by Greg Harmon

Last week’s review of the macro market indicators suggested, heading into the first week of summer, the markets were continuing to look weak. The week might start with a bounce though as they have run down pretty fast. It looked for Gold ($GLD) to consolidate or bounce before continuing the downtrend while Crude Oil ($USO) moved lower in the prior broad channel. The US Dollar Index ($UUP) looked ready to continue higher while US Treasuries ($TLT) continued lower. The Shanghai Composite ($SSEC) and Emerging Markets ($EEM) were biased to the downside with risk of the Emerging Markets consolidating first. Volatility ($VIX) looked to keep drifting higher keeping the bias lower for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts were in agreement with the IWM noticeably stronger than both the SPY and QQQ.

The week played out with Gold consolidating for a nanosecond before resuming lower while Crude Oil found a bottom and held near the recent range. The US Dollar continued higher while Treasuries made new lower lows before a week ending bounce. The Shanghai Composite made new lows as well while Emerging Markets caught a bid and retraced some of the down move. Volatility pulled back all week as the Equity Index ETF’s bounced off of lower lows made on Monday. What does this mean for the coming week? Lets look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

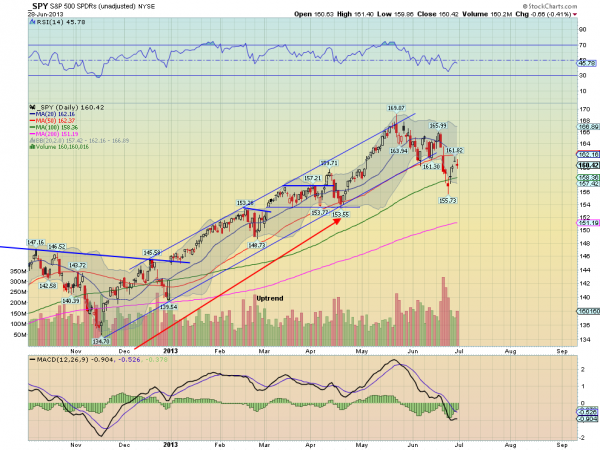

SPY Daily, $SPY

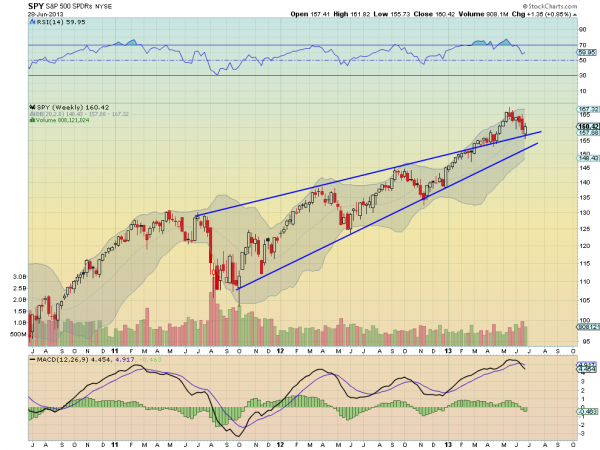

SPY Weekly, $SPY

The SPY printed a Spinning Top candle Monday which was confirmed higher Tuesday, signalling the bottom was in. But the Doji Tuesday, small body candle Wednesday after a gap and then a Shooting Star doji Thursday suggested some weakness in the move. The Shooting Star was confirmed lower Friday, with a candle that filled the gap lower. All of this happened under the 20 and 50 day Simple Moving Average (SMA) cross on the daily chart with a Relative Strength Index (RSI) that is continuing to trend lower and is turning back at the mid line and a Moving Average Convergence Divergence indicator (MACD) that is trying to improve. So many small body candles leading to confusion. Out on the weekly chart price retested the wedge breakout and held moving higher. The RSI has pulled back with a MACD that is falling. The divergence on the weekly chart is a bit troubling as well. There is resistance higher at 161.60, 163 and 166.50. Support comes lower at 159.70 and 157.10 before 153.50. If it breaks below 153.50 the uptrend is broken. A move back over 166.50 reignites the bull trend. Continued Rise in the Pullback in the Uptrend.

Heading into the Holiday shortened week the Equity markets look tired in their bounce. Look for Gold to consolidate or bounce in its downtrend while Crude Oil is biased higher in the consolidation. The US Dollar Index looks strong and ready to continue higher while US Treasuries may continue their bounce in the downtrend. The Shanghai Composite and Emerging Markets both look to bounce in their downtrends. Volatility looks to remain subdued but drifting higher keeping the bias lower for the equity index ETF’s SPY, IWM and QQQ. Their charts all look to be tired in upward move within their intermediate downtrends in the long term uptrend. Use this information as you prepare for the coming week and trad’em well.

No comments:

Post a Comment