Several very important currency effects are at work. Most economists are either silent on the factors or wrong footed on the dynamic. That is not surprising since they have been incorrectly analyzing, interpreting, and forecasting the financial crisis as it built up in 2005 and 2006, and as it exploded in 2007 and 2008 to surprise almost all of them, even as it has failed to recover in 2009 and 2010 in contrary fashion to their deceptive rosy positions. The major currencies must be examined for some key paradoxes. As the monetary system crumbles into its final phase, the foundation under which the major currencies stand, trade, and change is breaking down. Refer to the sovereign debt structure, overly burdened by runaway government debt.

The focus here is on some important paradoxes that go directly against both common sense and traditional economic logic. The unusual under-currents have confused most economists to the point that the economist profession has become a laughingstock to the American households, a chain of promotional carnival barkers for Wall Street in pursuit of annual bonuses, a heretic priesthood to parade in front the media cameras, and a den of USGovt harlots in search for official gatekeeper posts. They understand pitifully little within the USEconomy, within the US banking industry, and within the fracturing latticework in global finance. My acrimony toward their profession has been the most consistent theme of the Hat Trick Letter for seven full years. The following paradoxes are powerful contradictions that fly in the face of standard economic theory.

During the deterioration and crack-up phase underway, the clueless cast of economists remains befuddled and confused. The imbalances are so great that almost none of their theory has merit. They know not how to stimulate anything but big US bank balance sheets with endless grants. They would do well to discard their advanced textbooks and adopt the Sound Money Theory of the Von Mises crowd, which has provided excellent expert guidance during every phase of the Western world financial system breakdown. Consider the paradoxes after an introduction to an important deception by the financial pharmacy that doles out poison pills under central bank sponsorship. Witness Greece and Ireland, which took the IMF poison pills under coercion, washed down the gullet by fiat credit based liquidity of the most toxic variety. If electronic engineers were as incompetent as economists, then cars would not work and computers would not work and communications devices would not work. If industrial engineers were as incompetent as economists, then retail chains would have empty shelves, and gasoline stations would have empty tanks. If the mathematics field were as corrupt as economists, they would redefine the multiplication tables. If the physics field were as corrupt as economists, they would still call the earth flat and the center of the solar system. If the professional athletes were as corrupt as economists, then baseball players would almost all have a hitting percentage under the Mendoza Line. But no! The economists are the squires to the ruling bankers, and serve to propagate the dogma of the high priests who sit in the central bank marble offices. The economists and bankers have destroyed the Western economic and financial system, exploiting it to the hilt, committing deep fraud and demanding redemption from the public till. They are never prosecuted for high financial crimes. They rule the land with privilege and impunity. They are not finished in their deceptions and wrongful forecasts. Almost all their constructs are incorrectly built. Despite a massive skein of horrendous professional performance, they continue to ply their trade and deceive the masses during the great meltdown and fracture.

IMF PRICE FIXING PLAN

The IMF plan to create a basket with inherent currency exchange rates is an attempt at price fixing, a blatant ploy to halt the USDollar decline. The once prestigious and respected global reserve currency is caught in a death spiral. The Special Drawing Rights (SDR) includes the USDollar, the Euro, the Japanese Yen, and the British Pound. Talks are brisk and intense to include the Chinese Yuan also. Within the SDR basket, if used as global reserve substitute, the major currencies will have an interwoven nest of fixed relative exchange rates. The idea is to have the major global banks use the SDR as their reserve currency like a block, a basket. But in order to work, any new reserve basket by definition will contain a rigid set of ratios. To begin with, the ratios are very likely not to favor the USDollar (with USTreasury Bonds) as much as the current makeup among the big banks. Therefore, the fixed ratios would be strained immediately at the imposed start of any new system. The initial startup alignment would alter exchange rates and force the IMF plan to change their fixed ratios. Great difficulty will come with the initial price fixing effort, whose challenge will continue with each passing week. Price fixing never works. This time is no different. The entire fiat platform is sinking.

