by Jeff Miller

Last week I suggested that the market might need to "digest" the FOMC announcement. Wow, was I right! This continues a pretty good streak of predicting the main theme for the coming week.

I really struggled with last week's forecast since I absolutely hate the idea of a delayed reaction. In general, I do not like such explanations, and sharp readers could easily find my own words on this subject. We got a lot more than digestion. It was a full-fledged hissy fit. Since the issue has not been settled, the debate continues.

We have a rather strange week ahead – plenty of data, an ongoing debate about the Fed, and a mid-week holiday that usually sends market participants on vacation by Tuesday, if not for the full week.

I predict that the market focus will be on the new higher interest rate environment, especially the question of the implication for stocks and overall asset allocation.

Last Week's Battle Lines

There was so much written and spoken. As usual, my weekly summary can only hit the high spots. I am going to identify three perspectives:

- The Fed. There were many speeches and all had the same theme: The markets misinterpreted, over-reacted, and were basically just wrong! The New York Times used this language to describe a speech by NY Fed President William C. Dudley, but much the same could be said about the more hawkish Dallas Fed President Richard Fisher's reference to "feral hogs." CNBC's colorful commentator Jim Cramer did the typical trader extrapolation saying that the "word went out" and that everyone was on message, even including Sports Center!

- The Traders. The story from these sources was that the Fed was clueless and did not understand markets. This viewpoint was repeatedly expressed by Santelli and friends, mostly in the typical notion that having an advanced degree in economics proves that you are dumb and disqualifies you from making policy decisionsJ Instead, let us cite the more measured commentary from Vince Foster at Minyanville. He describes the effect on the Eurodollar market. I suspect that few academics and almost no individual investors even know what this market represents (confusing it with the currency), and despite the importance and size.

- The Academics. There is an honest and extensive effort to evaluate the effect of Fed policy and the market reaction. With many, many posts in the debate, I need to focus on just one. Scott Sumner has had more effect on economic thinking and Fed policy than most realize. He wisely notes other influences on interest rates – not just the Fed. Read his "Orient Express" post and follow the links if you want to understand the academic perspective.

What should we make of this? The disagreements are sharp and no clear resolution seems possible. As one who has moved comfortably among top government officials, traders, and academics I have an unusual perspective. It deserves a thoughtful response, and I am working on that. Meanwhile, I'll provide some thoughts in the conclusion. First, let us do our regular update of last week's news and data.

Background on "Weighing the Week Ahead"

There are many good lists of upcoming events. One source I regularly follow is the weekly calendar from Investing.com. For best results you need to select the date range from the calendar displayed on the site. You will be rewarded with a comprehensive list of data and events from all over the world. It takes a little practice, but it is worth it.

In contrast, I highlight a smaller group of events. My theme is an expert guess about what we will be watching on TV and reading in the mainstream media. It is a focus on what I think is important for my trading and client portfolios. Each week I consider the upcoming calendar and the current market, predicting the main theme we should expect. This step is an important part of my trading preparation and planning. It takes more hours than you can imagine.

My record is pretty good. If you review the list of titles it looks like a history of market concerns. Wrong! The thing to note is that I highlighted each topic the week before it grabbed the attention. I find it useful to reflect on the key theme for the week ahead, and I hope you will as well.

This is unlike my other articles at "A Dash" where I develop a focused, logical argument with supporting data on a single theme. Here I am simply sharing my conclusions. Sometimes these are topics that I have already written about, and others are on my agenda. I am putting the news in context.

Readers often disagree with my conclusions. Do not be bashful. Join in and comment about what we should expect in the days ahead. This weekly piece emphasizes my opinions about what is really important and how to put the news in context. I have had great success with my approach, but feel free to disagree. That is what makes a market!

Last Week's Data

Each week I break down events into good and bad. Often there is "ugly" and on rare occasion something really good. My working definition of "good" has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially -- no politics.

- It is better than expectations.

The Good

This was a very good week for economic data, despite the market reaction.

- The Senate approved the immigration bill with a solid bipartisan vote (68-32). It is now up to the House. Most average voters do not understand the economics of this issue including both competition for jobs, tax payments, and government spending. We shall see.

- Durable goods increased at a solid 3.6% pace.

-

Earnings per share move higher despite flat total earnings (and cash flow) growth. Ed Yardeni explains as follows:

"…(A)lthough corporate cash flow has flattened along with corporate profits, it's done so at a record high. There is plenty of it to drive stock prices higher. For the S&P 500, the sum of buybacks and dividends totaled $702 billion over the past four quarters through Q1-2013. Since the start of the bull market during Q1-2009, the sum total is a staggering $2.3 trillion."

