By John Mauldin

August 12, 2011

I came away from Maine, and meeting with some of the most astute economists in the world, with a series of impressions that will be the core of this week’s letter. On Friday night, S&P downgraded US debt, and of course I need to comment on that. But as we talked the next two days and into the nights, I came increasingly to the opinion that this is indeed the Beginning of the Endgame. I must admit it has come about faster than I thought. But that is the nature of these things. And so, with no “but first,” let’s jump right in.

I think it relevant to start off by quoting from my book

Endgame, where I quote in turn from what I think is the most important book of the last decade,

This Time is Different: Eight Centuries of Financial Folly, by Ken Rogoff and Carmen Reinhart. I truly urge you to read it. The book is consciously designed so you can read the first chapter and the last five and get the thrust of the work. You can order it from

www.amazon.com/Different. (The Kindle edition is only $9.99 and makes a perfect companion to my book

Endgame [shameless plug].) Quoting from my book:

“We are going to look at several quotes from [This Time is Different], as well as an extensive interview [the authors] graciously granted. We have also taken the great liberty of mixing paragraphs from various chapters that we feel are important. Please note that all the emphasis is our editorial license. Let’s start by looking at part of their conclusion, which we think eloquently sums up the problems we face:

“‘The lesson of history, then, is that even as institutions and policy makers improve, there will always be a temptation to stretch the limits. Just as an individual can go bankrupt no matter how rich she starts out, a financial system can collapse under the pressure of greed, politics, and profits no matter how well regulated it seems to be. Technology has changed, the height of humans has changed, and fashions have changed.

‘Yet the ability of governments and investors to delude themselves, giving rise to periodic bouts of euphoria that usually end in tears, seems to have remained a constant. No careful reader of Friedman and Schwartz will be surprised by this lesson about the ability of governments to mismanage financial markets, a key theme of their analysis.

‘As for financial markets, we have come full circle to the concept of financial fragility in economies with massive indebtedness. All too often, periods of heavy borrowing can take place

in a bubble and last for a surprisingly long time. But highly leveraged economies, particularly those in which continual rollover of short-term debt is sustained only by confidence in relatively illiquid underlying assets, seldom survive forever, particularly if leverage continues to grow unchecked.

‘This time may seem different, but all too often a deeper look shows it is not. Encouragingly, history does point to warning signs that policy makers can look at to assess risk—if only they do not become too drunk with their credit bubble–fueled success and say, as their predecessors have for centuries, “This time is different.”’

[Back to my voice] “Sadly, the lesson is not a happy one. There are no good endings once you start down a deleveraging path. As I have been writing for several years, much of the entire developed world is now faced with choosing from among several bad choices, some being worse than others.”

And this is key. Read it twice (at least!):

“‘Perhaps more than anything else, failure to recognize the precariousness and fickleness of confidence—especially in cases in which large short-term debts need to be rolled over

continuously—is the key factor that gives rise to the this-time-is-different syndrome. Highly indebted governments, banks, or corporations can seem to be merrily rolling along for an extended period, when bang! — confidence collapses, lenders disappear, and a crisis hits.

‘Economic theory tells us that it is precisely the fickle nature of confidence, including its dependence on the public’s expectation of future events, which makes it so difficult to predict the timing of debt crises. High debt levels lead, in many mathematical economics models, to “multiple equilibria” in which the debt level might be sustained—or might not be. Economists do not have a terribly good idea of what kinds of events shift confidence and of how to concretely assess confidence vulnerability. What one does see, again and again, in the history of financial crises is that when an accident is waiting to happen, it eventually does. When countries become too deeply indebted, they are headed for trouble. When debt-fueled asset price explosions seem too good to be true, they probably are. But the exact timing can be very difficult to guess, and a crisis that seems imminent can sometimes take years to ignite.’”

When the subprime crisis started, we were told by numerous authorities (including Ben Bernanke) that the problems would be “contained.” But by 2006 it was clear to anyone who studied the toxic instruments that the losses would be in the hundreds of billions. I estimated $400 billion, which just goes to show that I’m an optimist. That crisis spread to banks all over Europe and then back to the US. Authorities used every bullet in their guns, every legal means and –well let’s be charitable, perhaps they pushed the rules a bit – to try and stem the tide. And then we had a “Lehman moment” and all at once the markets seemingly froze. It was “Bang!”