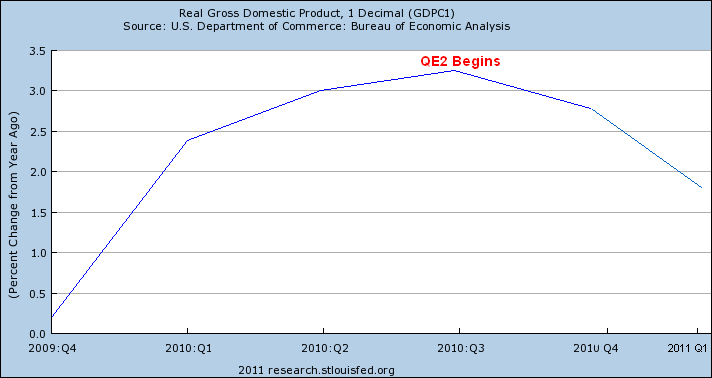

The central banks hope to stop the USDollar decline. However, what they earn is a uniform decline in all currencies in terms of commodity prices. Rather than devise a new fundamentally sound platform, they rig the broken reeds, tie them together, and hope the failed system functions despite using broken components. The central bankers are desperate. While they appear to be organized, they are actually at war, among themselves and versus big creditor nations like China. They react with increasing desperation to the gradually recognized failure of the monetary system, sinking under the weight of the rapid and uncontrollable expansion of debt. What compounds the rising sovereign debt is the banker welfare which has backfired badly on the political stage. The people are given crumbs while the bankers are given $billions.

The Gold price, the Silver price, the Crude Oil price, even the Copper price and Cotton price and Coffee price and Soybean price and Corn price, will all rise in uniform fashion versus the ludicrous basket that might be forced upon the global banking system. They would solve nothing, but instead impose a socialist pain uniformly. Instead of the USDollar falling more versus other major currencies, it would pull down the others like a huge stone. The true money measures in Gold & Silver would rise in a powerful fashion much more, but in an equitable fashion. Consider the basket creation with Chinese Yuan inclusion out of respect. The ugly cost to Europe and China would be to lose their independence and opportunity to fight off the USDollar. The Europeans and Chinese would lose any discount on commodity prices extended from rising individual currencies. Imagine two good swimmers in a big swimming pool, tied to three or four very bad swimmers. The good would be dragged down by the bad since joined by a deadly rope line. The basket would not float, since its reeds are rotten from old and burdensome debt. Look for Europe and China to nix the stupid vapid SDR basket concept.

Conclusion: A paradox with backfire is at work. The IMF concept is badly flawed, operating as a veiled price fixing initiative. Its SDR basket would be equally toxic to the global banking system. Rather than Gold & Silver rising fast versus the USDollar, the precious metals complex would rise uniformly versus all major currencies. The Gold & Silver bull market would be much more plainly visible from all corners of the world. The currencies would fail together, yoked by the toxic USDollar.

ABSENT US EXPORTER ADVANTAGE

The US exporter advantage from a weaker USDollar will not materialize, contrary to the mainstream nonsense songs of deceit spiced with drivel. The economists have lost their credibility after crackpot notions like Green Shoots of economic recovery, like an Exit Strategy from the 0% corner of capital destruction, like the empty label of a Jobless Recovery. Now they have another rotten plank to stand upon with more demagoguery and false preaching. The central banks have resigned themselves to bring the UDollar down in an orderly manner. They mistakenly believe doing so will stimulate the USEconomy and revive the global economy. Instead, a lower USDollar will lift the entire global economy cost structure and serve to dampen all growth while it leads to starvation in poor nations. They expect the US export trade to pick up and lead the economic recovery. They are mistaken. First of all, the US industry lacks critical mass after decades of dispatch of factories to Asia. The start was the electronics departure to the Pacific Rim in the 1980 decade. The climax was the grand industrial buildup in China with Western investment funds, mostly American. The USEconomy lacks sufficient industry to take advantage of export growth. Secondly, many legitimate industrial advantages are in the possession of companies whose products are widely banned for export. See the advanced computer systems, the advanced telecommunications systems, even some advanced bioengineering systems. They have been captured by the USMilitary and its sprawling defense industry pillboxes. Lastly, a much more engrained cancer will affect the few American exporters that can attempt to exploit a lower USDollar exchange rate. It is the cancer of rising costs.

