By: Tony_Caldaro

It was a wild week for sure. The SPX started the week by declining about 1.5% to

1136 and ended the week hitting 1220 for a 5.4% gain. The Central Banks

announced three separate USD swap programs mid-week, to increase liquidity in

Europe. There was also lots of talk of an ECB TALF program. In the mean time, in

the US, economic reports were decidedly negative. On the plus side: business

inventories improved, along with, the current account deficit, consumer

sentiment, the Philly FED, and the M-1 multiplier rose. On the negative side:

import/export prices declined, along with, retails sales, the CPI/PPI, the NY

FED, industrial production, capacity utilization, the monetary base and the

WLEI. The budget deficit increased, as did weekly jobless claims. If you are

counting that’s five positives and twelve negatives. Nevertheless, the SPX/DOW

were +5.05%, and the NDX/NAZ gained 6.45%. Asian markets lost 0.4%, European

markets gained 4.2%, the Commodity equity group 0.3%, and the DJ World index

gained 2.9%. Next week we have the much awaited FOMC meeting, the yet to

be interesting Housing reports, and Leading indicators.

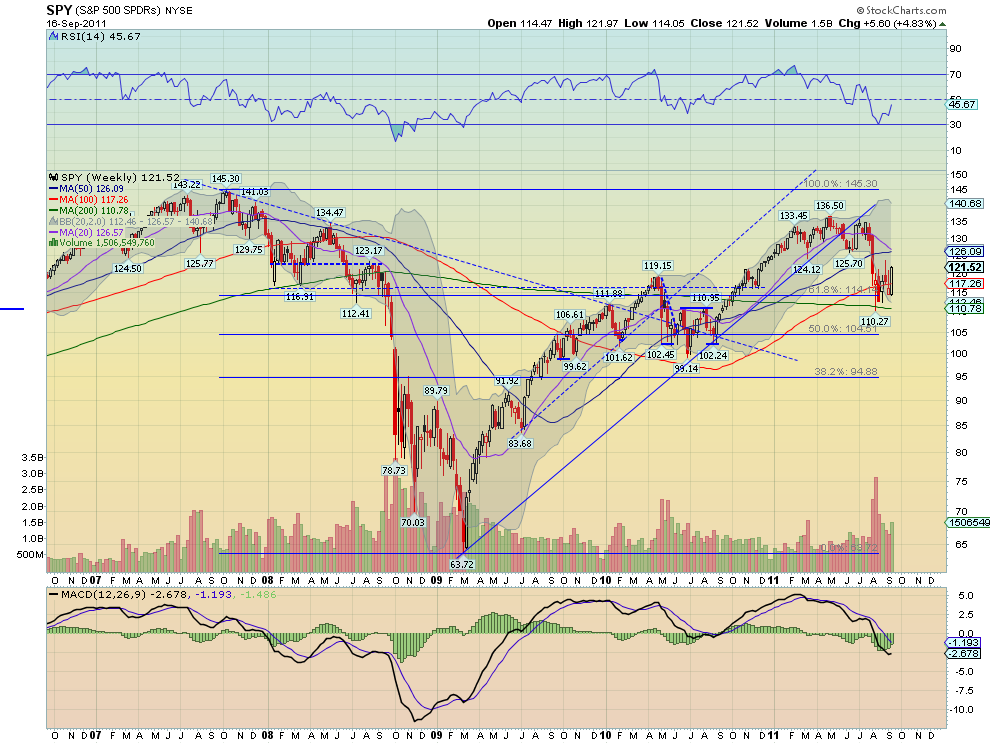

LONG TERM: bear market highly probable

After an important May high in the SPX at 1371, and a July high in the NDX at

2438, the market went into a tailspin. The SPX had lost 19.6%, and the NDX lost

16.5%, by early August. Since then, now mid-September, the SPX has retraced 48%

of that decline and the NDX has retraced 68%. New bull market? Not likely.

During the 2007-2009 bear market the SPX/NDX declined in fives waves into a

Mar08 low. After that they had a two month counter-trend rally that retraced:

SPX 57% and the NDX 68% of that decline. We all know what happened next. This

bear market is unfolding in a different pattern, thus far.

Instead of fives waves down into a significant low, with market internals

extremely oversold. This market has done three waves down into a significant

low, with similar internals. This suggests, when this apparent uptrend ends,

this market will not collapse like it did in 2008, but will do another set of

three waves down to create the bear market low. A couple of weeks ago we worked

out some numbers awaiting a potential uptrend confirmation. Since this appears

probable, at the moment, this is what we came up with.

The first decline was an ABC which took three months and we labeled it

Primary wave A. The current probable uptrend should last until October, two

months, and retrace between 50% and 62%, in the general markets, of the first

decline: Primary wave A. We will label this uptrend Primary B. Next, we should

have three Major waves down to complete Primary wave C and end the bear market.