My sense is that the S&P downgrade is like that moment when we were told things would be contained. In and of itself, the downgrade is not that important. What did we learn that we did not already know? The US is headed for a financial crisis if they do not get the deficit under control? This is news?

But I think it forces S&P to take a very hard look at France, whose loss of AAA would bring into doubt the whole EFSF mechanism. And Spain and Italy must come under scrutiny if S&P’s move in the US is not to be seen as politically motivated. The main result of the downgrade may not be here in the US but in Europe, where there are already issues. A series of downgrades (which are warranted if the US one was) would be traumatic.

My London partner Niels Jensen penned this observation:

“If France is downgraded, a number of French banks will almost certainly be downgraded, following which other European banks will face the same destiny. Such a scenario has the potential to cause calamity across Europe. The 90 European banks which recently went through the (so-called) stress test organized by the European Banking Authority need to roll a total of €5.4 trillion1 (!) of debt over the next 24 months. A massive amount even during the best of times. Probably undoable during times of stress.

“As Ambrose Evans-Pritchard, in consultation with Willem Buiter of Citigroup, pointed out in the Daily Telegraph over the weekend:

“ ‘... the issue is not how long Italy and Spain can ride out the storm in bond markets. There would be a banking and insurance crisis long before sovereign defaults came into play, simply because the fall in bond prices on the secondary market is causing carnage to bank books (among other transmission mechanisms).’

“With its downgrade of U.S. sovereign debt, Standard and Poors has started a chain of events which can only make things worse in an already crisis-hit eurozone. For that reason, the decision to downgrade was not only badly timed but also ill considered; that it was probably justified is of little relevance at the moment.”

My latest trip to Europe and discussions with friends in Maine, plus my reading, simply reinforces my sense that we are seeing Europe unravel, or at the very least come to a very important crossroads where they must make a fateful decision. And let’s make no mistake, this is a demon of a problem of their own making. Monetary union without fiscal union will not work in a world where there are so many cultures and different traditions. But how does that work? How do you exorcise that demon?

Which leads me to a sidebar. Michael Lewis is one of the greatest writers of our time. He is just brilliant. He has a piece in the latest

Vanity Fair on Germany and the crisis in Europe. It is rather long (about 15 pages in a Word doc) and makes some rather interesting (if odd) scatological references, trying to explain the German world view, so if you are of a delicate mindset, perhaps you should confine yourself to the few paragraphs I quote here. But I do suggest you set aside some time to read the entire piece. (You can read the whole thing at

http://www.vanityfair.com/business/features/2011/09/europe-201109.) Here is the editor’s intro to the piece:

“With Greece and Ireland in economic shreds, while Portugal, Spain, and perhaps even Italy head south, only one nation can save Europe from financial Armageddon: a highly reluctant Germany. The ironies—like the fact that bankers from Düsseldorf were the ultimate patsies in Wall Street’s con game—pile up quickly as Michael Lewis investigates German attitudes toward money, excrement, and the country’s Nazi past, all of which help explain its peculiar new status.”

And from the middle of the piece, these insights:

“Greeks are still refusing to pay their taxes, in other words. But it is only one of many Greek sins. ‘They are also having a problem with the structural reform. Their labor market is changing—but not as fast as it needs to,’ he continues. ‘Due to the developments in the last 10 years, a similar job in Germany pays 55,000 euros. In Greece it is 70,000.’ To get around pay restraints in the calendar year the Greek government simply paid employees a 13th and even 14th monthly salary—months that didn’t exist. ‘There needs to be a change of the relationship between people and the government,’ he continues. ‘It is not a task that can be done in three months. You need time.’ He couldn’t put it more bluntly: if the Greeks and the Germans are to coexist in a currency union, the Greeks need to change who they are.

