by Kimble Charting Solutions

Tuesday, June 21, 2011

Economic & Copper Advisory Services: Economic Report – June 2011

By John Mauldin

This week’s Outside the Box is from one of the more interesting thinkers and observers of the markets I know, Simon Hunt. When we get together in London, conversations are lively, as we don’t always see eye to eye; but we can always discuss, in a very civil manner, the affairs of the world. This particular piece is wide-ranging and thought-provoking. Simon is always ready to apply actual times to his predictions, and he has held steady on them for years.

It is late here in Geneva and I have to get up early for a speech. A big thanks to Hervig von Hove of Notz Stucki for hosting one of the more stimulating dinners with 16 people I have enjoyed in a long time, at his home out in the country, on a perfect night. I will probably make the discussion there the topic of this week’s letter. Charles Gave was in rare form. The Swiss gnomes were so very fascinating, and we had such an international table. These are the nights I wish my 1 million closest friends (a few of whom were there) could listen in on. More to come on Friday!

Economic & Copper Advisory Services: Economic Report – June 2011

By Simon Hunt

The global economy is facing a difficult period. The US Federal Reserve’s QE2 program ends at the end of the month. Europe’s debt issues continue to roll on as no party wants to pull the plug on Greece. The Middle East is in turmoil and high oil prices, together with food, are a tax on global consumers. Japan’s reconstruction has yet to get into full gear; and there are new concerns about the durability of China’s economy. Any significant slowdown there will send ripples of fear around the world.

The Federal Reserve is likely to sit pat for some months to see how the US economy will be able to perform without the steroids provided by them. Foreign central banks have largely been absent from Treasury auctions. In quarter 1 this year, foreign central banks bought just 16% of the issuances while the Federal Reserve acquired almost 200%, according to Russell Napier. In other words, the Fed’s activities have masked the exodus of foreign central banks including China from these auctions.

If foreign central banks continue to abstain from purchasing US Treasuries, the private sector will have to fund the fiscal deficit, implying quarterly remittances to the US Treasury of some $370bn. The private sector will be able to fund these auctions but at a price. They will demand a higher return on treasury paper and the funding will mean that the free-flow of funds into equity and commodities will come to an end. Many institutions are taking risk off the table.

On our associate’s, WaveTrack International technical work, 10-year US Treasuries should be yielding around 4% later this summer and 6% a year or so later. The repercussions of such a change in the yield structure will have global consequences, not least on stock and commodity markets.

Debt has woven a dangerous spider’s web in Europe. The basic truth is that Greece can never repay its debt; the ECB, the IMF and Euro governments are merely buying time by granting new loans, hoping that the problem goes away. Future stability, however, does not depend on what these institutions and governments do, but on how the electorates will react. In their view, austerity can be accepted only on a one or two year view, not as an ongoing way of life.

This is especially true of Greece whose national pride will find the sale of assets to foreigners wholly unacceptable. The same is true in other debt-laden Euro countries. All, apart from Italy, have seen their economies contract significantly over the past two years with little hope of any imminent improvement. The next major move could emanate from Ireland; the Irish government wants to renegotiate its ECB and other loans.

In fact, nearly all the conventional forward looking indicators (PMIs, OECD leading indicators etc.) are suggesting that global growth is slowing and rolling over. The US ISM data for May was universally awful with every component from New Orders to Imports down significantly. This is a view shared by industry mills we talk to and visit regularly.

The USA does not only have a cyclical problem, but a structural one also. The fundamental issue is that sooner rather than later government will be forced to introduce measures that will allow the country to live within its means. It will take a deep crisis before such policies can be put together and passed by the country’s politicians. For instance, a run on the US dollar sometime next year or early in 2013 might do the trick.

Unemployment amongst teenagers has become a serious structural and social problem for the USA in an economy that is becoming dominated by skilled workers. The number of unemployed teenagers (16-19) now totals almost one in four. However, the number of African-American, not seasonally adjusted U-3 unemployment, including both sexes, in the same age group has risen to a stunning 41%, almost every other teenager.

Once Washington puts its act together, (it will have to or else the crisis will get so deep that US markets will become dysfunctional), America will find a large number of companies which had vacated the shores of the USA for China and other parts of Asia returning to their homeland.

There are two main reasons for this change, what we call reverse globalisation. First, manufacturers want their supply chains located close to the market, not on the other side of the world. And second just as important is the cost differential trend which is narrowing together with the increasing logistical costs. It is not only the wage profile looking 10 years forward, but the other costs, such as land, electricity, taxes together with the indirect supply chain cost increases. There is also the reluctance of the system in China to allow foreign companies to gain access to government contracts.

Within a decade, the USA could supplant China as the manufacturing hub of the world. To repeat, big changes will be needed in Washington for this historic development to occur. The changes will not just be on the fiscal side, but the need to offer businesses the right incentives to produce in the USA rather than abroad, the permitting procedures to allow the development of the country’s resources, including oil (the USA could become self-contained), making government less intrusive in households and businesses and so on.

In short, it is putting back in place the principals that made America the great country it once was. Crises produce opportunities and this one is as big as they have been since the USA entered WW11. What is noteworthy is that should America grab its opportunity, it will become self-contained in energy and of course food. What other major power has those valuable twin assets?

China and the rest of Asia are no exception to this slowing economic trend. In the former, government’s focus on CPI inflation and the housing market together with its concerns on the degree of speculative or hot money circulating within the economy will almost ensure that the tight monetary policy will continue for some months yet. In these circumstances, further hikes in interest rates and Reserve Requirements are likely to be seen before the end of the year.

Chart 1: Shanghai Composite Index

Such a scenario fits the political cycle. Some of the country’s excesses can be cleaned out by end 2011, much to the delight of the incoming leadership, whilst monetary policy remains tight. The chief economist of the State Information Centre, who is well regarded in Beijing, said at a recent conference in Shanghai that “China has a serious inflation”. He concluded his speech by saying that China had to endure some short term pain for the longer term benefit of the economy. Early in 2012, monetary policy will start to be loosened and should continue to do so throughout that year. The economy should recover so allowing the outgoing leadership to depart on a high note. Post 2012, we guess that the incoming leadership will want to put the economy on a firmer long-term footing, meaning more tightening. This may well coincide with the real estate sector seeing major falls in prices and, externally, the global economy starting to suffer from the breakout of its second global credit crisis. Oil prices in the $150-200 will be a disaster for China as one senior government economist said to us. China may well go through two odd years of real recession in 2013-14 years, in our view. The impact of an effective recession in China on the rest of the world will be serious and widespread.

Chart 2: The Demographics of the Middle East

Some of the underlying causes for MENA countries’ youth to rebel against their autocratic governments are common with China. The youth in these countries don’t care about democracy or who governs: they want freedom of expression, for governments to uphold their rights and the right to work. It is why Beijing has become so sensitive to the Jasmine movement and ongoing developments in MENA. Workers’ protests appear to be on the rise. The ability to communicate via computers and mobile phones (Facebook etc.) increasingly makes government powerless to control the flow of information.

As the Financial Times wrote on 20th July, “the perception that local protests might be gaining a broader national coherence is deeply threatening to China’s Communist Party….That is the conclusion of the government itself. A report by the State Council Development Research Centre blamed protests on the marginalisation of about 150M migrant workers…

Graph 1: Global Food Prices

Global food prices have risen by 37% in the past year according to the FAO. It was higher food prices plus the high level of unemployment in MENA countries that sparked so much rioting in the region. China’s government is highly sensitive to rising food prices. They may well rise further over the coming months due to the hog cycle so ensuring that pork prices increase further followed by corn and in due course even wheat. But, China’s agricultural base is deteriorating. Top soil is collapsing to dangerous levels; its fertility is being destroyed by acidification; water is being consumed way beyond sustainable levels; and aquifers are being exhausted. These are structural issues, not short term cyclical ones.

The demographics of the rural areas of China imply that the pool of active workers in the age group 15-30 is fast diminishing. It means that productivity will decline to a rate closer to the Asian Tigers ex. China or down to the 2% a year level from its historic 5% rate. The above remarks also imply that China will be importing more foodstuffs over the coming decade. Unlike the USA, China is becoming increasingly dependent on imports of food and energy.

The above is a more likely scenario to evolve than the benign outlook postulated by so many. The world is not back to the 1990s sustainable growth, but its fragility is being patched up by unsustainable fiscal and monetary excesses. In fact, as Charles Gave wrote recently in GaveKal Five Corners, these policies have had the opposite effect than those intended (the unintended consequences of policy actions!), “Capitalism cannot work without a proper cost of capital. Capitalism needs the process of creative destruction, and if real rates are negative or abnormally low, the destruction part of the process cannot happen, zombie companies are kept on perpetual life support and growth flags.”

