by Gail Tverberg

| Credit Problems are a Very Current Issue In the past several years, the engine of world’s growth has been China. China’s growth has been fueled by debt. China now seems to be running into difficulties with its industrial growth, and its difficulty with industrial growth indirectly leads to debt problems. A Platt’s video talks about China’s demand for oil increasing by only 2.5% in 2013, but this increase being driven by rising gasoline demand. Diesel use, which tracks with industrial use, seems to be approximately flat. The UK Telegraph reports, “Markets hold breath as China’s shadow banking grinds to a halt.” According to that article,

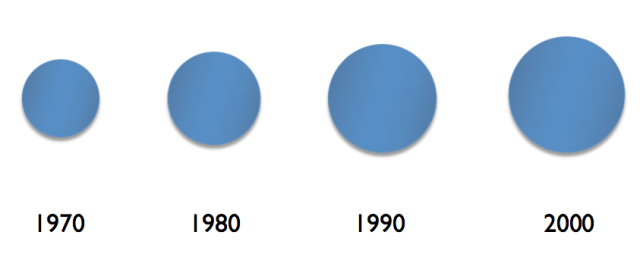

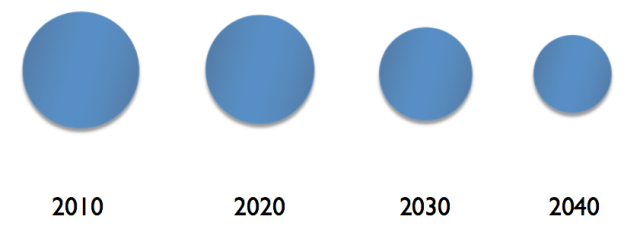

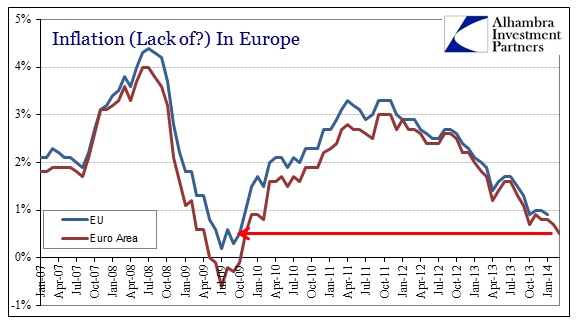

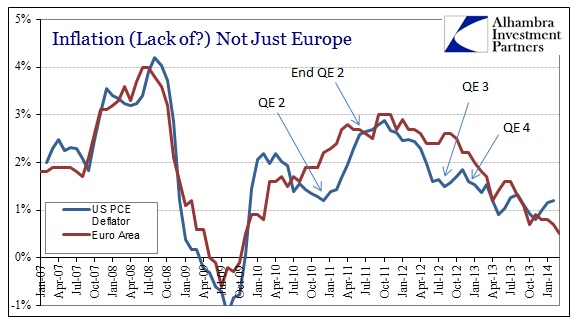

Many recent reports have talked about the huge growth in China’s debt in recent years, much of it outside usual banking channels. One such report is this video called How China Fooled the World with Robert Peston. Why Promises (and Debt) are Critical to the Economy Without promises, it is hard to get anyone to do anything that they really don’t want to do. Think about training your dog. The way you usually do this training is with “doggie treats” to reward good behavior. Rewards for desired behavior are equally critical to the economy. An employer pays wages to an employee (a promise of pay for work performed). It is possible to build a house or a store, stick by stick, as a person accumulates enough funds from other endeavors, but the process is very slow. Usually, if this approach is used, those building homes or stores will provide all of the labor themselves, to try to match outgo with income. If debt were used, it might be possible to use skilled craftsmen. It might even be possible to take advantage of economies of scale and build several homes together in the same neighborhood, and sell them to individuals who could buy the homes using debt. Adding debt has many advantages to an economy. With debt, a person can buy a new car or house without needing to save up funds. These purchases lead to additional workers being employed in building these new cars and homes, adding jobs. The value of existing homes tends to rise, if other people are available to afford them, thanks to cheap debt availability. Rising home prices allow citizens to take out home equity loans and buy something else, adding further possibility of more jobs. Availability of cheap debt also tends to make business activity that would otherwise be barely profitable, more profitable, encouraging more investment. GDP measures business activity, not whether the activity is paid for with debt, so rising debt levels tend to lead to more GDP. Webs of Promises and Debt As economies expand, they add more and more promises, and more and more formal debt. In high tech industries, supply lines using materials from around the world are needed. The promise made, formally or informally, is that if more of a supply is needed, it will be available, at the same or a similar price, in the quantity needed and in the timeframe needed. In order for this to happen, each supplier needs to have made many promises to many employees and many suppliers, so as to meet its commitments. Governments are part of this web of promises and debt. Some of the promises made by governments constitute formal debt; some of the promises are guarantees relating to debt of other parties (such as nuclear power plants), or of the finances of banks or pensions plans. Some of a government’s promises are only implied promises, yet people depend on these implied promises. For example, there is an expectation that the government will continue to provide paved roads, and that it will continue to provide programs such as Social Security and Medicare. Because of the latter programs, citizens assume that they don’t need to save very much or have many children–the government will provide funding sufficient for their basic needs in later years, without additional action on their part. What is the Limit to Debt? While our system of debt has gone on for a very long time, we can’t expect it to continue in its current form forever. One thing that we don’t often think about is that our system or promises isn’t really backed by the way natural system we live in works. Our system of promises has a hidden agenda of growth. Nature doesn’t have a similar agenda of growth. In the natural order, the amount of fresh water stays pretty much the same. In fact, aquifers may deplete if we over-use them. The amount of topsoil stays pretty much the same, unless we damage it or make it subject to erosion. The amount of wood available stays pretty constant, unless we over-use it. Nature, instead of having an agenda of growth, operates with an agenda of diminishing returns with respect to many types of resources. As we attempt to produce more of a resource, the cost tends to rise. For example, we can extract more fresh water, if we will go to the expense of drilling deeper wells or using desalination, either of which is more expensive. We can extract more metals, if we use as our source lower