“This is unlikely to happen soon enough to matter. The Greeks not only have massive debts but are still running big deficits. Trapped by an artificially strong currency, they cannot turn these deficits into surpluses, even if they do everything that outsiders ask them to do. Their exports, priced in euros, remain expensive. The German government wants the Greeks to slash the size of their government, but that will also slow economic growth and reduce tax revenues. And so one of two things must happen. Either Germans must agree to a new system in which they would be fiscally integrated with other European countries as Indiana is integrated with Mississippi: the tax dollars of ordinary Germans would go into a common coffer and be used to pay for the lifestyle of ordinary Greeks. Or the Greeks (and probably, eventually, every non-German) must introduce ‘structural reform,’ a euphemism for magically and radically transforming themselves into a people as efficient and productive as the Germans. The first solution is pleasant for Greeks but painful for Germans. The second solution is pleasant for Germans but painful, even suicidal, for Greeks.

“The only economically plausible scenario is that Germans, with a bit of help from a rapidly shrinking population of solvent European countries, suck it up, work harder, and pay for everyone else. But what is economically plausible appears to be politically unacceptable. The German people all know at least one fact about the euro: that before they agreed to trade in their deutsche marks their leaders promised them, explicitly, they would never be required to bail out other countries. That rule was created with the founding of the European Central Bank (E.C.B.)—and was violated a year ago. The German public is every day more upset by the violation—so upset that Chancellor Angela Merkel, who has a reputation for reading the public mood, hasn’t even bothered to try to go before the German people to persuade them that it might be in their interests to help the Greeks.

“That is why Europe’s money problems feel not just problematic but intractable. It’s why Greeks are now mailing bombs to Merkel, and thugs in Berlin are hurling stones through the window of the Greek consulate. And it’s why European leaders have done nothing but delay the inevitable reckoning, by scrambling every few months to find cash to plug the ever growing economic holes in Greece and Ireland and Portugal and praying that even bigger and more alarming holes in Spain, Italy, and even France refrain from revealing themselves.

Until now the European Central Bank, in Frankfurt, has been the main source of this cash. The E.C.B. was designed to behave with the same discipline as the German Bundesbank, but it has morphed into something very different. Since the start of the financial crisis it has bought, outright, something like $80 billion of Greek and Irish and Portuguese government bonds, and lent another $450 billion or so to various European governments and European banks, accepting virtually any collateral, including Greek government bonds.

“But the E.C.B. has a rule—and the Germans think the rule very important—that they cannot accept as collateral bonds classified by the U.S. ratings agencies as in default. Given that they once had a rule against buying bonds outright in the open market, and another rule against government bailouts, it’s a little odd that they have gotten so hung up on this technicality. But they have. If Greece defaults on its debt, the E.C.B. will not only lose a pile on its holdings of Greek bonds but must return the bonds to the European banks, and the European banks must fork over $450 billion in cash. The E.C.B. itself might face insolvency, which would mean turning for funds to its solvent member governments, led by Germany. (The senior official at the Bundesbank told me they already have thought about how to deal with the request. ‘We have 3,400 tons of gold,’ he said. ‘We are the only country that has not sold its original allotment from the [late 1940s]. So we are covered to some extent.’) The bigger problem with a Greek default is that it might well force other European countries and their banks into default. At the very least it would create panic and confusion in the market for both sovereign and bank debt, at a time when a lot of banks and at least two big European debt-ridden countries, Italy and Spain, cannot afford panic and confusion.

“At the bottom of this unholy mess, from the point of view of the German Finance Ministry, is the unwillingness, or inability, of the Greeks to change their behavior.

“That was what the currency union always implied: entire peoples had to change their ways of life. Conceived as a tool for integrating Germany into Europe, and preventing Germans from dominating others, it has become the opposite. For better or for worse, the Germans now own Europe. If the rest of Europe is to continue to enjoy the benefits of what is essentially a German currency, they need to become more German. And so, once again, all sorts of people who would rather not think about what it means to be ‘German’ are compelled to do so.”

As I will show below, the US (indeed much of the world) is on the edge of yet another recession. It will not take much to push us into one, just a small shock, like say a banking crisis in Europe, alluded to by Lewis and something I have been writing about for a year.