This is exactly what is happening nearly everywhere. Politicians won’t bite the bullet (perhaps with the exception of the UK) without a crisis. That crisis is coming, certainly by early 2013 if not sooner, to be followed by years of recession and deflation, a period when the down years will outnumber the up ones. It will be accompanied by a serious deflation of assets, both equities and commodities, perhaps excepting food. This period of austerity is likely to last until around 2018; a generation of debt should by then have been worked off so laying the foundations for a long period of sustainable growth.

Chart 3: Historical Sovereign Default/Restructuring Events

The truth is that the lessons of history have been conveniently forgotten or ignored, as illustrated by Carmen Reinhardt and Kenneth Rogoff in their epic work “Growth in a Time of Debt”. Those lessons are simple: credit crises are followed by years of sub-par growth and sovereign defaults.

Etichette:

articles,

Economy article,

Finance article,

market articles

THE KEY TO THE BALANCE SHEET RECESSION: HOUSING

by Cullen Roche

I hate to oversimplify things, but sometimes it’s easier to grasp an issue when we focus on its primary cause. In the case of the balance sheet recession, there is one primary cause – housing debt. According to the NY Fed 74% of all consumer debt is mortgage related. So, it’s no surprise that a housing bubble and a subsequent bust would lead to a balance sheet recession. And as housing has remained depressed the private sector has remained depressed. This also is not surprising given the tremendous headwinds that still confront the housing market in the USA. Moody’s recently elaborated on the situation:

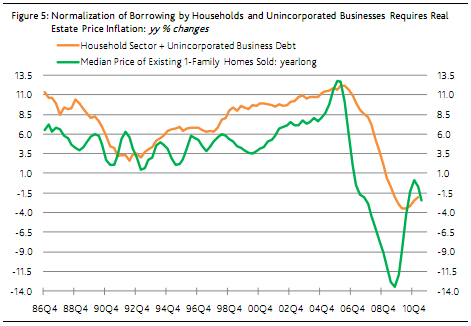

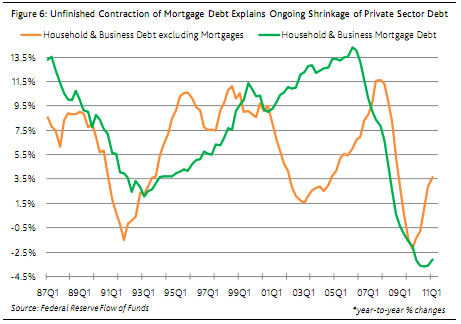

“Real estate price deflation trims private-sector borrowing. The first quarter’s 3.4% year to year drop in unincorporated business debt consisted of a 3.8% decline by mortgage debt and a 2.3% retreat by non-mortgage debt. Mortgage obligations comprise a comparatively large 73% of unincorporated business debt, wherein 13 percentage points of that share are home mortgages, 22 points are multi-family mortgages and 38 points are commercial mortgages. Mortgages supply an even greater 77% of household-sector debt. Thus, the price performance of real estate wields considerable influence over the paths taken by indebtedness of unincorporated businesses and households. Indeed, a normalization of the supply of credit to households and small businesses may be contingent on a convincing recovery by real estate prices. (Figure 5.)”“In fact, the unfinished shrinkage of mortgage obligations fully explains the ongoing contraction by the broadest measure of household and business debt. The first quarter’s 0.2% year to year dip in private nonfinancial-sector debt was comprised by a 3.1% drop by mortgage obligations and a 3.7% increase by non-mortgage debt. (Figure 6.)”

So the balance sheet recession and housing markets are intricately interconnected. Finding the bottom of the balance sheet recession might be as easy as finding the bottom of the housing market. That’s easier said than done. Hopefully, when I have some time one of these days I’ll release my latest update on the outlook for housing. That should provide us with some insights into the potential end of the balance sheet recession and the beginning of the next leg up in an organic and sustainable recovery.

Etichette:

articles,

Economy article,

Finance article,

market articles

Hungry China Shops in Argentina

BY SHANE ROMIG

China's investment in Latin America hit $15.6 billion during the 12-month period through the end of May, nearly three times greater than the year-ago period, consulting firm Deloitte said in a report. Of that amount, Brazil received about 60% and Argentina close to 40%.

During the last three years, more than 70% of China's investment in the region went to energy and minerals, but farming is attracting more attention as the country seeks to fill its bowls from foreign fields.

China already buys the bulk of Argentina's soybean exports, its top crop and largest source of export revenue. Soybeans are mainly used as livestock feed in China, where meat consumption is rising along with personal incomes. At the same time, urbanization is shrinking the amount of arable land available in China.

Last week, China's largest farming company, Heilongjiang Beidahuang Nongken Group, signed a joint venture with Argentina's Cresud SA to buy land and farm soybeans.

Cresud is one of Argentina's top agriculture firms with control over more than one million hectares (2.47 million acres) of farmland that produce grain, cattle and milk.

Cresud didn't respond to requests for comment.

Heilongjiang Beidahuang Chairman Sui Fengfu told Dow Jones Newswires in March that the company plans to buy 200,000 hectares of overseas farmland this year, and that Latin America is a target area. The company is already farming two million hectares of land outside China.

Heilongjiang Beidahuang is also spending $1.5 billion to lease and develop farms on 300,000 hectares in Argentina's Rio Negro Province. Over a five- to 10-year period, the company plans to grow wheat, corn, soybeans, fruit, vegetables and wine grapes for export to China.

The deals with local partners such as Cresud and the province of Rio Negro appear aimed at avoiding a backlash against foreign ownership of farmland in Argentina, since Heilongjiang Beidahuang won't be buying the land outright.

President Cristina Fernandez has introduced legislation limiting land purchases by foreign individuals and companies to 1,000 hectares in rural areas, a move with popular support after a number of foreigners bought large holdings in recent years.

Heilongjiang Beidahuang's incursion in agriculture comes hot on the heels of heavy Chinese investment in Argentina's oil sector.

In February, Occidental Petroleum Corp. sold its local assets to China Petroleum & Chemical Corp. for $2.5 billion. Last year, China's Cnooc Ltd., in partnership with Argentina's Bridas Corp., agreed to buy a 60% stake in Pan American Energy from BP PLC for $7.1 billion.

Deloitte predicts that Chinese investment will continue pouring into Latin America but expects a diversification in the future into other industries such as manufacturing, infrastructure and finance.

Etichette:

articles,

China,

commodity,

commodity article,

market articles

Morning markets: dollar dip lets grain futures off the hook

by Agrimoney.com

It was a Turnaround Tuesday of sorts, and not just for farm commodities.

Many risk assets enjoyed a reprieve from the recent selling trend, amid hopes that Greece will manage to approve enough spending cuts and tax increases to qualify for a E12bn emergency rescue package from other eurozone nations.

(That said, the Greek government faces a confidence motion in parliament later.)

Japan's Nikkei index closed up 1.1%, while the dollar, which has become an inverse indicator of investment sentiment, eased 0.4%, making dollar-denominated assets including many commodities more affordable to buyers in other currencies.

Crops improve

Copper edged higher, while New York crude rebounded 0.9% to reclaim $94 a barrel, as of 07:30 GMT (08:30 UK time).

And Chicago crops across the board had a firm start too – something of a rarity of late.

Sure. US Department of Agriculture data out overnight showed the condition of the majority of US crops improving, a factor which, in implying higher yields, should be a negative for crop prices.

Of corn, 70% was rated in "good" or "excellent" condition, up one point week on week, and narrowing the gap on last year's 75%.

The proportion of the soybean crop in the top two bands also rose by one point, to 68%, with even the condition of spring wheat improving, by four points to 72% rated good or excellent, despite the heavy rains which have still prevented 9% of the crop being sown.

(Drought-stressed cotton was one crop to deteriorate over the week, by two points to 26% in the top bands, helping New York's new crop December lot add 1.4% to 125.84 cents a pound.)

Canada sowings stall

But the grains condition data were in line with market forecasts, after a warmer and drier week for many areas of the US.

And "next week could tell us a different story", with many states "expected to receive heavy amounts of precipitation this week", Jon Michalscheck at Benson Quinn Commodities said.

Wet areas include Canada, where spring sowings have also been significantly held up, so much so that growers got only 1% of their crop in the ground last week, taking the total to 87%.

(Statistics Canada data will give a further insight into expectations for lost acres although, being based on a survey at the end of last month, the findings are forecast to be conservative.)

Options complication

Other factors are in play too, notably the expiration of July options, which may prevent corn prices at least falling too far.

"Liquidation since the USDA June 9 report may have run its course, in the short term at least, as the market may be setting up for some modest consolidation ahead of the July options expiring on Friday," Mr Michalscheck said.

"The largest amount of open interest is currently at the July $7.00 a bushel call strike price with the $7.50 call coming in second. July put open interest is the largest at the $7.00 level, with the $6.50 level coming in a distant second."

Many analysts have noted a pick-up in demand for crops too at these lower price levels, with South Korean feed groups notably busy.

