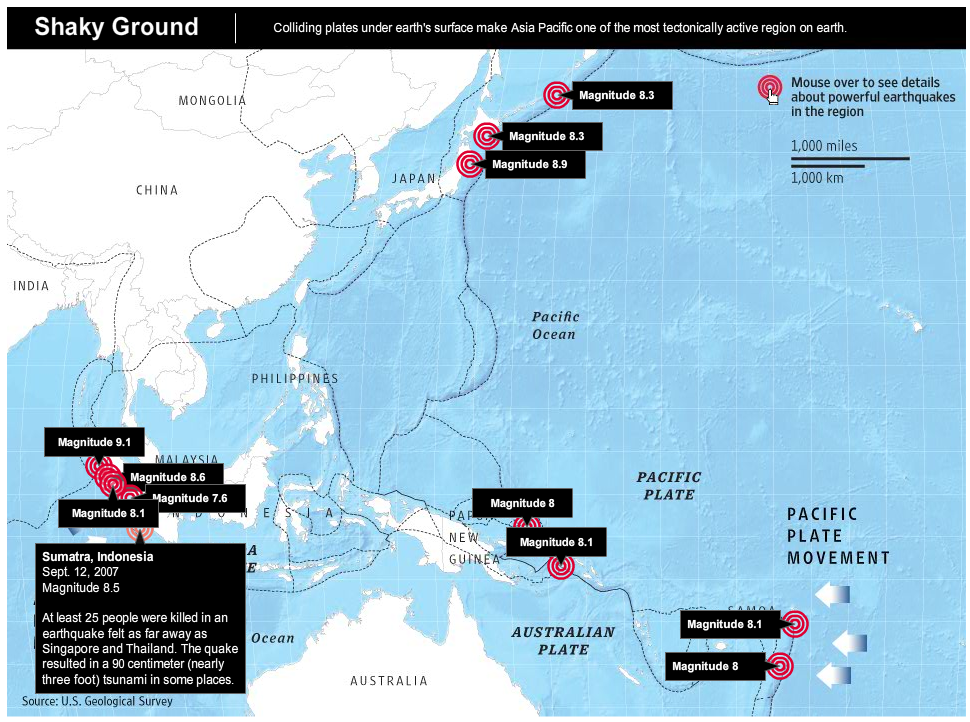

Il giorno 11 marzo 2011 il mondo è cambiato. Nulla sarà più come prima. Siamo entrati nel post nucleare. Una nuova era in cui non ci sarà più spazio per i deliri dell'energia dell'atomo. Il Giappone si è immolato per noi, certo non volontariamente, ma è ciò che è successo. Se l'incubo nucleare che ci accompagna dal dopoguerra, da Chernobyl a Three Mile Island, cesserà (e cesserà) lo dovremo al sacrificio di milioni di persone in fuga dalla nube di Fukushima. Un esodo biblico. Neppure immaginabile. Il Giappone rischia di diventare l'isola che non c'è, un luogo dove non si entra e non si esce. Una trappola nucleare. Se persino la portaerei Reagan ha abbandonato la sua missione umanitaria, quali flotte accorreranno in soccorso delle popolazioni del l'Est del Giappone? Le merci giapponesi contaminate non potranno più uscire dal Paese.

Le nubi non si fermano. Forse arriveranno fino in Europa se il vento soffierà verso Ovest. Il senso di quello che è successo è troppo grande, troppo profondo per poterlo afferrare, ma qualcosa si può intuire. Le persone hanno capito immediatamente che il nucleare è finito per sempre. Alcuni capi di Stato hanno già preso posizione contro le centrali, sanno che continuare sarebbe la loro fine politica. Succede in Germania, in Svizzera, perfino in Australia che possiede il 28% dell'uranio mondiale. L'Italia, in questo scenario, recita la parte del giapponese sperduto in un'isola del Pacifico che continua a combattere dopo dieci anni dalla fine della guerra. Personaggi che finiranno presto nel dimenticatoio del ridicolo con le loro affermazioni nucleariste.

La Prestigiacomo è l'unico ministro dell'Ambiente nel mondo che vuole nuove centrali nucleari. Lei, Testa, Veronesi, Berlusconi, Cicchitto, Scaroni, Maroni, Casini, Fini, Frattini e i pennivendoli fusi del nocciolino nucleare sono come i fascisti che giravano in divisa da federale dopo il 25 aprile. Le loro dichiarazioni sono da conservare per il futuro, i loro volti, i video, le argomentazioni sono la testimonianza di un preciso momento, l'ultimo. Domani, tra qualche giorno o qualche mese, non potranno più permettersi di sparare stronzate. L'unico motivo per cui si vuole il nucleare è il debito pubblico di 500 miliardi di euro in mano alla Francia. L'EDF è il mandante, Berlusconi e la Confindustria gli esecutori interessati.

Questa classe politica sarà spazzata via dal referendum del 12 e 13 giugno. Da questa settimana partirà un'iniziativa che durerà fino al referendum: "Spegni il nucleare". Voglio coinvolgere milioni di italiani, non ci sono alibi. Con il quorum Maroni ci potrà fare il bunga bunga solitario. Il 29 aprile ci sarà l'assemblea dell'ENEL delle centrali nucleari, io ci sarò, il blog ci sarà con la diretta streaming. Loro non si arrenderanno mai (ma gli conviene?). Noi neppure.