by Tyler Durden

The highlight of today's economic releases will be the 8:30 am non-farm payroll data, expected to print at 180K jobs, up from July's 162K, and result in an unchanged 7.4% unemployment rate. The "most important jobs number ever " is neither, because even if it comes as a wild outlier to the good or bad side, the Fed is unlikely to change its tapering intentions this late in the game. Still, it will provide fireworks in a very jittery market and if the number is far stronger than expected, expect the 10 Year to finally blow out from below the 3% range which it breached briefly overnight, and never look back, at least not until there is an August 2011 wholesale risk revulsion episode and stocks tumble. Speaking of jittery, overnight the WSJ reports that if picked as Bernanke's replscament, Larry Summers' faces an uphill battle to get the votes of three key democrats on the Senate Banking Committee (Jeff Merkley, Sherrod Brown and Elizabeth Warren). It would be only fitting that the dysfunctional Democratic dominated senate now lashes out against the president, and in the process scuttles the market's only hope of maintaining its Fed-derived gains over the past five years.

In other news, we got more disappointing data out of Germany where Industrial Production slid -1.7%, from +2.0%, missing expectations of -0.5%. In the aftermath of yesterday's non-event ECB press conference, both JPM and Goldman now expect that the ECB will announce a new fixed-interest LTRO will be announced before the end of the year to normalize liquidity concerns (earlier today banks repaid another €5.91 billion from the existing LTROs) that have threatened short-term rates.

And there is, of course, Syria which is becoming increasingly problematic for Obama whose support in Congress is looking ever shakier. Will he go it alone in the case of a no vote?

Overnight news highlight bulletin:

- Treasury 10Y yield last night rose to 3.00% for first time since 2011 before reports forecast to show U.S economy added 180k jobs in August, unemployment rate held at 7.4%.

- Markets looking for upside surprise, roundup of views here * Yields from 2Y to 10Y all reached 2-year highs yesterday after Aug. ISM Non-Manufacturing Composite rose to an 8-yr high, bolstering expectations for Fed tapering of asset purchases

- Fed meets Sept. 17-18, includes release of updated economic projections and Bernanke press conference; many expect olicy makers to announce QE tapering, roundup of views here

- German industrial production fell 1.7% in July, more than forecast, after surging in June

- G-20 leaders discussed efforts to shield their economies from potential stimulus withdrawal as the fallout from the Syrian conflict amplified global risks

- A week after he surprised his national security advisers by deciding to seek authorization from Congress, Obama’s path to military strikes against Syria faces reluctance at home and abroad

- Disclosures that the U.S. National Security Agency can crack codes protecting the online traffic of the world’s largest Internet companies will inflict more damage than earlier reports of complicity in government spying, according to technology and intelligence specialists.

- Sovereign yields mostly lower, EU peripheral spreads mixed. Euro Stoxx Banks -0.1%. Nikkei falls 1.5% as JPY gains through 100 level, Shanghai Composite -0.8%. European equities mixed, U.S. equity index-futures fall. WTI crude, copper and gold gain

- Analysts at Goldman Sachs expect that a new LTRO from the ECB with a fixed interest rate for the duration of the refinancing operation will be announced this year, probably toward the end of the year.

- Larry Summers faces key 'no' votes if picked for Fed as 3 Senate banking panel Democrats expected to reject Summers's nomination, according to a report.

Market Re-Cap from RanSquawk

Stocks traded steady on Friday as market participants awaited the release of the latest jobs report from the BLS. Despite higher energy prices, basic materials and oil & gas sectors underperformed in Europe, while utilities outperformed after SocGen raised the sector to neutral from underweight. There was little in terms of fresh EU related macroeconomic news flow, but analysts at Moody’s revised the German banking sector outlook to stable from negative, reflecting a year of reduced crisis-related losses.Elsewhere, the release of less than impressive macroeconomic data from the UK meant that GBP underperformed, which in turn saw the GBP 1y1y forward swap rate move off its highest levels this year, which also matched best levels since July 2011.

Even though the ECB failed to appease market concerns of excessively high money market rates when the council met yesterday, the Euribor curve flattened this morning, with various tier 1 banks such as JP Morgan and GS stating that they expect the ECB to launch another LTRO later in the year. Of note, overnight during the Asian session, USTs yield finally topped 3.00% mark, highest since July 2011. As a guide, the last time the 10-year yield was this high was just before the US debt-ceiling fears intensified which eventually led to the downgrade of its AAA sovereign rating. Going forward, apart from digesting the release of the latest jobs report, market participants will also await the release of the latest jobs report from Canada.

Asian Headlines

PBOC governor Zhou said China has ample measures for QE exit and that global stabilizations in line with China interest.