Heavy rains

Meanwhile, the US winter wheat harvest, while continuing apace, had not been all plain sailing, as one Kansas farmer, Jim Michael, discovered.

Mr Michael at the weekend "woke up to a thunderstorm that dumped four inches of rain and hail on his wheat crop near McCune - he had harvested about 40% of his acreage to that point", the McPherson Sentinel reported, adding that the crop have suffered severe damage.

Chicago wheat for July added 1.0% to $6.65 ¾ a bushel, with July corn gaining 1.2% to $7.08 ¾ a bushel.

Soybeans for July added 0.8% to $13.45 ¾ a bushel.

Thai elections

Elsewhere, Kuala Lumpur palm oil for September delivery added 0.6% to 3,213 ringgit a tonne, rebound from a six month closing low in the last session, amid hopes of increased orders.

Ker Chung Yang at Phillip Futures noted talk of "increased demand from China and as buyers replenished stockpiles ahead of the Muslim fasting month of Ramadan". (To be clear, Ramadan is not all about fasting.)

But rubber for November edged 0.2% lower to 377.00 yen a kilogramme in Tokyo.

"According to The International Rubber Consortium, natural rubber prices this week could be volatile and sentiment-driven. Besides, the coming Thai election will also be closely watched as well," Mr Ker said.

Etichette:

articles,

commodity,

commodity article,

market articles

Agriculture's Impending 'Storm' Will Send Corn Prices Soaring

by Kerri Shannon

Worldwide demand for corn has surged, and shrinking stockpiles are unlikely to be replaced due to extreme weather conditions that have destroyed millions of acres of farmland.

Even as corn production rises to record levels this year, it won't be enough to keep up with demand, and prices will climb.

"There is a storm developing in agriculture," Jean Bourlot, global head of commodities at UBS AG (NYSE: UBS), told Bloomberg News. "If we have the slightest disruption in any part of the world, the effect on the price will be considerable."

Even as corn production rises to record levels this year, it won't be enough to keep up with demand, and prices will climb.

"There is a storm developing in agriculture," Jean Bourlot, global head of commodities at UBS AG (NYSE: UBS), told Bloomberg News. "If we have the slightest disruption in any part of the world, the effect on the price will be considerable."

Corn prices are up 4.9% this year - currently hovering around $6.60 a bushel - and have averaged $7.0225 since December. They could climb 36% this year to a record $9 a bushel, as demand is up 66%.

Global corn production will rise 5.6% this year, but still fall short of demand, according to the United States Department of Agriculture.

In a report on global supply and demand estimates released June 9, the USDA reduced planted corn acres by 1.5 million acres from its March planting intentions survey. The USDA projects U.S. corn production to be 13.2 billion bushels this year - still a record - but down 305 million bushels from the May estimate, creating a bigger gap between supply and demand.

The USDA also reduced its estimate of corn stocks by the end of the 2011/2012 marketing year to 695 million bushels - a 23% drop from its May estimate of 900 million bushels. U.S. stockpiles are down to 47 days of use - the lowest since 1974.

"This is a very, very tight stocks situation," said Todd Davis, crops economist with the American Farm Bureau Federation (AFBF). "We clearly need a big crop this year to build our supply reservoir. Farmers can still make up for planting delays brought on by flooding, but they clearly need cooperative weather in July and August to make a good corn crop."

Global corn production will rise 5.6% this year, but still fall short of demand, according to the United States Department of Agriculture.

In a report on global supply and demand estimates released June 9, the USDA reduced planted corn acres by 1.5 million acres from its March planting intentions survey. The USDA projects U.S. corn production to be 13.2 billion bushels this year - still a record - but down 305 million bushels from the May estimate, creating a bigger gap between supply and demand.

The USDA also reduced its estimate of corn stocks by the end of the 2011/2012 marketing year to 695 million bushels - a 23% drop from its May estimate of 900 million bushels. U.S. stockpiles are down to 47 days of use - the lowest since 1974.

"This is a very, very tight stocks situation," said Todd Davis, crops economist with the American Farm Bureau Federation (AFBF). "We clearly need a big crop this year to build our supply reservoir. Farmers can still make up for planting delays brought on by flooding, but they clearly need cooperative weather in July and August to make a good corn crop."

"Food Fight" Pushes Corn Prices

China, the second-biggest corn consumer after the United States, will use 47 times more corn than it did 10 years ago. That's an increase exceeding the entire corn crop of Brazil, the world's third-largest producer.Rising meat and poultry prices also have kicked up demand for corn as animal feed. China's pork consumption has doubled and chicken demand quadrupled over the past 20 years, according to the USDA.

Tyson Foods Inc. (NYSE: TSN), the biggest U.S. meat processor, will spend $500 million more this fiscal year on feed costs. Corn and soybean meal account for about 42% of the company's spending. Tyson, like many farmers, has started using more wheat for poultry feed.

Finally, rising energy prices and the push for less reliance on oil has increased ethanol production. The U.S. ethanol industry now uses seven times as much corn for ethanol than it did 10 years ago.

This is the first year more corn will be used for ethanol than livestock feed, and next year the United States plans to convert more than 5 billion bushels of corn into ethanol.

The U.S. Senate last week voted to eliminate $6 billion in federal subsidies that support ethanol production, but that isn't expected to hurt the industry. The Renewable Fuel Standard, which requires fuel companies to blend at least 12.6 billion gallons of ethanol with gasoline each year, will keep ethanol production popular. The mandate will increase to 36 billion gallons annually by 2022.

Some analysts say that corn will remain an affordable oil alternative at any price below $9 a bushel.

"For the livestock industry, the ethanol industry, and the food industry, it's going to be a food fight," John Cory, chief executive officer of grain processing company Prairie Mills, told Bloomberg. "Any kind of weather problems are really going to be a significant problem."

Wild Weather Slams Farmers

If 2011's second half sees weather conditions anything like the first, crop yields could slip even more.Flooding along the Mississippi River has hurt around 3.6 million acres of U.S. cropland, according to the AFBF. Arkansas has lost about one million acres, with Illinois, Mississippi, Missouri and Tennessee also affected.

In Texas and North Carolina, hot, dry weather threatens corn crops. Inclement weather has delayed plantings in many states, putting crops in danger of September frost.

"There is no doubt that the wild weather year we're seeing is impacting all the crops farmers produce," said the AFBF's Davis. "Drought and floods are taking their toll on cotton, corn, wheat and other crops, and USDA's newest numbers demonstrate just that."

With weather problems likely, Goldman Sachs Group Inc. (NYSE: GS) analysts said last week that forecasts for corn prices could be too low because the USDA isn't pessimistic enough in its estimates for U.S. corn, wheat, and soybean harvests.

Inclement weather is not just hitting U.S. agriculture. China is set to see harsher droughts after experiencing some of the lowest rainfalls in 50 years this season. China's drought has affected 6.5 million hectares (16.1 million acres) of farmland, according to the Office of State Flood Control and Drought Relief Headquarters.

"Extreme events will become more intense in the future, especially the heat waves and extreme precipitations," Omar Baddour, a division chief at the United Nations' World Meteorological Organization, told Bloomberg. "That, combined with less rainfall in some regions like the Mediterranean region and China, will affect crop production and agriculture."

Etichette:

articles,

commodity,

commodity article,

corn,

grains,

market articles

What Can Be Learned from the USDA Stocks and Acreage Reports?

by University of Illinois

See the original article >>

A large number of factors have contributed to the higher prices of corn and other commodities over the past year. The beginning of the price increase can be traced to the USDA’s forecast of 2010 corn planted acreage and the estimate of June 1 corn stocks released on June 30, 2010, says University of Illinois Agricultural Economist Darrel Good.

“The USDA’s June 2010 forecast of corn planted acreage came in at 87.872 million acres, 926,000 fewer than indicated in the March 2010 Prospective Plantings report. The market was generally expecting acreage to exceed March intentions,” he says.

The final planted acreage estimate for 2010 was 320,000 acres larger than the June forecast. Area harvested for grain was 441,000 acres larger than was forecast in June, but declining yield prospects more than offset the slightly larger acreage estimates, he adds.

The USDA’s estimate of June 1, 2010, corn inventories was about 300 million bushels – or 6.5% – smaller than were anticipated by the market and about 245 million bushels smaller than our pre-report calculation, he says.

“The low stocks estimate implied a level of feed and residual use during the third quarter of the 2009-2010 marketing year that was too large to be believed. Subsequently, the Sept. 1, 2010, corn stocks estimate came in larger than expected so that feed and residual use of corn during the final quarter of the year appears abnormally small,” he says.

The estimates of feed and residual use for the last half of the year and for the entire year appear logical, but the distribution between the third and fourth quarters was unusual, he notes.

“A year later, there is once again a major focus on the USDA’s Grain Stocksand Acreage reports to be released on June 30,” Good says. “For the June 1 stocks estimate, it is useful to calculate what the inventory should have been based on the estimate of March 1 stocks, known consumption in March, April and May (domestic processing uses and exports) and an estimate of feed and residual use during the quarter.”