Most global currencies are rising versus the US$, so the USEconomy is actually hit much harder than other economies, and thus the domestic competitor firms. The lower USDollar will be offset by steadily rising costs, eliminating any exporter advantage. The cost squeeze is so profound in fact, that some of the US exporters will simply go out of business from vanished profit margins and a damaged customer base that is squeezed by global food & energy costs. The US export business costs will rise even more than the USDollar will fall, from rising input costs and even rising federal mandates like health care. Most other nations have less of a cost shock than the United States. The domestic US export industry cost shock eliminates the entire USDollar exchange rate advantage, something so basic that it cannot be seen, and surely not admitted for its heavy political effect. The higher cost of food & energy is painful enough. Americans who believe the export advantage will lead to new jobs are deaf dumb and blind, the sad result of years of propaganda and false teachings.

Conclusion: A paradox with backfire is at work. The US export industries will not be able to take advantage of a lower USDollar exchange rate, since their costs will be the fastest rising in the world. The commodity prices are rising faster versus the USDollar than almost all other currencies. No USEconomic recovery will occur, but instead a massive deterioration will unfold as it hits the wall from rising costs.

CHINESE YUAN UPWARD REVALUATION

Inside China, a monetary system shared with the United States for a long time has wrought similar problems. They have had a similar structure that funds the system from bank credit to stock market investment to construction. They have a housing bubble, insolvent banks, but also $3 trillion in savings. The currency peg has created common asset bubbles in a systemic manner, much like a three-legged race inflicts similar wounds from falls to the ground to the two people joined. The entire Chinese Economy has had to adapt to rising commodity input costs. Some expected them to revalue the Yuan upward by 10%, which would give all of China a discount on input costs. They would pass on the nearly 10% export price hike to customers, the trade partners. Something has happened in the last two to three years. The Chinese have expanded to the Persian Gulf after continued European expansion, and thus made bigger footprints in the malls to fill the stores. China is not as US-centric so much anymore. They are more willing to raise US export prices and lose a portion of market share in the US.

On the financial front, those who have not noticed the war waged by Beijing simply are asleep at the wheel, and far too devoted to suckle from the banker teat of illiteracy and deception. The Chinese have been busy building up their Yuan currency to be first a globally used vehicle in trade settlement and second a reserve currency held in the financial institutions. Success on both fronts have been realized with key bilateral swap facilities with Russia, Brazil, and pockets of the Persian Gulf. They have been diversifying out of US$-based assets for two years. Last week came a shocker. The Peoples Bank of China plans to shed $2 trillion of US$ assets, a tough task to implement. Even if it turns out to be a multi-year plan, it is significant. The effect is obvious on the USDollar, a downward force, a strong force. Any manifested action to dump US$ bonds will be followed by Japanese and Arabs and Koreans, who will follow the Chinese lead in shedding assets. Such is a topic of the expanded G-20 Meetings, whose initiatives are no longer led by Anglos. In the process, the USFed will be isolated as the global revolt continues. The fact of life extending from the financial crisis is that foreign creditors have abandoned the USTBonds.

The Chinese must contend with a vicious cycle. As they shed assets with US$ markings, the USDollar will fall further. It is inevitable that the USDollar will fall another 20% to 30%. Only Americans living under the US Dome of Deception believe otherwise, an echo of either arrogance or ignorance. Import prices will rise for Chinese goods sent to the USEconomy. Their asset dump will push up the Yuan, while official forceful action will attempt to formalize the structure behind the Yuan exchange rates. Watch Wal-Mart for clues, which has already warned of higher store prices. China will finally pass on higher costs, reluctant until in recent months. A small Yuan currency upward revaluation buys a commodity discount. But Chinese export trade is much more global and less US-centric than a few years ago. They will permit a US price rise, both from necessity in profit management and the desire to insult the Americans. They will gleefully flick the noses of the US leadership, and kick their shins, whose shallow leadership and corrupt management deserves response.