That being said, the apparent willingness of the Germans to come up with creative ideas (and to get the French to go along) to fund the various nations in crisis, in order to avoid technical defaults, is somewhat amazing. And if there was an election today and the socialists and Greens won in Germany, they would be even more open to the idea of a eurobond, to be somehow guaranteed by member countries. The current EFSF can deal with Greece, Ireland, and Portugal until maybe 2013, and the next version will be large enough to deal with Spain, unless of course the Eurozone elites decide to call it quits, which is something they have not shown the slightest hint of doing. What is more likely is that we lurch from crisis to crisis, with each crisis somehow being averted by throwing more money at it, until the debt of the AAA guarantors like France (and to a lesser extent Italy) starts to be called into question by the markets.

Remember, the demographics of Spain and Italy are horrendous, soon to be on a level with Japan. The government portion of GDP in France is already 53% (not a typo!) and is only going to get worse as aging Boomers have been promised monster benefits that simply cannot be provided without Greek-level austerities. Their future numbers are worse than those of the US.

This can go on for a long time, or it can end in a Bang! moment this year. That is the nature of the lesson from Rogoff and Reinhart. Look at Japan. They took what were functionally insolvent banks and kept them going for decades. Where there is a political will there can be a way … but there will be an Endgame. That is also the lesson we learn from history. Japan will not be able to stave off a crisis of major proportions forever. Neither will Europe, unless they all become Germans in their national accounting.

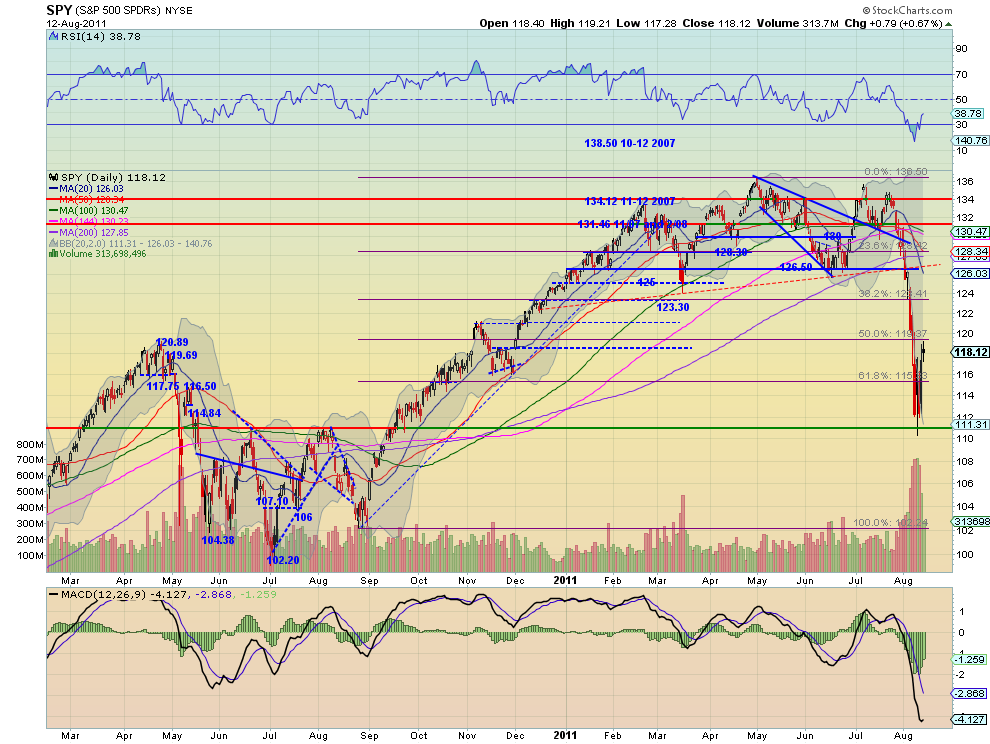

My friend Barry Ritholtz posted the above question today, and wrote:

“The first one is an overlay the University of Michigan consumer confidence index vs the Conference Board’s data. The second chart shows the long term history of the Conference Board data. At an implied level of 43.37 we would be in recession now; not only that but a deep recession.