Based on weekly USDA estimates and Census Bureau estimates for March and April, exports during the March-May quarter were near 504 million bushels, Good says.

“Based on weekly estimates of ethanol production and the projected rate of use for other food and industrial products, total processing use of corn during the quarter was likely near 1.62 billion bushels,” he says.

For the year, the USDA projects feed and residual use of corn at 5.15 billion bushels. USDA has estimated use during the first half of the year at 3.614 million bushels. If the projection for the year is correct, 1.536 billion bushels will be consumed in the last half of the year, he notes.

“Fourth-quarter feed and residual use will be influenced by the level of wheat feeding, which is expected to be large due to the much larger soft red winter wheat crop and the current low price of wheat relative to corn,” he says.

Based on the number of livestock being fed, use during the third quarter should have been relatively large. Third-quarter use is estimated at 950 million bushels, equal to that of two years ago. Total consumption during the quarter is estimated at 3.074 billion bushels, which points to June 1 stocks of 3.455 billion bushels. Stocks between 3.4 and 3.5 billion bushels appear to be a reasonable expectation, he adds.

“For soybeans, the magnitude of the domestic crush and exports during the March-May quarter can be fairly closely predicted based on estimates from the USDA, Census Bureau, and National Oilseed Processor Association,” Good says.

The domestic crush during the quarter was likely near 394 million bushels, whereas exports were near 230 million bushels. The crush will be known with the release of the Census Bureau crush report on June 23. Seed, feed and residual use during the quarter is highly variable from year to year, he says.

“Estimated use during the first half of the current year was unusually large, suggesting that third-quarter use could be less than normal. If use during the third quarter was near 28 million bushels, June 1 stocks should have been near 600 million bushels,” he says.

According to Good, planted and harvested acreage forecasts for both corn and soybeans are more difficult to anticipate than is typically the case. Late planting in the eastern Corn Belt and northern Plains along with flooding in the Ohio, Mississippi and Missouri River Valley is thought to have reduced total cropland acres planted relative to intentions reported in the USDA’s March Prospective Plantingsreport. Intentions were for 92.2 million acres of corn and 76.6 million acres of soybeans.

“The mix of acreage is still difficult to anticipate,” he says. “Most believe that corn acreage is less than intended, but ideas have shifted from a loss of 3 to 4 million acres to a loss of less than 2 million acres. Corn acreage may exceed intentions in some western areas,” he says.

Last year’s experience with the June 30 reports, along with the high degree of uncertainty about planted and harvested acreage, highlights the importance of this year’s reports, Good adds.

Etichette:

articles,

commodity,

commodity article,

grains,

market articles

Cattle prices jump, as feedlots put the brakes on

by Agrimoney.com

Cattle prices soared again on Monday, with feeder cattle touching limit up for a third successive session, as data showing a tumble in feedlot animal populations encouraged buyers to bid up.

Live cattle for August, the best traded lot, stood 1.6% higher at 111.975 cents a pound in late deals in Chicago, seeking its highest close in six weeks, and taking its gains in three sessions nearly to 8%.

Feeder cattle - animals ready to be placed on feedlots rather than the live cattle already fattened for slaughter - stood up the maximum 3.0 cents that the Chicago exchange allows, taking the contract to 135.65 cents a pound, also up nearly 7% since Wednesday.

"Cattle are in a run-away to the upside," Jerry Stowell at broker Country Futures said.

"We got the bullish [[US cattle on feed] report, and we are off to the races again today."

'Prices still too low'

The US Department of Agriculture briefing on Friday showed US feedlots running, at 10.9m cattle, with some 140,000 fewer animals as of the start of the month than investors had expected, if a number higher than at the start of June last year.

The shortfall was down both to a jump in sales of cattle for slaughter to well above expectations as well as to a 10.8% slide in the number of animals placed on feed last month, compared with a year before.

In part these dynamics reflected the difficulty some feedlot operators are having in turning a profit in the face of high corn prices.

"Feedlots are finding it increasingly difficult to realise a positive margin," a report from Paragon Economics and Steiner Consulting said.

"Live cattle prices are still far from where they should be in order to encourage placements," despite gains in futures markets which were echoed on cash markets, where prices gained some $3-4 a hundredweight in the south of the US last week to hit $109-110 a hundredweight.

In the north, prices rose by $4-5 to reach $111-112 a hundredweight.

Feeder shortage

However, the slide in placements was also seen down to supplies of feeder cattle dwindling – as long foreseen - after being boosted by drought in Mexico and the south of the US.

"With the smallest calf crop in over 50 years, feedlots will find it increasingly difficult to find feeders that have breakevens anywhere close to acceptable levels," Paragon Economics and Steiner Consulting said.

With feeder cattle supplies potentially dwindling, and live cattle supplies coming out of feedlots to dwindle as lower placements feed through, the USDA data was "bullish across the board", Terry Roggensack at Hightower report said.

Question of speed

Nonetheless, Mr Roggensack was among analysts surprised by the extent of Monday's reaction, given the "strong moves the market has already made this past week".

Mr Stowell, at Country Futures, said: "With all due respect to the bull outlook, we question the speed to which we are rising."

Price rises are seen being fuelled by buying by speculators who had a relatively small net long position in live cattle, and were net short in feeder cattle, last week heading into the rally, official data show.

Etichette:

articles,

commodity,

commodity article,

live cattle,

market articles,

meats

The Great Stagnation of 2011

by Econophile

I go away for a few days and come back to a slug of not encouraging economic news.

The really big news was related to industrial production and manufacturing which was either down or stagnant, depending on the index you look at.

The two reports that were negative were the Empire State Fed and the Philadelphia Fed manufacturing reports which both reported substantial drops in economic activity:

As you can see, Philadelphia dropped 7.7% (the first drop since September) and NY dropped 7.8% (the first drop since November). The weakness was in new orders and inventory accumulation, things that you don't want to see decline. Separately the inventory-to-sales ratio increased 0.8%, a small but negative indicator.

The index of industrial production as announced by the Fed was flat in May, up 0.1%, but the year-over-year trend was still declining:

It is true that all production is aimed at consumer consumption but looking at consumption alone is not as good an indicator of real organic economic growth as is the production side of the economy. The reason being that production usually leads consumption out of an economic slump, not the other way around. The Fed's and the Administration's attempts at monetary and fiscal stimulus haven't worked because of their misplaced emphasis on consumption. They don't examine the issue of why people aren't consuming. As readers of The Daily Capitalist know, the keys to new economic growth are savings, debt reduction, and the liquidation of malinvested projects.

People aren't going to spend until they feel they are economically secure and there aren't a lot of reasons right now for them to feel secure. And the data shows it.

Retail sales for May came out slightly negative (-0.2%), but that is a bit misleading. Here is the chart:

As you can see, the trend has been flat-to-negative since January, 2011. For several reasons economists like to strip out auto sales, a big ticket item that may skew the data. Doing that, ex. autos, retail sales were up 0.3%. Again the data is confusing because the ex. auto data still includes gasoline sales which were up 22.3% YoY. Gains were seen in health care, building materials, miscellaneous retailers, and non-store (Internet) retailers.

Then there is price inflation.

The PPI and CPI reports also came in last week. Starting at the producer level, the PPI increase moderated to a 0.2% gain (core, ex. energy and food, up 0.2%). But the year-over-year trend was still up 7.0% in May (ex. energy and food, up 2.1%). The PPI has been declining since January, 2011, but the rate of increase is still high:

On the consumer side, the May CPI also was up 0.2%, slightly less than in April, but still a strong upward trend as shown in this YoY chart (up 3.2% YoY):

Ex. energy and food, it was up 0.3% for the month, and 1.5% YoY. Apparel, shelter, new vehicles, and recreation were all up, but energy and gasoline were down along with airline fares, tobacco, and personal care. This price inflation may seem mild to the casual observer, but it is the trendline that is important.

Interestingly, someone revived the Misery Index, or at least I just discovered it. The Misery Index was created back in the 1970s and is described thusly:

It is simply the unemployment rate added to the inflation rate. It is assumed that both a higher rate of unemployment and a worsening of inflation both create economic and social costs for a country. A combination of rising inflation and more people out of work implies a deterioration in economic performance and a rise in the misery index.

The Index is now at 12.16. To put this in perspective, it was at its highest, 20.76 during the Carter Administration, and hasn't been this high since 1983 (it declined after Reagan was elected). Its lowest points were 3.53 during the Eisenhower Administration (1953) and again during the Clinton years, 6.05 in 1998.

This has resulted in a decline in consumer confidence. The Gallup Economic Confidence Index declined 9 points in the past two weeks (ending June 12):

The Reuters/Univ. of Michigan consumer sentiment poll reflected a similar decline.