This is likely to take either three or six months, which puts us into January or

April. Should the decline be a simple one, three months, we’re looking at a low

around SPX 1011, the previous Primary wave II. Should it take six months then

the likely target will be the SPX 869 area, the previous Major 2 low of Primary

I.

Fibonacci retracement levels of the previous bull market suggest: SPX 1102

(38.2%) which was hit precisely, SPX 1018 (50.0%) and SPX 935 (61.8%). If we

take the orthodox low of SPX 1121, for the failed fifth wave, we have a 250

point decline from 1371. Should this uptrend rally to SPX 1261, then we have

another three month 250 point decline the SPX would hit exactly 1011. We also

have OEW pivots at 1018, 1007 and 988. As a result of all these technical

relationships we favor the three month, SPX 1011, bear market bottom

scenario.

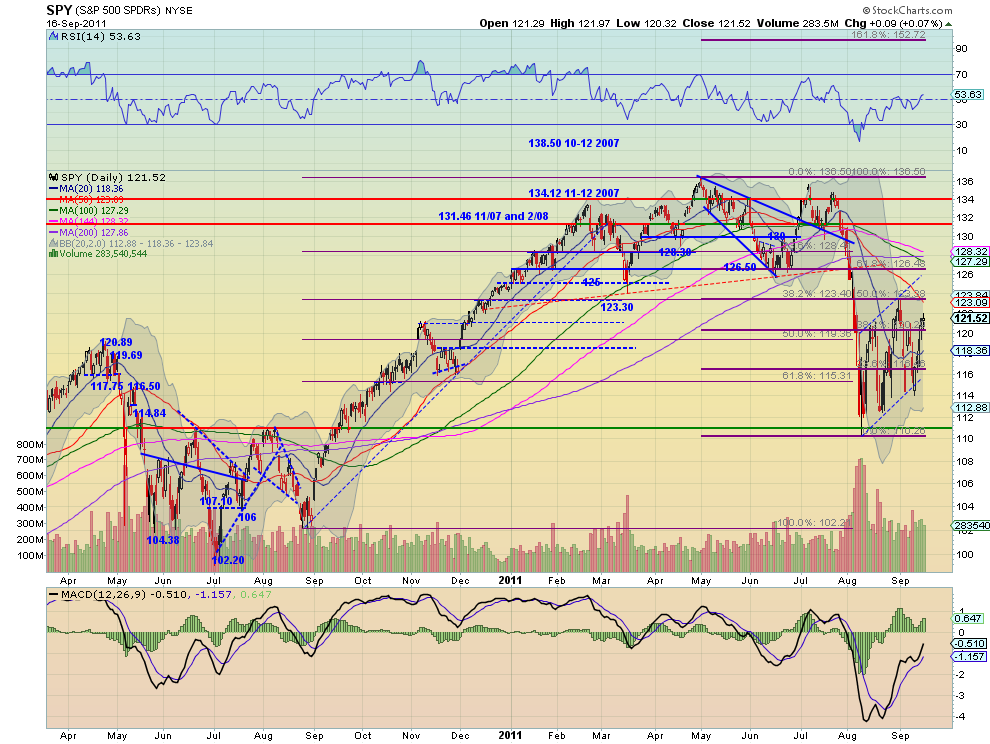

When we review the weekly chart, we observe the economy is still in

contraction mode with the WLEI well below 50%, and the public is quite

pessimistic about the economy. Also, the MACD is in bear market territory and

still declining. The RSI has worked its way from quite oversold to neutral, and

may even hit slightly overbought like it did in July. But until it registers an

extremely overbought reading this market will eventually head lower. In

conclusion, we’re not as pessimistic as we were at the beginning of the bear

market as the wave structure is unfolding like a normal ABC bear market.

MEDIUM TERM: downtrend likely ended at SPX 1102

We remain under the assumption, with no OEW confirmation yet, the downtrend

from the SPX 1356 July high ended in August, on a failed fifth wave, at SPX

1121. Since then this market has been tracing out an abA-abB-abC counter-trend

rally uptrend. Thus far we have observed the abA from SPX 1121 (1191-1136-1231),

and the abB from SPX 1231 (1140-1204-1136). Now we should be in the abC portion

of this complex double three uptrend.

Thus far we have witnessed a fairly good rally from SPX 1136 to 1220 this

friday. This should be the ‘a’ portion of the abC. When it concludes the ‘b’

portion should drop fairly quickly and sharply. The first one, in this

structure, dropped 55 points in only one day. Once the ‘b’ portion concludes we

should get another good rally to complete the ‘c’ portion, and it will

likely coincide with a belated uptrend confirmation. When we review the rising

abA we observe three moves: 70 points up, 55 down, and 95 up. The current rally

has already gained 84 points, exceeding the ‘a’ of the first similar structure.

