P500 forecasts briefly tagged a good while back. In fact, that was the late 2007 expectation for 2008—a year notable for its proof that the Great Moderation wasn’t all that; that recessions still do happen; and that rot builds up on business balance sheets during the Fed’s bubble phase, as attested to by that year’s massive write-offs and restructurings which caused actual earnings to come in on the short side at about $15!

In short, recent US history signifies nothing except that the sudden financial and economic paroxysm of 2008-2009 arrived, apparently, on a comet from deep space and shortly returned whence it came. Nor are there any headwinds from abroad. The eventual thundering crash of China’s debt pyramids is no sweat because the carnage will stay wholly inside the Great Wall; and even as Japan sinks into old-age bankruptcy, it demise will occur silently within the boundaries of its archipelago. No roiling waters from across the Atlantic are in store, either: Europe’s 500 million citizens will simply endure stoically and indefinitely the endless stream of phony fixes and self-serving lies emanating from their overlords in Brussels.

Meanwhile, what hasn’t been creeping along is the Fed’s balance sheet, which has exploded by $1.2 trillion or 41 percent versus two years ago and the S&P price index, which is up 47 percent in that span. Likewise, the NASDAQ index is up 60 percent compared to earnings growth that languishes in single digits.

Not Even Orange?

Still, Dr.Yellen recently told a credulous Congressman that “I can’t see threats to financial stability that have built to the point of flashing orange or red.”

Not even orange? Apparently, green is the new orange. The truth is, the monetary central planners ensconced in the Eccles Building are terrified of another Wall Street hissy-fit. So they strive by word cloud and liquidity deed to satisfy the petulant credo of the fast money gamblers—namely, that the stock indices remain planted firmly in the green on any day the market’s open. It is not a dearth of clairvoyance, then, but a surfeit of mendacity which causes our mad money printers to ignore the multitude of bubbles in plain sight.

Actually, the Fed’s bubble blindness stems from even worse than servility. The problem is an irredeemably flawed monetary doctrine that tracks, targets and aims to goose Keynesian GDP flows using the crude tools of central banking. Yet these tools of choice— pegged interest rates and stock market puts—actually result not in jobs and income for Main Street but ZERO-COGS for Wall Street. And the latter is an incendiary, avarice-inducing financial stimulant that enables speculators to chase the price of financial assets to the mountain tops and beyond. So at the heart of our drastically over-financialized, bubble-ridden economy is this appalling truth: the speculator’s COGS—that is, his entire “cost of goods”—consists of the funding expense of carried assets, and the Fed’s prevailing doctrine is to price that at near zero for at least seven years running through 2015.

Pricing anything at zero is a recipe for trouble, but the last thing on earth that should deliberately be made free is the credit lines of gamblers and speculators. That is especially so when the free stuff—-repo, short-term unsecured paper, the embedded carry cost in options, futures and OTC derivatives—-is guaranteed to remain free through a extended time horizon by the central banking branch of the state. In that respect and even with tapering having allegedly commenced, just look at the two-year treasury benchmark. In the world of fast money speculation the latter time horizon is about as far as the eye can see, but the cost to play amounts to a paltry 37 basis points.

Even J.M. Keynes Knew Better

Once upon a time traders confronted reasonably honest two-way money markets. When they woke up in the morning in 1980-1981 they most definitely did not believe that the money market rate was pegged even for the day–let alone seven years. Instead, by allowing short rates to soar to market-clearing levels, the Volcker Fed laid low the carry trade in commodities, thereby reminding speculators that spreads can go negative—suddenly,sharply and even catastrophically

Owing to the reasonably honest money markets of the Volcker era, the leading edge of inflation–soaring commodity prices—was decisively crushed and the inflationary fevers were quickly drained from the system. But more importantly, the vastly swollen level of capital pulled into the carry trades during the 1970s Great Inflation was reduced to its natural minimum—that is, to the amount needed by professional market-makers to arbitrage-out imbalances in the term structure of interest rates. Under those conditions, fund managers made a living actually investing capital, not chasing carry.

But nowadays, by contrast, the central bank’s free money guarantee nullifies all that and induces massive inflows to speculative positions in any and all financial assets that can generate either a yield or an appreciation rate slightly north of zero. To adapt Professor Keynes’ famous aphorism, the Fed’s quasi-permanent regime of ZERO-COGS “engages all of the hidden forces of economic law on the side of [speculation], and does it in a manner that not one in [nineteen members of the Fed] is able to diagnose”.