I will leave you with one more bit of data, perhaps the most important, from the National Federation of Independent Business (NFIB) who regularly put out data from the member surveys. Their ??Small Business Optimism Index declined again, for the third straight month:

“Corporate profits may be at a record high, but businesses on Main Street are still scraping by,” said NFIB chief economist Bill Dunkelberg. ...

For the third month running, several key economic indicators continued their downward tumble. Job market indicators continued to deteriorate, anticipating very weak job creation and a higher unemployment rate. Capital spending plans and inventory investment plans all weakened and remain at recession levels. Inflation continues to rise, a notable business concern for owners who are raising their own prices at the fastest pace seen in years. And driving the economic uncertainty, one in four owners still report weak sales as their top business problem (followed by taxes and regulations and red tape, only 3 percent cite financing).

The most important thing among these data was the lack of capital spending:

Capital spending remains historically low in spite of very low interest rates and all sorts of expensing incentives. Fifty percent of firms reported making capital expenditures over the past six months, and the percent of owners planning capital outlays in the next 3 to 6 months fell 1 point to 20 percent, a recession level reading.

What does all this mean? It means that the foundry of job creation for one-half of the new jobs created in America, small businesses, are stalling out again because of all the factors discussed above. Also, I wouldn't expect a lot of job growth from the multinationals as not even a declining dollar can offset the cooling off of demand from money-stimulated countries like China, India, and Brazil.

It means that consumers aren't going to save our economy from stagnation. It means that stagnation will continue along with inflation. And it will be fun to watch all the naysayers who don't think you can have an economic slowdown and inflation at the same time.

It also means that my forecast of the likelihood of QE3 is still valid.

Etichette:

articles,

Economy article,

Finance article,

market articles

U.S. Debt Ceiling Debate: Struggle of the Financially Privileged

By Stewart Smith

The debate of the debt ceiling between the Republicans and the Democrats over the limit to the amount of debt the government can rack up is becoming as interesting as a WWE wrestling match. Treasury Secretary Geithner pondered over the disastrous consequences of failing to increase the debt ceiling, but is it at all believable? As the common Americans chew their finger nails into nubs, waiting to hear their fate, consumerism started to rear its head once again.

History has witnessed the rise of USA, blindly depending on the country’s industrial production. British Empire supported the South during the Civil War because they desperately tried to keep their fleeting colonies as poor agrarian countries supplying raw materials. However, nothing last forever and with passage of time, industrialists overpowered the agrarians and started providing tremendous growth of wealth and power to their country.

For the last 50 years the scene has changed dramatically. We had witnessed the rise and fall of dominant forces like Soviet Union and Nazi Germany, headed by a small group of people who perceived themselves as "the elite" and attempted to rule the whole world by force. The turning point was certainly the World War II which clearly deomonstrated that "the elite" can no longer assert control over the world by surpressing the people.

However, soon a new fatal weapon was developed which is more lethal than bureaucracy or diplomacy - fiat money.

Prior to the 1971 Nixon Shock, money was just a substitute for gold which can be exchanged across the border in dire need of goods and services. The new fiat currency system allows the privileged class to control wealth and financial streams. Dollar finally achieved the throne of the world’s top reserve currency, which has made United States and its industrial elite vulnerable to the financial elite.

Once producing real wealth became less profitable than manipulating financial flows, industrial elite started to gain power by partially merging with financial elites. Together, they form our current capitalistic corporate and market structure as we know it.

It is true that when you produce real products you need people to engineer them, build them, sell them and finally consumers to purchase them. But if you can extract profits from financial flows, you no longer need a large labor pool to participate in the process. This is the pivotal point where the rise of USA as an financial empire began, and the decline of America as "We The People" started.

See the original article >>

History has witnessed the rise of USA, blindly depending on the country’s industrial production. British Empire supported the South during the Civil War because they desperately tried to keep their fleeting colonies as poor agrarian countries supplying raw materials. However, nothing last forever and with passage of time, industrialists overpowered the agrarians and started providing tremendous growth of wealth and power to their country.

For the last 50 years the scene has changed dramatically. We had witnessed the rise and fall of dominant forces like Soviet Union and Nazi Germany, headed by a small group of people who perceived themselves as "the elite" and attempted to rule the whole world by force. The turning point was certainly the World War II which clearly deomonstrated that "the elite" can no longer assert control over the world by surpressing the people.

However, soon a new fatal weapon was developed which is more lethal than bureaucracy or diplomacy - fiat money.

Prior to the 1971 Nixon Shock, money was just a substitute for gold which can be exchanged across the border in dire need of goods and services. The new fiat currency system allows the privileged class to control wealth and financial streams. Dollar finally achieved the throne of the world’s top reserve currency, which has made United States and its industrial elite vulnerable to the financial elite.

Once producing real wealth became less profitable than manipulating financial flows, industrial elite started to gain power by partially merging with financial elites. Together, they form our current capitalistic corporate and market structure as we know it.

It is true that when you produce real products you need people to engineer them, build them, sell them and finally consumers to purchase them. But if you can extract profits from financial flows, you no longer need a large labor pool to participate in the process. This is the pivotal point where the rise of USA as an financial empire began, and the decline of America as "We The People" started.

|

| (Infographic added by EconMatters via Business Insider by BankruptingAmerica.com.) |

See the original article >>

Etichette:

articles,

Economy article,

Finance article,

Infographics,

market articles

EXPECT SLOWER GROWTH IN Q2 EARNINGS

By Dirk Van Dijk

Key Points:

- First quarter season is over. Median surprise of 3.70% and surprise ratio of 3.03 for EPS, 1.32% and 2.23 for revenues. Solid growth of 17.1% (19.1% ex-Financials) reported. Slowdown from fourth quarter pace of 30.9%, mostly due to super financial growth in 4Q. Growth ex-Financials as 19.8% in 4Q.

- Quarterly net margins rise to 9.40% from 8.73% a year ago, up from 9.02% in fourth quarter. Margins excluding Financials rise to 8.90% from 8.28% last year, 8.83% in fourth quarter. In the second quarter 9.96% net margins expected, 9.44% ex-Financials.

- Full-year total earnings for the S&P 500 jumps 45.9% in 2010, expected to rise 16.5% further in 2011. Growth to continue in 2012 with total net income expected to rise 12.1%. Financials major earnings driver in 2010. Excluding Financials, growth was 27.7% in 2010, and expected to be 17.1% in 2011 and 10.4% in 2012.

- Total revenues for the S&P 500 rise 7.80% in 2010, expected to be up 5.83% in 2011, and 6.14% in 2012. Excluding Financials, revenues up 9.19% in 2010, expected to rise 9.62% in 2011 and 6.14% in 2012.

- Annual Net Margins marching higher, from 5.88% in 2008 to 6.39% in 2009 to 8.65% for 2010, 9.49% expected for 2011 and 10.05% in 2012.

- Margin Expansion major source of earnings growth. Net margins ex-Financials 7.79% in 2008, 7.08% in 2009, 8.28% for 2010, 8.85% expected in 2011, and 9.22% in 2012.

- Revisions ratio for full S&P 500 at 1.09 for 2011, at 1.18 for 2012, both neutral readings. Sharp drop from recent weeks, but driven by old increases falling out, not new cuts. Ratio of firms with rising to falling mean estimates at 1.33 for 2011, 1.31 for 2012, marginally positive readings. Total revisions activity near seasonal lows.

- S&P 500 earned $544.3 billion in 2009, rising to $794.0 billion in 2010, expected to climb to $924.7 billion in 2011. In 2012 the 500 are collectively expected to earn $1.036 Trillion.

- S&P 500 earned $57.13 in 2009: $83.33 in 2010 and $97.04 in 2011 expected bottom-up. For 2012, $108.79 expected. Puts P/Es at 15.2x for 2010, and 13.1x for 2011 and 11.7x for 2012, very attractive relative to 10-year T-note rate of 2.92%. Top-down estimates, $95.87 for 2011 and $103.94 for 2012.

Soft Data, Falling Revisions Ratios

The first quarter earnings season is done. Net income growth was 17.12%. While that is down from the extremely strong 30.9% the same 495 of the S&P 500 firms posted in the fourth quarter, it is still a very strong growth rate.

Almost all of the growth slowdown is from a failure of the Financial sector to repeat the massive growth it posted in the fourth quarter. Growth excluding the Financials was 19.1%, down only slightly from the 19.8% growth posted in the fourth quarter. Before the first quarter earnings season started, it was expected that growth would be just 6.7% for the S&P 500 as a whole, and 10.2% excluding Financials.

Rate of Growth Slowing

The rate of growth is expected to continue to slow in the second quarter, with total growth of 9.33% and growth of 11.24% if the Financials are excluded. Note, however, that those year-over-year growth expectations are still higher than the expectations for the first quarter before the first quarter earnings season started.

I would be very surprised if we didn’t end up with double-digit growth on both a total and ex-Financials basis. Normally about three times as many firms will report positive surprises as disappointments, and that in turn makes the intial growth projections very conservative.