grade ores, perhaps with more surface material covering the ore. We can get extract more oil, if we will go to the expense of digging deeper wells is less hospitable parts of the world. We can even use substitution, but that will likely be more expensive yet. A major issue that most economists have missed is the fact that wages don’t rise in response to this higher cost of resource extraction. (I have shown a chart illustrating that this is true for oil prices.) If the higher cost simply arises from the fact that nature is putting more obstacles in our way, we end up spending more for, say, desalinated water than water from a local well, or more for gasoline than previously. Much of the cost goes into fuel that is burned, or building special purpose equipment (such as a desalination plant or offshore drilling rigs) that will degrade over time. Our system is, in effect, becoming less and less efficient, as it takes more resources and more of people’s time, to produce the same end product, measured in terms of barrels of oil or gallons of water. Even if there are additional salaries, they are often in a different country, around the globe. At some point, the amount of products we can actually produce starts shrinking, because workers cannot afford the ever-more-expensive products or because some essential “ingredient” (such as fresh water, or oil, or an imported metal) is not available. Since we live in a finite world, we know that at some point such a situation must occur, even if the shrinkage isn’t as soon as I show it in Figure 2 below. Figure 1. Author’s image of an expanding economy. Figure 2. Author’s image of declining economy. The “catch” with debt is that we are in effect borrowing from the future. It is much easier to pay back debt with interest when the economy is growing than when the economy is shrinking. When the economy is shrinking, there is less in the future to begin with. Repaying debt from this shrinking amount becomes a problem. Even promises that aren’t formally debt, such as most Social Security payments, Medicare, and future road maintenance become a problem. With fewer goods available in total, citizens on average become poorer. Governments depend on tax revenue from citizens, so they become poorer as well–perhaps even more quickly than the individual citizens who live in their country. It is in situations like this that richer parts of countries decide to secede, leading to country break-ups. Or the central government may fail, as in the Former Soviet Union. Which Promises are Least Affected? Some promises are very close in time; others involve many years of delay. For example, if I bring food I grew to a farmers’ market, and the operator of the market gives me credit that allows me to take home some other goods that someone else has brought, there are some aspects of credit involved, but it is very short term credit. I am being allowed to “run a tab” with credit for things I brought, and this payment is being used to purchase other goods, or perhaps even services. Perhaps someone else would offer some of their labor in putting together the farmers’ market, or in working in a garden, in return for getting some of the produce. As I see it, such short term promises are not really a problem. Such credit arrangements have been used for thousands of years (Graeber, 2012). They don’t depend on long supply lines, around the world, that are subject to disruption. They also don’t depend on future events–for example, they don’t depend on buyers being available to purchase goods from a factory five or ten years from now. Thus, local supply chains among people in close proximity seem likely to be available for the long term. Long-Term Debt is Harder to Maintain Debt which is long-term in nature, or provides promises extending into the future (even if they aren’t formally debt) are much harder to maintain. For example, if governments are poorer, they may need to cut back on programs citizens expect, such as paving roads, and funding for Social Security and Medicare. Governments and economies are already being affected by the difficulty in maintaining long term debt. This is a big reasons why Quantitative Easing (QE) is being used to keep interest rates artificially low in the United States, Europe (including the UK and Switzerland), and Japan. If interest rates should rise, it seems likely that there would be far more defaults on bonds, and far more programs would need to be cut. Even with these measures, some borrowers near the bottom are already being adversely affected–for example, subprime loans were problems during the Great Recession. Also, many of the poorer countries, for example, Greece, Egypt, and the Ukraine, are already having debt problems. Indirect Casualties of the Long-Term Debt Implosion The problem with debt defaults is that they tend to spread. If one major country has difficulty, banks of many other countries are likely be to affected, because many banks will hold the debt of the defaulting country. (This may not be as true with China, but there are no doubt indirect links to other economies.) Banks are thinly capitalized. If a government tries to prop up the banks in its