He also notes that corporate buybacks seem to be less than announced or modeled – something to watch.

- Pending home sales were strong, 12.5% higher y-o-y and accelerating. (See Steven Hansen's analysis at GEI).

- Personal income was up strongly at 0.5%. Calculated Risk has a good story with charts.

- Michigan sentiment was solid. This was a final reading for June and a touch below May's final. I am scoring it as "good" because there has been a lot of variation from preliminary to final and the 84 range is important, as you can see from Doug Short (who shows GDP and recessions as well as the long-term series:

The Bad

There was very little bad news. Feel free to add in the comments anything you think I missed!

- Q1 GDP? El stinko! With the second quarter about to end, there was little market interest in this final revision, just as I suggested in last week's preview. The very weak commentary from CNBC's floor analyst, struggling to explain the market rally, was that the weak number showed that the Fed would act more strongly. It is amazing that anyone would even think the Fed might be influenced by this. It does provide a historical record, where it is important to note the impact of reduced government spending. People seem to have difficulty in detaching their politics from the data. If you want to reduce government spending, there is an economic effect. That is why we have a national debate about priorities. Wisconsin Prof. Menzie Chinn has a typically thorough analysis. Here is a key chart:

- Mortgage rates spiked higher. Calculated Risk shows the impact on refinancing activity.

- Chicago PMI disappointed at a 51.6 reading. Bad news for next week's ISM report?

- China – a continuing worry about growth, but the data are difficult to interpret.

The Ugly

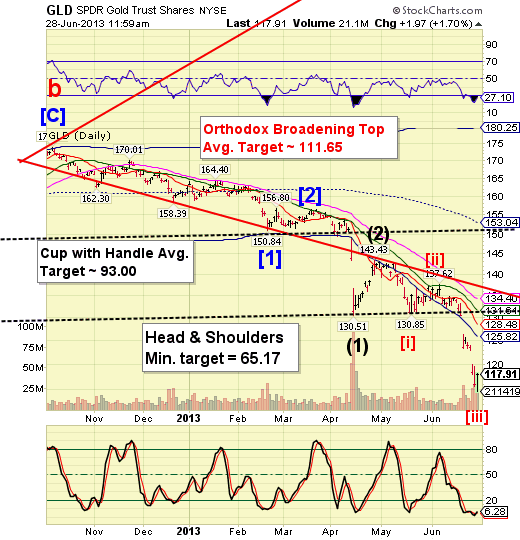

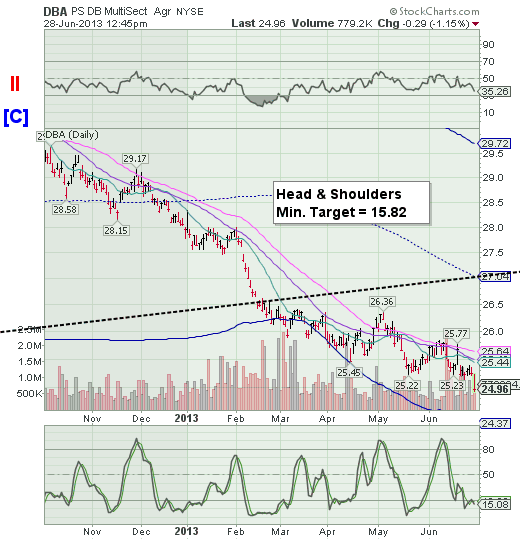

The failing search for safety was the clear winner of last week's "ugly" award.

Abnormal Returns has a powerful analysis of the "risk parity" ideas. These funds were supposed to provide protection against big losses, even when interest rates increase, by asset allocations to offsetting ideas. The funds represent the best efforts of some very smart managers. Tadas explains as follows:

"In light of this relative underperformance a good old fashioned balanced portfolio looks good. One of the key tenets of risk parity and most other asset allocation strategies is diversification. While a 60/40 portfolio is no slouch one can easily argue that additional diversification, including the rebalancing opportunities they represent, can add value over time. Diversification is no panacea as this month as shown but it hard to argue what the alternative may be."

Here is the featured chart from Tom Brakke:

We can now add the "all weather" funds to the list of failed "safe investments," a theme I have been warning about for many weeks.

Getting some safe yield requires a path that is less traveled. Volatility increases call premiums and the "modest dividend" stocks do not have the same overvaluation as the Grandma names. Looking for enhanced yield is something you can do at home if you have a little wisdom, courage, and patience, as I suggested here.