Revenue Growth Stayed Strong

Revenue growth was also very strong at 8.82%, up from the 8.31% growth the S&P 500 posted in the fourth quarter. Financials are a major drag on revenue growth; if they are excluded, reported revenue growth was 10.80%, up from the 8.35% growth posted last quarter.

Revenue growth is also expected to slow dramatically in the second quarter, falling to 0.62% year over year for the S&P 500 as a whole. Revenue growth is expected to slip to 3.13% if the Financials are excluded. Relative to expectations before the quarter started, the revenue outperformance has been just as spectacular as the earnings performance. Before the earnings season started, growth expectations were just 1.41% overall, and 2.16% if the Financials are excluded.

Net Margin Expansion Slowing

Net margin expansion has been a driver of earnings growth, but that expansion is slowing down, particularly if one excludes the Financials. Overall net margins were 9.40%, up sharply from 8.73% a year ago and from 9.02% in the fourth quarter. Strip away the Financials and the picture is somewhat different, rising to 8.90% from 8.28% a year ago and from the 8.83% reported in the fourth quarter.

At the start of the season, net margins were expected to be 9.13%, and 8.14% excluding the Financials. For the second quarter, total net margins are expected to be 9.96%, and 9.44%, excluding the Financials.

On an annual basis, net margins continue to march northward. In 2008, overall net margins were just 5.88%, rising to 6.39% in 2009. They hit 8.65% in 2010 and are expected to continue climbing to 9.49% in 2011 and 10.05% in 2012.

The pattern is a bit different, particularly during the recession, if the Financials are excluded, as margins fell from 7.78% in 2008 to 7.08% in 2009, but have started a robust recovery and rose to 8.28% in 2010. They are expected to rise to 8.85% in 2011 and 9.22% in 2012.

Full-Year Expectations Still Good

The expectations for the full year are very healthy, with total net income for 2010 rising to $794.0 billion in 2010, up from $544.3 billion in 2009. In 2011, the total net income for the S&P 500 should be $924.7 billion, or increases of 45.9% and 16.5%, respectively. The expectation is for 2012 to have total net income passing the $1 Trillion mark to $1.036 Trillion.

That will also put the “EPS” for the S&P 500 over the $100 “per share” level for the first time at $108.79. That is up from $57.13 for 2009, $83.33 for 2010, and $97.04 for 2011. In an environment where the 10-year T-note is yielding 2.92%, a P/E of 15.2x based on 2010 and 13.1x based on 2011 earnings looks attractive. The P/E based on 2012 earnings is 11.7x.

There has been a sharp decline in the ratio of estimate increases to estimate cuts over the last few weeks, with the Revisions ratio for 2011 falling to 1.09 from 1.42 two weeks ago and 1.89 a month ago. For 2012, the ratio is down to 1.18 from 1.67 two weeks ago and 2.03 a month ago. Most of that decline has been due to old estimate increases falling out of the sample than due to a flood of new estimate cuts.

Warning Signs Exist

We are nearing the seasonal low point in estimate revisions activity. While the numbers are still firmly in the neutral zone to slightly on the positive side, the sharp fall off is a bit of a yellow flag. If it continues to be lackluster as revisions activity picks up in a few weeks it will be a significant reason for concern.

The fundamental backing for the market continues to be solid. It is important to keep your eyes on the prize. There is lots of news out there, and much of it is more dramatic than earnings results, but rarely does it have more significance for your portfolio.

Earning are, and are going to remain, the single-most-important thing for the stock market. Interest rates are an important — but distant — second.

That does not mean that all is smooth sailing ahead. In a similar, but contrary nod to history, we are now at the softest part of the year (historically). There is a fair amount of truth to the old adage “Sell in May, but remember to return by November.” Since 1945, the gain on the S&P 500 has averaged 6.8% (ex-dividends) from November through April, but only 1.3% from May through October.

The biggest threat to the market is if the debt ceiling is not raised by the beginning of August. If it looks like it will not happen — watch out. The Government of the United States defaulting on its debt is likely to have a somewhat larger impact on the markets and the economy than the impact of Lehman Brothers defaulting on its debts.

The nation would be shoved right back into recession, and one deeper than the one that followed the Lehman collapse. If that happens, then corporate profits would also collapse. However, when push comes to shove, I find it hard to believe that even Congress could be so stupid as to let that happen.

While not the most likely case, the chance of no increase by the time the ceiling is hit is a very real possibility. Given the disastrous potential consequences, taking out some insurance in the form of “deep out of the money” puts would make a lot of sense at this point.

Low Government Spending Drags

We are already feeling the impact from lower government spending. First quarter GDP growth came in at just 1.8%, down from 3.1% in the fourth quarter. Total government spending was a drag of 1.09 points, up from being a 0.34 point drag in the fourth quarter.

In other words 0.75 of the total 1.30 point growth slowdown (57.8%) was due to increased austerity in Government spending. The recovery is clearly slowing, but so far, that has not shown up in the analysts’ profit forecasts.

Economic Data Softening

The overall tone of the economic data in recent weeks has been on the soft side. We got very disappointing news from the two “mini-ISM’s” last week; the Empire State and Philly Fed reports were both far weaker than expected and showed an actual contraction in manufacturing activity in the mid-Atlantic region.

Initial Claims for unemployment insurance fell by 16,000 but remained above the key 400,000 level of the 10th week in a row. Industrial production rose only 0.1% in May and April was revised lower. However, the headline numbers there were worse than the actual situation. Most of the decline was from the Utility sector and reflected cool weather as much as a slowdown in economic activity.

Manufacturing output rose by 0.4%, recouping most of its 0.5% decline in April. The April decline was mostly due to the supply chain effects of the Japan disaster. Overall Capacity Utilization was unchanged at 76.7%, but factory utilization rose to 74.5% from 74.2%. Both measures remain well below their historical averages, but have improved substantially over the last year.

Utility output plunged 2.8% on the month and utility utilization fell to 79.0% from 81.4%, and is now below the lowest level of the recession. Inflation was also hotter than expected at the core level, with the core CPI up 0.3% versus expectations of a 0.1% increase and higher than the 0.2% level in April. Headline inflation was actually lower than core at 0.2% due to falling gasoline prices. That will probably happen again in June.

Some Data Surprised to the Upside

Not all the economic data was bad. While retail sales fell 0.2%, that was much better than the 0.7% decline that was expected. Also, housing starts were higher than expected at an annual rate of 560,000, up from 541,000 in April, and April was revised sharply higher from a 523,000 rate. Most of the strength, though, was in the volatile multi-family segment, and the absolute level is still just plain awful.

Still, there is hope that the recovery (such as it is) in residential investment will continue as building permits also rose to an annual rate of 612,000, far above the expected 548,000 level and higher than the upwardly revised 563.000 level in April. Overall, though, it looks like economic growth in the second quarter is going to look a lot more like the 1.8% level of the first quarter than a return to the 3.1% level of the fourth quarter.

International Concerns Remain

The international situation clearly has the potential to abort the recovery as well. The disaster in Japan will clearly slow its economy dramatically in the second quarter, although much of that growth will be made up later in the year as the reconstruction process gets under way. Many U.S.-made products have parts which are made in Japan, and that is likely to disrupt production here.

The debt crisis in Europe is not going away. There were riots in Greece protesting the current austerity measures, even as the ECB and Germany are demanding even more in order to get the next tranche of the bailout. Rates for the Greek, Irish and Portuguese debt are substantially higher than when the crisis first started.

It is clear now that at least Greece will be forced to restructure (aka partially default) its debt. The austerity campaigns have weakened those economies and undermined tax revenues, and so the bailouts have not made the situation much better. A Greek default will cause European banks to take a serious hit.

Don’t Despair

On balance I remain bullish, and I think we will end the year with the S&P 500 north of 1400, but that does not mean we will have a smooth ride between here and there. Strong earnings should trump a dicey international situation and the drama in DC (provided it turns out to be just drama, and the game of chicken does not end in tragedy).

Valuations on stocks look very compelling, with the S&P trading from just 13.06x 2011, and 11.65x 2012 earnings. That is extremely competitive with the 2.92% yield on the 10-year Treasury note. In fact, 100 (20%) of the stocks in the S&P 500 now have dividend yields higher than the T-note. However, be prepared to move to the exits (or have some put protection in place) if it looks like the debt ceiling will not be raised.

Since there are virtually no firms that have reported second quarter earnings yet, I am going to omit the Surprise tables and the Reported Quarterly Growth and Margin tables this week.

Expected Quarterly Growth: Total Net Income

- The total net income of 9.33% is expected, down from 17.08% year-over-year growth in the first quarter (and down from 30.8% growth in the fourth quarter).

- Sequential earnings growth of 0.42% expected, 2.19 ex-Financials.

- Growth slowdown mostly due to Financials not repeating extraordinary growth of the fourth quarter. Growth ex-Financials of 11.24% is expected, versus 19.13% in the first quarter and down from 19.8% in fourth quarter.

