by Graham Summers

The facts are now becoming abundantly clear, that the forecast we’ve maintained for well over two years has been validated: the US is in a DE-pression and both Washington and the Federal Reserve have wasted trillions of Dollars.

The reality is that what’s happening in the US today is not a cyclical recession, but a one in 100 year, secular economic shift.

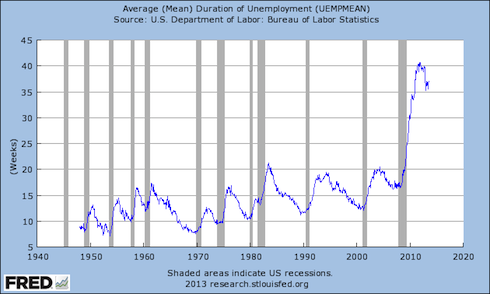

See for yourself. Here’s duration of unemployment. Official recessions are marked with gray columns. Bear in mind that the Feds measure unemployment based on people looking for work, so if you stop looking, you no longer count as unemployed and this number will fall.

Even with this accounting gimmick, the average duration is still at 35 weeks.

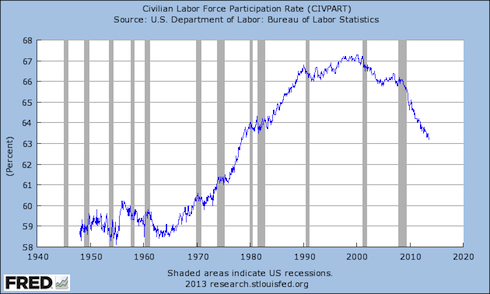

Here’s the labor participation rate with recessions again market by gray columns:

Another way to look at this chart is to say that since the Tech Crash, a smaller and smaller percentage of the US population has been working. Today, the same percentage of the US population are working as in 1978.

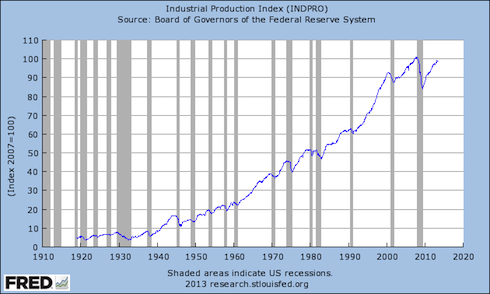

Here’s industrial production. I want to point out that during EVERY recovery since 1919 industrial production has quickly topped its former peak. Not this time. We’ve spent literally trillions of US Dollars on Stimulus and bailouts and production is well below the pre-Crisis highs.

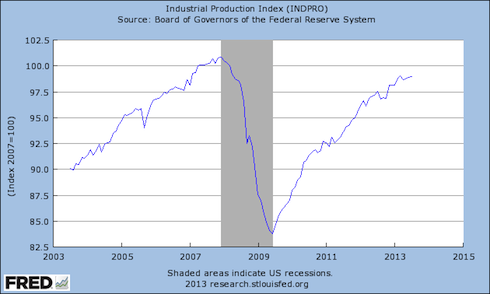

Here’s a close up of the last 10 years.

Again, what’s happening in the US is NOT a garden-variety cyclical recession. It is a STRUCTURAL SECULAR DEPRESSION.

And those who claim we’ve turned a corner are going by “adjusted” AKA “massaged” data. The actual data (which is provided by the Federal Reserve and Federal Government by the way) does not support these claims at all. In fact, if anything they prove we’ve wasted money by not permitted the proper debt restructuring/ cleaning of house needed in the financial system.

Which is why smart investors are already preparing for a market meltdown.

On that note, I’ve already prepared readers of my Private Wealth Advisory newsletter with a number of targeted investment strategies designed to help them not only manage risk, but produce outsized profits during the coming economic slowdown.

No comments:

Post a Comment