EU & UK Headlines

Analysts at Goldman Sachs expect that a new LTRO from the ECB with a fixed interest rate for the duration of the refinancing operation will be announced this year, probably toward the end of the year.

ECB says banks to repay EUR 3.705bln from 1st 3y LTRO and EUR 2.2bln from 2nd LTRO.

Moody's revised the German banking sector outlook to stable from negative, reflecting a year of reduced crisis-related losses. Outlook change reflects improved capital strength, but warns that pressures on profit margins are to persist.

German Industrial Production SA (Jul) M/M -1.7% vs. Exp. -0.5% (Prev. 2.4%, Rev. 2.0%)

German Industrial Production WDA (Jul) Y/Y -2.2% vs. Exp. 0.9% (Prev. 2.0%, Rev. 0.1%)

UK Industrial Production (Jul) M/M 0.0% vs. Exp. 0.2% (Prev. 1.1%, Rev. 1.3%)

UK Industrial Production (Jul) Y/Y -1.6% vs. Exp. -1.7% (Prev. 1.2%, Rev. 1.4%)

UK Manufacturing Production (Jul) M/M 0.2% vs. Exp. 0.2% (Prev. 1.9%, Rev. 2.0%)

UK Manufacturing Production (Jul) Y/Y -0.7% vs. Exp. -0.7% (Prev. 2.0%, Rev. 2.1%)

US Headlines

Larry Summers faces key 'no' votes if picked for Fed as 3 Senate banking panel Democrats expected to reject Summers's nomination, according to a report. The likely 'no' votes are Elizabeth Warren, Sherrod Brown and Jeff Merkley. Democrats currently hold a 2-vote majority in the 22 member panel so the loss of three Democrats would make it impossible for Summers to be confirmed without the backing of at least some of the 10 Republicans on the panel.

Equities

Stocks traded steady on Friday as market participants awaited the release of the latest jobs report from the BLS. Despite higher energy prices, basic materials and oil & gas sectors underperformed in Europe, while utilities outperformed after SocGen raised the sector to neutral from underweight.

FX

Even though USD/JPY trended lower overnight amid profit taking related flow after topping the key 100.00 the day before, the release of less than impressive data from Eurozone and the UK ensured that the USD traded steady. Going forward, the volatility is expected to pick up, especially once market participants digest the jobs report from the BLS. Analysts at Goldman Sachs expect INR and IDR to lag until 2015.

Commodities

US officials said that Iran is plotting revenge on US in case of a Syria strike and that they have Intercepted message calls for militant reprisals in Iraq if Syria is hit.

- Obama at G20 leaders dinner stressed US has high confidence that Syria used chemical weapons according to a Senior White House Advisor.

- China says UN should play role resolving Syria issue.

- Russia sends another landing ship towards Syria according to Interfax News Agency.

Iraqi crude oil pumping halted to Turkish port of Ceyhan via the Kirkuk-Ceyhan pipeline.

* * *

Macro recap from the SocGen FX team:

“All oars expected in the water” is the title of the US employment report preview by our US data watcher par excellence Brian Jones, but what you get when a crew of eight steams up to the finish line is an immense amount of spray, and finally exhaustion when the boat crosses the line. This is how the market has traded up to the marquee event and finishing line of the week, with US yields threatening to extend over 3.00% and the USD reaching the highest level since 19 July. A weekly close above 3.00% for the 10y today would deal a significant psychological blow to investors in most asset classes and would set the scene for a further hit to EM assets. Our year-end target of 3.25% is emerging rather rapidly over the horizon but there should be a pause in the market once the next FOMC meeting is out of the way. Markets have not behaved this week as if Syria is a major tremor waiting to happen but we should see yields temporarily snap back when a military strike gets underway (next week?) though the scale of any safe haven flight will be dependent on stocks and oil.

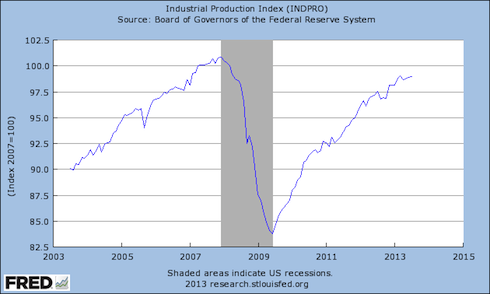

The focus will be firmly on what today means for the FOMC meeting of 18 September. The Congress may vote next week in favour of a 60day strike window for the US military but that is unlikely to keep the Fed out of tapering action for two months with strengthening output growth and falling unemployment make a powerful case to start reducing asset purchases. After the hint of the Beige Book Wednesday, today's employment report should clear the final hurdle for a cautious $10bn start to tapering. Brian's call for a 220k gain in August employment sits comfortably at the top end of the range (consensus 180k). The unemployment rate is forecast to fall to 7.3%, 0.3ppts away from the 7% guideline the Fed set out before it considers terminating asset purchases altogether.