- Very early expectations are for 13.1% year-over-year growth in the third quarter, 14.1% excluding Financials.

- Energy, Materials and Industrials expected to lead again, Construction and Aerospace expected to post lower total net income than last year.

| Quarterly Growth: Total Net Income Expected | |||||

|---|---|---|---|---|---|

| Income Growth | Sequential Q3/Q2 E | Sequential Q2/Q1 A | Year over Year 2Q 11 E | Year over Year 3Q 11 E | Year over Year 1Q 11 A |

| Oils and Energy | 0.07% | 11.26% | 37.75% | 52.75% | 40.52% |

| Basic Materials | -4.22% | -9.87% | 32.01% | 45.12% | 48.26% |

| Industrial Products | 3.39% | 5.21% | 24.09% | 23.69% | 65.09% |

| Consumer Discretionary | -0.29% | 11.96% | 19.13% | -0.19% | 13.37% |

| Business Service | 3.96% | 9.35% | 15.12% | 16.93% | 12.25% |

| Conglomerates | 3.91% | 8.21% | 13.44% | -11.17% | -29.30% |

| Transportation | 9.78% | 32.10% | 12.34% | 17.27% | 23.82% |

| Retail/Wholesale | -10.59% | 6.39% | 6.04% | 2.56% | 5.68% |

| Computer and Tech | 11.64% | -6.66% | 5.80% | 8.37% | 24.88% |

| Consumer Staples | 11.35% | 10.01% | 3.46% | 6.58% | 3.78% |

| Finance | 2.62% | -7.53% | 0.77% | 8.36% | 8.74% |

| Medical | 0.57% | -3.81% | 0.12% | 2.15% | 5.90% |

| Utilities | 28.23% | -5.55% | 0.05% | 5.66% | -1.09% |

| Auto | -16.53% | -7.26% | -0.03% | 3.38% | 46.88% |

| Aerospace | 5.30% | 7.31% | -6.28% | 1.96% | 5.04% |

| Construction | 34.26% | 216.81% | -12.61% | 86.88% | -34.25% |

| S&P | 4.26% | 0.42% | 9.33% | 13.10% | 17.08% |

| Excl Financials | 4.60% | 2.19% | 11.24% | 14.09% | 19.13% |

Quarterly Growth: Total Revenues Expected

- Revenue growth expected to slow sharply, up from the 8.82% growth posted in the first quarter. Ex-Financials growth of 3.18% expected, down from 10.80% in the first quarter.

- Sequentially revenues 5.27% lower than in the first quarter, down 3.61% ex-Financials.

- Financials, Aerospace and Utilities sectors have falling revenues, seven sectors post double-digit revenue growth, Industrials and Energy grow sales over 25%.

- As one would expect in an economic recovery, cyclicals are leading the way on revenue growth. Energy and Materials growth helped by strong commodity prices.

| Quarterly Growth: Total Revenues Expected | |||||

|---|---|---|---|---|---|

| Sales Growth | Sequential Q3/Q2 E | Sequential Q2/Q1 A | Year over Year 2Q 11 E | Year over Year 3Q 11 E | Year over Year 1Q 11 A |

| Industrial Products | -4.73% | 6.01% | 25.26% | 16.12% | 23.85% |

| Oils and Energy | 2.82% | 8.96% | 25.09% | 22.59% | 17.13% |

| Basic Materials | 3.07% | 7.88% | 19.48% | 16.28% | 18.16% |

| Computer and Tech | -2.48% | -5.76% | 15.74% | 9.24% | 15.67% |

| Auto | -0.85% | 3.12% | 13.96% | 2.78% | 1.62% |

| Transportation | 7.96% | -1.17% | 11.75% | 10.91% | 12.71% |

| Consumer Discretionary | 6.91% | -6.51% | 10.40% | 13.50% | 6.48% |

| Business Service | -4.79% | -3.45% | 7.52% | 7.87% | 7.21% |

| Conglomerates | -1.34% | -6.75% | 7.40% | 0.15% | 4.37% |

| Consumer Staples | 2.14% | -7.55% | 5.80% | -4.16% | 6.41% |

| Retail/Wholesale | 2.67% | -5.96% | 5.60% | 7.11% | 3.68% |

| Medical | 1.10% | -1.69% | 2.56% | 4.43% | 4.27% |

| Construction | 16.50% | -7.03% | 0.84% | 2.11% | -3.88% |

| Utilities | -5.79% | 5.09% | -0.69% | 3.39% | 1.08% |

| Finance | -18.71% | -4.95% | -2.19% | -17.66% | 8.05% |

| Aerospace | 6.46% | -12.80% | -3.24% | -0.84% | -0.16% |

| S&P 500 | 3.91% | -5.27% | 0.62% | 3.70% | 8.82% |

| Excl Financials | 4.98% | -3.61% | 3.18% | 7.28% | 10.80% |

Quarterly Net Margins Expected

- Sector and S&P net margins are calculated as total net income for the sector divided by total revenues for the sector.

- Net margins for the full S&P 500 expected to expand to 9.96% from 9.17% a year ago, and up from 9.40% in the first quarter. Net margins ex-Financials rise to 9.41% from 8.76% a year ago but down from 9.44% in the first quarter.

- Eleven sectors expected to see year-over-year margin expansion, only five to see contraction. Sequentially twelve up and four down. Further margin expansion expected for third quarter, rising to 10.00%, but falling to 9.41% excluding the Financials.

- Margin expansion the key driver behind earnings growth.

| Quarterly: Net Margins Expected | ||||||

|---|---|---|---|---|---|---|

| Net Margins | Q3 2011 Estimated | Q2 2011 Estimated | 1Q 2011 Reported | 4Q 2010 Reported | 3Q 2010 Reported | 2Q 2010 Reported |

| Computer and Tech | 17.08% | 15.72% | 16.37% | 17.56% | 16.51% | 15.80% |

| Finance | 14.61% | 13.71% | 12.49% | 10.13% | 11.09% | 11.61% |

| Medical | 13.28% | 13.46% | 13.85% | 12.62% | 13.68% | 13.77% |

| Business Service | 13.08% | 13.13% | 11.90% | 12.48% | 11.84% | 11.78% |

| Consumer Staples | 13.04% | 12.66% | 10.47% | 10.59% | 11.91% | 10.87% |

| Conglomerates | 10.18% | 10.37% | 8.94% | 10.73% | 9.41% | 8.65% |

| Oils and Energy | 9.07% | 10.33% | 8.38% | 7.72% | 7.19% | 8.07% |

| Consumer Discretionary | 9.58% | 10.29% | 9.09% | 9.98% | 10.48% | 9.14% |

| Industrial Products | 9.03% | 9.60% | 8.69% | 7.89% | 8.18% | 8.18% |

| Transportation | 9.08% | 8.84% | 6.75% | 8.03% | 8.49% | 8.17% |

| Basic Materials | 7.77% | 8.83% | 9.17% | 6.71% | 6.27% | 7.15% |

| Utilities | 10.34% | 7.38% | 8.02% | 6.78% | 9.10% | 8.31% |

| Auto | 5.17% | 6.66% | 6.64% | 3.76% | 5.52% | 6.38% |

| Aerospace | 6.52% | 6.50% | 6.14% | 6.49% | 6.19% | 6.55% |

| Retail/Wholesale | 3.19% | 3.63% | 3.41% | 4.13% | 3.33% | 3.54% |

| Construction | 4.20% | 3.56% | 1.16% | 2.04% | 2.34% | 3.66% |

| S&P 500 | 10.00% | 9.96% | 9.40% | 9.02% | 9.17% | 9.17% |

| Excl Financials | 9.41% | 9.44% | 8.90% | 8.83% | 8.84% | 8.76% |

Annual Total Net Income Growth

- Following a rise of just 2.1% in 2009, total earnings for the S&P 500 jumps 45.9% in 2010, 16.5% further expected in 2011. Growth ex-Financials 27.7% in 2010, 17.1% in 2011.

- For 2012, 12.1% growth expected. 10.4% ex-Financials.

- Auto net income expands more than 15x in 2010, Financial net income more than quadruples.

- All sectors expected to show total net income rise in 2011 and in 2012. Utilities only (small) decliner in 2010. Eleven sectors expected to post double-digit growth in 2011 and 13 in 2012. Medical the only sector expected to grow less than 5% in 2012.

- Cyclical/Commodity sectors expected to lead in earnings growth again in 2011 and into 2012.