Indeed, no less an authority on the great game of central bank front-running than Pimco’s Bill Gross trenchantly observed last week: “Our entire finance-based system….is based on carry and the ability to earn it.”

Stated differently, the preponderant effect of the Fed’s horribly misguided ZIRP has been to unleash a global horde of financial engineers, buccaneers and plain old punters who ceaselessly troll for carry. The spreads they pursue may be derived from momentum-driven stock appreciation and credit risk premiums or, as Bill Gross further observed, they may be “duration, curve, volatility or even currency related…..but it must out-carry its bogey until the system itself breaks down.”

Not surprisingly, therefore, our monetary central planners are always, well, surprised, when financial fire storms break-out. Even now, after more than a half-dozen collapses since the Greenspan era of Bubble Finance incepted in 1987, they don’t recognize that it is they who are carrying what amounts to monetary gas cans. Having no doctrine at all about ZERO-COGS, they pour on the fuel completely oblivious to its contagious, destabilizing and perilous properties. Nor is recognition likely at any time soon. After all, ZERO-COGS is an artificial step-child of central bankers’ writ; its what they do, not a natural condition on the free market.

The Prehistoric Era of Volcker the Great vs. Bathtub Economics

When money market yields and the term structure of interest rates are not pegged by the Fed but cleared by the market balance between the supply of economic savings and the demand for borrowed funds, the profit in the carry trades is rapidly arbitraged away—as last demonstrated during the pre-historic era of Volcker the Great. So the way back home is clear: liberate interest rates from the destructive embrace of the FOMC and presently money markets would gyrate energetically and the global horde of carry-seekers would shrink to a corporals’ guard. Pimco’s mighty balance sheet would also end-up nowhere near $2 trillion gross, if it survived at all.

By contrast, as we approach the bursting of the third central banking bubble of this century, the fates have saddled the world with the most oblivious and therefore dangerous Keynesian Fed-head yet. Not only does Yellen not have the slightest clue that ZERO-COGS is a financial time-bomb, she is actually so invested in the archaic catechism of the 1960s New Economics that she mistakes today’s screaming malinvestments and economic deformations for “recovery.”

In that regard, the ballyhooed housing recovery in the former sub-prime disaster zones is not exactly all that. Instead, the housing price indices in Phoenix, Los Vegas, Sacramento, the Inland Empire and Florida went screaming higher in 2011-2013 due to speculator carry trades.

Stated differently, the 29-year olds in $5,000 suits riding into Scottsdale AZ on the back of John Deere lawnmowers are not there owing to their acumen as landlords of single-family, detached homes, nor do they bring competitively unique skills at managing crab-grass in the lawns, insect infestations in the trees and mold in the basement. What they bring is cheap funding for the carry. They will be gone as soon as housing prices stop climbing, which in many of these precincts has already happened.

Similarly, the auto sector has rebounded smartly, but the catalyst there is not hard to spot either—namely, the re-eruption of auto debt and especially of the sub-prime kind. The latter specie of dopey credit had almost been killed off by the financial crisis—when issuance plummeted by 90%, and properly so. After all, sub-prime “ride” loans had been mainly issued against rapidly depreciating used cars and down-market new vehicles at 115% loan-to-value ratios for seven year terms to borrowers living paycheck-to-paycheck, meaning that they had an excellent chance of defaulting if the Fed’s GDP levitation game failed and their temp jobs vanished.

All the forgoing transpired in 2008-2009, of course, but that is ancient credit market history that has now been forgiven and forgotten. Since those clarifying moments, sub-prime car loans have soared 10X—-rising from $2 billion to $22 billion last year, when issuance clocked in above the frenzied level of 2007. Sub-prime loans now fund a record 55% of used car loans and 30% of new car loans, but there’s more. The Wall Street meth labs have already produced a credit mutant called “deep sub-prime” which now account for one-in-eight car loans. Borrowers able to post a shot-gun or PlayStation as downpayment can get a loan even with credit scores below 580.

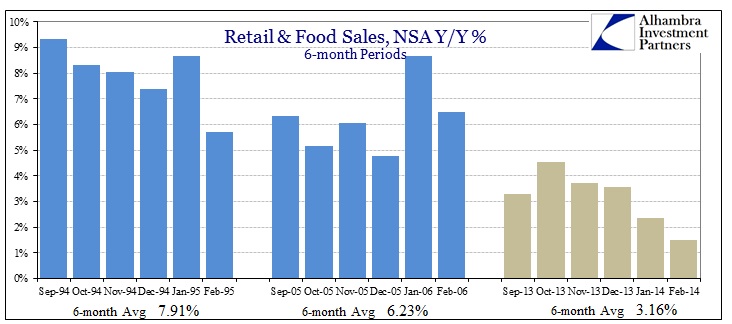

In short, even as real wage and salary incomes grew by less than 1% last year, new vehicle sales boomed by 25% during the last two years to nearly the pre-crisis level of 16 million units. The yawning disconnect between stagnant incomes and soaring car sales is readily explained, of course, by the usual suspect in our debt-besotted economy—namely, auto loans, which were up 25% since the post-crisis bottom and now at an all-time high.