country, it is likely to be drawn into the debt default mess. Insurance companies and pension plans may also be affected by the debt defaults. In such a situation of debt defaults spreading from country to country, interest rates can be expected to shift suddenly, causing financial difficulty for those issuing derivatives. There may also be liquidity problems in dealing with these sudden changes. As a result, banks issuing derivatives may need to be bailed out. There may also be a sudden loss of credit availability, or much higher interest rates, as banks issuing loans become more cautious. In fact, if problems are severe enough, some banks may be closed altogether. With less credit available, prices of commodities can be expected to drop dramatically. For example, during the credit crisis in the second half of 2008, oil prices dropped to the low $30s per barrel. It was not until after QE was started in November 2008 that oil prices started to rise again. This time, central banks are already using QE to try to fix the situation. It is not clear that they can do much more, so the situation would seem to have the potential to spiral out of control. Without credit availability, the prices of most stocks are likely to drop dramatically. In part, this is because without credit availability, it is not clear that the companies listed in the stock market can actually produce very much. Even if the particular company does not need credit, it is likely that some of the businesses on which it depends for supplies will have credit problems, and not be able to provide needed supplies. Also, with less credit availability, potential buyers of shares of stock may not be about to get the credit they need to purchase shares of stock. As a result of the credit problems in 2008, the Dow Jones Industrial Average dropped to $6,547 on March 9, 2009. Furthermore, lack of credit availability tends to lead to low selling prices for commodities, making production of these commodities unprofitable. Production of these commodities may not drop off immediately, but will in time unless the credit situation is quickly turned around. Can’t governments simply declare a debt jubilee for all debt, and start over again? Not that I can see. Declaring a debt jubilee is, in effect, saying, “We have decided to renege on our past promises. In fact, we are letting others renege on their promises as well.” This means that insurance companies, pension plans, and banks will all be in very poor financial situation. Many who depend on pensions will find their monthly checks cut off as well. In fact, businesses without credit availability are likely to lay off workers. If it is possible to start over, it will need to be on a much more restricted basis. Everyone will be poorer, so there won’t be much of a market for expensive new cars and homes. Instead, most demand will be for will be the basics–food, water, clothing, and fuel for heat. Unfortunately, it is doubtful that prices will be high enough, or the chains of supply robust enough, to again produce fossil fuels in quantity. Without fossil fuels, what we think of as renewables will disappear from availability quickly as well. For example, hydroelectric, wind and solar PV all work as parts of a system. If the billing system is unavailable because banks are closed, or if the transmission system is in need of repair because lines are down and the diesel fuel needed to make repairs is unavailable, electricity may not be available. As indicated above, demand will be primarily for basics such as food, water, clothing, and fuel for cooking and heating. It will still be possible to use local supply chains, even if long distance supply chains don’t really work well. The challenge will be trying to shift modes of production to new approaches in which goods can be made locally. A major challenge will be training potential farmers, getting needed equipment for them, and transferring land ownership in ways that will allow food to be produced in ways that do not depend on fossil fuels. Belief in credit will be severely damaged by a debt jubilee. The place where credit will be easy to reestablish will be in places where everyone knows everyone else, and supply lines are short. Debt will mostly be of the nature of “running a tab” when one type of good is exchanged for another. Over time, there may be some long-term trade re-established, but it is likely to be much more limited in scope than what we know today. Conclusion Long-term debt tends to work much better in a period of economic growth, than in a period of contraction. Reinhart and Rogoff unexpectedly discovered this point in their 2008 paper “This Time is Different: A Panoramic View of Eight Centuries of Financial Crises.” They remark “It is notable that the non-defaulters, by and large, are all hugely successful growth stories.” Slowing growth in China is likely to mean that world economic growth is slowing. This will add to stresses, making failure of the system more likely than it otherwise would be. We can cross our fingers and hope that Janet Yellen and other central bankers can figure out yet other ways to keep the system together for a while longer. |