- Sector dispersion of earnings growth narrows dramatically between 2010 and 2012, only four sectors expected to grow more than 20% in 2012, seven grew more than 40% in 2010.

| Annual Total Net Income Growth | ||||

|---|---|---|---|---|

| Net Income Growth | 2009 | 2010 | 2011 | 2012 |

| Basic Materials | -50.26% | 72.13% | 40.65% | 11.19% |

| Oils and Energy | -55.09% | 50.09% | 37.86% | 9.59% |

| Industrial Products | -35.08% | 36.41% | 33.79% | 17.22% |

| Computer and Tech | -5.06% | 47.83% | 20.38% | 10.96% |

| Consumer Discretionary | -15.44% | 22.51% | 19.32% | 14.17% |

| Transportation | -30.22% | 44.44% | 18.07% | 20.85% |

| Business Service | 1.35% | 15.95% | 16.01% | 13.08% |

| Construction | - to - | - to + | 14.28% | 36.42% |

| Auto | - to + | 1457.95% | 14.02% | 11.90% |

| Finance | - to + | 319.87% | 13.53% | 20.13% |

| Retail/Wholesale | 2.61% | 14.65% | 10.64% | 12.58% |

| Conglomerates | -23.60% | 11.23% | 10.16% | 17.75% |

| Consumer Staples | 5.79% | 11.72% | 6.75% | 8.17% |

| Medical | 2.52% | 10.40% | 5.24% | 4.20% |

| Utilities | -13.47% | -0.86% | 3.87% | 6.86% |

| Aerospace | -16.75% | 21.02% | 2.20% | 14.65% |

| S&P | 2.05% | 45.88% | 16.46% | 12.07% |

Annual Total Revenue Growth

- Total S&P 500 Revenue in 2010 rises 7.80% above 2009 levels, a rebound from a 6.68% 2009 decline.

- Total revenues for the S&P 500 expected to rise 5.83% in 2011, 6.14% in 2012.

- Energy to lead revenue race in 2011. Six other sectors (all cyclical) also expected to show double-digit revenue growth in 2011.

- All sectors but Staples and Finance expected to show positive top-line growth in 2011, but four sectors expected to show positive growth below 5%. All sectors see 2012 growth, three in double digits.

- Aerospace the only sector to post lower top line for 2010. Revenues for Financials were virtually unchanged.

- Construction, Transportation and Industrials the only sectors expected to post double-digit top line growth in 2012. No sector expected to post falling revenues. Autos Tech and Energy all expected to see revenues grow by more than 8%.

- Revenue growth significantly different if Financials are excluded, down 10.46% in 2009 but growth of 9.19% in 2010, 9.62% in 2011, and 5.95% in 2012.

| Annual Total Revenue Growth | ||||

|---|---|---|---|---|

| Sales Growth | 2009 | 2010 | 2011 | 2012 |

| Oils and Energy | -34.41% | 23.15% | 21.32% | 7.45% |

| Basic Materials | -19.30% | 12.78% | 16.37% | 5.65% |

| Industrial Products | -20.96% | 12.34% | 16.21% | 10.84% |

| Consumer Discretionary | -4.95% | 3.93% | 13.24% | 6.98% |

| Transportation | 7.25% | 10.83% | 12.35% | 10.89% |

| Computer and Tech | -10.42% | 15.36% | 11.52% | 8.91% |

| Auto | -21.40% | 8.53% | 11.15% | 9.53% |

| Business Service | -2.43% | 5.99% | 7.12% | 5.86% |

| Retail/Wholesale | 1.40% | 4.08% | 5.86% | 5.72% |

| Utilities | -5.84% | 2.46% | 5.74% | 2.99% |

| Medical | 6.38% | 11.37% | 4.28% | 2.67% |

| Construction | -15.92% | 0.47% | 4.17% | 12.24% |

| Conglomerates | -13.30% | 0.94% | 2.12% | 4.88% |

| Aerospace | 6.51% | -0.34% | 1.41% | 6.03% |

| Consumer Staples | -0.36% | 4.77% | -1.74% | 4.76% |

| Finance | 21.51% | 0.10% | -14.94% | 5.01% |

| S&P 500 | -6.68% | 7.80% | 5.83% | 6.14% |

| Excl Financials | -10.46% | 9.19% | 9.62% | 5.95% |

- Net Margins marching higher, from 5.88% in 2008 to 6.39% in 2009 to 8.65% for 2010, 9.49% expected for 2011. Trend expected to continue into 2012 with net margins of 10.05% expected. Major source of earnings growth.

- Financials significantly distort overall net margins. Net margins ex-Financials 7.78% in 2008, 7.08% in 2009, 8.28% for 2010, 8.85% expected in 2011. Expected to grow to 9.22% in 2012.

- Financials net margins soar from -8.42% in 2008 to 16.59% expected for 2012.

- All sectors but Medical and Utilities saw higher net margins in 2010 than in 2009. All sectors but Utilities expected to post higher net margins in 2011 than in 2010. Widespread margin expansion currently expected for 2012 as well with all sectors expected to post expansion in margins.

- Six sectors to boast double digit net margins in 2012, up from just three in 2009.

- Sector net margins are calculated as total net income for sector divided by total revenues. However, there are generally fewer revenue estimates than earnings estimates for individual companies.

| Annual Net Margins | |||||

|---|---|---|---|---|---|

| Net Margins | 2009A | 2010A | 2011E | 2012E | |

| Computer and Tech | 11.86% | 15.20% | 16.30% | 16.72% | |

| Finance | 2.59% | 10.86% | 14.50% | 16.59% | |

| Medical | 13.17% | 13.06% | 13.16% | 13.38% | |

| Business Service | 10.78% | 11.80% | 12.76% | 13.65% | |

| Consumer Staples | 9.85% | 10.50% | 11.36% | 11.78% | |

| Conglomerates | 8.19% | 9.02% | 9.73% | 10.93% | |

| Consumer Discretionary | 7.50% | 8.84% | 9.23% | 9.94% | |

| Oils and Energy | 6.27% | 7.65% | 8.69% | 8.86% | |

| Industrial Products | 6.15% | 7.46% | 8.56% | 9.09% | |

| Basic Materials | 4.47% | 6.82% | 8.23% | 8.67% | |

| Utilities | 8.36% | 8.09% | 7.94% | 8.24% | |

| Transportation | 5.83% | 7.59% | 7.83% | 8.70% | |

| Aerospace | 5.04% | 6.12% | 6.16% | 6.67% | |

| Auto | 0.36% | 5.23% | 5.37% | 5.48% | |

| Retail/Wholesale | 3.06% | 3.37% | 3.50% | 3.75% | |

| Construction | -0.51% | 2.68% | 2.94% | 3.57% | |

| S&P 500 | 6.39% | 8.65% | 9.49% | 10.05% | |

| Excl Financials | 7.08% | 8.28% | 8.85% | 9.22% | |

Earnings Estimate Revisions: Current Fiscal Year

The Zacks Revisions Ratio: 2011

The Zacks Revisions Ratio: 2011

- Revisions ratio for full S&P 500 at 1.09, down from 1.42 two weeks ago, now a neutral reading. Nearing seasonal low in activity, meaning changes are driven more by old estimates falling out than new estimates being added (lowering significance of revisions ratio).

- Four sectors with revisions ratios at or above 2.0. Industrials and Transports lead. Business Service and Energy also strong. Eight sectors with positive revisions ratios, seven negative (below 1.0). Many sector sample sizes very small.

- Ratio of firms with rising to falling mean estimates at 1.33, down from 1.67, still a bullish reading.

- Total number of revisions (4-week total) plunging at 1,379, down from 2,264 two weeks ago (-39.1%), and down from 5068 a month ago.

- Increases at 720 down from 1,330 (-45.9%), cuts at 659, down from 934 (-29.4%).

| The Zacks Revisions Ratio: 2011 | |||||||

|---|---|---|---|---|---|---|---|

| Sector | %Ch Curr Fiscal Yr Est – 4 wks | # Firms Up | # Firms Down | # Ests Up | # Ests Down | Revisions Ratio | Firms up/down |

| Industrial Products | 0.20 | 10 | 10 | 45 | 13 | 3.46 | 1.00 |

| Transportation | 0.61 | 4 | 2 | 13 | 4 | 3.25 | 2.00 |

| Business Service | 0.05 | 9 | 5 | 14 | 5 | 2.80 | 1.80 |

| Oils and Energy | -0.11 | 30 | 8 | 121 | 51 | 2.37 | 3.75 |

| Consumer Staples | -0.02 | 19 | 13 | 54 | 37 | 1.46 | 1.46 |

| Auto | 0.36 | 4 | 3 | 8 | 7 | 1.14 | 1.33 |

| Medical | -0.11 | 25 | 16 | 54 | 49 | 1.10 | 1.56 |

| Computer and Tech | -0.09 | 27 | 26 | 106 | 105 | 1.01 | 1.04 |

| Aerospace | -0.11 | 2 | 5 | 6 | 6 | 1.00 | 0.40 |

| Utilities | 0.10 | 16 | 16 | 30 | 31 | 0.97 | 1.00 |

| Retail/Wholesale | -0.59 | 22 | 22 | 130 | 139 | 0.94 | 1.00 |

| Basic Materials | 0.14 | 12 | 9 | 11 | 13 | 0.85 | 1.33 |