Conclusion: A paradox with backfire is at work. The desired goal is to mitigate higher input costs to the Chinese Economy, whether by edict of a higher Yuan value or by action from massive asset sales. It is coming. The process of disconnect from the US shared monetary policy started with several rate hikes and raised bank ratios. The rest of the process will be more painful in outright asset shedding and currency revaluation in the quest toward becoming a global reserve currency.

JAPANESE YEN WILL RISE

The disaster in Japan has many facets and channels of damage. The after effects in Japan will work in numerous hidden ways to lift their Yen currency. Its steady stubborn rise will confuse the constantly wrong-footed economists. Japan must liquidate assets to finance the broad cleanup, the painful displacement, the urgent market support, and the eventual reconstruction. Their entire array of supply industries is very disrupted. The Japanese financial structure has hit the saturation point in national debt at a 140% Debt/GDP ratio, the highest among all industrialized nations. This is the ugly consequence of endless recessions and being trapped in the corner at the 0% rate. The dull blades posing as economists in the United States fail to observe the Japanese lesson that a nation never emerges from the 0% corner. To admit this is to admit a failure of the monetary system and central bank franchise control tower.

The next phase inside Japan will include an unspoken emphasis of foreign asset sales in order to fund the staggering costs and to avert price inflation. Additional debt with Yen markings risks a surge in domestic price inflation. They are at a tipping point. Their supply industry will suffer from capital destruction as the profit squeeze hits Japan. It will compound the displacement problem encountered by worker homes being destroyed or declared in an uninhabitable area. It will compound the disruption problem seen in interrupted plant operations from power supply cutbacks and input material shipment reductions. The supply industry will shrink somewhat, but it is unclear how much due to government subsidies that could be raised in a big way. The effect on the global economy has only begun to be felt with the supply chain disruptions. Since the Chinese industrial expansion, a victim has been Japan. They lost their trade surplus, recently turned flat. In the next year, the Japanese trade balance will turn into an outright deficit. The effect of the rising Yen will work in a nasty mix with the disruptions from the earthquake and tsunami to bring about a sizeable trade deficit. This is basic, but still missed by the American economists.

Here is the paradox. The trade deficit will not keep down the Yen exchange rate down. The deficit will send into reverse the process of suppressing the Yen currency for 20 to 30 years.

The key to understanding is to recognize the Bank of Japan (BOJ) for its past role. It has served as a loyal (if not controlled) financial colony outpost for the US, dutifully keeping the Yen down and the USDollar up despite the chronic US deficits, both fiscal (government) and trade (gaps from imports over exports). The final phase of Yen Carry Trade unwind has begun. Their 0% corner is permanent. Japan has been stuck in the corner after 20 years, despite strong trade surplus and significant industry, a point that economists never bothered to explain. No longer will the Japanese financial institutions, led by the BOJ, purchase the USTBonds. Next is the flip into reverse of the Yen Carry Trade. Since 1990 incredibly easy money was made in the biggest financial turnstyle of illicit profit, a veritable factory of turnstyles. They used to borrow 0% Yen, with no risk of a rising currency, and invest in high yielding USTreasury Bonds and briskly rising US stocks even if bound in S&P500 baskets. Next Japan will sell assets and send the process into reverse. The YCTrade is never discussed in the US press. Even the venerable Kurt Richebacher never heard of it. Imagine him being instructed on the carry trade dynamics in 2003, a point of embarrassment for him and awkward role reversal for the younger Jackass.