The Indicator Snapshot

It is important to keep the current news in perspective. I am always searching for the best indicators for our weekly snapshot. I make changes when the evidence warrants. At the moment, my weekly snapshot includes these important summary indicators:

- For financial risk, the St. Louis Financial Stress Index.

- An updated analysis of recession probability from key sources.

- For market trends, the key measures from our "Felix" ETF model.

Financial Risk

The SLFSI reports with a one-week lag. This means that the reported values do not include last week's market action. The SLFSI has recently edged a bit higher, reflecting increased market volatility. It remains at historically low levels, well out of the trigger range of my pre-determined risk alarm. This is an excellent tool for managing risk objectively, and it has suggested the need for more caution. Before implementing this indicator our team did extensive research, discovering a "warning range" that deserves respect. We identified a reading of 1.1 or higher as a place to consider reducing positions.

The SLFSI is not a market-timing tool, since it does not attempt to predict how people will interpret events. It uses data, mostly from credit markets, to reach an objective risk assessment. The biggest profits come from going all-in when risk is high on this indicator, but so do the biggest losses.

Recession Odds

I feature the C-Score, a weekly interpretation of the best recession indicator I found, Bob Dieli's "aggregate spread." I have now added a series of videos, where Dr. Dieli explains the rationale for his indicator and how it applied in each recession since the 50's. I have organized this so that you can pick a particular recession and see the discussion for that case. Those who are skeptics about the method should start by reviewing the video for that recession. Anyone who spends some time with this will learn a great deal about the history of recessions from a veteran observer.

I have promised another installment on how I use Bob's information to improve investing. I hope to have that soon. Meanwhile, anyone watching the videos will quickly learn that the aggregate spread (and the C Score) provides an early warning. Bob also has a collection of coincident indicators and is always questioning his own methods.

I also feature RecessionAlert, which combines a variety of different methods, including the ECRI, in developing a Super Index. They offer a free sample report. Anyone following them over the last year would have had useful and profitable guidance on the economy. RecessionAlert has developed a comprehensive package of economic forecasting and market indicators, well worth your consideration. Dwaine's leading indicators are currently showing some weaker readings, as you can see here.

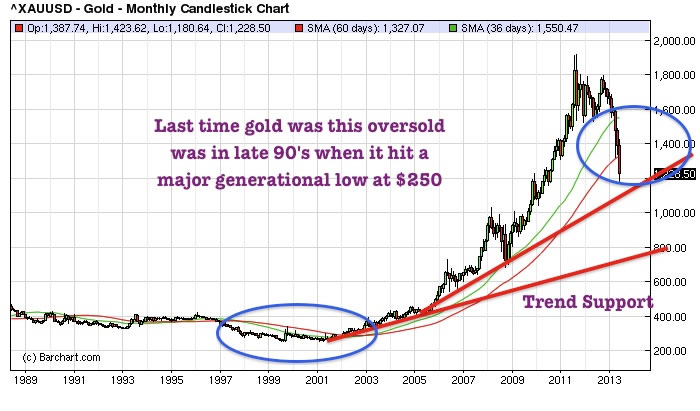

Georg Vrba's four-input recession indicator is also benign. "Based on the historic patterns of the unemployment rate indicators prior to recessions one can reasonably conclude that the U.S. economy is not likely to go into recession anytime soon." Georg has other excellent indicators for stocks, bonds, and precious metals at iMarketSignals.

Unfortunately, and despite the inaccuracy of their forecast, the mainstream media features the ECRI. Doug Short has excellent continuing coverageof the ECRI recession prediction, now over 18 months old. Doug updates all of the official indicators used by the NBER and also has a helpful list of articles about recession forecasting. His latest comment points out that the public data series has not been helpful or consistent with the announced ECRI posture. Doug also continues to refresh the best chart update of the major indicators used by the NBER in recession dating.

The average investor has lost track of this long ago, and that is unfortunate. The original ECRI claim and the supporting public data was expensive for many. The reason that I track this weekly, emphasizing the best methods, is that it is important for corporate earnings and for stock prices. It has been worth the effort for me, and for anyone reading each week.

Readers might also want to review my Recession Resource Page, which explains many of the concepts people get wrong.