This reversion to borrowing our way to prosperity also highlights the untoward pathways through which the Fed’s toxic medicine of cheap debt disperses through the body economic. Much of the dodgy auto paper now flowing out of dealer showrooms is not coming from Dodd-Frank disabled banks, but from non-banks like Exeter Finance and Santander Consumer USA that have a tell-tale capital structure. They are funded with a dollop of “private equity” from the likes of Blackstone and KKR and tons of junk bonds that have been voraciously devoured by yield hungry money managers who have been flushed out of safer fixed income investments by the monetary central planners in the Eccles building.

The Financial Crime of ZERO-COGS

At the end of the day, the financial crime of ZERO-COGS is a product of the primitive 1960s ”bathtub economics” of the New Keynesians. Not coincidentally, their leading light was professor James Tobin, who was not only the architect of the disastrous Kennedy-Johnson fiscal and financial policies that caused the breakdown of Bretton Woods and its serviceably stable global monetary order, but who was also PhD advisor to Janet Yellen. To this day Tobin’s protégé ritually incants all the Keynesian hokum about slack aggregate demand, potential GDP growth shortfalls and central bank monetary “accommodation” designed to guide GDP and jobs toward full capacity.

In more graphic terms, however, the fancy theories of Tobin-Yellen reduce to this: the $17 trillion US economy amounts to a giant bathtub that must be filled to the brim at all times in order to insure full employment and maximum societal bliss. But it is only the deft management of the fiscal and monetary dials by enlightened PhDs that can that can keep the water line snuff with the brim–otherwise known as potential GDP. Indeed, left to its own devices, market capitalism tends in the opposite direction—that is, a circling motion toward the port at the bottom.

For nigh onto fifty years, however, it has been evident that the bathtub economics of the New Keynesians was fundamentally flawed. It incorrectly assumes the US economy is a closed system and that artificial demand induced by the fiscal or monetary authorities will cause idle domestic labor and productive assets to be mobilized. Well, we now have $8 trillion of cumulative and chronic current account deficits that prove the opposite—that is, the relevant labor supply is the 2 billion or so workers who have come out of the EM rice paddies and the relevant industrial capacity is the massive excess supply of steel mills, shipyards, bulk-carriers and iron ore mines that have been built all over the planet based on export demand originating in the borrowed prosperity of the West and ultra-cheap capital flowing from central bank printing presses around the world.

The truth is, pumping up the American ”demand” mobilizes lower cost factors of production abroad in a great economic swapping game. Exchange rate-pegging, mercantilist-oriented central banks in the EM swap the sweat of their domestic workers and the resource endowments of their lands for the paper emissions of the US and other DM treasuries. And the $5.7 trillion of USTs held abroad, mostly by central banks, proves that proposition, as well. In any event, it is not Uncle Sam’s fiscal rectitude that has created the EMs’ ginormous appetite for pint-sized yields on America’s swelling debts.

So through all the twists and turns of Keynesian demand management since the days when Tobin and his successors and assigns supplanted the four-square orthodoxy of President Dwight Eisenhower and Chairman William McChesney Martin, what really happened was not the triumph of modern policy science or economic enlightenment in Washington, as Kennedy’s arrogant PhD’s then averred. Instead, “policy” spent nearly a half-century using up the balance sheet of the American economy and all its components on a one-time basis. Total credit market debt—-including business, household, financial and government–went from its historic ratio of 1.5X GDP to 3.5X at the crisis peak in 2007—where it remains until this day.

The $30 Trillion Rebuke To Keynesian Professors

Those extra two turns of aggregate debt amount to $30 trillion—a one time exploitation of American balance sheets that did seemingly accommodate Keynesian miracles of demand management. GDP was boosted by households that were enabled to spend more than they earned and a national economy that was empowered to consume more than it produced.