The critical point was reached three weeks ago when an emergency G-7 Meeting was convened. Its purpose was coordination to buy USTBonds and keep the Yen down, ergo Global QE. The Yen Sale Pact was never called Global QE but that is the proper interpretation, since all major central banks became USTBond buyers of last resort. The Gold & Silver market properly interpreted the event, and surged to breakout levels. The effect of the G-7 desperate clumsy pact was temporary. The Yen has climbed back, now at the belt-line level of 121 to 123, the level often seen in a long string of weeks in 2011. Turn to the object of the YCTrade. The USTreasury Bonds have reached an elevated nosebleed bubble level of prices, as a result of the asset bubble promoted and fed with full broad support. Recall the primary vulnerability of asset bubbles, that they require an acceleration in funds to maintain a constant price level. The USTBonds have lost their buyers, as foreign creditors abandoned them long ago. They acted upon the disgust by installing broad diversification schemes. The Japanese natural crisis has mushroomed into an economic and financial crisis. They have responded by selling rafts of USTBonds, which is their right. The G-7 Accord is a stopgap, nothing more. They cannot divert their attention, but they already have. The USGovt budget disaster is just that distraction. In rising from 117 to 122, the Yen demonstrates the slipped attention span. The Yen is back above both 50-day and 200-day moving averages, recovering from the natural process that cannot be halted by bumbling central bankers under siege. Their system is failing on the global stage, with the whole world watching, yet comprehending little except the obvious chaos.

The trade deficit will not keep down the Yen exchange rate down. Contrary to standard economic theory, their trade gap will push up the Yen currency. Such a Jackass forecast goes directly contrary to their broken standard theoretical concepts, few if any have shown to contain much validity or sinew to hold together the broken planks of their financial theory. The Japanese Yen currency will continue to rise even though a trade deficit comes. Their trade surplus used to enable vast funds to suppress the Yen, now gone. The Japanese will sell foreign assets to cover the deficits. They will have to avoid price inflation by selling available foreign assets, in particular the plentiful US$-based assets. Banks will lead the final phase of the Yen Carry Trade unwinding process. Insurance companies will unload US$-based assets in order to finance claims. The financial firms will unload US$-based assets so as to protect Japanese stock values. Asset sales will cover deficits, simply stated, a basic fact of finance. The Bank of Japan will not be able to anticipate or keep up with the pace of asset sales. The overall national costs will be a multiple of current estimates. Already this week the estimates were raised on ultimate costs. Ripple effects will be vast in the supply chain for the electronics and car industries. The Yen will be out of the news until it rises past the 123 level, at which time it will be blow away the veil and reveal the crisis.

Conclusion: A paradox with backfire is at work. The Yen currency will continue to rise, despite a growing trade deficit. Standard theory will not explain the phenomenon, which is that the funds usually devoted to suppress the Yen exchange rate and defend the export industries will be sold in order to fund the cleanup, the support, the displacements, and the reconstruction. The primary assets sold will be US$-based assets, since they are held in high volume and whose sale works to prevent the price inflation backfire.

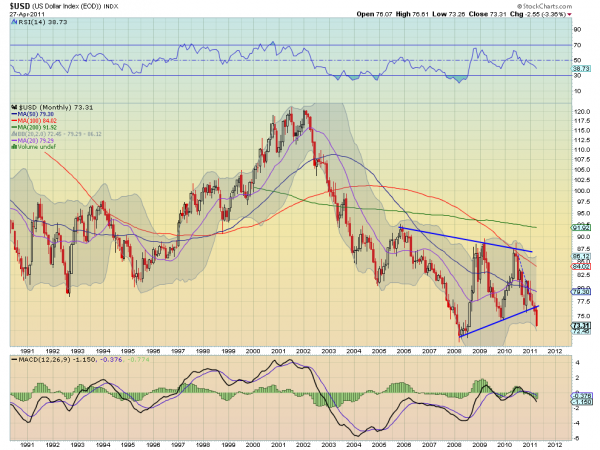

THE BESIEGED USDOLLAR

The USDollar DX index is flirting with a breakdown. Many analysts, the Jackass included, believe the DX index will eventually break below support lines and emergency tethers, seek its true value, and plunge the financial arena into a full blown global financial crisis. The crisis has not ended, and soon will intensify. Rather than embark on debt restructure and systemic reform, the national leaders dominated by the banker syndicate chose to dole of multi-$trillion welfare for the big US banks, redemption at nearly full value of their toxic bonds, coverage of the endless bills at the black holes in Fannie Mae and AIG, and blind approval of executive bonuses for those largely responsible for the national collapse. The global reaction is to abandon the USDollar and seek an alternative, a monstrous challenge. If foreign nations cannot control decisions or influence them in the USGovt, they can surely discard the USDollar and work to sink the corrupt raft afloat posing as a helm of control. US stewardship has morphed into crime syndicate operation, following a shrouded coup d'etat.