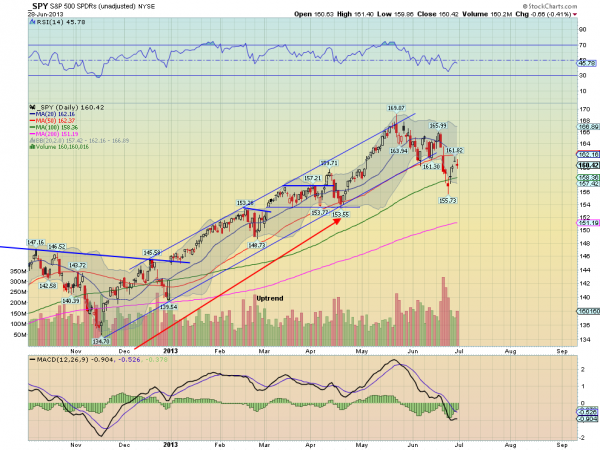

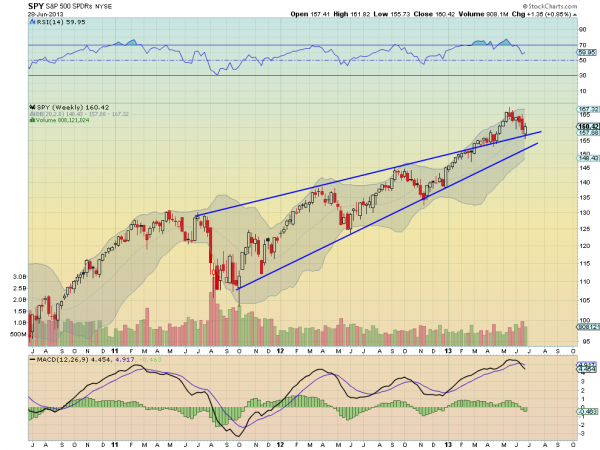

Our "Felix" model is the basis for our "official" vote in the weekly Ticker Sense Blogger Sentiment Poll. We have a long public record for these positions. A few weeks ago we switched to a neutral position. It was a close call at the time and has remained so for the last month. This week we are switching to a bearish vote. The inverse ETFs have further strengthened in the ratings, but remain in the penalty box. These are one-month forecasts for the poll, but Felix has a three-week horizon. The penalty box percentage measures our confidence in the forecast. A high rating means that most ETFs are in the penalty box, so we have less confidence in the overall ratings. That measure remains elevated, so we have less confidence in short-term trading.

[For more on the penalty box see this article. For more on the system ratings, you can write to etf at newarc dot com for our free report package or to be added to the (free) weekly ETF email list. You can also write personally to me with questions or comments, and I'll do my best to answer.]

The Week Ahead

This week brings plenty of data despite the holiday-shortened week.

The "A List" includes the following:

- The employment report (F). This is always given the most market attention, and the Fed emphasis can only increase that.

- Initial jobless claims (Th). The most timely and responsive employment indicator.

- ISM index (M). Widely followed as an important concurrent indicator of manufacturing.

The "B List" includes the following:

- ADP private employment (W). I view this as an important independent employment measure.

- ISM services index (W). Less historical data than manufacturing but a growing part of the economy.

- Construction spending (M). May data, but interesting given the importance of growth in construction.

- Trade balance (W). Interesting both for overall economic health and as a component of GDP.

- Factory Orders (T). May data.

NY Fed President Dudley speaks on Tuesday. Markets around the world have various vacation days. Were it not for Employment Friday I would expect a really slow week beginning Wednesday morning. Even so, we may have the "B Teams" on duty for Friday morning trading with things getting quiet swiftly after the opening. It could provide a good opportunity for those of us at work!

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a "one size fits all" approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix has moved (marginally) to a bearish posture, but this is not yet reflected in trading accounts which have no positions. The overall ratings are slightly negative, and we might purchase one or more inverse index funds in the coming week. While it is a three-week forecast, we update the model every day and trade accordingly. It is fair to say that Felix remains cautious about the next few weeks. Felix did well to avoid the premature correction calls that have been prevalent since the first few days of 2013, accompanied by various slogans and omens. I should also note that the last time we anticipated the purchase of inverse funds, the market stabilized and the inverse funds never emerged from the penalty box. The bearish tilt is marginal.

