Japan is facing two meltdowns in the wake of its devastating earthquake. The first, and more critical, is the meltdown at the Fukushima I Nuclear Plant, 150 miles north of Tokyo. Surely, this is the greater near-term threat. But long-term, another threat looms, having to do with the Japanese government's response to the former.

As the fourth largest economy in the world, behind the EU, US, and China, any major setback in Japan likely will have widespread repercussions. Japan is also the third largest holder of US Treasuries, behind the United States and China. While it is too early even to assess the Japanese damage accurately - let alone to forecast the full implications - it is possible to see the potential for a meltdown of the US Treasury market and international monetary system.

Current estimates hold that the Japanese disaster has already lowered world economic growth by a full percentage point for the year.

Leaving aside massive international aid, a complete nuclear meltdown, or other escalations, Japan already will have to spend a massive amount of money to cope with the current disaster. This raises the question: from where will such an enormous amount of money come?

Japan could borrow. However, with a debt-to-GDP ratio of some 200 percent, or twice as bad as that of the United States, and with the main credit rating agencies exercising more scrutiny than before the Credit Crunch, raising funds will be difficult at an economic rate of interest. Moreover, Japan will likely be spending a large chunk of its foreign exchange reserves to buy oil to replace its lost nuclear power generating capacity - diminishing its collateral in the eyes of creditors.

Japan could follow the US example and "paper over" its problems. But without the benefits of being the international reserve currency, the Japanese would immediately feel the effects of domestic inflation. The Bank of Japan has already pumped out ¥8 trillion ($98 billion) in the wake of the earthquake, but it is unlikely to try to match the Fed's $600 billion printing spree this quarter.

So, if Japan is limited in its ability to borrow or print money, it may have to sell part of its vast holdings of US Treasuries.

At the end of last month, the US Treasury had outstanding debt worth some $14.19 trillion. This represents 96.8 percent of the total $14.66 trillion value of business generated within the United States for the entire year of 2010. It is just short of the $14.294 trillion debt limit set in 2010 by a profligate Democrat Congress. To put it in perspective, the US government now owes $91,400 for every working American. However, this represents only some 22 percent of Washington's $62 trillion of unfunded obligations, which include Social Security, Medicare, housing, and other guarantees.

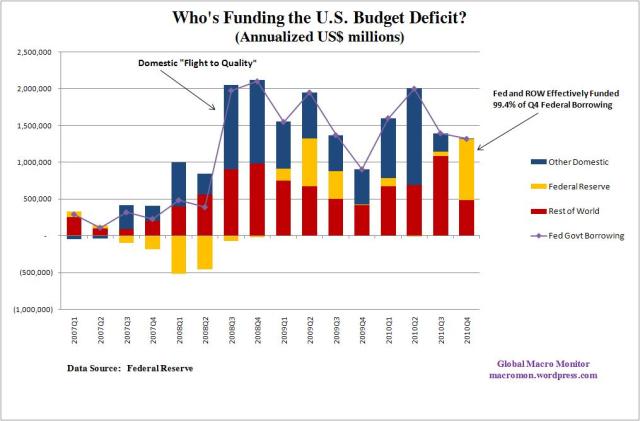

Japan is the third largest holder of US Treasuries ($877 billion), behind China ($896 billion) and the Fed ($1.108 trillion). Should Japan start selling Treasuries in large amounts to fund the repair of its economy, it could have a serious effect on US interest rates and the market value of Treasuries the world over. US bonds are widely held by central banks, international banks, and insurance companies, which already are concerned about their funding of loss claims arising from the damage in Japan.

Thus, a Japanese selloff could trigger a liquidity crisis like the one following the collapse of Lehman Bros. and AIG. Large institutions may not be willing or able to bear with US bonds through a steep correction.

Western economies are on thin ice as it is, even without a shock in their presumed "safe" asset.

Stock markets in the EU and US are weakening, destroying large amounts of private wealth and potential consumer confidence.

Further, the EU is facing the reality that the financial rescue programs it organized to save some of its members are not working. China and Japan offered to help. Now Japan may not be able to fulfill its promises. This could reignite further speculative downward pressure on the euro.

It seems that while we are all concerned about the effects of nuclear meltdown on the residents of Japan, we should also be aware that the fallout could spread further in the financial markets than it does in the atmosphere. Just as Californians are stocking up on iodide pills as a precautionary measure, investors should be stocking up on hard assets. After health, it's vital to guard your wealth - especially in emergency times like these.