If we are getting these three waves in reverse this time, it suggests a

potential high for ‘a’ at SPX 1231, a decline to 1176, then a rally to 1246. This is all hypothetical of course. But sometimes these structures do unfold

this way.

The daily chart suggests the RSI should get quite overbought before this

uptrend ends. Thus far it has only touched overbought a couple of times. This

suggests the SPX could make it up to the original targets of the 1261 and/or the

1291 pivots. The OEW 1261 pivot fits right in line with our simple bear market

scenario ending in January. An uptrend into the 1261 area would also overlap the

Jun11 low of SPX 1258. This activity would certainly confirm the current bear

market wave count. This market just needs to continue to chop its way higher for

about three more weeks for all this to unfold. With two WROC buy signals, since

the SPX 1121 low, this scenario appears quite probable.

SHORT TERM

Support for the SPX remains at 1187 and then 1176, with resistance at 1222

and then 1240. Short term momentum just started to decline after registering a

negative RSI divergence on the hourly chart. This market has gyrated from one

short term divergence to another, with two exceptions, since the market hit SPX

1102 in early August. It has been quite choppy, reacting to the daily news, but

well defined and anticipated. A similar bear market counter-trend structure

unfolded between Mar08-May08, as previously noted.

We believe this market has set itself up for another disappointing FED

statement. Three important lows, during this probable uptrend, have occurred

after FED statement/speeches. The SPX 1102 low occurred after the last FOMC

statement. The SPX 1136 low occurred after the FED chairman’s speech at Jackson

Hole. Then the second SPX 1136 low after the chairman’s speech in Minnesota. We

should get another FOMC statement on wednesday. Short term support is in the low

1200′s, then the 1187, 1176 and 1168 pivots. Overhead resistance is in the low

1230′s, then the 1240 and 1261 pivots. Should anything new develop we will

naturally update everyone during the week. Best to your trading!

FOREIGN MARKETS

The Asian markets were mixed this week for a net loss of 0.4%. Australia,

Hong Kong, and China were all lower.

The European markets we all higher gaining 4.2% on the week.

The Commodity equity group were mostly lower but did have a net gain of 0.3%.

Russia and Canada lost ground.

The DJ World index gained 2.9% on the week. Overall individual world markets

were quite mixed.