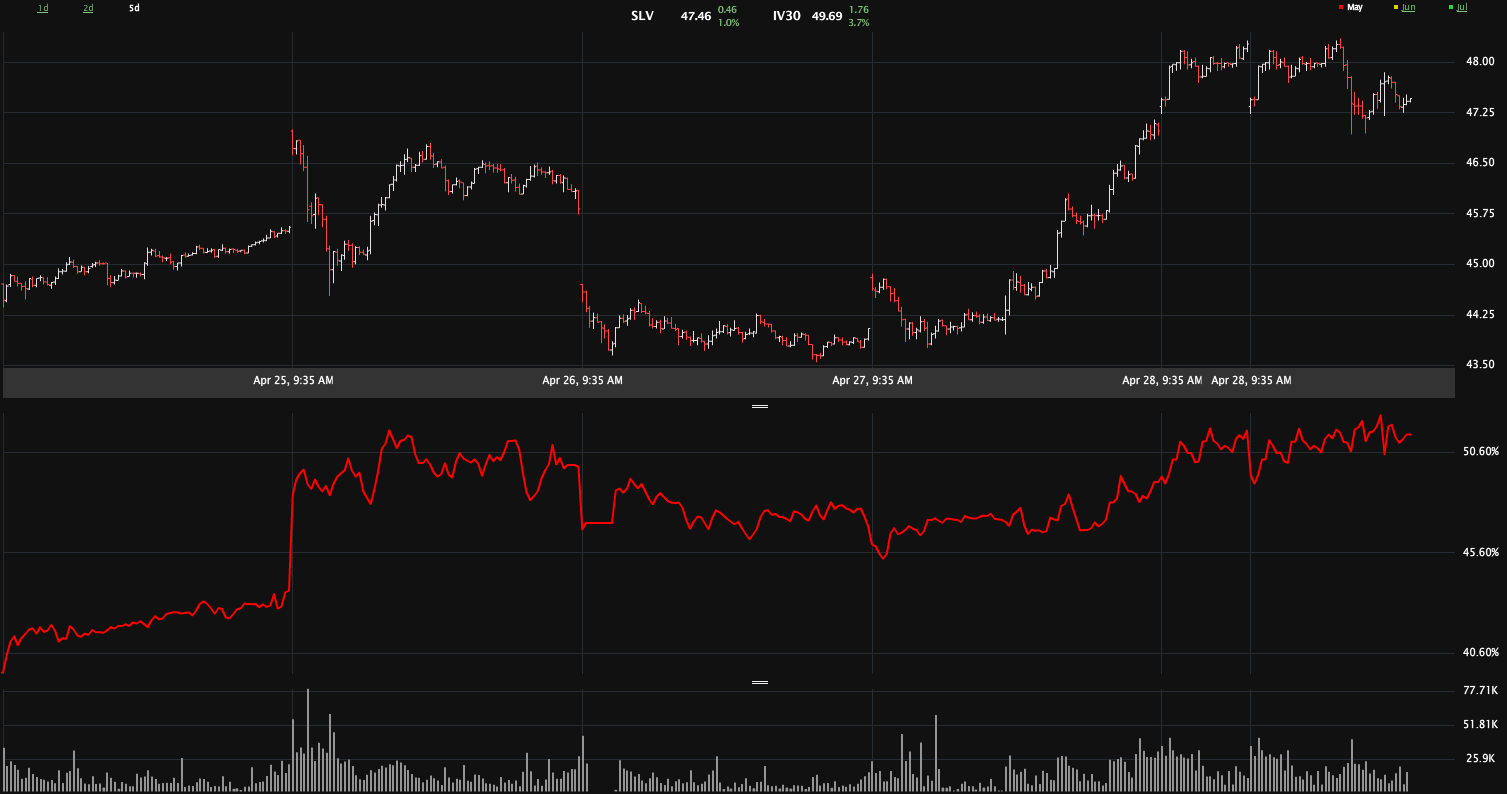

If the Gold & Silver price correction this week was the beginning of a greater correction, or a signal of end of the great bull run, then the USDollar would not display such extreme and vivid weakness. The rise through December and the January resumed decline cleared out the oversold condition, thus permitting further declines. The global monetary system is crumbling. The sovereign debt foundation for that monetary system is suffering from toxemia, a septic flow in circulation within the blood system. The US$ DX index cannot rise above the critical 75 level. The next test is of the 72 level, the generational low that must be defended. If overrun, then the global financial crisis will be squarely focused on the failing USDollar. That is precisely what to expect, as Gold & Silver resume their upward powerful march undeterred by paper hangers. The best propulsion for the precious metals is USFed Chairman Bernanke speaking. He reveals the desperation, the failure, the futility. Let him speak.

MANDATORY WAGE INCREASE

The Jackass will go out on the limb. A public distress signal has come from cost shock. The effect is lower retail spending, lower discretionary spending, lower business spending. The topline growth is in sales, which enables accounting games and claims of expansion. However, higher gasoline sales is not indicative of USEconomic growth, since less volume. It is evidence of price inflation. My forecast is that a nationwide movement by the autumn months will form. The movement will demand mandatory wage increases at a national level. The objective will be to help households squeezed by higher costs, and to avert an explosion of personal bankruptcies and business shutdowns. In time, look for (maybe hope for) two parts of wage and salary increases, merit raise and cost