“As the charts show, the ABC index has diverged from the Conference Board data for some time now. The correlation between consumer confidence and recession might not hold this time — although that would be the first split for 40 plus years. There is also an implication from this data series that we are already in recession. Given yesterday’s data showing both imports and exports falling, we may have an implied Q2 GDP revised lower by 0.8% to 0.5% annualized growth — putting Q2 into the negative category.

“Hence, it is not unfeasible that we could be the verge of recession.”

And that brings me to a chart I asked Rich Yamarone (chief econ type at Bloomberg) to update for me. Again, it is about the horrific consumer confidence number that came in today, but this time it is correlated with GDP. As you can see, there is a close correlation. With GDP growth of less than 1% for the last six months, asking if we are close to or already in a recession is not a question without merit. And either way, this does not bode well for the long-term direction of stocks and corporate earnings. Consumer confidence is really saying that a recession is in the cards. Maybe it is just weariness with the political malaise (which would be understandable), but we should pay attention.

And while I won’t print the chart again, every time year-over-year GDP growth falls below 2%, we end up in a recession. It is now 1.6%. Past performance is not indicative of future recessions, but the trend is not in our favor.

The economy is getting weaker. What can we do? The short answer is, sadly, not much. There were some in Maine who argued for more fiscal stimulus, but I think there is little political will for another major stimulus program. The last one got us up to 3% GDP growth before we fell back, and all we got was a major debt bill and a higher level of government spending. I fully get that lowering government spending will have negative short-term effects, but we are at the point in the Endgame where we must bite the bullet.

And fiscal policy is becoming a drag on the entire Eurozone, as well as Great Britain. Austerity may be warranted, but is has consequences.

What about QE3? Let’s look at how that last move turned out. We ended up with more money on the Fed’s balance sheet and higher commodity prices. The NFIB survey I cited last week showed there was no great demand on the part of small business for loans. 91% had what they needed. What they want are sales and customers! The trade data yesterday showed exports fell by over $2.3 billion last month. That suggests a slowing world economy. Which is borne out by numerous other indicators.

One has to applaud the Chinese for allowing their currency to rise by a significant (for them) amount this week, as almost every other government (including Switzerland) wants a weaker currency. Everyone can’t devalue at the same time, just as everyone cannot export their way out of this crisis. Someone has to buy!

In short, there are no easy solutions. We have just about used up all our “rabbits in the hat” as far as fiscal and monetary policy are concerned. We now need to focus on what we can do to get out of the way of the private sector, so it can find ways to create new businesses and jobs. And that means figuring out how to get money to new businesses, because that is where net new jobs come from. But that takes time – and is a subject for another letter, as it is time to hit the send button.

I am home for (can you believe it?) more than 40 days, which, even with the Texas heat, I need. Then I’m off to Ireland, Geneva, and a few days in London. I am sure I will be making at least one presentation in London.

Maine was more serious this time. I think more of us realize that things are going to get harder and more volatile. While our group is not exactly indigent, we do get what all this means. On Sunday night, Trey came to me. He had been listening. “Dad, it is good for you that you wrote about all this already and are right, but I don’t think it’s so good for the rest of us.” And he is right.

Book sales have been quite steady, as more and more people are realizing that we truly are at the Endgame, and as we try to lay out how it plays out for us all. There is a lot of data in the book, and we back up our predictions with sources. As one reader wrote:

“John, I hope all is well. I just wanted to drop you a note and tell you how much I am enjoying Endgame. As a guy with a degree in economics, I read a lot of books trying to explain macroeconomics of the times, but I have to tell you this is the single best book I have read explaining how macroeconomics works to regular people like me. You have done a great service to your readers, as you do every day. Best, Steve”

It really is time to hit the send button and find something to eat. I am starved – and maybe I’ll catch a late movie. Have a great week.

Your glad God invented air conditioning analyst,

John Mauldin

See the original article >>