Insight for Investors

This is a time both of danger and of opportunity for investors. The changes are not just about markets in general, but a shift in what is safe and what is not. My recent themes are still quite valid. If you have not followed the links, find a little time to give yourself a checkup. You can follow the steps below:

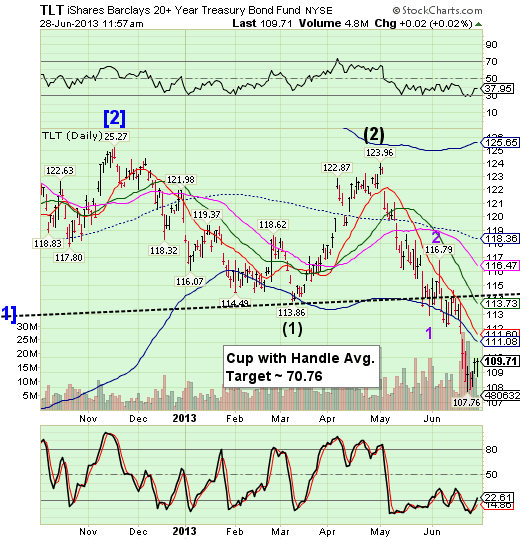

Let us start with the most dangerous investments, especially those traditionally regarded as safe. Interest rates have been falling for so long that investors in fixed income are accustomed to collecting both yield and capital appreciation. An increase in interest rates will prove very costly for these investments. It has already started. Check out Georg Vrba's bond model, which continues to signal the risk.

- Find a safer source of yield: Take what the market is giving you!

For the conservative investor, you can buy stocks with a reasonable yield, attractive valuation, and a strong balance sheet. You can then sell near-term calls against your position and target returns close to 10%. The risk is far lower than for a general stock portfolio. This strategy has worked well for over two years and continues to do so. I have had a number of questions about this suggestion, so I wrote an update last week. That post provides background as well as concrete examples showing how you can try this strategy yourself.

There is always risk. Investors often see a distorted balance of upside and downside, focusing too much on news events and not enough on earnings and value. You need to understand and accept normal market volatility, as I explain in this post: Should Investors be Scared Witless?

Too many long-term investors try to go all-in or all-out, thinking they can time the market. There is no reason for these extremes. While last week was a tough one for traders. Most were surprised by the market reaction to more FedSpeak. Our Felix model was safely on the sidelines.

For investors it was a different story. If you had your shopping list, there were good opportunities to buy stocks. For those following our enhanced yield approach you had both the chance to set new positions and to sell calls against old ones.

And finally, we have collected some of our recent recommendations in a new investor resource page -- a starting point for the long-term investor. (Comments and suggestions welcome. I am trying to be helpful and I love feedback).

Final Thought

My friends from the various competing groups are all very intelligent and experts at what they do. A policy maker has a long-term time frame and a viewpoint of avoiding imminent disaster. A trader, of necessity, translates any information into a simple rule. Doing otherwise can mean "blowing out." My academic friends develop data and evidence that stands up to peer review, but may not fit the relevance of the market.

At the moment, I think that all of these groups are correct. The Fed has accurately identified the actual economic effects of the QE policy – pretty minimal. The traders have exaggerated the Fed effects through rules like "don't fight the Fed," the Bernanke put, POMO, and the like. Perception becomes reality. Academics refuse to engage with the pop economists, which makes their work much less relevant than it could be. At least they are trying.

There are a few very savvy fund managers who understand what is going on. They know that higher interest rates are actually a sign of economic and market health. Barron's finally hit this theme in the current issue, and I predict that you will see it much more frequently in the weeks ahead. Take a few minutes to watch the advice of these three great interviews. It will be time well spent, explaining how stocks can thrive as interest rates rise.

For my own take, I find it helpful to think about a likely destination for the economy and financial markets. This is helpful in avoiding excessive focus on any single variable in a world where so many things are correlated. I expect the economy to improve, interest rates to move higher (starting with the long end), PE ratios to increase (as is usually the case when rates go to 4% or so), profit margins to decrease somewhat, and the U.S. deficit to decrease. This climate will be very negative for some stocks and sectors and very positive for others. (I provide more detail here.)

A key element is to avoid the fixation on the Fed. The idea that the Fed determines long-term interest rates is rapidly being proven wrong. James Hamilton shows (It's not just the Fed) that interest rates actually increased after the announcement of both QE2 and QE3. He writes, "It's worth emphasizing that the recent rise in interest rates has been a global phenomenon, not just something seen in the United States."

I have demonstrated that Fed buying is only 1% of daily trading in the cash markets. Nearly everyone confuses net new issuance of debt, total new issuance, and the float. This is a big mistake, and it can be a costly one.

And Finally

If you read one thing this week it should be Josh Brown's message about individual investors and market timing. You really need to read the entire post (and you should join me in reading everything else from Josh as well). Here is the key chart, showing the effect of investor attempts at market timing:

Josh gets our highest accolade: We turn off the mute button and TIVO back when we see him on TV!

See the original article >>