For EUR/USD, a strong US report today could open the floodgates to a lurch below 1.30 in the run-up to 18 September, with bearish seasonals and a dovish ECB chipping away at the currency's status as a refuge from faltering EM currencies. The ECB yesterday pledged to keep rates at the current level or lower and the isolation of downside growth risks and falling excess liquidity means that more non-standard measures (LTRO) to support credit growth cannot be ruled out. It's another 2.7% to the July low of 1.2755, and wider US/EU rate spreads should maintain downward pressure.

Canadian employment and German and UK industrial output are also due today as are Greek and Portugal Q2 GDP.

* * *

Finally, here is DB's Jim Reid with the full overnight narrative

Welcome to another Payrolls Friday. Today’s report is the last major jobs data before the next FOMC meeting in less than two weeks time where policymakers are highly anticipated to announce a tapering of the current asset purchase program. As for today’s release, DB economists are expecting +190k on both headline and private payrolls and a one-tenth decline in the unemployment rate to 7.3%. That said, given the strength in the two ISM reports that we saw this week, DB's Joe LaVorgna thinks that the risk to today’s number is on the upside.

Indeed yesterday’s ISM non-manufacturing index came in at a better-than-expected (58.6 v 55.0) with a 2.6pt rise over the month. This brings the index to its highest level since December 2005. Notably it is the meaningful improvement in the employment subcomponent of the report (57.0 v 53.2) that has Joe excited about today’s payroll print given that the service sector accounts for approximately 80% of employment. ISM aside, the ADP employment report (176k v 184k) was softer-than-expected but offsetting that was a lower-than-expected initial jobless claims print (323k v 330k). As for markets the positive momentum in the US data flow continues to add negative pressure on Treasuries as we saw the 10-year yield soar and close near its intraday highs of 2.9993%. In after hours trading and in the Asian session we've now breached 3% a couple of times. The last time the 10-year yield was this high was in July 2011 just before the US debt-ceiling fears intensified which eventually led to the downgrade of its AAA sovereign rating. As we highlighted in our latest August performance review on Monday, the very aggressive back-up in US yields have not just had a spill-over effect on other DM core yields but have also added serious pressure on EM carry.

Indeed since Bernanke’s infamous tapering speech on the 22 May, 10-year government yields in the US, UK, Germany, and France have risen 96bp, 111bp, 62bp and 73bp respectively. Across EM, we’ve also seen the local currency of Indonesia, India, Brazil and Turkey lose 16.3%, 15.9%, 11.8% and 10.6% against the Greenback, respectively. Other EM assets have also been hurt. Staying on this particular theme, the spill-over risks into EM from an unwinding of DM stimulus was a dominant theme at the two-day G20 summit that started yesterday. Chinese officials said that “we hope that as the issuing country of the largest reserve currency in the world the United States should be mindful of the spillover effects of its macroeconomic policies”. South Korea also weighed in by saying that “if a reserve currency country changes its monetary policy stance, it should consider not only its domestic economic conditions but the effects on the global economy”. India’s President also asked for the need for “an orderly exit from the unconventional monetary policies being pursued by the developed world for the last few years”. There are also reports that EM countries will create an $100bn pool of currency reserves to safeguard against potential financial shocks. According to a statement issued at the G20 summit as sighted by Bloomberg news, China will contribute $41bn to the pool while Russia, India, and Brazil will contribute $18bn each. South Africa will also add $5bn. DM central banks are treading across unchartered waters here as far as monetary policy is concerned and the unwinding of the unprecedented amount

of cheap liquidity was never going to be straightforward.

Back to markets, Asian equities are generally trading firmer as we type, helped by modest gains in the US overnight (S&P 500 +0.12%). The Hang Seng, Shanghai Composite and the KOSPI are +0.2%, +0.3% and +0.4%, respectively. The Nikkei (-0.9%) is underperforming regional peers as developers and other Olympic related companies fall ahead of this weekend’s host announcement. It seems like yesterday that London was given the nod!! In credit markets, Asian IG spreads are about 1-2bp tighter while the new Korean sovereign bond deal remains well supported in secondary markets. Gold is a little firmer in Asia overnight at $1371/oz after having fallen over 3% earlier this week. Crude is steady at around $115/bbl.

Looking at the day ahead we have trade balance and IP data across several countries in Europe but all eyes clearly will be on Payrolls.

See the original article >>