by Greg Harmon

Inflation expectations impact Commodities. After recent runs higher some of

these high flying commodities have been getting hit a bit lately. Some of this

would be expected with the run up in US Treasury prices, dropping yields, acting

similarly to squelching some inflation expectations. But that aspect may have

run its course as Treasuries stall this week. So what do the charts say now

about Coffee ($KC_F), Corn ($ZC_F),

and Sugar ($SB_F)? And do they give a clue about inflation

expectations? Let’s take a look.

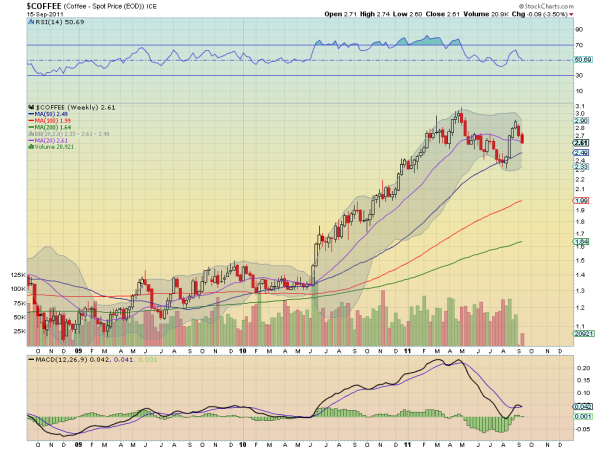

Coffee, $KC_F, had a massive run higher from June 2010

until May of this year. Since it has pulled back and then attempted to move

higher again. The weekly chart above shows it now pulling back to the 20 week

Simple Moving Average (SMA) at 2.61 as of Thursday close and it is dropping

further Friday, at 2.58 as I write this. The Relative Strength Index (RSI)

sloping lower and the Moving Average Convergence Divergence (MACD) crossing

negative support more downside. Look for a continuation lower that may find

support at the rising 50 week SMA, but if not then a target on the Measured Move

(MM) to 2.13. Coffee has been inversely correlated to Coffee stock like $GMCR, $CBOU,

$SBUX and $PEET so

watch them for more upside if the decline continues.

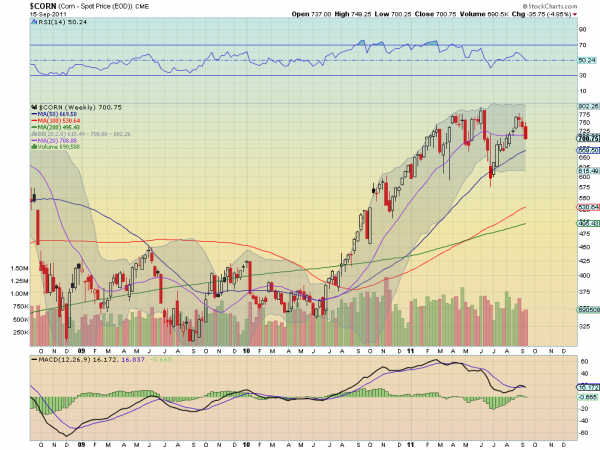

Corn, $ZC_F, had the same run higher that Coffee saw

complete with the pullback and push higher again. It also has the acceleration

to the downside now, under the 20 week SMA and moving lower Friday at 698 as I

write. A push back over the 20 week SMA would help but with the RSI heading

lower and the MACD crossing negative it is set up for more downside. A continued

fall sees support near the rising 50 week SMA at 663 and below that it has a MM

to 556. This same pattern is being played out in the Teucrium Commodity Trust

Corn Fund, $CORN, and can be played that way.

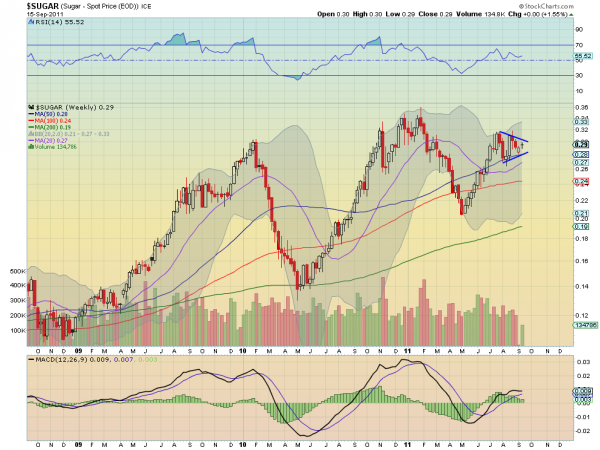

Sugar, $SB_F, had the same run higher from mid 2010 to

early 2011 and the pullback and advance, but has been in a tighter symmetrical

triangle the last few months. As I write this it is trading at 0.28 which would

be close to triggering a break down from the pattern, ad is below the 50 week

SMA. The RSI has stalled in the move lower near the mid line and is turning

higher for now, but the MACD is fading lower. All the SMA’s are rising though.

This looks to go either way. A continued move below 28 triggering the pattern

break would see a target of 0.23, under the 20 week SMA but where there is

support from April. If the pattern holds the the top rail at 0.30 is resistance

and a break above that triggers a target of 0.35, near the previous high from

February. This pattern is playing out with the iPath Dow Jones-UBS Sugar

Subindex Total Return ETN, $SGG, so

it can be played via the equity market as well. In fact, $SGG

looks a bit weaker.

Each of these commodities is set up to continue lower, despite the stall and

now move lower in US Treasuries. This could be a signal that inflation

expectations are moderating. Only time will tell.

No comments:

Post a Comment