But there was nothing enlightened about the rolling national LBO over the decades since Professor Tobin’s unfortunate arrival in Washington. It was then—and always has been—just a cheap debt trick. During each successive business cycle’s stimulus phase, debt ratios were ratcheted up to higher and higher levels. But now we have hit peak debt in both the public and private sectors, and there is no ratchet left because balance sheets have been exhausted.

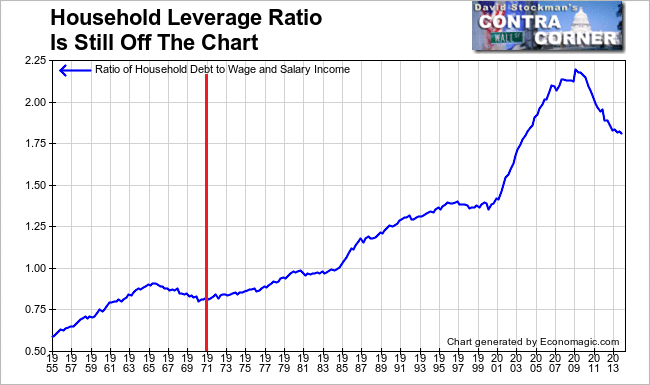

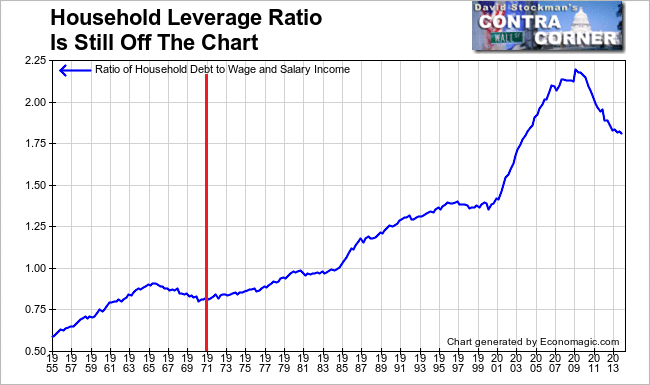

The household sector data tell the story of the cheap debt trick which is now over. The relevant leverage ratio here is household debt to wage and salary income, because the NIPA “personal income” metric is now massively bloated by $2.5 trillion of transfer payments—-flows which come from debt and taxes, not production and supply.

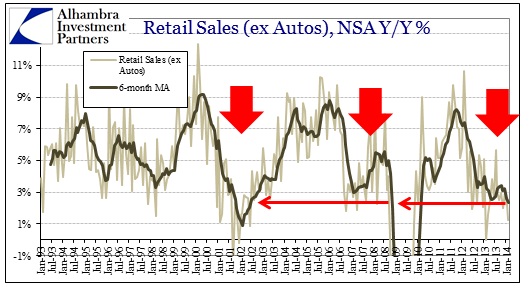

As shown below, the ratchet was powerful. During the 1980-1985 cycle, the household debt ratio jumped from 105% to 117% of wage and salary income; then it ratcheted from 130% to 147% during the 1990-1995 cycle; thereafter it climbed from 160% to 190% during 2000-2005; and it finally peaked out at almost 210% at the 2007 peak.

That’s the Keynesian cheap debt trick in a nutshell: it does not describe a timeless science that can be applied over and over again, but merely a one-time party that is over. As shown below, the ratio has now retraced to the 180s, but that’s still high by historic standards, and more importantly, is the reason that Professor Larry Summers can be seen on most days sucking his thumb, looking for “escape velocity” that can’t happen.

The up-ratchet in private and public leverage ratios is over, and that means that the Keynesian monetary policy is done, too. It worked for a few decades thru the credit transmission mechanism to the household sector, but one thing is now certain: the only part of household debt that is growing is NINJA loans to students and what amounts to de facto rent-a-car deals in autos, which in due course will lead to a new pile-up of defaulted paper and acres of repossessed used cars.

Meanwhile, Yellen and her mad money printers keep “accommodating” as they try to fill to the brim an imaginary bathtub of potential GDP. The exercise would be laughable, even stupid, if it were not for its true impact, which is ZERO-COGS. The latter, unfortunately, is fueling the mother of all bubbles here and abroad; crushing savers and fixed income retirees; showering the fast money traders and 1% with unspeakable windfalls of ill-gotten “trickle-down”; and placing control of the very warp and woof of our $17 trillion national economy in the hands of unelected, academic zealots.

The worst thing is that Yellenomics is just getting started because the whole crony capitalist dystopia that has become America can not function for more than a few days without another dose of its deadly monetary heroin.

Household Leverage Ratio – Click to enlarge

See the original article >>