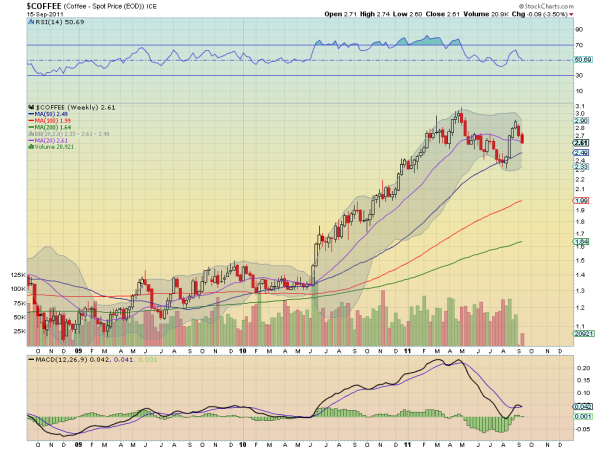

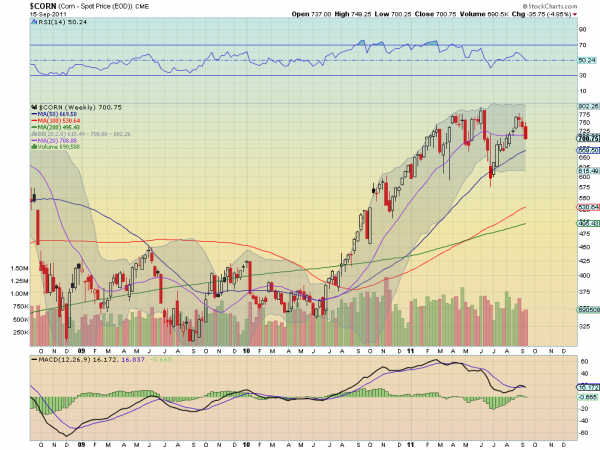

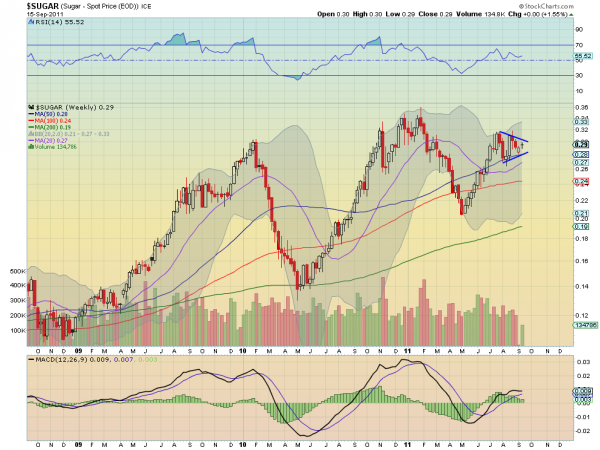

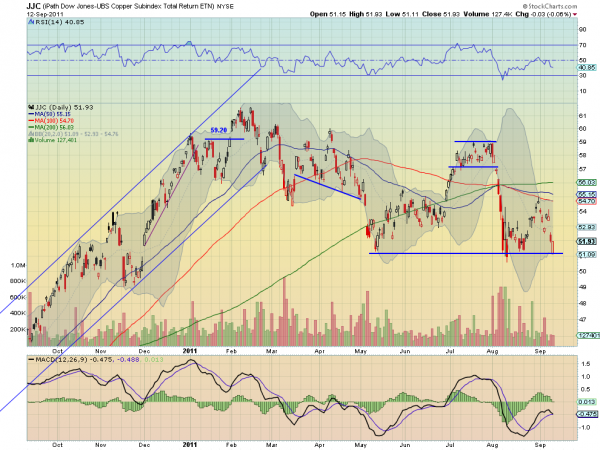

COMMODITIES

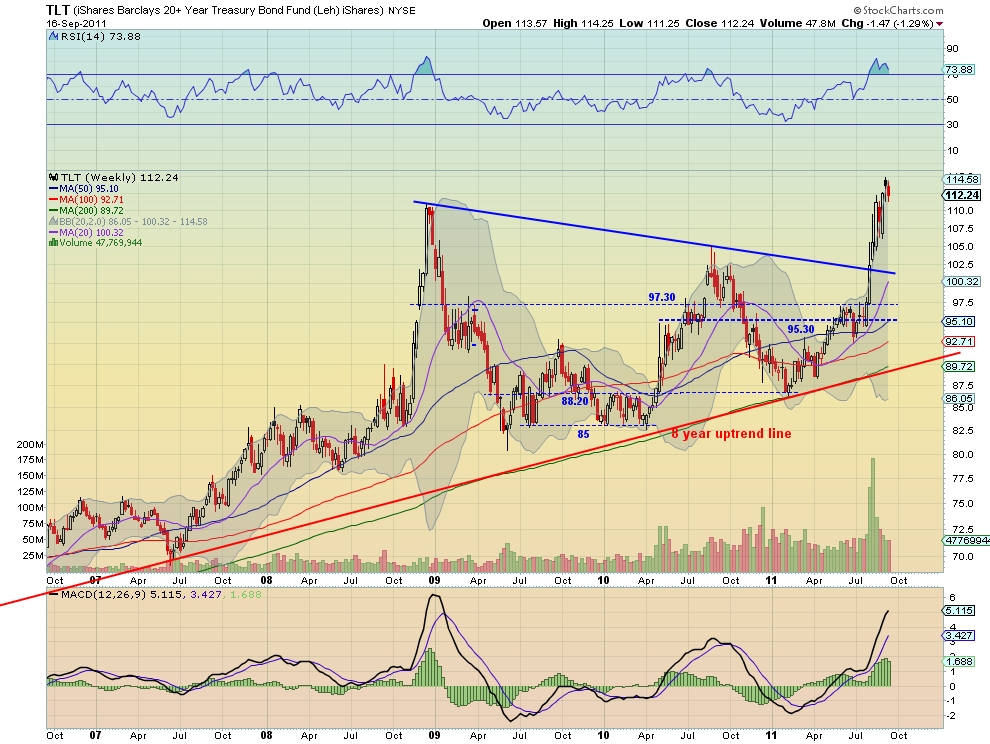

Bonds lost 1.0% on the week as negatvie divergences continued to appear on

the daily charts. The 10YR yield moved over 2% to 2.08% after touching a record

low at 1.90%.

Crude continued its choppy upside activity, which is looking more and more

like a rising wedge, gaining 1.0% on the week.

Gold still appears to be in an unconfirmed downtrend and lost 2.4% on the

week. Every time Gold declines it seem to find buyers waiting in the wings.

Silver, -1.9%, appears to be just following along at the moment.

The USD lost some ground this week (-0.8%) but remains in an uptrend.

Benefitting from the USD swap programs the downtrending EUR gained 1.1%, and the

JPY gained 1.3%.

NEXT WEEK

The economic calendar kicks off on monday, of this FED week, with the NAHB

housing index at 10:00. Tuesday we have Housing starts and Building permits.

Then on wednesday Existing home sales and the FOMC statement around 2:15. On

thursday, weekly Jobless claims, the FHFA housing index and Leading indicators.

The FED has nothing else scheduled. Best to you and yours this weekend and week.