of living raise. The public demand will be for a grand socialist directive to legislate Cost Of Living raises to all Americans. The tremendous squeeze of business profits and household discretionary spending must invite a reaction, a national movement. Either people take to the streets or they win an income hike, even if legislated. Without it the system known as the USEconomy will collapse. Notice the Philly Fed in April plunged down to 18.5 from 43.4 in March, a decline without precedent. It is difficult to hide the breakdown and collapse. If and when a national wage increase to offset the higher cost structure occurs, it will open the floodgate for price inflation. The cost squeeze has ravaged the middle class, and it is severe. The main shelves of food & energy are just the visible tips of the iceberg.

The leaders must throw the restless natives a bone. But here is the battle. The banking and political leaders have made a national objective to prevent the 'Secondary Inflation Effects' from occurring, namely rising wages. They observe the rising cost structure with all its consequent distress. The clownish USFed Chairman will conduct public meetings and press conferences. His mission is to explain the urgent need not to prevent wage and salary increases. HE WILL MEET A FIRESTORM OF PROTEST, HOSTILITY, AND ANGER. His mission in plain terms is to save the system by letting the public succumb to cost pressures. He will explain the need for the people to die an economic death so that the banker assets do not collapse, so that the hidden banking system laden with corrupt credit derivatives does not collapse, so that the scourge of systemic hyper-inflation does not ravage and destroy the US financial system. The people probably do not care about such arguments. They will instead demand supplemental wage increases.

SIGNAL TEST FOR END OF GOLD & SILVER BULL

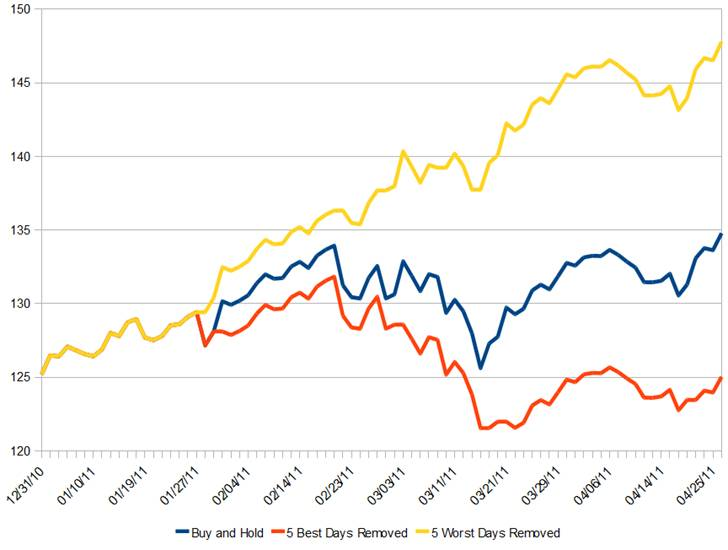

It is not complicated. Have they liquidated any big US banks?? Has any reform come for encouraging the return of US industry?? Has any regulatory reform been pursued for expanding business?? Have they stopped printing money to cover debt?? Has any reduction in USGovt deficits been realized?? The answer is a loud NO on all counts, which signals a continued bull market in precious metals. They print money to cover bonds which raises the cost structure and thus works to remove active capital through the natural process of business shutdowns due to vanished profitability. Watch for job cuts from the pervasive cost shock and its powerful squeeze. Watch for even greater propaganda of economic recovery in supposed business growth, which is almost all price inflation relabeled as growth, fully forewarned by the Jackass over the past three or four months. The Gold bull market will continue for at least a couple more years, as nothing is fixed and the major currencies continue their extreme debasement and ruin. Gold & Silver are currencies of last resort hated by central bankers, more widely embraced in the last year or more. The Silver bull market will continue for even longer, as nothing is fixed and the major currencies continue their extreme debasement and ruin, while industry must contend with widespread chronic shortages.

Bear in mind that the USFed is actively buying the TIPS, icing down the thermometer. They are doctoring the Treasury Inflation Protection Securities meter itself, done openly, without apology, without critical response by the bank analysts, asleep at the wheel. The upcoming wild card: foreign trade will no longer want the USDollar for crude oil or Chinese products. These two arenas are snake pits where the King Dollar will be bitten and delivered venom. So much intellectual inbreeding has taken place among bankers and economists. The jig is up and the game is over. Next comes the collapse, in progress but not yet widely recognized. Take your pick on imagery. The USDollar will face a shut door, as the welcome matt is removed, as foreigners pull the rug out. They are disgusted with unspeakable bond fraud. They are disgusted with endless banker welfare at global expense. They are disgusted with unbridled monetary inflation in the form of accelerating debt monetization. They are disgusted with runaway USGovt budget deficits. They are disgusted with fast rising food & energy prices, attributed directly to the USFed. They are disgusted with lost value of their reserve assets, attributed directly to the USFed. The USEconomy is in the process of collapse. CNN has yet to announce the collapse, so it is not widely perceived. They seem incapable even to report on a basic fact, that the USGovt has already exceeded the legal debt limit.

Just a final footnote on the Libya front. A quote from Manlio Dinucci. He wrote (in translation from Italian), "US and European ruling circles focused on these funds, so that before carrying out a military attack on Libya to get their hands on its energy wealth, they took over the Libyan sovereign wealth funds. Facilitating this operation is the representative of the Libyan Investment Authority, Mohamed Layas himself, as revealed in a cable published by WikiLeaks. On January 20th, Layas informed the US ambassador in Tripoli that LIA had deposited $32 billion in US banks. Five weeks later, on February 28th, the USTreasury froze these accounts. According to official statements, this is 'the largest sum ever blocked in the United States,' which Washington held 'in trust for the future of Libya.' It will in fact serve as an injection of capital into the US economy, which is more and more in debt. A few days later, the European Union froze around 45 billion Euros of Libyan funds." So not only debt monetization and hyper inflation keep the US and Western system going, but basic theft of tyrant's funds. One must wonder if destabilization of tyrant rule has a hidden ulterior motive of confiscation. The news media carefully avoids this confiscation topic and the central bank role in the heated war. Somehow, the Egyptian funds pilfered by Hosni Mubarak have escaped confiscation. My howls of laughter were heard 100 yards (meters) away when Bloomberg News reported that Mubarak had accumulated almost $60 billion over 30 years of dictatorial rule from prudent savings. The legal stealing rights among national leaders is epidemic, and includes the United States and England, the center of the Global Axis of Fascism.